|

市场调查报告书

商品编码

1693651

欧洲电动车:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

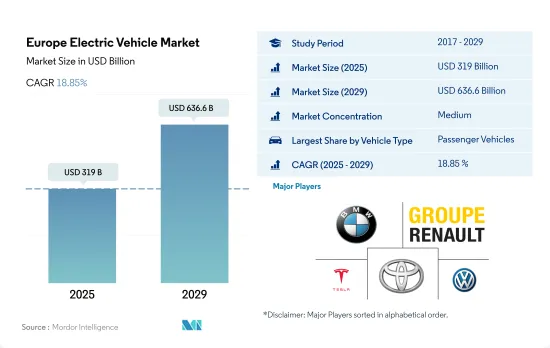

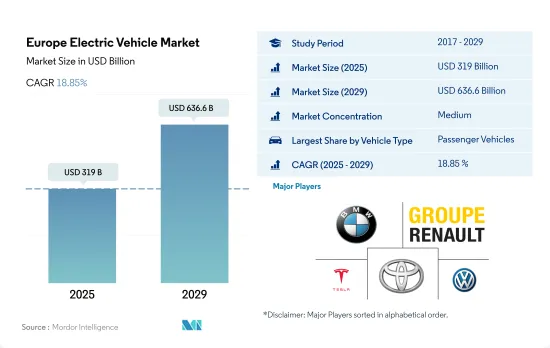

预计 2025 年欧洲电动车市场规模为 3,190 亿美元,到 2029 年将达到 6,366 亿美元,预测期内(2025-2029 年)的复合年增长率为 18.85%。

物流、供应链、基础设施和建筑行业的成长以及公共运输服务的增加将增强欧洲电动车市场

- 未来几年商用车的需求将大幅成长。这一成长的主要驱动力是物流、供应链、基础设施和建筑业。公共交通的增加也推动了对公车的需求。然而,受疫情影响,2020年商用车销量大幅下滑。 2021年市场迅速復苏,欧洲气候计画发挥了关键作用。随着欧洲计划在 2030 年前禁止柴油引擎汽车,我们预计商用消费者将明显转向电动商用汽车。

- 在整个欧洲,新产品的推出和战略合作伙伴关係(例如现代与 H2 Energy 的合作)有望推动电动卡车的销售。基于这项合作,现代氢能移动出行公司 (HHM) 于 2019 年 9 月成立,其愿景是在瑞士和欧洲培育绿色氢能生态系统。 HHM 有一个雄心勃勃的目标,即到 2025 年在其车队中拥有 1,600 辆燃料电池电动重型卡车。预计这些努力将在 2024 年至 2030 年期间促进欧洲重型电动卡车的销售。

- 2021年,德国公共运输领域的电动公车数量几乎翻了一番,新註册车辆数量从前一年的689辆跃升60%至1269辆。其中,586辆为电池式电动车,只有少数使用燃料电池或其他技术。此外,德国当地交通运输业者和政府机构都计划在 2025 年之前在其车队中增加 3,000 多辆电动公车。其他欧洲国家的类似趋势可能会在 2024 年至 2030 年期间推动整个欧洲商用车市场的发展。

欧洲电动车市场的特点是各国之间存在差异,反映了奖励、基础设施和消费者偏好的差异。

- 欧洲是世界上最大的电动车生产地之一。从全球来看,它是采用电动车速度最快的国家之一。就电动车而言,到 2023 年,纯电动车将占全部区域所有新乘用车註册量的最大份额,达到 8.3%。预计到2030年和2035年,大多数国家将禁止使用汽油动力汽车,这将推动电动车的销售。

- 新产品的推出和新品牌的进入预计将推动欧洲乘用车市场的发展。 2022年2月,中国汽车製造商小鹏汽车推出电动轿车P7和P5,进入瑞典电动乘用车市场。 2022年6月,美国汽车製造商福特宣布,2030年将在欧洲只生产和销售电动车。该公司计划投资114亿美元在其位于西班牙瓦伦西亚的製造工厂生产电动车。

- 由于政府的退税和补贴等倡议,电动车在欧洲国家越来越受欢迎。例如,到2023年,新电动车将获得2,950欧元的补贴,二手电动车将获得约2,000欧元的补贴。但车辆价格必须至少为12,000欧元,最多为45,000欧元。这些优势正在吸引客户对电动车的兴趣,预计2024年至2030年间欧洲国家对各种类型电动车的需求将会增加。

欧洲电动车市场趋势

环境问题、政府支持和脱碳目标刺激了欧洲电动车的需求和销售

- 近年来,欧洲国家对电动车的需求和销售量大幅成长。德国 2022 年电动车销量与 2021 年相比成长了 22%,其次是英国,2022 年电动车销量与 2021 年相比成长了 18.40%。日益增长的环境问题、严格的政府规范、电动车的优势(例如更好的燃油经济性、更低的服务成本、更少的碳排放)以及政府补贴是推动欧洲国家电动车成长的一些因素。

- 欧洲国家对电动商用车,特别是轻型卡车的需求逐渐增加。此外,世界各国政府也支持电动车的普及。 2021年11月,英国政府宣布承诺在2040年实现所有重型车辆零排放。这些因素将使2022年英国电动商用车销量较2021年成长23.17%,不同国家的类似做法将推动整个欧洲对电动商用车的需求。

- 预计未来几年欧洲国家的汽车电气化将呈指数级增长。预计政府在脱碳方面的努力将推动欧洲电动商用车市场的发展。例如,2022年1月,德国交通部长宣布了2030年道路上电动车保有量达到1,500万辆的目标。受这些因素影响,预计2024年至2030年间欧洲国家的电动车销量将会成长。

欧洲电动车产业概况

欧洲电动车市场适度整合,前五大企业占43.69%。市场的主要企业有:Bayerische Motoren Werke AG、雷诺集团、特斯拉公司、丰田汽车公司和大众汽车公司(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 共乘

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 二手车销售

- 燃油价格

- OEM生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆类型

- 商用车

- 搭乘用车

- 掀背车

- 多用途车辆

- 轿车

- SUV

- 摩托车

- 燃料类别

- BEV

- FCEV

- HEV

- PHEV

- 国家

- 奥地利

- 比利时

- 捷克共和国

- 丹麦

- 爱沙尼亚

- 法国

- 德国

- 爱尔兰

- 义大利

- 拉脱维亚

- 立陶宛

- 挪威

- 波兰

- 俄罗斯

- 西班牙

- 瑞典

- 英国

- 其他欧洲国家

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Audi AG

- Bayerische Motoren Werke AG

- Groupe Renault

- Hyundai Motor Company

- Kia Corporation

- Mercedes-Benz

- Tesla Inc.

- Toyota Motor Corporation

- Volkswagen AG

- Volvo Car AB

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93039

The Europe Electric Vehicle Market size is estimated at 319 billion USD in 2025, and is expected to reach 636.6 billion USD by 2029, growing at a CAGR of 18.85% during the forecast period (2025-2029).

The growing logistics, supply chain, infrastructure, and construction sectors and the rise in public transportation services are bolstering the European EV market

- The demand for commercial vehicles is set to witness a significant uptick in the coming years. Key drivers of this growth include the logistics, supply chain, infrastructure, and construction sectors. Additionally, a rise in public transportation services is bolstering the demand for buses. However, the sales of commercial vehicles experienced a downturn in 2020, largely due to the impact of the pandemic. The market swiftly rebounded in 2021, with Europe's Climate Plan playing a pivotal role. As Europe aims to ban diesel-powered vehicles by 2030, a notable shift is expected to be witnessed among business consumers toward electric commercial vehicles.

- Across Europe, the introduction of new products and strategic collaborations, such as the partnership between Hyundai Motor Company and H2 Energy, are poised to drive sales of electric trucks. This collaboration produced Hyundai Hydrogen Mobility (HHM) in September 2019 with a vision to foster a green hydrogen ecosystem in Switzerland and Europe. HHM has set an ambitious target of introducing 1,600 fuel-cell electric heavy-duty trucks by 2025. Such initiatives are expected to fuel the sales of heavy electric trucks in Europe from 2024 to 2030.

- In 2021, the number of electric buses in Germany's public transport sector nearly doubled, with new registrations surging by 60% to reach 1,269, up from 689 in the previous year. Of these, 586 were battery electric vehicles, while only a handful was fuel cell-powered or utilized other technologies. Furthermore, both local transport companies and government bodies in Germany have plans to add over 3,000 e-buses by 2025. Similar trends in other European nations are poised to propel the overall commercial vehicle market in Europe from 2024 to 2030.

The European electric vehicles market is characterized by country-level variations, reflecting differing incentives, infrastructure, and consumer preferences

- Europe is one of the largest electric vehicle manufacturers globally. Globally, it has one of the fastest adoptions of electric mobility. In terms of electric vehicles, sales of electric passenger cars accounted for the largest share of 8.3% of all newly registered cars across the region in 2023, which were fully electric. Gasoline-powered vehicles are expected to be banned by 2030 and 2035 in most countries, providing a boost to the sales of electric vehicles.

- The launch of new products and the entry of new brands are expected to drive the market for passenger cars in Europe. In February 2022, the Chinese automaker Xpeng entered Sweden's electric passenger cars with its debut electric cars, P7 and P5 sedans. In June 2022, the American automaker Ford announced that it would produce and sell only electric cars in Europe by 2030. The company plans to invest USD 11.4 billion in producing an electric car at a manufacturing plant in Valencia, Spain.

- Several government efforts in terms of rebates and subsidies are increasing the adoption of electric vehicles in various European countries. For instance, in 2023, a subsidy of EUR 2,950 was made eligible for new battery electric cars and a subsidy of around EUR 2,000 for used battery electric cars. However, the price of the vehicles should be a minimum of EUR 12,000 and a maximum of EUR 45,000. Such advantages attract customer attention to these vehicles, which is expected to enhance the demand for various types of electric vehicles in European countries from 2024 to 2030.

Europe Electric Vehicle Market Trends

Environmental concerns, government support, and decarbonization goals fuel European electric vehicle demand and sales

- The demand and sales of electric vehicles in European countries have grown significantly over the past few years. Germany witnessed a growth in the sales of electric cars by 22% in 2022 over 2021, followed by the United Kingdom with an 18.40% increase in 2022 over 2021. Growing environmental concerns, stringent governmental norms, advantages of electric vehicles such as fuel efficiency, low service cost, no carbon emissions, and subsidies by the government are some of the factors contributing to the growth of electric vehicles in European countries.

- The demand for electric commercial vehicles, especially light trucks, is growing gradually in European countries. Moreover, the governments of various countries are also supporting the adoption of electric vehicles. In November 2021, the government of the United Kingdom announced a pledge that all heavy-duty vehicles would be zero-emission by the year 2040. Such factors have increased the sales of electric commercial vehicles in the United Kingdom by 23.17% in 2022 over 2021, and similar practices in various countries are enhancing the demand for electric commercial vehicles across Europe.

- It is projected that the electrification of vehicles in European countries is expected to grow tremendously in the next few years. The efforts of the governments in the regions for decarbonization are expected to drive the electric commercial vehicle market in Europe. For instance, in January 2022, the transport minister of Germany announced a goal to put 15 million electric vehicles on the road by 2030. Such factors are expected to increase the sales of electric vehicles during the 2024-2030 period in European countries.

Europe Electric Vehicle Industry Overview

The Europe Electric Vehicle Market is moderately consolidated, with the top five companies occupying 43.69%. The major players in this market are Bayerische Motoren Werke AG, Groupe Renault, Tesla Inc., Toyota Motor Corporation and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.2 Passenger Vehicles

- 5.1.2.1 Hatchback

- 5.1.2.2 Multi-purpose Vehicle

- 5.1.2.3 Sedan

- 5.1.2.4 Sports Utility Vehicle

- 5.1.3 Two-Wheelers

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Country

- 5.3.1 Austria

- 5.3.2 Belgium

- 5.3.3 Czech Republic

- 5.3.4 Denmark

- 5.3.5 Estonia

- 5.3.6 France

- 5.3.7 Germany

- 5.3.8 Ireland

- 5.3.9 Italy

- 5.3.10 Latvia

- 5.3.11 Lithuania

- 5.3.12 Norway

- 5.3.13 Poland

- 5.3.14 Russia

- 5.3.15 Spain

- 5.3.16 Sweden

- 5.3.17 UK

- 5.3.18 Rest-of-Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Audi AG

- 6.4.2 Bayerische Motoren Werke AG

- 6.4.3 Groupe Renault

- 6.4.4 Hyundai Motor Company

- 6.4.5 Kia Corporation

- 6.4.6 Mercedes-Benz

- 6.4.7 Tesla Inc.

- 6.4.8 Toyota Motor Corporation

- 6.4.9 Volkswagen AG

- 6.4.10 Volvo Car AB

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219