|

市场调查报告书

商品编码

1842542

光学陶瓷:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Optical Ceramics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

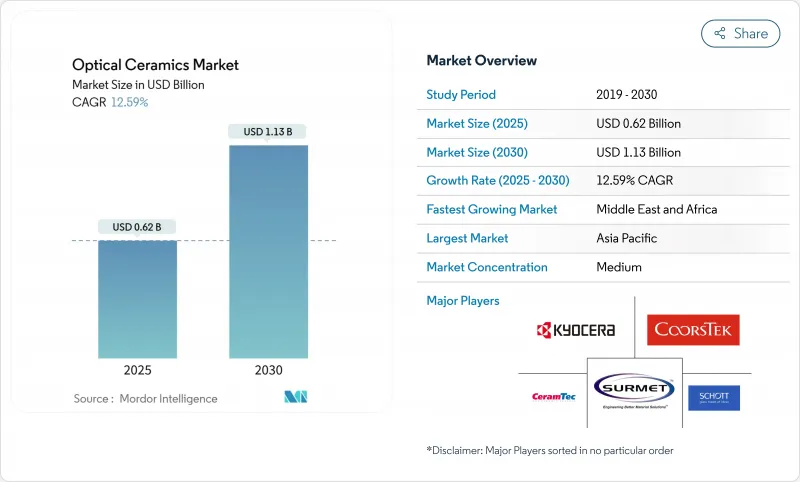

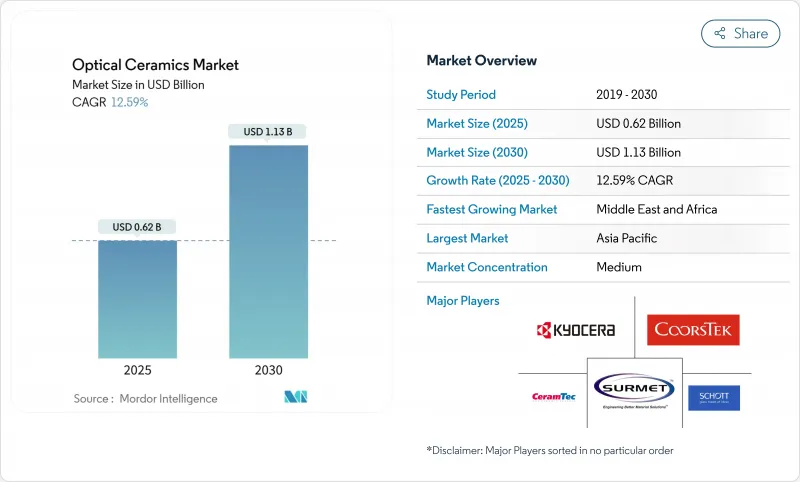

预计2025年光学陶瓷市场规模将达6.2亿美元,2030年将成长至11.3亿美元,复合年增长率为12.59%。

这一势头的推动因素包括:积极的国防采购,寻求轻量化、红外线渗透性装甲;多晶YAG在手术雷射中的日益普及;以及对极端温度能源系统的严格性能要求。 「清洁热等静压」(Clean HIP)和真空烧结等生产创新提高了光学透明度,同时降低了缺陷率,促进了其在大面积组件中的广泛应用。同时,智慧财产权整合以及直径超过120毫米的组件持续的高产量比率损失限制了新进入者,并使该领域保持中等集中度。国防、医疗和能源需求的交叉加速了跨部门的材料转移,并压缩了典型的创新週期。

全球光学陶瓷市场趋势与洞察

下一代战斗车辆将迅速采用红外线渗透性装甲

一项国防项目整合了铝合金和尖晶石窗玻璃,与夹层玻璃相比,其重量减轻高达60%,同时保持了防弹保护性能,并提高了燃油效率和乘员机动性。组件尺寸扩大到8平方英尺的面板,使整车嵌装玻璃安装实用化。机器学习引导的层压方案将厚度减少了22.2%,透射率提高了42.3%,证明了该概念的扩充性。与美国签订的供应合约加快了大型组件的认证,并缩短了测试週期。因此,采购机构下达了多年期固定数量和稳定价格的订单。

需要多晶YAG 光学元件的 UV-LED 和雷射医疗设备的普及

微创手术越来越多地使用激光,因为Ho:YAG和Nd:YAG雷射的波长可被水强烈吸收,从而能够精确切除组织,同时最大限度地减少伴随加热。多晶YAG雷射的热导率优于玻璃,从而能够实现更高的脉衝能量和更长的组件寿命。製程创新使1064奈米波长的透射率达到83.7%,提高了光转换效率,并促进了适用于门诊的可携式手术平台的开发。亚洲的合约设备製造商已扩大生产,加速了该地区雷射应用的成长曲线。

热热等静压线的高资本支出限制了其进入新兴市场

商业热静压(HIP)安装成本通常超过1500万美元,这给新参与企业设定了较高的财务门槛。压力容器设计和受控大气操作方面的专业知识仍然集中在成熟的工业领域,这扩大了能力差距。诸如「清洁热静压」和「转向冷却」等升级虽然提高了性能,但也增加了资本密集度,从而强化了现有企业的优势。

細項分析

YAG 凭藉其在工业雷射、闪烁体和感测光学领域的多功能性,在 2024 年光学陶瓷市场中保持 30.2% 的主导地位。多项烧结改进提高了 1064 nm 的透射率,改善了 10kW 级雷射切割机的光束品质。 ALON 的复合年增长率为 12.3%,满足了国防和航太领域对轻型弹道级窗口的严格要求。蓝宝石凭藉其无与伦比的硬度(Moci 9)和高达 2,000 度C 的热稳定性,在能源领域保持了忠诚度。尖晶石的立方晶格消除了屈光并支援航空成像。氧化钇在半导体工厂等电浆蚀刻室衬里的用途稳步扩大。新兴的镏石榴石显示出下一代闪烁体的前景。

YAG 系统中光学陶瓷的市场规模预计将以每年 11.6% 的速度增长,而 ALON 的不断增长的份额预计将在 YAG 产量不显着下降的情况下提升整个行业的价值。目前,YAG 和 ALON 的双重采购在供应链中已很常见,混合材料组件体现的是设计最佳化,而非严格的替代方案。

热等静压透过生产接近理论密度且孔隙率低的零件,确保了2024年41.3%的收入成长,这对于防弹装甲和高功率光学元件至关重要。气体纯化室等製程改进提高了更大尺寸面板的产量比率,增强了热等静压技术在高级产品领域的经济优势。然而,真空烧结技术实现了11.2%的最高复合年增长率,因为它在较低的单位能量下实现了透明氧化铝70%的透射率,对成本敏感的行业具有吸引力。固体烧结仍然适用于较简单的几何形状,而随着研究人员列印渐变折射率元件,积层製造加入了「其他」类别。

到2030年,随着真空烧结规模的扩大,HIP在光学陶瓷市场的份额可能会略有下降,但随着更大型的装甲组件推动产量成长,HIP炉的整体产量预计将上升。目前正在评估将真空预烧结与最终HIP緻密化相结合的混合流程,以平衡透明度和成本。

光学陶瓷行业材料类型(钇铝石榴石等)、製造方法(固体烧结等)、产品类型(多晶、单晶)、应用(透明装甲、防弹窗等)、最终用途行业(航太、国防、医疗保健等)和地区(北美、南美、欧洲、亚太、中东和非洲)细分。

区域分析

受中国电池组雷射的快速扩张以及日本对轻型卫星光学元件的关注推动,亚太地区将在2024年引领光学陶瓷市场,占38.3%的收入份额。韩国和台湾地区则新增了专门生产陶瓷闪光灯和感测器窗口的工厂。日本的《精细陶瓷蓝图2050》等政府倡议已规划出长期的技术需求。

北美凭藉着雄厚的国防费用,尤其是美国升级透明装甲和雷射系统的项目,保持了巨大的市场份额。桑迪亚国家实验室和私人企业组成的合作丛集,透过以基于物理的建模取代反覆试验,缩短了开发週期。加拿大和墨西哥贡献了专业的製造和研发能力,确保了北美供应链的韧性。

中东和非洲的复合年增长率最快,为 11.2%,其中沙乌地阿拉伯和阿拉伯联合大公国资助了 ALON 生产的机载红外线感测器圆顶,以色列陶瓷和硅酸盐研究所实现了区域技术转让,促进了国内弹道飞弹装甲的发展。

欧洲在涡轮机高温蓝宝石窗口和科学研究精密光学领域拥有丰富的专业知识。德国和英国推动了产品创新,北欧丛集率先使用氢燃窑炉,以减少陶瓷加工的碳排放。南美洲从小规模发展起来,巴西和阿根廷利用当地矿产资源,将蓝宝石检测口引入精炼和医疗保健领域。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 下一代战斗车辆将迅速采用红外线透明装甲

- 需要多晶YAG 光学元件的 UV-LED 和雷射医疗设备的普及

- 高温燃气涡轮机检测的成长需要蓝宝石窗口

- 太空船重量减轻增强了低地球轨道卫星的 ALON/尖晶石视口

- 大面积锂离子电池组雷射器,附陶瓷闪光灯

- 分配给陶瓷圆顶机载红外线感测器的军事现代化预算

- 市场限制

- 热等静压线的高资本投入限制了其进入新兴市场

- 如果直径超过120毫米,就会出现产量比率损失(15%以上),而且单价与玻璃失去竞争力。

- 5-7µm 波段的透射率有限,限制了较长波长红外线的采用。

- 超过 120 项美国专利阻碍新配方

- 价值链分析

- 技术展望

- 监理展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资及资本趋势分析

- 宏观经济因素的影响

第五章市场规模及成长预测

- 依材料类型

- 钇铝石榴石(YAG)

- 氮氧化铝(ALON)

- 尖晶石

- 蓝宝石

- 氧化钇

- 其他的

- 依製造方法

- 固体烧结

- 热等静压(HIP)

- 真空烧结

- 其他的

- 依产品类型

- 多晶

- 单晶

- 按用途

- 透明装甲和防弹窗

- 感测器和成像光学元件

- 雷射和照明组件

- 医学影像和诊断

- LED 和磷光体

- 用于能源和发电的光学元件

- 其他的

- 按行业

- 航太/国防

- 卫生保健

- 活力

- 消费性电子产品

- 工业和製造业

- 研究和测量设备

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 北欧国家(瑞典、芬兰、挪威、丹麦)

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 台湾

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Surmet Corporation

- CoorsTek Inc.

- CeramTec GmbH

- CeraNova Corporation

- Schott AG

- Saint-Gobain SA

- Kyocera Corporation

- Murata Manufacturing Co., Ltd.

- Konoshima Chemical Co., Ltd.

- Ceradyne Inc.(3M)

- II-VI Incorporated/Coherent Corp.

- Rubicon Technology Inc.

- Adamant Namiki Precision Jewel Co., Ltd.

- Crystalwise Technology Inc.

- Advanced Ceramics Manufacturing LLC

- AGC Inc.

- Baikowski SA

- Zhongke Jingcheng New Material Co., Ltd.

- Sinoma Advanced Nitride Ceramics Co., Ltd.

- SICCAS High-Tech Materials Co., Ltd.

- American Elements

- Toshima Manufacturing Co., Ltd.

- Ceratec Technical Ceramics BV

- Tera YAG Co., Ltd.

- Precision Ceramics International Ltd.

- Blasch Precision Ceramics Inc.

第七章 市场机会与未来展望

The optical ceramics market size stood at USD 0.62 billion in 2025 and is forecast to grow to USD 1.13 billion by 2030, registering a 12.59% CAGR.

Strong defense procurement for lighter, infrared-transparent armor, rising use of polycrystalline YAG in surgical lasers, and stricter performance demands in extreme-temperature energy systems supported this momentum. Production innovations such as 'Clean HIP' and vacuum sintering lifted optical clarity while lowering defect rates, encouraging wider use in large-area components. Meanwhile, intellectual-property consolidation and persistently high yield losses for parts above 120 mm diameters limited new entrants, keeping the field moderately concentrated. The intersection of defense, medical, and energy requirements accelerated material transfer across sectors, compressing typical innovation cycles.

Global Optical Ceramics Market Trends and Insights

Rapid Adoption of IR-Transparent Armor in Next-Gen Combat Vehicles

Defense programs integrated ALON and spinel windows that cut weight up to 60% versus laminated glass while maintaining ballistic stop levels, enhancing fuel efficiency, and crew mobility. Components grew to panel sizes of eight square feet, making full-vehicle glazing practical. Machine-learning-guided stacking schemes lowered thickness 22.2% yet raised transmission 42.3%, proving the concept's scalability. Supply contracts from the U.S. Army accelerated the qualification of larger parts and shortened testing cycles. As a result, procurement agencies issued multi-year orders that locked in volume and stabilized pricing.

Surge in UV-LED and Laser-Based Medical Devices Demanding Polycrystalline YAG Optics

Minimally invasive therapies increasingly relied on Ho:YAG and Nd:YAG lasers whose wavelengths are strongly absorbed by water, ensuring precise tissue removal with limited collateral heating. Polycrystalline YAG offered improved thermal conductivity over glass, enabling higher pulse-energy operation and longer component lifetimes. Process innovations delivered 83.7% transmittance at 1064 nm, lifting wall-plug efficiency and facilitating portable surgical platforms well suited to outpatient clinics. Asian contract-device makers expanded production, accelerating regional adoption curves.

Capex-Intensive Hot-Isostatic-Pressing Lines Limiting Emerging-Market Entry

Commercial HIP installations often exceeded USD 15 million, creating high financial thresholds for newcomers. Expertise in pressure-vessel design and controlled-atmosphere operations remained concentrated in mature industrial regions, widening the capability gap. Upgrades such as 'Clean HIP' and 'Steered Cooling' improved performance but also raised capital intensity, reinforcing incumbent advantages.

Other drivers and restraints analyzed in the detailed report include:

- Growth of High-Temperature Gas-Turbine Inspections That Require Sapphire Windows

- Spacecraft Light-Weighting Drives ALON/Spinel Viewports in LEO Satellites

- Yield Losses Above 15% for 120 mm-Diameter Components Keep Unit Costs Uncompetitive vs. Glass

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

YAG retained 30.2% dominance within the optical ceramics market in 2024 through versatility across industrial lasers, scintillators, and sensing optics. Multiple sintering refinements elevated its 1064 nm transmittance, improving beam quality in 10 kW-class laser cutters. ALON posted a 12.3% CAGR by fulfilling aggressive defense and space specifications for lightweight yet ballistic-grade windows. Sapphire maintained energy-sector loyalty thanks to unmatched hardness (Mohs 9) and 2,000 °C thermal stability. Spinel's cubic lattice removed birefringence, supporting airborne imaging. Yttria expanded steadily for plasma-etch chamber liners in semiconductor fabs. Emerging lutetium-based garnets showed promise in next-generation scintillators.

The optical ceramics market size for YAG systems is projected to rise at 11.6% annually, while ALON share gains are forecast to elevate total industry value without materially eroding YAG volumes. Supply chains now routinely dual-source YAG and ALON to tailor mixed-material assemblies, reflecting design optimization rather than strict substitution.

Hot isostatic pressing secured 41.3% revenue in 2024 by producing near-theoretical-density parts with low porosity, essential for ballistic armor and high-power optics. Process refinements like gas-purified chambers raised yield in large panels, reinforcing HIP's economic edge in premium products. Vacuum sintering, however, posted the highest 11.2% CAGR outlook by delivering 70% transmittance in transparent alumina at lower unit energy, appealing to cost-sensitive sectors. Solid-state sintering kept relevance for simpler geometries, while additive manufacturing joined the "Others" category as researchers printed gradient-index elements.

Through 2030, the optical ceramics market share for HIP may slip modestly as vacuum sintering scales, yet overall output from HIP furnaces will climb because larger armor sets drive volume. Hybrid flows that combine vacuum pre-sintering with final HIP densification are under evaluation to balance clarity and cost.

Optical Ceramics Industry is Segmented by Material Type (Yttrium Aluminum Garnet, and More), Fabrication Method (Solid-State Sintering, and More), Product Type (Polycrystalline and Monocrystalline), Application (Transparent Armor and Bullet-Resistant Windows, and More), End-Use Industry (Aerospace and Defense, Healthcare, and More), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa).

Geography Analysis

Asia-Pacific led the optical ceramics market with 38.3% 2024 revenue thanks to China's rapid battery-pack laser expansion and Japan's focus on light-weighted satellite optics. South Korea and Taiwan added fabs specializing in ceramic flash lamps and sensor windows. Government initiatives such as Japan's Fine Ceramics Roadmap 2050 mapped long-range technology needs.

North America leveraged strong defense spending, particularly U.S. programs upgrading transparent armor and laser systems, maintaining a sizeable share. Collaborative clusters involving Sandia National Laboratories and private industry shortened development cycles by replacing trial-and-error with physics-based modeling. Canada and Mexico contributed specialized production and R&D, securing resiliency in North American supply chains.

The Middle East and Africa recorded the fastest 11.2% CAGR, with Saudi Arabia and the United Arab Emirates funding airborne IR sensor domes built from ALON. Israel's Ceramic and Silicate Institute enabled regional know-how transfer, fostering domestic ballistic-grade armor developments.

Europe retained critical expertise in high-temperature sapphire windows for turbines and precision optics for scientific research. Germany and the United Kingdom drove product innovation, while the Nordic cluster pioneered hydrogen-fired kilns to cut carbon footprints in ceramic processing. South America grew from a small base as Brazil and Argentina introduced sapphire inspection ports in refining and healthcare sectors, leveraging local mineral resources.

- Surmet Corporation

- CoorsTek Inc.

- CeramTec GmbH

- CeraNova Corporation

- Schott AG

- Saint-Gobain S.A.

- Kyocera Corporation

- Murata Manufacturing Co., Ltd.

- Konoshima Chemical Co., Ltd.

