|

市场调查报告书

商品编码

1694003

北美棒状包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Stick Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

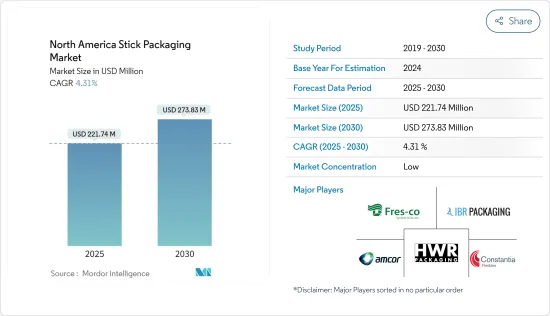

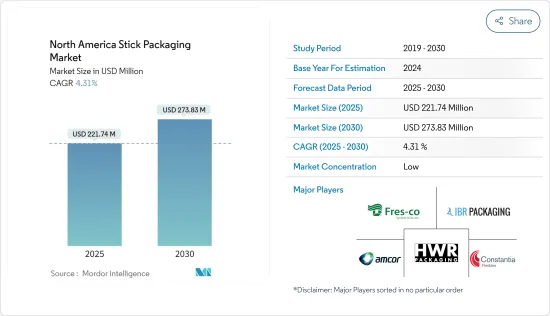

北美棒状包装市场规模预计在 2025 年为 2.2174 亿美元,预计到 2030 年将达到 2.7383 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.31%。

就出货量而言,预计将从 2025 年的 31.2 亿台成长到 2030 年的 37.8 亿台,预测期间(2025-2030 年)的复合年增长率为 3.94%。

关键亮点

- 北美对单份包装的需求受到消费者购买行为变化的推动,灵活、经济高效且易于使用的包装的普及预计将推动市场发展。与其他软包装一样,条形包装重量轻、方便且便于携带。单份尺寸的条状包装为消费者提供了独特的卖点。

- 此外,采用优质包装材料生产的棒状包装还可作为维持产品新鲜度和延长保质期的工具。所有这些因素都推动了全部区域全球对棒状包装的需求。

- 此外,单独包装是一个全新的创新概念。因此,该市场仍未开发,行业参与企业拥有利用这一尚未开发的细分市场的绝佳机会。技术的快速采用加上市场区隔将加剧竞争,最终导致产量增加。

- 根据产品的保质期要求、永续性目标和内容,条状包装可采用多种材质,包括塑胶、铝箔和层压纸。塑胶棒包装通常更受青睐,因为它们具有成本效益并且能够保持产品新鲜度。

- 此外,对于小型企业来说,条形包装是一种经济有效的销售单一产品的方式,但前提是使用塑胶作为材料。但随着美国逐步淘汰一次性塑料,一次性塑胶包装即将失去在市场上的地位。预计这将阻碍市场成长。

北美棒状包装市场趋势

个人护理和化妆品领域将显着增长

- 不断变化的消费趋势、对旅行友善选择的关注以及社交媒体的影响都促使棒状包装的个人护理用品越来越受欢迎。随着行业不断创新并满足不断变化的消费者需求,棒状包装有望在塑造个人护理和化妆品包装的未来方面保持其重要性。

- 不断发展的美丽偶像、对自我护理的重视以及日益增强的护肤意识是影响北美化妆品和个人保养用品消费的因素。为了满足这种需求,方便、便携的棒状包装越来越受欢迎。棒状包装的化妆品(例如化妆品和化妆水样品)可让消费者尝试新产品或在旅行时使用。

- 社群媒体和美容影响者的影响在塑造化妆品行业消费者偏好方面发挥着重要作用。棒状包装产品经常出现在教学和评论中,由于其易于使用和美观的外观而越来越受欢迎,促进了市场的成长。

- 棒状包装的使用不仅限于传统零售。餐饮、饭店和健身中心等领域也开始青睐棒状包装的个人护理用品。例如,饭店设施中越来越多地提供一次性使用的洗髮精、护髮素和沐浴露小袋或小棒。

- 棒状包装有助于开发护髮行业的定製配方和有针对性的治疗方法。专用油护理、免冲洗护髮素和头皮乳液可以轻鬆配製并以条状包装形式提供,为消费者提供满足其独特护髮需求的客製化解决方案。产品开发中的这种灵活性使得护髮产品更加多功能和有效。

美国将呈现最高成长率

- 棒状包装用于即食香辛料混合物、单份饮料(如咖啡、茶、糖、牛奶、饮料混合物等)等产品,因为它有助于保持产品的新鲜度,从而延长保质期。北美是世界上都市化最高的地区之一。该地区的城市人口严重依赖咖啡店和茶馆。

- 棒状包装以其方便和便携性而闻名。咖啡消费量的增加,尤其是忙碌生活方式的兴起,可能会推动单杯咖啡的需求。这种包装形式易于携带、打开和处理,为越来越多寻求快速、轻鬆享用咖啡的消费者提供了便利。

- 根据美国对外农业服务局的数据,2023/2024财年美国咖啡消费量超过2,730万袋(每袋60公斤)。单份咖啡消费量的增加与单独用餐的趋势一致。棒状包装非常适合单份产品,让消费者可以轻鬆测量一杯所需的咖啡量。这一趋势是由人们对新鲜、方便和减少废弃物的渴望所驱动的。

- 美国国家咖啡协会 (NCA) 发布了《2023 年全国咖啡数据趋势报告》。该报告追踪了过去 70 年来美国咖啡消费的最重要趋势。报告显示,咖啡仍是美国人最受欢迎的饮料,63%的受访者每天都喝咖啡。这使得咖啡在美国的受欢迎程度超过了瓶装水、茶和自来水。

- 在美国,优质咖啡和专门食品咖啡的消费量正在大幅增加。随着消费者对咖啡品质的要求越来越高,饭店业也热衷于提供高品质的单份咖啡以满足这一需求。美国人的生活方式以快节奏、忙碌的文化为特征,对便利的需求日益增长。棒状包装完美契合了这一趋势,让饭店住宿无需复杂的冲泡设备即可快速、轻鬆地享用一杯咖啡。此外,条状包装迎合了咖啡爱好者群体的偏好,鼓励饭店采用创新的包装解决方案,以满足对优质、便利和个人化咖啡体验日益增长的需求。

北美棒状包装产业概况

北美棒状包装市场由多个全球和区域参与企业组成,在竞争激烈的市场空间中争夺关注。该行业高度细分,包括 Amcor Plc、Constantia flexibles Group GmbH、Fres-Co System Inc、IBR Packaging 和 HWR Packaging LLC 等市场现有企业以及一些区域包装企业。

- 2023 年 11 月 - Amcor 宣布与最大的可持续聚乙烯製造商之一 NOVA Chemicals Corp. 签署了一份谅解备忘录,以采购 RPE(再生聚乙烯)来製造软包装薄膜。 Amcor 推动包装循环的关键倡议之一是增加 RPE 在软包装中的使用。 NOVA Chemicals 希望在未来几年内扩大其北美回收业务,以实现其行业领先的目标,即在含有再生成分的产品中占据聚乙烯 (PE) 总销售额的 30% 的市场占有率。

- 2023 年 4 月 - Fres-Co System USA Inc. 已开始采取以永续性为重点的方法,透过 NextRex 回收计画申请并认证其可回收咖啡包装。其带有角撑板的零售咖啡包装与其创新的排气阀相结合的认证凸显了 Fres-co 对环保实践的承诺,并使其成为第一家通过该计划认证的超高阻隔包装和接近零氧气透过的单一来源软包装供应商。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 生态系分析

- 行业标准和法规

- 消费者和最终用户对棒状包装的偏好分析

第五章市场动态

- 市场驱动因素

- 由于生产成本低,对条状包装食品的需求不断增加

- 棒状包装在製药业日益普及

- 市场问题

- 加大对一次性塑胶的禁令

第六章市场区隔

- 材料类型

- 塑胶

- 金属化薄膜

- 纸

- 最终用户

- 饮食

- 咖啡和茶产品

- 乳製品(优格、奶粉等)

- 其他食品和饮料(香辛料、调味料、盐、糖、酱汁、蘸料等)

- 製药

- 个人护理和化妆品

- 其他最终用户(黏合剂/密封剂、化学品等)

- 饮食

- 国家

- 美国

- 加拿大

第七章竞争格局

- 公司简介

- Amcor Group GmbH

- Constantia Flexibles Group GmbH

- Fres-co System Usa Inc.

- IBR Packaging

- HWR Packaging LLC

- Sonoco Products Company

- CATALENT INC.

- Sonic Packaging Industries

- Elis Packaging Solutions Inc.

- Glenroy Inc.

- Brand Nutra LLC

- Avery Dennison Corporation

第八章:市场的未来

The North America Stick Packaging Market size is estimated at USD 221.74 million in 2025, and is expected to reach USD 273.83 million by 2030, at a CAGR of 4.31% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 3.12 billion units in 2025 to 3.78 billion units by 2030, at a CAGR of 3.94% during the forecast period (2025-2030).

Key Highlights

- The demand for single-serve packaging in North America is attributed to changing consumer buying behavior, and the increasing prevalence of flexible, cost-effective, and user-friendly packaging is expected to drive the market. Like all flexible packaging, stick packs are lightweight, convenient, and highly portable. The single-serve size of stick packs serves as a unique selling point for consumers.

- Moreover, stick packaging can also serve as a tool for keeping products fresh and increasing their shelf life when produced with quality packaging materials when produced with quality packaging materials. All these factors boost the demand for stick packaging globally across the region.

- Additionally, single-service packaging is a new and innovative concept. As a result, the market remains unexplored, and industry players have tremendous opportunities to profit from this untapped market segment. The rapid adoption of technologies, combined with the fragmented nature of the market, leads to intense competition, ultimately increasing production output.

- Stick packs are available in various materials, including plastic, aluminum foil, and laminated paper, depending on the product's shelf-life requirements, sustainability objectives, and content. Plastic stick packs are generally preferred due to their cost-effectiveness and ability to keep products fresh.

- Moreover, Stick-pack packaging is a cost-effective way for small businesses to sell individual products, but only when they use plastic as a material, but single-use plastic packaging is on the verge of losing its grip on the market as the United States is phasing out single-use plastic. This is expected to hinder the market's growth.

North America Stick Packaging Market Trends

Personal Care and Cosmetics Segment to Witness Significant Growth

- Changing consumption trends, a focus on travel-friendly options, and the influence of social media contribute to the increasing popularity of stick-packaged personal care items. As the industry continues to innovate and cater to evolving consumer needs, stick packaging is expected to maintain its significance in shaping the future of personal care and cosmetics packaging.

- Factors like evolving beauty idols, a growing emphasis on self-care, and a heightened consciousness about skincare have shaped the consumption of cosmetic and personal care goods in North America. To cater to this demand, the market has witnessed a surge in the popularity of stick packaging, which offers convenience and portability. Stick-packaged cosmetics, like makeup or lotion samples, enable consumers to try out new products or use them while traveling.

- The influence of social media and beauty influencers has played a significant role in shaping consumer preferences in the cosmetics industry. Stick-packaged products, often featured in tutorials and reviews, gain popularity due to their user-friendly and visually appealing nature, contributing to their growth in the market.

- The use of stick packaging is not limited to traditional retail. Sectors such as hospitality, hotels, and fitness centers are incorporating stick-packaged personal care items into their offerings. Hotel amenities, for example, increasingly include single-use sachets or sticks of shampoo, conditioner, and body wash.

- Stick packaging allows for the development of customized formulas and targeted treatments in the hair care industry. Specialized oil treatments, leave-in conditioners, and scalp lotions can be easily formulated and delivered in stick packs, providing consumers with tailored solutions for their unique hair care needs. This product development flexibility enhances the variety and effectiveness of hair care offerings.

United States to Witness the Highest Growth Rate

- Stick packaging is used for products such as ready-portioned spice mixes and single-serve beverages, including coffee, tea, sugar, milk, drink mixes, and many more, owing to its ability to keep the products fresh, thereby providing a longer shelf life. North America is one of the most urbanized regions across the globe. The region's urban population largely depends on coffee shops and tea parlous.

- Stick packaging is known for its convenience and portability. With increased coffee consumption, especially for on-the-go lifestyles, there may be a higher demand for single-serve coffee sticks. This packaging format is easy to carry, open, and dispose of, making it convenient for consumers increasingly looking for quick and hassle-free ways to enjoy their coffee.

- According to the USDA Foreign Agricultural Service, Coffee consumption in the United States amounted to over 27.30 million 60-kilogram bags in the 2023/2024 fiscal year. The rise in single-serve coffee consumption aligns with the trend towards individualized portions. Stick packaging is well-suited for single-serve products, allowing consumers to easily measure and use the right amount of coffee for a single cup. This trend is driven by the desire for freshness, convenience, and reducing waste.

- The National Coffee Association (NCA) has released its National Coffee Data Trends Report 2023. The report tracks the most significant trends in coffee consumption in the United States over the past 70 years. According to the report, coffee remains the most popular beverage among Americans, with 63% of respondents consuming it daily. This puts coffee ahead of bottled water, tea, and tap water in terms of popularity in the United States.

- The United States has experienced a significant surge in premium and specialty coffee consumption. As consumers become more discerning about the quality of their coffee, hotels in the hospitality sector are motivated to offer high-quality, single-serve options that cater to this demand. The American lifestyle, marked by a fast-paced, on-the-go culture, has led to an increased demand for convenience. Stick packaging aligns perfectly with this trend, allowing hotel guests to enjoy a quick and hassle-free cup of coffee without needing elaborate brewing equipment. Moreover, stick packaging caters to the preferences of a coffee-savvy consumer base, driving hotels to adopt innovative packaging solutions that cater to the growing demand for premium, convenient, and personalized coffee experiences.

North America Stick Packaging Industry Overview

The North America stick packaging market comprises several global and regional players vying for attention in a contested market space. The industry is highly fragmented, comprising market incumbents such as Amcor Plc, Constantia Flexibles Group GmbH, Fres-Co System Inc, IBR Packaging, HWR Packaging LLC, and several regional packaging firms.

- November 2023 - Amcor announced signing an MOU with one of the largest sustainable polyethylene manufacturers, NOVA Chemicals Corp., for procuring RPE (Recycled Polyethylene) to produce flexible packaging films. One of Amcor's key initiatives to promote packaging circularity is increasing the use of RPE in flexible packaging. NOVA Chemicals is looking to grow its recycling operations in North America in the next few years to meet its industry-leading goal of achieving a 30% market share of total sales of polyethylene (PE) from products containing recycled materials.

- April 2023 - Fres-Co System USA Inc. has launched a sustainability-driven approach exemplified by submitting and certifying its recyclable coffee package in the NextRex Recycling program, which stands as a critical growth strategy for the company. The certification of its gusseted retail coffee package, coupled with the innovative degassing valve, highlights Fres-co's commitment to eco-friendly practices and establishes it as the first single-source flexible packaging provider with ultra-high barrier packaging and a near-zero oxygen transmission rate certified in the program.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

- 4.4 Industry Standards and Regulations

- 4.5 Analysis of Consumer and End-user Preference for Stick Packaging

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demands of Food In Stick Packs Due to Low Cost of Manufacturing

- 5.1.2 Increasing Penetration in the Pharmaceutical Industry for Stick Packs

- 5.2 Market Challenges

- 5.2.1 Increasing Ban on Single-Use Plastics

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Plastic

- 6.1.2 Metalized Films

- 6.1.3 Papers

- 6.2 End User

- 6.2.1 Food And Beverage

- 6.2.1.1 Coffee and Tea Products

- 6.2.1.2 Dairy Products (Yogurt, Milk Powder, Etc.)

- 6.2.1.3 Other Food And Beverage Products (Spices & Condiments, Salt & Sugar, Sauces & Dips, Etc.)

- 6.2.2 Pharmaceuticals

- 6.2.3 Personal Care and Cosmetics

- 6.2.4 Other End Users (Adhesive and Sealant, Chemicals, Among Others)

- 6.2.1 Food And Beverage

- 6.3 Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Constantia Flexibles Group GmbH

- 7.1.3 Fres-co System Usa Inc.

- 7.1.4 IBR Packaging

- 7.1.5 HWR Packaging LLC

- 7.1.6 Sonoco Products Company

- 7.1.7 CATALENT INC.

- 7.1.8 Sonic Packaging Industries

- 7.1.9 Elis Packaging Solutions Inc.

- 7.1.10 Glenroy Inc.

- 7.1.11 Brand Nutra LLC

- 7.1.12 Avery Dennison Corporation