|

市场调查报告书

商品编码

1842513

高速钢(HSS)切削刀具:市场份额分析、产业趋势、统计数据和成长预测(2025-2030)High Speed Steel Cutting Tools - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

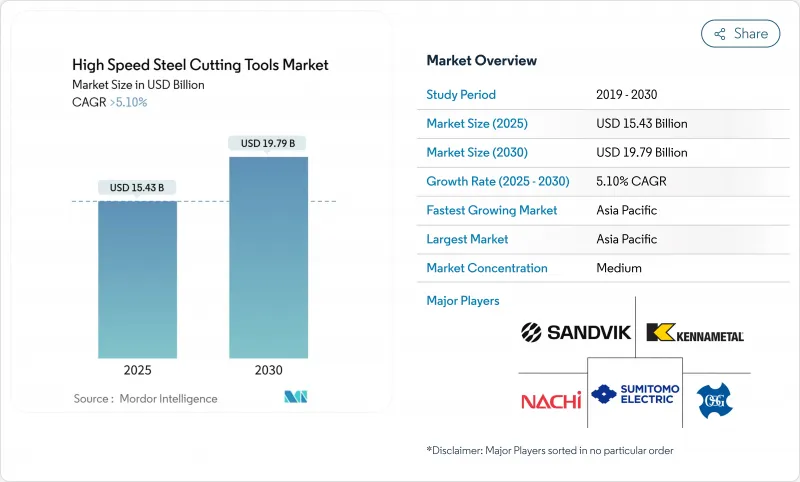

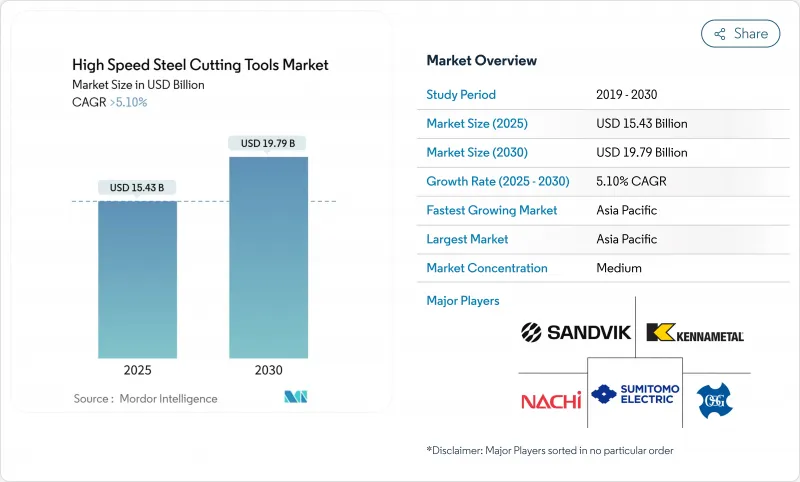

高速钢 (HSS) 切削刀具市场预计到 2025 年将达到 154.3 亿美元,到 2030 年将达到 197.9 亿美元,复合年增长率为 5.1%。

中等批量加工的復苏、亚洲的快速工业化以及粉末冶金技术的广泛应用是关键的成长引擎。製造商正在采用钴强化航太合金牌号,拓展DIY买家的电商管道,并改进自适应数控策略以延长刀具寿命。供应面压力依然存在,包括钼和钴价格的波动,以及汽车业逐渐转向硬质合金和聚晶钻石(PCD)刀具。竞争活动主要集中在有针对性的收购、数位化刀具管理以及碳中和生产的努力。

全球高速钢(HSS)切削刀具市场趋势与洞察

亚洲新兴机械加工厂对低成本刀具的需求

在中国、印度和东协市场,二级和三级加工车间的数量正在增加,这有利于降低初始刀具成本。传统的高速钢刀具符合此优先考虑,尤其是采用基本数控机床可以透过优化进给和转速来延长刀具寿命。中国各省支持本国的工具机製造商,巩固国内采购,并锁定重复性需求週期。同样的趋势正在蔓延到印度的汽车零件丛集和越南的电子产品供应基地,支撑了标准高速钢铣刀和钻头的强劲消费。

北美DIY与家电零售繁荣

北美房主、业余爱好者和「产消者」推动消费级高速钢钻头、丝锥和开孔器线上销售的两位数成长。工具製造商正在调整形状、涂层和包装,以在数位货架上脱颖而出;电动工具品牌则将入门套装与无线电钻和迷你车床捆绑销售。经验丰富的业余爱好者寻求以适中的价格分布获得工业性能,正在扩大潜在市场,巩固了该通路11.4%的复合年增长率前景。

快速转向汽车硬质合金和 PCD 刀具

电动车平台依赖薄壁铝外壳、复合材料支架和高强度钢筋。整体硬质合金和PCD刀具使用这些材料时,能够实现高表面品质和高产量,并逐渐取代动力传动系统、电池和底盘线中的高速钢。汽车模具的决策将影响上游供应商和钢材服务中心,进而降低对高速钢的需求,尤其是在产量较高的欧洲工厂。

細項分析

到2024年,铣刀将占全球刀具总收入的32.4%,凭藉其在面加工、槽加工和轮廓加工方面的灵活性,支撑高速钢 (HSS) 刀具市场。该细分市场受益于径向切屑减薄和高效粗加工方法的持续改进,这些改进在不影响表面光洁度的情况下提高了金属去除率。相较之下,到2030年,丝锥的复合年增长率将达到6.8%,这是最快的,因为螺纹成型形式缩短了加工週期,并避免了排放难题。无切屑螺纹加工适用于汽车电子机壳和薄壁压铸件,正在推动亚洲和东欧地区的应用。

注重成本的机械加工车间依靠高速钢钻头、铰刀和拉刀进行钻孔和精加工,而锯和锪钻则满足了小规模的维护和维修需求。数位化设计平台现在可以模拟切屑流动、前角和冷却液输送,并根据每种基材自订切割刃。利用此类软体,刀具製造商甚至可以从标准高速钢 (HSS) 材质中汲取新的生命力,从而巩固了铣刀在高速钢 (HSS) 刀具市场中的核心地位。

传统M系列牌号广泛应用于中等韧性应用领域,且价格极具竞争力,到2024年将达到48%的收入份额。粉末冶金牌号目前仅占产量的14.5%,但其复合年增长率将达8.3%,成长率惊人。均匀的碳化物弥散、细小的晶粒边界和较低的偏析使粉末冶金高速钢(PM-HSS)在加工航太紧固件和医疗植入方面具有优势,因为在这些领域,最大限度地减少削片至关重要。富含钴的M42和M35在耐热合金中占据战略性利基市场,弥补了粉末冶金和标准类型之间的成本差距。

随着欧洲产能差距缩小以及亚洲企业升级其国内雾化生产线,与粉末冶金高速钢 (PM-HSS) 相关的高速钢 (HSS) 切削刀具市场规模预计将扩大。增材製造试验也正在探索硬度梯度调整的高速钢粉末混合物,以拓展未来的设计可能性,并支持高速钢切削刀具市场材料等级的长期多样化。

高速钢 (HSS) 切削刀具市场报告按刀具类型(例如钻头)、材料等级(例如传统高速钢 (M 系列))、製造工艺(例如粉末冶金)、分销渠道(例如 OEM 直销)、最终用户行业(例如石油和天然气)和地区(例如北美)进行细分。报告提供了上述所有细分市场的市场规模和预测(以美元计)。

区域分析

由于中国的电子和工具机製造业、印度的汽车产业丛集以及越南的组装出口,亚洲引领高速钢 (HSS) 切削刀具市场,收益份额达 46.2%,预计复合年增长率为 6.3%。目前,国内刀具製造商正在向价值链上游迈进,采用 TiN 和 AlCrN 涂层,并推动粉末冶金 (PM) 的普及,从而减少对进口的依赖,巩固地区自给自足能力。

排名第二的北美地区,其成长动力源自于製造业回流计画、国防补偿以及蓬勃发展的DIY文化。航太和能源工厂的混合加工单元需要能够在适应性强的数控环境中高效运作的多功能刀具。电子商务的兴起使小型参与企业能够直接获得专用丝锥和铰刀,从而拓宽了高速钢 (HSS) 切削刀具市场。

欧洲技术先进,但产能受限。 PM-HSS 供应有限,导致优质刀具的前置作业时间较长。儘管如此,德国、法国和英国的工厂仍在强调永续修復和闭合迴路回收,以实现碳减排目标。儘管汽车传动系统中硬质合金会受到腐蚀,但刀具寿命监控和 ISO 14001 计划仍在推动对数据丰富的 HSS 解决方案的需求。

拉丁美洲依赖巴西的工业基础,中东依赖能源维修和持续的基础设施建设,而非洲的需求丛集则以南非的矿产供应和埃及的零件工厂为基础。总体而言,这些新兴地区体现了高速钢 (HSS) 切削刀具市场多元化和在地化增值的潜力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场洞察与动态

- 市场概况

- 市场驱动因素

- 亚洲新兴机械加工厂对低成本刀具的需求

- 北美和欧洲再共享主导通用 HSS 的采用

- 航太合金钴强化M42高速钢的推广

- 北美DIY与居家装潢热潮

- 透过基于 CNC 的自适应加工延长高速钢刀具寿命

- 市场限制

- 钼钴价格波动

- 汽车产业快速转向硬质合金和 PCD 刀具

- 碳中和工具寿命要求

- 欧洲PM-HSS产能有限,供应瓶颈

- 价值/供应链分析

- 监理展望

- 五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 全球製造业展望

- 影响机械加工产业的政府法规

- 钢铁业概况

- 技术简介(添加剂製造、奈米涂层)

- 粉末冶金高速钢聚焦

- 刀架和刀架见解

- 永续性和循环经济前景

- 全球中断和供应链弹性

第五章市场规模及成长预测

- 按工具类型

- 铣刀

- 钻头

- 轻敲

- 铰刀和拉刀

- 其他(锯子、埋头孔)

- 按材料等级

- 常规高速钢(M系列)

- 高钴高速钢(T系列/M42/M35)

- 粉末冶金高速钢(PM-HSS)

- 按製造工艺

- 常规锻造

- 粉末冶金

- 按销售管道

- OEM直销

- 工业经销商

- 电子商务/DIY零售

- 按最终用户产业

- 製造/汽车

- 石油和天然气

- 采矿和采石业

- 农业、渔业、林业

- 建设业

- 医疗保健和製药

- 能源产出(涡轮机和核能)

- 其他最终用户(分销行业等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- Nordix(丹麦、芬兰、冰岛、挪威、瑞典)

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东协(印尼、泰国、菲律宾、马来西亚、越南)

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 产业主要企业的策略倡议

- 市占率分析(主要企业)

- 公司简介

- Sandvik AB

- Kennametal Inc.

- OSG Corporation

- Sumitomo Electric Industries Ltd.

- Nachi-Fujikoshi Corp.

- Walter AG

- Erasteel SAS

- YG-1 Co. Ltd.

- Tiangong International Co. Ltd.

- Mitsubishi Materials Corp.

- Guhring KG

- Dormer Pramet

- Somta Tools(Pty)Ltd.

- Niagara Cutter LLC

- Arch Cutting Tools

- DeWALT(Stanley Black & Decker)

- Addison & Co. Ltd.

- Morse Cutting Tools

- Union Tool Co.

- Chongqing Zhengtai Tools

第七章 市场机会与未来展望

The High Speed Steel Cutting Tools market size stands at USD 15.43 billion in 2025 and is on track to reach USD 19.79 billion by 2030, advancing at a 5.1% CAGR.

A resurgence of mid-volume machining, rapid industrialization in Asia, and wider use of powder metallurgy are the primary growth engines. Manufacturers are adopting cobalt-enriched grades for aerospace alloys, expanding e-commerce channels for DIY buyers, and refining adaptive CNC strategies that stretch tool life. Supply-side pressures remain, including volatile molybdenum and cobalt prices and the automotive sector's gradual pivot to carbide and PCD tools. Competitive moves center on targeted acquisitions, digital tool management, and carbon-neutral production commitments.

Global High Speed Steel Cutting Tools Market Trends and Insights

Demand for Low-cost Tooling in Emerging Asian Job Shops

Mounting numbers of tier-2 and tier-3 job shops across China, India, and ASEAN markets favor low initial tooling outlays. Conventional HSS tools meet that priority, especially as basic CNC adoption lets operators extend tool life by optimizing feeds and speeds. Chinese provincial support for indigenous machine-tool makers entrenches domestic sourcing, locking in repetitive demand cycles. The same trend spreads through India's automotive component clusters and Vietnam's electronics supply base, anchoring robust consumption for standard HSS milling cutters and drills.

DIY & Home-Improvement Retail Boom in North America

North American home-owners, hobbyists, and "prosumers" are driving double-digit online growth for consumer-grade HSS bits, taps, and hole saws. Tool makers now tailor geometries, coatings, and packaging to stand out on digital shelves, while power-tool brands bundle starter sets with cordless drills and compact lathes. Upskilled enthusiasts demanding industrial-style performance at modest price points have expanded the addressable segment, reinforcing the channel's 11.4% CAGR outlook.

Rapid Shift Toward Carbide & PCD Tools in Automotive

Electric vehicle platforms rely on thin-walled aluminum housings, composite brackets, and high-strength steel reinforcements. Carbide and PCD cutters deliver higher surface integrity and throughput on such materials, gradually displacing HSS in power-train, battery, and chassis lines. Automotive tooling decisions influence upstream tier suppliers and steel service centers, amplifying the drag on HSS demand, especially in Europe's high-volume plants.

Other drivers and restraints analyzed in the detailed report include:

- Re-shoring-led Adoption of Versatile HSS in North America & Europe

- Uptake of Cobalt-enriched M42 HSS for Aerospace Alloys

- Volatility in Molybdenum & Cobalt Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Milling cutters generated 32.4% of global 2024 revenue and anchor the High Speed Steel Cutting Tools market by virtue of their flexibility in face, slot, and profile machining. The segment benefits from continual refinement of radial chip thinning and high-efficiency roughing methods that raise metal-removal rates without compromising finish. Taps, in contrast, secure the quickest 6.8% CAGR through 2030 as thread-forming formats cut cycle times and avoid chip evacuation challenges. Chip-free threading aligns with automotive electronics housings and thin-section die-cast parts, pushing adoption across Asia and Eastern Europe.

Cost-sensitive job shops still prize HSS drills, reamers, and broaches for hole-making and finishing, while saws and countersinks meet niche needs in maintenance and repair. Digital design platforms now simulate chip flow, rake angle, and coolant delivery to customize cutting edges for each substrate. By leveraging such software, toolmakers unlock new shelf life even within standard HSS chemistries, reinforcing milling cutters' central role in the High Speed Steel Cutting Tools market.

Conventional M-series grades held 48% revenue share in 2024 thanks to broad availability and competitive pricing for mid-toughness jobs. Powder metallurgy variants command only 14.5% of output today, yet they capture disproportionate growth at 8.3% CAGR. Uniform carbide dispersion, refined grain boundaries, and reduced segregation give PM-HSS an edge when machining aerospace fasteners or medical implants where minimal chipping is critical. Cobalt-rich M42 and M35 maintain a strategic niche for heat-resistant alloys, bridging the cost gulf between PM and standard types.

The High Speed Steel Cutting Tools market size attached to PM-HSS is poised to expand as Europe resolves capacity gaps and as Asian players upscale domestic atomizing lines. Additive manufacturing trials also explore HSS powder blends with tailored hardness gradients, broadening future design possibilities and supporting long-term material-grade diversification across the High Speed Steel Cutting Tools market.

The High-Speed Steel Cutting Tools Market Report is Segmented by Tool Type (Drills and More), by Material Grade (Conventional HSS (M-Series) and More), by Production Process (Powder Metallurgy and More), by Distribution Channel (Direct OEM Sales and More), by End-User Industry (Oil & Gas and More) and by Geography (North America and More). The Report Offers Market Size and Forecasts in Value (USD) for all the Above Segments.

Geography Analysis

Asia leads the High Speed Steel Cutting Tools market with a 46.2% revenue share and a 6.3% CAGR forecast, thanks to China's electronics and machine-tool build-outs, India's automotive clusters, and Vietnamese assembly exports. Domestic tool makers now climb the value chain, adopting TiN and AlCrN coatings and pushing PM adoption, thereby reducing reliance on imports and cementing regional self-sufficiency.

North America ranks second and is revitalized by reshoring programs, defense offsets, and a thriving DIY culture. Hybrid machining cells in aerospace and energy plants require versatile cutters that thrive in adaptive CNC environments. E-commerce penetration also gives small workshops direct access to specialty taps and reamers, broadening High Speed Steel Cutting Tools market participation.

Europe sustains a technologically advanced yet capacity-constrained scenario. Limited PM-HSS supply elongates lead times for premium cutters. Nevertheless, German, French, and UK plants emphasize sustainable reconditioning and closed-loop recycling to hit carbon-reduction targets. Tool life monitoring and ISO 14001 programs elevate demand for data-rich HSS solutions despite carbide encroachment in automotive drivetrain lines.

South & Central America depend on Brazil's industrial base, while the Middle East leans on energy equipment refurbishment and ongoing infrastructure builds. Africa's demand cluster arises in South African mining supply and Egyptian component plants. Collectively, these emerging territories reflect the High Speed Steel Cutting Tools market's potential for diversification and localized value-add.

- Sandvik AB

- Kennametal Inc.

- OSG Corporation

- Sumitomo Electric Industries Ltd.

- Nachi-Fujikoshi Corp.

- Walter AG

- Erasteel SAS

- YG-1 Co. Ltd.

- Tiangong International Co. Ltd.

- Mitsubishi Materials Corp.

- Guhring KG

- Dormer Pramet

- Somta Tools (Pty) Ltd.

- Niagara Cutter LLC

- Arch Cutting Tools

- DeWALT (Stanley Black & Decker)

- Addison & Co. Ltd.

- Morse Cutting Tools

- Union Tool Co.

- Chongqing Zhengtai Tools

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for Low-cost Tooling in Emerging Asian Job Shops

- 4.2.2 Re-shoring-led Adoption of Versatile HSS in North America & Europe

- 4.2.3 Uptake of Cobalt-enriched M42 HSS for Aerospace Alloys

- 4.2.4 DIY & Home-Improvement Retail Boom in North America

- 4.2.5 CNC-based Adaptive Machining Extending HSS Tool Life

- 4.3 Market Restraints

- 4.3.1 Volatility in Molybdenum & Cobalt Prices

- 4.3.2 Rapid Shift Toward Carbide & PCD Tools in Automotive

- 4.3.3 Carbon-neutrality-driven Tool-life Mandates

- 4.3.4 Limited European PM-HSS Capacity & Supply Bottlenecks

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Global Manufacturing Sector Outlook

- 4.8 Government Regulations Impacting Machining Industry

- 4.9 Steel Industry Snapshot

- 4.10 Technology Snapshot (Additive MFG, Nanocoatings)

- 4.11 Spotlight on Powder Metallurgy HSS

- 4.12 Insights on Tool Posts & Tool Holders

- 4.13 Sustainability & Circular-Economy Outlook

- 4.14 Global Disruptions and Supply Chain Resilience

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Tool Type

- 5.1.1 Milling Cutters

- 5.1.2 Drills

- 5.1.3 Taps

- 5.1.4 Reamers & Broaches

- 5.1.5 Others (Saws, Countersinks)

- 5.2 By Material Grade

- 5.2.1 Conventional HSS (M-Series)

- 5.2.2 High-Cobalt HSS (T-Series/M42/M35)

- 5.2.3 Powder-Metallurgy HSS (PM-HSS)

- 5.3 By Production Process

- 5.3.1 Conventional Forged

- 5.3.2 Powder Metallurgy

- 5.4 By Distribution Channel

- 5.4.1 Direct OEM Sales

- 5.4.2 Industrial Distributors

- 5.4.3 E-commerce/DIY Retail

- 5.5 By End-user Industry

- 5.5.1 Manufacturing & Automotive

- 5.5.2 Oil & Gas

- 5.5.3 Mining & Quarrying

- 5.5.4 Agriculture, Fishing & Forestry

- 5.5.5 Construction

- 5.5.6 Healthcare & Pharmaceutical

- 5.5.7 Energy Generation (Turbines & Nuclear)

- 5.5.8 Other End users (distributive trade, etc.)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 UAE

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Egypt

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Strategic Moves by Key Players in the Industry

- 6.2 Market Share Analysis (Key Players)

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.3.1 Sandvik AB

- 6.3.2 Kennametal Inc.

- 6.3.3 OSG Corporation

- 6.3.4 Sumitomo Electric Industries Ltd.

- 6.3.5 Nachi-Fujikoshi Corp.

- 6.3.6 Walter AG

- 6.3.7 Erasteel SAS

- 6.3.8 YG-1 Co. Ltd.

- 6.3.9 Tiangong International Co. Ltd.

- 6.3.10 Mitsubishi Materials Corp.

- 6.3.11 Guhring KG

- 6.3.12 Dormer Pramet

- 6.3.13 Somta Tools (Pty) Ltd.

- 6.3.14 Niagara Cutter LLC

- 6.3.15 Arch Cutting Tools

- 6.3.16 DeWALT (Stanley Black & Decker)

- 6.3.17 Addison & Co. Ltd.

- 6.3.18 Morse Cutting Tools

- 6.3.19 Union Tool Co.

- 6.3.20 Chongqing Zhengtai Tools