|

市场调查报告书

商品编码

1836436

人力资源管理软体:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Workforce Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

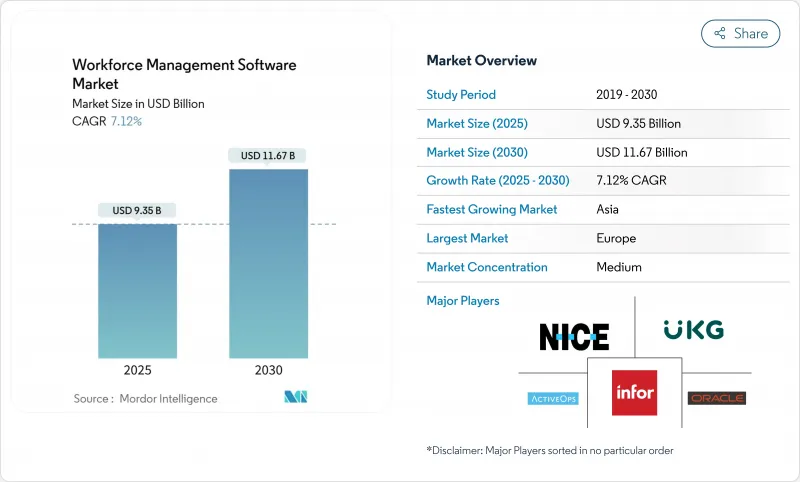

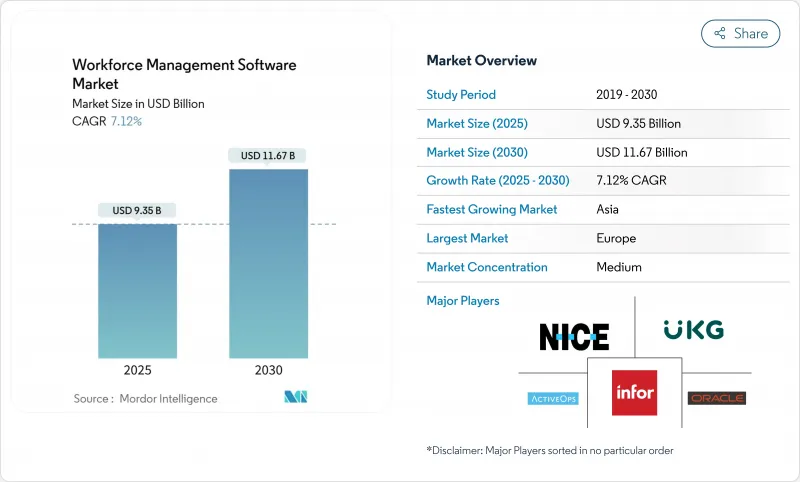

预计人力资源管理软体市场在 2025 年的价值将达到 93.5 亿美元,到 2030 年将达到 116.7 亿美元,复合年增长率为 7.12%。

成长的驱动力在于明确的成果,即将劳动力优化从日常管理提升到董事会层面的优先事项,包括人事费用可视性、自动化合规性以及将人工智慧融入核心时间和考勤管理。将预测性排班、即时薪资核算和分析功能整合到单一平台上的供应商正在利用互联员工体验生态系统的需求。混合和远端工作需要始终在线的访问,这推动了大部分透过云端部署新增支出,而行动介面正逐渐被从实体零售到医疗保健等一线职能部门所采用。同时,生物识别和预测分析正在帮助大公司将加班时间减少两位数,这让财务总监相信,精简的劳动力编配可以带来直接的利润槓桿。

全球人力资源管理软体市场趋势与洞察

人工智慧驱动的劳动力预测试点加速欧盟轮班产业的采用

试验预测性排班的欧洲工厂在缩短生产时间窗口的同时,加班成本降低了高达 25%,尤其是在需求每週波动的汽车和消费品领域。 Paycor 的 2024 AI 助理将这些预测直接纳入排班中,让规划人员可以了解两週的人员需求。经营团队指出,在单一演算法中交叉引用预测订单、技能概况和工资水平,可以减少最后一刻的代理劳动力,并在供应链衝击期间增强利润率弹性。随着欧洲劳动力市场进一步收紧,董事会不再将 AI 试点计画作为实验性预算,而是作为与生产力 KPI 挂钩的核心营运升级。其结果是决策週期更快,计划外停机时间明显减少,推动 AI 排班从小附加元件附加功能成为中型工厂的预设功能。

东南亚多地点零售连锁店采用行动优先的 WFM

印尼、泰国和菲律宾的零售集团正在部署行动办公室应用程序,以便根据即时客流量、天气变化和当地节日调整人员配置。 Rippling 将于 2025 年 3 月推出离线自助服务终端功能,无需宽频即可打卡,解决了阻碍 SaaS 在二线城市推广的连线问题。总部现在拥有涵盖数百家门市的统一人事费用仪錶盘,高阶主管可以对曾经局限于电子表格中的生产力指标进行基准测试。早期采用者报告称,转换率实现了个位数百分比的成长,因为楼层经理可以在客流量高峰期即时调换班次。由于东协成员国之间的法规存在差异,能够整合当地劳动法规并为企业财务团队提供综合分析的行动解决方案正迅速受到跨境零售商的青睐。

德国中型製造商的传统 MES/ERP 整合成本

巴登-符腾堡州的一家专业製造商经营一套老旧的製造执行系统,缺乏现代化的API,不得不透过自订连接器与云端调度引擎集成,这耗费了其年度IT预算的20%。经营团队面临着一个两难的境地:虽然即时劳动力编配能够显着提升效率,但添加自订中间件和改进数据品质却需要较长的投资回报期。结果,一级汽车零件製造商正在升级,而规模较小的工具製造商则在推迟升级,这进一步扩大了行业内的生产力差距。瞄准德国市场份额的供应商正在透过低程式码整合中心和按效能付费的定价策略来应对预算风险,但大规模的转型仍是长期挑战。

报告中分析的其他驱动因素和限制因素

- 海湾合作委员会医疗保健人才短缺刺激云端基础的WFM 投资

- 基于区块链的代币化的出现将使亚洲的房地产交易更加便捷

- 中国的资料居住规则限制了外国 SaaS WFM 的部署

細項分析

由于企业将劳动力转型视为整体变革管理过程,而非技术采购,服务收入的复合年增长率达到12.5%,超过了成熟软体授权的收入。应用研讨会、基于角色的培训和持续的优化计划支撑着多年期协议,将供应商转变为长期顾问。随着董事会将营运支出预算分配给经常性价值交付而非资本支出项目,劳动力管理软体服务市场规模预计将大幅扩张。由于买家要求对结果负责,将人力资源咨询与合规审核捆绑在一起的合作伙伴生态系统正在更快地达成交易。

集考勤、排班和分析功能于一体的整合套件将帮助软体企业保留62%的收益,因为它们降低了曾经青睐最佳单点解决方案的整合开销。供应商正在整合机器学习模组和预先建立的监管内容,以增强客户黏着度。这种模式可以提高毛利率,降低转换成本,并确保劳动力管理软体市场持续评估功能的广度和深度。能够平衡平台规模和高触感接触咨询服务的供应商将在续约週期中占据优势。

虽然考勤管理仍然是基础,经营团队寻求的是前瞻性的洞察,而不是回顾性的合规日誌。分析引擎现在将内部班次资料与外部讯号(经济指标、天气预报、假期日历)结合,以预测2个百分点以内的人员需求。利用离职率预测分数的细分市场报告称,招聘成本节省了两位数,证明了分析作为成本控製手段的有效性。当仪表板将提高的劳动效率与提高的营业利润率直接连结时,费用的合理性就变得更容易了。

随着全球监管机构加强记录保存和薪资核算要求,考勤软体市场占有率仍高达 27%。生物辨识打卡可以有效遏制代打卡,而人工智慧视讯验证则可以防止分散式办公环境中的身分盗窃。排班模组日益成为编配层,同时兼顾技能认证、劳动法限制和员工偏好。随着企业逐渐转向以绩效为基础的排班,内建于分析塔中的疲劳管理功能可以提升职场的安全性和雇主品牌价值。

劳动力管理软体市场按元件(软体、服务)、软体类型(考勤管理、劳动力排班等)、部署模式(云端、本地)、组织规模(大型企业、中小型企业)、终端产业(金融服务、保险和保险业、消费品和零售业等)和地区细分。市场预测以美元(USD)计算。

区域分析

在严格的劳动法规和主导预测引擎的早期应用的推动下,欧洲将在2024年占据全球收益的30%。高层对将国家加班标准、集体协议和GDPR通讯协定直接纳入调度逻辑的平台表示讚赏。儘管如此,演算法管理仍受到工会的严格审查,法国和瑞典的劳工团体要求提高透明度。在德国,整合障碍减缓了中小企业的采用,但大型汽车和製药集团仍在继续试行先进模组,这表明长期需求将持续存在。

亚太地区将成为成长最快的地区,到2030年复合年增长率将达到16.1%。在中国,本地供应商正在利用其驻地地位收购国有企业,而外国供应商则正在洽谈云端运算合资企业。东南亚的零售商正在用行动优先的SaaS系统取代旧有系统,而澳洲的法定报告要求正在推动企业朝向整合套件迈进。同时,新兴市场的宽频差距限制了即时服务,但世界银行支持的光纤计划预计将自2019年以来覆盖1.6亿新用户,到2027年将缓解这项限制。

在持续的企业现代化和人工智慧排班新兴企业创新管道的推动下,北美保持强劲成长。巴西和哥伦比亚的物流中心正在实施生物识别打卡系统,以遏制工资欺诈,这展现了南美洲在互联互通和合规框架稳定后的巨大潜力。在中东,富有远见的公告和不断增长的石油收入正在为医院扩建和智慧城市试点项目提供资金,这些项目将编配纳入设计阶段,展现了区域投资正朝着将现代工作时间管理(WFM)作为基础设施的方向发展。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 人工智慧驱动的劳动力预测试点加速欧盟轮班产业的采用

- 东南亚多地点零售连锁店采用行动优先的 WFM

- 海湾合作委员会医疗保健人才短缺刺激云端基础的WFM 投资

- 澳洲和纽西兰的即时工资税报告要求增加整合套件

- 生物识别考勤管理遏制南美物流中心的工资欺诈

- 市场限制

- 德国中型製造商的传统 MES/ERP 整合成本

- 中国资料居住规则限制了海外基于 SaaS 的 WFM 的采用

- 不可靠的宽频基础设施阻碍了撒哈拉以南非洲地区云端运算的采用

- 法国工会反对演算法排班

- 价值链分析

- 监理展望

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 市场宏观经济趋势评估

- 投资分析(资本流动与资金筹措趋势)

第五章 市场规模及成长预测(金额)

- 按组件

- 软体

- 按服务

- 依软体类型

- 考勤管理

- 劳动力调度

- 劳动力分析

- 缺勤和休假管理

- 疲劳和任务管理

- 依部署方式

- 云

- 本地部署

- 按组织规模

- 大公司

- 小型企业

- 按行业

- BFSI

- 消费品和零售

- 车

- 能源与公共产业

- 卫生保健

- 製造业

- 资讯科技/通讯

- 物流/运输

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧的

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ActiveOps PLC

- NICE Ltd.

- Infor Group

- Oracle Corporation

- UKG Inc.

- SAP SE

- ADP LLC

- Blue Yonder Group, Inc.(Panasonic)

- IBM Corporation

- Workday Inc.

- Reflexis Systems Inc.(Zebra)

- SISQUAL Workforce Management, Lda

- ServiceMax Inc.

- Atoss Software AG

- Mitrefinch Ltd(Advanced)

- Deputy Group Pty Ltd

- 7shifts Employee Scheduling Software Inc.

- Sage Group plc

- Roubler Australia Pty Ltd

- tamigo ApS

- Verint Systems Inc.

- ClickSoftware(Salesforce Field Service)

- Ceridian HCM Holding Inc.

- Humanity(TCP Software)

第七章 市场机会与未来展望

The workforce management software market is valued at USD 9.35 billion in 2025 and is projected to reach USD 11.67 billion by 2030, expanding at a 7.12% CAGR.

Growth stems from clear gains in labor-cost visibility, automated compliance, and the infusion of artificial intelligence into time-and-attendance cores, all of which elevate workforce optimization from routine administration to a board-level priority. Vendors that link predictive scheduling, real-time payroll, and analytics in one platform are capitalizing on demand for connected employee-experience ecosystems. Cloud deployment dominates new spending because hybrid and remote work require anytime access, while mobile interfaces unlock adoption in frontline sectors ranging from on-site retail to healthcare. Simultaneously, biometric authentication and predictive analytics help large enterprises cut overtime by double-digit percentages, convincing chief financial officers that streamlined labor orchestration is a direct profit lever.

Global Workforce Management Software Market Trends and Insights

AI-driven Labor Forecasting Pilots Accelerate Adoption in EU Shift-based Industries

European factories that trial predictive scheduling have lowered overtime outlays by up to 25% while tightening production windows, especially in automotive and consumer goods segments where demand fluctuates weekly. Paycor's 2024 AI assistant embeds these forecasts directly into roster creation, giving planners a two-week view of required headcount. Management teams note that cross-referencing predicted orders, skill profiles, and wage tiers within one algorithm curtails last-minute agency labor and bolsters margin resilience during supply-chain shocks. As European labor markets tighten further, boards are funding AI pilots not as experimental budgets but as core operational upgrades tied to productivity KPIs. The result is faster decision cycles and demonstrable reductions in unplanned downtime, pushing AI scheduling from a niche add-on to a default capability in midscale factories.

Mobile-first WFM Penetration in Southeast Asian Multi-site Retail Chains

Retail groups in Indonesia, Thailand, and the Philippines are rolling out mobile workforce apps that re-align staffing levels with real-time footfall, weather shifts, and regional festivals. Rippling's March 2025 offline kiosk functionality allows clock-in without broadband, solving the connectivity gap that has stalled SaaS rollouts in secondary cities. Headquarters gain unified labor-cost dashboards across hundreds of stores, letting executives benchmark productivity metrics that were once trapped in spreadsheets. Early adopters report single-digit percentage increases in conversion rates because floor managers can swap shifts on the fly when traffic spikes. As regulations diverge across ASEAN member states, mobile solutions that embed local labor rules while feeding consolidated analytics to corporate finance teams are rapidly becoming table stakes for cross-border retailers.

Legacy MES/ERP Integration Costs among German Mittelstand Manufacturers

Specialty manufacturers in Baden-Wurttemberg operate aging manufacturing execution systems that lack modern APIs, forcing custom connectors that swallow up to 20% of the annual IT budget when linking to cloud scheduling engines.Management faces a dilemma: the efficiency upside of real-time labor orchestration is clear, yet payback horizons lengthen when bespoke middleware and data-quality remediation are added. Consequently, tier-one automotive suppliers proceed, while smaller toolmakers postpone upgrades, widening intra-sector productivity disparities. Vendors seeking German market share are responding with low-code integration hubs and success-based pricing to de-risk budgets, but widespread conversion remains a long-run challenge.

Other drivers and restraints analyzed in the detailed report include:

- GCC Healthcare Staffing Shortages Spur Cloud-based WFM Investments

- Emergence of Blockchain-Based Tokenization Enabling Fractional Real-Estate Deals in Asia

- China's Data Residency Rules Limiting Foreign SaaS WFM Deployments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services revenue is on track for a 12.5% CAGR, outpacing mature software licenses, as enterprises view successful workforce transformation as a holistic change-management journey rather than a technology procurement. Implementation workshops, role-based training, and continuous optimization programs now anchor multi-year contracts, converting vendors into long-term advisers. The workforce management software market size for services is projected to expand materially as boards allocate operating-expenditure budgets toward recurring value realization rather than capital-expenditure line items. Partner ecosystems that bundle HR consulting with compliance audits are closing deals faster because buyers seek one accountable owner for outcomes.

Software retains 62% revenue because unified suites that integrate attendance, scheduling, and analytics reduce the integration overhead that once favored best-of-breed point solutions. Vendors embed machine learning modules and pre-built regulatory content to increase stickiness. This model shores up gross margins and raises switching costs, ensuring that the workforce management software market continues to prize breadth and depth of functionality. Providers that balance platform scale with high-touch advisory services are pulling ahead in renewal cycles.

Time and Attendance remains foundational, yet Workforce Analytics is registering the strongest 14% CAGR as executive teams demand forward-looking insights rather than retrospective compliance logs. Analytics engines now merge internal shift data with external signals-economic indices, weather feeds, and holiday calendars-to predict staffing demand within 2-percentage-point accuracy. Segments that harness predictive turnover scores report reducing recruitment spend by low-double-digit percentages, validating analytics as a cost-containment lever. Expense justification is easier when dashboards tie labor efficiency gains directly to operating-margin improvements.

The workforce management software market share for Time and Attendance stays compelling at 27% because regulators worldwide tighten record-keeping and payroll mandates. Biometric clock-in curbs buddy punching, while AI video verification guards against spoofing in dispersed workforces. Scheduling modules increasingly serve as orchestration layers that weigh skill credentialing, labor-law ceilings, and employee preferences simultaneously. As organizations move toward outcome-based scheduling, fatigue management embedded in analytics towers elevates workplace safety and employer-brand equity.

Workforce Management Software Market is Segmented by Component (Software, Services), Software Type (Time and Attendance Management, Workforce Scheduling, and More), Deployment Mode (Cloud, On-Premises), Organization Size (Large Enterprises, Smes), End-Use Industry (BFSI, Consumer Goods and Retail, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe contributes 30% of 2024 global revenue, underpinned by stringent labor legislation and early adoption of AI-led forecasting engines. Executives appreciate platforms that bake national overtime thresholds, works-council agreements, and GDPR protocols directly into scheduler logic. Nevertheless, algorithmic management faces union scrutiny, with French and Swedish labor groups pushing for transparency safeguards. Germany's integration hurdles slow uptake among Mittelstand firms, yet large automotive and pharma conglomerates continue to pilot advanced modules, signaling long-run demand.

Asia-Pacific is the fastest mover with a 16.1% CAGR to 2030. In China, local vendors exploit residency rules to win state-owned enterprises, while foreign providers negotiate joint cloud ventures to remain relevant. Southeast Asian retailers leapfrog legacy systems via mobile-first SaaS, and Australian statutory reporting mandates coax organizations toward integrated suites. Simultaneously, broadband gaps in emerging markets constrain real-time services, but World Bank-backed fiber projects covering 160 million new users since 2019 are expected to ease constraints by 2027.

North America keeps a solid growth clip through sustained enterprise modernization and an innovation pipeline of AI scheduling startups. Logistics hubs in Brazil and Colombia deploy biometric time clocks to curb payroll fraud, indicating South American potential when connectivity and compliance frameworks stabilize. In the Middle East, Vision announcements and elevated oil revenues fund hospital expansions and smart-city pilots that embed workforce orchestration at the design phase, demonstrating that regional investments increasingly assume modern WFM as infrastructure.

- ActiveOps PLC

- NICE Ltd.

- Infor Group

- Oracle Corporation

- UKG Inc.

- SAP SE

- ADP LLC

- Blue Yonder Group, Inc. (Panasonic)

- IBM Corporation

- Workday Inc.

- Reflexis Systems Inc. (Zebra)

- SISQUAL Workforce Management, Lda

- ServiceMax Inc.

- Atoss Software AG

- Mitrefinch Ltd (Advanced)

- Deputy Group Pty Ltd

- 7shifts Employee Scheduling Software Inc.

- Sage Group plc

- Roubler Australia Pty Ltd

- tamigo ApS

- Verint Systems Inc.

- ClickSoftware (Salesforce Field Service)

- Ceridian HCM Holding Inc.

- Humanity (TCP Software)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-driven Labor Forecasting Pilots Accelerate Adoption in EU Shift-based Industries

- 4.2.2 Mobile-first WFM Penetration in Southeast Asian Multi-site Retail Chains

- 4.2.3 GCC Healthcare Staffing Shortages Spur Cloud-based WFM Investments

- 4.2.4 Real-time Payroll Tax Reporting Mandates in Australia and New Zealand Boost Integrated Suites

- 4.2.5 Biometric Time and Attendance to Curb Payroll Fraud in South American Logistics Hubs

- 4.3 Market Restraints

- 4.3.1 Legacy MES/ERP Integration Costs among German Mittelstand Manufacturers

- 4.3.2 China's Data Residency Rules Limiting Foreign SaaS WFM Deployments

- 4.3.3 Unreliable Broadband Infrastructure Hindering Cloud Adoption in Sub-Saharan Africa

- 4.3.4 French Union Pushback Against Algorithmic Shift Scheduling

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

- 4.9 Investment Analysis (Capital Flow and VC Funding Trends)

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Software Type

- 5.2.1 Time and Attendance Management

- 5.2.2 Workforce Scheduling

- 5.2.3 Workforce Analytics

- 5.2.4 Absence and Leave Management

- 5.2.5 Fatigue and Task Management

- 5.3 By Deployment Mode

- 5.3.1 Cloud

- 5.3.2 On-premise

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-use Industry

- 5.5.1 BFSI

- 5.5.2 Consumer Goods and Retail

- 5.5.3 Automotive

- 5.5.4 Energy and Utilities

- 5.5.5 Healthcare

- 5.5.6 Manufacturing

- 5.5.7 IT and Telecommunications

- 5.5.8 Logistics and Transportation

- 5.5.9 Other Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Nordics

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Southeast Asia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Chile

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ActiveOps PLC

- 6.4.2 NICE Ltd.

- 6.4.3 Infor Group

- 6.4.4 Oracle Corporation

- 6.4.5 UKG Inc.

- 6.4.6 SAP SE

- 6.4.7 ADP LLC

- 6.4.8 Blue Yonder Group, Inc. (Panasonic)

- 6.4.9 IBM Corporation

- 6.4.10 Workday Inc.

- 6.4.11 Reflexis Systems Inc. (Zebra)

- 6.4.12 SISQUAL Workforce Management, Lda

- 6.4.13 ServiceMax Inc.

- 6.4.14 Atoss Software AG

- 6.4.15 Mitrefinch Ltd (Advanced)

- 6.4.16 Deputy Group Pty Ltd

- 6.4.17 7shifts Employee Scheduling Software Inc.

- 6.4.18 Sage Group plc

- 6.4.19 Roubler Australia Pty Ltd

- 6.4.20 tamigo ApS

- 6.4.21 Verint Systems Inc.

- 6.4.22 ClickSoftware (Salesforce Field Service)

- 6.4.23 Ceridian HCM Holding Inc.

- 6.4.24 Humanity (TCP Software)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment