|

市场调查报告书

商品编码

1821516

收益管理的全球市场(~2035年):各元件类型,各解决方案类型,各服务形式,各部署方式,各产业类型,各地区,产业趋势,预测Revenue Management Market, Till 2035: Distribution by Type of Component, Type of Solution, Type of Service, Deployment Mode, Type of Vertical, and Geographical Regions: Industry Trends and Global Forecasts |

||||||

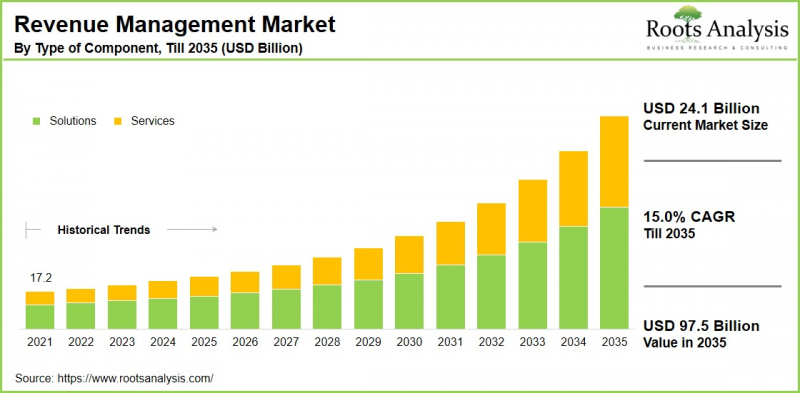

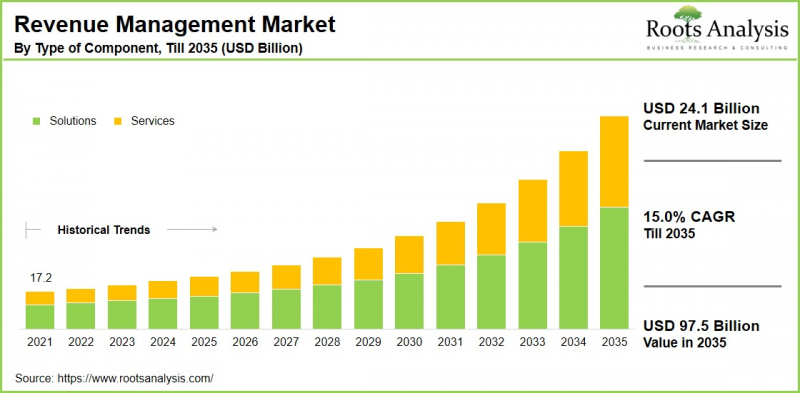

预计到 2035 年,全球收益管理市场规模将从目前的 241 亿美元增长至 975 亿美元,预测期内的复合年增长率为 15.0%。

收益管理市场:成长与趋势

收益管理透过数据分析来预测需求、调整定价并识别有价值的客户群,从而推动业务成功。越来越多的公司采用收益管理解决方案来评估过去的销售数据、预测未来趋势并做出明智的定价决策。这种方法使公司能够在优化营运的同时提高利润。随着对客户行为的理解需求日益增长,公司依靠这种软体在快速变化的市场中保持竞争力。

随着创新技术和全球化的兴起,收益管理已成为现代商业策略的关键。收益管理系统 (RMS) 使用客製化定价演算法,使公司能够采用动态定价技术并改善库存管理,同时降低营运费用。

饭店、航空、零售和电信等固定成本高、边际成本低的产业在收益管理领域占据主导地位。这些行业依靠定价分析和库存管理来提高获利能力。

收益管理,尤其是在旅馆业,可以提高入住率和客户获取成本等关键指标,从而促进收益管理市场的成长。航空公司利用收益管理来改善动态定价和座位库存,以最大限度地提高每次航班的收入。

即时分析的重要性日益提升,加速了这些工具的普及,为快速决策提供了切实可行的洞察。人工智慧、机器学习和数位转型在收益管理中的整合等突出趋势正在改变收益优化功能。人工智慧和机器学习能够分析大量资料集,预测客户行为并即时调整定价,而基于云端的收益管理解决方案则具备可扩展性和适应性。因此,受这些因素影响,预期收益管理市场在预测期内将大幅成长。

本报告研究了全球收益管理市场,并提供了市场规模估算、机会分析、竞争格局和公司概况等资讯。

目录

章节1 报告概要

第1章 序文

第2章 调查手法

第3章 市场动态

第4章 宏观经济指标

章节2 定性知识和见解

第5章 摘要整理

第6章 简介

第7章 法规Scenario

第8章 供应链的分析

章节3 市场概要

第9章 主要收益管理解决方案/服务供应商的市场格局

第10章 企业的竞争力的分析

第11章 Start-Ups生态系统的分析

章节4 企业简介主要的成功策略

第12章 企业简介

- 章概要

- Accenture

- Amdocs

- Cerillion

- Ericsson

- Fiserv

- Huwaei

- IdeaS

- Infor

- Netcracker

- Optiva

- Oracle

- RIA Advisory

- Sabre

- SAP

- Workday

- Zuora

第13章 重要的胜利策略

章节5 市场趋势

第14章 市场趋势

第15章 专利分析

第16章 近几年的发展

章节6 市场预测和机会分析

第17章 市场影响的分析

第18章 全球收益管理市场

第19章 市场机会:各元件类型

第20章 市场机会:各解决方案类型

第21章 市场机会:各服务形式

第22章 市场机会:各部署方式

第23章 市场机会:各产业类型

第24章 市场机会:各地区

章节7 :地理地区的市场机会的分析

第25章 市场机会分析:北美

第26章 市场机会分析:欧洲

第27章 市场机会分析:亚太地区

第28章 市场机会分析:中东·非洲

第29章 市场机会分析:南美

章节8 策略性工具

第30章 波特的五力分析

第31章 个案研究:改革收益管理,关注未满足的需求与关键缓解措施策略

章节9 其他的执行见解

第32章 结论

章节10 附录

Revenue Management Market Overview

As per Roots Analysis, the global revenue management market size is estimated to grow from USD 24.1 billion in the current year to USD 97.5 billion by 2035, at a CAGR of 15.0% during the forecast period, till 2035.

The opportunity for revenue management market has been distributed across the following segments:

Type of Component

- Solutions

- Services

Type of Solution

- Billing and Payment

- Channel Management

- Price Management

- Revenue Assurance and Fraud Management

Type of Service

- Managed Services

- Professional Services

Deployment Mode

- Cloud

- On-Premises

Type of Vertical

- Telecom

- Hospitality

- Healthcare

- BFSI

- Retail & E-Commerce

- Public

- Utilities

- Others

Geographical Regions

- North America

- US

- Canada

- Europe

- UK

- France

- Germany

- Spain

- Netherlands

- Rest of Europe

- Asia

- India

- China

- Australia

- Singapore

- South Korea

- Rest of Asia-Pacific

- Latin America

- Brazil

- Colombia

- Mexico

- Rest of Latin America

- Middle East and North Africa

- UAE

- Israel

- Saudi Arabia

- Rest of Middle East and Africa

Revenue Management Market: Growth and Trends

Revenue management promotes business success through the use of data analytics to anticipate demand, adjust pricing, and identify valuable customer segments. More businesses are adopting revenue management solutions to evaluate past sales data, forecast future trends, and make informed pricing choices. This technique allows companies to enhance profits while optimizing their operations. As the need to grasp customer behavior increases, organizations depend on this software to maintain a competitive edge in rapidly changing markets.

The emergence of innovative technologies and globalization has made revenue management an essential aspect of contemporary business strategies. Revenue management systems (RMS) enable businesses to employ dynamic pricing techniques and improve inventory management, using customized pricing algorithms that increase revenue while lowering operational expenses.

Sectors characterized by high fixed costs and low marginal costs, such as hospitality, airlines, retail, and telecommunications, dominate the revenue management landscape. These industries rely on pricing analysis and inventory management to enhance profitability.

Specifically, revenue management in hospitality enhances vital metrics like occupancy rates and customer acquisition expenses, contributing to the growth of the revenue management market. Airlines utilize revenue management to refine dynamic pricing and seat inventory, maximizing revenue for each flight.

The increasing importance of real-time analytics has driven the accelerated adoption of these tools, offering actionable insights for prompt decision-making. Prominent trends, including the integration of AI in revenue management, machine learning, and digital transformation, are transforming the revenue optimization sector. AI and machine learning analyze extensive datasets to forecast customer behavior and fine-tune pricing in real time, while cloud-based revenue management solutions provide scalability and adaptability. As a result, owing to the above mentioned factors, the revenue management market is expected to grow significantly during the forecast period.

Revenue Management Market: Key Segments

Market Share by Type of Component

Based on type of component, the global revenue management market is segmented into solutions and services. According to our estimates, currently, the solutions segment captures the majority of the market share.

However, the services segment is expected to grow at a higher CAGR throughout the forecast period. This can be attributed to the rising complexities associated with revenue management systems (RMS), including the difficulties of integrating omnichannel payment options and overseeing advanced platforms with limited internal expertise.

Market Share by Type of Solution

Based on type of solution, the global revenue management market is segmented into billing and payment, channel management, price management, and revenue assurance and fraud management. According to our estimates, currently, the billing and payments segment captures the majority of the market share.

However, the revenue assurance and fraud management segment is expected to grow at a higher CAGR throughout the forecast period. This can be attributed to the increasing occurrence of revenue loss and fraudulent activities.

Market Share by Type of Service

Based on type of service, the global revenue management market is segmented into managed services and professional services. According to our estimates, currently, the managed services segment captures the majority of the market share. This can be attributed to the intricate nature of IT environments, which necessitates specialized skills that organizations frequently do not possess in-house.

The rising emphasis on cybersecurity and compliance also promotes the demand for outsourced security solutions and risk management expertise that managed service providers (MSPs) offer. Additionally, the increasing adoption of cloud technologies significantly contributes, as businesses utilize cloud-based services for scalability, cost-effectiveness, and flexibility, often depending on MSPs to efficiently manage their cloud infrastructure.

Market Share by Deployment Mode

Based on deployment mode, the global revenue management market is segmented into cloud and on-premises. According to our estimates, currently, the cloud segment captures the majority of the market share, owing to its scalability and flexibility. Additionally, cloud-based solutions offer companies easy implementation, allowing them to adjust their operations in response to demand fluctuations.

Market Share by Type of Vertical

Based on type of vertical, the global revenue management market is segmented into telecom, hospitality, Healthcare, BFSI, Retail & E-commerce, public, utilities and other industries. According to our estimates, currently, the telecom segment captures the majority of the market share, due to its foundational role in quantum key distribution.

This dominance is due to several factors, including the rapidly increasing number of mobile and internet users, the challenges of managing a wide range of evolving telecom services (such as IoT and 5G), and the growing demand for effective billing and revenue assurance solutions to mitigate revenue loss.

Market Share by Geographical Regions

Based on geographical regions, the revenue management market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, North America captures the majority share of the market. However, the market in Asia-Pacific region is expected to experience a relatively higher compound annual growth rate (CAGR) during the forecast period, driven by the swift digital transformation and an emphasis on embracing advanced technologies such as automation.

Example Players in Revenue Management Market

- Accenture

- Amdoc

- Cerillion

- Ericsson

- Fiserv

- Huawei

- IdeaS

- Infor

- Netcracker

- Optiva

- Oracle

- RIA Advisory

- Sabre

- SAP

- Workday

- Zuora

Revenue Management Market: Research Coverage

The report on the revenue management market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the revenue management market, focusing on key market segments, including [A] type of component, [B] type of solution, [C] type of service, [D] deployment mode, [E] type of vertical, and [F] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the revenue management market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the revenue management market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] revenue management portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the revenue management industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the revenue management domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the revenue management market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the revenue management market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the revenue management market.

Key Questions Answered in this Report

- How many companies are currently engaged in revenue management market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross-Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Overview of Revenue Management

- 6.2. Key Components

- 6.3. Need of Revenue Management Solutions and Services

- 6.4. Real-world Impact of Revenue Management Solutions

- 6.5. Future Outlook

7. REGULATORY SCENARIO

8. SUPPLY CHAIN ANALYSIS

- 8.1. Chapter Overview

- 8.2. Core Components of Supply Chain Analysis

- 8.2.1. Key Steps under Primary Activities

- 8.2.2. Key Steps under Support Activities

- 8.3. Processes and Stakeholders Involved

- 8.4. Key Challenges and Mitigation Strategies

SECTION III: MARKET OVERVIEW

9. LEADING REVENUE MANAGEMENT SOLUTION / SERVICE PROVIDERS MARKET LANDSCAPE

- 9.1. Methodology and Key Parameters

- 9.2. Analysis by Year of Establishment

- 9.3. Analysis by Company Size

- 9.4. Analysis by Location of Headquarters

- 9.5. Analysis by Type of Solutions

- 9.6. Analysis by Type of Services

- 9.7. Analysis by Deployment Mode

- 9.8. Analysis by Type of Vertical

10. COMPANY COMPETITIVENESS ANALYSIS

- 10.1. Methodology and Scoring Criteria

- 10.2. Comparison of Leading Revenue Management Solution / Service Providers

- 10.3. Leading Revenue Management Solution / Service Providers

11. STARTUP ECOSYSTEM ANALYSIS

- 11.1. Methodology and Key Parameters

- 11.2. Analysis by Year of Establishment

- 11.3. Analysis by Company Size

- 11.4. Analysis by Location of Headquarters

- 11.5. Analysis by Type of Solutions

- 11.6. Analysis by Type of Services

- 11.7. Analysis by Deployment Mode

- 11.8. Analysis by Type of Vertical

SECTION IV: COMPANY PROFILES AND KEY WINNING STRATEGIES

12. COMPANY PROFILES

- 12.1. Chapter Overview

- 12.2. Accenture

- 12.2.1. Company Details

- 12.2.2. Revenue Management Portfolio

- 12.2.3. Initiatives in the Revenue Management Market

- 12.2.4. Future Outlook

- 12.3. Amdocs

- 12.4. Cerillion

- 12.5. Ericsson

- 12.6. Fiserv

- 12.7. Huwaei

- 12.8. IdeaS

- 12.9. Infor

- 12.10. Netcracker

- 12.11. Optiva

- 12.12. Oracle

- 12.13. RIA Advisory

- 12.14. Sabre

- 12.15. SAP

- 12.16. Workday

- 12.17. Zuora

13. KEY WINNING STRATEGIES

SECTION V: MARKET TRENDS

14. MARKET TRENDS

- 14.1. Overview of Ongoing Trends

- 14.2. Insights on Emerging Trends

15. PATENT ANALYSIS

- 15.1. Scope and Methodology

- 15.2. Key Parameters

- 15.3. Revenue Management: Patent Analysis

- 15.3.1. Analysis by Application Year

- 15.3.2. Analysis by Type of Patent

- 15.3.3. Analysis by Patent Jurisdiction

- 15.3.4. Analysis by Patent Publication Year

- 15.3.5. Analysis by Type of Patent and Patent Publication Year

- 15.3.6. Analysis by Type of Applicant

- 15.3.7. Leading Players: Analysis by Number of Patents

- 15.3.8. Leading Individual Patent Assignees: Analysis by Number of Patents

- 15.3.9. Analysis by Patent Age

- 15.3.10. Patent Valuation

16. RECENT DEVELOPMENTS

- 16.1. Chapter Overview

- 16.2. Revenue Management: Recent Partnerships and Collaborations

- 16.2.1. Analysis by Month of Partnership

- 16.2.2. Analysis by Type of Partnership

- 16.2.3. Analysis by Type of Solution

- 16.2.4. Analysis by Type of Vertical Targeted

- 16.2.5. Intercontinental and Intracontinental Deals

- 16.2. Revenue Management: Recent Funding and Investments

- 16.2.1. Analysis by Funding Activity

- 16.2.2. Analysis by Type of Funding

- 16.2.3. Analysis by Purpose of Funding

- 16.2.4. Most Active Investors: Analysis by Funding Instances

SECTION VI: MARKET FORECAST AND OPPORTUNITY ANALYSIS

17. MARKET IMPACT ANALYSIS

- 17.1. Market Drivers

- 17.2. Market Restraints

- 17.3. Market Opportunities

- 17.4. Market Challenges

18. GLOBAL REVENUE MANAGEMENT MARKET

- 18.1. Key Assumptions and Methodology

- 18.2. Global Revenue Management Market, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.1. Scenario Analysis

- 18.2.1.1. Conservative Scenario

- 18.2.1.2. Optimistic Scenario

- 18.2.1. Scenario Analysis

- 18.3. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF COMPONENT

- 19.1. Key Assumptions and Methodology

- 19.2. Revenue Management Market, by Type of Component

- 19.2.1. Revenue Management Market for Solutions, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.2.2. Revenue Management Market for Services, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

20. MARKET OPPORTUNITIES BASED ON TYPE OF SOLUTION

- 20.1. Key Assumptions and Methodology

- 20.2. Revenue Management Market, by Type of Solution

- 20.2.1. Revenue Management Market for Billing and Payment, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2.2. Revenue Management Market for Channel Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2.3. Revenue Management Market for Price Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2.4. Revenue Management Market for Revenue Assurance and Fraud Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

21. MARKET OPPORTUNITIES BASED ON TYPE OF SERVICE

- 21.1. Key Assumptions and Methodology

- 21.2. Revenue Management Market, by Type of Service

- 21.2.1. Revenue Management Market for Managed Services, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.2.2. Revenue Management Market for Professional Services, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

22. MARKET OPPORTUNITIES BASED ON DEPLOYMENT MODE

- 22.1. Key Assumptions and Methodology

- 22.2. Revenue Management Market, by Deployment Mode

- 22.2.1. Revenue Management Market for Cloud, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.2.2. Revenue Management Market for On-premises, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

23. MARKET OPPORTUNITIES BASED ON TYPE OF VERTICAL

- 23.1. Key Assumptions and Methodology

- 23.2. Revenue Management Market, by Type of Vertical

- 22.2.1. Revenue Management Market for Telecom, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.2. Revenue Management Market for Hospitality, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.3. Revenue Management Market for Healthcare, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.4. Revenue Management Market for BFSI, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.5. Revenue Management Market for Retail and E-commerce, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.6. Revenue Management Market for Public, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.7. Revenue Management Market for Utilities, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.8. Revenue Management Market for Other Industries, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

24. MARKET OPPORTUNITIES BASED ON GEOGRAPHICAL REGIONS

- 24.1. Key Assumptions and Methodology

- 24.2. Revenue Management Market, by Geographical Regions

- 24.2.1. Revenue Management Market in North America, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 24.2.2. Revenue Management Market in Europe, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 24.2.3. Revenue Management Market in Asia-Pacific, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 24.2.4. Revenue Management Market in Middle East and Africa, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 24.2.5. Revenue Management Market in Latin America, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 24.3. Revenue Management Market, by Geographical Regions: Market Dynamics Assessment

- 24.3.1. Market Movement Analysis

- 24.3.2. Penetration Growth (P-G) Matrix

SECTION VII: MARKET OPPORTUNITY ANALYSIS WITHIN GEOGRAPHICAL REGIONS**

25. MARKET OPPORTUNITY ANALYSIS: NORTH AMERICA

- 25.1. Revenue Management Market in North America: Distribution by Type of Component

- 25.1.1. Revenue Management Market in North America for Solution, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.1.2. Revenue Management Market in North America for Service, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.2. Revenue Management Market in North America: Distribution by Type of Solution

- 25.2.1. Revenue Management Market in North America for Billing and Payment, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.2.2. Revenue Management Market in North America for Channel Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.2.3. Revenue Management Market in North America for Price Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.2.4. Revenue Management Market in North America for Risk Assurance and Financial Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.3. Revenue Management Market in North America: Distribution by Type of Service

- 25.3.1. Revenue Management Market in North America for Managed Services, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.3.2. Revenue Management Market in North America for Professional Services, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.4. Revenue Management Market in North America: Distribution by Deployment Mode

- 25.4.1. Revenue Management Market in North America for Cloud, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.4.2. Revenue Management Market in North America for On-premises, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.5. Revenue Management Market in North America: Distribution by Type of Vertical

- 25.5.1. Revenue Management Market in North America for Telecom, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.5.2. Revenue Management Market in North America for Hospitality, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.5.3. Revenue Management Market in North America for Healthcare, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.5.4. Revenue Management Market in North America for BFSI, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.5.5. Revenue Management Market in North America for Retail and E-commerce, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.5.6. Revenue Management Market in North America for Utilities, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.5.7. Revenue Management Market in North America for Public, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 25.5.8. Revenue Management Market in North America for Other Industries, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

26. MARKET OPPORTUNITY ANALYSIS: EUROPE

- 26.1. Revenue Management Market in Europe: Distribution by Type of Component

- 26.1.1. Revenue Management Market in Europe for Solution, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.1.2. Revenue Management Market in Europe for Service, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.2. Revenue Management Market in Europe: Distribution by Type of Solution

- 26.2.1. Revenue Management Market in Europe for Billing and Payment, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.2.2. Revenue Management Market in Europe for Channel Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.2.3. Revenue Management Market in Europe for Price Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.2.4. Revenue Management Market in Europe for Risk Assurance and Financial Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.3. Revenue Management Market in Europe: Distribution by Type of Service

- 26.3.1. Revenue Management Market in Europe for Managed Services, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.3.2. Revenue Management Market in Europe for Professional Services, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.4. Revenue Management Market in Europe: Distribution by Deployment Mode

- 26.4.1. Revenue Management Market in Europe for Cloud, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.4.2. Revenue Management Market in Europe for On-premises, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.5. Revenue Management Market in Europe: Distribution by Type of Vertical

- 26.5.1. Revenue Management Market in Europe for Telecom, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.5.2. Revenue Management Market in Europe for Hospitality, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.5.3. Revenue Management Market in Europe for Healthcare, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.5.4. Revenue Management Market in Europe for BFSI, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.5.5. Revenue Management Market in Europe for Retail and E-commerce, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.5.6. Revenue Management Market in Europe for Utilities, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.5.7. Revenue Management Market in Europe for Public, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 26.5.8. Revenue Management Market in Europe for Other Industries, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

27. MARKET OPPORTUNITY ANALYSIS: ASIA PACIFIC

- 27.1. Revenue Management Market in Asia Pacific: Distribution by Type of Component

- 27.1.1. Revenue Management Market in Asia Pacific for Solution, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.1.2. Revenue Management Market in Asia Pacific for Service, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.2. Revenue Management Market in Asia Pacific: Distribution by Type of Solution

- 27.2.1. Revenue Management Market in Asia Pacific for Billing and Payment, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.2.2. Revenue Management Market in Asia Pacific for Channel Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.2.3. Revenue Management Market in Asia Pacific for Price Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.2.4. Revenue Management Market in Asia Pacific for Risk Assurance and Financial Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.3. Revenue Management Market in Asia Pacific: Distribution by Type of Service

- 27.3.1. Revenue Management Market in Asia Pacific for Managed Services, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.3.2. Revenue Management Market in Asia Pacific for Professional Services, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.4. Revenue Management Market in Asia Pacific: Distribution by Deployment Mode

- 27.4.1. Revenue Management Market in Asia Pacific for Cloud, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.4.2. Revenue Management Market in Asia Pacific for On-premises, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.5. Revenue Management Market in Asia Pacific: Distribution by Type of Vertical

- 27.5.1. Revenue Management Market in Asia Pacific for Telecom, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.5.2. Revenue Management Market in Asia Pacific for Hospitality, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.5.3. Revenue Management Market in Asia Pacific for Healthcare, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.5.4. Revenue Management Market in Asia Pacific for BFSI, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.5.5. Revenue Management Market in Asia Pacific for Retail and E-commerce, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.5.6. Revenue Management Market in Asia Pacific for Utilities, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.5.7. Revenue Management Market in Asia Pacific for Public, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 27.5.8. Revenue Management Market in Asia Pacific for Other Industries, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

28. MARKET OPPORTUNITY ANALYSIS: MIDDLE EAST AND AFRICA

- 28.1. Revenue Management Market in Middle East and Africa: Distribution by Type of Component

- 28.1.1. Revenue Management Market in Middle East and Africa for Solution, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.1.2. Revenue Management Market in Middle East and Africa for Service, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.2. Revenue Management Market in Middle East and Africa: Distribution by Type of Solution

- 28.2.1. Revenue Management Market in Middle East and Africa for Billing and Payment, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.2.2. Revenue Management Market in Middle East and Africa for Channel Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.2.3. Revenue Management Market in Middle East and Africa for Price Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.2.4. Revenue Management Market in Middle East and Africa for Risk Assurance and Financial Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.3. Revenue Management Market in Middle East and Africa: Distribution by Type of Service

- 28.3.1. Revenue Management Market in Middle East and Africa for Managed Services, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.3.2. Revenue Management Market in Middle East and Africa for Professional Services, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.4. Revenue Management Market in Middle East and Africa: Distribution by Deployment Mode

- 28.4.1. Revenue Management Market in Middle East and Africa for Cloud, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.4.2. Revenue Management Market in Middle East and Africa for On-premises, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.5. Revenue Management Market in Middle East and Africa: Distribution by Type of Vertical

- 28.5.1. Revenue Management Market in Middle East and Africa for Telecom, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.5.2. Revenue Management Market in Middle East and Africa for Hospitality, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.5.3. Revenue Management Market in Middle East and Africa for Healthcare, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.5.4. Revenue Management Market in Middle East and Africa for BFSI, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.5.5. Revenue Management Market in Middle East and Africa for Retail and E-commerce, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.5.6. Revenue Management Market in Middle East and Africa for Utilities, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.5.7. Revenue Management Market in Middle East and Africa for Public, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.5.8. Revenue Management Market in Middle East and Africa for Other Industries, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

29. MARKET OPPORTUNITY ANALYSIS: LATIN AMERICA

- 29.1. Revenue Management Market in Latin America: Distribution by Type of Component

- 29.1.1. Revenue Management Market in Latin America for Solution, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.1.2. Revenue Management Market in Latin America for Service, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.2. Revenue Management Market in Latin America: Distribution by Type of Solution

- 29.2.1. Revenue Management Market in Latin America for Billing and Payment, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.2.2. Revenue Management Market in Latin America for Channel Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.2.3. Revenue Management Market in Latin America for Price Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.2.4. Revenue Management Market in Latin America for Risk Assurance and Financial Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.3. Revenue Management Market in Latin America: Distribution by Type of Service

- 29.3.1. Revenue Management Market in Latin America for Managed Services, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.3.2. Revenue Management Market in Latin America for Professional Services, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.4. Revenue Management Market in Latin America: Distribution by Deployment Mode

- 29.4.1. Revenue Management Market in Latin America for Cloud, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.4.2. Revenue Management Market in Latin America for On-premises, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.5. Revenue Management Market in Latin America: Distribution by Type of Vertical

- 29.5.1. Revenue Management Market in Latin America for Telecom, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.5.2. Revenue Management Market in Latin America for Hospitality, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.5.3. Revenue Management Market in Latin America for Healthcare, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.5.4. Revenue Management Market in Latin America for BFSI, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.5.5. Revenue Management Market in Latin America for Retail and E-commerce, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.5.6. Revenue Management Market in Latin America for Utilities, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.5.7. Revenue Management Market in Latin America for Public, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.5.8. Revenue Management Market in Latin America for Other Industries, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- *Detailed information on Section VII is available in the Excel Data Packs shared along with the report**

SECTION VIII: STRATEGIC TOOLS

30. PORTER'S FIVE FORCES ANALYSIS

- 30.1. Chapter Overview

- 30.2. Significance of Porter's Five Forces Analysis

- 30.3. Porter's Five Forces

- 30.3.1. Methodology

- 30.3.2. Threats to New Entrants

- 30.3.3. Bargaining Power of Buyers

- 30.3.4. Bargaining Power of RMS Solution Providers

- 30.3.5. Threat of Substitute Products

- 30.3.6. Rivalry among Existing Competitors

- 30.3.7. Harvey Ball Analysis

31. CASE STUDY: REVENUE MANAGEMENT REINVENTED: FOCUS ON UNMET NEEDS AND KEY MITIGATION STRATEGIES

- 31.1. Evolution of Revenue Management

- 31.2. Key Historical Events in the Revenue Management Market

- 31.3. Key Verticals Targeted by Revenue Management Solution / Service Providers

- 31.4. Current Revenue Management Practices across Key Industries

- 31.4.1. BFSI Industry

- 31.4.2. Healthcare Industry

- 31.4.3. Hospitality Industry

- 31.4.4. Retail and E-commerce Industry

- 31.4.5. Public Industry

- 31.4.6. Utilities Industry

- 31.4.7. Logistics and Transportation Industry

- 31.4.8. IT and Tele-communication Industry