|

市场调查报告书

商品编码

1842478

汽车引擎封装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Engine Encapsulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

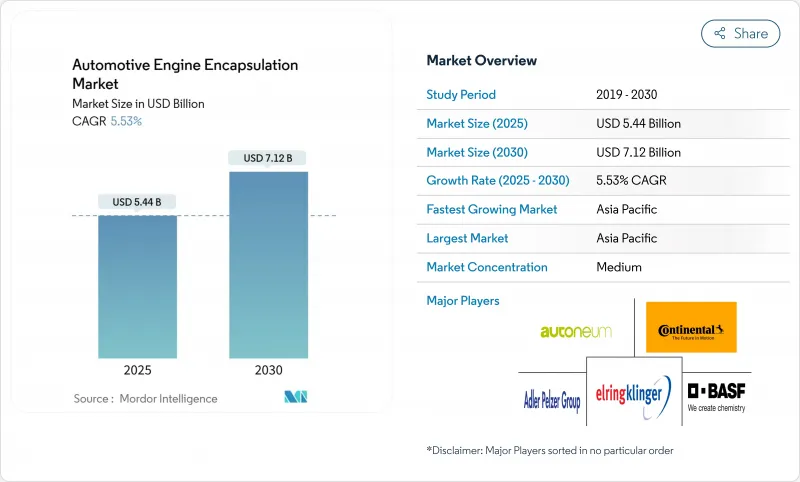

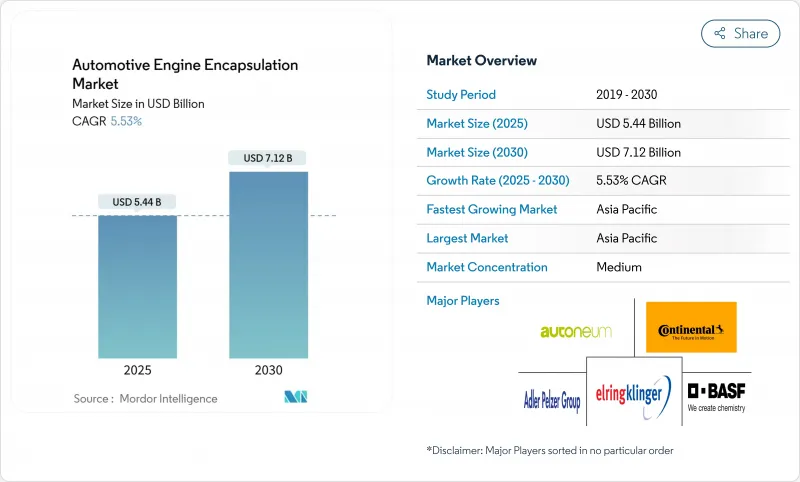

预计汽车引擎封装市场规模到 2025 年将达到 54.4 亿美元,到 2030 年将达到 71.2 亿美元,复合年增长率高达 5.53%。

随着欧7法规收紧冷启动二氧化碳排放限值、高端品牌追求图书馆般安静的座舱环境以及混合动力传动系统对先进引擎盖下热控制的需求不断增长,需求将加速成长。汽车製造商正在采用千兆乙太网路和数数位双胞胎设计环路,将结构、热和声学功能整合在一起,以减少零件数量并提高热效率。材料策略正转向可回收热塑性塑胶以满足循环经济的要求,而碳纤维成本的下降也为中等产量车型提供了轻量化的选择。随着汽车引擎封装市场从内燃机向电动转型,供应商正在与电池热专家合作,以弥合内燃机和电动车需求之间的差距。

全球汽车引擎封装市场趋势与洞察

欧7标准后冷启动二氧化碳排放目标更加严格

欧盟7标准将于2026年11月在新车型上生效,届时车辆续航里程将延长至20万公里,对冷启动排放的审查也将比以往任何时候都更加严格。汽车製造商现在需要能够加快预热速度并在-7°C至35°C环境温度范围内降低引擎噪音的封装材料。这项要求推动了混合材料堆迭的发展,该堆迭将碳纤维结构与相变层相结合,以确保排放合规性,同时又不牺牲声学性能。

奢侈品牌转向安静、图书馆般的 ICE 车厢

豪华品牌的目标是将怠速状态下的车内噪音水平控制在40分贝以下,以体现电动车的静谧性。多层气凝胶封装技术在维持隔热性能的同时,实现了超过0.9的降噪係数。目前,该专案已从引擎延伸至变速箱通道,将整个动力传动系统视为单一声音来源,从而打造一体化解决方案。

纯电动车动力传动系统快速混合稀释了内燃机车队

预计到 2024 年,BEV 在欧洲新车註册中的渗透率将达到 15.40%,到 2030 年将超过 50%。供应商将不得不将 ICE 项目下降的利润重新投资到 EV热感产品中,否则将面临利润率下降的情况。

細項分析

引擎封装将在2024年引领汽车引擎封装材料市场,占51.71%的市场。这些模组直接安装在动力装置上,具有出色的隔振性能,可快速预热并实现线边安装。车身安装设计正以7.56%的复合年增长率加速成长,在大型车身底部应用的应用日益广泛。

车身安装式封装将隔音屏障与结构构件集成,在密封引擎室的同时提高刚性。这种设计与 Gigacast 底盘完美契合,无需使用多个支架和紧固件。供应商必须研发出能够承受晶粒热循环且不发生分层的材料。因此,预计到 2030 年,车身安装式汽车引擎封装解决方案的市场规模将稳定成长。

2024年,汽油引擎将占汽车引擎封装材料市场规模的65.91%。汽油引擎封装注重快速预热和怠速时抑制噪音。

由于混合动力汽车和增程式车型将电池冷却与燃烧隔热相结合,电动动力传动系统发展势头最为强劲,复合年增长率高达 7.87%。供应商正在设计双用途屏障,以保护电池免受引擎热峰值的影响,同时抑制逆变器的轰鸣声。柴油引擎仍然适用于扭力驱动的用途,但由于复杂的后处理,柴油引擎面临成本方面的挑战。

区域分析

至2024年,亚太地区将以48.55%的市占率引领汽车引擎封装材料市场,复合年增长率达8.52%。中国占据主导地位的原因在于其庞大的汽车产量以及政策主导的混合动力汽车,即使中国製定了以电动车为中心的发展蓝图,这也将延长内燃机汽车对封装材料的需求。在印度,与生产相关的激励措施鼓励供应商在本地生产封装,将成本竞争力与关税优势相结合。

欧洲则位居第二,因为欧盟7标准推动了先进的冷启动排放解决方案,而混合动力汽车的普及则延长了内燃机汽车的适用性。碳纤维数位双胞胎工具将首先在这里成熟,然后推广到全球,从而增强该地区的思想领袖。北美将因使用大型动力传动系统的SUV和皮卡的销售而实现强劲增长,这些车型需要坚固的隔热隔音屏障。

中东、非洲和南美洲仍是新兴市场。这些地区依赖进口和CKD组装生产NVH套件,但随着本地产能的增加,越来越多的供应商正在待开发区工厂。总体而言,汽车引擎封装市场正在经历区域整合,亚太地区在产能方面处于领先地位,而欧洲则引领全球规格趋势。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 欧7标准后冷启动二氧化碳排放目标更加严格

- 转向高阶品牌ICE舱“图书馆安静”

- 插电式混合动力汽车 (PHEV) 的电池预处理需求

- 轻量化碳纤维成本曲线弯曲。

- 扩大机身支架,配备 Gigacasting

- OEM 的数位双胞胎优化了引擎盖热图

- 市场限制

- 纯电动车动力传动系统快速混合稀释了内燃机车队

- 聚合物泡沫石化产品价格的波动;

- 多层NVH复合材料的可回收性有限

- 内燃机小型化引发引擎室封装竞争

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测(单位:美元)

- 依产品类型

- 引擎配备型

- 车身支架

- 按燃料类型

- 汽油

- 柴油引擎

- 电

- 按材质

- 碳纤维

- 聚氨酯

- 聚丙烯

- 聚酰胺

- 玻璃绒

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中大型商用车

- 按销售管道

- 配备 OEM 的车辆

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 纽西兰

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 埃及

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Autoneum Holding AG

- Continental AG

- ElringKlinger AG

- BASF SE

- 3M Company

- Rochling Group

- Adler Pelzer Group

- Trocellen Automotive

- Woco Group

- SA Automotive

- Charlotte Baur Formschaumtechnik GmbH

- Sumitomo Riko Co. Ltd

- Sika Automotive

- Pritex Ltd

- UGN Inc.

- Langfang Sound(China)

第七章 市场机会与未来展望

The automotive engine encapsulation size market is valued at USD 5.44 billion in 2025 and is projected to reach USD 7.12 billion by 2030, reflecting a robust 5.53% CAGR.

Demand accelerates as Euro 7 regulations tighten cold-start CO2 limits, premium brands chase library-quiet cabins, and hybrid powertrains require sophisticated under-hood thermal control. Automakers adopt gigacasting and digital-twin design loops that merge structural, thermal, and acoustic functions, cutting component counts while boosting thermal efficiency. Material strategies pivot toward recyclable thermoplastics to meet circular-economy mandates, and carbon-fiber cost declines open lightweight options for mid-volume models. Suppliers form alliances with battery-thermal specialists to bridge ICE and EV requirements as the automotive engine encapsulation market navigates the combustion-to-electric transition.

Global Automotive Engine Encapsulation Market Trends and Insights

Stricter Post-Euro 7 Cold-Start CO2 Targets

Euro 7 takes effect for new vehicle types in November 2026 and extends compliance to 200,000 km, putting cold-start emissions under unprecedented scrutiny. Automakers now need encapsulation that accelerates warm-up times and dampens engine noise across ambient ranges from -7°C to 35°C. The requirement pushes hybrid material stacks that blend carbon-fiber structures with phase-change layers, securing emission compliance without sacrificing acoustics.

Premium-Brand Shift to Library-Quiet ICE Cabins

Luxury marques target idle cabin noise below 40 dB, mirroring silent EV experiences. Multi-layer encapsulation with aerogel barriers achieves noise reduction coefficients above 0.9 while sustaining thermal insulation. Programs now extend beyond engines to transmission tunnels, treating the full powertrain as one acoustic source for a unified solution.

Rapid BEV Power-Train Mix Diluting ICE Volume

BEV penetration in new car registration across Europe hit 15.40% in 2024 and is forecast to be above 50% by 2030, shrinking demand for ICE-specific encapsulation. Suppliers must reinvest profits from declining ICE programs into EV-thermal products or face margin erosion.

Other drivers and restraints analyzed in the detailed report include:

- Battery Pre-Conditioning Needs in PHEVs

- Lightweight Carbon-Fiber Cost Curve Inflection

- Petro-Chemical Price Volatility for Polymer Foams

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Engine-mounted encapsulations led the automotive engine encapsulation market with a 51.71% share in 2024. These modules excel at vibration isolation because they sit directly on the power unit, enabling rapid warm-up and line-side installation. Body-mounted designs are accelerating at 7.56% CAGR and increasingly cast into large underbody sections, supporting platform consolidation and lowering assembly time.

Body-mounted encapsulation integrates acoustic barriers with structural members, improving stiffness while sealing the engine bay. This format dovetails with gigacast underbodies that eliminate multiple brackets and fasteners. Suppliers must formulate materials that tolerate die-casting thermal cycles without delamination. Consequently, the automotive engine encapsulation market size for body-mounted solutions is projected to expand steadily through 2030.

Gasoline engines accounted for 65.91% automotive engine encapsulation market size in 2024, supported by their prevalence in global passenger fleets. Encapsulation for gasoline units emphasizes rapid warm-up and idle noise suppression.

Electric powertrains exhibit the briskest 7.87% CAGR because hybrids and range-extended models blend battery cooling with combustion insulation. Suppliers engineer dual-purpose barriers that protect cells from engine heat spikes while muting inverter whine. Diesel remains for torque-intensive use cases but faces cost headwinds due to after-treatment complexity.

The Automotive Engine Encapsulation Market Report is Segmented by Product Type (Engine-Mounted and Body-Mounted), Fuel Type (Gasoline, Diesel, and More), Material Type (Carbon Fiber, Polyurethane, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM-Fitted and Aftermarket), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the automotive engine encapsulation market with 48.55% share in 2024 and is advancing at 8.52% CAGR. China's dominance derives from vast vehicle output and policy-driven hybrid growth that prolongs ICE encapsulation demand even in an EV-centric roadmap. India's production-linked incentives lure suppliers to localize encapsulation, combining cost competitiveness with duty advantages.

Europe ranks second as Euro 7 catalyzes advanced solutions for cold-start emissions, plus widespread hybrid adoption that prolongs ICE relevance. Carbon-fiber and digital-twin tools mature here first, then migrate globally, reinforcing the region's thought leadership. North America grows steadily on the back of SUV and pickup sales that use larger powertrains, which need robust thermal-acoustic barriers.

The Middle East and Africa, and South America remain emerging pockets. They rely on imported NVH kits or CKD assembly, yet rising local output attracts suppliers establishing greenfield plants. Altogether, the automotive engine encapsulation market continues regional consolidation around APAC capacity while Europe drives specification trends embraced worldwide.

- Autoneum Holding AG

- Continental AG

- ElringKlinger AG

- BASF SE

- 3M Company

- Rochling Group

- Adler Pelzer Group

- Trocellen Automotive

- Woco Group

- SA Automotive

- Charlotte Baur Formschaumtechnik GmbH

- Sumitomo Riko Co. Ltd

- Sika Automotive

- Pritex Ltd

- UGN Inc.

- Langfang Sound (China)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter post-Euro 7 cold-start CO2 targets

- 4.2.2 Premium-brand shift to "library-quiet" ICE cabins

- 4.2.3 Battery pre-conditioning needs in PHEVs

- 4.2.4 Lightweight carbon-fiber cost curve inflection

- 4.2.5 Gigacasting enabling larger body-mounted encapsulations

- 4.2.6 OEM digital twins optimising under-hood thermal maps

- 4.3 Market Restraints

- 4.3.1 Rapid BEV power-train mix diluting ICE volumes

- 4.3.2 Petro-chemical price volatility for polymer foams

- 4.3.3 Limited recyclability of multi-layer NVH composites

- 4.3.4 Engine-bay packaging conflicts in downsized ICEs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers / Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Engine-Mounted

- 5.1.2 Body-Mounted

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Electric

- 5.3 By Material Type

- 5.3.1 Carbon Fiber

- 5.3.2 Polyurethane

- 5.3.3 Polypropylene

- 5.3.4 Polyamide

- 5.3.5 Glasswool

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Medium and Heavy Commercial Vehicles

- 5.5 By Sales Channel

- 5.5.1 OEM-Fitted

- 5.5.2 Aftermarket

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Egypt

- 5.6.5.4 Turkey

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Autoneum Holding AG

- 6.4.2 Continental AG

- 6.4.3 ElringKlinger AG

- 6.4.4 BASF SE

- 6.4.5 3M Company

- 6.4.6 Rochling Group

- 6.4.7 Adler Pelzer Group

- 6.4.8 Trocellen Automotive

- 6.4.9 Woco Group

- 6.4.10 SA Automotive

- 6.4.11 Charlotte Baur Formschaumtechnik GmbH

- 6.4.12 Sumitomo Riko Co. Ltd

- 6.4.13 Sika Automotive

- 6.4.14 Pritex Ltd

- 6.4.15 UGN Inc.

- 6.4.16 Langfang Sound (China)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment