|

市场调查报告书

商品编码

1693969

中东行销和广告代理商市场-市场占有率分析、产业趋势和成长预测(2025-2031)Middle East Marketing and Advertising Agency Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

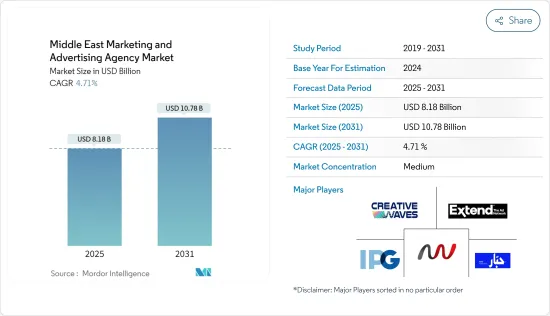

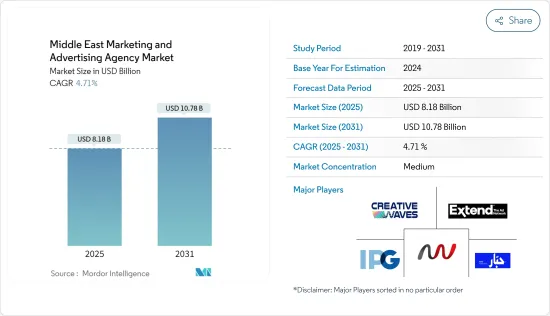

中东行销和广告代理商市场规模预计在 2025 年为 81.8 亿美元,预计到 2031 年将达到 107.8 亿美元,预测期内(2025-2031 年)的复合年增长率为 4.71%。

中东正在经历快速的数位转型,其特点是智慧型手机和网路使用量的增加。消费行为受到这种变化的严重影响,Facebook、Instagram 和 X(以前称为 Twitter)等社群媒体网站的普及使得企业更加关注数位行销策略。行销机构正在适应这种新的数位环境。

关键亮点

- 中东是行动普及率最高的地区之一。如今,任何宣传活动如果没有行动广告(包括简讯行销和应用程式内广告)都是不完整的。为了在客户选择的设备上接触到他们,各机构正在加大对以行动为中心的宣传活动的投资。良好的行销策略通常需要透彻了解当地的方言和文化怪癖。有效的定位技术可以帮助代理商与目标客户建立更深层的联繫。斋月宣传活动是体现斋月在穆斯林占多数的地区的重要性的一个常见例子。

- 中东消费者很快就接受了新技术。扩增实境(AR) 和虚拟实境 (VR) 体验越来越多地被融入行销宣传活动中,以创造身临其境且引人入胜的品牌体验。科技融合的例子是宜家在中东几个国家设立的虚拟实境展示室。 VR 体验让消费者在购买之前可以虚拟探索和体验宜家产品。这种富有创意的行销策略吸引了那些重视现代、沉浸式零售环境的中东科技爱好者。

- 为了满足产业不断变化的需求,确保人才是重中之重。为了确保拥有具备最新数位行销、数据分析和创新内容製作能力的人才,中东的行销机构正在投资培训计画并与教育机构合作。总部位于杜拜的创意实验室 (创新 Lab) 就是该产业在人才培育方面做出努力的一个例子。该实验室提供资源、培训和指导,帮助他们在广告业取得成功,并成为新兴创意人才的培养箱。这些项目有助于在快速变化的营销和传播领域培养训练有素的劳动力和创造力。

- 中东正在经历一场快速的数位革命,越来越多的消费者依赖网路管道。社群媒体搜寻引擎行销和线上展示广告等数位平台占公司广告支出的很大一部分。中东人口不断成长,为企业提供了更广泛的消费群体。为了打入这个市场,各公司都在大力投资广告策略,以提高品牌知名度和市场占有率。

- 中东行销和广告代理商市场具有很大的成长空间,但也存在一些障碍,其中最大的障碍是资金限制以及中小企业对行销和广告服务的接受度低。由于油价波动、地缘政治动盪和全球总体经济状况等因素造成的周期性景气衰退,中东地区的企业经常面临预算紧张的局面。在这样的景气衰退时期,行销和广告成本往往是首先被考虑和削减的成本。

中东行销和广告代理商市场趋势

中小企业显着成长

- 中小型企业的定义是员工人数不超过 250 人、年销售额不超过 2 亿沙特里亚尔(约 5,331 万美元)的公司。预计沙乌地阿拉伯的行销和广告代理商市场将整体终端行业广告支出增加的推动。由于影片和行动广告趋势的兴起,广告投资的增加对沙乌地阿拉伯行销和广告代理商的市场发展做出了巨大贡献。

- 社群媒体平台的兴起对于塑造沙乌地阿拉伯的消费行为至关重要。消费者透过社群媒体平台与品牌和有影响力的人互动,进行产品研究、评论和推荐。因此,响应不断变化的消费者偏好对于市场相关人员增加竞争力和满足客户不断变化的需求至关重要。

- 沙乌地阿拉伯的中小企业正在拥抱数位转型和创新技术。人工智慧、区块链和物联网等新兴技术正在增强中小企业的业务营运。此外,数位技术彻底改变了该国的广告格局。

- 根据沙乌地阿拉伯中小企业总局(Monsha'at)的报告,2023年沙乌地阿拉伯王国的中小企业数量与2022年第四季相比大幅增加了4.8%。报告进一步显示,2023年第一季,全国新推出了88,858新业务,其中利雅德占41.4%,麦加占18.1%,东部省占11.1%,其他城市占28.6%。预计这将刺激旅游、电子商务、零售、食品饮料和金融科技等关键行业的新成长。由于电子商务销售额的成长,所研究的市场预计将变得更加活跃。

- 作为「2030 年愿景」目标的一部分,中小企业部门的目标是到 2030 年国内生产总值贡献 35%。透过公共和私人投资以及机构间的独特伙伴关係,「2030愿景」将把该国的广告业定位为提升国家文化、经济和社会转型的关键组成部分。沙乌地阿拉伯的广告业正在经历指数级增长,吸引了许多本地和国际机构,并增加了对扩大其能力的投资需求。这种激增也导致该国出现了大量独立的营销和广告机构。

- 「2030愿景」也旨在减少沙乌地阿拉伯对其主要经济引擎石油的严重依赖。由于这些改革,沙乌地阿拉伯拥有最高的年经济成长率之一,年轻人口热衷于数位科技和社群媒体。这为行销和广告公司以及新兴企业提供了无限的机会和成长潜力。此外,为促进创业,沙乌地阿拉伯商务部在2022年登记了314,500家公司和机构进行商业登记。利雅德拥有最多的註册企业,是商业环境中创业精神最强的城市,其中大多数活跃于广告业。

利雅德经济强劲成长

- 利雅德是沙乌地阿拉伯的首都和最大城市,正在引领该国的数位革命。王储穆罕默德·本·萨勒曼的「沙乌地阿拉伯2030愿景」经济多元化计画可能会对行销和广告业产生重大影响。

- 此外,包括利雅德在内的沙乌地阿拉伯是世界上社群媒体普及率最高的国家之一。由于其极高的受欢迎程度,Snapchat、Instagram、Twitter 和 YouTube 等平台对于任何行销宣传活动都至关重要。

- 在利雅德,有影响力的行销取得了巨大的成功,因为有影响力的人对顾客偏好有着巨大的影响力。利雅德是时尚、旅游、科技和生活风格等各行各业影响力人士的聚集地。品牌利用这些影响者与特定目标市场建立联繫。例如,像阿卜杜勒阿齐兹·巴兹 (Abdulaziz Baz) 这样的有影响力的人物在利雅德已经相当出名。许多品牌,尤其是时尚和生活方式领域的品牌,都与他合作进行促销活动。例如,一家位于利雅德的时装公司可以与 Abdulaziz Baz 合作推出其最新系列,并吸引更多潜在买家。

- 利雅德拥有多元化的人口,因此行销机构在进行宣传活动时必须考虑文化敏感度。为了与目标受众建立联繫,广告经常融入当地的传统、价值观和仪式。尊重和认可沙乌地阿拉伯文化的企业更有可能与利雅德的消费者建立牢固、信任的关係。例如,联合国开发计画署表示,到2030年,利雅德的人口将达到790万人。

中东行销与广告代理商市场概览

该地区拥有众多领先的国际广告公司,例如 Impact Creative Waves、Extend The Ad Network、Creative Habbar 和 Advertising Ways Company。儘管市场正在整合,但各大代理商仍在零售、科技和金融等多个领域争夺大额交易。近年来,影响者行销越来越受欢迎,影响者文化在中东地区蓬勃发展。特别是在电子商务产业,由于网路购物的扩张,对数位行销服务的需求正在激增。

- 2023年10月,主要企业赢得了Remat Al-Riyadh Development提案的在利雅德安装、营运和维护户外广告看板的计划。作为计划的一部分,透过与公共投资基金公司沙乌地阿拉伯人工智慧公司(SCAI)合作,该城市将转变为一个数位化、创新和永续发展的地区。

- 2023 年 6 月,数位能力开发公司 AstroLabs 和 TikTok 关闭了其旗舰合作伙伴计划,以支援沙乌地阿拉伯的中小企业。 TikTok 与 AstroLabs 合作,有效地为小型企业提供在数位时代进行广告宣传和取得成功的知识和工具。 AstroLabs 与 TikTok 的合作将支持小型企业进行数位转型,并将尖端广告工具交给当地小型企业。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 市场估计和预测

- 产业价值链分析

- 主要趋势分析

- 关键指标分析

第五章市场动态

- 市场驱动因素

- 组织广告支出增加,导致外包给广告代理商

- 加强行销策略整合,将其作为中东主要国家成长策略的一部分

- 市场问题

- 预算限制和中小企业缺乏渗透是障碍

- 中东地区的关键创新与倡议

第六章市场区隔

- 按组织规模

- 中小型企业

- 大型企业

- 按目标范围

- 全方位服务

- 专业技能

- 按最终用户部门

- 公共部门

- 私部门

- 按地区-沙乌地阿拉伯

- 利雅得

- 吉达

- 达曼

- 按最终用户产业

- 科技与通讯

- 医疗保健

- 消费品

- 金融服务

- 教育

- 零售与电子商务

- 製造业

- 媒体娱乐

- 政府

- 车

- 旅行

- 其他的

第七章竞争格局

- 公司简介

- Creative Waves

- Extend The Ad Network

- Creative Habbar

- Advertising Ways Company

- The Interpublic Group of Companies Inc.

- Publicis Groupe

- WPP Plc

- Omnicom Group Inc.

- Accenture Song(Accenture PLC)

- Havas Saudi Arabia(Vivendi)

- Dentsu KSA(Dentsu Group Inc.)

第八章:未来市场展望

The Middle East Marketing and Advertising Agency Market size is estimated at USD 8.18 billion in 2025, and is expected to reach USD 10.78 billion by 2031, at a CAGR of 4.71% during the forecast period (2025-2031).

The Middle East has experienced a swift digital shift characterized by a rise in smartphone and Internet usage. Consumer behavior has been significantly impacted by this change, which has prompted businesses to concentrate more on digital marketing tactics due to the widespread use of social media sites like Facebook, Instagram, and X (formerly Twitter). Marketing agencies are changing to fit in this new digital environment.

Key Highlights

- The Middle East has one of the highest rates of mobile penetration. Campaigns now cannot function without mobile advertising, which includes SMS marketing and in-app advertisements. In order to reach customers on their chosen devices, agencies are investing more and more in mobile-centric campaigns. Good marketing strategies frequently require a thorough comprehension of regional dialects and cultural quirks. Effective location techniques help agencies connect with their target audience more deeply. Ramadan promotions are a common example of how the month is significant in the region where Muslims predominate.

- Consumers in the Middle East are quick to accept new technologies. In order to create immersive and captivating brand experiences, augmented reality (AR) and virtual reality (VR) experiences are increasingly being included in marketing campaigns. One instance of technological integration is the virtual reality showroom that IKEA has set up in several Middle Eastern nations. Before making a purchase, shoppers may virtually explore and engage with IKEA products due to the VR experience. This creative marketing strategy appeals to tech-savvy Middle Eastern customers who value modern and immersive retail environments.

- Building a competent workforce is a priority in order to satisfy the industry's changing demands. To ensure that its talent pool has the newest capabilities in digital marketing, data analytics, and creative content creation, marketing agencies in the Middle East are investing in training programs and forming collaborations with educational institutions. An illustration of industry efforts in talent development is the Dubai-based creative lab. With resources, training, and coaching to help them thrive in the advertising profession, it acts as an incubator for upcoming creatives. These kinds of programs support the development of a trained labor force and creativity in the quickly changing field of marketing and communication.

- The Middle East is undergoing a swift digital revolution as a growing proportion of its consumers depend on Internet channels. Digital platforms such as social media search engine marketing and online display advertising receive a large share of organizations' advertising spending. The population in the Middle East is growing, giving firms access to a wider consumer base. Organizations are spending on aggressive advertising strategies to increase brand awareness and market share to enter into this market.

- Although the Middle Eastern market for marketing and advertising agencies has a lot of room to grow, there are several obstacles in the way, chief among them being financial limitations and the low uptake of marketing and advertising services by smaller businesses. Enterprises in the Middle East frequently face tighter budgets as a result of periodic economic downturns brought on by variables, including shifting oil prices, geopolitical unrest, and general global economic conditions. One of the first things to be examined and reduced during one of these downturns is marketing and advertising spending.

Middle East Marketing and Advertising Agency Market Trends

Small and Medium Enterprises to Witness Significant Growth

- SMEs are enterprises that have an employee size of less than 250 employees and annual revenue of less than SAR 200 million (~USD 53.31 million). Increased advertisement spending across end-use industry verticals is expected to drive the demand for the marketing and advertising agencies market in Saudi Arabia. An increase in ad investment owing to the rising trends of video and mobile ads is a significant contributor to the development of marketing and advertising agencies in Saudi Arabia.

- The rise in social media platforms is essential in shaping consumer behavior in the country. Consumers engage with brands and influencers across social media platforms for product research, reviews, and recommendations. As a result, adapting to evolving consumer preferences is essential for market players to gain a competitive edge and meet customers' changing needs.

- Small- and medium-sized enterprises (SMEs) in Saudi Arabia are embracing digital transformation and innovative technology. Emerging technologies such as AI, blockchain, and the Internet of Things (IoT) enhance the SME's business operations. Further, digital technologies have revolutionized the advertising landscape in the country.

- According to the Small and Medium Enterprises General Authority (Monsha'at) report, Small- and medium-sized enterprises in the Kingdom of Saudi Arabia reflected a 4.8% surge in 2023 compared to the final quarter of 2022. The report further revealed that 88,858 new businesses were launched across the country in the first quarter of 2023. Riyadh was home to 41.4%, followed by Makkah at 18.1%, the Eastern Province at 11.1%, and the other cities for 28.6% of the total SMEs in Saudi Arabia. This is anticipated to spur new growth across critical sectors such as tourism, e-commerce, retail, food and beverage, and fintech. The growing e-commerce sales are expected to boost the market studied.

- The SME sector aims to contribute 35% of the gross domestic product by 2030 as part of the Vision 2030 goals. Vision 2030 elevates the country's advertising sector, making it a vital component of the cultural, economic, and social transformation through a unique partnership between public and private investments and agencies. The advertising sector in Saudi Arabia is witnessing an exponential rise in growth and demand within both local and global agencies to converge and invest in expanding their capacity. This surge has also led to the emergence of numerous independent marketing and advertising agencies in the country.

- Vision 2030 also aims to reduce Saudi Arabia's over-dependence on oil as the main economic driver. As a result of these reforms, Saudi Arabia boasts the highest annual economic growth rate and possesses a young demographic that prefers digital technology and social media. Therefore, marketing and advertising enterprises and startups have access to limitless opportunities and growth potential. Additionally, to boost entrepreneurship, the Saudi Arabian Ministry of Commerce issued 314,500 commercial registrations for firms and establishments in 2022. Riyadh led the most commercial registrations, making it the city with the most emerging entrepreneurs in the business landscape, most of whom operate within the advertising sector.

Riyadh to Witness Major Growth

- Saudi Arabia's capital and largest city, Riyadh, is leading the nation's digital revolution. The marketing and advertising industry will be greatly impacted by Crown Prince Mohammed bin Salman's Saudi Vision 2030 plan, which intends to diversify the economy.

- Moreover, Saudi Arabia, which includes Riyadh, has one of the highest rates of social media adoption worldwide. Because of their enormous popularity, platforms like Snapchat, Instagram, Twitter, and YouTube are essential for marketing campaigns.

- In Riyadh, influencers have a big impact on customer preferences, making influencer marketing quite successful. Influencers from a variety of industries, including fashion, tourism, technology, and lifestyle, may be found in Riyadh. These influencers are used by brands to establish a connection with particular target markets. For instance, influencers such as Abdulaziz Baz have become quite well-known in Riyadh. Brands work with him on promotional initiatives, particularly in the fashion and lifestyle domains. For example, a fashion firm with headquarters in Riyadh elaborates with Abdulaziz Baz to present its most recent collection, which would reach a large number of prospective buyers.

- Due to the diverse population in Riyadh, marketing agencies must take cultural sensitivity into account while creating campaigns. In order to connect with the intended audience, advertisements frequently incorporate regional traditions, values, and rituals. Companies that are cognizant of in respectful of Saudi culture have a greater chance of establishing a strong rapport with Riyadh consumers. For instance, UNDP indicate that by 2030, the population of Riyadh will reach 7.9 million residents.

Middle East Marketing and Advertising Agency Market Overview

There is a notable presence of major international advertising firms in the area, including Impact Creative Waves, Extend The Ad Network, Creative Habbar, and Advertising Ways Company. Although the market is consolidated, agencies are fighting it out for big accounts in various sectors like retail, technology, and finance. Influencer marketing has been more popular in recent years, and the Middle East has a thriving influencer culture. The e-commerce industry, in particular, is seeing a surge in demand for digital marketing services due to the growth of online purchasing.

- October 2023: Saudi Arabia's one of the leading out-of-home advertising firms, AlArabia Outdoor Advertising, won a project proposed by Remat Al-Riyadh Development company to establish, operate, and maintain outdoor advertising billboards in Riyadh. The city will be transformed into a digital, innovative, and sustainable region, achieved through an alliance with the Saudi Artificial Intelligence Company (SCAI), one of the Public Investment Fund companies, as a part of the project.

- June 2023: AstroLabs, a digital capability-building company, and TikTok concluded their flagship partner program supporting small- and medium-sized businesses in Saudi Arabia. TikTok partnered with AstroLabs to effectively equip small and medium enterprises with the knowledge and tools to advertise and thrive in the digital era. AstroLabs' partnership with TikTok will support the digital transformation efforts of SME businesses, bringing cutting-edge advertising tools to the fingertips of local SMBs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Size Estimates and Forecasts

- 4.3 Industry Value Chain Analysis

- 4.4 Key Trends Analysis

- 4.5 Key Base Indicator Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Advertisement Spending of Organizations Leading to Outsourcing to Advertising Agency

- 5.1.2 Increased Integration of Marketing Strategies as Part of Growth Strategies in Key Middle East Countries

- 5.2 Market Challenges

- 5.2.1 Budgetary Constraints and Lack of Penetration Amongst Smaller Companies Act as a Barrier

- 5.3 Key Technological Innovations and Initiatives in the Middle East

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small and Medium-sized Enterprises

- 6.1.2 Large Enterprises

- 6.2 By Coverage

- 6.2.1 Full-Service

- 6.2.2 Specialized Capabilities

- 6.3 By End-user Sector

- 6.3.1 Public and Institutional

- 6.3.2 Private Enterprises

- 6.4 By Region - Saudi Arabia

- 6.4.1 Riyadh

- 6.4.2 Jeddah

- 6.4.3 Dammam

- 6.5 By End-user Industry

- 6.5.1 Technology and Telecom

- 6.5.2 Healthcare

- 6.5.3 Consumer Goods

- 6.5.4 Financial Services

- 6.5.5 Education

- 6.5.6 Retail and E-commerce

- 6.5.7 Manufacturing

- 6.5.8 Media and Entertainment

- 6.5.9 Government

- 6.5.10 Automotive

- 6.5.11 Travel

- 6.5.12 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Creative Waves

- 7.1.2 Extend The Ad Network

- 7.1.3 Creative Habbar

- 7.1.4 Advertising Ways Company

- 7.1.5 The Interpublic Group of Companies Inc.

- 7.1.6 Publicis Groupe

- 7.1.7 WPP Plc

- 7.1.8 Omnicom Group Inc.

- 7.1.9 Accenture Song (Accenture PLC)

- 7.1.10 Havas Saudi Arabia (Vivendi)

- 7.1.11 Dentsu KSA (Dentsu Group Inc.)