|

市场调查报告书

商品编码

1836576

近距离场通讯(NFC):市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)Near Field Communication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

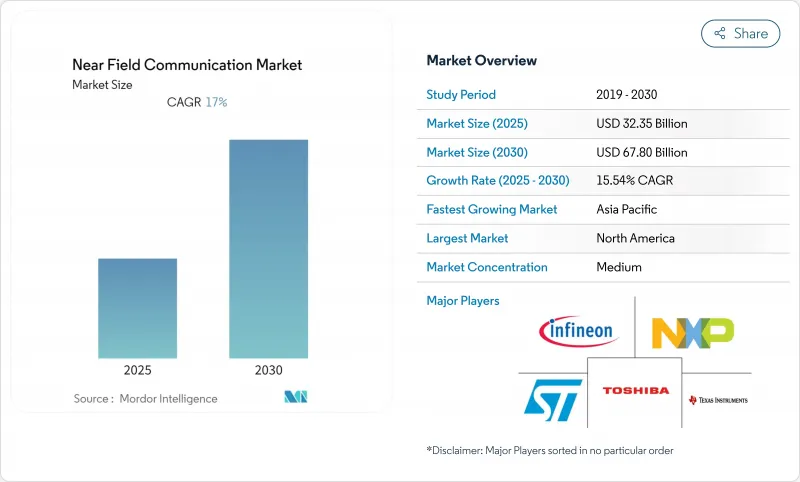

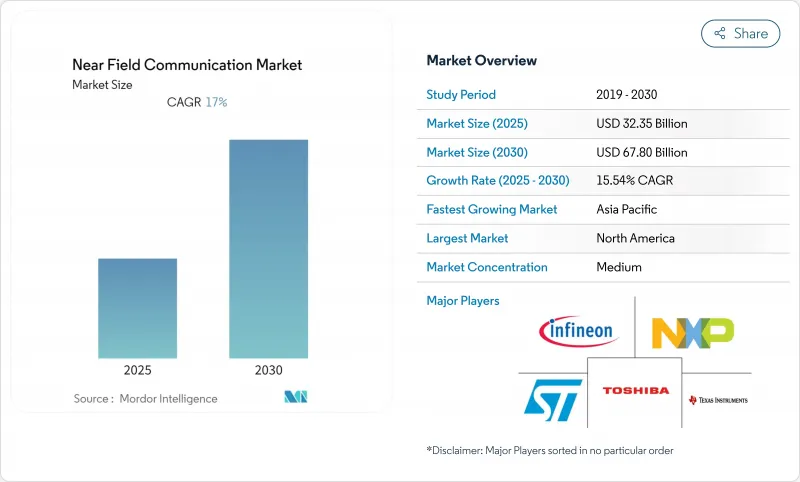

近距离场通讯(NFC) 市场预计在 2025 年价值为 323.5 亿美元,到 2030 年将达到 678 亿美元,复合年增长率为 15.54%。

智慧型手机製造商正在将NFC晶片整合标准化,以涵盖中高阶设备,从而拓宽行动电子钱包和新兴身分服务的选项范围。欧洲强制要求行动装置开放NFC接口,这正在刺激银行和金融科技公司之间的竞争,而亚太地区「行动优先」的经济体则透过高普及率的数位钱包持续扩大规模。在供应方面,13.56 MHz前端组件製造商正在竞相提高产量,以满足日益增长的读取器和标籤需求。电动车充电、智慧城市基础设施和数位产品护照的同步发展,凸显了NFC正从以支付为中心的工具转向多用途、安全的近距离平台的转变。

全球近距离场通讯(NFC) 市场趋势与洞察

新冠疫情后非接触式支付的兴起

疫情期间,消费者欣然接受「一触即付」(Tap-to-Pay),并认为其快速便捷。万事达卡数据显示,74% 的用户计划未来继续使用非接触式支付。法国的现金提领大幅下降,显示对 ATM 的依赖度正在结构性下降。超过 50 个市场提高了非接触式支付限额,进一步提升了平均交易额。在新兴市场,商家正在同时采用基于二维码的钱包和支援 NFC 的终端,从而超越磁条基础设施。支付网路代币化蓝图的目标是到 2030 年在电子商务中消除手动输入卡片的环节,将 NFC 定位为无摩擦线上结帐,同时强化其作为主要店内身份验证方法的地位。

智慧型手机 OEM 预载 NFC 晶片

更广泛的晶片整合将使NFC从高端附加功能转变为行动商务、交通票务和数位钥匙的预设通道。 NFC论坛的多用途触碰(Multi-Purpose Tap)规范将于2024年发布,该规范将支援一次触碰即可同时启动支付、会员积分和访问等操作,从而提升日常用户参与度。新的Release 15安全升级已于2025年6月完成,将扩展加密灵活性并提高互通性,鼓励OEM厂商深化系统级整合。由此产生的NFC行动电话装置量将为开发者提供巨大的规模,使他们能够瞄准数十亿台设备,而不会造成硬体碎片化。

资料安全和隐私问题

交易量的不断增长加剧了学术文献中记录的NFC中继、克隆和盗刷攻击的后果。令牌化凭证可以减轻卡号盗窃的风险,但仍有25%的线上交易绕过了令牌化,暴露了安全链中的漏洞。英飞凌的生物辨识卡和正在开发的距离限制通讯协定有望增强防御能力,但也增加了部署成本和整合复杂性。欧盟监管机构正在收紧PSD3合规性要求,强制发卡机构采用多因素身分验证和持续诈欺监控。额外的步骤可能会增加结帐时的摩擦,这可能会减缓那些更注重无摩擦流程而非最高安全性的行业(例如快餐零售)的采用。

报告中分析的其他驱动因素和限制因素

- 行动NFC监管对第三方钱包EV开放

- 透过 NFC 进行「即插即充」身份验证

- BLE 和 UWB 的短距离/干扰有限

細項分析

到 2024 年,读卡机将占据近距离场通讯(NFC) 市场份额的 41.2%,这反映了商家对符合 EMV 标准的 POS 硬体的大力投资。责任转移授权推动零售商青睐支援磁条、晶片和感应卡的一体化终端,从而提高了单位销售额和平均售价。印度、印尼和巴西政府对中小企业 (SME)数位化的奖励策略进一步推动了市场发展。读卡机部分还受益于软体可更新的韧体,该韧体可使终端与不断发展的卡片计划要求保持同步。相反,标籤虽然以收益为准较小,但预计到 2030 年将以 16.9% 的复合年增长率增长,是近距离场通讯(NFC) 市场中增长最快的。欧洲的数位产品护照法规要求奢侈品、电子产品和汽车品牌将不可变的可追溯性纳入产品中,而 NFC 标籤则提供了一种低成本、符合标准的方法。亚洲各地越来越多地采用智慧货架、互动式包装和防伪标籤,进一步扩大了可寻址标籤池。

天线和分离式积体电路等二级硬体产品线正受益于穿戴式装置和医疗设备领域的设计胜利,并紧跟着主要细分市场的步伐。微型天线阵列如今已能够无缝整合到智慧型手錶的金属机壳中。软体和服务虽然仍占收入的个位数百分比,但透过在已安装硬体之上迭加令牌生命週期管理、分析仪錶板、忠诚度引擎等功能,实现了更高的毛利率。使用宣传活动关联标籤的零售商报告称,在用NFC取代QR码后,转换率提高了近30%,这表明部署服务后具有持续的收益潜力。

读/写模式将在 2024 年占据近距离场通讯(NFC) 市场的主导地位,市占率为 46%,这要归功于其在门禁卡、海报轻触和檔案传输的传统普及。这种模式的简单性(只需要标籤和阅读器)支持其在图书馆、博物馆和智慧海报中的应用,这些地方的安全性优先于成本。然而,在开放式钱包计画和数位身分计划的推动下,卡片模拟预计将以 17.13% 的复合年增长率加速发展。主机卡模拟允许在没有实体安全元件的情况下在软体中复製卡小程序,从而降低量贩店行动电话的物料清单成本。第 15 版增强了基于安全通道的对等身份验证,使银行和运输机构能够自信地部署基于软体的票务。虽然P2P正在被蓝牙中更快的檔案传输速度所取代,但它对装置对配置仍然很重要,其中必须在没有云端连线的情况下安全地传递 Wi-Fi 凭证和 Zigbee 金钥。

随着消费者对无摩擦互动的兴趣日益浓厚,NFC 论坛的「多用途触碰」 (Multipurpose Tap) 有望透过将模拟和读写操作整合到单一手势中,模糊模式界限。零售试点研究表明,结帐时间最多可缩短 15%,这充分说明了用户体验的提升如何再形成模式偏好。开发人员也正在将远端检测上传、软体启动和忠诚度获取功能整合到单一触碰中,从而避免切换应用的疲劳。

区域分析

亚太地区将在2024年引领近距离场通讯(NFC) 市场,市占率达37.8%,预计到2030年复合年增长率将达到17.02%。在行动优先的经济体中,智慧型手机普及率超过63%,行动服务已为该地区的GDP贡献了5.3%。 2024年,中国公车业者将处理超过600亿次NFC地铁出行,印度统一支付介面的每日点击支付交易量较去年同期成长三倍。政府电子身份证计划和国家健康卡计划正在进一步刺激身份和身份验证用例,帮助该地区超越全球平均水平。

欧洲在价值方面排名第二,这得益于鼓励开放行动级NFC(近场通讯)和推行强客户身份验证的法规。欧盟的《数位产品护照》法规要求奢侈品和汽车零件必须使用可追溯标籤,推动了标籤供应链的扩张。卡网路的代币化倡议旨在十年内消除手动卡片输入,并有望推动浏览器内点击支付的激增。北欧银行报告称,非接触式金融卡的市场渗透率已达到90%,显示交易量成长健康且成熟。

得益于电动车充电基础设施的快速普及和企业安全升级,北美正以中等速度稳定成长。联邦政府的「通用即插即充」框架将于2025年生效,预计将为全国范围内的互通性奠定基准,并推动充电读卡机部署的激增。 《晶片法案》(CHIPS Act)的製造业在岸化计画和税额扣抵鼓励了国内NFC组件的製造,从而缓解了部分全球供应限制。同时,中东和非洲地区正处于早期应用阶段,受制于分散的监管和较低的POS机普及率,但得益于优先考虑低成本、安全的近场支付的行动货币计划。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 新冠疫情后非接触式支付的兴起

- 智慧型手机OEM预载NFC晶片

- 向第三方钱包开放行动电话NFC

- NFC用于电动车「即插即充」认证

- 欧盟数位产品护照强制使用NFC标籤

- 折迭式/XR穿戴装置使用NFC实现空间使用者体验

- 市场限制

- 资料安全和隐私问题

- BLE 和 UWB 的短距离/干扰限制

- 13.56MHz前端晶片供应受限

- 商户代币化费用减缓了新兴市场的采用

- 价值链分析

- 监管状况

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业相关人员分析

- 新冠疫情与宏观经济逆风的影响

- 地缘政治紧张局势的影响

第五章市场规模及成长预测(金额)

- 依产品类型

- NFC标籤

- NFC IC/安全元件

- NFC 读取器

- NFC天线

- 软体和服务

- 按运转方式

- 读/写

- P2P

- 卡模拟

- 按用途

- 支付

- 存取控制

- 配对和性能验证

- 身份和身份验证

- 智慧海报和行销

- 物联网配置及更多

- 透过终端设备

- 智慧型手机

- 穿戴式装置

- 个人电脑及其他家用电器

- 医疗设备

- 车载资讯娱乐系统/电动车充电器

- 其他设备

- 按行业

- BFSI

- 资讯科技/通讯

- 零售与电子商务

- 卫生保健

- 饭店和交通

- 政府/公共部门

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 其他亚太地区

- 中东和非洲

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度分析

- 策略性措施和采购

- 市占率分析

- 公司简介

- NXP Semiconductors

- STMicroelectronics NV

- Infineon Technologies AG

- Broadcom Inc.

- Sony Group Corp.

- Samsung Electronics

- Qualcomm Technologies

- Toshiba Electronic Devices and Storage Corp.

- Texas Instruments Inc.

- Zebra Technologies Corp.

- HID Global

- Thales(Gemalto)

- Renesas Electronics

- Shanghai Fudan Microelectronics

- Identiv Inc.

- Smartrac Technology

- Marvell Technology Group

- Inside Secure(Verimatrix)

- Huawei Technologies

- Apple Inc.

第七章 市场机会与未来展望

The Near Field Communication market is valued at USD 32.35 billion in 2025 and is forecast to reach USD 67.80 billion by 2030, reflecting a brisk 15.54% CAGR.

Growth is powered by the permanent shift toward touch-free commerce, with contactless payments now representing 79% of day-to-day consumer purchases worldwide.Smartphone makers have normalised NFC chip integration across mid-tier and premium devices, broadening the addressable base for mobile wallets and emerging identity services. Europe's decision to compel open access to handset NFC interfaces is accelerating competition among banks and fintechs, while Asia Pacific's mobile-first economies continue to drive scale through high digital-wallet penetration. On the supply side, makers of 13.56 MHz front-end components are scrambling to lift output to meet surging reader and tag demand. Parallel progress in EV charging, smart city infrastructure, and digital product passports underscores NFC's transition from a payment-centric tool to a multipurpose secure-proximity platform.

Global Near Field Communication Market Trends and Insights

Proliferation of Contactless Payments Post-COVID-19

Consumers embraced tap-to-pay behaviour during the pandemic and have retained it for speed and convenience. Mastercard reports that 74% of users plan to keep paying contactlessly in the future. Cash withdrawals in France have fallen sharply, signalling a structural decline in ATM reliance. Rising contactless limits in more than 50 markets further lift average transaction values. In emerging economies, merchants leapfrog mag-stripe infrastructure by adopting QR-based wallets and NFC-enabled terminals in tandem. Payment networks' tokenisation roadmaps, aimed at removing manual card entry for e-commerce by 2030, cement NFC's role as the foremost in-store authentication method while positioning it for friction-free online checkout.

Smartphone OEMs Pre-Installing NFC Chips

Apple's decision to include NFC in every iPhone since 2018 set an industry baseline, and Android brands quickly followed suit with secure-element support in Snapdragon and Exynos platforms.Broader chip integration turns NFC from a premium extra into default plumbing for mobile commerce, transit ticketing, and digital keys. The NFC Forum's Multi-Purpose Tap specification, published in 2024, lets a single tap launch payment, loyalty, and access actions simultaneously, boosting daily user engagement. New Release 15 security upgrades, finalised in June 2025, extend cryptographic agility and improve interoperability, encouraging OEMs to deepen system-level integration. As a result, the installed base of NFC-ready phones provides critical mass for developers who can target billions of devices without hardware fragmentation.

Data-Security and Privacy Concerns

Higher transaction volumes magnify the consequences of NFC relay, cloning, and skimming attacks documented in academic literature. While tokenised credentials mitigate card-number theft, 25% of online transactions still bypass tokenisation, exposing gaps in the security chain. Biometric cards from Infineon and distance-bounding protocols under development promise stronger defences, yet they also raise deployment costs and integration complexity. Regulators in the EU are tightening PSD3 compliance requirements, obliging issuers to adopt multifactor authentication and continuous fraud monitoring. The extra steps can increase friction at checkout and may slow adoption in sectors that favour frictionless flows over maximum security, such as quick-service retail.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Opening of Handset NFC to Third-Party Wallets

- EV "Plug-and-Charge" Authentication via NFC

- Short-Range / Interference Limits versus BLE and UWB

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, readers captured 41.2% of the Near Field Communication market share, reflecting heavy merchant investment in EMV-compliant point-of-sale hardware. Mandatory liability-shift deadlines nudged retailers to favour all-in-one terminals that support mag-stripe, chip and tap, boosting unit volumes and ASPs. Government stimulus for small-business digitisation in India, Indonesia and Brazil added further momentum. The reader segment also benefits from software-updatable firmware that keeps terminals current with evolving card-scheme requirements. Conversely, tags-although accounting for a smaller revenue base-are forecast to register a 16.9% CAGR to 2030, the fastest within the Near Field Communication market. Europe's Digital Product Passport regulation obliges luxury-goods, electronics and automotive brands to embed immutable traceability into items, and NFC tags supply a low-cost, standards-based method to comply. Growing adoption of smart shelves, interactive packaging, and anti-counterfeit labels across Asia further widens the addressable tag pool.

Second-tier hardware lines such as antennas and discrete ICs trail the main segments yet profit from design-win richness in wearables and medical devices. Miniaturised antenna arrays now support metal-backed smartwatch casings without detuning. Software and services-though only a single-digit slice of revenue-record higher gross margins by layering token-lifecycle management, analytical dashboards and loyalty engines on top of installed hardware. Retailers using campaign-linked tags report conversion-rate uplifts approaching 30% after replacing QR codes with NFC, illustrating the recurring-revenue potential of post-deployment services.

Read/write mode dominated the Near Field Communication market size with 46% share in 2024, thanks to legacy uptake in access cards, poster tapping and file transfer. The mode's simplicity, requiring only a tag and a reader, underpins adoption in libraries, museums and smart posters where cost trumps security. Card emulation, however, is projected to accelerate at a 17.13% CAGR on the back of open-wallet initiatives and digital-ID projects. Host Card Emulation lets software replicate a card applet without a physical secure element, cutting bill-of-materials for mass-market phones. Release 15 elevates secure-channel-based peer authentication, persuading banks and transit authorities to roll out software-based tickets confidently. Peer-to-peer lags due to Bluetooth's faster file-transfer speeds, yet it remains relevant in device-pair provisioning where Wi-Fi credentials or Zigbee keys must pass securely without cloud connectivity.

As consumer interest in frictionless interactions grows, the NFC Forum's Multi-Purpose Tap could blur mode boundaries by chaining emulation and read/write operations into a single gesture. Retail pilots indicate checkout time reductions of up to 15%, illustrating how UX gains may reshape mode preferences. Developers are likewise bundling telemetry upload, software licence validation and loyalty accrual into one tap to avoid app-switching fatigue

The Near Field Communication Market Report is Segmented by Product Type (NFC Tags, NFC Readers, and More), Operating Mode (Read / Write, Peer-To-Peer, and More), Application (Payments, Access Control, Pairing and Commissioning, and More), End-Device (Smartphones, Wearables, Medical Equipment, and More), End-User Vertical (BFSI, Healthcare, and More), and Geography

Geography Analysis

Asia Pacific leads the Near Field Communication market with 37.8% share in 2024 and an estimated 17.02% CAGR to 2030. Mobile-first economies benefit from smartphone penetration exceeding 63% of the population, and mobile services already contribute 5.3% to regional GDP. China's transit operators processed more than 60 billion NFC metro rides in 2024, while India's Unified Payments Interface saw daily tap-and-pay volumes triple year-on-year. Government e-ID and national health-card schemes further stimulate identity and authentication use cases, helping the region outpace global averages.

Europe sits second in value thanks to regulatory tailwinds that force handset-level NFC openness and push strong customer authentication. The EU's Digital Product Passport regulation mandates traceability tags for luxury goods and automotive components, catalysing a tag supply-chain ramp. Tokenisation initiatives by card networks aim to eradicate manual card entry by decade's end, promising a surge in in-browser tap-to-pay flows. Nordic banks have already reported 90% market penetration for contactless debit, signalling maturity yet still healthy transaction-value expansion.

North America records steady mid-teen growth, buoyed by its rapid roll-out of EV charging infrastructure and enterprise security upgrades. The federal universal plug-and-charge framework, effective 2025, sets a baseline for nationwide interoperability and is expected to lift charger-reader deployments sharply. Manufacturing onshoring programmes and tax credits under the CHIPS Act encourage domestic NFC component fabrication, partly mitigating global supply tightness. Meanwhile, Middle East and Africa exhibit early-stage adoption, constrained by fragmented regulation and lower POS penetration but aided by mobile-money initiatives that prioritise low-cost, secure proximity payments.

- NXP Semiconductors

- STMicroelectronics N.V.

- Infineon Technologies AG

- Broadcom Inc.

- Sony Group Corp.

- Samsung Electronics

- Qualcomm Technologies

- Toshiba Electronic Devices and Storage Corp.

- Texas Instruments Inc.

- Zebra Technologies Corp.

- HID Global

- Thales (Gemalto)

- Renesas Electronics

- Shanghai Fudan Microelectronics

- Identiv Inc.

- Smartrac Technology

- Marvell Technology Group

- Inside Secure (Verimatrix)

- Huawei Technologies

- Apple Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of contactless payments post-COVID-19

- 4.2.2 Smartphone OEMs pre-installing NFC chips

- 4.2.3 Regulatory opening of handset NFC to third-party wallets

- 4.2.4 EV "plug-and-charge" authentication via NFC

- 4.2.5 EU Digital Product Passport mandates for embedded NFC tags

- 4.2.6 Foldable/XR wearables adopting NFC for spatial UX

- 4.3 Market Restraints

- 4.3.1 Data-security and privacy concerns

- 4.3.2 Short-range/interference limits vs BLE and UWB

- 4.3.3 13.56 MHz front-end chip supply constraints

- 4.3.4 Merchant tokenisation fees slowing acceptance in emerging markets

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Industry Stakeholder Analysis

- 4.9 Impact of COVID-19 and Macroeconomic Headwinds

- 4.10 Impact of Geopolitical Tensions

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 NFC Tags

- 5.1.2 NFC ICs / Secure Elements

- 5.1.3 NFC Readers

- 5.1.4 NFC Antennas

- 5.1.5 Software and Services

- 5.2 By Operating Mode

- 5.2.1 Read / Write

- 5.2.2 Peer-to-Peer

- 5.2.3 Card Emulation

- 5.3 By Application

- 5.3.1 Payments

- 5.3.2 Access Control

- 5.3.3 Pairing and Commissioning

- 5.3.4 Identity and Authentication

- 5.3.5 Smart Posters and Marketing

- 5.3.6 IoT Provisioning and Others

- 5.4 By End-Device

- 5.4.1 Smartphones

- 5.4.2 Wearables

- 5.4.3 PCs and Other Consumer Electronics

- 5.4.4 Medical Equipment

- 5.4.5 Automotive Infotainment / EV Chargers

- 5.4.6 Other Devices

- 5.5 By End-User Vertical

- 5.5.1 BFSI

- 5.5.2 IT and Telecommunications

- 5.5.3 Retail and e-Commerce

- 5.5.4 Healthcare

- 5.5.5 Hospitality and Transportation

- 5.5.6 Government and Public Sector

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and Funding

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NXP Semiconductors

- 6.4.2 STMicroelectronics N.V.

- 6.4.3 Infineon Technologies AG

- 6.4.4 Broadcom Inc.

- 6.4.5 Sony Group Corp.

- 6.4.6 Samsung Electronics

- 6.4.7 Qualcomm Technologies

- 6.4.8 Toshiba Electronic Devices and Storage Corp.

- 6.4.9 Texas Instruments Inc.

- 6.4.10 Zebra Technologies Corp.

- 6.4.11 HID Global

- 6.4.12 Thales (Gemalto)

- 6.4.13 Renesas Electronics

- 6.4.14 Shanghai Fudan Microelectronics

- 6.4.15 Identiv Inc.

- 6.4.16 Smartrac Technology

- 6.4.17 Marvell Technology Group

- 6.4.18 Inside Secure (Verimatrix)

- 6.4.19 Huawei Technologies

- 6.4.20 Apple Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment