|

市场调查报告书

商品编码

1842471

紧急照明:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Emergency Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

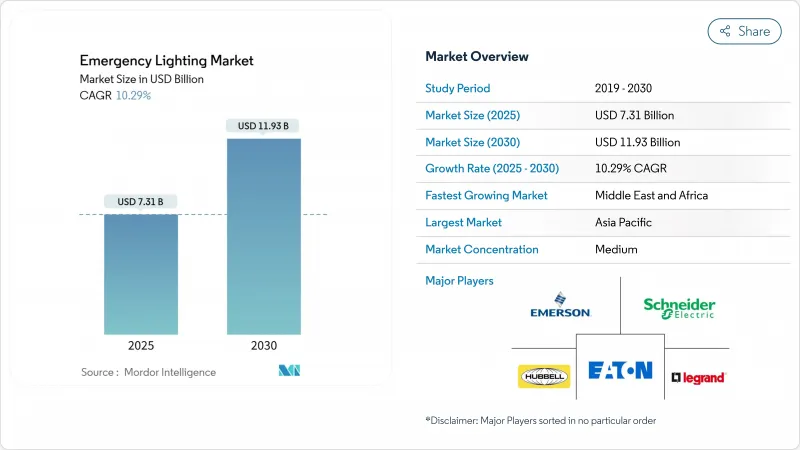

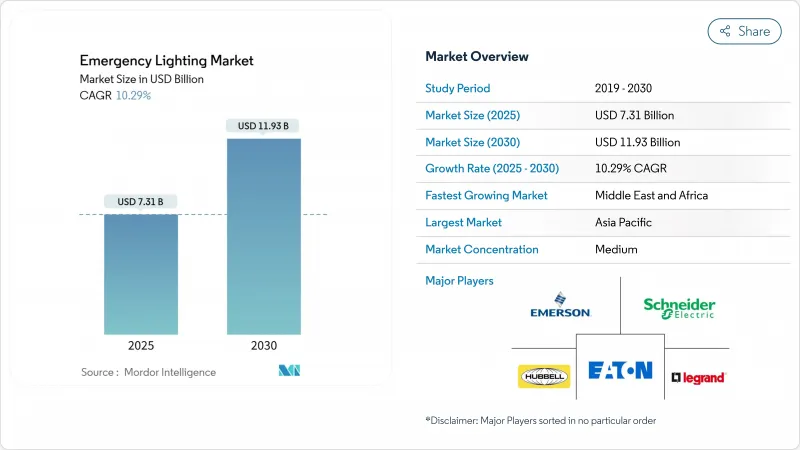

预计紧急照明市场规模到 2025 年将达到 73.1 亿美元,到 2030 年将达到 119.3 亿美元,复合年增长率为 10.29%。

这项扩张的驱动力在于严格的救生安全标准、与绿建筑目标紧密相关的维修,以及提供自动化测试和远端监控的智慧照明技术。 LED 照明仍然是最大的升级驱动力,而无线连接则降低了现有建筑的安装成本。隧道、机场和资料中心的基础设施投资将进一步刺激需求,尤其是在亚太地区和中东地区。将硬体与云端基础诊断相结合,使设施管理人员能够透过单一仪表板监控数千台设备的品牌将更具优势。

全球紧急照明市场趋势与洞察

欧洲公共基础设施中的智慧LED维修

欧洲各市政当局正以连网LED灯具取代萤光,将能耗降低高达50%,同时简化了合规报告流程。欧盟绿色交易正在推动公共建筑在2030年前实现碳中和,连网灯具会自动将测试日誌发送到设施的仪表板,从而减少维护工作。 Acuity Brands的STAR Gateway展示了自动化审核如何满足EN 50172标准要求,使智慧LED成为火车站、学校和政府办公室的预设选择。

美国IBC/NFPA 101 法规对高层建筑的要求更加严格

2024 年规范週期将 90 分钟的最低照度提升至 1.07 勒克斯,并将启动时间缩短至 10 秒。许多传统的镍镉设备无法通过更新的 UL924 测试,该测试现在要求「正常供电」讯号,迫使设备所有者在重新认证截止日期前更换设备。联邦设施正在透过指定整合控制设备的 LED 系统来施加额外压力,以满足 GSA 的能源目标。

医疗机构锂离子电池的消防安全问题

此前,由于发生热失控事件导致医院病房紧急疏散,医院推迟了锂离子电池的推广。美国国家消防协会 (NFPA) 正在起草 NFPA 800 标准,该标准将规范现场存储,但在最终版本出台之前,许多医疗网络仍在使用密封铅酸电池或镍氢电池组,儘管这些电池的使用寿命较短。美国提案的电池安全标准立法也进一步增加了不确定性。

細項分析

到2024年,LED设备将占据紧急照明市场份额的57.9%,到2030年,该细分市场的复合年增长率将达到9.8%。萤光管仍保留在老旧建筑中,但能源价格上涨和禁灯令正在加速其更换。利基高强度放电灯仍保留在石化带,这些地区更重视10kV的抗突波能力,而非功效。

智慧二极体,例如创新 的Universal CCT Select 灯管,现在具有内建感测器、内存、可选色温以及无需更换硬体即可调节眩光水平的功能。这种智慧与照明的融合意味着,即使无线通讯协定重塑了产品线路蓝图,LED 系统仍将是紧急照明市场的核心。

自足式电池组由于易于安装和模组化维护,到2024年将占据紧急照明市场规模的65.8%。然而,大型场馆更倾向于使用集中式电池组,以减少逐个房间检查电池的次数。资料中心就是这种转变的典型例子,其集中式机架确保所有灯具都能从单一集线器获得协调一致的电源和韧体更新。

伊顿的逆变器平台即将整合 Exertherm 热分析技术,重点在于预测预测性监控如何减少非计划性停机。锂离子电池组循环寿命较长,但在监管更加透明之前,医院和机场在关键区域仍会指定 VRLA 电池。自主性和集中式指挥之间的差异将决定整个预测期内的采购选择。

区域分析

亚太地区占紧急照明市场的34.2%,并受惠于孟买地铁3号线和北京副中心隧道等计划。地区政府正在利用亚洲开发银行等机构的优惠贷款为偏远农村地区提供电力,所有新建变电站和铁路支线都指定使用合规照明灯具。半导体供不应求使进度管理更加复杂,但深圳和槟城的PCB企业正在缩短国内供应商的前置作业时间。

随着卡达扩大其液化天然气出口枢纽,以及沙乌地阿拉伯「2030愿景」加速旅游走廊建设,预计到2030年,中东和非洲地区的复合年增长率将达到10.9%。海湾地区的海上钻机正在寻求能够承受盐雾和高达60°C高温的无铜铝製船体。在北海油田,Kalmit品牌的Protecta X装置的使用寿命已达12万小时,促使各国石油公司加大预算,以购买高端解决方案。

在北美和欧洲,更换週期正在趋于稳定。美国立法变化迫使高层建筑在重新认证期限内进行升级,推动了维修项目数量的增加。欧洲的翻新浪潮正在推动公共部门LED照明更换津贴,而德国则正在承保智慧控制,以减少其碳足迹,使其超越2030年的目标。成熟的买家青睐那些将分析仪錶板与硬体捆绑在一起,并将软体维护合约提升为紧急照明市场关键组成部分的供应商。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 欧洲公共基础设施对智慧互联 LED 紧急照明改装的需求不断增长

- 加强美国高层建筑规范(IBC/NFPA 101)中的居住者安全要求

- 中国和印度快速城市轨道隧道建设

- 北美资料中心热潮推动集中式电池供电照明

- ESG主导的绿建筑认证推动LED出口标誌

- 中东地区海上平台投资激增

- 市场限制

- 锂离子电池的防火安全问题限制了医疗机构的采用

- 自 2023 年起,IC 驱动器和光学元件的供应链将变得紧张

- 东协地区分散的本地标准使产品在地化变得复杂

- 可寻址无线系统的安装和测试成本高

- 生态系分析

- 监理展望

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测(金额)

- 按光源

- LED

- 萤光

- 高强度放电灯 (HID)

- 指导及其他

- 按供电系统

- 自足式/电池备援

- 中央电池(UPS)

- 混合/分散式

- 按安装类型

- 表面安装

- 嵌入式

- 吊挂式

- 可携式的

- 按产品

- 紧急出口标誌

- 独立紧急照明

- 组合单元

- 安定器和驱动器

- 透过通讯

- 有线

- 无线/物联网相容

- 按最终用户

- 商业 - 办公室

- 商业 - 酒店和零售

- 工业 - 製造和仓储

- 石油、天然气和采矿

- 住房

- 公共基础设施(机场、隧道、铁路)

- 医疗机构

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 北欧的

- 其他欧洲国家

- 南美洲

- 巴西

- 南美洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 东南亚

- 其他亚太地区

- 中东和非洲

- 中东

- 波湾合作理事会成员国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Acuity Brands Inc.

- Arrow Emergency Lighting Ltd.

- Beghelli SpA

- Cooper Lighting Solutions(Signify)

- Daisalux SAU

- Digital Lumens

- Diehl Stiftung and Co. KG

- Eaton Corp. plc

- Emerson Electric Co.

- Fulham Co. Inc.

- Hubbell Lighting Inc.

- Legrand SA

- Lutron Electronics Co.

- Myers Emergency Power Systems

- OSRAM GmbH

- Schneider Electric SE

- Signify NV(Philips Lighting)

- Taurac BV

- Thorlux Lighting

- Toshiba Corporation

- Tridonic GmbH

- Zumtobel Group AG

第七章 市场机会与未来展望

The emergency lighting market size reached USD 7.31 billion in 2025 and is on track to hit USD 11.93 billion by 2030, reflecting a 10.29% CAGR.

The expansion is propelled by stringent life-safety codes, retrofits tied to green-building targets, and smart-lighting technologies that provide automated testing and remote monitoring. LED conversion remains the largest upgrade driver, while wireless connectivity lowers installation costs for existing buildings. Infrastructure investments in tunnels, airports, and data centers further accelerate demand, especially in Asia-Pacific and the Middle East. Competitive dynamics favor brands that pair hardware with cloud-based diagnostics, allowing facility managers to oversee thousands of devices from a single dashboard.

Global Emergency Lighting Market Trends and Insights

Smart LED retrofits across European public infrastructure

European municipalities are replacing fluorescent fixtures with networked LED luminaires that cut energy consumption by up to 50% while simplifying compliance reporting. The EU Green Deal pushes public buildings to reach carbon neutrality by 2030, and connected fixtures automatically send test logs to facility dashboards, trimming maintenance labor. Acuity Brands' STAR Gateway illustrates how automated audits meet EN 50172 requirements, making smart LEDs the default choice for rail stations, schools, and government offices.

Stricter U.S. IBC/NFPA 101 mandates for high-rises

The 2024 code cycle raises minimum egress illuminance to 1.07 lux for 90 minutes and cuts activation time to 10 seconds. Many legacy nickel-cadmium units cannot pass updated UL 924 tests that now require a "normal-power present" signal, compelling owners to replace equipment ahead of recertification deadlines. Federal facilities add another layer of pressure by specifying LED systems with integrated controls to meet GSA energy targets.

Lithium-ion fire-safety concerns in healthcare facilities

Hospitals are delaying lithium-ion rollouts after thermal-runaway incidents that led to ward evacuations. NFPA is drafting NFPA 800 to govern on-site storage, but until finalized, many health networks stay with sealed lead-acid or nickel-metal hydride packs despite shorter life. Proposed U.S. legislation to codify national battery safety standards adds further uncertainty.

Other drivers and restraints analyzed in the detailed report include:

- Urban rail-tunnel build-outs in China and India

- Data-center boom adopting centralized battery systems

- Supply-chain crunch for IC drivers and optics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

LED devices controlled 57.9% of emergency lighting market share in 2024, and the segment is set to advance at a 9.8% CAGR through 2030. Fluorescent tubes linger in older buildings, yet rising energy tariffs and lamp bans speed replacement schedules. Niche high-intensity discharge units remain in petrochemical zones where 10 kV surge immunity takes precedence over efficacy.

Smart diodes now embed sensors, memory, and selectable color temperatures, exemplified by the Green Creative Universal CCT Select tube, which helps specifiers tailor glare levels without swapping hardware. This convergence of intelligence with illumination keeps LED systems as the anchor of the emergency lighting market, even as wireless protocols reshape product line roadmaps.

Self-contained packs represented 65.8% of emergency lighting market size in 2024, thanks to straightforward installation and unitized maintenance. Large venues, however, prefer central banks to cut room-by-room battery checks. Data centers exemplify the shift, with centralized racks ensuring all fixtures receive conditioned power and firmware updates from a single hub.

Eaton's inverter platforms, soon incorporating Exertherm thermal analytics, highlight how predictive monitoring reduces unscheduled downtime. Lithium-ion strings deliver long cycle life, yet hospitals and airports still specify VRLA in critical zones until regulatory clarity improves. The split between autonomy and central command will define procurement choices over the forecast horizon.

The Emergency Lighting Market Report is Segmented by Light Source (LED, Fluorescent, and More), Power System (Self-Contained/Battery-Backup, Central Battery (UPS), and More), Installation Type (Surface-Mounted, Recessed, and More), Product (Emergency Exit Signs, and More), Communication (Wired, and More), End-User (Residential, Industrial, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific, with a 34.2% stake in the emergency lighting market, benefits from megaprojects such as Mumbai Metro Line 3 and Beijing Sub-Center Tunnel. Regional governments use concessional loans from institutions like ADB to electrify outlying provinces, ensuring every new substation or rail spur specifies compliant luminaires. Semiconductor shortages make scheduling tricky, but local PCB houses in Shenzhen and Penang shorten lead times for domestic vendors.

The Middle East and Africa will register a 10.9% CAGR through 2030 as Qatar extends LNG export hubs and Saudi Vision 2030 accelerates tourism corridors. Offshore rigs in the Gulf demand copper-free aluminum bodies that survive salt-spray and 60 °C highs. Chalmit-branded Protecta X fixtures in North Sea fields validate 120,000-hour lifespans, encouraging NOCs to budget for premium solutions.

North America and Europe offer steady replacement cycles. U.S. code revisions now force high-rise landlords to upgrade within recertification windows, bolstering retrofit volumes. Europe's Renovation Wave funnels grants toward public-sector LED swaps, with Germany underwriting smart controls that shave carbon footprints ahead of 2030 targets. Mature buyers favor vendors that bundle analytics dashboards with hardware, elevating software maintenance contracts as a vital slice of the emergency lighting market.

- Acuity Brands Inc.

- Arrow Emergency Lighting Ltd.

- Beghelli SpA

- Cooper Lighting Solutions (Signify)

- Daisalux SAU

- Digital Lumens

- Diehl Stiftung and Co. KG

- Eaton Corp. plc

- Emerson Electric Co.

- Fulham Co. Inc.

- Hubbell Lighting Inc.

- Legrand SA

- Lutron Electronics Co.

- Myers Emergency Power Systems

- OSRAM GmbH

- Schneider Electric SE

- Signify NV (Philips Lighting)

- Taurac BV

- Thorlux Lighting

- Toshiba Corporation

- Tridonic GmbH

- Zumtobel Group AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing retrofit demand for smart-connected LED emergency luminaires across Europe-s public infrastructure

- 4.2.2 Stricter occupant-safety mandates in United States high-rise codes (IBC/NFPA 101)

- 4.2.3 Rapid urban rail-tunnel build-outs in China and India

- 4.2.4 Data-center boom driving centralized battery-backup lighting in North America

- 4.2.5 ESG-led green-building certifications fueling LED exit-sign upgrades

- 4.2.6 Surge in offshore platform investments in Middle East

- 4.3 Market Restraints

- 4.3.1 Lithium-ion battery fire-safety concerns limiting adoption in healthcare facilities

- 4.3.2 Supply-chain crunch for IC drivers and optics since 2023

- 4.3.3 Fragmented local standards complicating product localization in ASEAN

- 4.3.4 High installation and testing cost for addressable wireless systems

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Light Source

- 5.1.1 LED

- 5.1.2 Fluorescent Lamps

- 5.1.3 High-Intensity Discharge (HID)

- 5.1.4 Induction and Others

- 5.2 By Power System

- 5.2.1 Self-Contained/Battery-Backup

- 5.2.2 Central Battery (UPS)

- 5.2.3 Hybrid/Distributed

- 5.3 By Installation Type

- 5.3.1 Surface-Mounted

- 5.3.2 Recessed

- 5.3.3 Suspended

- 5.3.4 Portable

- 5.4 By Product

- 5.4.1 Emergency Exit Signs

- 5.4.2 Stand-alone Emergency Luminaires

- 5.4.3 Combo Units

- 5.4.4 Emergency Ballasts and Drivers

- 5.5 By Communication

- 5.5.1 Wired

- 5.5.2 Wireless/IoT-Enabled

- 5.6 By End-user

- 5.6.1 Commercial - Offices

- 5.6.2 Commercial - Hospitality and Retail

- 5.6.3 Industrial -Manufacturing and Warehouses

- 5.6.4 Oil and Gas/Mining

- 5.6.5 Residential

- 5.6.6 Public Infrastructure (Airports, Tunnels, Rail)

- 5.6.7 Healthcare Facilities

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Nordics

- 5.7.2.5 Rest of Europe

- 5.7.3 South America

- 5.7.3.1 Brazil

- 5.7.3.2 Rest of South America

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South-East Asia

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Gulf Cooperation Council Countries

- 5.7.5.1.2 Turkey

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Acuity Brands Inc.

- 6.4.2 Arrow Emergency Lighting Ltd.

- 6.4.3 Beghelli SpA

- 6.4.4 Cooper Lighting Solutions (Signify)

- 6.4.5 Daisalux SAU

- 6.4.6 Digital Lumens

- 6.4.7 Diehl Stiftung and Co. KG

- 6.4.8 Eaton Corp. plc

- 6.4.9 Emerson Electric Co.

- 6.4.10 Fulham Co. Inc.

- 6.4.11 Hubbell Lighting Inc.

- 6.4.12 Legrand SA

- 6.4.13 Lutron Electronics Co.

- 6.4.14 Myers Emergency Power Systems

- 6.4.15 OSRAM GmbH

- 6.4.16 Schneider Electric SE

- 6.4.17 Signify NV (Philips Lighting)

- 6.4.18 Taurac BV

- 6.4.19 Thorlux Lighting

- 6.4.20 Toshiba Corporation

- 6.4.21 Tridonic GmbH

- 6.4.22 Zumtobel Group AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment