|

市场调查报告书

商品编码

1836716

外骨骼:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Exoskeleton - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

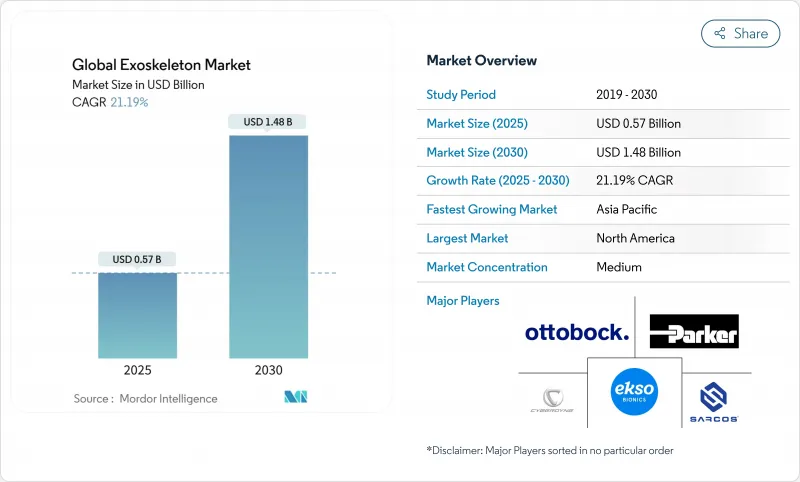

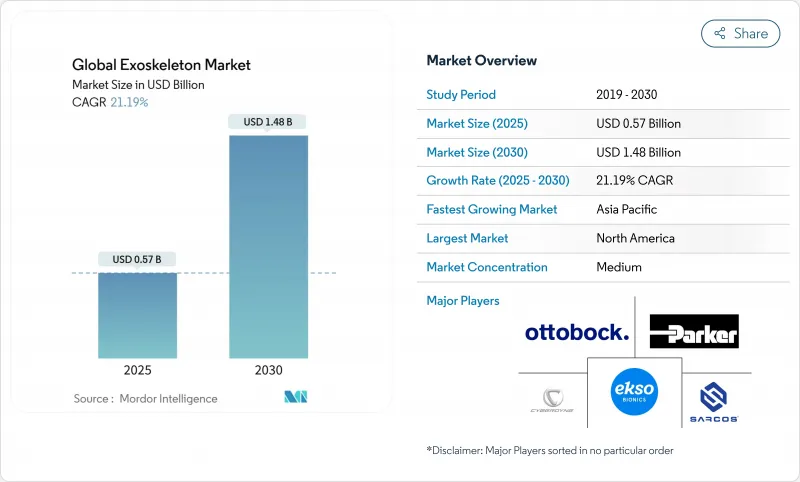

预计 2025 年全球外骨骼市场规模为 5.7 亿美元,到 2030 年将达到 14.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 21.19%。

从早期的医疗试点到大规模项目,从单线到企业部署的工业人体工学计划,以及国防机构将原型转入小规模生产,该技术的应用正在迅速发生。嵌入在控制软体中的人工智慧 (AI) 重塑了设备的反应能力。同行评审的研究表明,在重复举重过程中,背部肌肉活动减少了 35%,直接减少了伤害索赔。轻质复合材料、功率重量比致致动器和电池能量密度的同步改进使平均单位质量减少了约 30%,提高了佩戴者的舒适度并延长了使用时间。美国医疗保险于 2024 年 1 月决定将个人外骨骼归类为有资格享受矫正器具福利的机构,这加速了私人共同支付的引入,并影响了德国、韩国和日本的类似政策。随着以软体为中心的参与企业获得设计胜利,竞争日益激烈。 NVIDIA 决定在 2025 年将 Ekso Bionics 加入其 Connect 计画中,这表明加速培养运算人才对于持续的差异化至关重要。

全球外骨骼市场趋势与洞察

需要先进復健解决方案的神经肌肉骨骼疾病迅速增加

同时,预计到2030年,65岁及以上老年人口将占全球总人口的16%,将增加对助行器的需求。对照临床试验表明,与传统治疗相比,早期外骨骼干预可使功能恢復提高高达30%,凸显了快速部署的临床意义。医疗系统管理人员开始将机器人治疗视为提升医疗效率的工具。这些机器人单元能够以更少的治疗师数量,实现更长、更精准的疗程。在中风、多发性硬化症和创伤性脑损伤等多种神经系统疾病领域,已有确凿证据增强了付款人的信心,并有助于理赔决策的顺利进行。

