|

市场调查报告书

商品编码

1836442

汽车压力感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Pressure Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

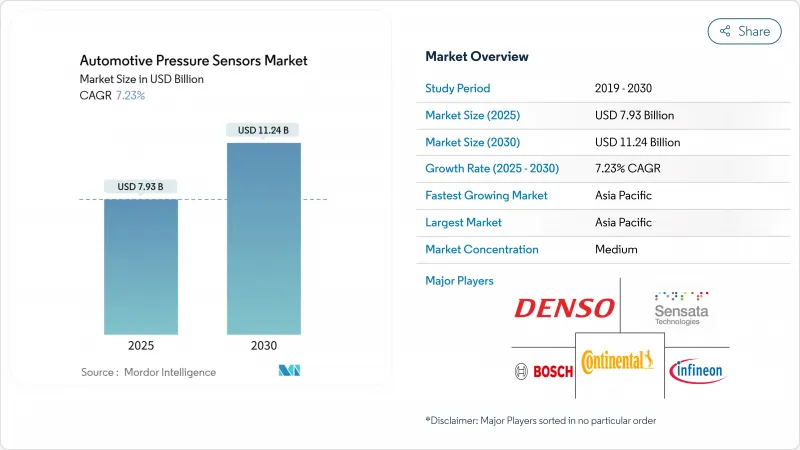

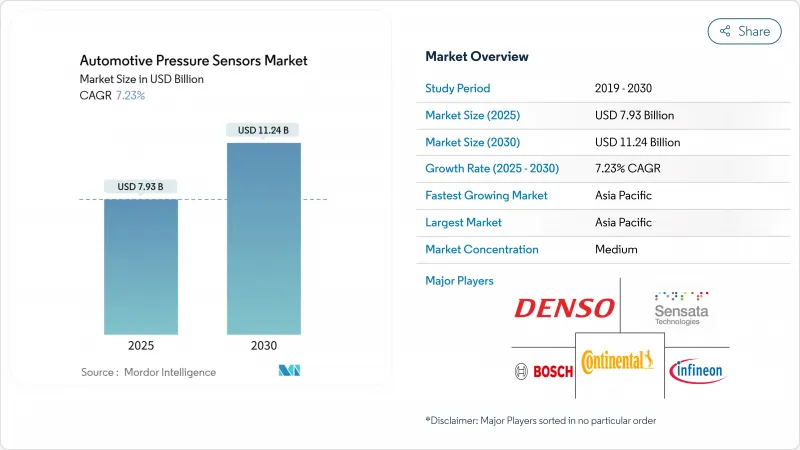

预计汽车压力感测器市场规模到 2025 年将达到 79.3 亿美元,到 2030 年将达到 112.4 亿美元,复合年增长率为 7.23%。

随着製造商用固态设备取代机械仪表,并将数据输入软体定义的汽车平臺,市场需求强劲。电力推进系统、自动线控刹车系统以及全球统一的排放气体法规都要求每辆车配备更多的压力节点,推高了感测器数量和平均价格。亚太地区在产量和新能源汽车部署方面继续保持领先地位,而欧洲和北美正在升级车辆,以符合欧盟通用安全法规II,该法规要求所有新车型都必须配备轮胎压力监测装置。同时,供应商正在投资碳化硅和电容式MEMS设计,以承受更高的排气温度和更低的电池冷却液压力,从而扩大了汽车压力感测器市场的潜在范围。

全球汽车压力感测器市场趋势与洞察

政府强制安装TPMS

监管机构现在将胎压资料视为第一线安全资讯。自2024年7月起,欧盟《通用安全法规II》将要求所有新乘用车、巴士、卡车和拖车必须安装胎压监测系统 (TPMS)。美国已经颁布了类似的规定,南美洲和东南亚各国政府也正在起草相应的法规。原始设备製造商正在利用强制的无线骨干网路来分层进行胎面磨损分析和云端警报,提升感测器的价值,并青睐那些提供通过网路安全审核的加密通讯协定的供应商。

扩大电动动力传动系统生产

纯电动平台在冷却液迴路、线控刹车电路和密封冷媒系统中引入了额外的压力节点。精准的回馈可防止热失控,并优化快速充电温度视窗。中国组装商在每个模组中整合多个低压MEMS晶片,而欧洲高阶品牌则转向需要更强电气隔离的800伏特架构。资料点数量的成长推动了产量和复杂性的提升,这使得在汽车压力感测器市场中,那些将强大的硬体与电池组健康演算法相结合的供应商受益匪浅。

感测器价格下降和利润压力

儘管汽车製造商正在协商将传统歧管和胎压监测系统(TPMS)仪表的年度成本降低2-3%,但东南亚的代工厂正在复製成熟的设计,导致利润率不断下降。为了保护价格,供应商正在捆绑诊断和预测性维护API,以产生订阅收入。然而,持续的成本削减目标要求精益封装、外包测试和大幅缩小晶粒尺寸,这给规模较小的製造商带来了挑战,并削弱了汽车压力感测器市场的短期盈利。

报告中分析的其他驱动因素和限制因素

- ADAS 与自动驾驶系统的整合度不断提高

- 更严格的全球排放气体和燃油经济性标准

- 半导体供应链不稳定

細項分析

乘用车占据了大部分部署,这不仅反映了全球生产规模,也反映了向电力推进的快速转变。到 2024 年,乘用车平台将占据汽车压力感测器市场份额的 65.18%,到 2030 年的复合年增长率将达到 8.15%。随着豪华车整合自我调整空气悬吊、主动空气动力学和预测性煞车服务,应用将会加速。电动轿车将在电池冷却系统和座舱热泵中增加低压节点,从而增加每辆车的感测器数量。商用厢型车和轻型卡车的销售落后,但正受到需要负载监控和再生煞车优化的最后一哩送货车队的关注。根据欧盟的新批准,中型和重型卡车面临强制性的 TPMS 要求,这促使人们采用更广泛范围的仪表来应对更苛刻的工作週期。自动驾驶货运飞机正在采用冗余压力迴路来满足故障操作标准。因此,透过提供跨车型的多样化产品,供应商可以对冲任何单一领域的周期性疲软,从而支持汽车压力感测器市场的持续成长。

第二梯队的成长来自专用非公路用车,这些车辆的液压操作和长时间运行推动了对高压膜片的需求。农业机械透过数位控制轮胎压力来管理土壤压实,而施工机械即时追踪液压健康状况。这些感测器配备不銹钢或陶瓷单元和密封连接器,儘管产量不大,但仍推动了平均售价的上涨。因此,乘用车领域的领先地位与重型应用领域盈利的利基市场并存,丰富了汽车压力感测器产业的整体价值。

胎压监测系统将占 2024 年销售量的 39.25%,巩固其作为新法规入口网站的角色。轻型车将配备四到六个轮舱感应器,高级内装将增加第五个备胎单元。感测器电池寿命可达 10 年,创造类似年金的售后市场。然而,欧盟 7 将推动对废气再循环、微粒捕集器和 SCR 剂量子系统的支出增加,这些子系统需要持续的压力回馈。这些排气模组的复合年增长率最快,为 10.45%,需要高温碳化硅晶片,其平均售价是典型 TPMS 单元的两倍。煞车和 ABS 压力感测仍将是稳定的核心,但向线控刹车的过渡将提高解析度和冗余度,从而增加设备的数量。引擎歧管、油晶粒和涡轮增压感测将持续发展,在压力波动较大的情况下变得更加精确,即使电气化不断发展,仍能维持原有的需求。在所有频宽中,汽车压力感测器市场受益于多样化的应用咨询,合规投资推动短期飙升,而软体支援的健康功能则产生长期收益。

在车内,智慧安全气囊模组利用气压资讯来改善乘员分类。下一代空调控制系统利用蒸气压缩监测来优化电动车常用热泵的冷媒充填量。驾驭控制系统整合高速10 kHz压力感知器,用于调节半主动式减震器。随着感测器数量的增加,多路復用数位汇流排正在取代类比线路,从而减轻线束重量并提高可靠性。感测器种类的不断扩展表明,汽车压力感测器市场正在从单一用途的类比仪表向为集中式域控制器提供资料的联网数位节点持续转型。

汽车压力感知器市场报告按车辆类型(乘用车、轻型商用车、其他)、应用(胎压监测系统 (TPMS)、其他)、压力类型(绝对压力、差压、其他)、感测器技术(压阻式 MEMS、其他)、销售管道(OEM 安装、售后市场)和地区细分。市场预测以销售额(美元)和销售量(单位)表示。

区域分析

亚太地区是汽车压力感测器市场的销售引擎,2024年将以49.66%的市占率位居榜首。随着中国加快电动车生产步伐,并采用多个低压节点以确保电池安全,预计到2030年,该地区的复合年增长率将达到9.66%。 「国家内容授权」奖励MEMS(微机电系统)的国内采购,从而减少对进口的依赖,本地製造商正受益于此。印度正在古吉拉突邦和泰米尔纳德邦扩大其汽车组装丛集,培育区域感测器供应链以及动力传动系统电子元件。日本将保持在微加工工具领域的领先地位,为全球品牌提供外包晶圆製造服务。政府对智慧移动实验室的补贴将缩短该地区的设计週期,并增强其竞争力。

北美正经历着监管拉动和技术推动的双重驱动。美国国家公路交通安全管理局(NHTSA)关于胎压通讯协定(TPMS)的规定和美国环保署(EPA)的排放标准确保了基准需求,而硅谷的软体堆迭则加速了向偏向数位压力协议的集中式领域的转变。总部位于底特律的原始设备製造商(OEM)正在实现电池组组装和温度控管整合的本地化,从而增加了国产感测器的数量。随着加拿大重型卡车产业采用高精度胎压控制以提高燃油经济性,感测器的应用范围扩展到职业应用。墨西哥的二级供应商生态系统提供模製外壳和导线架冲压件,支援整个汽车压力感测器市场的区域成本最佳化。

欧洲的政策情势最具挑战性。欧7强制要求即时废气监测,推动了碳化硅高温感测器的广泛应用。通用安全法规要求所有车型安装胎压监测系统 (TPMS),从而提高了拖车和乘用车的感测器密度。德国高阶汽车製造商指定使用双冗余煞车压力模组,用于3级自动驾驶认证。法国和义大利正在投资振兴整合先进电池冷却液感测技术的电动公车计划。东欧工厂正在吸引新的MEMS封装投资,并利用通用市场中具有竞争力的劳动力。总体而言,协调一致的法规和成熟的终端用户将稳定汽车压力感测器市场的长期需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 政府强制安装TPMS

- 电动动力传动系统产量增加

- ADAS 与自动驾驶系统的整合度不断提高

- 全球排放和燃油经济性法规更加严格

- 基于 SiC 的高温感测器开创了排气侧用例

- OTA预后诊断需要自我诊断智慧感测器

- 市场限制

- 感测器价格上涨和利润压力

- 半导体供应链的波动

- TPMS讯号欺骗带来的网路风险

- 复杂的多标准认证负担

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模与成长预测:价值(美元)与数量(单位)

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中大型商用车

- 按用途

- 轮胎压力监测系统(TPMS)

- 煞车助力器和 ABS

- 发动机和燃料/歧管管理

- 废气再循环/后处理

- 安全气囊和安全约束系统

- 车辆动力学和 ESC

- 按压力类型

- 绝对压力

- 表压(密封/通风)

- 微分

- 真空/低压

- 透过感测器技术

- 压阻式MEMS

- 电容式MEMS

- 共振/晶体

- 光电子,其他

- 按销售管道

- OEM 适配

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 埃及

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Robert Bosch GmbH

- Continental AG

- Sensata Technologies, Inc.

- DENSO Corporation

- Infineon Technologies AG

- STMicroelectronics NV

- NXP Semiconductors NV

- Texas Instruments Incorporated

- Autoliv Inc.

- Allegro MicroSystems, LLC

- TE Connectivity Ltd.

- Honeywell International Inc.

- Analog Devices, Inc.

- Melexis NV

- Aptiv PLC

- Amphenol Advanced Sensors

- Alps Alpine Co., Ltd.

- Bourns, Inc.

- Nidec-Copal Electronics

第七章 市场机会与未来展望

The automotive pressure sensors market size was USD 7.93 billion in 2025 and is projected to reach USD 11.24 billion by 2030, reflecting a healthy 7.23% CAGR.

Robust demand arises as manufacturers replace mechanical gauges with solid-state devices that feed data into software-defined vehicle platforms. Electric propulsion, autonomous-ready brake-by-wire systems, and globally harmonized emission limits each call for more pressure nodes per vehicle, lifting both unit volumes and average sensor value. Asia-Pacific continues to set the pace in production scale and new-energy-vehicle rollouts, while Europe and North America upgrade fleets to comply with the EU General Safety Regulation II that obliges tire pressure monitoring on every new vehicle class . Meanwhile, suppliers invest in silicon-carbide and capacitive MEMS designs that survive hotter exhaust and lower battery-coolant pressures, expanding the total addressable scope of the automotive pressure sensors market.

Global Automotive Pressure Sensors Market Trends and Insights

Government Mandates for TPMS Fitment

Regulators now treat tire-pressure data as frontline safety information. From July 2024, the EU General Safety Regulation II requires TPMS on every new passenger car, bus, truck, and trailer . Comparable mandates already exist in the United States, while South American and Southeast Asian governments draft matching rules. OEMs exploit the mandatory wireless backbone to layer tread-wear analytics and cloud alerts, increasing sensor value, and they prefer vendors offering encrypted protocols that pass cybersecurity audits.

Escalating Electrified-Powertrain Production

Battery-electric platforms introduce extra pressure nodes in coolant loops, brake-by-wire circuits, and closed refrigerant systems; accurate feedback prevents thermal runaway and optimizes fast-charge temperature windows. Chinese assemblers embed several low-pressure MEMS dice per module, whereas European premium brands migrate to 800-volt architectures needing stronger electrical isolation. The growing datapoint count enlarges both volume and complexity, rewarding suppliers that marry robust hardware with pack-health algorithms inside the automotive pressure sensors market.

Sensor Price-Erosion and Margin Pressure

Automakers negotiate yearly 2-3% cost reductions on legacy manifold and TPMS gauges, while Southeast Asian contract foundries replicate mature designs, compressing margins. To defend pricing, suppliers bundle diagnostics and predictive-maintenance APIs that create subscription revenue. Nonetheless, relentless cost-down targets demand lean packaging, outsourced test, and aggressive die shrinks, challenging smaller firms and tempering short-term profitability inside the automotive pressure sensors market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Integration of ADAS and Autonomous Systems

- Stricter Global Emission and Fuel-Economy Norms

- Semiconductor Supply-Chain Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars dominate deployments, reflecting both global production scale and the rapid shift toward electric propulsion. In 2024, passenger platforms held 65.18% of the automotive pressure sensors market share and are tracking an 8.15% CAGR to 2030. Adoption accelerates as luxury marques integrate adaptive air suspension, active aerodynamics, and predictive brake servicing. Electric sedans place additional low-pressure nodes in battery chillers and cabin heat pumps, expanding sensor counts per vehicle. Commercial vans and light trucks trail in volume yet attract attention from last-mile delivery fleets that demand load monitoring and regenerative braking optimization. Medium and heavy trucks face EU mandates for TPMS on new approvals, spurring higher-range gauges that thrive in harsher duty cycles. Autonomous freight pilots employ redundant pressure circuits to satisfy fail-operational criteria. Consequently, diversified offerings across vehicle classes allow suppliers to hedge cyclical softness in any single segment, supporting sustainable gains for the automotive pressure sensors market.

Second-tier growth comes from specialized off-highway vehicles where hydraulic workloads and extended duty drive demand for high-proof-pressure diaphragms. Agricultural machinery integrates digital tire inflation control for soil compaction management, while construction equipment adopts real-time hydraulic health tracking. Though unit volumes are modest, ASPs rise because these sensors pack stainless or ceramic cells and sealed connectors. Passenger car leadership therefore coexists with profitable niches in heavy applications, enriching the overall value capture of the automotive pressure sensors industry.

Tire pressure monitoring systems generated 39.25% of 2024 revenue, cementing their role as the entry point for new regulations. Each light vehicle carries four to six wheel-well sensors, and premium fitments add a fifth spare-wheel unit. Sensor batteries last up to 10 years, creating an annuity-like aftermarket. Yet Euro 7 shifts incremental expenditure toward exhaust gas recirculation, particulate trap, and SCR dosing subsystems that now need continuous pressure feedback. These exhaust modules post the fastest 10.45% CAGR and require high-temperature silicon-carbide dies that command double the ASP of common TPMS units. Brake and ABS pressure sensing remains a steady core, though migration to brake-by-wire introduces finer resolution and redundancy that raise device count. Engine manifold, fuel rail, and turbo boost sensing evolve toward higher accuracy at large pressure swings, keeping legacy demand intact even as electrification proceeds. Across every bandwidth, the automotive pressure sensors market benefits from diversified application pull, with compliance spend fueling near-term spikes and software-enabled health features creating longer-cycle revenue.

Inside the cabin, smart airbag modules employ barometric pressure information to improve occupant classification. Next-generation climate control leverages vapor-compression monitoring to optimize refrigerant charge in heat pumps common to EVs. Ride-control systems embed fast 10 kHz pressure pick-ups to regulate semi-active dampers. As sensor counts expand, multiplexed digital buses replace analog lines, simplifying harness weight and boosting reliability. The widening scope underlines how the automotive pressure sensors market continues to migrate from single-purpose analog gauges to networked digital nodes that feed centralized domain controllers.

The Automotive Pressure Sensors Market Report is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Application (Tire Pressure Monitoring System (TPMS), and More), Pressure Type (Absolute, Differential, and More), Sensor Technology (Piezoresistive MEMS, and More), Sales Channel (OEM-Fitted and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific remains the volume engine for the automotive pressure sensors market, leading with 49.66% share in 2024. The region is further projected to grow with a 9.66% CAGR by 2030, as China accelerates electric-vehicle production and embeds multiple low-pressure nodes for battery safety. Local makers benefit from national content mandates that incentivize domestic MEMS sourcing, reducing import reliance. India scales automotive assembly clusters in Gujarat and Tamil Nadu, fostering regional sensor supply chains alongside powertrain electronics. Japan sustains leadership in micro-machining tools, feeding outsourced wafer fabrication for global brands, while South Korea leverages its consumer-electronics fabs to push sensor miniaturization. Government subsidies for smart mobility labs keep regional design cycles short, enhancing competitiveness.

North America combines regulatory pull with technology push. NHTSA rules on TPMS and EPA emission standards ensure baseline demand, while Silicon Valley software stacks accelerate the shift to centralized domains that favor digital pressure protocols. Detroit OEMs localize battery pack assembly and thermal management integration, increasing domestic sensor content. Canada's heavy-truck sector adopts high-accuracy tire inflation control for fuel-efficiency gains, extending sensor use into vocational applications. Mexico's Tier-2 ecosystem supplies molded housings and lead frame stampings, supporting regional cost optimization across the automotive pressure sensors market.

Europe's policy landscape is the most stringent. Euro 7 legislation forces real-time exhaust monitoring, driving uptake of SiC high-temperature sensors . The General Safety Regulation obliges TPMS on every vehicle class, elevating sensor density in trailers and coaches. Germany's premium OEMs specify dual-redundant brake pressure modules for Level-3 autonomous approval. France and Italy channel recovery funds into electric-bus projects that integrate advanced battery coolant sensing. Eastern European plants attract new MEMS packaging investments, exploiting competitive labor while staying inside the common market. Altogether, synchronized regulations and sophisticated end-users stabilize long-run demand across the automotive pressure sensors market.

- Robert Bosch GmbH

- Continental AG

- Sensata Technologies, Inc.

- DENSO Corporation

- Infineon Technologies AG

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Texas Instruments Incorporated

- Autoliv Inc.

- Allegro MicroSystems, LLC

- TE Connectivity Ltd.

- Honeywell International Inc.

- Analog Devices, Inc.

- Melexis NV

- Aptiv PLC

- Amphenol Advanced Sensors

- Alps Alpine Co., Ltd.

- Bourns, Inc.

- Nidec-Copal Electronics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government mandates for TPMS fitment

- 4.2.2 Escalating electrified-powertrain production

- 4.2.3 Rising integration of ADAS and autonomous systems

- 4.2.4 Stricter global emission and fuel-economy norms

- 4.2.5 SiC-based high-temperature sensors open exhaust-side use-cases

- 4.2.6 OTA prognostics require self-diagnosing smart sensors

- 4.3 Market Restraints

- 4.3.1 Sensor price-erosion and margin pressure

- 4.3.2 Semiconductor supply-chain volatility

- 4.3.3 Cyber-risk of TPMS signal spoofing

- 4.3.4 Complex multi-standard certification burden

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium and Heavy Commercial Vehicles

- 5.2 By Application

- 5.2.1 Tire Pressure Monitoring System (TPMS)

- 5.2.2 Brake Booster and ABS

- 5.2.3 Engine and Fuel/Manifold Management

- 5.2.4 Exhaust Gas Recirculation/After-treatment

- 5.2.5 Airbag and Safety Restraint Systems

- 5.2.6 Vehicle Dynamics and ESC

- 5.3 By Pressure Type

- 5.3.1 Absolute

- 5.3.2 Gauge (Sealed/Vent)

- 5.3.3 Differential

- 5.3.4 Vacuum/Low-pressure

- 5.4 By Sensor Technology

- 5.4.1 Piezoresistive MEMS

- 5.4.2 Capacitive MEMS

- 5.4.3 Resonant/Quartz

- 5.4.4 Opto-electronic and Others

- 5.5 By Sales Channel

- 5.5.1 OEM-Fitted

- 5.5.2 Aftermarket

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Egypt

- 5.6.5.4 South Africa

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 Sensata Technologies, Inc.

- 6.4.4 DENSO Corporation

- 6.4.5 Infineon Technologies AG

- 6.4.6 STMicroelectronics N.V.

- 6.4.7 NXP Semiconductors N.V.

- 6.4.8 Texas Instruments Incorporated

- 6.4.9 Autoliv Inc.

- 6.4.10 Allegro MicroSystems, LLC

- 6.4.11 TE Connectivity Ltd.

- 6.4.12 Honeywell International Inc.

- 6.4.13 Analog Devices, Inc.

- 6.4.14 Melexis NV

- 6.4.15 Aptiv PLC

- 6.4.16 Amphenol Advanced Sensors

- 6.4.17 Alps Alpine Co., Ltd.

- 6.4.18 Bourns, Inc.

- 6.4.19 Nidec-Copal Electronics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment