|

市场调查报告书

商品编码

1835658

汽车 3D 列印:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive 3D Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

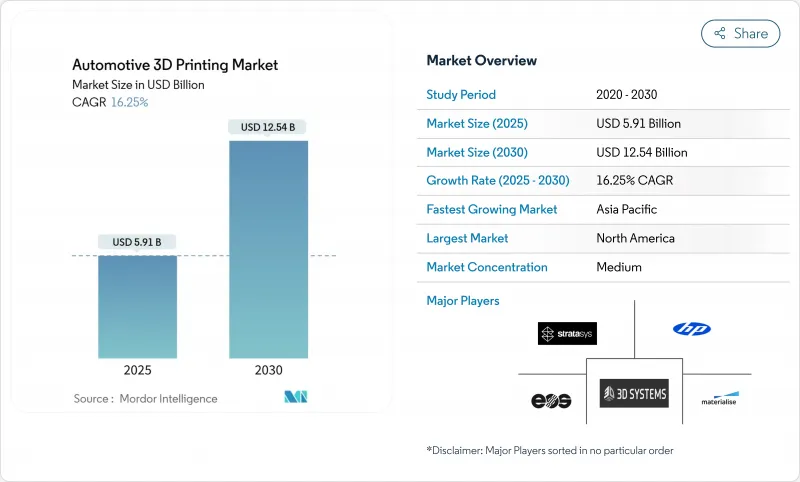

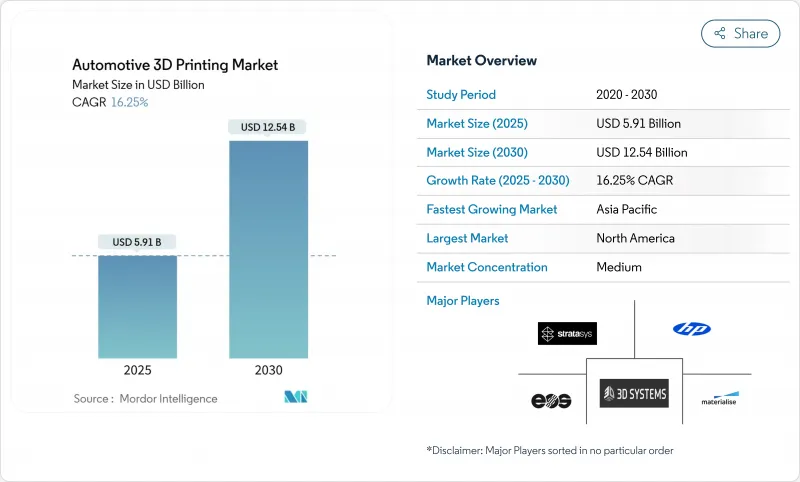

预计 2025 年汽车 3D 列印市场价值将达到 59.1 亿美元,到 2030 年将达到 125.4 亿美元,复合年增长率为 16.25%。

随着多材料加工、数位供应链编配和人工智慧主导的品管方面的突破重新定义了製造业经济学,从原型製作到全面生产的转变正在加速。对符合严格排放法规的轻型零件的需求正在支撑成长,BMW透过电弧积层製造减少了 27% 的排放就证明了这一点。熔融沈积成型 (FDM) 和选择性雷射烧结 (SLS) 硬体的进步正在提高产量,而具有成本效益的硅铁粉末正在为电动车 (EV) 马达零件的金属应用开闢道路。监管压力、在岸战略以及永续原料的可用性正在推动汽车 3D 列印市场在现有和新兴经济体中的扩张。

全球汽车 3D 列印市场趋势与洞察

对轻量化电动车零件的需求

电动车製造商正在追求重量优化,以增加续航里程并符合排放法规。通用汽车已在凯迪拉克 Celestiq 车型中采用了 130 多个列印零件,其中包括汽车生产中最大的积层製造铝製零件。欧洲的欧盟 7 法规正在加速煞车盘盘涂层和结构件的采用。砂基 3D 列印缩短了模具开发週期,并使得铸造设计能够在保持公差目标的同时减轻重量。为了减轻电池重量,各大厂商竞相将整个汽车平臺的重量降到最低。

降低快速原型製作成本

多家公司报告称,积层製造可以取代早期设计迭代中的机械加工,将原型前置作业时间缩短高达 90%,并显着降低单一零件成本。光固化成形法的高尺寸精度支援低成本的熔模铸造替代方案,而基于人工智慧的建造参数优化则提高了首次成功率。低于 3,000 美元的桌上型 SLS 印表机扩大了中小型供应商的可及性,并缩短了亚太製造群的创新週期。

金属印表机高成本

虽然工业级SLS印表机的成本在12,000美元到33,000美元之间,但特种金属粉末的平均价格为每公斤300美元到600美元,这限制了成本敏感型供应商的采用。氦雾化粉末製造是最永续的途径,但资本支出仍然很高。生命週期分析表明,粉末层熔融对于高复杂度零件而言经济实惠,但巨大的初始投资使其难以广泛采用。低成本的金属丝製程降低了进入门槛,但增加了后处理的复杂性,导致汽车3D列印市场的复合年增长率下降了2.4个百分点。

报告中分析的其他驱动因素和限制因素

- 客製化生产

- 模具数位化备件库存

- 材料品质差距

細項分析

2024年,FDM占据了汽车3D列印市场份额的38.32%,这得益于低廉的系统成本和丰富的材料选择。随着售价低于3,000美元的桌上型粉末床系统推动高性能尼龙和复合材料列印的普及,预计到2030年,SLS的复合年增长率将达到18.53%。光固化成形法至100奈米,列印速度达100微米/秒,使其应用领域拓展至微流体和光学领域。数位光处理(DLP)技术越来越多地支援珠宝饰品和牙科模型,而电子束熔化技术在航太钛合金零件的製造中发挥着重要作用。随着电动车製造商采用耐用的尼龙齿轮和引擎盖下零件,基于SLS技术的汽车3D列印零件市场预计将迅速扩张。

混合製造技术(即融合积层製造和减材製造技术)正在兴起。 FDM 刀具路径整合了连续纤维增强材料,无需二次加工即可提高拉伸强度。全像像体积列印透过同时固化整个列印层,已证明可将速度提升高达 20 倍,这在汽车内装零件的量产中展现出巨大的潜力。製程模拟软体的持续改进减少了试验,确保 FDM 在 SLS装置量不断增长的情况下仍然保持竞争力。

到2024年,硬体将占总收入的57.32%,其中包括印表机、后处理站和扫描器。然而,随着机器学习演算法降低缺陷率并促进多工厂车队组织,软体将以18.78%的复合年增长率成长。贝克休斯实施的製造营运平台将监控时间缩短了98%,废品率降低了18%。当汽车製造商外包特殊材料或小批量生产而无法证明资本支出合理性时,服务机构就会发挥作用。

人工智慧驱动的建置参数引擎将工程工作量减少了80%,帮助该软体扩大了其在汽车3D列印领域的市场份额。基于浏览器的协作套件支援跨洲设计迭代,从而实现同步工程和快速投产。随着云端连接的扩展,订阅收入为供应商提供了丰厚的年金,将竞争重点从机器转向数位生态系统。

汽车产业3D列印市场报告按技术类型(选择性雷射烧结 (SLS)、立体光刻技术(SLA)、其他)、组件类型(硬体、软体、服务)、材料类型(金属、聚合物、其他)、应用类型(生产、原型製作、其他)和地区细分。市场预测以金额(美元)和数量(单位)提供。

区域分析

北美在2024年将以38.63%的市占率领先汽车3D列印市场,这得益于美国主导的航太和电动车供应链。通用电气航空航太公司对增材製造设施的10亿美元投资,显示了对国内生产的长期信心。 「缩短製造週期倡议」与《通膨削减法案》相结合,奖励了本地製造业,并加速了印表机在汽车产业的部署。加拿大和墨西哥利用跨境贸易框架,透过轻型卡车零件和航太铸模做出了贡献。

受中国製造业数位化和印度新兴生物列印公司推动,亚太地区将成为成长最快的地区,到2030年复合年增长率将达到19.47%。中国的五年规划将积层製造确定为战略支柱,推动其在汽车轮毂和电池工厂的广泛应用。在印度,EOS和Godrej的合作将加速其在航太的应用,而公私合作研发中心将促进技能发展。日本和韩国将推动材料创新,开发用于混合动力电动动力传动系统的耐热聚合物。东南亚的电子产业丛集正在采用3D列印技术进行模具製造,部分原因是受到政府税收优惠政策的推动。

欧洲占了很大份额,其中以德国为首,大多数製造商都采用了积层製造流程。该地区增材製造公司30.6%的销售额用于研发,并巩固了其在金属印表机出口方面的领先地位。法国和义大利正在扩大超级跑车的复合材料列印,而斯堪地那维亚则正在探索用于汽车内饰的生物基聚合物。透过ISO/ASTM标准的监管协调,支援列印零件的跨境认证并简化了供应链。南美和中东的新兴地区正在追求多元化,沙乌地阿拉伯向中小企业提供入门级印表机,以降低金属加工的能源消耗。巴西正在试验建立一个农业机械增材维修中心,显示该技术正在向高所得经济体以外的地区扩展。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 对轻量化电动车零件的需求

- 降低快速原型製作成本

- 客製化生产工具

- 数位备件库存

- 多材料AM集成

- 促进供应链回流

- 市场限制

- 金属印表机高成本

- 材料品质的差异

- 能量密集型雷射系统

- IP安全问题

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模与成长预测:价值(美元)与数量(单位)

- 依技术类型

- 选择性雷射烧结(SLS)

- 光固化成形法(SLA)

- 数位光处理 (DLP)

- 电子束熔炼(EBM)

- 选择性雷射熔融(SLM)

- 熔融沉积建模(FDM)

- 依组件类型

- 硬体

- 软体

- 服务

- 依材料类型

- 金属

- 聚合物

- 陶瓷製品

- 复合材料

- 按用途

- 製造业

- 原型製作

- 模具和夹具

- 备件/维护、修理和运行

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Stratasys Ltd

- 3D Systems Corporation

- EOS GmbH

- HP Inc.

- Materialise NV

- GE Additive(Arcam AB)

- Desktop Metal(ExOne)

- Ultimaker BV

- Voxeljet AG

- Carbon Inc.

- Hoganos AB

- EnvisionTEC GmbH

- SLM Solutions Group AG

- Renishaw plc

- BASF Forward AM

- Markforged Inc.

- Sindoh Co. Ltd

- XYZprinting Inc.

- Moog Inc.

第七章 市场机会与未来展望

The Automotive 3D printing market is valued at USD 5.91 billion in 2025 and is forecast to reach USD 12.54 billion by 2030, reflecting a 16.25% CAGR.

The shift from prototyping toward full-scale production is accelerating as breakthroughs in multi-material processing, digital supply-chain orchestration, and artificial-intelligence-driven quality control redefine manufacturing economics. Demand for lightweight components that meet stringent emissions rules, illustrated by BMW's 27% emissions reduction using wire-arc additive manufacturing, underpins growth. Hardware advances in fused deposition modeling (FDM) and selective laser sintering (SLS) improve throughput, while cost-effective iron-silicon powders open metal applications for electric-vehicle (EV) motor parts. Regulatory pressure, on-shoring strategies, and the availability of sustainable feedstocks align to expand the Automotive 3D printing market across established and emerging economies.

Global Automotive 3D Printing Market Trends and Insights

EV Lightweight-Parts Demand

Electric vehicle makers pursue weight optimization to extend their range and comply with emissions standards. General Motors integrates more than 130 printed parts in the Cadillac Celestiq, including the largest additively manufactured aluminum component in automotive production. Europe's Euro 7 norms accelerate adoption for brake-disc coatings and structural elements. Sand-based 3D printing shortens mold-development cycles, enabling casting designs that reduce mass while preserving tolerance targets. The need to offset battery weight intensifies competitive incentives to remove every gram across vehicle platforms.

Rapid Prototyping Cost-Cuts

Enterprises report up to 90% reductions in prototype lead times and sharp declines in single-part costs as additive manufacturing replaces machining for early-stage design iterations. Stereolithography's high dimensional accuracy supports low-cost investment casting alternatives, while AI-based build-parameter optimization elevates first-time-right success rates. Desktop SLS printers priced below USD 3,000 broaden access for small and midsize suppliers, compressing innovation cycles across Asia-Pacific manufacturing clusters.

High Cost of Metal Printers

Industrial SLS printers list between USD 12,000 and USD 33,000, while specialty metal powders average USD 300-600 per kg, limiting adoption among cost-sensitive suppliers. Helium-atomized powder production offers the most sustainable route, yet capital outlays remain steep. Lifecycle analyses show powder-bed fusion is economical for high-complexity components, but up-front capital still deters wide deployment. Lower-cost metal-filament processes mitigate entry barriers but add post-processing complexity, reducing the Automotive 3D printing market CAGR by 2.4 percentage points

Other drivers and restraints analyzed in the detailed report include:

- Custom Production Tooling

- Digital Spare-Parts Inventory

- Material-Qualification Gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

FDM accounted for 38.32% of the Automotive 3D printing market share in 2024, owing to low system costs and broad material selection. SLS is projected to grow at an 18.53% CAGR through 2030 as desktop powder-bed systems below USD 3,000 democratize high-performance nylon and composite printing. Advances in nanoscale photopolymerization have pushed stereolithography resolution to 100 nm at 100 µm per second, extending its use into microfluidic and optics applications. Digital Light Processing (DLP) increasingly supports jewelry and dental models, while electron-beam melting serves aerospace titanium parts. The Automotive 3D printing market size for SLS-based parts is forecast to expand sharply as EV manufacturers adopt durable nylon gears and under-hood components.

Hybrid manufacturing that blends additive and subtractive techniques is gaining ground. FDM toolpaths integrate continuous-fiber reinforcement, improving tensile strength without secondary operations. Holographic volumetric printing demonstrates up-to-20-fold speed gains by curing entire layers simultaneously, holding promise for high-volume automotive interiors. Continual improvements in process simulation software reduce trial iterations, ensuring FDM retains relevance even as the SLS installed base rises.

Hardware captured 57.32% of 2024 revenue, encompassing printers, post-processing stations, and scanners. However, software is expanding at 18.78% CAGR as machine-learning algorithms cut defect rates and orchestrate multi-factory fleets. Manufacturing operations platforms deployed at Baker Hughes trimmed monitoring time by 98% and scrap by 18%. Service bureaus flourish when automakers outsource specialty materials or small production runs that do not justify capital spending.

AI-driven build-parameter engines reduce engineering labor by 80%, contributing to a rising software share within the Automotive 3D printing market. Browser-based collaboration suites allow design iterations across continents, enabling simultaneous engineering and rapid release to production. As cloud connectivity scales, subscription revenue offers vendors a high-margin annuity, shifting the competitive balance from machines to digital ecosystems

The 3D Printing in Automotive Industry Market Report is Segmented by Technology Type (Selective Laser Sintering (SLS), Stereo Lithography (SLA), and More ), Component Type (Hardware, Software, and Service), Material Type (Metal, Polymer, and More), Application Type (Production, Prototyping, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America leads the Automotive 3D printing market with a 38.63% share in 2024, supported by the United States' dominant aerospace and EV supply chains. GE Aerospace's USD 1 billion investment in additive facilities signals long-term confidence in domestic productio. Reshoring initiatives combined with the Inflation Reduction Act incentivize localized manufacturing, accelerating printer installations across automotive tiers. Canada and Mexico contribute through lightweight truck components and aerospace casting molds, leveraging cross-border trade frameworks.

Asia-Pacific is the fastest-growing region at a 19.47% CAGR through 2030, propelled by China's manufacturing digitalization and India's emerging bioprinting startups. Chinese five-year plans earmark additive manufacturing as a strategic pillar, spurring installation growth across automotive hubs and battery factories. India's collaboration between EOS and Godrej accelerates aerospace applications, while public-private R&D centers foster skill development. Japan and South Korea push materials innovation, developing heat-resistant polymers tailored to hybrid-electric powertrains. Southeast Asian electronics clusters adopt 3D printing for tooling, aided by government tax incentives.

Europe holds a significant share, anchored by Germany where majority of manufacturers deploy additive processes. The region invests 30.6% of AM company turnover back into R&D, reinforcing leadership in metal-printer exports. France and Italy expand composite printing for supercars, while Scandinavia explores bio-based polymers for vehicle interiors. Regulatory alignment through ISO/ASTM standards supports cross-border qualification of printed parts, smoothing supply-chain flows. Emerging regions in South America and the Middle East pursue diversification; Saudi Arabia outfits SMEs with entry-level printers to decrease energy consumption in metal fabrication. Brazil pilots additive repair hubs for agricultural machinery, demonstrating the technology's reach beyond high-income economies.

- Stratasys Ltd

- 3D Systems Corporation

- EOS GmbH

- HP Inc.

- Materialise NV

- GE Additive (Arcam AB)

- Desktop Metal (ExOne)

- Ultimaker BV

- Voxeljet AG

- Carbon Inc.

- Hoganos AB

- EnvisionTEC GmbH

- SLM Solutions Group AG

- Renishaw plc

- BASF Forward AM

- Markforged Inc.

- Sindoh Co. Ltd

- XYZprinting Inc.

- Moog Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV lightweight-parts demand

- 4.2.2 Rapid prototyping cost-cuts

- 4.2.3 Custom production tooling

- 4.2.4 Digital spare-parts inventory

- 4.2.5 Multi-material AM integration

- 4.2.6 Supply-chain on-shoring push

- 4.3 Market Restraints

- 4.3.1 High cost of metal printers

- 4.3.2 Material-qualification gaps

- 4.3.3 Energy-intensive laser systems

- 4.3.4 IP-security concerns

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Technology Type

- 5.1.1 Selective Laser Sintering (SLS)

- 5.1.2 Stereolithography (SLA)

- 5.1.3 Digital Light Processing (DLP)

- 5.1.4 Electron Beam Melting (EBM)

- 5.1.5 Selective Laser Melting (SLM)

- 5.1.6 Fused Deposition Modeling (FDM)

- 5.2 By Component Type

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Service

- 5.3 By Material Type

- 5.3.1 Metal

- 5.3.2 Polymer

- 5.3.3 Ceramic

- 5.3.4 Composite

- 5.4 By Application Type

- 5.4.1 Production

- 5.4.2 Prototyping

- 5.4.3 Tooling and Fixtures

- 5.4.4 Spare-Parts / MRO

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Stratasys Ltd

- 6.4.2 3D Systems Corporation

- 6.4.3 EOS GmbH

- 6.4.4 HP Inc.

- 6.4.5 Materialise NV

- 6.4.6 GE Additive (Arcam AB)

- 6.4.7 Desktop Metal (ExOne)

- 6.4.8 Ultimaker BV

- 6.4.9 Voxeljet AG

- 6.4.10 Carbon Inc.

- 6.4.11 Hoganos AB

- 6.4.12 EnvisionTEC GmbH

- 6.4.13 SLM Solutions Group AG

- 6.4.14 Renishaw plc

- 6.4.15 BASF Forward AM

- 6.4.16 Markforged Inc.

- 6.4.17 Sindoh Co. Ltd

- 6.4.18 XYZprinting Inc.

- 6.4.19 Moog Inc.