- Ceradyne Inc. (3M)

- II-VI Incorporated / Coherent Corp.

- Rubicon Technology Inc.

- Adamant Namiki Precision Jewel Co., Ltd.

- Crystalwise Technology Inc.

- Advanced Ceramics Manufacturing LLC

- AGC Inc.

- Baikowski SA

- Zhongke Jingcheng New Material Co., Ltd.

- Sinoma Advanced Nitride Ceramics Co., Ltd.

- SICCAS High-Tech Materials Co., Ltd.

- American Elements

- Toshima Manufacturing Co., Ltd.

- Ceratec Technical Ceramics BV

- Tera YAG Co., Ltd.

- Precision Ceramics International Ltd.

- Blasch Precision Ceramics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of infra-red transparent armor in next-gen combat vehicles

- 4.2.2 Surge in UV-LED and laser-based medical devices demanding polycrystalline YAG optics

- 4.2.3 Growth of high-temperature gas-turbine inspections that require sapphire windows

- 4.2.4 Spacecraft light-weighting drives ALON/spinel viewports in LEO satellites

- 4.2.5 Large-area Li-ion battery pack lasers using ceramic flash lamps

- 4.2.6 Military modernization budgets earmarked for airborne IR sensors with ceramic domes

- 4.3 Market Restraints

- 4.3.1 Capex-intensive hot-isostatic-pressing lines limiting emerging-market entry

- 4.3.2 Yield-losses (>15 %) above 120 mm diameter keep unit costs uncompetitive vs. glass

- 4.3.3 Limited transmittance in the 5-7 µm band constrains long-wave IR adoption

- 4.3.4 IP consolidation-over 120 active U.S. patents block new formulations

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment and Funding Trends Analysis

- 4.9 Impact of Macroeconomic factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Yttrium Aluminum Garnet (YAG)

- 5.1.2 Aluminum Oxynitride (ALON)

- 5.1.3 Spinel

- 5.1.4 Sapphire

- 5.1.5 Yttria

- 5.1.6 Others

- 5.2 By Fabrication Method

- 5.2.1 Solid-state Sintering

- 5.2.2 Hot Isostatic Pressing (HIP)

- 5.2.3 Vacuum Sintering

- 5.2.4 Others

- 5.3 By Product Type

- 5.3.1 Polycrystalline

- 5.3.2 Monocrystalline

- 5.4 By Application

- 5.4.1 Transparent Armor and Bullet-resistant Windows

- 5.4.2 Sensor and Imaging Optics

- 5.4.3 Laser and Lighting Components

- 5.4.4 Medical Imaging and Diagnostics

- 5.4.5 LEDs and Phosphors

- 5.4.6 Energy and Power Generation Optics

- 5.4.7 Others

- 5.5 By End-Use Industry

- 5.5.1 Aerospace and Defense

- 5.5.2 Healthcare

- 5.5.3 Energy

- 5.5.4 Consumer Electronics

- 5.5.5 Industrial and Manufacturing

- 5.5.6 Research and Instrumentation

- 5.5.7 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Nordics (Sweden, Finland, Norway, Denmark)

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 Taiwan

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Surmet Corporation

- 6.4.2 CoorsTek Inc.

- 6.4.3 CeramTec GmbH

- 6.4.4 CeraNova Corporation

- 6.4.5 Schott AG

- 6.4.6 Saint-Gobain S.A.

- 6.4.7 Kyocera Corporation

- 6.4.8 Murata Manufacturing Co., Ltd.

- 6.4.9 Konoshima Chemical Co., Ltd.

- 6.4.10 Ceradyne Inc. (3M)

- 6.4.11 II-VI Incorporated / Coherent Corp.

- 6.4.12 Rubicon Technology Inc.

- 6.4.13 Adamant Namiki Precision Jewel Co., Ltd.

- 6.4.14 Crystalwise Technology Inc.

- 6.4.15 Advanced Ceramics Manufacturing LLC

- 6.4.16 AGC Inc.

- 6.4.17 Baikowski SA

- 6.4.18 Zhongke Jingcheng New Material Co., Ltd.

- 6.4.19 Sinoma Advanced Nitride Ceramics Co., Ltd.

- 6.4.20 SICCAS High-Tech Materials Co., Ltd.

- 6.4.21 American Elements

- 6.4.22 Toshima Manufacturing Co., Ltd.

- 6.4.23 Ceratec Technical Ceramics BV

- 6.4.24 Tera YAG Co., Ltd.

- 6.4.25 Precision Ceramics International Ltd.

- 6.4.26 Blasch Precision Ceramics Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment