|

市场调查报告书

商品编码

1844471

透明陶瓷:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Transparent Ceramics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

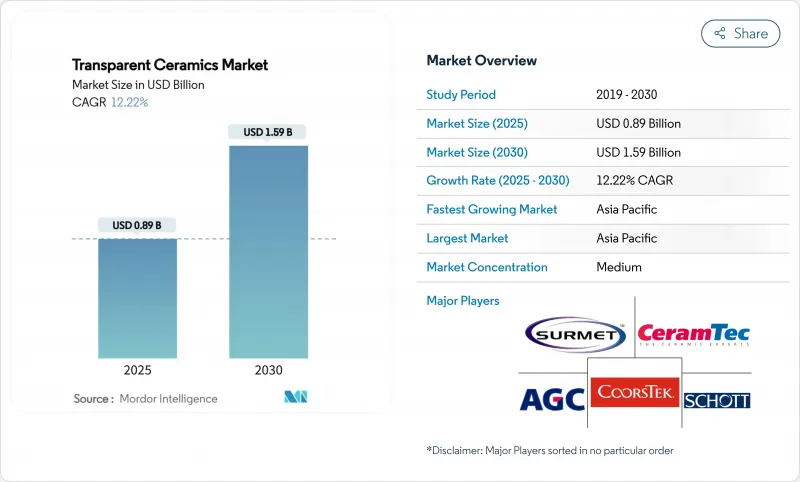

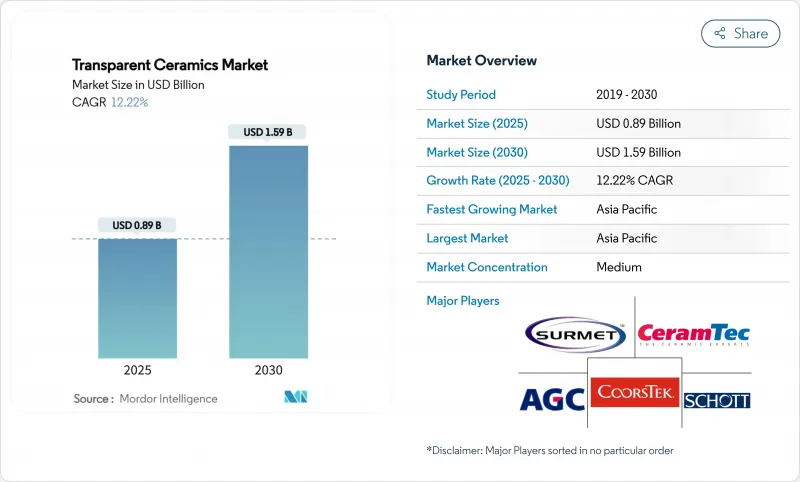

透明陶瓷市场规模预计在 2025 年为 8.9 亿美元,预计到 2030 年将达到 15.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.22%。

对核融合级雷射光学元件、高超音速飞行器整流罩和下一代光电元件的需求不断重新定义性能基准,刺激了对可降低缺陷率和扩大产量的製造技术的投资。受中国和日本半导体和航太工业建设的推动,亚太地区贡献了最大的收益块并创下了最快的区域增长记录,这反映了规模经济和协调的产业政策。晶体陶瓷目前在出货量中占主导地位,特别是在军用光学领域。然而,随着家用电子电器品牌转向抗刮性、高清晰度外壳,具有成本优势的玻璃陶瓷变体正在涌现。虽然蓝宝石在材料市场主导,但氮氧化铝的弹道性能正在赢得高超音速平台下一代红外线 (IR) 窗口的设计。虽然竞争格局较为鬆散,但垂直整合正趋向于稀土投入和专有烧结技术,以降低单位成本并确保人工植牙和 LED 照明等大批量应用的生产能力。

全球透明陶瓷市场趋势与洞察

加速光学和光电子领域的应用

雷射驱动的製造、雷射雷达和光子积体电路正在推动对高纯度、低缺陷透明陶瓷的需求达到创纪录的水平。钛:绝缘体上蓝宝石原型可实现紧凑的布局,从而减少系统占用空间并提高功率密度,证明了晶圆级雷射阵列的商业性可行性。掺铈石榴石陶瓷的亮度饱和阈值现已达到65 W mm-2,为LED背光和工业雷射中的单晶增益介质提供了一种耐用且热稳定的替代方案。因此,透明陶瓷市场与宽频通讯资讯息相关,而小型化的压力正在放大能够承受强光通量和高结温的材料的价值。

航太和国防需求不断成长

透明陶瓷满足超音速飞机、飞弹探求者和卫星感测器窗口光纤传输和耐高温的双重要求。多孔氮化硅(Si3N4)雷达罩的孔隙率达到56%,同时保持机械完整性,从而减轻了远距拦截飞弹的总重量。高超音速滑翔飞行器的透明罩必须承受2000°C的外壳温度,而氮化铝(AlON)和尖晶石材质不仅超过了这个阈值,还能承受热衝击。美国联邦政府的蓝图将这些陶瓷列为高弹性能量武器光学元件和定向能係统的基础材料。以满足感测器频宽需求的硫系玻璃衍生物取代锗窗口,可降低策略性矿产供应风险,进而进一步促进透明陶瓷市场的发展。

製造成本高

透明陶瓷需要高纯度原料和多级烧成工艺,因此其窑炉停留时间和功耗显着超过标准瓷砖和结构陶瓷。两级烧结可以提高密度,但需要高精度的热感灯,而蓝宝石组件的钻石砂轮精加工会增加高速主轴和冷却系统的资本投资。产业对碳排放的严格审查正在加速绿色氢窑炉的转变,但短期转换成本正在拖累利润率。

細項分析

晶体陶瓷在0.3-5微米波段表现出持续的高透射率,抗压强度超过2GPa,到2024年将占据透明陶瓷市场64.67%的份额。细晶粒蓝宝石圆顶和YAG雷射板展现了该领域在机载雷达罩和固体雷射的多功能性。同时,非晶微晶玻璃凭藉灵活的熔铸生产线和较低的废品率,已占领行动电话镜头盖和智慧型手錶背板市场。 12.78%的复合年增长率凸显了价格敏感型消费通路的需求韧性。

堇青石微晶玻璃的透光率高达 82.3%,热膨胀係数低于 2.6 ppm 度C-1,为实现无需聚合物层压的单片移动萤幕奠定了基础。同时,先进的成核剂系统——P2O5 + ZrO2 + TiO2——将结晶转移到本体,在不牺牲透明度的情况下提高了机械抗拉强度。火花电浆烧结技术将加工时间从数小时缩短至数分钟,将能量输入减半,并缩小晶粒边界以抑制散射。

区域分析

2024年,亚太地区将占全球销售额的56.67%,主要得益于湖南成熟的蓝宝石晶棒和名古屋的大直径AlON板材。政府对半导体蚀刻和显示器工厂的奖励策略将推动需求,而中国出口导向国防企业集团将在其下一代ISR无人机中采用尖晶石圆顶。到2030年,该地区的收入将以14.23%的复合年增长率显着增长。韩国的奈米透明萤幕计画将每英吋成本降低至OLED的十分之一,从而扩大了可寻址显示器的覆盖范围,并深化了区域供应链。

北美持续引领技术发展,津贴,展示定向能雷射耦合器和核融合级光学元件。 Lightpath Technologies 正在使用 BDNL4 硫系玻璃取代锗,以保护国防基础设施免受地缘政治风险的影响。墨西哥电子加工厂(Electronics Maquiladora)正在将微晶玻璃散热器应用于电源模组,这标誌着先进材料正在向该地区以外的地区扩展。

在欧洲,肖特致力于高附加价值、低碳生产。肖特4.5亿欧元的资本计画包括一条氢燃浮法生产线,该生产线将于2024年生产首批二氧化碳中性玻璃,并正在检验陶瓷烧结炉的可行性。德国陶瓷复合材料网路的目标是到2025年将其氧化纤维加工能力翻一番,这对于航太涡轮机中的陶瓷基复合材料至关重要。中东和非洲地区正在进行早期但具有战略意义的部署,尤其是在聚光型太阳光电领域,防尘、红外线透明的屏蔽层可以延长定日镜的使用寿命。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 加速光学和光电子领域的应用

- 航太和国防领域的需求不断增长

- 精密陶瓷正在取代塑胶和金属

- 核融合级高功率陶瓷雷射

- 高超音速飞行器红外线罩中透明陶瓷的使用日益增多

- 市场限制

- 製造成本高

- 製造复杂性和产量比率损失

- 稀土开采的永续性问题

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按结构

- 结晶质的

- 结晶质(玻璃陶瓷)

- 按材质

- 蓝宝石(Al2O3)

- 钇铝石榴石(YAG)

- 氧氮化铝(AlON)

- 尖晶石(MgAl2O4)

- 钇安定氧化锆(YSZ)

- 其他先进材料

- 按用途

- 光学与光电子学

- 航太/国防

- 机械/化学加工

- 医疗保健和牙科

- 消费性电子产品

- 能源和电力

- 其他的

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 北欧的

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 奈及利亚

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- AGC Inc.

- CeramTec GmbH

- CILAS

- CoorsTek Inc.

- Deisenroth Engineering GmbH

- Fraunhofer IKTS

- General Electric

- II-VI Optical Systems

- Konoshima Chemical Co. Ltd

- Kyocera Corporation

- Meller Optics Inc

- Murata Manufacturing

- OptoCity Inc.

- Philips Lighting Holdings

- Raytheon Technologies(RTX)

- Saint-Gobain Group

- SCHOTT AG

- Surmet Corporation

第七章 市场机会与未来展望

The Transparent Ceramics Market size is estimated at USD 0.89 billion in 2025, and is expected to reach USD 1.59 billion by 2030, at a CAGR of 12.22% during the forecast period (2025-2030).

Demand for fusion-grade laser optics, hypersonic vehicle domes, and next-generation optoelectronic components continues to redefine performance baselines, spurring investment in manufacturing technologies that shrink defect rates and expand throughput. Asia Pacific, supported by semiconductor and aerospace buildouts in China and Japan, contributes the largest revenue block and simultaneously registers the fastest regional growth, reflecting scale economics and coordinated industrial policy. Crystalline-structure ceramics dominate current shipments, especially in military optics, yet cost-advantaged glass-ceramic variants are closing ground as consumer electronics brands pivot to scratch-resistant, high-clarity covers. Material leadership resides with sapphire, but aluminum oxynitride's ballistic performance is allowing it to seize design-in wins for next-generation infrared (IR) windows on hypersonic platforms. The competitive field, while moderately consolidated, is tilting toward vertical integration as players race to secure rare-earth inputs and proprietary sintering know-how, lowering unit costs and unlocking capacity for high-volume sectors such as dental implants and LED lighting.

Global Transparent Ceramics Market Trends and Insights

Accelerating Usage in Optics & Optoelectronics

Laser-driven manufacturing, lidar, and photonic-integrated circuits are fueling record off-take for high-purity, low-defect transparent ceramics. Titanium:sapphire-on-insulator prototypes have delivered compact layouts that cut system footprints while boosting power density, signaling commercial feasibility for wafer-level laser arrays. Ce-doped garnet ceramics now demonstrate luminance saturation thresholds of 65 W mm-2, offering durable, thermally stable alternatives to single-crystal gain media in LED backlights and industrial lasers. The transparent ceramics market is, therefore, intertwined with broadband communications, where miniaturization pressures amplify the value of materials that can survive intense photon flux and elevated junction temperatures.

Growing Demand from Aerospace & Defense

Transparent ceramics meet the dual mandate of optical transmission and high-temperature resilience imposed by supersonic aircraft, missile seekers, and satellite sensor windows. Porous Si3N4 radomes have reached 56% porosity while preserving mechanical integrity, trimming overall weight for long-range interceptors. Transparent domes on hypersonic glide bodies must tolerate 2,000 °C skin temperatures; AlON and spinel exceed such thresholds while resisting thermal shock. U.S. federal roadmaps name these ceramics as cornerstone materials for resilient energy weapon optics and directed-energy systems. Substitution away from germanium windows further elevates the transparent ceramics market, alleviating strategic mineral supply risk through chalcogenide glass derivatives that match sensor bandwidth needs.

High Production Cost

Transparent ceramics require high-purity feedstocks and multi-stage sintering profiles that push furnace dwell times and electricity usage well above standard tile or structural ceramics. Two-step sintering raises density but demands precision thermal ramps, while diamond-wheel finishing of sapphire parts adds capex for high-RPM spindles and coolant systems. Industry carbon-footprint scrutiny is accelerating shifts to green hydrogen kilns, but near-term conversion expenses weigh on margins.

Other drivers and restraints analyzed in the detailed report include:

- Advanced Ceramics Increasingly Replacing Plastics and Metals

- Fusion-Grade High-Power Ceramic Lasers

- Manufacturing Complexity & Yield Losses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Crystalline variants secured 64.67% transparent ceramics market share in 2024, validated by consistently higher transmission in the 0.3-5 μm band and compressive strengths above 2 GPa. Fine-grain sapphire domes and YAG laser slabs illustrate the segment's versatility across radomes and solid-state lasers. Non-crystalline glass-ceramics, conversely, capitalized on agile melt-casting lines and lower scrap rates, capturing handset lens covers and smart-watch backplates. Their 12.78% CAGR underscores demand elasticity in price-sensitive consumer channels.

Cordierite glass-ceramics that combine 82.3% transmittance with sub-2.6 ppm °C-1 thermal expansion pave the way for monolithic mobile screens that forego polymer lamination. Meanwhile, advanced nucleant systems-P2O5 + ZrO2 + TiO2-shift crystallization to the bulk, enhancing mechanical tensile strength without sacrificing clarity. Spark plasma sintering reduces processing windows from hours to minutes, halving energy input and shrinking grain boundaries to suppress scattering.

