|

市场调查报告书

商品编码

1842422

收益週期管理:市场占有率分析、产业趋势与统计、收益预测(2025-2030)Revenue Cycle Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

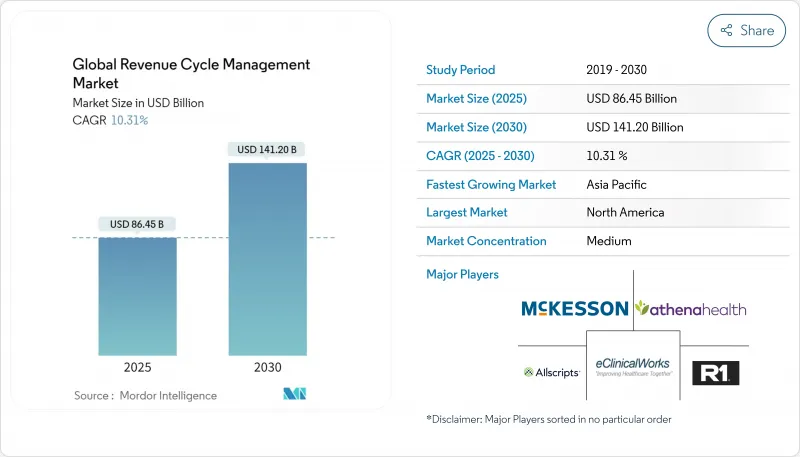

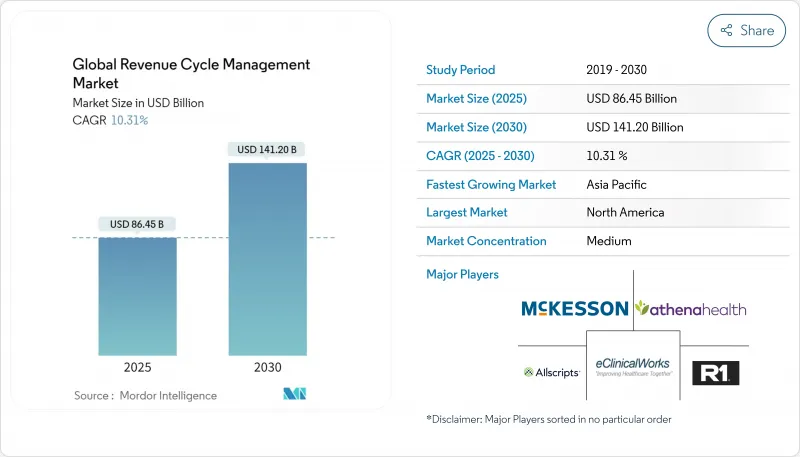

预计到 2025 年收益週期管理市场价值将达到 864.5 亿美元,到 2030 年将达到 1,412 亿美元,复合年增长率为 10.31%。

不断增长的管理费用、向基于价值的报销的转变以及人工智慧的日益普及,这些因素共同推动了自动化收益获取成为董事会层面的当务之急。医疗保健组织正在优先考虑将临床文件、不可否认性和现金流分析整合到单一工作区中的整合平台,以减少手动工作并缩短应收帐款处理时间。虽然北美医疗保健系统继续支持需求,但亚太地区的私人保险渗透率正在扩大新的可寻址量。虽然由于持续的人手不足,服务外包仍然盛行,但云端软体的快速发展标誌着从密集型模式逐渐转向可随患者数量扩展的基于订阅的架构。这导致能够将预测分析和合规性更新组合成单一可互通堆迭的技术供应商之间的竞争加剧。

全球收益周期管理市场趋势与洞察

全球转向基于价值和基于绩效的报销

基于价值的医疗服务如今已融入与主要付款方签订的合约中,并透过将付款与临床品质而非服务量挂钩,重塑了收益週期管理行业的优先事项。采用负责任医疗框架的医疗系统已累积节省超过7亿美元,证明了当组织掌握品质指标时,其财务效益是存在的。为此,RCM平台正在整合人口健康仪錶板,将临床结果转化为报销触发机制,使医疗服务提供者能够在医疗服务缺口成为支付风险之前对其进行追踪。这种演变隐含地要求来自不同来源的标准化数据,这使得互通性具有新的商业性紧迫性。

日益增加的行政成本压力推动 RCM 自动化

由于行政管理成本占美国医疗支出的20-25%,高阶主管认为自动化是遏止成本上升的有效途径。人工智慧机器人可以在几秒钟内完成常规预核准交易,而这些交易以前需要人工审核,工作人员还需要数天的后续交易。一些医院自实施以来,结算时间缩短了50%。这些改进使结算负责人能够专注于复杂的异常处理,而计划外的生产力提升则使经营团队能够专注于面向患者的任务。重要的是,已实现入院到结算工作流程自动化的医疗保健机构报告称,由于省去了繁琐且容易出错的资料输入工作,员工满意度有所提高。

异质且不断变化的付款人规则和编码标准

拒付率仍维持在10-15%左右,证明了付款人更新编辑和政策的速度之快。医疗保健集团的领导者预计,2024年的拒付率将进一步上升,这促使各机构投资于持续的程式码更新和预测性清理器,以便在提交之前标记潜在的拒付情况。领先的医疗系统拥有专门的团队来调查拒付的根本原因,而编码员和临床医生之间的迭代回馈循环缩短了补救週期。人工智慧主导的规则引擎能够从付款人汇款中自我学习,目前正在大幅减少附件请求数量并降低管理开销。

报告中分析的其他驱动因素和限制因素

- 数位健康加速发展,互通性成为全球要求

- 医疗保健消费化,病患帐单日益复杂

- 熟练编码和 RCM 人才持续短缺

細項分析

到2024年,服务将占收益週期管理市场规模的78%,这反映出在人才短缺的情况下,供应商更倾向于提供承包的专业服务。客户将外包视为快速获得更高回报的途径,因为服务合作伙伴将承担技术投资和持续流程改善的责任。即便如此,由于订阅定价将成本与使用量挂钩,并消除了大规模资本投资的障碍,云端基础的软体将超过整体市场成长率,到2030年复合年增长率将达到14.2%。

采用云端收入週期管理 (RCM) 套件的医院通常会发现更多好处,例如即时仪表板可查看医生文件的缺失,从而能够在单一班次内提供纠正指导。随着时间的推移,这些分析功能会鼓励内部团队从交易营运转型为策略性收入完整性角色。这两种成长模式表明,将内部监督与选择性外包相结合的混合营运模式将变得更加普遍,从而为软体公司和服务机构在收益週期管理行业拓展更多机会。

到2024年,本地收益周期管理将占据58.5%的市场。然而,由于灵活的基础设施、自动升级以及与付款人API的轻鬆集成,到2030年,云端采用率将以14.2%的复合年增长率增长。在HFMA技术采用曲线上不断上升的组织经常将云端迁移视为週期时间指标开始下降的曲折点。云端供应商可以更快地实施监管程式码集,因为他们可以集中推送更新,而无需依赖客户IT团队。

随着网路安全框架的日趋成熟,异地正在逐渐消退,财务长们也注意到,可预测的订阅费用简化了多年的预算编制。这种成本透明度是加速整体收益週期管理市场成长的隐形驱动力,因为曾经只有大型学术中心才能使用的功能,现在也可供中型医院使用。

区域分析

北美占据了当前收益週期管理市场的48%,这得益于其复杂的多付款人框架和悠久的EHR实施历史。供应商整合非常活跃,89亿美元的R1 RCM交易显示私募股权相信规模化的流程专业知识将显着改善现金流。 46%的美国医院报告称已在其收益週期工作流程中使用某种形式的人工智慧。有趣的是,加拿大的单一付款人系统仍然需要RCM工具进行省际对账,这表明付款人的复杂性并非成长的唯一驱动力。该地区的报销透明度创造了丰富的数据集,使供应商能够比其他地区更快地完善机器学习模型,从而巩固了北美的领导地位。

预计到 2030 年,亚太地区的复合年增长率将达到 16.4%,成为收益週期管理行业中成长最快的地区,这得益于政府支持的数位医疗投资和中阶对私人保险日益增长的需求。在印度,国家健康保险的扩大正在使计费基础设施标准化,而儘早实现计费数位化的医院可以缩短结算时间。中国三线城市的医院越来越多地寻求基于云端的收入週期管理 (RCM),以超越传统的客户端-伺服器模式,这与其他行业的智慧型手机普及曲线如出一辙。在日本等市场,资料本地化法律决定了託管架构,因此,本地合作伙伴对于获得监管部门的核准至关重要。这种调适需求为全球供应商设置了进入壁垒,但也为那些抢先的企业带来了丰厚回报。

在欧洲,收益週期管理市场份额仍然很高,儘管由于许多国家采用集中计费标准的单一付款人模式,成长已经稳定下来。然而,GDPR的要求正在推动医院走向具有严格加密和审核追踪的云端环境,促使拥有丰富隐私工程经验的美国和欧洲软体公司之间建立合资企业。在英国,国家医疗服务体系(NHS)重新将重点放在减少积压案件上,这导致人们对类似于私人RCM的人工智慧调度和理赔分类功能的兴趣日益浓厚。同时,私人医院连锁正在推动中东/非洲和南美的早期需求,这些新兴地区一旦法律规范成熟,就具备加速采用的基础。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 全球医疗收费转向基于价值和与结果挂钩

- 管理成本压力不断增加推动 RCM 自动化

- 数位医疗加速发展,全球要求互通性

- 医疗保健消费化增加了病患帐单的复杂性

- 云端原生医疗 IT 平台和 SaaS 经济的兴起

- 市场限制

- 多样化且不断变化的付款人法规和编码标准

- 熟练编码和 RCM 人才持续短缺

- 受保护的健康资讯的资料隐私和网路安全风险

- 前期投资高,变更管理障碍多

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争的激烈程度

第五章市场规模与成长预测(价值,美元)

- 按组件

- 软体

- 整合 RCM 套件

- 独立模组

- 服务

- RCM外包BPO

- 咨询与培训

- 软体

- 按部署

- 云端基础

- 本地部署

- 按功能

- 理赔与拒赔管理

- 医疗编码和计费

- 电子健康记录(整合RCM)

- 临床文件改进(CDI)

- 保险资格验证

- 其他功能(患者安排、价格透明度)

- 按最终用户

- 医院

- 医院和诊所

- 门诊手术中心

- 检验中心

- 诊断影像中心

- 其他最终用户

- 按专业

- 放射学

- 肿瘤学

- 循环系统

- 病理

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第六章 竞争态势

- 市场集中度

- 市占率分析

- 公司简介

- Optum(UnitedHealth Group)

- R1 RCM Inc.

- Conifer Health Solutions

- Cognizant(Trizetto)

- athenahealth

- Oracle Cerner

- Epic Systems

- Veradigm LLC

- Solventum

- GeBBS Healthcare

- MCKESSON Corporation

- Accenture Health

- Infosys Limited

- Med-Metrix

- Access Healthcare

- Conduent

- eClinicalWorks

- XIFIN

- Quest Diagnostics RCM

- HCLTech Healthcare

第七章 市场机会与未来展望

The revenue cycle management market is valued at USD 86.45 billion in 2025, is set to expand at a 10.31% CAGR, and should reach USD 141.20 billion by 2030.

Expanding administrative overhead, the pivot toward value-based reimbursement, and widening AI adoption are combining to make automated revenue capture a board-level necessity. Providers are prioritizing integrated platforms that merge clinical documentation, denial avoidance, and cash-flow analytics in one workspace, cutting manual touches and shortening days in accounts receivable. North American health systems continue to anchor demand, yet rising private-insurance penetration in Asia-Pacific is unlocking sizable new addressable volumes. Service outsourcing remains prevalent because staffing gaps persist, but cloud software's rapid acceleration signals a gradual hand-off from labor-heavy models to subscription-based architectures that scale with patient volumes. The net effect is heightened competition among technology vendors that can wrap predictive analytics and compliance updates into a single, interoperable stack.

Global Revenue Cycle Management Market Trends and Insights

Global Shift Toward Value-Based & Outcome-Linked Reimbursement

Value-based care, now written into major payer contracts, is recasting Revenue Cycle Management industry priorities by tying payment to clinical quality rather than service volume. Health systems that adopted accountable care frameworks recorded collective savings in excess of USD 700 million, proving that financial upside exists once organizations master quality metrics. As a response, RCM platforms are integrating population-health dashboards that translate clinical outcomes into reimbursement triggers, ensuring that providers track gaps in care before payment risk materializes. That evolution implicitly demands normalized data from disparate sources, giving interoperability a new commercial urgency.

Escalating Administrative Cost Pressure Prompting RCM Automation

Administrative expenses routinely consume 20 - 25 % of United States healthcare spending, so executives view automation as a proven lever to arrest cost inflation. AI-enabled bots now complete routine prior authorization transactions in seconds, a process that previously required manual review and days of staff follow-up, and some hospitals have documented a 50 % reduction in claim preparation time after deployment. These improvements free billing professionals to concentrate on complex exceptions, generating an unplanned productivity dividend that management can redeploy toward patient-facing roles. Importantly, institutions that automate admit-through-cash workflows report heightened staff satisfaction because tedious, error-prone data entry tasks disappear.

Heterogeneous, Ever-Changing Payer Rules and Coding Standards

Denial rates hovering around 10 - 15 % illustrate how quickly payer edits and policy updates can overturn otherwise compliant claims. Medical group leaders confirm that denials climbed further in 2024, so organizations are investing in continuous code updates and predictive scrubbers that flag likely rejections before submission. Forward-looking health systems allocate dedicated teams to mine denial root causes, and iterative feedback loops between coders and clinicians are shortening correction cycles. AI-driven rules engines that self-learn from payer remittances now deliver measurable reductions in attachment requests, cutting administrative overhead.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated Digital-Health & Interoperability Mandates Worldwide

- Consumerization of Healthcare Increasing Patient Billing Complexity

- Persistent Shortage of Skilled Coding and RCM Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services hold 78% market share of the Revenue Cycle Management market size in 2024, mirroring providers' preference for turnkey expertise amid staffing shortages. Clients view outsourcing as an immediate route to improved collections because service partners assume responsibility for technology investment and continuous process refinement. Nevertheless, cloud-based software is posting a 14.2% CAGR through 2030, more than the overall market growth, because subscription pricing aligns cost with usage and removes large capital hurdles.

Hospitals that implement cloud RCM suites often discover secondary benefits, such as real-time dashboards that spotlight physician documentation gaps, enabling corrective coaching within a single shift. Over time, these analytics capabilities encourage in-house teams to transition from transactional tasks to strategic revenue integrity roles. The dual-track growth pattern implies that hybrid operating models, combining retained oversight with selective outsourcing-will become common, broadening the Revenue Cycle Management industry opportunity for both software firms and service bureaus.

On-premise deployments retain 58.5% Revenue Cycle Management market share in 2024, reflecting earlier capital purchases and residual security concerns. Yet cloud installations are expanding at a 14.2% CAGR to 2030, propelled by flexible infrastructure, automatic upgrades, and easier integration with payer APIs. Organizations that climb the HFMA technology-adoption curve frequently cite cloud moves as the inflection point when cycle-time metrics start to trend downward. One observed benefit is faster implementation of regulatory code sets, since cloud vendors push updates centrally instead of relying on client IT teams.

As cyber-security frameworks mature, board-level resistance to off-site hosting is receding, and CFOs note that predictable subscription fees simplify multi-year budgeting. This cost transparency acts as a hidden accelerant to overall Revenue Cycle Management market size growth because even mid-tier hospitals can now access features that were once reserved for large academic centers.

The Revenue Cycle Management Market is Segments by Component (Software [Integrated RCM Suite, and More], and Services [Outsourced RCM BPO, and More]), Deployment (Cloud-Based and On-Premise), Function (Claims & Denial Management, and More) End User (Hospitals, Laboratories, and More), Specialty (Radiology, Oncology, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands 48% of the current Revenue Cycle Management market size, supported by complex multi-payer frameworks and a long history of EHR adoption. Vendor consolidation is active, evidenced by R1 RCM's USD 8.9 billion transaction, signaling private-equity conviction that scaled process expertise can deliver outsized cash-flow gains. Hospitals in the United States report that 46% already utilize some form of AI in revenue-cycle workflows. Interestingly, Canadian single-payer structures still require RCM tools for provincial reconciliation, revealing that payer complexity is not the only growth driver. The region's reimbursement transparency mandates create rich data sets, enabling vendors to refine machine-learning models faster than elsewhere, reinforcing North American leadership.

Asia-Pacific is forecast to post a 16.4% CAGR through 2030, the fastest regional pace in the Revenue Cycle Management industry, propelled by government-backed digital-health investments and swelling middle-class demand for private insurance. India's national insurance expansion is catalyzing standardized claims infrastructure, and hospitals that digitize billing early capture accelerated settlement times. China's tier-three city hospitals increasingly seek cloud RCM to leapfrog older client-server models, mirroring the smartphone adoption curve seen in other industries. Local partners remain critical for navigating regulatory approval in markets such as Japan, where data localization laws shape hosting architecture. This need for contextual adaptation presents a barrier to entry for global vendors but simultaneously offers high returns to firms that secure first-mover standing.

Europe retains meaningful Revenue Cycle Management market share, although growth is steadier because many countries operate single-payer models that centralize claim standards. Even so, GDPR requirements push hospitals toward cloud environments with strict encryption and audit trails, spurring joint ventures between U.S. and European software firms experienced in privacy engineering. In the United Kingdom, the National Health Service's renewed focus on backlog reduction has elevated interest in AI scheduling and billing triage features that resemble private-sector RCM. Meanwhile, Middle East, Africa, and South America represent emerging territories where private hospital chains drive early demand, setting a foundation for accelerated adoption once regulatory frameworks mature.

- Optum (UnitedHealth Group)

- R1 RCM

- Conifer Health Solutions

- Cognizant (Trizetto)

- athenahealth

- Oracle

- Epic Systems

- Veradigm

- Solventum

- GeBBS Healthcare

- MCKESSON Corporation

- Accenture Health

- Infosys

- Med-Metrix

- Access Healthcare

- Conduent

- eClinicalWorks

- XIFIN

- Quest Diagnostics RCM

- HCLTech Healthcare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global Shift Toward Value-Based & Outcome-Linked Reimbursement

- 4.2.2 Escalating Administrative Cost Pressure Prompting RCM Automation

- 4.2.3 Accelerated Digital-Health & Interoperability Mandates Worldwide

- 4.2.4 Consumerization of Healthcare Increasing Patient Billing Complexity

- 4.2.5 Proliferation of Cloud-Native Health IT Platforms & SaaS Economics

- 4.3 Market Restraints

- 4.3.1 Heterogeneous, Ever-Changing Payer Rules and Coding Standards

- 4.3.2 Persistent Shortage of Skilled Coding & RCM Talent

- 4.3.3 Data-Privacy & Cyber-security Risks Handling Protected Health Info

- 4.3.4 High Up-Front Investment and Change-Management Barriers

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Component

- 5.1.1 Software

- 5.1.1.1 Integrated RCM Suite

- 5.1.1.2 Standalone Modules

- 5.1.2 Services

- 5.1.2.1 Outsourced RCM BPO

- 5.1.2.2 Consulting & Training

- 5.1.1 Software

- 5.2 By Deployment

- 5.2.1 Cloud-based

- 5.2.2 On-premise

- 5.3 By Function

- 5.3.1 Claims & Denial Management

- 5.3.2 Medical Coding & Billing

- 5.3.3 Electronic Health Record (Integrated RCM)

- 5.3.4 Clinical Documentation Improvement (CDI)

- 5.3.5 Insurance Eligibility Verification

- 5.3.6 Other Functions (Patient Scheduling, Pricing Transparency)

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Physician Offices & Clinics

- 5.4.3 Ambulatory Surgery Centers

- 5.4.4 Laboratories

- 5.4.5 Diagnostic Imaging Centers

- 5.4.6 Other End Users

- 5.5 By Specialty

- 5.5.1 Radiology

- 5.5.2 Oncology

- 5.5.3 Cardiology

- 5.5.4 Pathology

- 5.5.5 Multi-specialty & Others

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Optum (UnitedHealth Group)

- 6.3.2 R1 RCM Inc.

- 6.3.3 Conifer Health Solutions

- 6.3.4 Cognizant (Trizetto)

- 6.3.5 athenahealth

- 6.3.6 Oracle Cerner

- 6.3.7 Epic Systems

- 6.3.8 Veradigm LLC

- 6.3.9 Solventum

- 6.3.10 GeBBS Healthcare

- 6.3.11 MCKESSON Corporation

- 6.3.12 Accenture Health

- 6.3.13 Infosys Limited

- 6.3.14 Med-Metrix

- 6.3.15 Access Healthcare

- 6.3.16 Conduent

- 6.3.17 eClinicalWorks

- 6.3.18 XIFIN

- 6.3.19 Quest Diagnostics RCM

- 6.3.20 HCLTech Healthcare

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment