|

市场调查报告书

商品编码

1851533

美国汽车空气滤清器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)United States Automotive Air Filters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

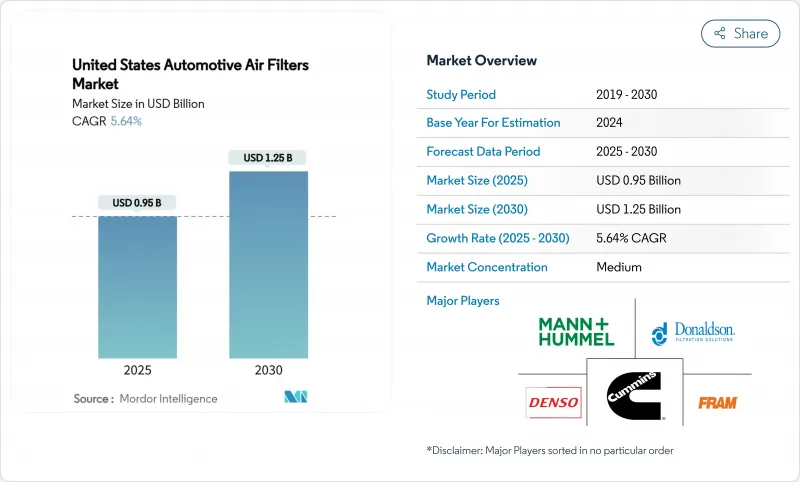

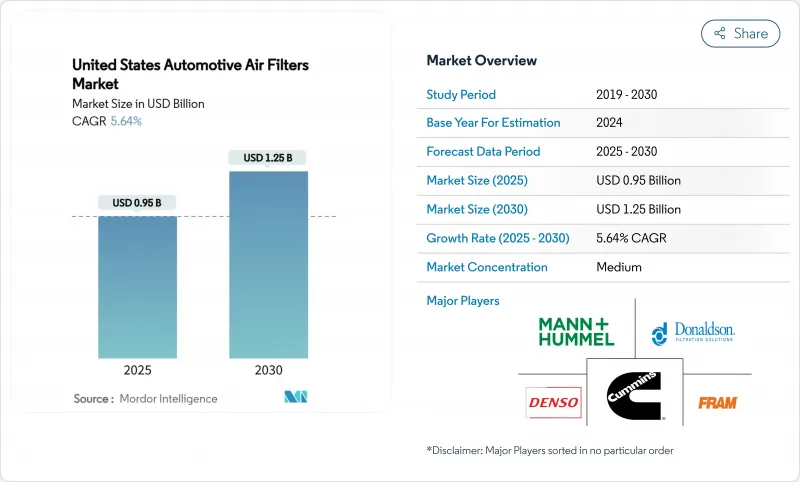

预计到 2025 年,美国汽车空气滤清器市场价值将达到 9.5 亿美元,到 2030 年将达到 12.5 亿美元,年复合成长率为 5.64%。

国内汽车保有量老化、排放气体法规日益严格以及疫情后人们对车内空气品质的担忧,共同推动了汽车市场的稳定成长。平均车龄达到创纪录的12.6年,这促使汽车不断更换;同时,美国环保署(EPA)将颗粒物排放限值设定为0.5毫克/英里,迫使汽车製造商整合高效汽油颗粒过滤器。随着消费者寻求抵御过敏原和病原体,车厢过滤器创新也在加速发展,奈米纤维滤材因其更高的捕获效率和更低的压力降而备受青睐。 2025年5月进口关税上调后,供应链重组促使製造商转向本地采购,而具有前瞻性的供应商正在投资研发先进的温度控管过滤器,以应对未来内燃机汽车保有量下降的影响。

美国汽车空气滤清器市场趋势与洞察

汽车产量增加和停车场扩建

汽车生产的復苏和停车场的扩建将带来双重需求激增。约有1.1亿辆汽车处于6-14年的使用寿命高峰期,占所有车辆的38%,这将导致滤清器更换频率的增加。消费者推迟购买新车并将支出转向维修配件,也支撑了售后市场的强劲成长。随着美国组装厂产能的提升和供应链的逐步恢復正常,OEM需求也将随之成长。在此背景下,原厂安装滤清器和替换滤清器的销售量均呈现稳定成长。

严格的美国环保署排放法规

美国环保署针对2027-2032款轻型车辆的最终规定,将车队平均温室气体排放减半,并首次设定了0.5毫克/英里的全国颗粒物排放限值。这要求汽车製造商为缸内直喷引擎配备汽油颗粒过滤器,实际上增加了一条全新的大批量过滤器生产线。加州和其他一些适用《177条款》的州已经设定了更严格的基准值,这将导致采购週期提前,并对整个供应商产生连锁反应。

转向纯电动车会减少内燃机过滤器的体积。

纯电动车将不再需要燃油滤清器和机油滤清器,并降低对进气滤清器的需求。美国环保署 (EPA) 预测,到 2032 年,轻型汽车销量中将有 30% 至 56% 为电动车,这将对纯燃油汽车市场构成结构性挑战。新兴的纯电动车温度控管滤清器可以部分取代燃油滤清器,但到 2030 年仍无法完全抵消燃油滤清器需求的下降,从而削弱传统零件製造商的整体成长前景。

细分市场分析

到2024年,纸质滤芯仍将占据美国汽车空气滤清器市场42.38%的份额。由于其成熟的模具基础和大规模生产能力,该细分市场对DIY爱好者和车队管理人员来说仍具有吸引力的单价。儘管如此,奈米纤维复合材料预计到2030年将以8.54%的复合年增长率成长,成为所有基材中成长最快的。合成熔喷混合物占据中价格分布市场,兼具耐用性和可接受的效率,而纱布和发泡体则被高性能爱好者和专用非公路设备所采用。

随着製造商维修国内生产线以大规模生产奈米级卷材,减少进口依赖并配合关税减免策略,市场趋势正在转变。永续性压力也在影响材料的选择:在新的询价函中,不含 PFAS 的涂层和再生纤维正从可选要求转变为基本要求。能够兼顾环保资格和过滤性能的供应商将在美国汽车空气滤清器市场中获得优势。在预测期内,即使传统纸张的产量趋于稳定,向先进材料的价值转移也将支撑价格的实现。

到2024年,车内过滤器将占总销售量的56.27%,凸显了消费者对车载健康功能的偏好。虽然粒状物过滤器仍然是销量领先的产品,但由于人们对过敏原、野火烟雾和空气传播病毒的敏感性增加,高效空气微粒过滤器(HEPA)和抗病毒过滤器的销量到2030年将以12.83%的复合年增长率增长。进气过滤器对于内燃机(ICE)引擎仍然至关重要,中型卡车和非公路用设备的需求将保持稳定,但随着纯电动车(BEV)市场份额的增长,其销量将逐渐下降。燃油、机油和变速箱过滤器在售后市场依然强劲,但在原厂配套通路的需求趋于平稳,因为原厂配套产品采用了更长寿的设计。

高端车厢空气滤芯也将推动净利率成长,抵消传统引擎空气滤芯销售下滑的影响。汽车製造商目前正大力宣传空气品质技术,将其作为竞争优势,并将先进的滤芯与连网感测器捆绑销售,以便在需要更换滤芯时提醒驾驶员。监管机构正在考虑制定车内空气品质标准,进一步巩固了该品类的地位。综上所述,这些因素共同确保车厢产品将继续成为美国汽车空气滤芯市场的主要成长引擎。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 汽车产量增加和公园面积成长

- 严格的EPA/CARB排放法规

- 老旧车辆推动售后市场需求

- 车内空气清净机在汽车空调系统的应用日益普及

- 电动动力传动系统需要复杂的热管理和空气管理。

- 奈米纤维和抗病毒介质进入大规模生产阶段

- 市场限制

- 向纯电动车的转型将减少内燃机过滤器的数量。

- 原料(纤维素、合成树脂)价格波动

- 延长原厂保养週期可降低更换频率

- 可清洗/可重复使用过滤器的成长

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依材料类型

- 纸媒

- 合成

- 纱布

- 形式

- 奈米纤维/复合材料

- 其他的

- 按筛选类型

- 进气过滤器

- 纤维素摄取量

- 合成摄取

- 奈米纤维/复合材料摄入

- 空调滤芯

- 颗粒物

- 活性碳

- 高效能空气滤清器/抗病毒

- 进气过滤器

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中型和重型商用车辆

- 非公路(建筑和农业)

- 摩托车

- 按销售管道

- OEM

- 售后市场

- 透过分销管道

- 线上零售商

- 实体店面销售

- 服务中心/经销商

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- KandN Engineering Inc.

- Mahle GmbH

- AL Group Ltd.

- Parker-Hannifin Corp.

- MANN+HUMMEL Group

- Denso Corporation

- Robert Bosch GmbH

- ACDelco(General Motors)

- First Brands Group LLC

- Cummins Filtration Inc.

- Donaldson Company Inc.

- Sogefi Filtration USA

- Fram Group

- Baldwin Filters

- Ahlstrom-Munksjo

- Hengst North America

- WIX Filters

- Fleetguard

- Freudenberg Filtration Technologies

第七章 市场机会与未来展望

The United States automotive air filters market is valued at USD 0.95 billion in 2025 and is projected to grow at a 5.64% CAGR to reach USD 1.25 billion by 2030.

Steady expansion is underpinned by an aging national vehicle fleet, stricter emissions rules, and post-pandemic concern for in-car air quality. A record average vehicle age of 12.6 years boosts replacement volumes, while Environmental Protection Agency (EPA) particulate limits of 0.5 mg/mi compel automakers to integrate high-efficiency gasoline particulate filters. Cabin filter innovation accelerates as consumers seek allergen and pathogen protection, and nanofiber media gains traction by delivering higher capture efficiency with lower pressure drop. Supply-chain reconfiguration after the May 2025 import-tariff hike is pushing manufacturers toward regionalized sourcing, and forward-looking suppliers are investing in advanced thermal-management filtration to offset future internal-combustion-engine (ICE) volume attrition.

United States Automotive Air Filters Market Trends and Insights

Rise in Vehicle Production and Parc Growth

Vehicle production recovery and an expanding parc create a dual-demand surge. About 110 million units sit in the 6-14-year sweet spot for service, representing 38% of the total fleet and translating into higher filter-replacement frequency. Robust aftermarket expansion is supported by consumers deferring new-car purchases, which channels spending toward maintenance parts. OEM demand also rises as U.S. assembly plants ramp up output following supply-chain normalization. Together, these trends underpin stable volume increases across both factory-installed and replacement filters.

Stringent EPA Emission Standards

The EPA final rule for model-year 2027-2032 light-duty vehicles cuts fleet-average greenhouse-gas emissions in half and sets the first nationwide 0.5 mg/mi particulate limit. Automakers must therefore fit gasoline particulate filters on direct-injection engines, effectively adding an entirely new high-volume filter line. Compliance pressure is highest in California and other Section 177 states that historically adopt more aggressive thresholds, driving early procurement cycles that ripple through the supplier base.

Shift Toward BEVs Curbing ICE Filter Volumes

Battery-electric models eliminate fuel and oil filters and cut intake-air filter demand. The EPA forecasts that 30%-56% of light-duty sales will be electric by 2032, producing a structural headwind for ICE-specific categories. Although emerging BEV thermal-management filters offer partial volume substitution, they cannot fully offset the decline through 2030, tempering overall growth prospects for legacy component makers.

Other drivers and restraints analyzed in the detailed report include:

- Aging Fleet Boosting Aftermarket Demand

- Rising Adoption of Cabin Filters for In-Car Air Quality

- Raw-Material Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper still commands 42.38% of the United States automotive air filters market share in 2024, owing to low cost and wide availability. The segment's entrenched tooling base and mass-production scale keep unit prices attractive for do-it-yourself shoppers and fleet managers alike. Nevertheless, nanofiber composites are forecast to grow at an 8.54% CAGR through 2030, the fastest among all substrates, as automakers and tier-ones specify media that deliver superior particulate capture without boosting pressure drop. Synthetic melt-blown blends occupy a mid-price niche, marrying durability with acceptable efficiency, while gauze and foam serve performance enthusiasts and specialty off-highway equipment.

Momentum is shifting as manufacturers retrofit domestic lines to mass-produce nano-enabled rolls, reducing import exposure and aligning with tariff-mitigation strategies. Sustainability pressures also influence material choice: PFAS-free coatings and recycled fibers are moving from optional to baseline requirements in new RFQs. Suppliers able to balance environmental credentials with filtration performance gain an edge in the United States automotive air filters market. Over the forecast horizon, value migration toward advanced materials supports price realization even as traditional paper volumes plateau.

Cabin units generated 56.27% of 2024 revenue, underscoring the consumer pivot toward wellness features inside the vehicle. Particulate cabin filters remain the volume leader, yet HEPA and antiviral variants are advancing at a 12.83% CAGR to 2030, driven by heightened sensitivity to allergens, wildfire smoke, and airborne viruses. Intake-air filters, still essential for ICE engines, face gradual volume erosion as BEVs gain share, although medium-duty trucks and off-highway machinery sustain demand. Fuel, oil, and transmission filters hold steady in the aftermarket but plateau in OEM channels as factory-filled units adopt extended-life designs.

Premium cabin media also deliver higher margins that offset sliding sales of traditional engine-air elements. Automakers now market air-quality technology as a competitive differentiator, bundling advanced filters with connected sensors that alert drivers when replacements are due. Regulatory bodies are exploring indoor-air-quality standards, further legitimizing the category. Collectively, these forces ensure cabin products remain the principal growth engine within the United States automotive air filters market.

The United States Automotive Air Filters Market Report is Segmented by Material Type (Paper, Synthetic, and More), Filter Type (Intake Filters [Cellulose Intake and More] and Cabin Filters [Particulate and More]), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM and Aftermarket), and Distribution Channel (Online Retailers and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- KandN Engineering Inc.

- Mahle GmbH

- AL Group Ltd.

- Parker-Hannifin Corp.

- MANN+HUMMEL Group

- Denso Corporation

- Robert Bosch GmbH

- ACDelco (General Motors)

- First Brands Group LLC

- Cummins Filtration Inc.

- Donaldson Company Inc.

- Sogefi Filtration USA

- Fram Group

- Baldwin Filters

- Ahlstrom-Munksjo

- Hengst North America

- WIX Filters

- Fleetguard

- Freudenberg Filtration Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in vehicle production and parc growth

- 4.2.2 Stringent EPA / CARB emission standards

- 4.2.3 Aging fleet boosting aftermarket demand

- 4.2.4 Rising adoption of cabin filters for in-car air quality

- 4.2.5 Electrified powertrains need advanced thermal-air management

- 4.2.6 Nanofiber and antiviral media enter mass production

- 4.3 Market Restraints

- 4.3.1 Shift toward BEVs curbing ICE filter volumes

- 4.3.2 Raw-material (cellulose, synthetics) price volatility

- 4.3.3 Extended OEM service intervals lower replacement frequency

- 4.3.4 Growth of washable / reusable filters

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Material Type

- 5.1.1 Paper

- 5.1.2 Synthetic

- 5.1.3 Gauze

- 5.1.4 Foam

- 5.1.5 Nanofiber / Composite

- 5.1.6 Others

- 5.2 By Filter Type

- 5.2.1 Intake Filters

- 5.2.1.1 Cellulose Intake

- 5.2.1.2 Synthetic Intake

- 5.2.1.3 Nanofiber / Composite Intake

- 5.2.2 Cabin Filters

- 5.2.2.1 Particulate

- 5.2.2.2 Activated Carbon

- 5.2.2.3 HEPA / Antiviral

- 5.2.1 Intake Filters

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.3.4 Off-Highway (Construction and Agriculture)

- 5.3.5 Two-Wheelers

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Distribution Channel

- 5.5.1 Online Retailers

- 5.5.2 Brick and Mortar Retail

- 5.5.3 Service Centers and Dealerships

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 KandN Engineering Inc.

- 6.4.2 Mahle GmbH

- 6.4.3 AL Group Ltd.

- 6.4.4 Parker-Hannifin Corp.

- 6.4.5 MANN+HUMMEL Group

- 6.4.6 Denso Corporation

- 6.4.7 Robert Bosch GmbH

- 6.4.8 ACDelco (General Motors)

- 6.4.9 First Brands Group LLC

- 6.4.10 Cummins Filtration Inc.

- 6.4.11 Donaldson Company Inc.

- 6.4.12 Sogefi Filtration USA

- 6.4.13 Fram Group

- 6.4.14 Baldwin Filters

- 6.4.15 Ahlstrom-Munksjo

- 6.4.16 Hengst North America

- 6.4.17 WIX Filters

- 6.4.18 Fleetguard

- 6.4.19 Freudenberg Filtration Technologies

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment