|

市场调查报告书

商品编码

1836475

云端基础的医疗保健分析:全球市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Global Healthcare Cloud Based Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

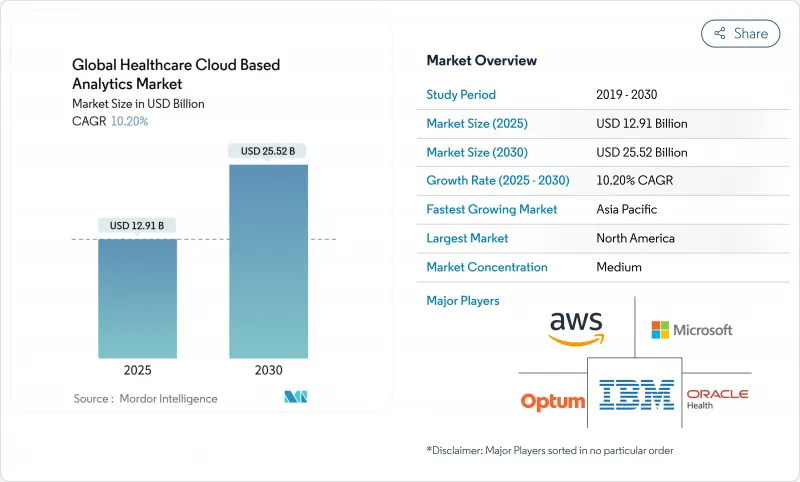

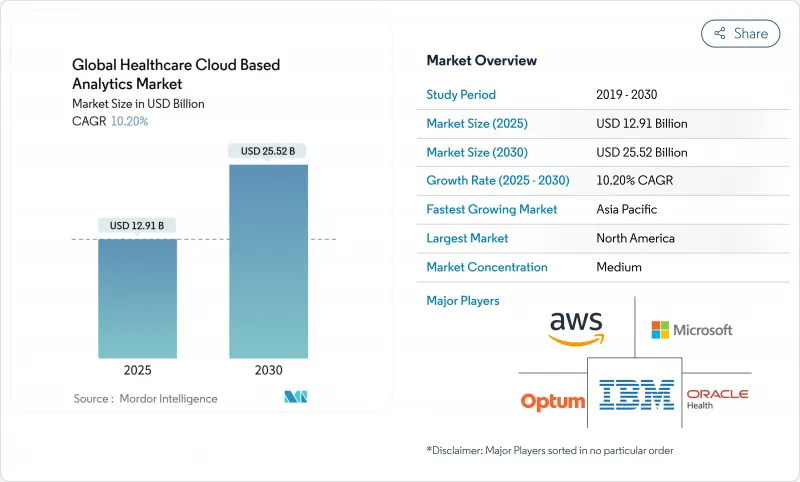

预计 2025 年医疗云端基础分析市场价值将达到 129.1 亿美元,到 2030 年将达到 255.2 亿美元,复合年增长率为 14.6%。

越来越大的证明可衡量结果的压力、数位化病患资讯的激增以及向基于价值的报销的决定性转变,正在加速医院、付款人和生命科学赞助商对云端原生分析的投资。 《21世纪治疗方法》等监管规定、远端医疗的迅速普及为临床系统带来了新数据,以及显着的基础设施节省前景,都强化了采用云端技术的经济理由。接受云端迁移的供应商已记录到大型计划基础设施成本节省高达 95%,这证明了弹性按需运算的经济吸引力。人才短缺和网路风险加剧正在抑制这一发展势头,但与此同时,对于那些将託管服务与强大的安全架构捆绑在一起的供应商来说,閒置频段的机会正在涌现。

全球医疗保健云端基础分析市场趋势与洞察

数位医疗记录导致数据爆炸

目前,几乎所有美国医院(96%)和超过四分之三(78%)的门诊诊所都运行着经过认证的电子健康记录(EHR) 系统。海量的结构化、半结构化和非结构化资讯正在淹没传统伺服器,同时也催生了对云端託管分析引擎的需求,这些引擎可以筛选文字、图像、波形和串流遥测资料。自然语言处理将医生的诊疗记录转化为可用数据,而机器学习流程则能够发现有助于预防再入院和优化人员配置的模式。医疗服务提供者结合基因组图谱、穿戴式装置指标和社会决定因素,建构精细的病患檔案,以支持精准医疗和全部区域介入。

向基于价值的医疗费用过渡

根据美国医疗保险和医疗补助服务中心 (Centers for Medicare & Medicaid Services) 的数据,到 2030 年,所有医疗保险受益人都将在基于价值的模式下获得医疗服务,这一转变将重质不重量。参与预付费计画的机构已透过及时的、以分析为导向的干预措施,每年减少 2,800 万美元的支出,彰显了云端可扩展性的财务优势。随着负责任医疗的参与度在欧洲不断扩大,持续的绩效追踪对于公共和私人医疗系统都至关重要。

持续的资料隐私和网路安全威胁

2024年,医疗保健产业共发生677起重大资料外洩事件,影响了1.824亿人,其中包括一起勒索软体事件,导致1亿笔病患记录外洩。平均资料外洩成本高达977万美元,迫使服务供应商在加密、零信任架构和全天候监控方面投入大量资金。许多机构仍然缺乏内部专业知识,导致采购週期过长,并在一定程度上减缓了医疗保健云端基础分析市场的发展势头。

报告中分析的其他驱动因素和限制因素

- 经济高效且富有弹性的云端基础设施

- 政府强制推行医疗保健互通性标准

- 遗留基础设施和整合的复杂性

細項分析

到2024年,预测工具将占据云端基础分析市场的40.8%,凸显了医疗服务提供者对预测再入院率、败血症事件和人员需求的渴望。解决方案整合了纵向电子病历记录、即时生命征象和社会经济指标,以触发主动护理路径,从而提高品质并降低成本。整合式仪表板可向多学科团队发出高风险病患警报,从而降低急诊室的使用率。

处方引擎尚处于起步阶段,但成长速度最快,到2030年的复合年增长率将达到16.1%。这些平台模拟药物治疗方案或手术室吞吐量的「假设」情景,并建议最佳干预措施。决策优化与寻求在基于价值的合约下持续提高利润率的医疗系统产生了共鸣,这使得处方模组成为下一个成长前沿。

2024年,临床分析占据了医疗云端基础分析市场45.5%的份额,因为床边决策支援、影像分类和药物交互作用为患者带来了切实的益处。深度学习演算法缩短了放射科的周转时间,并揭示了细微的病理,而即时抗生素管理仪錶板则抑制了抗药性的趋势。

人口健康平台的复合年增长率高达 17.4%,它汇集总理赔、药房和社会需求数据,以分层风险并指导社区干预。随着按人头付费模式的日益普及,付款人和提供者依赖队列层级的指标来识别医疗服务中的差距。在计算数百万受试者的数千个变数时,云端的可扩展性至关重要。

云端基础的医疗分析市场报告按技术类型(预测性、规范性、其他)、应用程式(临床数据、管理数据、其他)、组件(硬体、其他)、部署模型(公共、私人、其他)、最终用户(医疗保健提供者、付款人、其他)和地区(北美、欧洲、其他)细分。市场规模和预测以美元提供。

区域分析

北美保持了其收益主导地位,这得益于电子健康檔案(EHR)的近乎普遍的采用、慢性病管理代码的慷慨报销以及联邦政府对互通性的积极推动。将全部分析工作负载迁移到超大规模运算平台的医疗系统报告称,成本节省高达 95%,并加速了人工智慧自动化进度记录试点。网路事件仍然是一个持续存在的威胁,推动了对零信任框架的广泛投资,并影响了医疗云端基础分析市场的供应商选择标准。

随着欧洲健康资料空间 (EDS) 强制要求跨境记录可携性和研究成果重复利用,欧洲正经历强劲的两位数成长。德国 C5 和法国 HDS 等国家特定法规正在推动私有云端和混合云战略的发展,以保障资料驻留。卫生署正在拨款数位转型,以解决劳动力短缺问题,并加强云端供应商与公共机构的合作。综合医疗卫生区域正在利用联邦学习模型,在无需导出原始影像的情况下联合运行癌症筛检演算法,从而在满足隐私监管机构要求的同时扩展分析能力。

受中国网路医疗繁荣和东南亚蓬勃发展的远距远端医疗产业的推动,亚太地区将呈现最快的成长轨迹。日本、韩国和新加坡的政府项目正在津贴医院向云端迁移和临床人工智慧试点项目,以应对人口老化和临床医生短缺的问题。专科资源有限的国家正在透过实施远端读取解决方案并将影像检查安排到异地放射科医生来扩大诊断覆盖范围。区域科技巨头不断增加的投资正在培育一个充满活力的合作伙伴伙伴关係,这些生态系统可以根据当地的工作流程和语言差异来客製化分析产品。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 数位医疗记录导致数据爆炸

- 向基于价值的护理过渡

- 经济高效且富有弹性的云端基础设施

- 政府强制实施医疗保健互通性标准

- 远端医疗的扩展产生了连续的病患资料流

- 采用 Fhir 和开放 API 生态系统可实现跨医疗保健分析

- 市场限制

- 持续的资料隐私和网路安全威胁

- 遗留基础设施和整合的复杂性

- 云端原生医疗资料人才短缺

- 数据主权和碳足迹监管的兴起

- 供应链分析

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(金额)

- 依技术类型

- 预测分析

- 指示性分析

- 说明分析

- 按用途

- 临床分析

- 管理和财务分析

- 人口健康与调查分析

- 真实世界证据与药物安全检测

- 按组件

- 硬体

- 软体

- 按服务

- 按部署模型

- 公共云端

- 私有云端

- 混合云端

- 按最终用户

- 医疗保健提供者

- 付款人

- 生命科学与合约研究组织

- 公共卫生机构

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第六章 竞争态势

- 市场集中度

- 市占率分析

- 公司简介

- Oracle(Cerner)

- Optum

- IBM(Merative)

- Microsoft

- Amazon Web Services

- Google Cloud Platform

- Allscripts(Veradigm)

- SAS Institute

- CitiusTech

- Health Catalyst

- Philips Healthcare

- HP Enterprise

- Snowflake Inc.

- MedeAnalytics

- Verisk Health

- McKesson

- Inovalon

- Flatiron Health

- IQVIA Analytics

- Arcadia IO

第七章 市场机会与未来展望

The Healthcare cloud-based analytics market is valued at USD 12.91 billion in 2025 and is forecast to reach USD 25.52 billion by 2030, advancing at a 14.6% CAGR.

Heightened pressure to prove measurable outcomes, surging volumes of digital patient information, and a decisive shift toward value-based reimbursement are accelerating investment in cloud-native analytics across hospitals, payers, and life-science sponsors. Regulatory mandates such as the 21st Century Cures Act, rapid telehealth adoption that funnels fresh data into clinical systems, and the promise of substantial infrastructure savings strengthen the economic rationale for cloud deployment. Providers that embraced cloud migration recorded infrastructure cost reductions of up to 95% in large-scale projects, demonstrating the fiscal appeal of elastic, on-demand computing. Talent shortages and intensifying cyber-risk temper momentum but simultaneously create white-space opportunities for vendors that bundle managed services with robust security architectures.

Global Healthcare Cloud Based Analytics Market Trends and Insights

Data Explosion from Digital Health Records

Nearly every U.S. hospital (96%) and more than three-quarters of ambulatory physicians (78%) now run certified electronic health record (EHR) systems. The torrent of structured, semi-structured, and unstructured information overwhelms legacy servers yet fuels demand for cloud-hosted analytic engines that sift text, images, waveforms, and streaming telemetry. Natural-language processing converts physician notes into usable data, while machine-learning pipelines uncover patterns that inform readmission prevention and staffing optimization. By blending genomic profiles, wearable metrics, and social determinants, providers compose granular patient portraits that underpin precision medicine and community-wide interventions.

Transition To Value-Based Care Reimbursement

As per the Centers for Medicare & Medicaid Services, all Medicare beneficiaries are slated to receive care under value-based models by 2030, a shift that rewards quality over volume.Providers, therefore, require real-time cohort visibility, risk scoring, and predictive alerts to avoid costs. Organizations participating in advanced payment arrangements have already shaved USD 28 million from annual spending through timely analytics-driven interventions, underscoring the fiscal upside of cloud scalability. As accountable-care participation widens in Europe, continual performance tracking becomes indispensable for both public and private systems.

Persistent Data Privacy and Cyber Security Threats

Healthcare recorded 677 major breaches affecting 182.4 million people in 2024, including the ransomware incident that compromised 100 million patient records. Average breach costs reached USD 9.77 million, pressuring providers to invest heavily in encryption, zero-trust architecture, and 24/7 monitoring. Many organizations still lack in-house expertise, prolonging procurement cycles and slightly dampening the healthcare cloud-based analytics market momentum.

Other drivers and restraints analyzed in the detailed report include:

- Cost Efficiency and Elasticity of Cloud Infrastructure

- Government Mandates for Healthcare Interoperability Standards

- Legacy Infrastructure and Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Predictive tools accounted for 40.8% of the healthcare cloud-based analytics market in 2024, highlighting provider appetite for foresight into readmissions, sepsis onset, and staffing needs. Solutions ingest longitudinal EHR records, real-time vitals, and socio-economic markers to trigger proactive care pathways that lift quality scores and compress costs. Integrated dashboards alert multidisciplinary teams to high-risk patients, reducing emergency utilization.

Prescriptive engines, though still nascent, are scaling fastest at a 16.1% CAGR through 2030. These platforms simulate "what-if" scenarios across medication regimens or operating-room throughput and recommend optimal interventions. Decision optimization resonates with health systems seeking continuous margin improvement under value-based contracts, positioning prescriptive modules as the next growth frontier.

Clinical analytics captured 45.5% of the 2024 healthcare cloud-based analytics market share because bedside decision support, imaging triage, and drug interactions deliver visible patient benefits. Deep-learning algorithms shorten radiology turnaround times and subtle pathologies, while real-time antimicrobial-stewardship dashboards curb resistance trends.

Population health platforms, expanding at 17.4% CAGR, aggregate claims, pharmacy, and social-needs data to stratify risk and orchestrate community interventions. As capitated payment models proliferate, payers and providers rely on cohort-level metrics to pinpoint gaps in care. Cloud scalability proves vital when crunching thousands of variables across millions of covered lives.

The Healthcare Cloud Based Analytics Market Report is Segmented by Technology Type (Predictive, Prescriptive and More), Application (Clinical Data, Administrative Data, and More), Component (Hardware, and More), Deployment Model (Public, Private, and More), End-User (Healthcare Providers, Payers, and More), and Geography (North America, Europe, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains the leading revenue position, supported by near-universal EHR penetration, generous reimbursement for chronic-care management codes, and aggressive federal pushes for interoperability. Health systems shifting entire analytics workloads to hyperscalers report up to 95% cost savings and accelerated AI pilots that automatically draft progress notes. Cyber incidents remain an ever-present hazard, prompting widespread investment in zero-trust frameworks and influencing vendor selection criteria for the healthcare cloud-based analytics market.

Europe records solid double-digit growth as the European Health Data Space mandates cross-border record portability and research reuse. Country-specific rules, such as Germany's C5 and France's HDS, spur private-cloud or hybrid strategies that assure data residency. Health ministries allocate digital-transformation grants to tame workforce shortages, tightening cooperation between cloud vendors and public agencies. Integrated health regions leverage federated-learning models to run joint cancer-screening algorithms without exporting raw images, satisfying privacy watchdogs while expanding analytic prowess.

Asia Pacific exhibits the fastest trajectory, propelled by China's internet-health boom and Southeast Asia's burgeoning telehealth sector. Government programs in Japan, South Korea, and Singapore subsidize hospital cloud migration and clinical AI pilots to counter aging populations and clinician scarcity. Countries with limited specialist availability deploy remote-read solutions that route imaging studies to off-site radiologists, improving diagnostic reach. Investment momentum from regional technology giants fosters vibrant partnership ecosystems that tailor analytics offerings to local workflows and language nuances.

- Oracle

- Optum

- IBM (Merative)

- Microsoft

- Amazon Web Services

- Google Cloud Platform

- Allscripts (Veradigm)

- SAS Institute

- CitiusTech

- Health Catalyst

- Koninklijke Philips

- HP Enterprise

- Snowflake Inc.

- MedeAnalytics

- Verisk Health

- Mckesson

- Inovalon

- Flatiron Health

- IQVIA Analytics

- Arcadia IO

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Data Explosion From Digital Health Records

- 4.2.2 Transition To Value Based Care Reimbursement

- 4.2.3 Cost Efficiency And Elasticity Of Cloud Infrastructure

- 4.2.4 Government Mandates For Healthcare Interoperability Standards

- 4.2.5 Telehealth Expansion Generating Continuous Patient Data Streams

- 4.2.6 Adoption Of Fhir And Open Api Ecosystems Enabling Cross Provider Analytics

- 4.3 Market Restraints

- 4.3.1 Persistent Data Privacy And Cyber Security Threats

- 4.3.2 Legacy Infrastructure And Integration Complexity

- 4.3.3 Shortage Of Cloud Native Healthcare Data Talent

- 4.3.4 Emerging Data Sovereignty And Carbon Footprint Regulations

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Technology Type

- 5.1.1 Predictive Analytics

- 5.1.2 Prescriptive Analytics

- 5.1.3 Descriptive Analytics

- 5.2 By Application

- 5.2.1 Clinical Analytics

- 5.2.2 Administrative & Financial Analytics

- 5.2.3 Population Health & Research Analytics

- 5.2.4 Real-World Evidence & Pharmacovigilance

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Deployment Model

- 5.4.1 Public Cloud

- 5.4.2 Private Cloud

- 5.4.3 Hybrid Cloud

- 5.5 By End-user

- 5.5.1 Healthcare Providers

- 5.5.2 Payers

- 5.5.3 Life-Science & CROs

- 5.5.4 Public Health Agencies

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Oracle (Cerner)

- 6.3.2 Optum

- 6.3.3 IBM (Merative)

- 6.3.4 Microsoft

- 6.3.5 Amazon Web Services

- 6.3.6 Google Cloud Platform

- 6.3.7 Allscripts (Veradigm)

- 6.3.8 SAS Institute

- 6.3.9 CitiusTech

- 6.3.10 Health Catalyst

- 6.3.11 Philips Healthcare

- 6.3.12 HP Enterprise

- 6.3.13 Snowflake Inc.

- 6.3.14 MedeAnalytics

- 6.3.15 Verisk Health

- 6.3.16 McKesson

- 6.3.17 Inovalon

- 6.3.18 Flatiron Health

- 6.3.19 IQVIA Analytics

- 6.3.20 Arcadia IO

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment