|

市场调查报告书

商品编码

1836506

医用气体和设备:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Medical Gases And Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

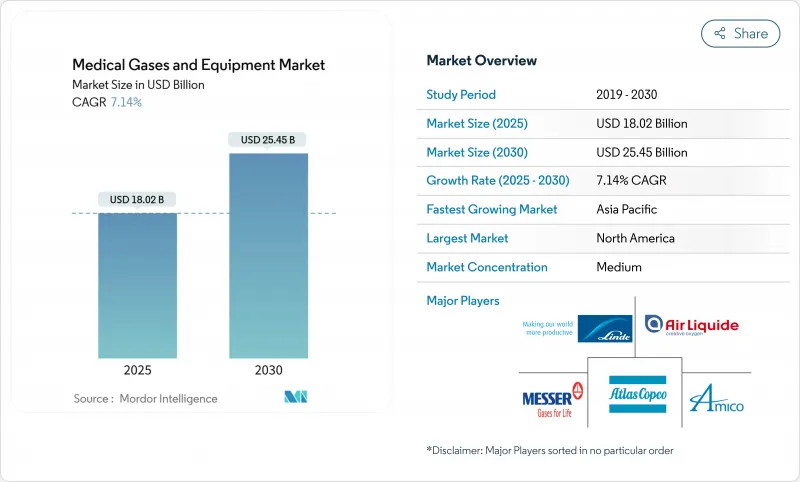

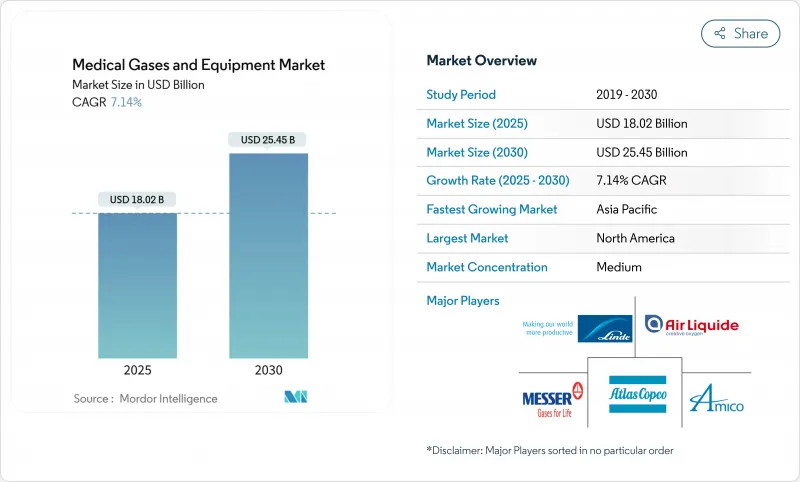

预计 2025 年医用气体和设备市场规模将达到 180.2 亿美元,预计到 2030 年将达到 254.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.14%。

人口老化导致的治疗需求不断增长、新冠疫情后医院基础设施的稳步升级以及携带式浓缩器的快速技术创新,支撑了医用气体和设备市场的持续扩张。政府支持的氧气弹性计划、可穿戴感测器的小型化以及低全球暖化麻醉剂混合物的商业化将进一步促进销量成长,而整合的气体供应商则利用其规模优势,在急性护理环境中获得长期合约。设备製造商仍然分散,为补充性收购提供了空间,以丰富产品系列併提供地理多元化的服务,尤其是在高成长的亚太市场。持续向居家医疗的转变正在扩大对气瓶补充、现场紧凑型发电和人工智慧监控的需求,从而塑造了医用气体和设备市场的竞争格局。

全球医用气体和设备市场趋势和洞察

家庭医疗保健和 POC氧气疗法的需求不断增长

FlexO2 流量选择器等技术在临床部署后,使用户主导的调节功能翻了一番,并将感知活动能力得分提高了 80 分。采用优化沸石床的可携式浓缩器现在可实现 98.68% 的氧准确度,缩小了与固定式系统的性能差距。居家照护领域的复合年增长率为 13.01%,显示这些改进正在满足患者对熟悉环境的偏好。 CMS 的 2025 年支付更新使居家医疗费率提高了 2.5%,进一步支持了分散式照护模式。林德针对睡眠呼吸中止症患者的 AIRGENIOUS 研究降低了持续性正压呼吸器 (CPAP) 不遵从的情况,并引入了对慢性病护理依从性的预测分析。

呼吸系统疾病盛行率不断上升

慢性阻塞性肺病 (COPD) 仍然是氧气使用的主要驱动因素,占三级医院呼吸科病房的 44.5%。典型的床位气体需求平均每年为 350 立方公尺氧气和 325 立方公尺医用空气,与出院量和手术强度成正比。欧洲规划部门已将医用气体系统升级纳入国家呼吸策略,例如奥地利的《2025 年总体规划》。疫情期间氧气消耗激增的分析显示,氧气消费量增加了 20 倍,凸显了供应基础设施永久冗余的必要性。波兰的「健康需求地图」倡议强调了呼吸系统疾病地图如何指南医院层面的气体系统投资。

严格遵守多司法管辖区的 cGMP 和药典

美国食品药物管理局(FDA)的最终规则(将于2025年12月生效)将要求全面遵守现行的医用气体生产控制和标籤通讯协定,迫使供应商投资升级其填充和分析系统。香港将从2026年6月起将医用气体归类为药品,并为经销商引入新的许可等级。同时修订的规则将使基于ISO的器械品管与cGMP的明确规定相协调,促进全球标准的融合,同时增加跨境合规成本。

报告中分析的其他驱动因素和限制因素

- 后疫情时代政府资助的氧气基础建设

- 可携式/可穿戴浓缩器和感测器的小型化

- 长期居家氧气疗法的报销限制

細項分析

到2024年,纯医用气体将占医用气体和设备市场的37.81%,反映出其在医院和家庭环境中的重要治疗应用。预计氧气的复合年增长率将达到8.91%,这得益于居家医疗的日益普及和呼吸系统疾病的流行。医用空气、二氧化碳和氦气/特种气体可满足手术气腹、诊断和核磁共振成像的需求,但氦气供应波动正在推高价格,并对医院预算造成压力。继加州大学旧金山分校成功将氧化亚氮消耗量减少80-90%后,医疗机构正在转向使用便携式气瓶,并取消管道以减少废弃物。

互补医用气体设备涵盖压缩机、气缸和管路监控系统等多种领域。阿特拉斯·科普柯于2023年收购Medi-teknique,标誌着一项旨在拓展服务范围并持续创造维护收入的整合。 BeaconMedaes的全球经销商网路利用多模光纤环网实现即时警报功能,并将真空和歧管系统融入新建医院。对永续性的日益关注正推动医院采用低全球暖化潜势(GWP)的麻醉剂混合物。欧洲监管机构已认可SEVOFLURANE的全球暖化潜势值远低于地DESFLURANE,促使供应商重新设计挥发性气体的回收和清除系统。

到2024年,封装式氧气瓶的市场份额将保持45.79%,而随着患者寻求更便捷的出行方式,以及医疗保健机构优先考虑经济高效的慢性病护理模式,携带式氧气浓缩器预计将以每年9.81%的速度增长。德克萨斯农工大学的计算设计表明,动态沸石结构可以在不牺牲纯度的情况下减轻重量,并可调节氧气流量以满足不断变化的患者需求。同时,林德在2024年获得了59份小型现场氧气发电厂订单,这反映出医院对自主供氧供给能力的兴趣,以应对供应中断的风险。

现场批量生产持续吸引寻求可预测单位成本的大型三级医院,而批量液体供应则为需要超高纯度的专科中心提供支援。对气瓶备用的持续偏好确保了所有医疗模式的稳定需求,从而丰富了医用气体和设备市场的收益结构。

区域分析

受成熟的支付系统、严格的FDA监管以及可携式製氧机的广泛应用的推动,北美地区将占2024年销售额的35.87%。医院透过现场大容量储氧罐维持氧气的冗余生产,随着CMS(医疗保险和居家医疗设备的采用率也持续成长。区域设备供应商受益于清晰的监管路径,该路径鼓励创新,且没有模糊的市场进入规则。

亚太地区13.51%的复合年增长率在所有地区中最高,这得益于大规模医院扩建、人口老化以及政府对医疗基础设施的大力投入。印度计画新增17,800张病床,并制定了500亿美元的医疗设备蓝图,支撑了管道系统和气瓶需求的激增。中国自2024年起推出的支持性采购政策预计将在2025年释放医疗设备支出,巩固其作为该地区最大成长引擎的地位。林德和梅塞尔在印度和东南亚的空分装置扩建项目,彰显了供应商致力于维护区域供应稳定的决心。

欧洲仍然是一个关键市场,受严格的环境法规推动,这些法规正在加速低全球暖化潜势麻醉剂的采用。英国国家医疗服务体系(NHS)逐步淘汰地DESFLURANE,对整个欧洲大陆的医疗机构产生了连锁反应,迫使供应商调整配方,医院升级復苏系统。液化空气集团在法国、德国和巴西签订的低碳氧气供应合同,凸显了范围三排放在公立医院采购标准中日益重要的地位。

中东/非洲和南美洲是潜力巨大但仍处于萌芽阶段的市场。对三级医疗机构的投资以及药典标准的逐步统一将释放更多机会,但经济波动和报销机制的碎片化可能会在短期内阻碍其规模化发展。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 家庭医疗保健和 POC氧气疗法的需求不断增长

- 呼吸系统疾病增加

- 后疫情时代政府资助的氧气基础设施

- 可携式/可穿戴浓缩器和感测器的小型化

- 环保、低全球升温潜势麻醉气体混合物的商业化

- 人工智慧驱动的天然气管道预测监控和库存管理

- 市场限制

- 严格遵守多司法管辖区的 cGMP 和药典

- 长期居家氧气疗法的报销限制

- 散装气体处理中的职业安全责任和保险费用。

- 氦气供应的不确定性推高了特种气体成本

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测(单位:美元)

- 按产品

- 医用气体

- 纯医用气体

- 氧

- 氧化亚氮

- 医用空气

- 二氧化碳

- 氦气和特种气体

- 医用气体混合物

- 生物空气

- 医用气体设备

- 压缩机

- 圆柱

- 软管组件和阀门

- 面罩和插管

- 真空和抽吸系统

- 歧管和管路系统

- 警报和监控系统

- 医用气体

- 按方式

- 现场批量发电

- 封装圆筒

- 液体/散装运输

- 可携式浓缩器

- 按用途

- 治疗

- 诊断与影像诊断

- 药品製造和研究

- 果冻和冷冻疗法

- 家庭医疗保健

- 按最终用户

- 医院

- 门诊手术中心

- 居家医疗

- 学术和研究机构

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第六章 竞争态势

- 市场集中度

- 市占率分析

- 公司简介

- Linde plc

- Air Liquide

- Air Products & Chemicals

- Messer Group

- Taiyo Nippon Sanso

- Atlas Copco

- BeaconMedaes

- Amico Group

- Matheson Tri-Gas

- GCE Group

- NOVAIR

- Luxfer Gas Cylinders

- Getinge AB

- Dragerwerk AG

- INOX Air Products

- South African Oxygen(Afrox)

- Gulf Cryo

- Coregas Pty

- SOL Group

- Air Water Inc.

- Invacare Corporation

第七章 市场机会与未来展望

The Medical Gases And Equipment Market size is estimated at USD 18.02 billion in 2025, and is expected to reach USD 25.45 billion by 2030, at a CAGR of 7.14% during the forecast period (2025-2030).

Rising therapeutic demand from aging populations, steady hospital infrastructure upgrades after COVID-19, and rapid innovation in portable concentrators underpin sustained expansion of the medical gases and equipment market. Government-supported oxygen resilience projects, miniaturization of wearable sensors, and the commercialization of low-GWP anesthetic blends further reinforce volume growth, while consolidated gas suppliers leverage scale to secure long-term contracts across acute-care settings. Equipment makers remain fragmented, creating space for bolt-on acquisitions that deepen product portfolios and geographically diversified service footprints, especially in high-growth Asia-Pacific markets. The continued shift toward home-based care amplifies cylinder refilling, small on-site generation, and AI-enabled monitoring demand, collectively shaping the competitive contours of the medical gases and equipment market.

Global Medical Gases And Equipment Market Trends and Insights

Rising Demand for Home Healthcare & POC Oxygen Therapy

Medicare's 36-month rental framework underpins predictable reimbursement, encouraging supplier investment in portable devices and reinforcing patient acceptance of at-home oxygen therapy.Technology such as FlexO2 flow selectors has doubled user-initiated adjustments, raising perceived activity capacity scores by 80 points after clinical deployment.Portable concentrators that use optimized zeolite beds now deliver 98.68% oxygen accuracy, narrowing the performance gap with stationary systems. A 13.01% CAGR in the home-care segment illustrates how these improvements align with patient preference for familiar environments. CMS's 2025 payment update, lifting home health rates by 2.5% adds further momentum to decentralized care models. Linde's AIRGENIOUS pilot among sleep-apnea users cut CPAP non-compliance, showcasing predictive analytics for chronic-care adherence.

Growing Prevalence of Respiratory Diseases

COPD remains the chief driver of oxygen admissions, representing 44.5% of respiratory ward volume in tertiary hospitals. Typical bed-based gas demand averages 350 m3 oxygen and 325 m3 medical air each year, scaling directly with discharge volumes and surgical intensity. European planners have already embedded medical gas system upgrades into national respiratory strategies, as shown in the Austrian Masterplan 2025. Analysis of pandemic surges revealed oxygen consumption rising up to 20-fold, anchoring the need for permanent redundancy in supply infrastructure. Poland's Maps of Health Needs initiative highlights how respiratory disease mapping guides investment in gas systems at hospital level.

Stringent Multi-Jurisdictional cGMP & Pharmacopeia Compliance

The FDA's final rule, effective December 2025, mandates full current good manufacturing practice and labeling protocols for medical gases, compelling suppliers to invest in upgraded filling and analytical systems. Hong Kong will classify medical gases as pharmaceutical products from June 2026, introducing a new licensing layer for distributors. Parallel amendments harmonize ISO-based device quality management with cGMP clarifications, raising cross-border compliance costs yet fostering global standard convergence.

Other drivers and restraints analyzed in the detailed report include:

- Government-Funded Oxygen Infrastructure Build-Outs Post-COVID

- Miniaturization of Portable/Wearable Concentrators & Sensors

- Limited Reimbursement for Long-Term Home Oxygen Therapy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pure Medical Gases captured 37.81% of the medical gases and equipment market in 2024, reflecting indispensable therapeutic use across hospitals and home settings. Oxygen is projected to record an 8.91% CAGR, aided by expanding home-care adoption and respiratory disease prevalence. Medical Air, Carbon Dioxide, and Helium & Specialty Gases serve surgical insufflation, diagnostics, and MRI needs, though helium supply volatility has driven price escalations that strain hospital budgets. Nitrous Oxide consumption is shifting toward portable cylinders as institutions remove piped lines to curb waste, following UCSF's 80-90% reduction success.

Complementary medical gas equipment ranges from compressors and cylinders to pipeline monitoring systems. Atlas Copco's 2023 Medi-teknique acquisition illustrates consolidation aimed at service breadth and recurring maintenance revenue. BeaconMedaes' global distributor network embeds vacuum and manifold systems within new hospital builds, leveraging multi-mode optical fiber ring networks for real-time alarm capabilities. A rising focus on sustainability is prompting hospitals to adopt low-GWP anesthetic blends. European regulators endorse sevoflurane over desflurane because of its far lower global-warming potential, nudging suppliers to re-engineer recovery and scavenging systems for volatile agents.

Packaged Cylinders retained a 45.79% share in 2024, yet Portable Concentrators are forecast to grow 9.81% annually as patients demand mobility and healthcare providers emphasize cost-effective chronic-care models. Computational design by Texas A&M shows that dynamic zeolite configurations can tailor oxygen flow to fluctuating patient needs, reducing weight without cutting purity. Meanwhile, Linde recorded 59 small on-site plant wins in 2024, reflecting hospital interest in self-reliant oxygen capacity to hedge against supply disruptions.

Bulk on-site generation continues to attract large tertiary hospitals seeking predictable unit costs, whereas liquid bulk delivery supports specialty centers with ultra-high purity requirements. The continued preference for cylinder backup ensures steady demand across every modality, cementing a diversified revenue mix within the medical gases and equipment market.

The Medical Gases and Equipment Market Report is Segmented by Product (Medical Gases [Pure Medical Gases, and More], and Medical Gas Equipment [Compressors, and More]), Modality (Bulk On-Site Generation, and More), Application (Therapeutic, and More), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 35.87% of 2024 revenue, anchored by mature payer systems, strict FDA oversight, and widespread adoption of portable concentrators. Hospitals maintain redundant oxygen generation backed by on-site bulk tanks, while home-care penetration continues to rise as CMS refines reimbursement. Regional equipment vendors benefit from clear regulatory pathways that reward innovation without ambiguous market access rules.

Asia-Pacific is projected to grow at 13.51% CAGR, the highest among all regions, driven by large-scale hospital expansion, aging populations, and proactive government funding for medical infrastructure. India's planned capacity additions of 17,800 beds alongside a USD 50 billion medical device roadmap illustrate the underlying demand surge for pipeline systems and cylinders. China's supportive procurement policies post-2024 are expected to unlock medical device spending in 2025, reinforcing the region's status as the foremost growth engine. Air separation unit expansions by Linde and Messer across India and Southeast Asia signal supplier commitment to sustaining regional supply security.

Europe remains a major market, propelled by stringent environmental mandates that accelerate low-GWP anesthesia adoption. The NHS elimination of desflurane has cascaded across continental practice, compelling suppliers to reformulate and hospitals to upgrade recovery systems. Air Liquide's low-carbon oxygen supply contracts in France, Germany, and Brazil showcase the rising importance of Scope 3 emissions in public hospital procurement criteria.

Middle East & Africa and South America collectively represent high-potential but early-stage markets. Investments in tertiary care facilities and the gradual harmonization of pharmacopeia standards will unlock incremental opportunities, although economic volatility and reimbursement fragmentation temper near-term scale.

- Linde plc

- Air Liquide

- Air Products & Chemicals

- Messer Group

- Taiyo Nippon Sanso

- Atlas Copco

- Beckton Dickinson

- Amico Group

- Matheson Tri-Gas

- GCE Group

- NOVAIR

- Luxfer Gas Cylinders

- Getinge

- Dragerwerk AG

- INOX Air Products

- South African Oxygen (Afrox)

- Gulf Cryo

- Coregas Pty

- SOL Group

- Air Water Inc.

- Invacare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Home Healthcare & POC Oxygen Therapy

- 4.2.2 Growing Prevalence of Respiratory Diseases

- 4.2.3 Government-Funded Oxygen Infrastructure Build-Outs Post-COVID

- 4.2.4 Miniaturization of Portable/ Wearable Concentrators & Sensors

- 4.2.5 Commercialization of Eco-Friendly Low-GWP Anaesthesia Gas Blends

- 4.2.6 AI-Enabled Predictive Gas-Pipeline Monitoring & Inventory Control

- 4.3 Market Restraints

- 4.3.1 Stringent Multi-Jurisdictional cGMP & Pharmacopeia Compliance

- 4.3.2 Limited Reimbursement for Long-Term Home Oxygen Therapy

- 4.3.3 Workplace-Safety Liability & Insurance Costs for Bulk-Gas Handling

- 4.3.4 Helium Supply Volatility Driving Up Specialty-Gas Costs

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Medical Gases

- 5.1.1.1 Pure Medical Gases

- 5.1.1.1.1 Oxygen

- 5.1.1.1.2 Nitrous Oxide

- 5.1.1.1.3 Medical Air

- 5.1.1.1.4 Carbon Dioxide

- 5.1.1.1.5 Helium & Specialty Gases

- 5.1.1.2 Medical Gas Mixtures

- 5.1.1.3 Biological Atmosphere

- 5.1.2 Medical Gas Equipment

- 5.1.2.1 Compressors

- 5.1.2.2 Cylinders

- 5.1.2.3 Hose Assemblies & Valves

- 5.1.2.4 Masks & Cannulas

- 5.1.2.5 Vacuum & Suction Systems

- 5.1.2.6 Manifold & Pipeline Systems

- 5.1.2.7 Alarm & Monitoring Systems

- 5.1.1 Medical Gases

- 5.2 By Modality

- 5.2.1 Bulk On-site Generation

- 5.2.2 Packaged Cylinders

- 5.2.3 Liquid/Bulk Delivery

- 5.2.4 Portable Concentrators

- 5.3 By Application

- 5.3.1 Therapeutic

- 5.3.2 Diagnostic & Imaging

- 5.3.3 Pharmaceutical Manufacturing & Research

- 5.3.4 Cryosurgery & Cryotherapy

- 5.3.5 Home Healthcare

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Home Care Settings

- 5.4.4 Academic & Research Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Linde plc

- 6.3.2 Air Liquide

- 6.3.3 Air Products & Chemicals

- 6.3.4 Messer Group

- 6.3.5 Taiyo Nippon Sanso

- 6.3.6 Atlas Copco

- 6.3.7 BeaconMedaes

- 6.3.8 Amico Group

- 6.3.9 Matheson Tri-Gas

- 6.3.10 GCE Group

- 6.3.11 NOVAIR

- 6.3.12 Luxfer Gas Cylinders

- 6.3.13 Getinge AB

- 6.3.14 Dragerwerk AG

- 6.3.15 INOX Air Products

- 6.3.16 South African Oxygen (Afrox)

- 6.3.17 Gulf Cryo

- 6.3.18 Coregas Pty

- 6.3.19 SOL Group

- 6.3.20 Air Water Inc.

- 6.3.21 Invacare Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment