|

市场调查报告书

商品编码

1851735

球阀:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Ball Valve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

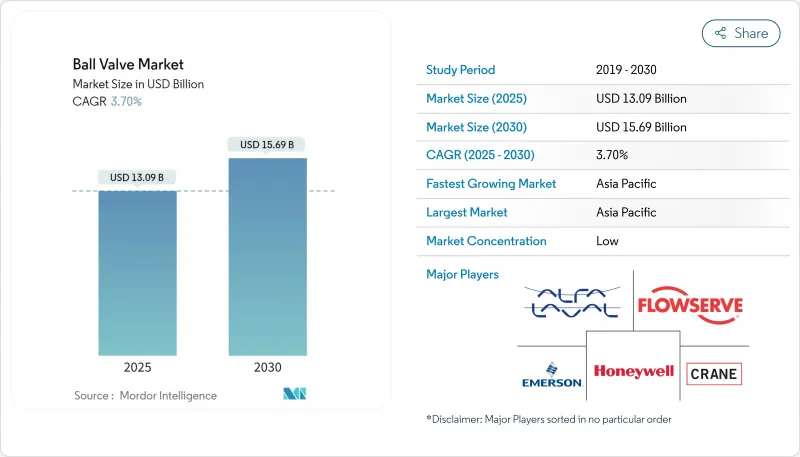

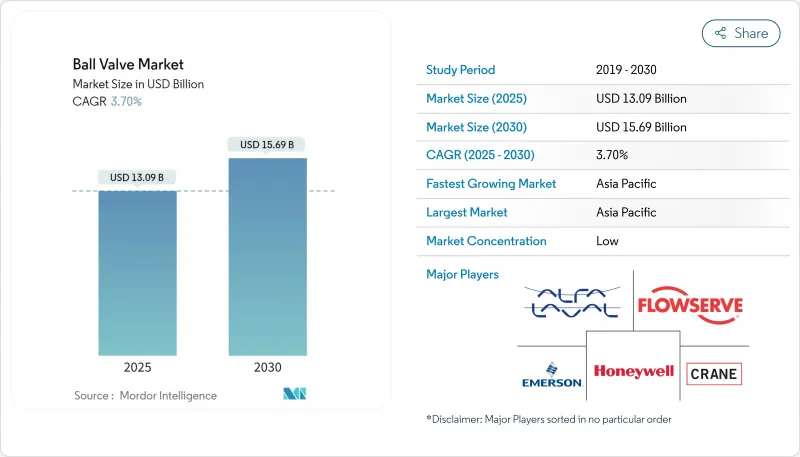

预计到 2025 年,球阀市场规模将达到 130.9 亿美元,到 2030 年将达到 156.9 亿美元,年复合成长率为 3.7%。

这项展望证实了需求驱动的稳定扩张,反映的是全球基础设施升级的步伐,而非经济繁荣週期所带来的成长。液化天然气(LNG)在亚洲的广泛应用、碳氢化合物经济体减少排放气体的监管压力以及水务部门数位化,都是推动阀门长期需求成长的关键因素。计划业主优先考虑零件的完整性、安全合规性和低生命週期排放,因此更倾向于选择高端球阀而非低成本替代品。同时,特种锻件的供应链瓶颈和不銹钢价格的波动限制了中型加工商(尤其是在亚洲)的近期利润率。

全球球阀市场趋势与洞察

新兴亚太国家液化天然气基础设施扩张加速

亚洲各国政府将液化天然气(LNG)视为加强能源安全和减少对煤炭依赖的直接解决方案。预计到2025年,全球LNG出口能力将成长18%,主要出口至亚洲进口终端,这将推动对-162 ℃低温球阀的需求。这些装置必须确保在液化、运输和再气化过程中甲烷的密封性,因此,拥有深厚冶金专业知识和可靠低温测试记录的供应商更具优势。像越南和菲律宾这样依赖进口、缺乏管道网路的市场,正在部署浮体式储存再气化装置(FSRG),这些装置要求使用高阶耳轴式低温球阀。这项需求推高了平均售价,保护了主要供应商免受替代风险的影响,并增强了球阀市场的利润成长。

严苛工况球阀在欧洲的氢能和碳捕集与封存(CCS)计划中得到越来越广泛的应用。

欧盟计画在2030年生产1000万吨可再生氢,这就要求管道和储氢网路能够承受超过700巴的压力,同时避免氢致裂纹的产生。为了满足这些机械性能要求,并应对碳捕获与储存(CCS)管线中超临界二氧化碳的腐蚀挑战,双相不銹钢和超级双相不銹钢正逐步进入主流生产领域。由于工厂业主在签订合约前要求提供可靠的安全证明文件,因此,那些能够根据不断发展的氢能标准对其材料进行认证的製造商将获得先发优势。这一趋势巩固了欧洲作为技术试验场的地位,并扩大了高端球阀市场的份额。

由于全球锻造能力受限,前置作业时间延长。

十年的供应商整合使得目前仅剩少数几家能够生产大直径镍合金坯料的开式模锻厂。航太和能源产业的同步需求加剧了产能紧张,导致交货週期从传统的12-16週延长至24-32週。计划业主现在要么增加缓衝库存,要么在进度风险超过技术优势时接受替代阀门类型。一些原始设备製造商(OEM)正在寻求垂直整合,但资金需求和资格确认时间限制使得缓解措施的实施要等到本世纪下半叶才能实现。

细分市场分析

预计到2024年,浮动球阀市场规模将达到27%的年均收入成长率。低温球阀虽然市场定位小众,但由于LNG接收站和氢气出口枢纽对低至-162 ℃的密封性能有较高要求,预计其复合年增长率将达到6.4%。终端用户重视经氦质谱测试检验的零洩漏阀座和防爆阀桿。

目前已在海底试验中得到现场验证,增材製造的流道相比全焊接阀体可减轻重量并降低压力损失;而轨道阀和升降桿阀可在节流操作下保持阀座寿命,避免传统浮动阀在此类操作中受损。这些市场发展丰富了产品系列併拓展了功能范围,使球阀在寻求蝶阀和旋塞阀替代方案的市场中保持竞争力。

碳钢因其优异的强度成本比,在管道和工业设施领域具有优势,预计2024年将占球阀市场规模的32%。氢气计划目前更倾向使用抗脆性的超双相不銹钢和奥氏体不銹钢阀体,推动合金需求以5.2%的复合年增长率成长。此外,双相不銹钢还具有更高的耐压等级,有助于管道工程师缩短工期并降低资本支出。

不銹钢价格的波动促使原始设备製造商 (OEM) 寻求符合 304L 和 316L 双认证标准的钢材,从而提高采购弹性。积层製造技术正在引入功能梯度材料,其中高镍基体增强了座椅区域,而碳钢则主导了外壳,从而优化了总成本。

区域分析

到2024年,亚洲将占球阀市场收入的31%,这主要得益于中国工业的成长和东南亚液化天然气进口终端的建设。各国政府所推行的清洁能源政策支持阀门的永续采购。印度的「印度製造」计画促进了阀门的国内生产,但氢能试点计画仍依赖进口重型阀门配件。日本和韩国优先发展用于特定化学製程的高性能合金,从而在区域贸易中保持技术优势。

中东是成长最快的丛集,预计到2030年将以5.1%的复合年增长率成长,这主要得益于营运商对现有气田进行低排放阀门维修,以及新建待开发区天然气巨型生产线。光是卡达北部气田的扩建就需要数千台低温阀门装置,而沙乌地阿美公司正在其天然气收集网路中部署智慧致动器,以满足甲烷排放强度目标。土耳其的天然气过境运输雄心也带动了对大口径管道阀门的订单。

北美地区由于中游环节的更换义务,占据了相当大的市场份额。页岩气集输系统需要耐酸性气体的高压球阀。加拿大油砂管路需要硬质阀座以承受沥青的磨损。随着墨西哥能源市场的开放,其出口级管道进口了符合API 6D认证标准的阀门。气候法规推动了ISO-15848-1认证产品的应用,并增加了有利于现有品牌的额外要求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加速亚太新兴国家液化天然气基础设施的扩张

- 严苛工况球阀在欧洲氢能和碳捕集与封存计划中得到更广泛的应用

- 北美中游资产现代化改造指令推动了替换需求

- 斯堪的纳维亚水务公司的快速数位化推动了智慧球阀的维修。

- FPSO部署激增推动巴西和西非地区低温球阀的应用

- 中东地区加强对低排放(「无甲烷逸散」)阀门的监管

- 市场限制

- 由于全球锻造能力受限,前置作业时间延长。

- 在高度磨蚀性的采矿应用中,金属座阀需要高额的资本投入。

- 在紧凑型暖通空调系统中,塞阀和蝶阀越来越偏好。

- 不銹钢价格波动侵蚀了亚洲二级製造商的利润空间

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资与资金筹措分析

第五章 市场规模与成长预测

- 按阀门类型

- 浮动球阀

- 耳轴式球阀

- 升桿/轨道球阀

- 顶部进入式球阀

- 全焊接球阀

- 低温球阀

- 材料

- 碳钢

- 防锈的

- 铸铁/球墨铸铁

- 合金基体(双相钢、因科镍合金、哈氏合金)

- 青铜和黄铜

- 其他材料

- 按阀门尺寸

- 最大 1 英吋(DN 25)

- 1"-6"

- 6 "-25"

- 25"-50"

- 50吋或以上

- 透过驱动

- 手动的

- 电

- 气动

- 油压

- 电液

- 按最终用户行业划分

- 石油和天然气

- 化工/石油化工

- 用水和污水

- 发电业务

- 采矿和金属

- 饮食

- 製药和生物技术

- 暖通空调和製冷

- 纸浆和造纸

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Emerson Electric Co.

- Flowserve Corporation

- Schlumberger(Cameron)

- IMI plc

- Kitz Corporation

- Crane Co.

- Baker Hughes(Valves and Process Solutions)

- Honeywell International Inc.

- Alfa Laval AB

- Curtiss-Wright Corporation

- SAMSON AG

- Velan Inc.

- CIRCOR International Inc.

- AVK Holding

- Mueller Water Products Inc.

- Neway Valve Co., Ltd.

- Bonney Forge Corp.

- Metso Corporation(Valmet)

- Hitachi Ltd.

- Valvitalia SpA

- Georg Fischer Ltd.

- Danfoss A/S

- Castel SRL

- Sanhua Holding Group

第七章 市场机会与未来展望

The Ball valve market reached USD 13.09 billion in 2025 and is forecast to advance at a 3.7% CAGR, lifting revenue to USD 15.69 billion by 2030.

The outlook confirms a steady, demand-backed expansion that mirrors the pace of global infrastructure upgrades rather than boom-cycle growth. Widespread liquefied natural gas (LNG) build-outs in Asia, regulatory pressure to cut fugitive emissions in hydrocarbon economies, and accelerated digitalization of water utilities are the principal forces reinforcing long-term valve demand. Project owners are prioritizing component integrity, safety compliance, and low lifetime emissions, which amplifies preference for premium ball valves over lower-cost substitutes. At the same time, supply-chain bottlenecks in specialty forgings and volatile stainless-steel prices are tempering near-term profit margins, especially for mid-tier Asian fabricators.

Global Ball Valve Market Trends and Insights

Accelerated LNG Infrastructure Expansion in Emerging Asia Pacific

Asian governments view LNG as an immediate route to strengthen energy security and cut coal reliance. An 18% rise in global LNG export capacity in 2025, mainly aimed at Asian import terminals, magnifies demand for cryogenic ball valves rated to -162 °C. These units must guarantee methane-tight sealing throughout liquefaction, transport, and regasification duty, which favors vendors with deep metallurgical expertise and validated low-temperature testing records. Import-dependent markets such as Vietnam and the Philippines, lacking pipeline grids, are rolling out floating storage and regasification units that specify premium trunnion-mounted cryogenic valves. This requirement lifts average selling prices and insulates leading suppliers from substitution risk, reinforcing profitable growth for the Ball valve market.

Rising Adoption of Severe-Service Ball Valves in Hydrogen & CCS Projects across Europe

The EU's plan to generate 10 million t of renewable hydrogen by 2030 requires pipelines and storage networks that can withstand pressures above 700 bar while avoiding hydrogen-induced cracking. Duplex and super-duplex alloys are moving into mainstream production to meet these mechanical demands and the corrosion challenges of supercritical CO2 in carbon capture and storage (CCS) lines. Manufacturers that certify materials under evolving hydrogen standards enjoy a first-mover advantage, because plant owners seek proven safety documentation before awarding contracts. This trend cements Europe's role as a technology test bed and enlarges the premium tier of the Ball valve market.

Prolonged Lead-Times due to Global Forging Capacity Constraints

A decade of supplier consolidation has left only a handful of open-die forges capable of producing large-diameter, nickel-alloy blanks. Simultaneous demand from aerospace and energy increases capacity strain, with delivery cycles stretching to 24-32 weeks versus the historical 12-16 week window. Project owners now embed buffer inventories or accept alternate valve styles if schedule risk outweighs technical benefit. Some OEMs pursue vertical integration, but capital needs and qualification timelines delay relief until late decade.

Other drivers and restraints analyzed in the detailed report include:

- North American Mid-stream Asset Modernization Mandates Driving Replacement Demand

- Rapid Digitalization of Water Utilities Spurs Smart Ball Valve Retrofit in Nordics

- High Capital Outlay for Metal-Seated Valves in Abrasive Mining Applications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Ball valve market size for floating designs logged 27% revenue in 2024, driven by their adaptability across refinery, water, and general-purpose services. Cryogenic ball valves, though niche, are rising at a 6.4% CAGR as LNG terminals and hydrogen export hubs demand guaranteed sealing down to -162 °C. End users emphasize zero-leakage seats and blow-out-proof stems validated by helium mass-spectrometer testing, a standard that raises entry barriers and sustains premium price realization.

Additive-manufactured flow paths, now field-proven in subsea pilots, reduce weight and pressure drop in fully welded bodies. Meanwhile, orbit and rising-stem variants preserve seat life where throttling duty would damage conventional floating valves. Together, these developments diversify product portfolios and extend the functional scope, preserving relevance of ball valves even in markets exploring butterfly or plug alternatives.

Carbon steel held 32% share of the Ball valve market size in 2024 thanks to its favorable strength-to-cost ratio across pipelines and industrial utilities. Hydrogen projects now favor alloy-based bodies with super-duplex or austenitic grades to resist embrittlement, raising alloy demand at a 5.2% CAGR. Duplex grades also unlock higher allowable pressure ratings, enabling pipeline engineers to downsize schedules and shave capex.

Stainless-steel price volatility pushes OEMs to qualify dual-certified grades that meet both 304L and 316L requirements, streamlining procurement flexibility. Additive manufacturing introduces functionally graded materials where high-nickel matrices reinforce seat zones, while carbon-steel dominates outer shells, optimizing total cost.

The Ball Valve Market Report is Segmented by Valve Type (Floating, Trunnion-Mounted, Rising-Stem, Top-Entry, Fully-Welded, Cryogenic), Material (Carbon Steel, Stainless Steel, Cast Iron, and More), Valve Size (Up To 1", 1"-6", 6"-25", and More), Actuation (Manual, Electric, Pneumatic, and More), End-User (Oil & Gas, Chemicals, Water, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia accounted for 31% of Ball valve market revenue in 2024, propelled by Chinese industrial growth and Southeast Asian LNG import terminals. Government policies that mandate cleaner energy mix underpin sustained valve procurement. India's "Make in India" scheme fosters domestic valve production yet still relies on imported severe-service trims for hydrogen pilots. Japan and South Korea prioritize high-performance alloys for niche chemical processes, maintaining a technology premium in regional trade.

The Middle East is the fastest-growing cluster, projecting 5.1% CAGR to 2030 as operators retrofit low-emission valves in legacy fields and build green-field LNG mega-trains. Qatar's North Field expansion alone calls for thousands of cryogenic units, while Saudi Aramco deploys smart actuators across gas gathering networks to satisfy methane-intensity goals. Turkey's transit ambitions also translate into large-bore pipeline valve orders.

North America retains sizable share owing to mid-stream replacement mandates. Shale-gas gathering systems need high-pressure ball valves resistant to acid gases. Canadian oil sands lines demand hard-faced seats to manage bitumen abrasion. Mexico, opening its energy market, imports API 6D-certified valves for export-class pipelines. Climate regulation stimulates adoption of ISO-15848-1 certified products, adding incremental requirements that favor established brands.

- Emerson Electric Co.

- Flowserve Corporation

- Schlumberger (Cameron)

- IMI plc

- Kitz Corporation

- Crane Co.

- Baker Hughes (Valves and Process Solutions)

- Honeywell International Inc.

- Alfa Laval AB

- Curtiss-Wright Corporation

- SAMSON AG

- Velan Inc.

- CIRCOR International Inc.

- AVK Holding

- Mueller Water Products Inc.

- Neway Valve Co., Ltd.

- Bonney Forge Corp.

- Metso Corporation (Valmet)

- Hitachi Ltd.

- Valvitalia S.p.A.

- Georg Fischer Ltd.

- Danfoss A/S

- Castel SRL

- Sanhua Holding Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated LNG Infrastructure Expansion in Emerging Asia Pacific

- 4.2.2 Rising Adoption of Severe-Service Ball Valves in Hydrogen and CCS Projects across Europe

- 4.2.3 North American Mid-stream Asset Modernization Mandates Driving Replacement Demand

- 4.2.4 Rapid Digitalization of Water Utilities Spurs Smart Ball Valve Retrofit in Nordics

- 4.2.5 Surge in FPSO Deployments Boosting Cryogenic Ball Valve Uptake in Brazil and West Africa

- 4.2.6 Regulatory Push for Low-Emission ("Fugitive-Methane-Free") Valves in the Middle East

- 4.3 Market Restraints

- 4.3.1 Prolonged Lead-Times due to Global Forging Capacity Constraints

- 4.3.2 High Capital Outlay for Metal-Seated Valves in Abrasive Mining Applications

- 4.3.3 Increasing Preference for Plug and Butterfly Valves in Compact HVAC Systems

- 4.3.4 Volatile Stainless-Steel Prices Eroding Margins for Tier-2 Asian Manufacturers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Valve Type

- 5.1.1 Floating Ball Valves

- 5.1.2 Trunnion-Mounted Ball Valves

- 5.1.3 Rising-Stem / Orbit Ball Valves

- 5.1.4 Top-Entry Ball Valves

- 5.1.5 Fully-Welded Ball Valves

- 5.1.6 Cryogenic Ball Valves

- 5.2 By Material

- 5.2.1 Carbon Steel

- 5.2.2 Stainless Steel

- 5.2.3 Cast Iron / Ductile Iron

- 5.2.4 Alloy-Based (Duplex, Inconel, Hastelloy)

- 5.2.5 Bronze and Brass

- 5.2.6 Other Materials

- 5.3 By Valve Size

- 5.3.1 Up to 1" (DN 25)

- 5.3.2 1" - 6"

- 5.3.3 6 " - 25"

- 5.3.4 25" - 50"

- 5.3.5 Above 50"

- 5.4 By Actuation

- 5.4.1 Manual

- 5.4.2 Electric

- 5.4.3 Pneumatic

- 5.4.4 Hydraulic

- 5.4.5 Electro-Hydraulic

- 5.5 By End-User Industry

- 5.5.1 Oil and Gas

- 5.5.2 Chemicals and Petrochemicals

- 5.5.3 Water and Wastewater

- 5.5.4 Power Generation

- 5.5.5 Mining and Metals

- 5.5.6 Food and Beverage

- 5.5.7 Pharmaceuticals and Biotechnology

- 5.5.8 HVAC and Refrigeration

- 5.5.9 Pulp and Paper

- 5.5.10 Other Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 Israel

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 United Arab Emirates

- 5.6.4.4 Turkey

- 5.6.4.5 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Egypt

- 5.6.5.3 Rest of Africa

- 5.6.6 South America

- 5.6.6.1 Brazil

- 5.6.6.2 Argentina

- 5.6.6.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Emerson Electric Co.

- 6.4.2 Flowserve Corporation

- 6.4.3 Schlumberger (Cameron)

- 6.4.4 IMI plc

- 6.4.5 Kitz Corporation

- 6.4.6 Crane Co.

- 6.4.7 Baker Hughes (Valves and Process Solutions)

- 6.4.8 Honeywell International Inc.

- 6.4.9 Alfa Laval AB

- 6.4.10 Curtiss-Wright Corporation

- 6.4.11 SAMSON AG

- 6.4.12 Velan Inc.

- 6.4.13 CIRCOR International Inc.

- 6.4.14 AVK Holding

- 6.4.15 Mueller Water Products Inc.

- 6.4.16 Neway Valve Co., Ltd.

- 6.4.17 Bonney Forge Corp.

- 6.4.18 Metso Corporation (Valmet)

- 6.4.19 Hitachi Ltd.

- 6.4.20 Valvitalia S.p.A.

- 6.4.21 Georg Fischer Ltd.

- 6.4.22 Danfoss A/S

- 6.4.23 Castel SRL

- 6.4.24 Sanhua Holding Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment