|

市场调查报告书

商品编码

1693967

亚太交叉层积木材:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia-Pacific Cross-Laminated Timber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

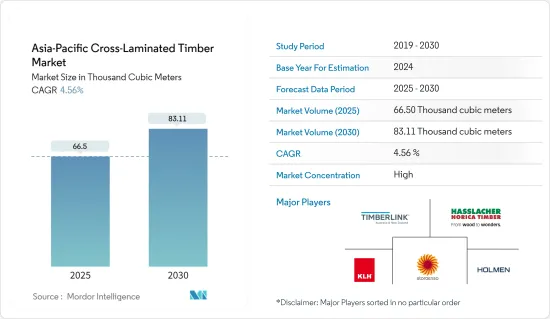

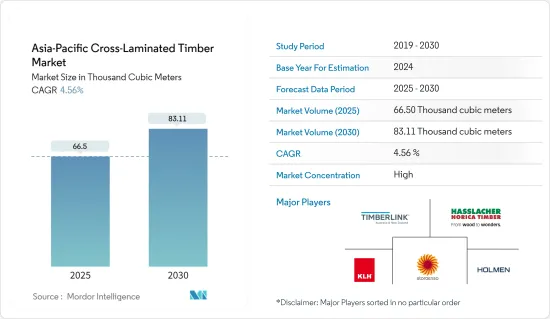

预计 2025 年亚太地区交叉层积木材 (CLT) 市场规模将达到 66,500 立方米,到 2030 年将达到 83,110 立方米,预测期内(2025-2030 年)的复合年增长率为 4.56%。

亚太地区交叉层积木材市场受到了 COVID-19 的不利影响。由于实施严格的封锁措施,工业活动陷入停滞。然而,自从限制解除以来,它一直在稳步復苏。工业活动的成长为亚太地区交叉层压木材市场带来了积极的趋势。

关键亮点

- 短期内,该地区商业部门的成长是市场成长的主要动力。

- 然而,预计材料吸湿相关风险是预测期内抑制目标产业成长的主要因素。

- 基于交叉层压木材的碳负未来很可能在不久的将来为全球市场创造丰厚的成长机会。

- 由于全国各地在各种应用中大量消费这种材料,中国已成为该地区成长最快的市场。

亚太地区交叉层压木材市场趋势

非住宅领域占据市场主导地位

- 在饭店、办公室和餐厅等商业建筑中,交叉层积木材用于横樑、支撑结构、家具、地板、墙壁和天花板等各个部分,使房间看起来美观。

- 交叉层压木材 (CLT) 因其高强度重量比、易于安装和美观的特点,以及相对较低的碳排放,已成为建筑施工中钢骨/混凝土的创新替代品。

- 交叉层压木材最近已在亚太地区的各种机构中使用。例如,在澳大利亚,今年9月决定在纽卡斯尔大学的新大楼中使用交叉层积木材。该计划耗资约 5,800 万澳元(3,725 万美元),将成为新南威尔斯州中央海岸建造的第一座大型木造建筑。

- 今年,新加坡投资建造了亚洲最着名的大型木造建筑—南洋理工大学南洋商学院盖亚大楼。该计划由伊东丰雄建筑设计事务所主导,是继南洋理工大学体育馆「The Wave」之后,南洋理工大学校园内的第二座大型木造建筑。

- 此外,菲律宾麦克坦国际机场是亚洲第一座屋顶完全由胶合木製成的机场。胶合木(交叉层积木材)是一种由单块木材组合而成的结构材料。这种木材非常耐用且防潮,使用工业黏合剂(通常称为三聚氰胺或聚氨酯树脂)黏合后,可以轻鬆製作成大件和独特的形状。

- 因此,随着商业建筑的兴起,对墙壁、屋顶、地板和天花板的需求也大幅增加,为亚太国家交叉层压木材创造了巨大的市场。

中国占市场主导地位

- 中国是世界上最大的木材进口国。随着中国经济持续快速发展,木材产业也经历转型和现代化。此外,根据中国木材与木製品协会的统计,中国是世界上最大的木材和木製品消费国,每年消耗5.7亿立方公尺木材,其中包括3.1亿立方公尺进口木材(RWE)。

- 2022年,中国推出了多项倡议,以重振停滞的房地产开发并帮助开发人员弥补资金短缺。然而,年底的一项新调查显示,全国只有21%的停工计划完全恢復建设。

- 中国政府致力于促进全国建筑业的投资,以促进整体经济成长。例如,近期增加基础建设贷款的措施包括将政策性银行贷款比例提高1,200亿美元。政府也考虑允许地方政府使用最多约2,200亿美元的特别债券窗口为基础建设融资。

- 预计2023年建筑业增加价值将成长6%,达到8.75兆元(1.2兆美元)。随着基础设施计划的启动,商用房地产建设预计将增长,但预计 2023 年住宅将几乎不会增长。

- 2023年8月,三校一院计划建设将进入新阶段。北京正在帮助该新区建造三所学校和一所医院。

- 预计这些倡议将在预测期内推动国内建筑业的发展。这可能会刺激建筑业研究的市场需求。政府也希望促进建筑业,特别是基础设施产业的活动,以帮助该国在从新冠疫情中復苏后恢復经济。

- 因此,预计上述因素将在预测期内影响该国所研究市场的需求。

亚太地区交叉层积木材产业概况

亚太地区交叉层压木材市场本质上是整合的,由几家主要企业主导市场。主要企业(排名不分先后)包括 Stora Enso、Timberlink Australia & New Zealand、KLH Massivholz GmbH、HASSLACHER Holding GmbH 和 Holmen。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 该地区商业部门的成长

- 与其他传统木材相比,交叉层压木材越来越受欢迎

- 限制因素

- 材料吸湿的风险

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 类型

- 黏合剂黏合

- 机械固定

- 应用

- 住宅

- 非住宅

- 商用

- 工业/设施

- 其他的

- 地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- AGROP NOVA as

- HASSLACHER Holding GmbH

- Holmen

- KLH Massivholz GmbH

- Mercer International Inc.

- SCHILLIGER HOLZ AG

- SEIHOKU CORPORATION

- Stora Enso

- Timberlink Australia & New Zealand

- XLam Australia Pty Ltd

第七章 市场机会与未来趋势

- 交叉层积木材的碳负性未来

The Asia-Pacific Cross-Laminated Timber Market size is estimated at 66.50 thousand cubic meters in 2025, and is expected to reach 83.11 thousand cubic meters by 2030, at a CAGR of 4.56% during the forecast period (2025-2030).

The Asia-Pacific cross-laminated timber market was negatively impacted by COVID-19. The implementation of stringent lockdown measures led to a halt of industrial operations. However, the sector has been recovering well since restrictions were lifted. The growth in industrial activities registered a positive trend for the cross-laminated timber market in the Asia-Pacific region.

Key Highlights

- Over the short term, growing commercial sectors in the region are the major factor driving the growth of the market studied.

- However, moisture absorption-related risks of the material are the key factors anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the carbon-negative future based on cross-laminated timber is likely to create lucrative growth opportunities for the global market soon.

- China emerged as the largest growing market for cross-laminated timber in the region owing to considerable consumption of the material across the country for various applications.

Asia-Pacific Cross-Laminated Timber Market Trends

Non-Residential Application Segment to Dominate the Market

- In commercial buildings such as hotels, offices, and restaurants, cross-laminated timber is used in various parts, including beams, support structures, furniture, floors., walls, ceilings, and other such areas, giving the rooms an aesthetic appearance.

- Cross-laminated timber (CLT) has emerged as an innovative alternative material to steel/concrete in building construction, given its relatively low carbon footprint, not to mention its high strength-to-weight ratio, simple installation, and aesthetic features.

- Cross-laminated timber has recently been used in various institutions in the Asia-Pacific. For instance, in Australia, the University of Newcastle's new building was set to be made using cross-laminated timber in September this year. The project cost around AUD 58 million (~ USD 37.25 million) and would be the first mass timber building constructed on the NSW Central Coast.

- This year, Singapore made an investment in the construction of Asia's most prominent mass timber building: the Gaia building for the Nanyang Business School at Nanyang Technological University (NTU). This project has been led by Toyo Ito & Associates, and is the second building on the NTU campus to use mass timber, following NTU's 'The Wave' sports hall.

- The Mactan International Airport in the Philippines is Asia's first airport with a roof structure composed entirely of glulam. Glulam (Glued Laminated Wood) is a structural material produced from the union of individual wood segments. This wood has high durability and humidity resistance, making it easy to make big pieces and unique shapes when binding with industrial adhesives commonly known as melamine or polyurethane resin.

- Therefore, with such a rise in the construction of commercial buildings, the demand for walls, roofs, floors, and ceilings has also increased substantially, thus creating a significant market for cross-laminated timber in the Asia-Pacific countries.

China to Dominate the Market

- China operates as the world's largest importer of timber. As China's economy continues to develop rapidly, the timber sector is also in a state of transformation and modernization. Furthermore, as per the Chinese Timber and Wood Products Association, China is the world's biggest consumer of timber and timber products, with an annual consumption of 570 million m3 of timber, including 310 million m3 of imported timber (RWE).

- In 2022, China launched several initiatives to revive stalled property developments and help developers recover from a funding shortage. Still, at year-end, a new survey showed that only 21% of the country's stalled projects had completely resumed construction.

- The Chinese government is focusing on boosting investments across the construction sector in the country to boost overall economic growth. For instance, recent moves to increase financing for infrastructure construction include a USD 120 billion increase in the lending ratio of policy banks. The government is also considering allowing local governments to spend up to about USD 220 billion of the special bond quota through which local governments fund infrastructure construction.

- The value-added of the construction industry is expected to grow by 6% in 2023, reaching CNY 8.75 trillion (USD 1.2 Trillion). The growth of commercial property construction is expected to increase, with infrastructure projects starting, while residential property construction is projected to show little growth in 2023.

- In August 2023, the construction of 3 schools and one hospital project entered a new phase. Beijing is aiding the new area by building three schools and one hospital.

- These policies are expected to drive the nation's construction industry over the forecast period. This will likely spur the demand for the market studied in the construction industry. The government is also looking forward to boosting activities in the construction sector, more specifically in the infrastructure sector, after the recovery from COVID-19 to bounce back from the country's economic impact.

- Thus, the aforementioned factors are expected to impact the market's demand studied in the country during the forecast period.

Asia-Pacific Cross-Laminated Timber Industry Overview

The Asia Pacific cross-laminated timber (CLT) market is consolidated in nature, with few key players leading the studied market. The major players (not in any particular order) include Stora Enso, Timberlink Australia & New Zealand, KLH Massivholz GmbH, HASSLACHER Holding GmbH, and Holmen.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Commercial Sector in the Region

- 4.1.2 Increasing Popularity of Cross-Laminated Timber Over other Traditional Wood Materials

- 4.2 Restraints

- 4.2.1 Moisture Absorption Related Risks of the Material

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Adhesive Bonded

- 5.1.2 Mechanically Fastened

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Non-Residential

- 5.2.2.1 Commercial

- 5.2.2.2 Industrial/Institutional

- 5.2.2.3 Other Applications

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGROP NOVA a.s.

- 6.4.2 HASSLACHER Holding GmbH

- 6.4.3 Holmen

- 6.4.4 KLH Massivholz GmbH

- 6.4.5 Mercer International Inc.

- 6.4.6 SCHILLIGER HOLZ AG

- 6.4.7 SEIHOKU CORPORATION

- 6.4.8 Stora Enso

- 6.4.9 Timberlink Australia & New Zealand

- 6.4.10 XLam Australia Pty Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Carbon-negative Future Based on Cross-laminated Timber