|

市场调查报告书

商品编码

1693700

印度软体服务出口 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)India Software Services Export - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

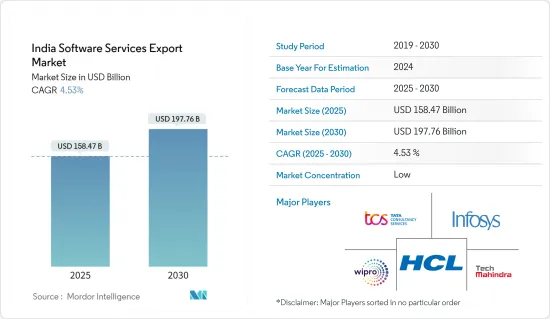

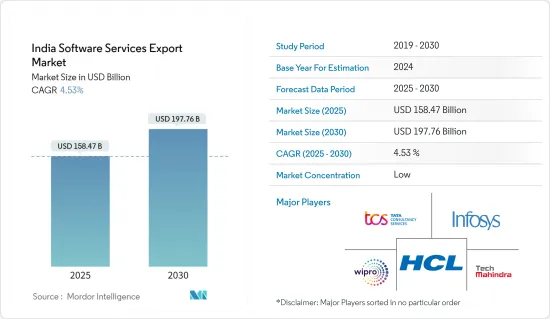

印度软体服务出口市场规模预计在 2025 年为 1,584.7 亿美元,预计到 2030 年将达到 1977.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.53%。

北美和欧洲国家的云端转型高成本,缺乏合适的资源,因此选择印度,因为印度处于境外外包外包的前沿,并且正在更新新趋势、新技术和新技巧。预计这些因素将有助于预测期内市场的扩张。

关键亮点

- 各行各业的快速数字转型、物联网、人工智慧和区块链等新技术的采用,以及透过外包非核心业务越来越注重利用核心竞争力,是市场的主要驱动力。

- 数位转型 (DX) 和 IT 现代化支出已成为印度企业的首要任务,因为他们倾向于使用云端、人工智慧 (AI)、自动化、网路基础设施、物联网 (IoT) 和其他先进技术进行数位转型。

- 向云端服务的日益转变是市场的主要驱动力,从而带来了可观的收益合作。云端迁移允许大大小小的企业将其软体应用程式、资料库和其他 IT 资源迁移到云端伺服器,从而创建一个无缝、安全和透明的系统。这使得企业软体开发生命週期流程管理更有效率。企业通常会投资云端迁移策略,以获得更好的可扩展性、可用性和更快的软体服务部署。

- 印度的国家软体产品政策部分由下一代孵化计划(NGIS)解决,该计划已获核准用于支援软体产品生态系统。蓬勃发展的软体产品生态系统旨在帮助持续扩大强大的 IT 产业、创造新的就业机会并提高竞争力。根据NASSCOM估计,印度软体产品产业在23财年的营收将创下历史新高,达到142亿美元。

- 然而,管理法规和合规需求等因素可能会在预测期内抑制市场成长。这会给企业带来成本,因为它会增加营运成本,由于严格的资料保护法而限制服务交付,并且由于需要不断适应不断变化和发展的法规而转移创新和扩张努力的资源。

- 此外,在新冠疫情爆发后,许多公司都安排员工在家工作,这大大增加了对高效 IT 系统的需求。越来越多的组织正在将其应用程式和软体迁移到云端和云端基础的平台。这种情况大大增加了被调查市场的成长机会。

印度软体服务出口市场趋势

对基础设施现代化、数位支援和云端服务的需求不断增长

- 基础设施现代化涉及增强组织的 IT 设置,旨在提高效能、可扩展性和安全性。这包括将旧系统迁移到云端基础的平台、采用容器化以及整合自动化和 DevOps 方法。主要目标是提高灵活性、降低营运成本、加速数位转型并使企业始终走在技术趋势和客户需求的前沿。

- 对网路安全、营运效率和成本效益的日益关注正在推动基础设施现代化。这些改进将使印度软体服务供应商不仅能够满足全球客户不断变化的需求,而且还能透过提供高品质、创新和安全的解决方案在国际市场上保持竞争力。

- 印度正在向已开发市场经济转型,先进技术的采用预计将在这一过程中发挥关键作用。此外,印度财政部长在该国临时预算中强调了印度数位基础设施在推动现代经济正规化方面的作用。 Vi Business(沃达丰 Idea 的子公司)最近对近 1,000 家中小微型企业进行的一项调查显示,各个垂直行业的企业中,只有不到 60% 实现了数位化。

- 据印度电子和资讯技术部称,印度的 IT/ITeS 产业具有全球重要性,是出口和创造就业机会的重要推动力。国内 IT-BPM 产业(不包括电子商务)价值 2,540 亿美元,预计 2023-24 财年出口额将达到 2,000 亿美元左右(估计)。此外,IT-ITeS 行业预计将大幅增加就业,僱用约 543 万名专业人员。这比上年度年(2022-2023 年)增加了 6 万人。值得注意的是,女性占该行业劳动力的36%。

- 市场相关人员正在帮助企业建立数位转型 IT 策略。例如,2024 年 3 月,塔塔咨询服务公司宣布与总部位于丹麦的伙伴关係、工程和顾问公司 Ramboll 建立价值数百万美元的策略合作伙伴关係,以协助其实现端到端 IT 转型。该公司的目标是在未来七年内实现 Ramboll 的 IT 营运模式现代化和简化,并推动 IT 业务成长。

IT服务可望占据主要市场占有率

- 许多国家一直将 IT业务出口到印度等新兴经济体,以节省人事费用。许多大型 IT 服务出口公司已在印度开展业务,预计未来几年 IT 服务出口需求将获得显着成长。随着世界经历数位转型,企业正在迅速升级其传统IT基础设施,从而产生了对印度 IT 咨询和实施服务的需求。数位转型在确定IT服务及其重要性、进一步将IT服务组织到计划-建构-运行的活动框架中以及定义组织的IT服务策略方面为企业提供了策略和竞争优势。

- 印度的 IT 服务格局正在快速改变。巨量资料和机器学习等先进技术在各个终端用户行业的广泛应用正在推动IT基础设施更新的需求。采用这些新技术也使企业能够更换过时的基础设施和硬件,从而推动印度 IT 服务领域的成长。此外,随着IT营运在云端基础平台上的推进,IT服务越来越数据主导、即时化,为企业创造了巨大的价值,特别是在提高业务效率、发掘机会、优化远端存取等方面。根据NASSCOM的数据,对先进、现代化数位基础设施的投资帮助印度科技产业成长了2,450亿美元。

- 此外,云端运算被视为企业、政府和消费者的变革技术。云端运算不仅支援数位转型,还促进了IT生态系统参与企业之间的创新和协作。根据印度国际贸易部的数据,ICT产业和数位经济合计占印度GDP的13%以上,是印度经济的重要支柱。印度有一个雄心勃勃的目标:到2025年将其ICT产业的估值提高到1兆美元。

- IT服务供应商也与各种最终用户公司伙伴关係,帮助他们采用先进技术。 2024年2月,Wipro宣布将成为Agne的大股东。此举使 Wipro 能够获得 Agne 的先进技术和专业知识,从而巩固其在产物保险行业的地位。 Wipro 和 Agne 的全面能力将有助于利用科技为产物保险业的客户提供更快的上市时间和有竞争力的服务。

- 此外,用户数量的增加也推动了对 CRM、收费和网路管理系统等电讯专用软体解决方案的需求,这大大推动了市场成长。增强的连接和通讯能力将增加远端协作和外包的机会,使软体服务供应商能够在全球范围内提供服务。此外,通讯的进步将促进创新应用和数位服务的发展,扩大软体出口商的市场机会。电讯扩张和软体需求之间的这种协同效应正在极大地推动市场成长。根据TRAI统计,截至2023年12月,印度德里都市区电讯用户超过5,800万,测量期间印度全国都市区电讯用户总数超过6.62亿。

印度软体服务出口产业概况

印度软体服务出口产业市场呈现细分化。塔塔咨询服务有限公司、印孚瑟斯有限公司、威普罗有限公司、HCL 科技、Tech Mahindra 有限公司等是主要企业。公司不断创新并形成策略联盟以保持市场占有率。

- 2024 年 4 月:HCL Tech 宣布与 Google Cloud 合作建立产业解决方案并部署多模态大规模语言 AI 模型 Gemini。 HCL 计划利用 Gemini 先进的程式码完成和摘要功能来增强其 HCL Tech AI Force 平台,使工程师能够有效率地编写程式码、解决问题、缩短交付时间并提高客户软体计划的品质。

- 2024 年 2 月:技术服务和顾问公司 Wipro Limited推出了Wipro 企业人工智慧 (AI) 就绪平台,使客户能够建立企业级、完全整合和客製化的 AI 环境。该平台包括投资人工智慧所需的基础设施和核心软体,用于自动化和产生人工智慧工作负载的消耗,动态资源管理,使用预测分析动态调整以适应不断变化的工作负载,以及投资减少事故并提高企业业务效率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 宏观经济趋势如何影响市场

第五章市场动态

- 市场驱动因素

- 疫情挑战推动基础设施现代化、数位支援和云端服务需求

- 政府改革以支持IT产业,减少合规性,提高生产力并增强国际竞争力

- 市场限制

- 管理全球监管和合规需求

- 软体服务趋势和技术发展

- 区域分析

- 卡纳塔克邦

- 泰米尔纳德邦

- 特伦甘纳邦

- 马哈拉斯特拉邦

- 北方邦

- 哈里亚纳邦

第六章市场区隔

- 按活动

- IT服务

- 软体产品开发

- BPO服务

- 工程服务

- 按服务类型

- 现场

- 异地

- 按出口目的地

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章竞争格局

- 公司简介

- Tata Consultancy Services Limited

- Infosys Limited

- Wipro Limited

- HCL Technologies

- Tech Mahindra Ltd

- Mphasis Limited

- Oracle Corporation

- LTIMindtree Limited

- Microsoft Corporation

- Capgemini Technology Services India Ltd

- IBM Corporation

- Accenture PLC

- Deloitte Touche Tohmatsu Limited

- PWC LLP

第八章 取得公司列表

第九章 咨询机构名录

第十章投资分析

第十一章 市场的未来

The India Software Services Export Market size is estimated at USD 158.47 billion in 2025, and is expected to reach USD 197.76 billion by 2030, at a CAGR of 4.53% during the forecast period (2025-2030).

As the cloud transformation in the North American and European nations involves high costs and lacks proper resources, India is preferred as it is at the forefront of offshoring and outsourcing and is updated with emerging trends, techniques, and technology. This factor is expected to contribute to the market's expansion during the forecast period.

Key Highlights

- Rapidly increasing digital transformation across industries, adoption of new technologies such as IoT, AI, and blockchain, and a growing emphasis on leveraging the core competencies by outsourcing non-core operations are the major driving factors of the market.

- As Indian organizations gravitate toward the cloud, artificial intelligence (AI), automation, network infrastructure, Internet of Things (IoT), and other developed technologies to transform them digitally, spending on digital transformation (DX) and IT modernization are the top priorities of Indian companies.

- The growing migration to cloud services is a crucial driving factor in the market studied, resulting in significant collaborations generating revenue from it. Cloud migration facilitates both large and small businesses to move their software applications, databases, and other IT resources to cloud servers for seamless, secure, and transparent systems. This allows the company's software development lifecycle process management to be more efficient. Businesses generally invest in cloud migration strategies for better scalability, availability, and quicker deployment of software services.

- The Indian National Policy on Software Products has been addressed partly by the Next Generation Incubation Scheme (NGIS), which has been approved to support the software product ecosystem. It is planned to build a thriving software product ecosystem to support the strong IT sector's sustained expansion, new job creation, and competitiveness improvement. As per NASSCOM estimate, the Indian Software Product industry has made historic achievements in revenue in FY 2023, reaching USD 14.2 billion.

- However, factors like managing regulatory and compliance needs can restrain the market's growth during the forecast period. It is because this involves increasing operational costs, limiting service offerings due to stringent data protection laws, and diverting resources from innovation and expansion efforts due to the constant need to adapt to varying and evolving regulations.

- Furthermore, after the COVID-19 pandemic, several businesses have employees working from home, and the need to adopt efficient IT systems has increased substantially. Organizations have increasingly migrated to the cloud or cloud-based platforms for their applications and software. This situation has significantly augmented the growth opportunities for the market studied.

India Software Services Export Market Trends

Increasing Demand for Infrastructure Modernization, Digital Support, and Cloud Services

- Infrastructure modernization involves enhancing an organization's IT setup for better performance, scalability, and security. This encompasses transitioning from older systems to cloud-based platforms, embracing containerization, and integrating automation and DevOps methodologies. The primary goal is to boost agility, cut operational expenses, and facilitate digital transformation, empowering businesses to stay ahead of tech trends and customer needs.

- The increasing emphasis on cybersecurity, operational efficiency, and cost-effectiveness is driving the push for infrastructure modernization. These enhancements empower Indian software service providers to not only meet the evolving demands of global clients but also to stay competitive in the international market by delivering high-quality, innovative, and secure solutions.

- India is on a journey to transition into a developed market economy and advanced technology deployment, which is expected to play a significant part in this process. Moreover, India's Finance Minister has emphasized India's digital infrastructure in driving economic formalization in the modern era in the country's interim budget. According to a recent survey by Vi Business (the Arm of Vodafone Idea), nearly one lakh MSMEs said that less than 60% of businesses had embraced digitalization across various verticals.

- As per the Ministry of Electronics and Information Technology, India's IT/ITeS industry holds a significant global position, significantly bolstering exports and job creation. The nation's IT-BPM sector (excluding e-commerce) is poised to hit a valuation of USD 254 billion, with exports making up approximately USD 200 billion in the fiscal year 2023-24 (estimated). The IT-ITeS industry has also significantly bolstered employment and is anticipated to employ a total workforce of around 5.43 million professionals. This marks an increase of 60,000 individuals from the previous fiscal year (FY 2022-2023). Notably, women constitute 36% of the industry's workforce.

- The market players are helping companies build their digital transformation IT strategies. For instance, in March 2024, Tata Consultancy Services declared the multimillion-dollar strategic partnership to support the end-to-end IT transformation of Ramboll, an architecture, engineering, and consultancy company headquartered in Denmark. The company would modernize and streamline Ramboll's IT operating model to strive for business growth in IT over the next seven years.

IT Services Expected to Capture Significant Market Share

- Many countries have long exported IT work to developing economies like India to save on labor costs. With the country housing many major IT service export players, the demand for IT services export is expected to gain significant momentum in India in the coming years. In the wake of digital transformation worldwide, companies are rapidly upgrading their legacy IT infrastructure, thus creating demand for IT consulting and implementation services in India. Digital transformation provides companies with a strategic and competitive advantage in terms of determining IT services and their importance, further organizes the IT services as an activity of a plan-build-run framework, and defines the IT service strategy for the organization.

- The landscape of IT services in India is changing rapidly. The proliferation of advanced technologies, like big data and machine learning in various end-user industries, fuels the need for updated IT infrastructure. In addition, this adoption of emerging technologies enables businesses to replace outdated infrastructure and hardware, driving the IT services segment's growth in India. Moreover, due to advancements in IT operation across the cloud-based platform, IT services have become more data-driven and real-time, creating greater value for the business, especially in operational efficiency, business opportunity discovery, and remote access optimization. As per data by NASSCOM, the technology sector grew by USD 245 billion in India due to investments in advanced and modern digital infrastructure.

- Furthermore, cloud computing is envisioned as a transformative technology for enterprises, governments, and consumers. It not only supports digital transformation but also enables innovation and collaboration among the IT ecosystem players. According to the International Trade Administration, the ICT sector and the digital economy collectively account for over 13% of India's GDP, making them pivotal economic pillars. India has set an ambitious target, aiming to elevate the ICT sector to a USD 1 trillion valuation by 2025, representing a significant 20% of the projected GDP.

- In addition, IT service providers are indulging in partnerships with various end-user companies to assist them with advanced technology implementation. In February 2024, Wipro announced becoming a majority shareholder in Aggne. This move strengthens Wipro's position in the property and casualty (P&C) insurance industry by giving them access to Aggne's advanced technology and expertise. The integrated capabilities of Wipro and Aggne will help leverage technologies to deliver faster speed-to-market and more competitive services to clients in the P&C sector.

- Furthermore, the rising number of telecom subscribers is driving the market's growth significantly, as it increases the demand for telecom-specific software solutions, such as CRM, billing, and network management systems. Enhanced connectivity and communication capabilities boost remote collaboration and outsourcing opportunities, enabling software service providers to deliver their services globally. In addition, telecom advancements promote the development of innovative applications and digital services, expanding market opportunities for software exporters. This synergy between telecom expansion and software demand fuels the growth of the market significantly. According to TRAI, as of December 2023, there were over 58 million urban telecom subscribers in Delhi, India, and the total number of urban telecom subscribers across India during the measured time period was more than 662 million.

India Software Services Export Industry Overview

The Indian software services export industry market is fragmented. Tata Consultancy Services Limited, Infosys Limited, Wipro Limited, HCL Technologies, and Tech Mahindra Ltd are among the major companies. The corporations continue to innovate and form strategic partnerships to maintain their market share.

- April 2024: HCL Tech announced an alliance with Google Cloud to establish industry solutions and deploy Gemini for its multimodal large-language AI model. HCL planned to boost the HCL Tech AI Force platform with Gemini's advanced code completion and summarization capabilities, which allow engineers to code efficiently, solve issues, reduce delivery time, and enhance the quality of software projects for clients.

- February 2024: Wipro Limited, a technology services and consulting company, launched the Wipro Enterprise Artificial Intelligence (AI)-Ready Platform to help clients create enterprise-level, fully integrated, and customized AI environments. This platform provides the necessary infrastructure and core software for the consumption of AI and generative AI workloads for automation, dynamic resource management to adjust to varying workloads using predictive analytics dynamically, and investment in improvements in incident reduction and operational efficiency in the enterprise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Infrastructure Modernization, Digital Support, and Cloud Services Owing to Pandemic Challenges

- 5.1.2 Government Reforms Aiding IT Industry that has Reduced Compliance, Increased Productivity, and Increased Global Competitiveness

- 5.2 Market Restraints

- 5.2.1 Managing Regulatory and Compliance Needs Across the World

- 5.3 Trends and Technology Developments in Software Services

- 5.4 Regional Analysis

- 5.4.1 Karnataka

- 5.4.2 Tamil Nadu

- 5.4.3 Telangana

- 5.4.4 Maharashtra

- 5.4.5 Uttar Pradesh

- 5.4.6 Haryana

6 MARKET SEGMENTATION

- 6.1 By Activity

- 6.1.1 IT Services

- 6.1.2 Software Product Development

- 6.1.3 BPO Services

- 6.1.4 Engineering Services

- 6.2 By Services Type

- 6.2.1 On-site

- 6.2.2 Off-site

- 6.3 By Export Destination

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tata Consultancy Services Limited

- 7.1.2 Infosys Limited

- 7.1.3 Wipro Limited

- 7.1.4 HCL Technologies

- 7.1.5 Tech Mahindra Ltd

- 7.1.6 Mphasis Limited

- 7.1.7 Oracle Corporation

- 7.1.8 LTIMindtree Limited

- 7.1.9 Microsoft Corporation

- 7.1.10 Capgemini Technology Services India Ltd

- 7.1.11 IBM Corporation

- 7.1.12 Accenture PLC

- 7.1.13 Deloitte Touche Tohmatsu Limited

- 7.1.14 PWC LLP