|

市场调查报告书

商品编码

1694010

虚拟扩增实境与混合实境(VR/AR) - 市场占有率分析、产业趋势与统计、成长预测 (2025-2030)Virtual Augmented and Mixed Reality (VR/AR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

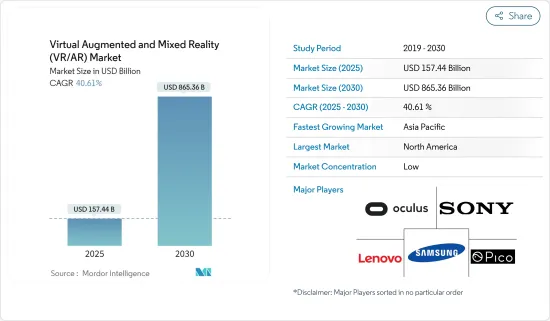

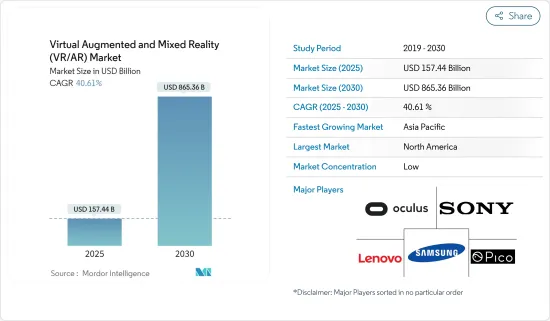

虚拟和混合实境( VR/AR)市场规模预计在 2025 年达到 1,574.4 亿美元,预计到 2030 年将达到 8,653.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 40.61%。

关键亮点

- 虚拟实境是电脑技术的应用,主要目的是产生模拟环境。与传统使用者介面相比,VR 允许使用者沉浸在身临其境的体验中,而不是简单地观察监视器萤幕。这项技术透过提供视觉、触觉、听觉、嗅觉等多感官模拟,无疑在许多方面彻底改变了世界。

- 相较之下,扩增实境是一种令人着迷的体验,它透过结合电脑生成的感官资讯来丰富现实世界。扩增实境使用软体、应用程式和硬体(如 AR 眼镜)将数位内容无缝地融入我们的周围环境和物体中。

- 扩增实境(AR) 技术在商业环境中的广泛应用,该技术正在经历显着成长。考虑到苹果、谷歌、Facebook、微软和亚马逊等知名科技市场领导者在创新和采用方面投入了大量资金,预计它将在未来几年占据突出地位。智慧型手机的日益普及以及 AR 在手机游戏中的日益融合是该市场的主要驱动力,从而促使该领域的主要供应商向市场推出解决方案。

- 混合实境可以让教师展示概念的虚拟范例并结合游戏元素来补充教科书,从而提高课堂教育的互动性。因此,这种创新方法加速了学生的学习并提高了资讯的保留能力。

- 值得承认的是,越来越多的学生,尤其是大专院校的学生,面临着在整个学习过程中保持专注的挑战。他们也可能遇到一系列心理健康问题,包括忧郁症和焦虑。

- 虚拟实境正在成为一项革命性的技术,对各种终端使用者产业产生显着影响。这项技术的接受度不断增长,导致其使用案例显着扩展。虚拟实境技术也提供了多种优势,正在改变传统企业和商业企业的动态。

- 例如,该技术正在零售业中用于改善消费者体验。您可以在购买产品之前在虚拟环境中查看产品。透过利用这项技术,各个终端用户产业的企业可以进行强大的行销宣传活动来吸引更多客户的注意。它还透过在虚拟环境中提供说明来帮助提供远端维护和支援。

- 培训和技能发展是虚拟实境技术需求预计将出现显着增长的主要领域之一,这主要是因为它为流程带来了便利。此外,它还最大限度地降低了整体培训成本,同时提供了比传统方法更安全的过程。例如,为了培训员工在危险环境中工作,组织可以使用模拟虚拟环境,而不是派遣员工到实际现场。

- AR/VR/MR市场正在向各个行业扩张,然而,由于这些都是新兴技术,尚未实现标准化和大规模接受,因此市场仍然存在技术和成本限制。此外,这些技术非常复杂,需要熟练的劳动力来进一步开发。因此,无法确保足够数量的技术纯熟劳工也是市场成长的一大障碍。

虚拟扩增实境与混合实境(VR/AR) 市场趋势

游戏是 VR 成长最快的终端用户

- 虚拟实境 (VR) 因其能够提供身临其境的动态体验而在游戏领域变得流行。透过将参与企业直接置于虚拟环境中,VR 创造了一种真实感和沈浸感。虚拟实境耳机让参与企业能够以第一人称观点体验游戏。这种身临其境的体验增强了游戏体验,让参与企业感觉与虚拟世界及其角色更加紧密地联繫在一起。

- 全高清 (FHD)、超高清 (UHD) 和 4K 显示器等新技术的研究和开发正在推动电视用于玩游戏。游戏产业虚拟实境的成长也受到新技术投资增加的推动。预计图形效能的持续改进将推动 VR 游戏产业的未来。游戏公司正在使用强大的图形处理器来提供融合物理和幻想环境的最佳 VR 游戏。图形在提供逼真的游戏体验方面发挥着至关重要的作用。 3D效果和互动式图形等技术为使用者在虚拟实境平台上玩游戏或行走时提供即时专业知识。

- 全球AR和VR游戏玩家的快速成长正在拓宽市场视野。据人工智慧、机器学习、巨量资料分析和 AR/VR 解决方案提供商 NewGenApps 称,到 2025 年,全球 AR 和 VR 游戏用户群将成长到 2.16 亿。

- 对电玩游戏的需求不断增长,为供应商提供VR头戴装置创造了机会。根据娱乐零售商协会的数据,2022 年英国消费者在电子游戏上的花费约为 46.6 亿英镑(59.5 亿美元),与前一年同期比较增长了 2.3%。 2028年, VR头戴装置市场规模预计将超过2,700万台。

- 游戏产业认识到VR的市场潜力。随着这项技术变得越来越普及和便宜,对 VR 游戏体验的需求也不断增长。游戏开发商和市场先驱将 VR 视为创造令人兴奋、身临其境的体验的机会,可以吸引新的受众并在拥挤的市场中脱颖而出。

北美将在虚拟实境和混合实境( VR/AR)市场占据主要市场占有率

- 北美对虚拟实境 (VR) 的需求正在快速增长,这主要是由于各个领域的个人越来越多地参与技术。需求的成长是由 VR 技术的多样化用途所推动的,从娱乐和游戏到教育、医疗保健和企业解决方案。

- 技术进步使得 VR 设备更加易于存取和用户友好,进一步推动了对 VR 的需求。 VR头戴装置价格低廉且效能不断提升,促使其在北美广泛普及,从技术爱好者到寻求新颖有趣体验的普通用户。因此,许多公司正在推出新产品以增加市场占有率。

- 随着 VR 变得越来越容易获得和使用,它为政府探索创新方法提供了巨大的潜力。因此,美国政府正在利用 VR 作为跨多个领域的宝贵工具。例如,美国食品药物管理局于2023年9月宣布,一些通常只在诊所或医院提供的临床服务可以在患者家中或其他非临床环境中提供;明年这一数字可能会增加,从而推动对 VR 的需求。

- 由于多家供应商大力投资市场创新,且美国在全球软体市场占据主导地位,预计北美扩增实境市场在预测期内将大幅成长。

- 北美市场行动装置普及率的提高和新主机的推出促进了过去几年游戏产业的显着成长。美国是世界上最大的游戏市场之一,为其公民提供各种各样的游戏。在美国,人们报告称,在 COVID-19 疫情隔离期间,他们玩电子游戏的时间与前一周相比增加了 45%。

- 北美对混合实境(MR) 的需求正在快速增长,这主要是由于各个领域的个人越来越多地参与技术。由于多家供应商大力投资市场创新,且美国在全球市场占据主导地位,预计北美混合实境市场在预测期内将大幅成长。

虚拟扩增实境与混合实境(VR/AR) 市场概览

虚拟扩增实境和混合实境(VR/AR) 市场高度细分,主要企业包括 Oculus VR LLC(Meta Platform Technologies)、索尼公司、三星电子、联想集团有限公司和 Pico Interactive Inc.。市场参与企业正在采用联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2023 年 11 月—三星电子宣布计划于 2024 年下半年与 Galaxy Z Flip 6 和 Galaxy Z Fold 6 一起推出其下一代混合实境耳机。据该公司称,三星正在与谷歌和高通合作开发混合实境实境耳机。

- 2023 年 9 月 - Oculus VR LLC 宣布与 15 所美国大学建立新的合作计划,教授身临其境型技术。各大学正在举办虚拟实境课堂和练习,探索身临其境型科技如何推动未来教育的发展。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 和其他宏观经济因素对市场的影响

- 企业需求急剧下降

- 游戏领域将成为未来几个月成长的领头羊

- 远距远端保健的普及将推动医疗保健领域的成长

- 比较VR和AR的相对影响

- 技术简介

第五章市场动态

- 市场驱动因素

- AR/VR 在商业应用的采用率不断提高

- 不同终端使用者群体对 VR 培训设备的需求不断增长

- 技术进步、网路化和连结性增强

- 市场挑战/限制

- 长期使用 AR/ VR头戴装置的健康风险

- 开发 AR/VR 设备的复杂性和高成本

- 网路安全和资料隐私问题

第六章市场区隔

- 按类型

- 硬体

- 系留式 HMD

- 独立式 HMD

- 无萤幕检视器

- 软体

- 硬体

- 按行业

- 游戏

- 媒体娱乐

- 零售

- 医疗保健

- 军事和国防

- 房地产

- 教育

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章扩增实境(AR)市场区隔

- 按类型

- 硬体

- 软体

- 按行业

- 游戏

- 媒体娱乐

- 零售

- 医疗保健

- 军事和国防

- 房地产

- 教育

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第八章混合实境(MR)市场区隔

- 按行业

- 游戏

- 媒体和娱乐

- 零售

- 医疗保健

- 军事和国防

- 房地产

- 教育

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第九章竞争格局

- 公司简介

- Oculus VR LLC

- Sony Corporation

- Samsung Electronics Co. Ltd

- Lenovo Group Ltd

- Pico Interactive Inc.

- Qualcomm Technologies Inc.

- FOVE Inc.

- Unity Technologies Inc

- Unreal Engine(Epic Games Inc.)

- DPVR(Lexiang Technology Co. Ltd)

- Autodesk Inc.

- Eon Reality Inc.

- 3D Systems Corporation

- Dassault Systemes SE

- HTC Vive(HTC Corporation)

- Google LLC(Alphabet Inc.)

- Seiko Epson Corporation

- Vuzix Corporation

- Realwear Inc.

- Dynabook Americas Inc.(Sharp Corporation)

- Niantic Inc.

- Optinvent

- Atheer Inc.

- Blippar.com Ltd

- PTC Inc.

- Ultraleap Limited

- Wikitude GmbH

- TechSee Augmented Vision Ltd

- Microsoft Corporation

- HP Development Company LP

- Dell Technologies Inc.

- AsusTek Computer Inc.

- Acer Inc.

- Magic Leap Inc.

- Amber Garage(Holokit)

- Barco

第 10 章供应商市场占有率

第十一章投资分析

第十二章:投资分析市场的未来

The Virtual Augmented and Mixed Reality Market size is estimated at USD 157.44 billion in 2025, and is expected to reach USD 865.36 billion by 2030, at a CAGR of 40.61% during the forecast period (2025-2030).

Key Highlights

- Virtual reality is the utilization of computer technology primarily aimed at generating a simulated environment. In contrast to the conventional user interface, VR enables users to fully engage in an immersive experience rather than merely observing a monitor screen. This technology has undoubtedly revolutionized various aspects globally by providing a multi-sensory simulation encompassing aspects like vision, touch, hearing, and smell.

- In contrast, augmented reality is a captivating experience that enriches the real world by incorporating computer-generated perceptual information. Augmented reality seamlessly incorporates digital content into our surroundings and objects by utilizing software, apps, and hardware like AR glasses.

- Augmented reality (AR) has experienced remarkable growth due to the widespread utilization of this technology in commercial settings. It is anticipated to hold significant importance in the upcoming years, considering the substantial investments made in innovation and adoption by prominent technology market leaders like Apple, Google, Facebook, Microsoft, and Amazon. The expanding presence of smartphones and the increasing integration of AR in mobile gaming are key drivers of this market, leading to the development of more solutions by major vendors in this segment.

- Using mixed reality may enhance the interactivity of classroom education, as it empowers teachers to present virtual examples of concepts and incorporate gaming elements to supplement textbooks. Consequently, this innovative approach facilitates accelerated learning and improved retention of information for students.

- It is worth acknowledging that an increasing number of students face challenges in maintaining focus and concentration during their educational journey, particularly at universities and colleges. They may also encounter various mental health issues, such as depression and anxiety.

- Virtual reality is emerging as a revolutionary technology that may notably impact various end-user industries. The acceptance of the technology is witnessing continuous growth, leading to significant expansion in the number of use cases. Virtual reality technology also offers several advantages that are changing the dynamics of businesses and commercial enterprises used to operate earlier.

- For instance, the technology is being used in the retail industry to enhance consumer experience. Before purchasing, they may use it to check the product in a virtual environment. By using the technology, businesses across various end-user industries may develop robust marketing campaigns to attract the attention of more customers. It also helps them offer remote maintenance and support by providing the procedures in a virtual environment.

- Training and skill development are among the major sectors wherein the demand for virtual reality technology is anticipated to witness substantial growth primarily due to factors such as the convenience the technology adds to the process. Furthermore, it also helps minimize the overall training cost while making the process safer than traditional methods. For instance, to train employees to work in hazardous environments, organizations may use a simulated virtual environment rather than sending the employee to the actual site.

- Although the AR/VR/MR market is finding an enhanced footprint across various industries, the technological and cost limitations remain relevant in the market as these are emerging technologies and are yet to achieve standardization and mass acceptance. Furthermore, these technologies are complex and require a skilled workforce for further development. Hence, the lack of sufficient availability of a skilled workforce is another major factor challenging the market's growth.

Virtual Augmented and Mixed Reality (VR/AR) Market Trends

Gaming to be the Fastest Growing End-user for VR

- Virtual reality (VR) has become widely used in the gaming sector because of its ability to deliver an immersive and dynamic experience. By sending players directly into the virtual environment, VR creates a sense of presence and immersion. Virtual reality headsets allow players to experience games from a first-person perspective. This heightened immersion enhances the gaming experience and makes players feel more connected to the virtual world and its characters.

- R&D of new technologies, such as Full High-Definition (FHD), Ultra-High Definition (UHD), and 4K displays, has boosted the adoption of TVs for playing games. The growth of virtual reality in the gaming industry has also been stimulated by increasing investments in new technologies. The future of the VR gaming industry is projected to be driven by continued improvement in graphics performance. Gaming companies use potent graphics processors to provide the best VR games to integrate physical and fantasy environments. Graphics play an essential role in providing a realistic gaming experience. Real-time expertise is offered to users by technologies such as 3D effects and interactive graphics while playing games or walking on virtual reality platforms.

- Rapid growth in AR and VR gamers worldwide has expanded the market's horizon. According to NewGenApps, a provider of Artificial Intelligence, Machine Learning, Big Data Analytics, and AR/VR solutions, the global user base of AR and VR games will increase to 216 million users by 2025.

- The increasing demand for video games creates an opportunity for vendors to offer VR headsets. According to the Entertainment Retailers Association, in 2022, British consumers spent approximately GBP 4.66 billion (USD 5.95 billion) on video games. This represents a 2.3% increase from the previous year. By 2028, the market volume of VR headsets is expected to be over 27 million.

- The gaming industry recognizes the market potential of VR. As the technology becomes more accessible and affordable, the demand for VR gaming experiences is increasing. Game developers and publishers see VR as an opportunity to reach new audiences and create exciting, immersive experiences that stand out in a crowded market.

North America to Hold Major Market Share in the Virtual, Augmented, and Mixed Reality Market

- The demand for virtual reality (VR) in North America has experienced rapid growth owing to the significant shift in individuals across various sectors engaging with technology. This increasing demand is fueled by the various applications of VR technology, from entertainment and gaming to education, healthcare, enterprise solutions, and others.

- The demand for VR is further propelled by technological advancements, making VR devices more accessible and user-friendly. The affordability and improved performance of VR headsets have contributed to broader adoption across North America, from tech enthusiasts to casual users seeking novel and engaging experiences. Hence, many companies are launching new products to increase their market share.

- As VR becomes more accessible and easier to use, it offers a lot of great possibilities for the government to explore innovative approaches. Hence, the US government uses VR as a valuable tool across multiple sectors. For instance, in September 2023, the US Food and Drug Administration announced that VR could deliver some clinical services, normally delivered only in clinics and hospitals, to patients in their homes or other non-clinical settings, and in the coming year, this will increase, which will boost the demand of VR.

- Due to several vendors making significant investments in market innovation and the US's dominant position in the global software market, the augmented reality market in North America is expected to grow significantly during the forecast period.

- Increased mobile penetration and the availability of new consoles in the North American market have contributed to tremendous growth in the gaming sector over the last few years. The US is one of the world's biggest gaming markets and offers many games for its citizens. In the United States, video gamers reported an increase of 45% in the time spent playing video games during the quarantine period of the COVID-19 pandemic compared to previous weeks.

- The demand for mixed reality (MR) in North America has experienced rapid growth owing to the significant shift in individuals across various sectors engaging with technology. Due to several vendors making substantial investments in market innovation and the US's dominant position in the global market, the mixed reality market in North America is expected to grow significantly during the forecast period.

Virtual Augmented and Mixed Reality (VR/AR) Market Overview

The virtual, augmented, and mixed reality market is highly fragmented with the presence of major players like Oculus VR LLC (Meta Platform Technologies), Sony Corporation, Samsung Electronics Co. Ltd, Lenovo Group Ltd, and Pico Interactive Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - Samsung Electronics Co. Ltd announced plans to launch its upcoming mixed-reality headset in the second half of 2024 alongside the Galaxy Z Flip6 and the Galaxy Z Fold6. According to the company, Samsung is working on a mixed-reality headset in partnership with Google and Qualcomm.

- September 2023 - Oculus VR LLC announced a new partnership program with 15 US universities teaching immersive technology. Every university is hosting virtual reality classrooms and exercises to explore how immersive technology may advance the future of education.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.3.1 Sharp Decline in Demand Observed in the Enterprise Segment

- 4.3.2 The Gaming Segment to be at the Forefront of Growth in the Upcoming Months

- 4.3.3 Rise in Telehealth-based Implementation to Drive Growth in the Healthcare Segment

- 4.3.4 How Does VR Stack Up Against AR in Terms of the Relative Impact

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of AR/VR in Commercial Application

- 5.1.2 Increasing Demand for VR Setup for Training Across Various End-user Segments

- 5.1.3 Technological Advancements, Networking, and Connectivity Improvements

- 5.2 Market Challenges/Restraints

- 5.2.1 Health Risks from Using AR/VR Headsets in the Longer Run

- 5.2.2 Development Complexity and High Cost of AR/VR Devices

- 5.2.3 Cybersecurity and Data Privacy Issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Tethered HMD

- 6.1.1.2 Standalone HMD

- 6.1.1.3 Screenless Viewer

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By End-user Vertical

- 6.2.1 Gaming

- 6.2.2 Media and Entertainment

- 6.2.3 Retail

- 6.2.4 Healthcare

- 6.2.5 Military and Defense

- 6.2.6 Real Estate

- 6.2.7 Education

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 AUGMENTED REALITY (AR) MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Hardware

- 7.1.2 Software

- 7.2 By End-user Vertical

- 7.2.1 Gaming

- 7.2.2 Media and Entertainment

- 7.2.3 Retail

- 7.2.4 Healthcare

- 7.2.5 Military and Defense

- 7.2.6 Real Estate

- 7.2.7 Education

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

8 MIXED REALITY (MR) MARKET SEGMENTATION

- 8.1 By End-user Vertical

- 8.1.1 Gaming

- 8.1.2 Media and Entertainment

- 8.1.3 Retail

- 8.1.4 Healthcare

- 8.1.5 Military and Defense

- 8.1.6 Real Estate

- 8.1.7 Education

- 8.2 By Geography

- 8.2.1 North America

- 8.2.2 Europe

- 8.2.3 Asia

- 8.2.4 Australia and New Zealand

- 8.2.5 Latin America

- 8.2.6 Middle East and Africa

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Oculus VR LLC

- 9.1.2 Sony Corporation

- 9.1.3 Samsung Electronics Co. Ltd

- 9.1.4 Lenovo Group Ltd

- 9.1.5 Pico Interactive Inc.

- 9.1.6 Qualcomm Technologies Inc.

- 9.1.7 FOVE Inc.

- 9.1.8 Unity Technologies Inc

- 9.1.9 Unreal Engine (Epic Games Inc.)

- 9.1.10 DPVR (Lexiang Technology Co. Ltd)

- 9.1.11 Autodesk Inc.

- 9.1.12 Eon Reality Inc.

- 9.1.13 3D Systems Corporation

- 9.1.14 Dassault Systemes SE

- 9.1.15 HTC Vive (HTC Corporation)

- 9.1.16 Google LLC (Alphabet Inc.)

- 9.1.17 Seiko Epson Corporation

- 9.1.18 Vuzix Corporation

- 9.1.19 Realwear Inc.

- 9.1.20 Dynabook Americas Inc. (Sharp Corporation)

- 9.1.21 Niantic Inc.

- 9.1.22 Optinvent

- 9.1.23 Atheer Inc.

- 9.1.24 Blippar.com Ltd

- 9.1.25 PTC Inc.

- 9.1.26 Ultraleap Limited

- 9.1.27 Wikitude GmbH

- 9.1.28 TechSee Augmented Vision Ltd

- 9.1.29 Microsoft Corporation

- 9.1.30 HP Development Company LP

- 9.1.31 Dell Technologies Inc.

- 9.1.32 AsusTek Computer Inc.

- 9.1.33 Acer Inc.

- 9.1.34 Magic Leap Inc.

- 9.1.35 Amber Garage (Holokit)

- 9.1.36 Barco