|

市场调查报告书

商品编码

1693623

印度电动车:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

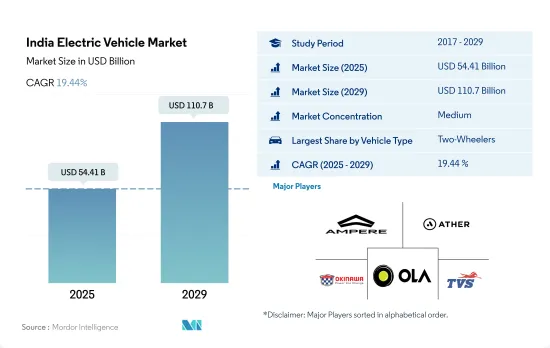

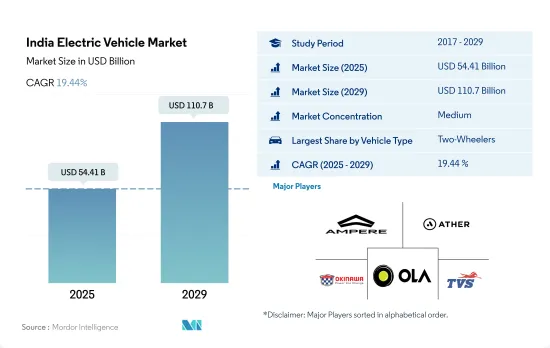

印度电动车市场规模预计在 2025 年为 544.1 亿美元,预计到 2029 年将达到 1,107 亿美元,预测期内(2025-2029 年)的复合年增长率为 19.44%。

印度在各个车型中采用电动车(EV)的综合战略正在推动向永续交通的转变。

- 印度电动车(EV)市场根据车型分为乘用车、商用车和两轮车,正在经历重大变革时期,这反映了该国致力于采用清洁能源和减少二氧化碳排放的承诺。每个部分都迎合不同的市场动态、用户需求和成长潜力,描绘出印度迈向电动车的全貌。

- 受消费者意识增强、政府政策利好以及国内外製造商日益增多的影响,电动乘用车在印度市场正稳步普及。儘管目前与传统汽车相比规模较小,但该细分市场正在迅速扩张,从面向大众市场的经济型车型到面向豪华市场的高檔电动车。

- 电动商用车产业虽然仍处于起步阶段,但预计将呈现显着成长。这种成长的动力源自于物流和运输业对永续性和成本效率的日益关注。在政府旨在减少污染和促进公共交通和货物运输电动化的措施的支持下,电动公车、卡车和货车正逐步引入都市区车队。电动商用车的营运成本优势,加上各州和中央政府的激励措施,正在鼓励车队营运商和公司转向电动选项。这一领域的成长对于实现印度雄心勃勃的环境目标和改善城市空气品质至关重要。

印度电动车市场趋势

政府措施和严格规范推动印度电动车市场快速成长

- 随着印度政府制定积极的策略来对抗污染,印度的电动车 (EV) 市场正处于成长阶段。 2015年启动的Fame India计画在推动汽车电气化方面发挥了关键作用。基于其成功经验,Fame 第二阶段计划将持续到 2022 年 4 月,预计将进一步推动电动车的销量,尤其是在 2021 年,政府将为电池容量高达 15kWh 的电动车提供 10,000 印度卢比(约 1,000 万美元)的补贴。

- 印度各邦政府正大力引进电动公车,以摆脱内燃机(ICE)公车的束缚。此举不仅可以降低营运成本,还可以抑制碳排放并改善空气品质。引人注目的是,德里政府已于 2021 年 3 月批准采购 300 辆新型低地板电动(AC)公车,其中 100 辆将于 2022 年 1 月上路。这些倡议导致印度对电动商用车的需求大幅成长,2022 年与 2021 年相比成长了 62.58%。

- 受政府严格标准的推动,近年来电动车的需求激增。 2021年8月,印度政府宣布了一项车辆报废政策,旨在逐步淘汰污染严重且不合规的车辆,无论其使用年限为何。该政策将于 2024 年实施,旨在推动消费者购买电动车。此外,政府还设定了一个雄心勃勃的目标,即到 2030 年使印度 30% 的汽车实现电动化。这些倡议预计将在 2024 年至 2030 年期间促进印度的电动车销售。

印度电动汽车产业概况

印度电动车市场适度整合,前五大厂商占43.74%的市场。市场的主要企业有:Ampere Vehicle Private Limited、Ather Energy Pvt。有限公司、冲绳汽车技术私人有限公司有限公司、Ola Electric Mobility Pvt. Ltd. 和 TVS Motor Company Limited(按字母顺序)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 共乘

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 二手车销售

- 燃油价格

- OEM生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆类型

- 商用车

- 公车

- 大型商用卡车

- 轻型商用皮卡车

- 轻型商用厢型车

- 中型商用卡车

- 搭乘用车

- 掀背车

- 多用途车辆

- 轿车

- SUV

- 摩托车

- 商用车

- 燃料类别

- FCEV

- HEV

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Ampere Vehicle Private Limited

- Ather Energy Pvt. Ltd.

- BYD India Private Limited

- Hero Electric Vehicles Pvt. Ltd.

- Hyundai Motor India Limited

- JBM Auto Limited

- Mahindra & Mahindra Limited

- MG Motor India Private Limited

- Okinawa Autotech Pvt. Ltd.

- Ola Electric Mobility Pvt. Ltd.

- Olectra Greentech Ltd.

- Switch Mobility(Ashok Leyland Limited)

- Tata Motors Limited

- Toyota Kirloskar Motor Pvt. Ltd.

- TVS Motor Company Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

The India Electric Vehicle Market size is estimated at 54.41 billion USD in 2025, and is expected to reach 110.7 billion USD by 2029, growing at a CAGR of 19.44% during the forecast period (2025-2029).

India's comprehensive strategy to adopt electric vehicles (EVs) across various vehicle categories is driving the nation's transition toward sustainable mobility

- India's electric vehicle (EV) market, segmented by vehicle type into passenger cars, commercial vehicles, and two-wheelers, is undergoing a significant transformation, reflecting the country's commitment to embracing clean energy and reducing carbon emissions. Each segment caters to distinct market dynamics, user needs, and growth potential, painting a comprehensive picture of India's journey toward electric mobility.

- Electric passenger cars are steadily gaining traction in the Indian market, driven by increasing consumer awareness, favorable government policies, and the growing presence of both international and local manufacturers. Although currently small compared to conventional vehicles, the segment is witnessing a rapid expansion in offerings, ranging from affordable models aimed at the mass market to premium electric cars catering to the luxury segment.

- The electric commercial vehicle sector, though still in its early stages, is set to witness significant growth. This growth is being driven by a rising emphasis on sustainability and cost-effectiveness within the logistics and transportation sectors. Electric buses, trucks, and vans are gradually making their way into urban fleets, supported by government initiatives aimed at reducing pollution and promoting electric mobility in public transportation and goods delivery. The operational cost benefits of electric commercial vehicles, coupled with various state and central government incentives, are encouraging fleet operators and businesses to transition toward electric options. This segment's growth is critical for achieving India's ambitious environmental targets and improving urban air quality.

India Electric Vehicle Market Trends

Government initiatives and stringent norms drive rapid growth in the electric vehicle market in India

- India's electric vehicle (EV) market is in a growth phase, with the government actively formulating strategies to combat pollution. The Fame India scheme, launched in 2015, has played a pivotal role in driving vehicle electrification. Building on its success, Fame Phase 2, active till April 2022, further bolstered EV sales, especially in 2021, with the government offering subsidies like INR 10,000 grants for electric cars with battery capacities up to 15 kWh.

- State governments across India are increasingly incorporating electric buses into their fleets, aiming to transition from internal combustion engine (ICE) buses. This move not only cuts operational costs but also curbs carbon emissions and improves air quality. In a notable move, the Delhi government greenlit the procurement of 300 new low-floor electric (AC) buses in March 2021, with 100 of them hitting the roads in January 2022. These initiatives contributed to a significant 62.58% surge in demand for electric commercial vehicles in India in 2022 over 2021.

- The demand for electric cars has surged in recent times, driven by the government's introduction of stringent norms. In August 2021, the Indian government unveiled the Vehicle Scrappage Policy, targeting the phasing out of polluting and unfit vehicles, irrespective of their age. This policy, set to be implemented by 2024, is steering consumers toward electric cars. Additionally, the government has set an ambitious target of having 30% of all cars in India electrified by 2030. These initiatives are poised to propel electric car sales during the 2024-2030 period in India.

India Electric Vehicle Industry Overview

The India Electric Vehicle Market is moderately consolidated, with the top five companies occupying 43.74%. The major players in this market are Ampere Vehicle Private Limited, Ather Energy Pvt. Ltd., Okinawa Autotech Pvt. Ltd., Ola Electric Mobility Pvt. Ltd. and TVS Motor Company Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Buses

- 5.1.1.2 Heavy-duty Commercial Trucks

- 5.1.1.3 Light Commercial Pick-up Trucks

- 5.1.1.4 Light Commercial Vans

- 5.1.1.5 Medium-duty Commercial Trucks

- 5.1.2 Passenger Vehicles

- 5.1.2.1 Hatchback

- 5.1.2.2 Multi-purpose Vehicle

- 5.1.2.3 Sedan

- 5.1.2.4 Sports Utility Vehicle

- 5.1.3 Two-Wheelers

- 5.1.1 Commercial Vehicles

- 5.2 Fuel Category

- 5.2.1 FCEV

- 5.2.2 HEV

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ampere Vehicle Private Limited

- 6.4.2 Ather Energy Pvt. Ltd.

- 6.4.3 BYD India Private Limited

- 6.4.4 Hero Electric Vehicles Pvt. Ltd.

- 6.4.5 Hyundai Motor India Limited

- 6.4.6 JBM Auto Limited

- 6.4.7 Mahindra & Mahindra Limited

- 6.4.8 MG Motor India Private Limited

- 6.4.9 Okinawa Autotech Pvt. Ltd.

- 6.4.10 Ola Electric Mobility Pvt. Ltd.

- 6.4.11 Olectra Greentech Ltd.

- 6.4.12 Switch Mobility (Ashok Leyland Limited)

- 6.4.13 Tata Motors Limited

- 6.4.14 Toyota Kirloskar Motor Pvt. Ltd.

- 6.4.15 TVS Motor Company Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms