|

市场调查报告书

商品编码

1693653

电动车:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Electric Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

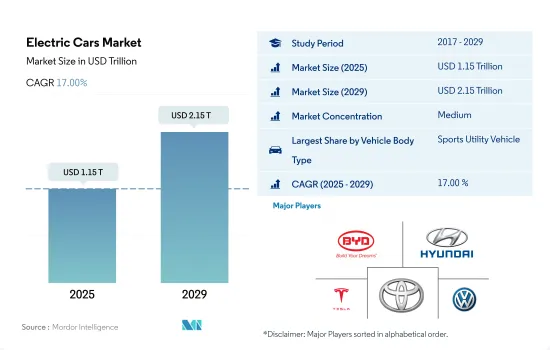

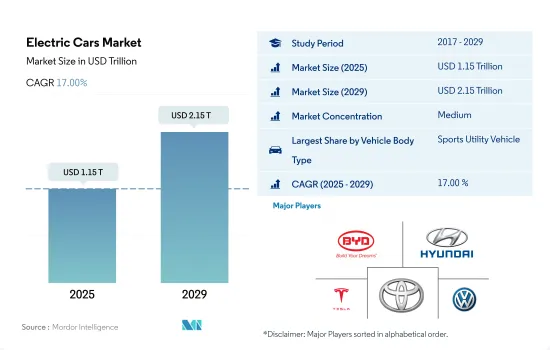

电动车市场规模预计在 2025 年达到 1.15 兆美元,预计到 2029 年将达到 2.15 兆美元,预测期内(2025-2029 年)的复合年增长率为 17.00%。

对减少石化燃料对环境产生负面影响的车辆的需求不断增长,推动了市场的成长

- 受新冠疫情影响,全球晶片短缺、供应链中断,汽车产业受到严重影响。儘管如此,特斯拉仍因其製造方法和生产的汽车导致气候变迁而受到批评。值得注意的是,欧盟消费者越来越多地选择能够减少石化燃料带来的负面环境影响的汽车。

- 去年,全球汽车市场受到了新冠疫情的重大影响。由于世界各地为应对疫情而实施旅行限制,该行业面临多重挫折。 2020年全球汽车销量达6,380万辆。预计2021年销量将逐步復苏,达到6,600万辆左右,但丰田、福斯集团等主要企业的销量下降了100万辆以上。

- 2021年全球乘用车销量约5,640万辆,较上年成长近5%。中国成为最大的区域市场,销售量接近 2,150 万台。未来十年汽车产业将发生重大变革。预计到 2030 年,全球新车销量的 26% 左右将是电动车。到2022年,全球市场将新增约5,800万辆自动驾驶汽车。这些技术进步正在重塑汽车供应链,尤其是汽车电子领域。随着自动化和电气化的兴起,汽车市场的未来前景光明。

- 2020年全球电动车消费支出达1,200亿美元,世界各国政府拨款约140亿美元激励电动车销售。这些努力已获得回报:2019 年电动车销量成长了 25%,这主要得益于欧洲加大的奖励。汽车电池产量也将大幅成长,到2020年将成长33%,达到160吉瓦。同时,这些电池的平均成本将下降13%,至137美元/度。根据国家电动车政策,世界各国政府都为电动车购买者和租赁者提供购置税、增值税甚至年度道路保险费的减免。

- 为了鼓励人们使用插电式电动车,政府推出了许多政策,为购买电动车提供有吸引力的奖励。例如,挪威目前拥有超过16,000个充电站,而2011年只有3,000个。挪威政府在所有主要路线上每隔50公里就设置了一个快速充电站,其中包括世界上最高的快速充电站。挪威的电动车充电站前景光明。

- 全球范围内对电动车有一些非常有吸引力的奖励。整体来看,目前许多国家已经签署了《巴黎协定》,目标是在汽车政策的支持下,到2030年将温室气体排放量减少40%。 2017 年国家交通计画已经制定了国家汽车目标,包括到 2030 年销售完全零排放汽车。挪威也承诺2030年将温室气体排放减少至少40%。所有这些因素都有望推动挪威电动车市场的成长。

全球电动车市场趋势

全球需求成长和政府支持将推动电动车市场成长

- 电动车(EV)已成为汽车产业的重要组成部分,因为它具有提高能源效率、减少温室气体和污染排放的潜力。这种快速成长背后的主要因素是日益增长的环境问题和政府的支持。其中,电动车全球销售呈现强劲成长势头,2022年较2021年成长10.82%。据预测,2025年底,电动乘用车年销量将超过500万辆,约占汽车总销量的15%。

- 领先的製造商和组织(例如伦敦警察厅和消防队)正在积极推行电动车策略。例如,该公司设定了在 2025 年实现零排放汽车、在 2030 年实现 40% 货车电气化、到 2040 年实现全电动化的目标。预计全球也将出现类似的趋势,2024 年至 2030 年间电动车的需求和销售量将急剧成长。

- 在电池技术和汽车电气化进步的推动下,亚太地区和欧洲有望主导电动车生产。 2020年5月,起亚汽车欧洲公司公布“S计划”,宣布转向电动化策略。这项决定是在起亚电动车在欧洲创下销售纪录之际做出的。起亚雄心勃勃地计划在 2025 年之前在全球推出 11 款电动车,涵盖轿车、SUV 和 MPV 等各个领域。该公司的目标是到 2026 年实现全球电动车年销量达到 50 万辆。

电动汽车产业概况

电动车市场适度整合,前五大公司占44.50%的市场。该市场的主要企业是:比亚迪汽车、现代汽车公司、特斯拉公司、丰田汽车公司和大众汽车公司(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 人均GDP

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 消费者汽车购买支出(cvp)

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 通货膨胀率

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 汽车贷款利率

- 共乘

- 电气化的影响

- 电动车充电站

- 电池组价格

- 非洲

- 亚太地区

- 欧洲

- 中东

- 北美洲

- 南美洲

- 新款 Xev 车型发布

- 二手车销售

- 燃油价格

- OEM生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆配置

- 搭乘用车

- 多用途车辆

- 搭乘用车

- 燃料类别

- BEV

- FCEV

- HEV

- PHEV

- 地区

- 非洲

- 南非

- 亚太地区

- 印度

- 欧洲

- 捷克共和国

- 英国

- 中东

- 阿拉伯聯合大公国

- 北美洲

- 墨西哥

- 南美洲

- 巴西

- 非洲

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- BYD Auto Co. Ltd.

- Daimler AG(Mercedes-Benz AG)

- Ford Motor Company

- General Motors Company

- Groupe Renault

- Hyundai Motor Company

- Nissan Motor Co. Ltd.

- Stellantis NV

- Tesla Inc.

- Toyota Motor Corporation

- Volkswagen AG

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93046

The Electric Cars Market size is estimated at 1.15 trillion USD in 2025, and is expected to reach 2.15 trillion USD by 2029, growing at a CAGR of 17.00% during the forecast period (2025-2029).

Increasing demand for vehicles mitigating the negative environmental impacts associated with fossil fuels is boosting the growth of the market

- The automotive industry was significantly impacted by the global chip shortages and supply chain disruptions stemming from the COVID-19 pandemic. Despite this, Tesla faced criticism for its perceived contributions to climate change, both in its manufacturing practices and the vehicles it produces. Notably, EU consumers are increasingly opting for vehicles that mitigate the negative environmental impacts associated with fossil fuels.

- The global automotive market witnessed significant repercussions from the COVID-19 pandemic in the past year. As travel restrictions were imposed worldwide in response to the pandemic, the industry faced several setbacks. In 2020, global car sales reached 63.8 million units. While a modest recovery was anticipated in 2021, and around 66 million cars were expected to be sold, major players like Toyota and the Volkswagen Group saw their deliveries decline by over a million units.

- In 2021, global passenger car sales reached approximately 56.4 million units, marking a nearly 5% increase from the previous year. China emerged as the largest regional market, accounting for just under 21.5 million units. The automotive landscape is poised for significant transformation in the coming decade. By 2030, it is projected that electric vehicles will make up around 26% of global new car sales. By 2022, around 58 million self-driving cars joined the global fleet. Such technological advancements are reshaping the automotive supply chain, particularly in the realm of automotive electronics. With the rise of automation and electrification, the future of the automotive market looks promising.

- In 2020, global consumer spending on electric cars reached USD 120 billion, while governments worldwide allocated nearly USD 14 billion to incentivize electric vehicle sales. These efforts paid off, with electric vehicle sales surging by 25% in 2019, largely driven by enhanced incentives in Europe. The production of automotive batteries also saw a significant uptick, rising by 33% to reach 160 GWh in 2020. Simultaneously, the average cost of these batteries dropped by 13% to USD 137/kWh. Governments globally, under their National EV Policies, exempt electric vehicle buyers and lessees from purchase tax, VAT, and even annual road traffic insurance charges.

- In order to boost the fleet of plug-in electric cars, many government policies have been established to offer several enticing incentives for buying electric vehicles. For instance, there are currently more than 16,000 charging stations in Norway, up from just 3,000 in 2011. On all important routes, including the highest fast-charging station in the entire world, the Norwegian government erected fast-charging stations every 50 km. EV charging stations appear to have a promising future in Norway.

- There are several highly attractive incentives for electric vehicles globally. Overall, many countries signed Paris Climate Policy targets, which call for a 40% decrease in greenhouse gas emissions by 2030, supported by the automobile policy. National vehicle targets, including the sale of entirely zero-emission cars by 2030, were already established by the National Transport Plan in 2017. Norway has also committed to reducing greenhouse gas emissions by at least 40% by 2030. These factors are all expected to boost the growth of the Norwegian electric car market.

Global Electric Cars Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Electric Cars Industry Overview

The Electric Cars Market is moderately consolidated, with the top five companies occupying 44.50%. The major players in this market are BYD Auto Co. Ltd., Hyundai Motor Company, Tesla Inc., Toyota Motor Corporation and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.9.1 Africa

- 4.9.2 Asia-Pacific

- 4.9.3 Europe

- 4.9.4 Middle East

- 4.9.5 North America

- 4.9.6 South America

- 4.10 New Xev Models Announced

- 4.11 Used Car Sales

- 4.12 Fuel Price

- 4.13 Oem-wise Production Statistics

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Passenger Cars

- 5.1.1.1 Multi-purpose Vehicle

- 5.1.1 Passenger Cars

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 South Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 India

- 5.3.3 Europe

- 5.3.3.1 Czech Republic

- 5.3.3.2 UK

- 5.3.4 Middle East

- 5.3.4.1 UAE

- 5.3.5 North America

- 5.3.5.1 Mexico

- 5.3.6 South America

- 5.3.6.1 Brazil

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Auto Co. Ltd.

- 6.4.2 Daimler AG (Mercedes-Benz AG)

- 6.4.3 Ford Motor Company

- 6.4.4 General Motors Company

- 6.4.5 Groupe Renault

- 6.4.6 Hyundai Motor Company

- 6.4.7 Nissan Motor Co. Ltd.

- 6.4.8 Stellantis N.V.

- 6.4.9 Tesla Inc.

- 6.4.10 Toyota Motor Corporation

- 6.4.11 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219