The Transparent Ceramics Market Report is Segmented by Structure (Crystalline, Non-Crystalline), Material (Sapphire, Yttrium Aluminum Garnet, Aluminum Oxynitride, and More), Application (Optics & Optoelectronics, Aerospace & Defense, Mechanical & Chemical Processing, and More), and Geography (Asia Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific controlled 56.67% of 2024 sales, buoyed by entrenched sapphire boules in Hunan and wide-aperture AlON plates in Nagoya. Government stimulus for local semiconductor etching and display fabs furnishes anchor demand, while export-oriented defense conglomerates in China adopt spinel domes for next-generation ISR drones. By 2030, the region is poised to generate significant incremental revenue, growing at a rate of 14.23% CAGR. South Korea's nano transparent screen initiative cuts per-inch costs to one-tenth of OLED, broadening addressable display footprints and deepening local supply chains.

North America remains the technology vanguard, leveraging DARPA and DoE grants to demonstrate directed-energy laser couplers and fusion-grade optics. LightPath Technologies is substituting BDNL4 chalcogenide glass for germanium, insulating the defense base from geopolitical risk. Mexico's electronics maquiladoras integrate glass-ceramic heat spreaders into power modules, signaling outward regional diffusion of advanced materials.

Europe positions itself on value-added, low-carbon production. SCHOTT's EUR 450 million capital program includes a hydrogen-fired float line that delivered its first CO2-neutral glass in 2024, validating feasibility for ceramic sintering kilns. Germany's Ceramic Composites network targets a doubling of oxide-fiber throughput by 2025, critical for ceramic-matrix composites in aerospace turbines. The Middle East and Africa record nascent but strategic uptake, especially in concentrated solar power fields where dust-resistant, IR-transparent shields elongate heliostat lifetimes.

- AGC Inc.

- CeramTec GmbH

- CILAS

- CoorsTek Inc.

- Deisenroth Engineering GmbH

- Fraunhofer IKTS

- General Electric

- II-VI Optical Systems

- Konoshima Chemical Co. Ltd

- Kyocera Corporation

- Meller Optics Inc

- Murata Manufacturing

- OptoCity Inc.

- Philips Lighting Holdings

- Raytheon Technologies (RTX)

- Saint-Gobain Group

- SCHOTT AG

- Surmet Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating usage in optics and optoelectronics

- 4.2.2 Growing demand from aerospace and defense

- 4.2.3 Advanced Ceramics Increasingly Replacing Plastics and Metals

- 4.2.4 Fusion-grade high-power ceramic lasers

- 4.2.5 Rising use of transparent ceramics in IR domes for hypersonic vehicles

- 4.3 Market Restraints

- 4.3.1 High production cost

- 4.3.2 Manufacturing complexity and yield losses

- 4.3.3 Sustainability issues in rare-earth mining

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts

- 5.1 By Structure

- 5.1.1 Crystalline

- 5.1.2 Non-crystalline (Glass-ceramic)

- 5.2 By Material

- 5.2.1 Sapphire (Al2O3)

- 5.2.2 Yttrium Aluminum Garnet (YAG)

- 5.2.3 Aluminum Oxynitride (AlON)

- 5.2.4 Spinel (MgAl2O4)

- 5.2.5 Yttria-stabilized Zirconia (YSZ)

- 5.2.6 Other Advanced Materials

- 5.3 By Application

- 5.3.1 Optics and Optoelectronics

- 5.3.2 Aerospace and Defense

- 5.3.3 Mechanical and Chemical Processing

- 5.3.4 Healthcare and Dental

- 5.3.5 Consumer Electronics and Goods

- 5.3.6 Energy and Power

- 5.3.7 Others Applications

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 Australia and New Zealand

- 5.4.1.6 ASEAN countries

- 5.4.1.7 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 NORDIC

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 UAE

- 5.4.5.3 South Africa

- 5.4.5.4 Egypyt

- 5.4.5.5 Nigeria

- 5.4.5.6 Rest of Middle East and Africa

- 5.4.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AGC Inc.

- 6.4.2 CeramTec GmbH

- 6.4.3 CILAS

- 6.4.4 CoorsTek Inc.

- 6.4.5 Deisenroth Engineering GmbH

- 6.4.6 Fraunhofer IKTS

- 6.4.7 General Electric

- 6.4.8 II-VI Optical Systems

- 6.4.9 Konoshima Chemical Co. Ltd

- 6.4.10 Kyocera Corporation

- 6.4.11 Meller Optics Inc

- 6.4.12 Murata Manufacturing

- 6.4.13 OptoCity Inc.

- 6.4.14 Philips Lighting Holdings

- 6.4.15 Raytheon Technologies (RTX)

- 6.4.16 Saint-Gobain Group

- 6.4.17 SCHOTT AG

- 6.4.18 Surmet Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Increasing Demand in the Medical Sector