|

市场调查报告书

商品编码

1694024

欧洲托盘包装机:市场占有率分析、行业趋势和成长预测(2025-2030)Europe Pallet Wrapping Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

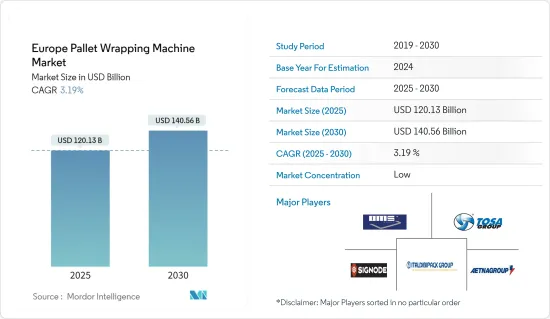

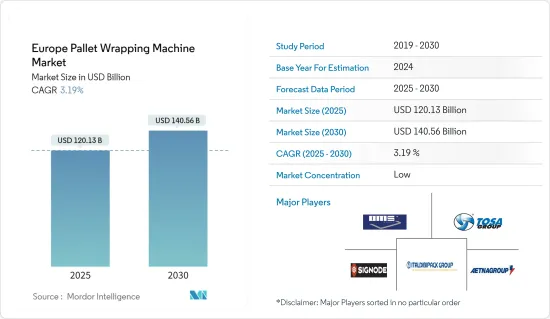

预计 2025 年欧洲托盘包装机市场规模为 1,201.3 亿美元,到 2030 年将达到 1,405.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.19%。

关键亮点

- 托盘是物流环节的主要元素之一。托盘是一种实现货物机械化运输、流通和分配的运输单元。它也是一种可有效用于装卸、搬运、仓储、运输和配送的储存设备。

- 此外,托盘的价值也转化为库存管理利润。现代生产企业的仓库管理认识到塑胶托盘的包装、储存、装卸、运输、配送一体化。托盘的价值正在从物流行业迅速扩大到各类生产加工企业,预计在预测期内托盘将在市场中占据不可或缺的地位。

- 此外,由于降低物流成本、淘汰以及减少购买、管理和收集托盘的麻烦的需求不断增长,预计托盘共享的销售额将会增加。此外,技术进步为托盘共享市场参与企业创造了成长前景。各托盘共享公司正致力于引入带有无线射频识别 (RFID) 标籤的托盘。托盘共享市场有望受益于自动化和各个终端用途领域的需求。

- 一次性塑胶包装通常用于固定托盘上的货物,但这并不环保。此外,虽然这种方法的成本效益最初看起来很有吸引力,但在高容量仓库中成本会迅速累积。

- 此外,托盘不合适或包装过度可能会损坏产品和包装并影响货物的结构完整性。在最坏的情况下,浪费的货物和损坏的产品可能会造成重大的经济损失。随着消费者越来越重视永续性,供应链经理正在积极寻求可重复使用的环保包装选择来取代塑胶包装和托盘包装技术。

欧洲托盘包装机市场趋势

食品和饮料显着增长

- 食品和饮料在运输和储存过程中通常需要防止变质、污染和损坏。托盘包装机确保产品安全包装并免受湿气、灰尘和害虫等外部因素的影响。

- 食品和饮料行业是欧洲经济中最大的製造业之一,与汽车和机械设备行业并列。根据德国联邦统计局的数据,2019年至2023年期间,德国家庭的食品消费支出增加。从数据来看,2023年私人家庭在食品上的支出将达到约2,033亿欧元(2,223.5美元),高于2022年的约1,894亿欧元(2,072.4美元)。

- 在食品和饮料行业,托盘包装由于其易于移动,是运输大量货物最实用的方式之一。

- 托盘包装领域的新创新为欧洲食品和饮料製造商带来了更高的效率和成本的节省。许多食品和饮料製造商倾向于采用自动化托盘包装解决方案来改善产品包装。

英国经济强劲成长

- 受工业活动激增以及物流和仓储领域自动化广泛应用的推动,英国对托盘包装机的需求将稳定成长。对高效、经济的包装解决方案的需求,以及对托盘包装机在减少运输过程中的产品损坏和提高整个供应链效率方面的作用的认识不断提高,进一步推动了这一增长轨迹。

- 此外,蓬勃发展的电子商务和快速成长的线上零售业正在推动对托盘包装机的需求不断增长,因为企业希望简化包装操作,以便将货物无缝地交付给消费者。例如,英国DHL集团的一项调查发现,31%的消费者使用订阅式电商模式。线上产品订购涵盖各种各样的产品,从服饰和剃须用品到食品和美容产品。

- 自动化在加强托盘包装市场方面发挥关键作用。人们对作为整体生产设备一部分的包装机或可以与现有机械一起安装的系统的需求日益增长。

- 例如,纱线和织物蒸汽定型和调理设备专家 Xorella 将透过在其係统中额外整合托盘包装机来增强其操作。新机器配备转盘、称重站、标籤印表机、安全围栏和安全系统,形成全面且高效的托盘包装系统。

欧洲托盘缠绕机产业概况

欧洲托盘包装机市场细分化,国内和参与企业的竞争十分激烈。主要参与企业有 Robopac(Aetna Group SPA)、Signode Industrial Group LLC(Crown Holdings Inc.)、Tosa Group、Italidibipack SPA 和 Officina Meccanica Sestese SPA(OMS Group)。

- 2023 年 12 月,纸袋製造商 Sentrex 为其托盘采用了 Mondi 的 Advantage StretchWrap 纸包装解决方案,旨在简化物流、精简包装流程并逐步淘汰不必要的塑胶。 Advantage 拉伸 Wrap 是一种完全可回收的牛皮纸,由负责任的来源材料製成。 Mondi 的 Advantage Stretchwrap 具有高度可拉伸性和抗穿刺性,使其成为传统用于托盘包装和运输的塑胶拉伸膜的理想替代品。

- 2023 年 10 月,包装技术和机械专家英国亚特兰大公司推出了 NovaCompact 环形托盘包装机,这是亚特兰大集团公司的最新创新产品。 Nova 以其紧凑的设计脱颖而出,可无缝融入传统包装机所占据的空间。这消除了更改设定时出现的物流问题。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 生态系分析

- 行业标准和法规

- 最近的新产品开发和创新趋势

- 进出口分析

- 包装器材行业现状分析

第五章市场动态

- 市场驱动因素

- 运输和物流业的成长以及对保护性包装的需求

- 托盘作为第三级包装的需求不断增加

- 市场问题

- 替代包装技术的可用性

第六章市场区隔

- 按机器类型

- 自动的

- 半自动

- 手动的

- 依技术

- 戒指

- 手臂

- 转盘

- 其他的

- 按最终用户产业

- 饮食

- 製药

- 消费品

- 车

- 纸

- 纤维

- 建造

- 其他的

- 按国家

- 法国

- 德国

- 义大利

- 英国

- 比荷卢经济联盟

- 比利时

- 卢森堡

- 荷兰

- 东欧

- 其他欧洲国家

第七章竞争格局

- 公司简介

- Robopac(Aetna Group SPA)

- Signode Industrial Group LLC(crown Holdings Inc.)

- TOSA Group

- Officina Meccanica Sestese SpA(OMS Group)

- Italdibipack SpA

- Atlanta Stretch SpA

- Siat SpA

- Strema Maschinenbau GmbH

- SYMACH BV(Barry-Wehmiller Group, Inc.)

- Matco International Holding BV

- Cyklop UK Limited

- C& C Group SRL

- Movitec Wrapping Systems SLU

- 公司排名分析

第八章:未来市场展望

The Europe Pallet Wrapping Machine Market size is estimated at USD 120.13 billion in 2025, and is expected to reach USD 140.56 billion by 2030, at a CAGR of 3.19% during the forecast period (2025-2030).

Key Highlights

- The pallet is one of the primary elements of the logistics sector. It is a carrier unit that acknowledges the mechanized transportation, circulation, and distribution of goods. It is also a storage appliance that can be used effectively in loading and unloading, handling, warehouse storage, transportation, and distribution.

- Moreover, the value of pallets is also reflected in the benefit of inventory management. In the warehouse management of modern production firms, the unitized packaging, storage, loading and unloading, transportation, and distribution of plastic pallets have been recognized. The value of pallets has rapidly extended from the logistics industry to various production and processing enterprises, and pallets are expected to occupy an essential position in the market during the forecast period.

- Furthermore, sales in pallet pooling are expected to increase development due to rising demand for lowering logistic costs, eliminating the need for managing pallet distribution and reducing the complexity of pallet purchase, management, and retrieval. Also, technological advancements create growth prospects for the pallet pooling market players. Various pallet pooling companies are focusing on introducing pallets covered in radio frequency identification (RFID) tags. The pallet pooling market is poised to benefit from automation and demand from various end-use sectors.

- Single-use plastic wrap is commonly used to secure pallet loads, which is not environmentally friendly. In addition, the cost-effectiveness of this approach may seem appealing initially, but expenses can accumulate rapidly in warehouses with high volumes.

- Furthermore, poorly or excessively wrapping a pallet can cause damage to both the product and packaging, which can affect the load's structural integrity. In the worst-case scenario, this can result in significant financial losses due to wasted shipments and damaged products. As consumers increasingly prioritize sustainability, supply chain managers are actively seeking reusable and environmentally-conscious alternative packaging options to plastic wrap and pallet wrapping machine technology.

Europe Pallet Wrapping Machine Market Trends

Food and Beverage to Witness Significant Growth

- Food and beverage products often require protection from spoilage, contamination, and damage during transportation and storage. Pallet wrapping machines ensure that products are securely wrapped, preventing exposure to external elements such as moisture, dust, and pests.

- The food and beverages industry is one of the largest manufacturing sectors in the European economy, alongside the automotive, machinery, and equipment industries. According to Statistisches Bundesamt, private household consumer spending on food in Germany increased from 2019 to 2023. In 2023, based on figures, private households spent roughly 203.3 billion euros (USD 222.35) on food, up from around 189.4 billion euros in 2022 (USD 207.24).

- In the food and beverages industry, pallet wrapping is one of the most practical ways to transport large amounts of goods owing to ease of mobility.

- New Innovations in pallet wrapping are offering high efficiency and cost reduction to Europe's food and beverage manufacturers. Many food and beverage manufacturers are inclined toward using automated pallet wrapping solutions to improve the containment of their products.

United Kingdom to Register Significant Growth

- The United Kingdom is poised to experience steady growth in the demand for pallet wrapping machines, propelled by a surge in industrial activities and the widespread adoption of automation within logistics and warehousing sectors. This growth trajectory is further fueled by the imperative for efficient and economical packaging solutions, as well as an increasing recognition of the role of pallet wrapping machines in mitigating product damage during transit and enhancing overall supply chain efficiency.

- Moreover, the flourishing e-commerce landscape and the burgeoning online retail sector drive heightened demand for pallet wrapping machines as businesses seek to streamline packaging operations for the seamless shipment of goods to consumers. For Instance, a DHL Group survey in the United Kingdom shows that 31 % of consumers use the subscription e-commerce model. Online product subscriptions exist for a large variety of products, from clothing and shaving products to food and beauty products.

- Automation plays an important part in enhancing the pallet wrapping market. Wrapping machines that are a part of the production machines as a whole or the systems that can be installed alongside existing machinery are more in demand.

- For example, Xorella, a steam setting and conditioning equipment specialist for yarns and fabrics, will enhance its operations by integrating an additional pallet wrapping machine into its system. This new machine will feature a turntable, weighing station, label printer, safety fence, and security system, forming a comprehensive and efficient pallet wrapping system.

Europe Pallet Wrapping Machine Industry Overview

The European pallet wrapping machine market is fragmented and characterized by intense competition among both domestic and international players. Key players such as Robopac (Aetna Group SPA), Signode Industrial Group LLC (Crown Holdings Inc.), Tosa Group, Italidibipack SPA, Officina Meccanica Sestese SPA (OMS Group) are continuously innovating to improve machine efficiency, reliability, and cost-effectiveness. Market consolidation through mergers and acquisitions is common as companies strive to expand their market share. Additionally, there's a trend toward offering integrated packaging solutions, including pallet wrapping machines, intensifying competition further.

- In December 2023, paper bag manufacturer Sentrex adopted Mondi's Advantage StretchWrap paper wrapping solution for its pallets to simplify logistics, optimize efficiency in the wrapping process, and phase out unnecessary plastics. Advantage Stretchwrap is a fully recyclable kraft paper made from responsibly sourced materials. Mondi developed it to stretch and resist punctures, making it ideal for replacing the plastic stretch film that has traditionally been used for pallet wrapping and transportation.

- In October 2023, Atlanta, UK, a specialist in packaging technology and machinery, introduced the Nova compact ring pallet wrapper, the newest innovative product from the Atlanta group of companies. The Nova stands out for its compact design, which allows it to seamlessly fit into the spaces previously occupied by older wrapping machines. This eliminates any logistical issues that businesses may encounter when changing their setup.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3 Industry Ecosystem Analysis

- 4.4 Industry Standards & Regulations

- 4.5 Recent New Product Development & Innovations

- 4.6 Import-Export Analysis

- 4.7 Insights On Packaging Machinery Industry Landscape

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Transportation and Logistics Industry and Need for Protective Packaging

- 5.1.2 Increasing Demand for Pallets as Tertiary Packaging

- 5.2 Market Challenges

- 5.2.1 Presence of Alternative Packaging Technologies

6 MARKET SEGMENTATION

- 6.1 By Machine Type

- 6.1.1 Automatic

- 6.1.2 semi-automatic

- 6.1.3 Manual

- 6.2 By Technology

- 6.2.1 Ring

- 6.2.2 Arm

- 6.2.3 Turntable

- 6.2.4 Other Technologies

- 6.3 By End-user Industries

- 6.3.1 Food and Beverages

- 6.3.2 Pharmaceutical

- 6.3.3 Consumer Products

- 6.3.4 Automotive

- 6.3.5 Paper

- 6.3.6 Textile

- 6.3.7 Construction

- 6.3.8 Others End-user Industries

- 6.4 By Country

- 6.4.1 France

- 6.4.2 Germany

- 6.4.3 Italy

- 6.4.4 United Kingdom

- 6.4.5 Benelux

- 6.4.5.1 Belgium

- 6.4.5.2 Luxembourg

- 6.4.5.3 Netherlands

- 6.4.6 Eastern Europe

- 6.4.7 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Robopac (Aetna Group SPA)

- 7.1.2 Signode Industrial Group LLC (crown Holdings Inc.)

- 7.1.3 TOSA Group

- 7.1.4 Officina Meccanica Sestese S.p.A. (OMS Group)

- 7.1.5 Italdibipack S.p.A.

- 7.1.6 Atlanta Stretch SpA

- 7.1.7 Siat S.p.A.

- 7.1.8 Strema Maschinenbau GmbH

- 7.1.9 SYMACH BV (Barry-Wehmiller Group, Inc.)

- 7.1.10 Matco International Holding BV

- 7.1.11 Cyklop UK Limited

- 7.1.12 C&C Group SRL

- 7.1.13 Movitec Wrapping Systems SLU

- 7.2 Company Ranking Analysis