|

市场调查报告书

商品编码

1842468

电致变色材料:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Electrochromic Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

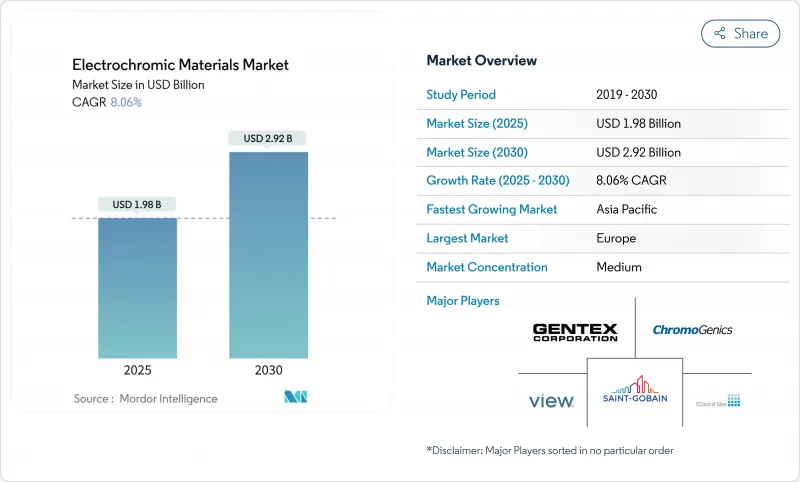

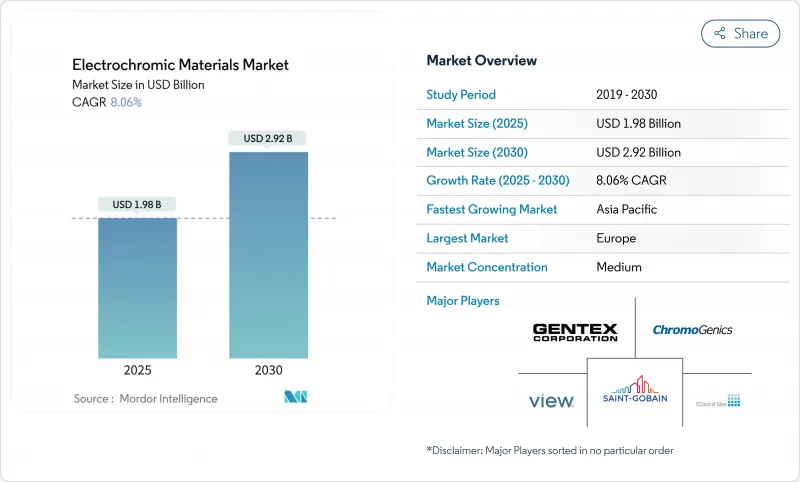

预计2025年电致变色材料市场规模将达19.8亿美元,2030年将成长至29.2亿美元,复合年增长率为8.06%。

这一增长反映了强制性能源效率法规的出台、设备成本的下降以及在建筑、汽车和飞机领域的快速商业化。动态嵌装玻璃可将建筑的冷却负载降低高达39.5%,这使得电致变色材料市场成为净零能耗建筑的理想解决方案。成本方面的突破已将智慧窗户的价格从每平方公尺180-250美元降至每平方公尺80美元,从而刺激了更广泛的改装应用。欧洲凭藉严格的碳排放法规引领产业发展,而亚太地区则在都市化和基础设施项目的推动下经历快速成长。产品创新着重于氧化钨的耐久性和聚合物的柔韧性,而竞争对手则专注于扩大低成本生产规模并提高循环稳定性。

全球电致变色材料市场趋势与洞察

能源效率法规加速智慧窗户的普及

加州2025年能源法规要求窗墙比超过一定标准的建筑必须使用有色嵌装玻璃,为美国其他州的评估提供了合规模板。 2024年国际节能规范收紧了U係数限值和空气洩漏阈值,指导建筑师采用动态嵌装玻璃。上海2024年光反射率评级指南使亚太地区法规与欧洲标准一致。亚洲开发银行强调,建筑效率对于快速发展的城市脱碳至关重要,并支持电致变色材料市场的持续需求。 ASHRAE标准90.1-2022明确了一条更倾向于电致变色玻璃而非静态玻璃的围护结构合规路径。

汽车对自动防眩后视镜和全景天窗的需求

镜泰公司计划在2024年出货超过5,000万台调光设备,并在2025年国际消费性电子展(CES 2025)上推出了一款以薄膜为基础的天窗。安比莱特(Ambilight)的第二代全车黑色智慧薄膜可实现40倍调光,并具有高红外线阻隔性,可满足电动车的散热需求。现代的奈米冷却薄膜可将车内温度降低10°C,且不会影响视野,与高阶电动车的电致变色嵌装玻璃相得益彰。汽车温度控管要求和感测器整合趋势正在将电致变色材料市场拓展到后视镜以外的领域。

单价高于传统镀膜玻璃

传统电致变色窗户的成本为每平方公尺180-250美元,阻碍了其大规模应用。预计2024年推出的无电极设备将使成本降至每平方公尺80美元,与Low-E低辐射镀膜玻璃相当。规模化生产仍然受限于利基市场的产量,但汽车产业的产量显示其经济效益正在改善。

細項分析

金属氧化物将占2024年营收的49.42%,凭藉氧化钨久经考验的稳定性,支撑电致变色材料市场。此细分市场的循环耐久性在60°C下超过10万次循环,钛插层WO3可达到85%的光调製深度和95.61%的可逆性。受PEDOT和聚苯胺柔韧性驱动的导电聚合物非常适合可捲曲显示器,复合年增长率为10.69%。掺杂MoS2的PEDOT可达到70.28%的色深,缩小了效能差距。儘管面临环保审查,紫罗兰碱和普鲁士蓝仍继续满足利基色彩切换需求。

金属氧化物製造商正转向与聚合物薄膜相容的薄涂层,而聚合物创新者则正在探索混合有机金属迭层,以提高抗紫外线性能。氧化铟锡靶材的供应链集中在亚洲,而高纯度三氧化钨的供应链集中在欧洲,凸显了材料安全在电致变色材料市场的优先地位。

到2024年,智慧窗户将维持46.04%的市场份额,并将继续成为电致变色材料市场的支柱,因为成本下降推动了计划,以平衡日照和太阳能发电。得益于适用于物流标籤、零售货架和曲面汽车仪錶板的印刷双稳态薄膜,小型显示器的复合年增长率达到11.02%。

后视镜业务保持稳定收益,尤其是在北美轻型汽车领域。薄膜作为汽车改装件,其市场份额正在不断扩大,而镀膜技术则能够实现平板玻璃无法实现的客製化形状。设备的多功能性使供应商免受单一细分市场週期性波动的影响,并有助于生产计画。

区域分析

由于2030年碳减排目标的约束性以及绿色改造计划补贴,欧洲在2024年维持了33.15%的销售额。瑞典能源署向Chromogenics公司提供了450万美元的贷款,显示了对该国电致变色生产能力的政策信心。在德国復兴信贷银行(KfW)的能源效率激励措施下,德国在智慧窗户安装方面处于主导,而英国正在扩大公共建筑智慧窗户的补贴。南欧地区对用于文物维修中眩光控制的高遮光需求日益增长。

亚太地区是成长最快的地区,复合年增长率达11.07%,这得益于中国积极的都市化和光污染监管。上海2024年的反光法规凸显了监管的收紧。日本充分利用其汽车天窗模组供应链,而韩国显示器巨头则共同开发柔性电致变色仪錶板。政府的净零排放蓝图和高电费加速了投资回报的计算,巩固了电致变色材料市场的发展轨迹。

在北美,加州法规和航太需求推动了电致变色技术的普及。波音和空中巴士的生产线采用了Gentex调光窗,推动了材料销售的稳定成长。联邦商业建筑节能维修税额扣抵正在获得大力支持。南美、中东和非洲地区仍在发展中,但海湾地区的机场和饭店计划正在试验能够管理沙漠太阳能增益的动态建筑幕墙,这预示着中期商机。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 能源效率法规加速智慧窗户的普及

- 汽车对自动防眩后视镜和全景天窗的需求

- 航太航太窗户升级,减轻重量并减少眩光

- 用于改装现有建筑的电致变色建筑幕墙膜

- 增加政府国防费用

- 市场限制

- 与传统镀膜玻璃相比,单价更高

- 关于循环稳定性和耐久性的问题

- 暂停执行紫精废弃物。

- 价值链分析

- 五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 依产品类型

- 紫罗兰碱

- 导电聚合物

- 金属氧化物

- 普鲁士蓝

- 其他产品类型

- 依设备类型

- 智慧窗户

- 镜子

- 展示

- 薄膜和涂层

- 其他设备

- 按外形规格

- 玻璃基板

- 聚合物薄膜

- 墨水和颜料

- 按最终用户产业

- 车

- 电气和电子

- 建筑/施工

- 航太/国防

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Changzhou YAPU new material Co., Ltd.

- ChromoGenics

- Crown Electrokinetics Corp.

- EControl-Glas GmbH & Co. KG

- GENTEX CORPORATION

- KIBING GROUP

- Kinestral Technologies(Halio)

- Ningbo Miruo Electronic Technology Co., Ltd.

- Polytronix, Inc.

- Ricoh

- Saint-Gobain

- View Inc.

- Zhuhai Kaivo Optoelectronic Technology Co., Ltd.

第七章 市场机会与未来展望

The electrochromic materials market stands at USD 1.98 billion in 2025 and is projected to grow to USD 2.92 billion by 2030, advancing at an 8.06% CAGR.

The growth reflects mandatory energy-efficiency codes, falling device costs, and rapid product commercialization across buildings, vehicles, and aircraft. Dynamic glazing lowers building cooling loads by up to 39.5%, positioning the electrochromic materials market as a preferred solution for net-zero construction. Cost breakthroughs have cut smart-window prices to USD 80 per m2 from USD 180-250 per m2, stimulating wider retrofit adoption. Europe leads due to stringent carbon mandates, while Asia-Pacific grows fastest on urbanization and infrastructure programs. Product innovation pivots on tungsten-oxide durability and polymer flexibility, and competitive focus centers on scaling low-cost manufacturing and improving cycling stability.

Global Electrochromic Materials Market Trends and Insights

Energy-efficiency regulations accelerating smart-window adoption

California's 2025 Energy Code requires chromogenic glazing for buildings surpassing specific window-to-wall ratios, creating a compliance template that other U.S. states are evaluating. The 2024 International Energy Conservation Code tightens U-factor limits and air-leakage thresholds, steering architects toward dynamic glazing. Shanghai's 2024 guidelines on light-reflection assessments align Asia-Pacific rules with European norms sthj.sh.gov.cn. The Asian Development Bank underscores building efficiency as vital for decarbonizing rapidly growing cities, supporting sustained demand for the electrochromic materials market. ASHRAE Standard 90.1-2022 clarifies envelope compliance paths that favor electrochromic over static glass.

Automotive demand for auto-dimming mirrors and panoramic sunroofs

Gentex shipped more than 50 million dimmable devices in 2024 and introduced film-based sunroofs at CES 2025, reducing system weight and enabling larger panoramic apertures. Ambilight's second-generation whole-vehicle black smart film delivers 40X dimming with high infrared rejection, addressing electric-vehicle cooling requirements. Hyundai's nano-cooling film cuts cabin temperature by 10 °C without darkening the view, complementing electrochromic glazing in premium EVs. Automotive thermal management mandates and sensor-integration trends are expanding the electrochromic materials market far beyond rearview mirrors.

High unit cost versus conventional coated glass

Traditional electrochromic windows cost USD 180-250 per m2, deterring mass adoption. Electrode-free devices published in 2024 slash cost to USD 80 per m2, signaling a path to parity with low-E glass. Scaling remains limited by niche production volumes, but automotive volumes hint at improving economies.

Other drivers and restraints analyzed in the detailed report include:

- Aerospace window upgrades for weight and glare reduction

- Retro-fit electrochromic facade films for existing buildings

- Cycling-stability and durability challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metal oxides accounted for 49.42% of 2024 revenue, anchoring the electrochromic materials market with proven tungsten-oxide stability. The segment's cycling durability surpasses 100,000 cycles at 60 °C, and titanium-intercalated WO3 reaches 85% optical modulation and 95.61% reversibility. Conducting polymers trail yet post a 10.69% CAGR, propelled by PEDOT and polyaniline flexibility that suits rollable displays. MoS2-doped PEDOT achieves 70.28% coloration depth, narrowing performance gaps. Viologens and Prussian Blue serve niche color-switching needs despite environmental scrutiny.

Metal-oxide makers pivot toward thinner coatings compatible with polymer films, while polymer innovators explore hybrid metal-organic stacks to improve UV tolerance. Supply chains remain concentrated in Asia for indium-tin-oxide targets and in Europe for high-purity tungsten trioxide, underscoring material security priorities for the electrochromic materials market

Smart windows retained a 46.04% stake in 2024 and will stay the backbone of the electrochromic materials market as cost drops expand project pipelines. Building-integrated photovoltaics increasingly pair with electrochromic layers to balance daylight and solar power. Displays, though smaller, log an 11.02% CAGR thanks to printed, bi-stable films suited to logistics tags, retail shelving, and curved automotive clusters.

Mirrors remain a stable revenue stream, especially in North American light vehicles. Films gain share in retrofits, while coatings enable custom shapes that flat glass cannot address. Device diversity protects suppliers from single-segment cyclicality and smooths production planning.

The Electrochromic Materials Market Report Segments the Industry by Product Type (Viologens, Conducting Polymers, and More), Device Type (Smart Windows, Mirrors, and More), Form Factor (Glass Substrates, Polymer Films, and More), End-User Industry (Automotive, Electrical and Electronics, and More) and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe retained 33.15% of 2024 revenue, propelled by binding 2030 carbon targets and subsidies for green-renovation projects. Sweden's energy agency converted a USD 4.5 million loan to ChromoGenics, signaling policy trust in domestic electrochromic capacity. Germany leads installations under KfW efficiency incentives, while the United Kingdom extends smart-window grants in public buildings. Southern Europe adds high-insolation demand for glare control in heritage retrofits.

Asia-Pacific is the fastest-growing region at an 11.07% CAGR, underpinned by China's aggressive urbanization and light-pollution rules that favor adaptive facades. Shanghai's 2024 reflection code underscores regulatory tightening. Japan leverages automotive supply chains for sunroof modules, while South Korea's display majors co-develop flexible electrochromic dashboards. Government net-zero roadmaps and high electricity tariffs accelerate payback calculations, cementing the electrochromic materials market trajectory.

North America adopts through leading California codes and aerospace demand. Boeing and Airbus lines integrate Gentex dimmable windows, driving steady material off-take. Federal tax credits for commercial-building energy retrofits add momentum. South America and Middle East & Africa remain nascent; however, Gulf airports and hospitality projects trial dynamic facades to manage desert solar gain, signaling medium-term opportunities.

List of Companies Covered in this Report:

- Changzhou YAPU new material Co., Ltd.

- ChromoGenics

- Crown Electrokinetics Corp.

- EControl-Glas GmbH & Co. KG

- GENTEX CORPORATION

- KIBING GROUP

- Kinestral Technologies (Halio)

- Ningbo Miruo Electronic Technology Co., Ltd.

- Polytronix, Inc.

- Ricoh

- Saint-Gobain

- View Inc.

- Zhuhai Kaivo Optoelectronic Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Energy-efficiency regulations accelerating smart-window adoption

- 4.2.2 Automotive demand for auto-dimming mirrors and panoramic sunroofs

- 4.2.3 Aerospace window upgrades for weight and glare reduction

- 4.2.4 Retro-fit electrochromic facade films for existing buildings

- 4.2.5 Increase in defense spending by the government

- 4.3 Market Restraints

- 4.3.1 High unit cost versus conventional coated glass

- 4.3.2 Cycling-stability & durability challenges

- 4.3.3 Pending ecotoxicity norms on viologen waste streams

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products & Services

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Viologens

- 5.1.2 Conducting Polymers

- 5.1.3 Metal Oxides

- 5.1.4 Prussian Blue

- 5.1.5 Other Product Types

- 5.2 By Device Type

- 5.2.1 Smart Windows

- 5.2.2 Mirrors

- 5.2.3 Displays

- 5.2.4 Films & Coatings

- 5.2.5 Other Devices

- 5.3 By Form Factor

- 5.3.1 Glass Substrates

- 5.3.2 Polymer Films

- 5.3.3 Inks & Paints

- 5.4 By End-User Industry

- 5.4.1 Automotive

- 5.4.2 Electrical and Electronics

- 5.4.3 Building and Construction

- 5.4.4 Aerospace and Defense

- 5.4.5 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Changzhou YAPU new material Co., Ltd.

- 6.4.2 ChromoGenics

- 6.4.3 Crown Electrokinetics Corp.

- 6.4.4 EControl-Glas GmbH & Co. KG

- 6.4.5 GENTEX CORPORATION

- 6.4.6 KIBING GROUP

- 6.4.7 Kinestral Technologies (Halio)

- 6.4.8 Ningbo Miruo Electronic Technology Co., Ltd.

- 6.4.9 Polytronix, Inc.

- 6.4.10 Ricoh

- 6.4.11 Saint-Gobain

- 6.4.12 View Inc.

- 6.4.13 Zhuhai Kaivo Optoelectronic Technology Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment