|

市场调查报告书

商品编码

1693843

欧洲聚醚醚酮(PEEK):市场占有率分析、产业趋势和成长预测(2024-2029)Europe Polyether Ether Ketone (peek) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

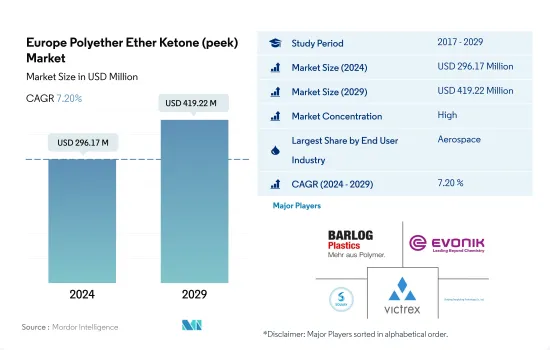

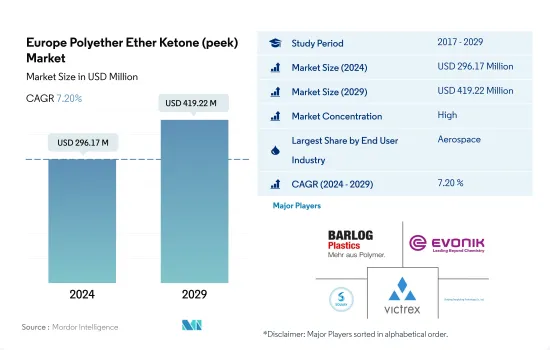

2024 年欧洲聚醚醚酮 (PEEK) 市场规模估计为 2.9617 亿美元,预计到 2029 年将达到 4.1922 亿美元,预测期内(2024-2029 年)的复合年增长率为 7.20%。

对高品质飞机零件的需求不断增长,推动市场成长

- PEEK树脂因其重量轻、强度高、低疲劳、低可燃性等特点,广泛应用于许多产业。 PEEK树脂具有优异的耐燃性,可承受约600°C的高温。

- 2020年,欧洲PEEK市场面临下滑,此现像被归咎于新冠疫情。由于供应链中断、原材料短缺以及该地区国家全国性停工,市场价值链与 2019 年相比下降了 20.43%。儘管遭遇这些挫折,但 PEEK 的需求仍然復苏,2021 年成长率达到 15.32%。

- PEEK 树脂具有重要用途的主要行业之一是航太。 PEEK树脂广泛应用于製造飞机内部零件、飞行控制零件以及各种其他零件。预计未来几年该地区航太零件产量的增加将刺激对 PEEK 树脂的需求。预计飞机零件生产收益将从 2022 年的 2,240 亿美元增至 2029 年的 3,480 亿美元。

- 在欧洲,电气和电子产业是 PEEK 树脂成长最快的消费产业,在 2023-2029 年预测期内,以金额为准复合年增长率为 8.75%。预计到 2029 年,该产业对 PEEK 树脂的使用量将达到约 402 吨。欧洲对电子产品的需求激增预计将进一步推动对 PEEK 树脂的需求。例如,该地区的电子产品市场预计将从 2023 年的 1,667 亿美元成长到 2027 年的 2,198 亿美元。

德国是该地区最大的 PEEK 树脂消费国

- 2022年,欧洲将占全球PEEK树脂消费量的37%。 PEEK树脂广泛应用于该地区的各个行业,因为它耐高温、耐辐射和化学品,并且具有良好的强度重量比。

- 2022年欧洲PEEK树脂消费总量将达到2,478吨,其中德国将占514吨,成为该地区最大的PEEK消费国。这是由航太业推动的,该行业占欧洲 PEEK 市场整体航太的近 19%。此外,全球对德国製造的工具机和设备的需求不断增长也成长要素了PEEK 树脂市场的发展。该国的工业和机械部门占欧洲市场总额 8,000 万美元中的 1,700 万美元。

- 法国是欧洲第二大PEEK树脂消费国,仅次于航太和电气电子工业,后两者分别占法国PEEK树脂消费量的约66%和14%。

- 预计英国PEEK 市场将成为成长最快的市场,预测期内 [2023-2029] 的以金额为准年增长率为 8.54%。 2022年全年,该国航太工业是欧洲第二大PEEK消费国,预计航太零件产量将从2022年的440亿美元飙升至2029年的708亿美元,这可能会在未来推动PEEK树脂的消费量。

欧洲聚醚醚酮(PEEK)市场趋势

科技创新推动家用电子电器市场

- 2017年至2021年,欧洲电气和电子设备产量的复合年增长率将超过3.8%。电子创新的快速步伐推动着对更新、更快的电气和电子产品的持续需求。因此,该地区对电气和电子设备生产的需求也在增加。

- 儘管远距工作和学习导致对电脑和笔记型电脑的需求增加,但欧洲消费性电子产品领域的每用户平均收入仍下降了 6.3%。 2020年销售额约2,521亿美元。因此,该地区2020年电气及电子设备产量较去年与前一年同期比较2.8%。

- 2021年,欧洲电气和电子设备出口额约2,283.7亿美元,比2020年成长12.4%。因此,该地区电气和电子设备产量有所增长,2021与前一年同期比较增长11.6%。

- 预计机器人、虚拟和扩增实境实境、物联网 (IoT) 和 5G 连线将在预测期内成长。由于技术进步,预计预测期内家用电子电器的需求将会上升。该地区消费电子领域的销售额预计将从 2023 年的 1,211 亿美元增至约 2027 年的 1,572 亿美元。到 2027 年,欧洲预计将成为全球第二大电气和电子设备生产国,占全球市场的 12.7% 左右。因此,预计未来几年家用电子电器的兴起将推动对电气和电子设备生产的需求。

欧洲聚醚醚酮(PEEK)产业概况

欧洲聚醚醚酮(PEEK)市场比较集中,前五大公司占100%。市场的主要企业包括BARLOG Plastics GmbH、Evonik Industries AG、Solvay、Victrex、浙江鹏富龙科技等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 电气和电子

- 包装

- 法律规范

- EU

- 法国

- 德国

- 义大利

- 俄罗斯

- 英国

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 电气和电子

- 工业/机械

- 其他的

- 国家

- 法国

- 德国

- 义大利

- 俄罗斯

- 英国

- 其他欧洲国家

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- BARLOG Plastics GmbH

- Evonik Industries AG

- Pan Jin Zhongrun High Performance Polymer Co.,Ltd

- Polyplastics-Evonik Corporation

- Solvay

- Victrex

- Zhejiang Pengfulong Technology Co., Ltd.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 5000181

The Europe Polyether Ether Ketone (peek) Market size is estimated at 296.17 million USD in 2024, and is expected to reach 419.22 million USD by 2029, growing at a CAGR of 7.20% during the forecast period (2024-2029).

Growing demand for high quality aircraft components to drive the market growth

- PEEK resin is widely used across numerous industries due to its lightweight nature, high strength, low fatigue, and low flammability. It possesses remarkable resistance to combustion, withstanding temperatures up to approximately 600°C.

- In 2020, the PEEK market in Europe faced a decline, a phenomenon attributable to the COVID-19 pandemic. The market value decreased by 20.43% in comparison to 2019, a result of supply chain disruptions, raw material shortages, and nationwide lockdowns in various countries across the region. Despite these setbacks, the demand for PEEK rebounded, showing a growth rate of 15.32% in 2021, driven primarily by a more reliable supply of raw materials.

- One major industry where PEEK resin finds significant application is aerospace. It is extensively used in manufacturing interior aircraft parts, flight control components, and various other parts. The escalating production of aerospace components in the region is anticipated to spur the demand for PEEK resin in the years to come. It is projected that the revenue from aircraft component production will increase to USD 348 billion by 2029 from USD 224 billion in 2022.

- The electrical and electronics industry is the fastest-growing consumer of PEEK resin in Europe, with a CAGR of 8.75% in terms of value during the forecast period, 2023-2029. The usage of PEEK resin in this industry is forecasted to reach approximately 402 tons by 2029. The burgeoning demand for European electronics is expected to further drive the demand for PEEK resin. For example, the electronics market in the region is projected to grow from USD 166.7 billion in 2023 to USD 219.8 billion in 2027.

Germany is the largest consumer of PEEK resin in the region

- Europe accounted for 37% of the global consumption of PEEK resin in 2022. Due to its ability to withstand high temperatures, resistance to radiation and chemicals, along with good strength-to-weight ratio, PEEK resin is widely used in various industries all over the region.

- In 2022, Europe consumed a total volume of 2,478 tons of PEEK resin out of which Germany accounted for the consumption of 514 tons, making it the largest consumer of PEEK in the region. This can be attributed to the aerospace industry which accounted for nearly 19% by volume compared to the overall aerospace in the Europe PEEK market. Additionally, the rising global demand for German machine tools and equipment has also served as a growth factor for the PEEK resin market. The industrial and machinery segment in the country accounts for USD 17 million of the overall Europe market which stood at USD 80 million.

- France is the second-largest consumer of PEEK resin in Europe led by the aerospace industry followed by the electrical & electronics industry which comprises nearly 66% and 14%, respectively of France's total PEEK consumption in those segments.

- The United Kingdom PEEK market is the fastest-growing segment and is predicted to witness a CAGR of 8.54% in terms of value during the forecast period [2023-2029]. The country's aerospace industry is the second largest consumer of PEEK in Europe during 2022 and is expected to see a surge in the production of aerospace components from USD 44 billion in 2022 to USD 70.8 billion by 2029 which is likely to raise the consumption of PEEK resin in the future.

Europe Polyether Ether Ketone (peek) Market Trends

Technological innovations to boost the consumer electronics market

- Europe's electrical and electronics production registered a CAGR of over 3.8% between 2017 and 2021. The rapid pace of electronic technological innovation is driving consistent demand for newer and faster electrical and electronic products. As a result, it has also increased the demand for electrical and electronics production in the region.

- Despite the increased demand for computers and laptops due to remote working and distance learning, the average revenue per user in the European consumer electronics segment dropped by 6.3%. It generated a revenue of around USD 252.1 billion in 2020. As a result, in 2020, the electrical and electronic production in the region decreased by 2.8% by revenue compared to the previous year.

- In 2021, Europe's electrical and electronic equipment exports were around USD 228.37 billion, 12.4% higher compared to 2020. As a result, electrical and electronic production in the region increased and registered 11.6% in 2021 compared to the previous year.

- Robotics, virtual reality and augmented reality, IoT (Internet of Things), and 5G connectivity are expected to grow during the forecast period. As a result of technological advancements, demand for consumer electronics is expected to rise during the forecast period. The consumer electronics segment in the region is projected to reach a revenue of around USD 157.2 billion in 2027 from USD 121.1 billion in 2023. By 2027, Europe is projected to be the second-largest electrical and electronics production accounting for around 12.7% of the global market. As a result, the rise in consumer electronics is projected to increase the demand for electrical and electronics production in the coming years.

Europe Polyether Ether Ketone (peek) Industry Overview

The Europe Polyether Ether Ketone (peek) Market is fairly consolidated, with the top five companies occupying 100%. The major players in this market are BARLOG Plastics GmbH, Evonik Industries AG, Solvay, Victrex and Zhejiang Pengfulong Technology Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Regulatory Framework

- 4.2.1 EU

- 4.2.2 France

- 4.2.3 Germany

- 4.2.4 Italy

- 4.2.5 Russia

- 4.2.6 United Kingdom

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Electrical and Electronics

- 5.1.4 Industrial and Machinery

- 5.1.5 Other End-user Industries

- 5.2 Country

- 5.2.1 France

- 5.2.2 Germany

- 5.2.3 Italy

- 5.2.4 Russia

- 5.2.5 United Kingdom

- 5.2.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 BARLOG Plastics GmbH

- 6.4.2 Evonik Industries AG

- 6.4.3 Pan Jin Zhongrun High Performance Polymer Co.,Ltd

- 6.4.4 Polyplastics-Evonik Corporation

- 6.4.5 Solvay

- 6.4.6 Victrex

- 6.4.7 Zhejiang Pengfulong Technology Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219