|

市场调查报告书

商品编码

1693828

欧洲氟聚合物:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Europe Fluoropolymer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

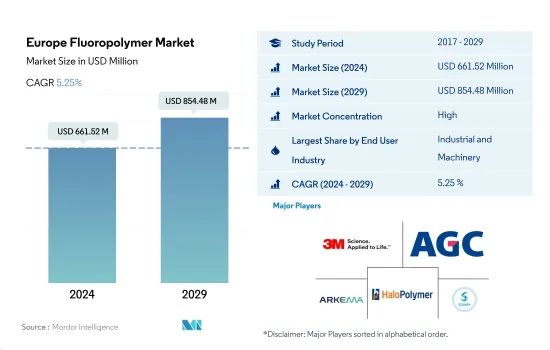

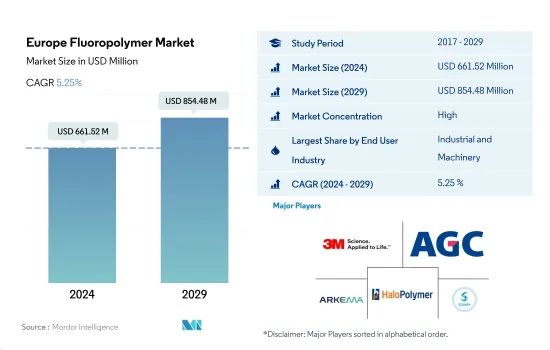

预计 2024 年欧洲氟聚合物市场规模为 6.6152 亿美元,到 2029 年将达到 8.5448 亿美元,预测期内(2024-2029 年)的复合年增长率为 5.25%。

工业和机械行业仍然是氟聚合物的最大终端用户

- 氟聚合物的应用范围很广,包括石油和天然气、半导体电子、化学加工、汽车、电线电缆、建筑、航太和製药。 2022 年,工业和机械产业约占欧洲氟聚合物市场销售额的 57.0%。

- 工业和机械部门是欧洲最大的部门。例如,2021 年工业产值达到 5.209 兆欧元,而 2020 年为 4.581 兆欧元,成长近 14%。这是由于对化学加工设备、泵浦、引擎等的需求不断增加,从而增加了该地区对氟聚合物的需求。

- 汽车将成为第二大产业,到 2022 年将占欧洲氟聚合物市场的 17%。该领域由德国、义大利和英国主导,从而推动了对氟聚合物的需求。该行业对整体 GDP 的贡献率为 7%,并且由于其对欧盟 (EU) 经济至关重要,预计还将继续增长。

- 电气和电子产业是该地区第三大产业,按收入计算,2022 年占欧洲氟聚合物市场的 10%,预计 2023 年收入将达到 6,480 万美元,这得益于电气和电子产品需求的不断增长,以及由于电动车、自动机器人和绝密防御技术的出现导致对氟聚合物的需求增加。

- 汽车是该地区成长最快的行业,复合年增长率为 9.28%,预计预测期内销量复合年增长率将达到 2.08%,这得益于汽车生产中塑胶复合材料中氟聚合物的使用不断扩大。

法国将在未来几年占据市场主导地位

- 在德国、义大利和法国等欧洲国家,氟聚合物广泛应用于汽车、航太、工业和机械等各行业。到2022年,欧洲将占全球氟聚合物消费以金额为准的18%。

- 受航太、汽车、工业和机械领域成长的推动,德国是该地区最大的氟聚合物消费国。 2021 年,飞机零件和汽车产量在地区层级约占销售额的 16.9%,产量的 20.1%。由于气候友善政策的增多,汽车、工业和机械产量的成长预计将推动该国对氟聚合物的需求。

- 由于汽车产量和工业机械的增加,义大利对氟聚合物的需求正在大幅增加。义大利是欧盟第五大汽车生产国。 2022年的产量将达到1,083,800辆,占该地区的6.1%。该国的工业机械市场也不断扩大。预计到 2025 年,义大利製造机械和设备的收益将达到约 334 亿美元。这些因素预计将推动该国对氟聚合物的需求。

- 法国是氟聚合物消费量成长最快的国家,预测期内收益的复合年增长率为 7.72%。汽车产量的成长以及电动和混合动力汽车需求的增加预计将增加该国对氟聚合物的需求。

欧洲氟聚合物市场趋势

科技创新推动家用电子电器市场

- 2017年至2021年,欧洲电气和电子设备产量的复合年增长率将超过3.8%。电子创新的快速步伐推动着对更新、更快的电气和电子产品的持续需求。因此,该地区对电气和电子设备生产的需求也在增加。

- 儘管远距工作和学习导致对电脑和笔记型电脑的需求增加,但欧洲消费性电子产品领域的每用户平均收入仍下降了 6.3%。 2020年销售额约2,521亿美元。因此,该地区2020年电气及电子设备产量较去年与前一年同期比较2.8%。

- 2021年,欧洲电气和电子设备出口额约2,283.7亿美元,比2020年成长12.4%。因此,该地区电气和电子设备产量有所增长,2021与前一年同期比较增长11.6%。

- 预计机器人、虚拟和扩增实境实境、物联网 (IoT) 和 5G 连线将在预测期内成长。由于技术进步,预计预测期内家用电子电器的需求将会上升。该地区消费电子领域的销售额预计将从 2023 年的 1,211 亿美元增至约 2027 年的 1,572 亿美元。到 2027 年,欧洲预计将成为全球第二大电气和电子设备生产国,占全球市场的 12.7% 左右。因此,预计未来几年家用电子电器的兴起将推动对电气和电子设备生产的需求。

欧洲氟聚合物产业概况

欧洲氟聚合物市场相当集中,前五大公司占92.57%的市占率。该市场的主要企业包括 3M、AGC Inc.、Arkema、HaloPolymer、Solvay 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 电气和电子

- 包装

- 进出口趋势

- 氟树脂交易

- 法律规范

- EU

- 法国

- 德国

- 义大利

- 俄罗斯

- 英国

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 电气和电子

- 工业/机械

- 包装

- 其他的

- 子树脂类型

- 乙烯-四氟乙烯(ETFE)

- 氟化乙丙烯 (FEP)

- 聚四氟乙烯(PTFE)

- 聚氟乙烯(PVF)

- 聚二氟亚乙烯(PVDF)

- 其他子树脂类型

- 国家

- 法国

- 德国

- 义大利

- 俄罗斯

- 英国

- 其他欧洲国家

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- AGC Inc.

- Arkema

- Gujarat Fluorochemicals Limited(GFL)

- HaloPolymer

- Kureha Corporation

- Solvay

- The Chemours Company

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 5000166

The Europe Fluoropolymer Market size is estimated at 661.52 million USD in 2024, and is expected to reach 854.48 million USD by 2029, growing at a CAGR of 5.25% during the forecast period (2024-2029).

The industrial and machinery sector to remain as the largest end user of fluoropolymers

- Fluoropolymers have applications ranging from oil and gas, semiconductor and electronics, chemical processing, automotive, wire and cable, building, aerospace, and pharmaceutical applications. The industrial and machinery sector accounted for around 57.0% of the revenue of the European fluoropolymer market in 2022.

- Industrial and machinery is the largest sector in Europe. For instance, the sold industrial production value reached EUR 5,209 billion in 2021, an increase of almost 14% compared to EUR 4,581 billion in 2020, owing to the increasing demand for chemical processing equipment, pumps, engines, and others, thereby increasing the demand for fluoropolymers in the region.

- Automotive is the second largest sector, with 17% of the European fluoropolymer market in 2022. It is dominated by Germany, Italy, and the United Kingdom, thereby increasing the demand for fluoropolymers. The sector contributed 7% to the overall GDP and is expected to increase as it is central to the European Union's economy.

- The electrical and electronics is the third-largest sector in the region and had a share of 10% of the European fluoropolymer market by revenue in 2022 and is projected to reach a revenue of USD 64.8 million in 2023 owing to increasing demand for electrical and electronics, empowering the onset of electric vehicles, autonomous robots, and top-secret defense technologies thereby increasing the demand for fluoropolymers in the region.

- Automotive is the fastest-growing sector in the region by revenue with a CAGR of 9.28% due to increasing applications of fluoropolymers for plastic composites in automotive production, which are expected to increase at a CAGR of 2.08% by volume during the forecast period.

France to dominate the market in the coming years

- Fluoropolymers are used in Europe in countries such as Germany, Italy, and France for various industries, including automotive, aerospace, industrial and machinery, and many others. Europe accounted for 18% by value of the global consumption of fluoropolymer resins in 2022.

- Germany is the largest consumer of fluoropolymer resin in the region, owing to its growing aerospace, automotive, industrial, and machinery sectors. Aircraft components and vehicle production held a share of around 16.9% by revenue and 20.1% by volume at the regional level in 2021. The rising automotive, industrial, and machinery production due to an increase in climate-conscious policies is expected to drive the demand for fluoropolymer resins in the country.

- Italy's demand for fluoropolymer resin is increasing significantly due to rising vehicle production and industrial machinery. Italy is European Union's fifth-largest vehicle producer. In 2022, the country produced 1,083,800 units, which has a share of 6.1% of the region. The country's industrial machinery market is also expanding. The revenue from manufacturing machinery and equipment in Italy is projected to amount to approximately USD 33.40 billion by 2025. These factors are expected to drive the demand for fluoropolymer resins in the country.

- France is the fastest-growing country in terms of fluoropolymer resin consumption, registering a CAGR of 7.72% by revenue during the forecast period. The rise in vehicle production coupled with increasing demand for electric and hybrid vehicles is expected to increase the demand for fluoropolymer resins in the country.

Europe Fluoropolymer Market Trends

Technological innovations to boost the consumer electronics market

- Europe's electrical and electronics production registered a CAGR of over 3.8% between 2017 and 2021. The rapid pace of electronic technological innovation is driving consistent demand for newer and faster electrical and electronic products. As a result, it has also increased the demand for electrical and electronics production in the region.

- Despite the increased demand for computers and laptops due to remote working and distance learning, the average revenue per user in the European consumer electronics segment dropped by 6.3%. It generated a revenue of around USD 252.1 billion in 2020. As a result, in 2020, the electrical and electronic production in the region decreased by 2.8% by revenue compared to the previous year.

- In 2021, Europe's electrical and electronic equipment exports were around USD 228.37 billion, 12.4% higher compared to 2020. As a result, electrical and electronic production in the region increased and registered 11.6% in 2021 compared to the previous year.

- Robotics, virtual reality and augmented reality, IoT (Internet of Things), and 5G connectivity are expected to grow during the forecast period. As a result of technological advancements, demand for consumer electronics is expected to rise during the forecast period. The consumer electronics segment in the region is projected to reach a revenue of around USD 157.2 billion in 2027 from USD 121.1 billion in 2023. By 2027, Europe is projected to be the second-largest electrical and electronics production accounting for around 12.7% of the global market. As a result, the rise in consumer electronics is projected to increase the demand for electrical and electronics production in the coming years.

Europe Fluoropolymer Industry Overview

The Europe Fluoropolymer Market is fairly consolidated, with the top five companies occupying 92.57%. The major players in this market are 3M, AGC Inc., Arkema, HaloPolymer and Solvay (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.2.1 Fluoropolymer Trade

- 4.3 Regulatory Framework

- 4.3.1 EU

- 4.3.2 France

- 4.3.3 Germany

- 4.3.4 Italy

- 4.3.5 Russia

- 4.3.6 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Sub Resin Type

- 5.2.1 Ethylenetetrafluoroethylene (ETFE)

- 5.2.2 Fluorinated Ethylene-propylene (FEP)

- 5.2.3 Polytetrafluoroethylene (PTFE)

- 5.2.4 Polyvinylfluoride (PVF)

- 5.2.5 Polyvinylidene Fluoride (PVDF)

- 5.2.6 Other Sub Resin Types

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Russia

- 5.3.5 United Kingdom

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Arkema

- 6.4.4 Gujarat Fluorochemicals Limited (GFL)

- 6.4.5 HaloPolymer

- 6.4.6 Kureha Corporation

- 6.4.7 Solvay

- 6.4.8 The Chemours Company

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219