|

市场调查报告书

商品编码

1694016

金属精密车削产品製造:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Metal Precision Turned Product Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

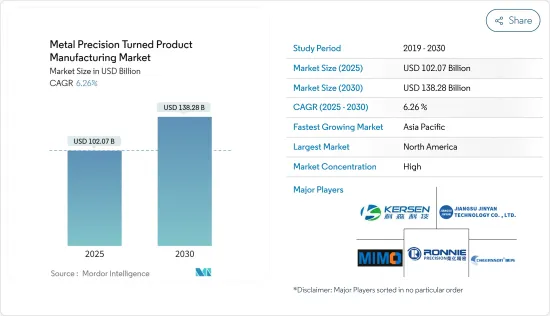

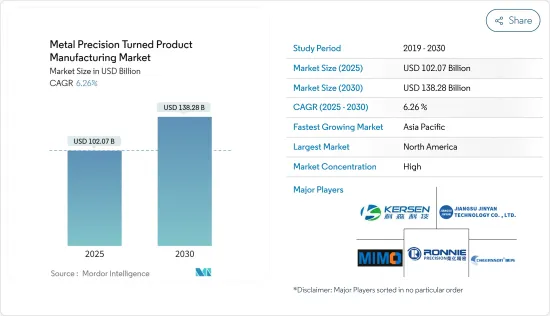

金属精密车削产品製造市场规模预计在 2025 年为 1,020.7 亿美元,预计到 2030 年将达到 1,382.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.26%。

关键亮点

- 精密金属车削产品的製造是一个有吸引力的市场。这涉及透过车床加工生产高精度金属零件。这些零件用于汽车、航太和电子等各个行业。

- 由于技术进步和对精密加工产品的需求,市场正在稳步成长。製造商使用先进的机械和技术来确保严格的公差和高品质的成品。

- 北美,尤其是美国,在金属精密车削产品製造市场中占有重要地位。该地区拥有强大的製造业基础,对精密零件的需求很高。汽车和航太工业以及各领域对先进技术的需求等因素推动了市场的发展。

- 市场竞争非常激烈,参与企业不断创新和改进其流程。推动市场发展的关键因素是对复杂和微型组件的需求不断增加、各种应用对高精度的需求以及汽车和电子等行业的成长。

金属精密车床加工产品製造市场趋势

蓬勃发展的汽车产业

金属精密车削产品在汽车领域中发挥着至关重要的作用。它们用于车辆内的各个部件和系统,有助于提高车辆的功能性、可靠性和性能。

2022年全球汽车和卡车产量约8,500万辆,较2021年成长约6%,其中中国、日本和德国在汽车产量方面处于领先地位。

中国是全球最大的乘用车生产国,预计2021年产量将超过2,100万辆,占全球乘用车产量的近三分之一。近年来,中国已成为全球汽车产业重要成长市场之一。

在汽车产业,金属精密车削产品应用于几个关键领域。一个突出的应用是引擎和动力传动系统系统。曲轴、凸轮轴和连桿等精密车削部件对于引擎的平稳运行至关重要。这些部件经过精密加工,以确保最佳性能和耐用性。

此外,金属精密车削产品也用于汽车变速箱和传动系统。齿轮轴、半轴等关键零件均采用高精度製造,确保动力传输高效率、换檔平顺。这些车削零件的精度和品质对于车辆的整体性能和可靠性至关重要。

此外,金属精密车削产品也应用于汽车转向和悬吊系统。拉桿、球头、控制臂等部件都经过精密製造,以保持正确的对准度并实现平稳的转向和悬吊运动。这些车削部件有助于提高车辆的整体安全性和操控特性。

金属精密车削产品在汽车领域的另一个应用领域是煞车系统。煞车卡钳活塞、轮缸和各种煞车零件均在车床上精密车削,以确保最佳的煞车性能和可靠性。这些部件的精密加工对于持续有效的煞车至关重要,有助于车辆的整体安全。

此外,金属精密车削产品也可在汽车内的各种电气和电子系统中找到。连接器、端子和感测器组件均经过精密製造,以确保可靠的电气连接和准确的感测能力。这些车削部件对于车辆电气系统和各种电子控制装置的正常运作至关重要。

北美占主导地位

北美金属精密车削产品製造市场是一个重要的产业,服务于汽车、航太和电子等各个领域。它在为这些行业提供必需部件方面发挥着至关重要的作用。

汽车製造业是北美经济最重要的组成部分之一。 2022年,北美乘用车和轻型商用车产量约1,480万辆。

北美洲包括加拿大、美国和墨西哥。美国拥有最大的市场占有率。 2020年,美国汽车产量约860万辆,墨西哥和加拿大汽车产量约440万辆。

精密金属车削产品的需求受到经济成长、技术进步和不断变化的客户需求等因素的驱动。随着产业的不断发展和创新,对高品质车削零件的需求将会增加。

北美市场竞争激烈,众多厂商争夺市场占有率。本公司的竞争是基于产品品质、精准度、成本效益、前置作业时间和客户服务等因素。

多年来,该行业取得了重大的技术进步。电脑数值控制(CNC) 机器、自动化和先进的加工技术彻底改变了精密车削产品的製造流程。这些进步提高了效率、精度和生产能力。

该行业的显着趋势包括采用物联网 (IoT) 和数据分析等工业 4.0 技术来优化生产流程。人们也越来越关注永续性和环保的生产方法。

金属精密车床加工产品製造业概况

在金属精密车削产品製造市场的竞争格局中,几个主要企业主导着这个产业。公司的竞争是基于产品品质、精准度、成本效益、创新和客户服务等因素。市场竞争非常激烈,各公司不断改进流程,努力维持技术进步的前端。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概览

- 市场动态

- 市场驱动因素

- 汽车产业需求增加

- 日益关注精密产品

- 市场限制

- 生产和运输成本

- 法规和品质标准

- 市场机会

- 市场驱动的技术进步

- 更重视永续製造

- 市场驱动因素

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 按操作

- 手动操作

- CNC操作

- 按机器类型

- 自动螺丝机

- 旋转传送机

- 计算机数值控制(CNC)

- 车床

- 其他机器

- 按最终用户

- 按行业

- 车

- 电子产品

- 国防和医疗

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 其他的

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Kunshan Kesen Technology Co., Ltd.

- Jiangsu Jingyan Technology Co., Ltd.

- Suzhou Ruima Precision Industry Co., Ltd.

- Zhejiang Rongyi Precision Machinery Co., Ltd.

- Jiangsu Mimo Metal Co., Ltd.

- Pmpinc

- Precision Metal Products Company

- APCS

- 其他公司(关键资讯/概述)

第七章:市场的未来

第 8 章 附录

The Metal Precision Turned Product Manufacturing Market size is estimated at USD 102.07 billion in 2025, and is expected to reach USD 138.28 billion by 2030, at a CAGR of 6.26% during the forecast period (2025-2030).

Key Highlights

- Metal precision turned product manufacturing is a fascinating market. It involves the production of high-precision metal components through turning processes. These components are used in various industries like automotive, aerospace, electronics, and more.

- The market has been steadily growing due to advancements in technology and the demand for precision-engineered products. Manufacturers use advanced machinery and techniques to achieve tight tolerances and high-quality finishes.

- North America, particularly the United States, has been a significant player in the metal precision turned product manufacturing market. The region has a strong manufacturing base and a high demand for precision components. The market was driven by factors such as the automotive industry, aerospace industry, and the need for advanced technology in various sectors.

- The market is highly competitive, with players constantly innovating and improving their processes. The key factors driving the market include increasing demand for complex and miniature components, the need for high precision in various applications, and the growth of industries like automotive and electronics.

Metal Precision Turned Product Manufacturing Market Trends

Booming Automotive sector

Metal precision-turned products play a crucial role in the automotive sector. They are used in various components and systems within vehicles, contributing to their functionality, reliability, and performance.

Around 85 million cars and trucks were manufactured worldwide in 2022, an increase of about six percent from 2021, with China, Japan, and Germany leading the way in terms of vehicle production.

China is the world's largest passenger car producer, with over 21 million cars produced in 2021, accounting for nearly one-third of the world's passenger car production. In recent years, China has been one of the key growth markets for the global automotive industry.

In the automotive sector, metal precision-turned products are employed in several key areas. One prominent application is in the engine and powertrain systems. Precision-turned components, such as crankshafts, camshafts, and connecting rods, are vital for the smooth operation of the engine. These components undergo precise machining processes to ensure optimal performance and durability.

Additionally, metal precision-turned products are used in the transmission and drivetrain systems of vehicles. Gear shafts, axle shafts, and other critical components are manufactured with high precision to ensure efficient power transfer and smooth shifting of gears. The accuracy and quality of these turned parts are crucial for the overall performance and reliability of the vehicle.

Furthermore, metal precision-turned products find application in the steering and suspension systems of automobiles. Components like tie rods, ball joints, and control arms are manufactured with precision to maintain proper alignment and enable smooth steering and suspension movement. These turned parts contribute to the overall safety and handling characteristics of the vehicle.

Another area where metal precision-turned products are utilized in the automotive sector is braking systems. Brake caliper pistons, wheel cylinders, and various brake components undergo precise turning operations to ensure optimal braking performance and reliability. Precision machining of these parts is essential for consistent and effective braking, contributing to the overall safety of the vehicle.

Moreover, metal precision turned products are found in various electrical and electronic systems within automobiles. Connectors, terminals, and sensor components are manufactured with precision to ensure reliable electrical connections and accurate sensing capabilities. These turned parts are critical for the proper functioning of the vehicle's electrical systems and various electronic controls.

North America Region Dominating the segment

The metal precision turned product manufacturing market in North America is a significant industry catering to various sectors such as automotive, aerospace, electronics, and more. It plays a crucial role in providing essential components for these industries.

Vehicle production is one of the most significant components of North America's economy. In 2022, North America produced approximately 14,8 million passenger cars and light commercial vehicles.

North America is made up of Canada, the US and Mexico. The US has the largest market share. In 2020, the US produced about 8.6 million cars, while Mexico and Canada produced about 4.4 million cars.

The demand for metal precision-turned products is driven by factors like economic growth, technological advancements, and evolving customer needs. As industries continue to evolve and innovate, the demand for high-quality turned components increases.

The market in North America is highly competitive, with numerous manufacturers vying for market share. Companies compete based on factors like product quality, precision, cost-effectiveness, lead times, and customer service.

The industry has witnessed significant technological advancements over the years. Computer Numerical Control (CNC) machines, automation, and advanced machining techniques have revolutionized the precision-turned-product manufacturing process. These advancements have improved efficiency, accuracy, and production capabilities.

Some notable trends in the industry include the adoption of Industry 4.0 technologies, such as the Internet of Things (IoT) and data analytics, to optimize production processes. There is also an increasing focus on sustainability and eco-friendly manufacturing practices.

Metal Precision Turned Product Manufacturing Industry Overview

In the competitive landscape of the metal precision-turned-product manufacturing market, several key players dominate the industry. The companies are competing based on factors such as product quality, precision, cost-effectiveness, innovation, and customer service. The market is highly competitive, driving companies to continuously improve their processes and stay at the forefront of technological advancements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Increasing demand from automobile industry

- 4.2.1.2 Increased focus on precision products

- 4.2.2 Market Restraints

- 4.2.2.1 The cost of production and transportation

- 4.2.2.2 Regulations and quality standards

- 4.2.3 Market Opportunities

- 4.2.3.1 Technological advancements driving the market

- 4.2.3.2 Increasing focus on sustainable manufacturing

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Operation

- 5.1.1 Manual Operation

- 5.1.2 CNC Operation

- 5.2 By Machine Types

- 5.2.1 Automatic Screw Machines

- 5.2.2 Rotary Transfer Machines

- 5.2.3 Computer Numerically Controlled(CNC)

- 5.2.4 Lathes or Turning Center

- 5.2.5 Other Machine Types

- 5.3 By End User

- 5.3.1 Industries

- 5.3.2 Automobile

- 5.3.3 Electronics

- 5.3.4 Defense and Healthcare

- 5.3.5 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.5 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Kunshan Kesen Technology Co., Ltd.

- 6.2.2 Jiangsu Jingyan Technology Co., Ltd.

- 6.2.3 Suzhou Ruima Precision Industry Co., Ltd.

- 6.2.4 Zhejiang Rongyi Precision Machinery Co., Ltd.

- 6.2.5 Jiangsu Mimo Metal Co., Ltd.

- 6.2.6 Pmpinc

- 6.2.7 Precision Metal Products Company

- 6.2.8 APCS

- 6.3 Other Companies (Key Information/Overview)