|

市场调查报告书

商品编码

1693808

西班牙资料中心:市场占有率分析、产业趋势与成长预测(2025-2030 年)Spain Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

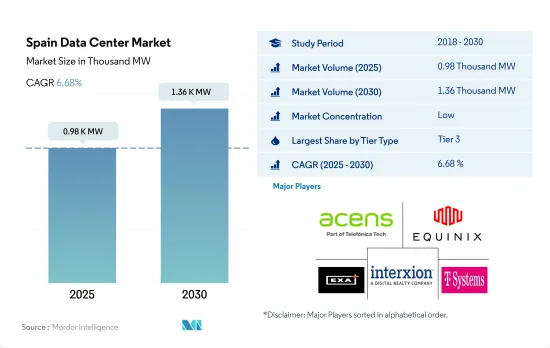

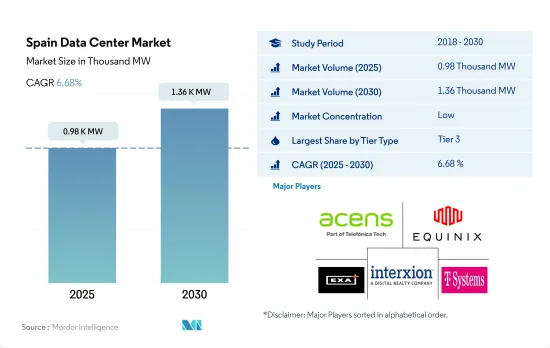

西班牙资料中心市场规模预计在 2025 年达到 980MW,预计 2030 年达到 1,360MW,复合年增长率为 6.68%。

预计主机託管收益将在 2025 年达到 9.638 亿美元,到 2030 年将达到 17.165 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.24%。

预计到 2023 年,Tier 3 资料中心将占据容量的大部分份额,并在整个预测期内保持主导地位。

- 2023年,西班牙Tier 3资料中心的IT负载容量预计将达到481.89MW,到2029年将超过795.09MW,复合年增长率为8.7%。另一方面,预计 Tier 4 资料中心的复合年增长率为 14.45%,到 2029 年容量将达到 547.68MW。

- 未来几年,预计一级和二级发电设施的成长速度将逐渐放缓,并因长时间的非计画停驶而负成长。此外,这些资料中心将拥有单一冷却和供电通道,预计运转率为 99.671%。这些资料中心比 Tier 3 和 Tier 4 设施便宜,但其容量较低意味着最终用户越来越多地选择后者。

- 到 2029 年,预计三级和四级市场的份额将分别达到 58.8% 和 40.5%。预计 2023 年对 Tier 3 设施的需求最高,占 65.8% 的市场占有率。三级资料中心因其现场服务、电力和冷却冗余等特点而最受欢迎。 BFSI、电信以及媒体和娱乐消费者主要使用批发和超大规模主机託管设施,大大推动了 Tier 3 设施的使用。

- 预计该国数付款用户数将从 2022 年的 3,235 万增至 2027 年的 4,060 万人。预计未来几年 Tier 4 资料中心将显着成长。大型企业偏好 Tier 4 资料中心,因为它们具有容错能力强、停机时间短、执行时间99.99%。此外,随着越来越多的企业采用云端基础的服务,对配备最新技术的主机託管空间的 3 级和 4 级设施的需求可能会增长。

西班牙资料中心市场的趋势

智慧型手机拥有量和应用程式下载量的增加正在推动市场成长

- 2022 年西班牙智慧型手机用户数为 4,251 万,预计到 2029 年将达到 4,660 万,预测期内复合年增长率为 1.3%。西班牙的数位化应用正在迅速成长。网路和行动科技在各行各业的快速应用正在影响消费者的行为。 2021年西班牙的消费者支出为8,027.9亿美元,较2020年成长12.04%。因此,更多的人能够购买智慧型手机,智慧型手机的使用率也在上升。

- 未来几年,随着 5G 技术在西班牙的推广,预计拥有能够使用新技术的智慧型手机的人数比例将会增加。西班牙有四家通讯业者:四家公司拥有 5G 客户:Movistar、Orange、Vodafone 和 Yoigo。使用这些电信商网路、5G 智慧型手机和 5G费率方案的消费者有 9.6% 到 10.6% 的时间连接到 5G 网路。

- 疫情加速了西班牙走向数位化的进程。 WhatsApp 是 95.05% 的西班牙人使用的社群媒体平台,其次是 Instagram、Facebook 和 YouTube。我每天花 3-4 个小时在这些应用程式上。为了维持非接触式服务,公共机构和私人企业已转向数位平台。

- 这一趋势在金融领域尤其明显,西班牙人越来越依赖网路银行。例如,目前有 36.4% 的银行用户每天或几乎每天都使用网路银行应用程序,高于疫情前的 17.3%。因此,智慧型手机产生的大量数据正在推动西班牙数据中心数量的增加。

FTTx 宽频和光纤网路的使用增加将推动市场需求

- 铜线网路连线的最大速度为 62.8Mbps,而光纤网路连线的最大速度为 134.6Mbps。 2022 年的 FTTx 宽频资料速度为 159.2 Mbps,而预期 2029 年的速度为 1,342 Mbps。资料中心加速工作的目标是提供更高的网路连线性,并随着频宽需求的变化实现简单、灵活的可扩展性。随着越来越多的人使用互联网,对资料储存的需求不断增长,处理设施的容量也在不断增长。

- 直到 2020 年,DSL 一直是西班牙最受欢迎的选择,但此后连接性一直在下降。 DSL 网路的衰落表明西班牙通讯业者优先部署新的 FTTP,而不是升级其铜线网路。 DSL 覆盖率下降的趋势是逐步淘汰和家庭数量增加的结果。到 2020 年,随着西班牙营运商扩展其 FTTP 网路基础设施,FTTP 覆盖率将提高 4.6%,84.9% 的家庭将可以使用 FTTP 宽频服务。

- 三大通讯业者控制西班牙大部分的光纤网路。通讯业者正在透过更快的网路满足用户日益增长的频宽需求。在Gigabit速度连线方面,随着 FTTP 的可用性不断提高,西班牙是领先的国家之一。西班牙的国家宽频计划主要侧重于农村地区,因为都市区的 FTTP 覆盖率已经很高,这正在推动农村 FTTP 的覆盖和扩展。

西班牙资料中心产业概况

西班牙资料中心市场细分化,前五大公司占35.82%。该市场的主要企业包括 Acens Technologies SL、Equinix Inc.、EXA Infrastructure、Interxion(Digital Reality Trust Inc.)和 T-Systems International GmbH。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 市场展望

- 负载能力

- 占地面积

- 主机代管收入

- 安装机架数量

- 机架空间利用率

- 海底电缆

第五章 产业主要趋势

- 智慧型手机用户数量

- 每部智慧型手机的数据流量

- 行动数据速度

- 宽频数据速度

- 光纤连接网路

- 法律规范

- 西班牙

- 价值炼和通路分析

第六章市场区隔

- 热点

- 马德里

- 其他中东和非洲地区

- 资料中心规模

- 大规模

- 超大规模

- 中等规模

- 超大规模

- 小规模

- 等级类型

- 1级和2级

- 第 3 层

- 第 4 层

- 吸收量

- 未使用

- 使用

- 按主机託管类型

- 超大规模

- 零售

- 批发的

- 按最终用户

- BFSI

- 云

- 电子商务

- 政府

- 製造业

- 媒体与娱乐

- 电信

- 其他的

第七章竞争格局

- 市场占有率分析

- 商业状况

- 公司简介

- Acens Technologies SL

- Adam Ecotech SA

- Data4

- Digital Data Centre Bidco SL(Nabiax)

- Equinix Inc.

- EXA Infrastructure

- Global Switch Holdings Limited

- Interxion(Digital Reality Trust Inc.)

- NetActuate Inc.

- T-Systems International GmbH

- VPS House Technology Group LLC

- Zenlayer Inc.

第八章:CEO面临的关键策略问题

第九章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 全球市场规模和DRO

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 数据包

- 词彙表

The Spain Data Center Market size is estimated at 0.98 thousand MW in 2025, and is expected to reach 1.36 thousand MW by 2030, growing at a CAGR of 6.68%. Further, the market is expected to generate colocation revenue of USD 963.8 Million in 2025 and is projected to reach USD 1,716.5 Million by 2030, growing at a CAGR of 12.24% during the forecast period (2025-2030).

Tier 3 data center accounted for majority share in terms of volume in 2023, and is expected to dominate through out the forecasted period

- In 2023, the IT load capacity of tier 3 data centers in Spain is expected to reach 481.89 MW and then register a CAGR of 8.7% to surpass 795.09 MW by 2029. Conversely, tier 4 data centers are predicted to record a CAGR of 14.45%, reaching a capacity of 547.68 MW by 2029.

- Over the coming years, facilities in tiers 1 and 2 will gradually slow down and exhibit negative growth, resulting from lengthy and irregular outages. Additionally, they possess a single channel for cooling and electricity, with a predicted uptime of 99.671%. Although these data centers are less expensive than tier 3 and tier 4 facilities, their reduced capability is prompting end users to increasingly opt for tier 3 and tier 4 facilities.

- In 2029, tier 3 and tier 4 facilities are expected to hold major shares of 58.8% and 40.5%, respectively. The year 2023 will witness the highest demand for tier 3 facilities, which are expected to hold a market share of 65.8%. Owing to features like onsite service, power, and cooling redundancy, tier 3 data centers are the most popular. BFSI, telecom, media, and entertainment consumers are primarily using wholesale and hyperscale colocation facilities, driving significant tier 3 facility usage.

- The number of digital payment users in the country is projected to reach 40.6 million by 2027, up from 32.35 million users in 2022. Tier 4 data centers are expected to experience significant growth over the coming years. Large businesses prefer tier 4 data centers due to their fault-tolerant capabilities, reduced downtime, and 99.99% uptime. Additionally, as more companies adopt cloud-based services, the demand for tier 3 and tier 4 facilities to offer colocation space with the latest technology will increase.

Spain Data Center Market Trends

Rising smartphone ownership and increase in number of app downloads boost the market growth

- The total number of smartphone users in the country was 42.51 million in 2022, which is expected to reach 46.6 million by 2029, witnessing a CAGR of 1.3% during the forecast period. In Spain, digital usage is growing quickly. The swift uptake of the internet and mobile technology in a range of enterprises has had an impact on consumer behavior. Consumer spending in Spain was USD 802.79 billion in 2021, a 12.04% increase from 2020. Thus, more people can now buy smartphones, increasing the usage of smartphones.

- Over the next several years, it is anticipated that when 5G technology is deployed throughout Spain, a greater proportion of people will have smartphones that can use the new technology. Spain has four operators: Movistar, Orange, Vodafone, and Yoigo, which have 5G customers. With a 5G smartphone and a 5G tariff plan, consumers on these operators' networks spent 9.6-10.6% of their time connected to a 5G network.

- The pandemic accelerated Spain's move toward digitalization. WhatsApp was the social media platform 95.05% of Spaniards utilized, followed by Instagram, Facebook, and YouTube. They spent three to four hours a day on these applications. In order to maintain contactless services, public and private organizations switched to digital platforms, which increased the need for data center services in Spain.

- This tendency has been especially noticeable in the financial sector, as Spaniards are becoming more dependent on online banking. For instance, compared to 17.3% before the pandemic, 36.4% of banking service users now utilize their online banking applications every day or virtually daily. As a result, the number of data centers in Spain has increased due to the large amount of data generated by smartphones.

Increase usage of FTTx broadband and fiber optic network lead to market demand

- The maximum speed of a copper-based internet connection is 62.8 Mbps, whereas the maximum speed of a fiber-optic internet connection is 134.6 Mbps. Compared to the expected speed of 1,342 Mbps in 2029, the FTTx broadband data speed in 2022 stood at 159.2 Mbps. The goal of data centers' efforts to become faster is to provide higher network connections and simple and flexible scalability as bandwidth demands change on a moment-by-moment basis. More people use the internet, which necessitates data storage that is increasing in size and boosting the volume of processing facilities.

- DSL remained the most prevalent technology in Spain till 2020, while its connectivity has decreased since then. The decline of DSL networks demonstrated that Spanish operators prioritize brand-new FTTP deployments over upgrading copper networks. The trend of declining DSL coverage is the result of both targeted decommissioning and a rise in the number of households. By 2020, 84.9% of homes had access to FTTP broadband services, owing to Spanish operators' expansion of their FTTP network infrastructure, which saw a 4.6% increase in FTTP coverage.

- Three major operators control the majority of Spain's extensive fiber optic network. Telecom companies better fulfill users' rising bandwidth demands with a quicker network. In terms of gigabit-speed connectivity, Spain is among the top countries, owing to the ongoing improvements in FTTP availability. The Spanish national broadband plan focused primarily on rural areas, given an already high FTTP coverage in urban areas, which is the driving rural FTTP coverage and expansion.

Spain Data Center Industry Overview

The Spain Data Center Market is fragmented, with the top five companies occupying 35.82%. The major players in this market are Acens Technologies SL, Equinix Inc., EXA Infrastructure, Interxion (Digital Reality Trust Inc.) and T-Systems International GmbH (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Spain

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 Madrid

- 6.1.2 Rest of Spain

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 Acens Technologies SL

- 7.3.2 Adam Ecotech SA

- 7.3.3 Data4

- 7.3.4 Digital Data Centre Bidco SL (Nabiax)

- 7.3.5 Equinix Inc.

- 7.3.6 EXA Infrastructure

- 7.3.7 Global Switch Holdings Limited

- 7.3.8 Interxion (Digital Reality Trust Inc.)

- 7.3.9 NetActuate Inc.

- 7.3.10 T-Systems International GmbH

- 7.3.11 VPS House Technology Group LLC

- 7.3.12 Zenlayer Inc.

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms