|

市场调查报告书

商品编码

1693635

中国电动车:市场占有率分析、产业趋势与统计、成长预测(2025-2030年)China Electric Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

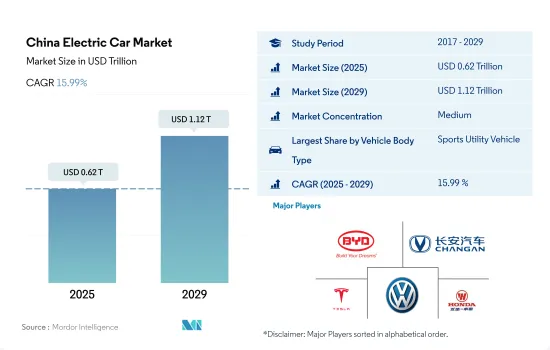

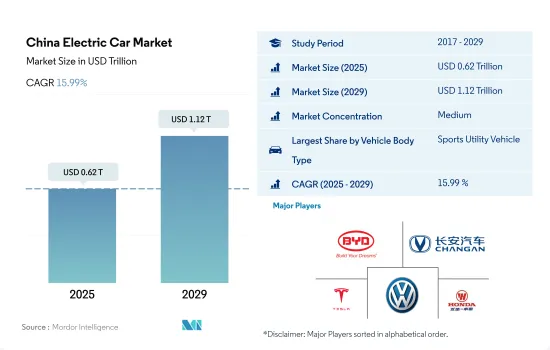

预计 2025 年中国电动车市场规模将达到 6,200 亿美元,到 2029 年预计将达到 1.12 兆美元,预测期内(2025-2029 年)的复合年增长率为 15.99%。

对多样化汽车组合的关注反映了中国引领电动车创新和满足广泛消费者偏好。

- 在中国充满活力的汽车市场中,电动车的兴起反映了消费者偏好和政策方向的更广泛转变,旨在培育更永续的交通生态系统,重塑不同汽车领域的市场动态。预计掀背车混合动力车市场将略有下滑,这表明市场正在向全面电气化进行调整,而轿车、SUV 和 MPV 市场预计将继续增长,这主要得益于绿色需求、技术进步和强有力的政府奖励。

- 混合动力汽车市场,尤其是轿车市场,经历了急剧的成长,并且由于中国积极的二氧化碳减排政策和补贴,混合动力汽车对消费者更具吸引力,预计还会进一步扩大。同样,SUV HEV 领域也正在经历指数级成长,显示人们明显偏好将 SUV 的实用性、多功能性与环境效益相结合的车辆。预计这一趋势将持续下去,混合动力技术的持续进步预计将在本世纪末带来可观的销售。

- MPV市场虽然规模较小,但却反映了这一上升趋势,并体现了中国消费者对宽敞、多功能和环保的交通解决方案的多样化需求。政府推行永续交通的政策以及充电基础设施和车辆技术的发展是推动这一成长的关键因素。随着中国继续推动电气化进程,这些汽车领域的不同发展轨迹揭示了一个复杂且快速发展的市场。

中国电动车市场趋势

政府措施和强劲的OEM投资推动中国电动车销售快速成长

- 政府减少汽车燃料排放的计画正在鼓励消费者转向更环保的汽车。 2020年11月,中国政府宣布将在2035年前禁止石化燃料汽车,并承诺在新能源计画下销售100%新能源汽车。这导致对电动车的需求增加。透过采取此类法规,中国近年来加强了电动车及其所用各种电池组的销售。

- 政府为消费者和製造商推出了各种计划和奖励,以促进和加强该国对电动车的需求。 2022年5月,政府宣布重新引入补贴计划,以增加电动车的销售量。此外,政府还将为选择电动车的客户提供1,500美元的补贴。这些因素正在鼓励消费者投资电动车,2022 年电动车销量将比 2021 年成长 2.90%。

- 电动车需求的不断增长迫使OEM计划扩大电动车类别的开发和生产。 2021年,通用汽车宣布计划在2025年将电动和自动驾驶汽车方面的支出增加到200亿美元。该公司计划在2023年推出20款新型电动车,并计划在中国每年销售超过100万辆电动车。因此,预计这些因素将在 2024 年至 2030 年期间推动中国电动车市场的发展。

中国电动汽车产业概况

中国电动车市场格局适度整合,前五大企业市占率达53.91%。市场的主要企业有:比亚迪汽车、重庆长安汽车股份有限公司、特斯拉公司、福斯汽车股份公司和五菱汽车控股有限公司(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 共乘

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 二手车销售

- 燃油价格

- OEM生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆配置

- 搭乘用车

- 掀背车

- 多用途车辆

- 轿车

- SUV

- 搭乘用车

- 燃料类别

- BEV

- FCEV

- HEV

- PHEV

第六章 竞争格局

- 重大策略倡议

- 市场占有率分析

- 商业状况

- 公司简介

- BYD Auto Co. Ltd.

- Chery Automobile Co. Ltd.

- Chongqing Changan Automobile Company Limited

- Gac Aion New Energy Automobile Co.Ltd

- Hozon New Energy Automobile Co. Ltd.

- Li Xiang(Li Auto Inc.)

- Nio(Anhui)Co. Ltd.

- Tesla Inc.

- Volkswagen AG

- Wuling Motors Holdings Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93023

The China Electric Car Market size is estimated at 0.62 trillion USD in 2025, and is expected to reach 1.12 trillion USD by 2029, growing at a CAGR of 15.99% during the forecast period (2025-2029).

The focus on diverse vehicle configurations mirrors China's ambition to lead in electric car innovation, catering to a broad spectrum of consumer preferences

- In China's vibrant automotive landscape, the push toward EVs is reshaping the market dynamics across different vehicle segments, reflecting broader shifts in consumer preferences and policy directives aimed at fostering a more sustainable transportation ecosystem. While the hatchback HEV segment anticipates a slight decline, signaling a market adjustment toward full electrification, the sedan, SUV, and MPV segments are poised for continued growth, propelled by a combination of eco-friendly demand, technological advancements, and strong governmental incentives.

- The sedan HEV market, in particular, has experienced dramatic increases, with projections indicating further expansion, underscored by China's aggressive carbon reduction policies and subsidies that make HEVs more appealing to consumers. Similarly, the SUV HEV sector has shown exponential growth, highlighting a clear preference for vehicles that merge environmental benefits with the practicality and versatility of SUVs. This trend is expected to continue, with sales projected to reach significant numbers by the end of the decade, driven by ongoing advancements in hybrid technology.

- The MPV segment, while smaller, mirrors this upward trajectory, showcasing the diverse needs of Chinese consumers for spacious, versatile, and eco-friendly transportation solutions. Government policies promoting sustainable transportation, alongside developments in charging infrastructure and vehicle technology, are key factors fueling this growth. As China continues to navigate its path toward electrification, the varying trajectories of these vehicle segments reveal a complex and rapidly evolving market.

China Electric Car Market Trends

Government initiatives and strong OEM investments drive rapid drowth in electric vehicle sales in China

- The programs launched by the government to reduce gas emissions caused by vehicle fuels are encouraging consumers to shift to green vehicles. In November 2020, the government of China announced a ban on fossil fuel vehicles by 2035, clearly stating the selling of 100% new energy vehicles under the new energy program. As a result, the demand for electric cars increased. Adopting such regulations enhanced the sales of electric cars and various types of battery packs used in them in China in recent years.

- The government is introducing various schemes and incentives for customers and manufacturers to promote and enhance the demand for electric vehicles in the country. In May 2022, the government announced the reintroduction of the subsidy program to increase the sales of electric vehicles. Moreover, the government will allocate a subsidy of USD 1500 to customers opting for an electric car. Such factors have encouraged customers to invest in electric mobility, which further has increased the sales of electric cars by 2.90% in 2022 over 2021 in China.

- The growing demand for electric vehicles has forced OEMs to plan to increase development and production in the electric vehicle category. In 2021, General Motors announced its plans to raise its spending on electric and autonomous vehicles to USD 20 billion by 2025. The company is expected to launch 20 new electric models by 2023 and aims to sell more than 1 million electric cars a year in China. As a result, these factors are expected to drive the electric vehicle market in China during the 2024-2030 period.

China Electric Car Industry Overview

The China Electric Car Market is moderately consolidated, with the top five companies occupying 53.91%. The major players in this market are BYD Auto Co. Ltd., Chongqing Changan Automobile Company Limited, Tesla Inc., Volkswagen AG and Wuling Motors Holdings Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchback

- 5.1.1.2 Multi-purpose Vehicle

- 5.1.1.3 Sedan

- 5.1.1.4 Sports Utility Vehicle

- 5.1.1 Passenger Cars

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Auto Co. Ltd.

- 6.4.2 Chery Automobile Co. Ltd.

- 6.4.3 Chongqing Changan Automobile Company Limited

- 6.4.4 Gac Aion New Energy Automobile Co.Ltd

- 6.4.5 Hozon New Energy Automobile Co. Ltd.

- 6.4.6 Li Xiang (Li Auto Inc.)

- 6.4.7 Nio (Anhui) Co. Ltd.

- 6.4.8 Tesla Inc.

- 6.4.9 Volkswagen AG

- 6.4.10 Wuling Motors Holdings Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219