医疗保健领域对机器人復健的需求不断增长

2025年的一项调查发现,80%的治疗师表示,当外骨骼机器人辅助手动操作时,他们的身体压力减轻,工作效率提高。临床基准测试表明,在Sheltering Arms Institute,经过12週的结构化机器人治疗,脊髓损伤患者的步行速度提高了25-40%;在BSW復健中心,与传统计画相比,中风患者的步态对称性提高了32%。这些结果支持从试点预算转向多机构采购。汽车工厂和物流设施的工业工程团队正在加入医疗产业的潮流,采购上肢机器人,以减少肩部损伤和加班成本。

高昂的资本投入和维护成本阻碍了商业性应用

标价从5万美元到15万美元不等,服务合约每年增加5000美元到1万美元。投资报酬率取决于预防工伤和减少住院时间,但新兴市场(公共资金是主要驱动力)受到限制和部署有限的限制。此后,供应商已收费按使用付费租赁和机器人即服务模式,儘管这些模式在北美以外的地区仍处于起步阶段。

报告中分析的其他驱动因素和限制因素

- 机器人技术的发展

- 新兴医疗市场出现有利的报销框架

- 由于安全指南不明确,使用外骨骼有风险

細項分析

到 2024 年,动力类产品的收入将成长 84.22%,这得益于复杂行走、爬楼梯和负重的机动辅助。这构成了大多数復健通讯协定和防御原型的支柱。然而,随着物流公司在物流中心部署数百个被动矫正器具,例如可减轻下背部压力的弹簧矫正器具,到 2030 年的复合年增长率将达到 22.82%。到 2025 年,被动腰椎外骨骼将被纳入职业健康预算,此前同行评审的研究证实,它们可以在搬运纸箱时将背部伸肌活动减少 35%。动力髋关节和被动脊椎支撑的结合可以同时减少能源需求和零件数量。

成本差异仍然很大,被动式产品的零售价仅为动力产品的三分之一。透过利用先进的复合材料和弹性扭转元件,製造商在保持辅助扭矩的同时减轻了重量,使被动式产品能够满足严格的采购限制。透过将感测器直接嵌入支撑框架,被动式产品开始为企业仪表板提供人体工学分析,从而缩小了与动力式产品之间的数据差距。即使动力系统在高强度治疗中仍然保持效用,被动式产品也有望从注重预算的买家那里抢占越来越大的市场份额。

2024年,移动外骨骼将占全球销售额的68.34%,这反映了它们能够适应各种地形,并适应独立的日常生活、仓库工作和步兵机动。电池创新使其运行时间达到6至8小时,比之前的型号延长40%,可支援完整的临床轮班或连续的生产週期。患者认为,与患者视线水平的互动具有心理益处,有助于提高居家环境中患者的依从性。固定式系统虽然目前规模较小,但由于其能够在有限的运动学习阶段提供高度重复的训练,到2030年,其复合年增长率将达到24.23%。在医疗中心,这些系统安装在龙门架上,治疗师可以使用扩增实境(AR) 迭加技术微调患者的步态运动,加速神经可塑性介入。

可互换模组允许单一机壳在跑步机安装和地面安装之间切换,模糊了移动和固定之间的界限。这种灵活性对于希望在各种患者群体中分摊资本的中型康復连锁机构来说极具吸引力。供应商正在提供即插即用的附加元件组件,例如扶手、安全带和跑步机踏板。

区域分析

由于成熟的支付生态系统和充足的创业投资资金,北美将在2024年占据外骨骼市场收益的40.33%。联邦医疗保险(Medicare)91,032美元的固定报销率大大提高了脊髓损伤患者的负担能力,并增加了向退伍军人健康管理局中心和一级创伤医院的设备出货量。在美国,包括汽车组装和宅配物流公司在内的工业雇主正在试行上身服装,以减少与伤害相关的停工时间,这些计划正在逐步转为框架合约。加拿大也走在类似的道路上,每个州的工人赔偿委员会都在进行试点项目,以评估索赔减少和生产力提高的效果。

欧洲的销售额排名第二,其中德国、法国和北欧国家领先。德国的 BARMER 覆盖范围涵盖 850 万名受益人,为近一半的法定受保人提供报销服务。由 Horizon Europe津贴的研究合作正在蓬勃发展,将亚琛、苏黎世和热那亚的机器人研究所与临床用户联繫起来。巴伐利亚汽车製造商正在将肩部支撑外骨骼引入其生产线,以符合肌肉骨骼暴露阈值。不断发展的 ExosCE 认证路径将医疗和机械指令合併为一个文件并缩短核准时间,从而促进了产品部署。

亚太地区是成长最快的丛集,到2030年的复合年增长率将达到23.78%。根据mobihealthnews.com报道,韩国製造商WIRobotics将于2025年在美国推出其WIM步行辅助机器人,凸显了该地区的出口野心。中国的「中国製造2025」计画为復健机器人工厂提供津贴奖励,而日本的老龄化社会则将公共研发重点转向辅助行动领域。儘管医疗报销存在不确定性,但电子和造船行业的工业客户正在批量采购腰部支撑服,以减少责任索赔。新加坡和澳洲之间的官民合作关係关係正专注于一项将外骨骼与智慧家庭生态系统结合的城市老化倡议。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 需要先进復健解决方案的神经肌肉骨骼疾病数量迅速增加

- 医疗保健产业对机器人復健的需求不断增长

- 机器人技术的进步

- 新兴医疗市场出现有利的报销框架

- 将人工智慧整合到控制系统中

- 更轻的材料和更高的电池效率

- 市场限制

- 高昂的资本投入和维护成本阻碍了商业性应用

- 由于安全指南不明确,使用外骨骼有风险

- 长期有效性的临床证据有限,影响付款人和临床医生的接受度

- 新兴市场的保险覆盖范围有限

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测(单位:美元)

- 依技术

- 有源/主动

- 被动的

- 透过移动

- 移动的

- 固定式

- 按部分

- 上肢

- 手外骨骼

- 手臂外骨骼

- 下肢

- 腰部

- 膝盖

- 脚踝和脚

- 全身

- 上肢

- 按组件

- 硬体

- 软体

- 服务

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第六章 竞争态势

- 市场集中度

- 市占率分析

- 公司简介

- CYBERDYNE Inc.

- Ekso Bionics Holdings Inc.

- Ottobock SE & Co. KGaA

- Parker Hannifin Corp.

- Sarcos Technology & Robotics Corp.

- ReWalk Robotics Ltd.

- BIONIK Laboratories Corp.

- Bioservo Technologies AB

- Gogoa Mobility Robots

- Rehab-Robotics Co. Ltd.

- Bioness Inc.(Bioventus)

- B-Temia Inc.

- Myomo Inc.

- Lockheed Martin Corp.

- Seismic Powered Clothing

- RB3D SAS

- Wearable Robotics SRL

- Fourier Intelligence

- Panasonic Corp.(Atoun)

第七章 市场机会与未来展望

- 閒置频段和未满足需求评估

The Global Exoskeleton Market size is estimated at USD 0.57 billion in 2025, and is expected to reach USD 1.48 billion by 2030, at a CAGR of 21.19% during the forecast period (2025-2030).

Rapid adoption is unfolding as early medical pilots convert into scaled programs, industrial ergonomics projects expand from single lines to enterprise roll-outs, and defense agencies move prototypes into limited-rate production. Artificial intelligence (AI) embedded within control software is reshaping device responsiveness, with peer-reviewed studies showing up to a 35% cut in back muscle activity during repetitive lifts, a jump that directly lowers injury claims. Parallel gains in lightweight composites, power-to-weight actuators, and battery energy density have trimmed average unit mass by roughly 30%, improving wearer comfort and session duration. The reimbursement breakthrough in the United States Medicare's January 2024 decision to classify personal exoskeletons under the brace benefit has triggered private-payer adoption and influenced similar policy moves in Germany, South Korea, and Japan. Competitive intensity is climbing as software-centric entrants secure design wins; NVIDIA's 2025 decision to place Ekso Bionics in its Connect program signaled that accelerated computing talent is now indispensable for sustained differentiation.

Global Exoskeleton Market Trends and Insights

Accelerating Prevalence of Neuro-Musculoskeletal Disorders Requiring Advanced Assistive Rehabilitation Solutions

Spinal cord injuries affect 294,000 individuals in the United States, with 17,000 new cases added annually, creating a sizeable candidate pool for robotic gait systems, while the share of people aged >= 65 is projected to reach 16% of the global population by 2030, elevating demand for mobility aids.Controlled clinical trials show that early exoskeleton intervention can lift functional recovery by up to 30% versus traditional therapy, underscoring the clinical rationale for rapid roll-out. Health-system administrators are starting to view robotic therapy as a throughput tool: units permit longer, more task-specific sessions with fewer therapists, an outcome that directly expands revenue capacity without proportionate head-count growth. Robust evidence across multiple neurological conditions stroke, multiple sclerosis, traumatic brain injury reinforces payer confidence, smoothing the path toward coverage decisions.

Growing Demand from Healthcare Sector for Robotic Rehabilitation

Hospital groups face chronic staffing gaps as rehabilitation workloads climb; surveys from 2025 show 80% of therapists reporting reduced physical strain and higher throughput when exoskeletons supplement manual assistance. Clinical benchmarking demonstrates 25-40% boosts in post-SCI walking speed after 12 weeks of structured robotic therapy at Sheltering Arms Institute, while stroke patients at BSW Rehabilitation enjoyed 32% better gait symmetry compared with conventional programs. These outcomes support a shift from pilot budgeting to multi-site procurement. Industrial engineering teams in automobile and logistics facilities are piggy-backing on medical proof points, sourcing upper-body units to curb shoulder injuries and overtime payments.

High Capital Expenditure and Maintenance Costs Limiting Widespread Commercial Adoption

List prices range between USD 50,000-150,000, with service contracts adding USD 5,000-10,000 yearly, figures that strain smaller hospitals and mid-sized factories. The return-on-investment case hinges on preventing workplace injuries and shortening inpatient stays; however, constraints in emerging markets, where public budgets dominate spend, suppress unit volumes. Vendors are subsequently pivoting to leasing and robotics-as-a-service models that charge per usage hour, but these schemes remain nascent outside North America.

Other drivers and restraints analyzed in the detailed report include:

- Advancement in Robotic Technologies

- Favorable Reimbursement Frameworks Emerging in Developed Healthcare Markets

- Risks Involved with Using Exoskeletons Due to Vague Safety Guidelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The powered category captured 84.22% revenue in 2024, benefitting from motor-driven assistance that supports complex gait, stair ascent, and load carriage. It forms the backbone of most rehabilitation protocols and defense prototypes. However, passive devices, such as spring-based braces that offload lower-back strain, are recording a 22.82% CAGR to 2030 as logistics firms deploy hundreds of units in distribution centers. In 2025, peer-reviewed trials confirmed passive lumbar exoskeletons could cut back-extensor activity by 35% during carton handling, bringing them into occupational health budgets. Hybrid designs are emerging: powered hip joints paired with passive spinal supports lower both energy demand and component count, pointing to a mid-term convergence of the two classes.

The cost delta remains pronounced, with passive models retailing for one-third of powered alternatives. Manufacturers leverage advanced composites and elastomeric torsion elements to maintain assistance torque while trimming weight, placing passive lines within stringent procurement caps. As sensors embed directly onto brace frames, passive units are starting to feed ergonomic analytics to enterprise dashboards, closing the data gap with their powered counterparts. These uptake catalysts position the passive cohort to absorb incremental share from budget-sensitive buyers, even as powered systems sustain utility in high-acuity therapy.

Mobile exoskeletons held 68.34% of 2024 global revenue, reflecting their ability to traverse varied terrain and therefore address daily-living independence, warehouse tasks, and infantry maneuvers. Battery innovations lifted operating time to 6-8 hours, 40% longer than older models, supporting full clinic shifts and continuous production cycles. Users cite psychological benefits from eye-level interaction, a factor boosting adherence in home settings. Stationary systems, although smaller today, clock a 24.23% CAGR through 2030 because they deliver high-repeatability training in constrained motor-learning phases. Medical centers position them on gantry frames where therapists fine-tune gait kinematics via augmented-reality overlays, a configuration that accelerates neuroplasticity interventions.

Interchangeable modules allow a single chassis to switch between treadmill-mounted and overground modes, blurring the mobile-stationary divide. This flexibility appeals to mid-sized rehabilitation chains seeking to amortize capital across varied patient cohorts. Vendors are consequently shipping plug-and-play add-ons, such as handrails, harnesses, and treadmill plates, that install without specialist tooling, reducing downtime.

The Exoskeleton Market Report is Segmented by Technology (Powered / Active and Passive), Mobility (Mobile and Stationary), Body Part (Upper Limb, Lower Limb, and Full Body), Component (Hardware, Software and Services), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 40.33% of 2024 exoskeleton market revenue, supported by a mature payer ecosystem and deep venture funding. Medicare's fixed reimbursement rate of USD 91,032 dramatically improved affordability for spinal cord injury patients, lifting device shipments to Veterans Health Administration centers and Level I trauma hospitals. U.S. industrial employers-including automotive assemblers and parcel logistics firms pilot upper-body exosuits to stem injury downtime, and these projects are progressively converting into framework agreements. Canada follows similar trajectories, with provincial workers' compensation boards underwriting pilot programs that assess claims reduction and productivity gains.

Europe ranks second in revenue, anchored by Germany, France, and the Nordics. Germany's BARMER coverage decision encompassed 8.5 million beneficiaries, bringing reimbursed access to nearly half of statutory-insured citizens. Research collaborations thrive under Horizon Europe grants, linking robotics labs in Aachen, Zurich, and Genoa with clinical partners. Industrial uptake is buoyed by strict ergonomic directives; automotive OEMs in Bavaria deploy shoulder-support exoskeletons on production lines to comply with musculoskeletal exposure thresholds. The evolving ExosCE certification path eases product rollout by combining medical and machinery directives into one dossier, shortening approval timelines.

Asia-Pacific is the fastest-growing cluster at 23.78% CAGR through 2030. South Korean manufacturer WIRobotics launched the WIM gait-assist robot in the United States in 2025, highlighting the region's export ambitions mobihealthnews.com. China's Made-in-China 2025 agenda attaches grant incentives to rehabilitation robotics factories, while Japan's ageing demographics funnel public R&D to assistive mobility. Despite pockets of reimbursement uncertainty, industrial customers in electronics and shipbuilding sectors procure lumbar-support suits en masse to curb compensation claims. Public-private partnerships in Singapore and Australia focus on urban ageing initiatives that integrate exoskeletons with smart-home ecosystems.

- CYBERDYNE Inc.

- Ekso Bionics

- Ottobock

- Parker Hannifin

- Sarcos Technology & Robotics Corp.

- ReWalk Robotics

- BIONIK Laboratories Corp.

- Bioservo Technologies

- Gogoa Mobility Robots

- Rehab-Robotics Co. Ltd.

- Bioness Inc. (Bioventus)

- B-Temia

- Myomo Inc.

- Lockheed Martin Corp.

- Seismic Powered Clothing

- RB3D SAS

- Wearable Robotics SRL

- Fourier Intelligence

- Panasonic Corp. (Atoun)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Prevalence of Neuro-Musculoskeletal Disorders Requiring Advanced Assistive Rehabilitation Solutions

- 4.2.2 Growing Demand from Healthcare Sector for Robotic Rehabilitation

- 4.2.3 Advancement in Robotic Technologies

- 4.2.4 Favorable Reimbursement Frameworks Emerging in Developed Healthcare Markets

- 4.2.5 AI Integration in Control Systems

- 4.2.6 Lightweight Materials and Battery Efficiency Gains

- 4.3 Market Restraints

- 4.3.1 High Capital Expenditure and Maintenance Costs Limiting Widespread Commercial Adoption

- 4.3.2 Risks Involved with Using Exoskeletons Due to Vague Safety Guidelines

- 4.3.3 Limited Clinical Evidence on Long-Term Efficacy Affecting Payer & Clinician Acceptance

- 4.3.4 Limited Insurance Coverage in Emerging Markets

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Technology

- 5.1.1 Powered / Active

- 5.1.2 Passive

- 5.2 By Mobility

- 5.2.1 Mobile

- 5.2.2 Stationary

- 5.3 By Body Part

- 5.3.1 Upper Limb

- 5.3.1.1 Hand Exoskeleton

- 5.3.1.2 Arm Exoskeleton

- 5.3.2 Lower Limb

- 5.3.2.1 Hip

- 5.3.2.2 Knee

- 5.3.2.3 Ankle & Foot

- 5.3.3 Full Body

- 5.3.1 Upper Limb

- 5.4 By Component

- 5.4.1 Hardware

- 5.4.2 Software

- 5.4.3 Services

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 CYBERDYNE Inc.

- 6.3.2 Ekso Bionics Holdings Inc.

- 6.3.3 Ottobock SE & Co. KGaA

- 6.3.4 Parker Hannifin Corp.

- 6.3.5 Sarcos Technology & Robotics Corp.

- 6.3.6 ReWalk Robotics Ltd.

- 6.3.7 BIONIK Laboratories Corp.

- 6.3.8 Bioservo Technologies AB

- 6.3.9 Gogoa Mobility Robots

- 6.3.10 Rehab-Robotics Co. Ltd.

- 6.3.11 Bioness Inc. (Bioventus)

- 6.3.12 B-Temia Inc.

- 6.3.13 Myomo Inc.

- 6.3.14 Lockheed Martin Corp.

- 6.3.15 Seismic Powered Clothing

- 6.3.16 RB3D SAS

- 6.3.17 Wearable Robotics SRL

- 6.3.18 Fourier Intelligence

- 6.3.19 Panasonic Corp. (Atoun)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment