|

市场调查报告书

商品编码

1836521

欧洲汽车空气滤清器:市场份额分析、产业趋势、统计数据和成长预测(2025-2030 年)Europe Automotive Airfilters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

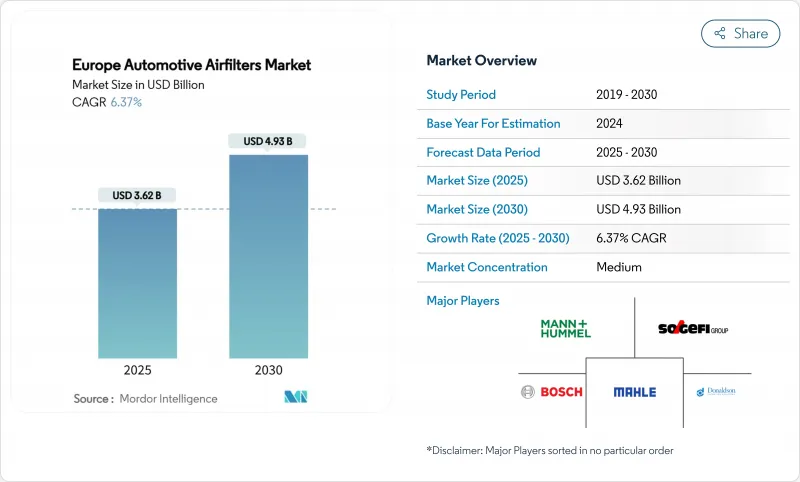

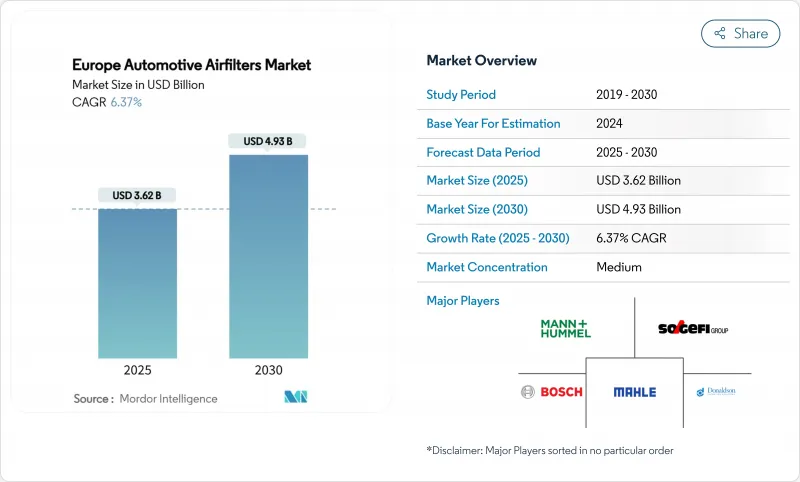

预计 2025 年欧洲汽车空气滤清器市场规模为 36.2 亿美元,到 2030 年将达到 49.3 亿美元,预测期间(2025-2030 年)的复合年增长率为 6.37%。

围绕着欧7的强劲监管势头、城市低排放气体区的快速扩张以及消费者持续的健康意识,都在推动这一成长。目标商标产品製造商 (OEM) 正在重新设计进气和座舱滤清器,以满足奈米级颗粒物法规的要求,而独立的售后市场参与者则正在利用欧洲大陆约2.8亿辆老旧车辆。因此,欧洲汽车空气滤清器市场正从商品量转向加值性能,将过滤为下一代出行中合规性关键、消费者可见且支援遥测的组件。

欧洲汽车空气滤清器市场趋势与洞察

汽车市场老化加剧了对独立售后市场的需求

到2025年,西欧的平均车龄将达到12年,车龄年资为15至20年。旧式内燃机 (ICE) 车型需要频繁更换进气滤清器和座舱滤清器,而独立维修店凭藉极具竞争力的价格和广泛的库存单位 (SKU) 覆盖范围,已在当地售后市场占据了相当大的份额。即使纯电动车 (BEV) 的普及消除了未来对进气滤清器的需求,欧洲汽车空气滤清器市场仍将保持强劲势头,至少还能再撑一个完整的更换週期,因为剩余的内燃机汽车能够保证长期使用。电商平台正在积极应对,他们扩大了传统平台的库存单位 (SKU) 选择,推出自有品牌活性碳座舱滤清器,并利用电商平台触达分散的农村车主。

加速过滤器更换週期,以符合欧盟 7 和欧盟 VI-D排放气体标准

欧盟委员会于2024年5月发布了欧7法规,引入了汽油车10奈米颗粒物基准值,并规定废气和非废气颗粒物均需终身符合排放标准。随着车载诊断系统监测滤清器劣化,进气和座舱滤清器必须比以往更长时间地保持高效,高里程车辆必须尽可能缩短实际更换週期。因此,OEM级供应商正在将高利润的多层滤清器与监管认证和RFID标籤捆绑销售,以提高单位收入,并加强欧洲汽车空气滤清器市场,使其成为关键的合规槓桿,而非可有可无的维护部件。

纯电动车的普及正在减少对进气引擎空气滤清器的需求

电池式电动车无需燃烧空气滤清器,从而消除了新车需求中进气滤清器的全部材料成本。德国将在2024年组装135万辆电动车,并计画在2025年达到167万辆(依据车队平均二氧化碳排放法规)。因此,欧洲汽车空气滤清器市场面临结构性产量阻力,尤其是在电气化发展最快的高端市场。座舱滤清器、电池组冷却微滤器和空气干燥器滤芯正呈现抵消性成长,但平均每辆车的产量正在下降。中期收益影响将集中在高价值进气部件上,这些部件传统上由研发预算覆盖,迫使供应商重新专注于复合材料座舱和温度控管领域。

报告中分析的其他驱动因素和限制因素

- 消费者对车内空气品质和过敏的担忧日益增加

- 原始设备製造商转向超低压降介质,以最大限度地延长电动车续航里程

- 车辆小型化,减少滤芯的数量/尺寸

細項分析

到2024年,纸质滤清器将占据欧洲汽车空气滤清器市场份额的56.17%,为高容量乘用车系列提供可靠的气流阻力和成本效益。几十年来,由于成熟的供应链和本地纸浆加工能力,这种传统基材支撑着欧洲汽车空气滤清器市场的规模。然而,受消费者对车内挥发性有机化合物 (VOC) 吸附和过敏原中和的需求推动,预计到2030年,活性碳和新兴复合材料的复合年增长率将达到6.51%。

主机厂正将奈米纤维层迭在纤维素骨架上,生产出能够捕捉10奈米颗粒的混合片材,同时保持低于15帕的压力降。纱布和发泡体分别在性能调校和非公路设备领域仍然是利基选择,其含油层和超大孔隙使其适用于多尘环境。随着欧盟7标准的成熟,纸质材料的份额将逐渐下降,但其可回收成分和低体积能量特性将使其保持竞争力,确保其在欧洲汽车空气滤清器市场中继续存在,而非被彻底取代。

到2024年,车厢滤清器将占欧洲汽车空气滤清器市场规模的61.22%,这得益于疫情后的健康担忧、都市区雾霾加剧以及过敏认证的市场吸引力。预计到2030年,该细分市场的复合年增长率将达到6.47%,超过进气滤清器,因为在污染严重的大都会圈,更换频率可能达到每年两次。原始设备製造商正在透过在手套箱后方整合过滤滤芯介面来简化自助更换流程,从而刺激独立零件零售商的电商销售。

进气过滤器继续占据剩余的市场份额,并面临纯电动车(BEV)的替换,但仍服务于欧洲庞大的传统内燃机车队。单位需求的波动正促使供应商向用于座舱和暖通空调(HVAC)应用的双功能颗粒滤芯领域拓展。在电动车中,座舱过滤器的选择会影响暖通空调(HVAC)的消费量,因此先进的低压降设计赢得了高利润的工厂安装。联网汽车仪錶板可以提醒驾驶者颗粒物积聚的突然增加,鼓励及时更换,并维持整个欧洲汽车空气滤清器市场的高单价。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 汽车产业的老化正在推动对独立售后市场(IAM)的需求

- 欧7和欧VI-D排放标准加速滤网更换週期

- 消费者对车内空气品质和过敏的担忧日益增加

- 推动超低压损介质的OEM,最大限度地延长电动车续航里程

- 欧洲城市级低排放气体区(LEZ)的扩张

- 透过基于订阅的无线 (OTA) 机上空气品质服务产生经常性过滤收益

- 市场限制

- 纯电动车的普及将减少对进气引擎空气滤清器的需求

- 随着汽车小型化,滤芯数量和尺寸不断减少

- 特种不织布和活性碳介质的供应瓶颈

- 高端市场越来越多地采用可清洗的高性能过滤器

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模与成长预测:价值(美元)

- 依材料类型

- 纸

- 纱布

- 形式

- 活性碳/复合材料

- 按过滤器类型

- 进气过滤器

- 车厢滤清器

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 大型商用车和公车

- 按销售管道

- OEM

- 售后市场

- 按国家

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- MANN+HUMMEL

- MAHLE

- Sogefi

- Robert Bosch GmbH

- Donaldson

- Hengst SE

- Freudenberg Filtration Tech.

- Ahlstrom

- Cummins Inc.

- DENSO

- K&N Engineering

- Purolator Filters LLC

- Advanced Flow Engineering

- AIRAID

- S&B Filters

- AL Filters

- JS Automobiles

- Allena Group

- Wsmridhi Manufacturing

- UFI Filters

第七章 市场机会与未来展望

The Europe Automotive Airfilters Market size is estimated at USD 3.62 billion in 2025, and is expected to reach USD 4.93 billion by 2030, at a CAGR of 6.37% during the forecast period (2025-2030).

Strong regulatory momentum around Euro 7, rapid expansion of city-level Low-Emission Zones, and persistent consumer health awareness anchor this expansion. Original-equipment manufacturers (OEMs) are redesigning intake and cabin filtration to meet nanometer-scale particulate limits, and independent aftermarket players are capitalizing on the continent's aging approximately 280 million-unit vehicle-parc. The Europe automotive air filters market is therefore transitioning from commodity volumes toward value-added performance, positioning filtration as a compliance-critical, consumer-visible, and telemetry-enabled component of next-generation mobility.

Europe Automotive Airfilters Market Trends and Insights

Ageing Car-Parc Expanding Independent Aftermarket Demand

Western Europe's average vehicle age reached 12 years in 2025, while Eastern European fleets stretch to 15-20 years. Older internal-combustion-engine (ICE) models require frequent intake and cabin filter swaps, and independent garages capture a considerable share of the regional aftermarket by offering competitive pricing and broad SKU coverage. Even as BEV penetration removes future intake filter demand, the residual ICE fleet guarantees long-dated volume, keeping the Europe automotive air filters market robust through at least one more full replacement cycle. Aftermarket specialists respond by widening SKU assortments for legacy platforms, introducing private-label activated-carbon cabin elements, and adopting e-commerce marketplaces to reach dispersed rural owners.

Euro 7 and Euro VI-D Emission Norms Accelerating Filter Replacement Cycles

The European Commission published Euro 7 rules in May 2024, introducing 10-nanometer particulate thresholds for gasoline vehicles and lifetime compliance for both tailpipe and non-exhaust particles. Because on-board diagnostics now monitor filter degradation, intake and cabin elements must sustain efficiency far longer than legacy, compressing real-world replacement to as low as possible in high-mileage fleets. OEM-grade suppliers therefore bundle higher-margin, multilayer elements that carry regulatory certificates and embedded RFID tags, lifting revenue per unit and reinforcing the Europe automotive air filters market as a critical compliance lever rather than a discretionary maintenance part.

BEV Adoption Shrinking Demand for Intake Engine Air-Filters

Battery-electric vehicles do not require combustion air filtration, removing entire intake filter bill-of-materials from new-vehicle demand. Germany assembled 1.35 million EVs in 2024 and is targeting 1.67 million units in 2025 under fleet-average CO2 rules, while Norway's new-car market reached majority of BEV share. The Europe automotive air filters market therefore confronts a structural volume headwind, chiefly in premium segments where electrification advances fastest. Counterbalancing growth arises in cabin filters, battery-pack cooling micro-filters, and air-drier cartridges-yet unit counts per vehicle fall on average. Medium-term revenue impact centers on high-value intake elements whose margins historically funded R&D budgets, compelling suppliers to pivot toward composite cabin and thermal-management niches.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Consumer Focus on In-Cabin Air Quality and Allergies

- OEM Drive for Ultra-Low Pressure-Drop Media to Maximize EV Range

- Vehicle Downsizing Reducing Number/Size of Filter Elements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper-based filters captured 56.17% of Europe automotive air filters market share in 2024, producing dependable airflow resistance and cost efficiency across high-volume passenger car lines. This traditional substrate underpinned Europe automotive air filters market size for decades, benefitting from mature supply chains and regional pulp processing capacity. Activated-carbon and emerging composite variants, however, are outpacing at 6.51% CAGR to 2030 as consumers demand volatile-organic-compound (VOC) adsorption and allergen neutralization within constrained cabin spaces.

OEMs are layering nanofibers atop cellulose backbones, creating hybrid sheets that trap 10-nanometer particles while holding pressure drops below 15 Pa. Gauze and foam remain niche options in performance tuning and off-highway equipment, respectively, where oil-impregnated layers or oversized pores suit dusty environments. As Euro 7 matures, paper's share erodes gradually but retains relevance due to recyclable composition and low embodied energy, ensuring coexistence rather than outright displacement inside the Europe automotive air filters market.

Cabin filters held 61.22% of the Europe automotive air filters market size in 2024, a position fortified by post-pandemic health concerns, urban smog episodes, and the marketing appeal of allergy certification. The segment grows at a 6.47% CAGR through 2030, outpacing intake filters, because replacement frequency can reach twice per year in polluted metropolitan zones. OEMs integrate filtration cartridge access behind glove boxes, simplifying do-it-yourself swaps and stimulating e-commerce sales by independent parts retailers.

Intake filters, covering the residual share, confront BEV substitution but still service Europe's large legacy ICE fleet. Turbulence in unit demand pushes suppliers to diversify toward dual-function cabin and HVAC micro-particle elements. Within EVs, cabin filter selection affects HVAC energy draw; thus, advanced low-pressure-drop designs win high-margin factory installs. Connected vehicle dashboards now alert drivers when particulate accumulation spikes, triggering timely replacements and preserving premium unit values across the Europe automotive air filters market.

The Europe Automotive Airfilters Market Report is Segmented by Material Type (Paper, Gauze, and More), Filter (Intake Filters and Cabin Filters), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM and Aftermarket), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- MANN+HUMMEL

- MAHLE

- Sogefi

- Robert Bosch GmbH

- Donaldson

- Hengst SE

- Freudenberg Filtration Tech.

- Ahlstrom

- Cummins Inc.

- DENSO

- K&N Engineering

- Purolator Filters LLC

- Advanced Flow Engineering

- AIRAID

- S&B Filters

- AL Filters

- JS Automobiles

- Allena Group

- Wsmridhi Manufacturing

- UFI Filters

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing car-parc expanding independent aftermarket (IAM) demand

- 4.2.2 Euro 7 & Euro VI-D emission norms accelerating filter replacement cycles

- 4.2.3 Heightened consumer focus on in-cabin air quality & allergies

- 4.2.4 OEM drive for ultra-low pressure-drop media to maximise EV range

- 4.2.5 Expansion of city-level Low-Emission Zones (LEZs) across Europe

- 4.2.6 Subscription-based OTA cabin-air-quality services creating recurring filter revenue

- 4.3 Market Restraints

- 4.3.1 BEV adoption shrinking demand for intake engine air-filters

- 4.3.2 Vehicle downsizing reducing number/size of filter elements

- 4.3.3 Supply bottlenecks for specialty non-woven & activated-carbon media

- 4.3.4 Rising adoption of washable performance filters in premium segment

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Material Type

- 5.1.1 Paper

- 5.1.2 Gauze

- 5.1.3 Foam

- 5.1.4 Activated-carbon / Composite

- 5.2 By Filter Type

- 5.2.1 Intake Filters

- 5.2.2 Cabin Filters

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Heavy Commercial Vehicles & Buses

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 MANN+HUMMEL

- 6.4.2 MAHLE

- 6.4.3 Sogefi

- 6.4.4 Robert Bosch GmbH

- 6.4.5 Donaldson

- 6.4.6 Hengst SE

- 6.4.7 Freudenberg Filtration Tech.

- 6.4.8 Ahlstrom

- 6.4.9 Cummins Inc.

- 6.4.10 DENSO

- 6.4.11 K&N Engineering

- 6.4.12 Purolator Filters LLC

- 6.4.13 Advanced Flow Engineering

- 6.4.14 AIRAID

- 6.4.15 S&B Filters

- 6.4.16 AL Filters

- 6.4.17 JS Automobiles

- 6.4.18 Allena Group

- 6.4.19 Wsmridhi Manufacturing

- 6.4.20 UFI Filters

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment