|

市场调查报告书

商品编码

1693636

欧洲轻型商用车电气化:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Europe Electric Light Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

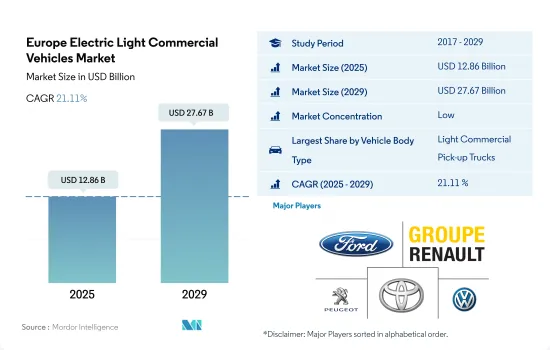

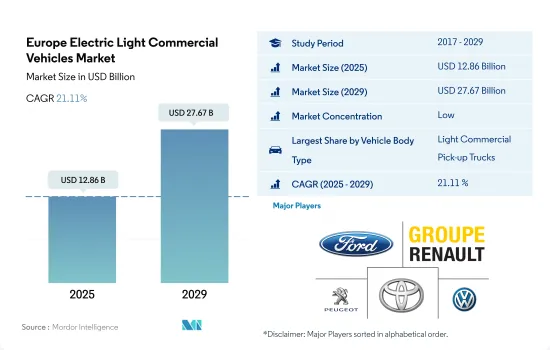

预计 2025 年欧洲轻型商用车市场规模将达到 128.6 亿美元,预计到 2029 年将达到 276.7 亿美元,预测期内(2025-2029 年)的复合年增长率为 21.11%。

欧洲在推动轻型商用车电气化方面发挥先锋作用,其配置可满足各种业务需求。

- 以货车和厢型车为特征的欧洲轻型商用车 (ELCV) 市场正在经历重大变革时期,这得益于向永续性和电气化的转变。特别是在货车领域,各大汽车製造商正在推出电动车,以满足日益增长的零排放汽车需求。例如,日产推出新款 Townstar 货车,这是取代 e-NV200 的战略倡议,提供全电动选择,旨在加速向零排放汽车的过渡。

- 欧洲市场动态受到多种因素的影响,包括技术进步、法律规范以及电子商务的成长,这些都推动了对高效最后一哩交付解决方案的需求。然而,市场面临的挑战包括商用车註册量整体下降和货车销售下降,部分原因是疫情对经济的影响以及旨在减少排放的监管环境的变化。

- 随着人们越来越关注减少温室气体排放和改善都市区空气质量,欧洲 ELCV 市场提供了多种机会。大众汽车计划在 2030 年之前在欧洲建立六家电池工厂等措施凸显了该行业对扩大电动车生态系统的承诺。此外,该领域的合作与创新,例如邦奇动力传动系统与 Gruau 达成的开发永续ELCV 的协议,预示着未来电动货车和卡车将在商业运输中发挥核心作用。

欧洲轻型商用车市场新兴国家的发展反映了欧洲大陆在电气化进程中的领导地位。

- 全球整体商用车销量达1770万辆。欧洲新註册的厢型车、卡车和巴士超过 290 万辆,占全球总量的 16.4%。由于人们对环境问题的日益关注、政府计划在 2030 年前禁止使用内燃机以及人们普遍认识到燃油效率和零排放等环保汽车的好处,消费者的购买习惯正在转向电动车。

- 新冠疫情对文化和经济产生了前所未有的影响。汽车产业也受到较大影响,復苏可能仍需时日;未来还面临许多挑战。儘管如此,义大利政府仍预测自 2025 年起电动车的普及率将大幅增加。此外,2019年12月,欧盟委员会核准七个成员国提供32亿欧元公共资金,用于泛欧研究和创新计划。它将促进锂离子电池高度创新和永续的技术发展,包括整个电池价值链直至首次工业部署的研发活动。

- 政府优先发展电池、汽车、充电站、数位行动应用程式、资讯通讯技术、智慧运输和能源服务,以加速未来几年电动车的普及。由于电子商务和物流活动的成长,对电动商用车的需求预计会增加。

欧洲轻型商用车市场趋势

环境问题、政府支持和脱碳目标刺激了欧洲电动车的需求和销售

- 过去几年,欧洲国家对电动车的需求和销售量大幅成长。德国 2022 年电动车销量与 2021 年相比成长了 22%,其次是英国,2022 年电动车销量与 2021 年相比成长了 18.40%。日益增长的环境问题、严格的政府规范、电动车的优势(例如更好的燃油经济性、更低的服务成本、更少的碳排放)以及政府补贴是推动欧洲国家电动车成长的一些因素。

- 欧洲国家对电动商用车,特别是轻型卡车的需求逐渐增加。此外,世界各国政府也支持电动车的普及。 2021年11月,英国政府宣布承诺在2040年实现所有重型车辆零排放。这些因素将使2022年英国电动商用车销量较2021年成长23.17%,各国类似做法将提振整个欧洲对电动商用车的需求。

- 预计未来几年欧洲国家的汽车电气化将呈指数级增长。预计政府在脱碳方面的努力将推动欧洲电动商用车市场的发展。例如,2022年1月,德国交通部长宣布了2030年道路上电动车保有量达到1,500万辆的目标。受这些因素影响,预计2024年至2030年间欧洲国家的电动车销量将会成长。

欧洲轻型商用车产业概况

欧洲轻型商用车市场较为分散,前五大企业占32.16%。市场的主要企业是:福特汽车公司、雷诺集团、标緻汽车公司、丰田汽车公司和大众汽车公司(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 物流绩效指数

- 燃油价格

- OEM生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆配置

- 轻型商用车

- 燃料类别

- BEV

- FCEV

- HEV

- PHEV

- 国家

- 奥地利

- 比利时

- 捷克共和国

- 丹麦

- 爱沙尼亚

- 法国

- 德国

- 爱尔兰

- 义大利

- 拉脱维亚

- 立陶宛

- 挪威

- 波兰

- 俄罗斯

- 西班牙

- 瑞典

- 英国

- 其他欧洲国家

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- ADDAX MOTORS NV.

- ARRIVAL LTD.

- Daimler AG(Mercedes-Benz AG)

- Fiat Chrysler Automobiles NV

- Ford Motor Company

- Groupe Renault

- Maxus

- Nissan Motor Co. Ltd.

- Peugeot SA

- Toyota Motor Corporation

- Volkswagen AG

- Volvo Group

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93024

The Europe Electric Light Commercial Vehicles Market size is estimated at 12.86 billion USD in 2025, and is expected to reach 27.67 billion USD by 2029, growing at a CAGR of 21.11% during the forecast period (2025-2029).

Europe has a pioneering role in driving the adoption of electric light commercial vehicles with configurations suited to various business needs

- The European electric light commercial vehicles (ELCVs) market, characterized by cargo trucks and vans, is undergoing significant transformations driven by a shift toward sustainability and electrification. The van segment, in particular, has seen notable activity, with major automotive players introducing electric variants to cater to the rising demand for zero-emission vehicles. For example, Nissan's introduction of the all-new Townstar van represents a strategic move to replace the e-NV200, offering a fully electric option designed to accelerate the transition to zero-emission motoring.

- The European market's dynamics are influenced by various factors, including technological advancements, regulatory frameworks, and the growth of e-commerce, which has increased the demand for efficient last-mile delivery solutions. However, the market has faced challenges, such as the overall decline in commercial vehicle registrations and the specific downturn in van sales, attributed partly to the economic impact of the pandemic and the changing regulatory landscape aimed at reducing emissions.

- The ELCV market in Europe presents several opportunities, underpinned by the growing emphasis on reducing greenhouse gas emissions and improving urban air quality. Initiatives like Volkswagen's plan to set up six battery factories across Europe by 2030 underscore the industry's commitment to expanding the electric vehicle ecosystem. Additionally, collaborations and innovations in the sector, such as Punch Powertrain's agreement with Gruau to develop sustainable ELCVs, signal a future where electric vans and trucks play a central role in commercial transportation.

Country-specific developments in the European electric light commercial vehicles market are showcasing the continent's leadership in electrification efforts

- Globally, sales of commercial vehicles reached a total of 17.7 million each year. With more than 2.9 million new vans, trucks, and buses, Europe accounts for 16.4% of global registrations. Consumer purchasing habits have shifted in favor of electric vehicles due to increasing environmental concerns, the government's plan to ban internal combustion engines by 2030, and a general understanding of the benefits of eco-friendly vehicles, such as fuel efficiency and zero emissions.

- The COVID-19 pandemic has had unparalleled repercussions on culture and the economy. The automobile industry has experienced significant effects, and the recovery process is still expected to be drawn out and challenging. Despite this, the Italian government continues to predict that starting in 2025, the use of electric vehicles will significantly expand. Additionally, the European Commission approved public financing of EUR 3.2 billion in December 2019 from seven Member States for pan-European research and innovation projects. This promotes the development of highly innovative and sustainable technologies for lithium-ion batteries, involving R&I activities up to the first industrial deployment along the entire battery value chain.

- The government has prioritized the development of batteries, vehicles, charging stations, digital mobility apps, ICT, smart mobility, and energy services to accelerate the adoption of electric vehicles in the coming years. The demand for electric commercial vehicles is anticipated to increase due to the growth of e-commerce and logistical activities.

Europe Electric Light Commercial Vehicles Market Trends

Environmental concerns, government support, and decarbonization goals fuel European electric vehicle demand and sales

- The demand and sales of electric vehicles in European countries have grown significantly over the past few years. Germany witnessed a growth in the sales of electric cars by 22% in 2022 over 2021, followed by the United Kingdom with an 18.40% increase in 2022 over 2021. Growing environmental concerns, stringent governmental norms, advantages of electric vehicles such as fuel efficiency, low service cost, no carbon emissions, and subsidies by the government are some of the factors contributing to the growth of electric vehicles in European countries.

- The demand for electric commercial vehicles, especially light trucks, is growing gradually in European countries. Moreover, the governments of various countries are also supporting the adoption of electric vehicles. In November 2021, the government of the United Kingdom announced a pledge that all heavy-duty vehicles would be zero-emission by the year 2040. Such factors have increased the sales of electric commercial vehicles in the United Kingdom by 23.17% in 2022 over 2021, and similar practices in various countries are enhancing the demand for electric commercial vehicles across Europe.

- It is projected that the electrification of vehicles in European countries is expected to grow tremendously in the next few years. The efforts of the governments in the regions for decarbonization are expected to drive the electric commercial vehicle market in Europe. For instance, in January 2022, the transport minister of Germany announced a goal to put 15 million electric vehicles on the road by 2030. Such factors are expected to increase the sales of electric vehicles during the 2024-2030 period in European countries.

Europe Electric Light Commercial Vehicles Industry Overview

The Europe Electric Light Commercial Vehicles Market is fragmented, with the top five companies occupying 32.16%. The major players in this market are Ford Motor Company, Groupe Renault, Peugeot S.A., Toyota Motor Corporation and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Light Commercial Vehicles

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Country

- 5.3.1 Austria

- 5.3.2 Belgium

- 5.3.3 Czech Republic

- 5.3.4 Denmark

- 5.3.5 Estonia

- 5.3.6 France

- 5.3.7 Germany

- 5.3.8 Ireland

- 5.3.9 Italy

- 5.3.10 Latvia

- 5.3.11 Lithuania

- 5.3.12 Norway

- 5.3.13 Poland

- 5.3.14 Russia

- 5.3.15 Spain

- 5.3.16 Sweden

- 5.3.17 UK

- 5.3.18 Rest-of-Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 ADDAX MOTORS NV.

- 6.4.2 ARRIVAL LTD.

- 6.4.3 Daimler AG (Mercedes-Benz AG)

- 6.4.4 Fiat Chrysler Automobiles N.V

- 6.4.5 Ford Motor Company

- 6.4.6 Groupe Renault

- 6.4.7 Maxus

- 6.4.8 Nissan Motor Co. Ltd.

- 6.4.9 Peugeot S.A.

- 6.4.10 Toyota Motor Corporation

- 6.4.11 Volkswagen AG

- 6.4.12 Volvo Group

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219