|

市场调查报告书

商品编码

1842552

无气轮胎:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Airless Tires - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

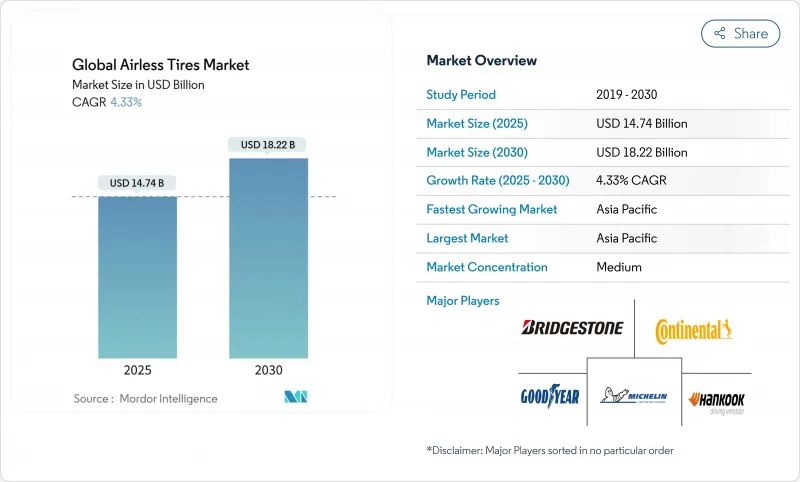

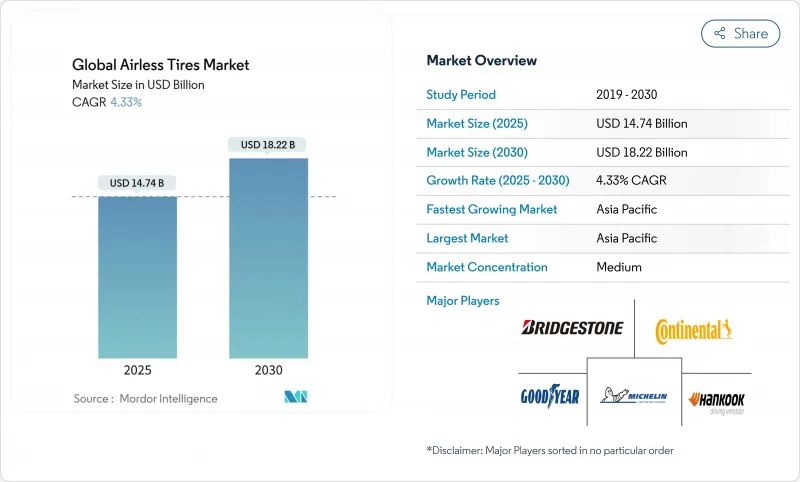

目前,无气轮胎市场规模在 2025 年的价值为 147.4 亿美元,预计到 2030 年将达到 182.2 亿美元,复合年增长率为 4.33%。

随着电动车 (EV) 製造商寻求防刺穿解决方案,国防机构指定防爆轮胎平台,以及永续性法规收紧处置规则,从原型车到商业化生产线的过渡正在进行中。特斯拉与米其林 Uptis 系列正在进行的测试讨论等伙伴关係,表明目标商标产品製造商 (OEM) 的参与如何加速其主流应用。采矿车队日益增长的需求、微出行服务的扩展以及 3D 列印晶格结构带来的快速迭代,进一步巩固了无气轮胎市场的成长路径。虽然现有轮胎公司拥有深厚的材料科学组合,但高昂的单位成本和 130 公里/小时以上的认证限制,限制了其短期内的普及。

全球无气轮胎市场趋势与洞察

电动车原始设备製造商寻求更快的防刺穿解决方案

电动车製造商正在减少备胎空间,以增加车厢容积和车辆重量。 Uptis 与特斯拉的试验表明,单一原始设备製造商 (OEM) 的决策将推动无气轮胎市场走向大规模应用。车队营运商报告称,改用免充气轮胎后,故障率降低了 80%,并降低了计画外停机成本。电池更高的质量和扭矩负载能力,加上无气轮胎结构的优势,使得米其林预测,广泛采用无气轮胎每年可减少 2 亿条轮胎的处置。这些因素使电动车平台成为加速无气轮胎市场发展的中期催化剂。

采矿业努力减少轮胎停机时间

閒置的运输车可能造成超过10万美元的矿石产量损失。Bridgestone的智慧现场套件将无气轮胎与人工智慧诊断相结合,为地下车辆提供预测性调度。米其林位于智利的轮胎回收厂每年处理3万吨土方轮胎,将耐用性与循环价值捕获结合。成熟的投资回报率已说服矿山营运商接受溢价,从而支持了亚太地区主导的无气轮胎市场的扩张。

单价比子午线轮胎更高

由于使用专用聚氨酯和复合材料,目前非充气轮胎的价格比同类子午线轮胎高出40-60%。全球充气轮胎产量为24亿条,远超过目前无气轮胎的产能,限制了规模经济。虽然采矿和包裹物流车队仍在购买充气轮胎,以节省停机时间,但主流乘用车销售仍然对价格敏感,这抑制了无气轮胎市场的中期走势。

細項分析

越野车的复合年增长率最高,为7.46%,而搭乘用的份额最高,为46.12%。由于采矿业者优先考虑运作,越野机械用无气轮胎的市场规模达到了可观的水平。休閒全地形车和多功能车使用径向刚度更高的辐条轮胎,以提高越野性能,从而扩大了其消费群体。

由于总拥有成本 (TCO) 模型更倾向于避免爆胎,商用卡车市场正在稳步发展。强力运动製造商正透过免维护功能来提升其车型的差异化,以吸引偏远的越野骑乘者。摩托车应用虽然规模较小,但在电动自行车车队重视可靠性的城市环境中却日益增长。总体而言,各种类型的车辆正在共同推动无气轮胎市场的发展,使其超越其最初的工业基点。

2024年,橡胶占了65.33%的市场份额,反映了其传统的供应链和成本优势。米其林的目标是到2030年,使用40%的可再生和可回收原料。聚氨酯基弹性体在辐条组件中具有出色的抗裂性能,并提高了整个无气轮胎市场的耐用性。

虽然橡胶在量产上仍具有成本效益,但复合材料具有环保优势。塑胶配方服务于机场地面支援设备 (GSE) 等利基市场,而耐化学性是这些市场的关键。材料的演变凸显了永续性要求如何重塑供应商策略,并强化其在无气轮胎市场的高端定位。

区域分析

亚太地区占38.55%的市场份额,复合年增长率为8.25%。政府的电动车激励措施、密集的整车厂基础以及韩泰iFlex项目等本土创新企业正在推动该地区的发展势头。全球排名前75的轮胎公司中有34家在中国开展业务,其规模和成本优势推动无气轮胎市场在国内和出口通路的发展。

北美受惠于国防合约和先进的研发生态系统。美国工程集团的零压业务以及特斯拉和米其林的试点项目展示了跨行业的检验。多个州的生产者责任法规支持可回收设计,儘管初始成本较高,但这种设计支持了无气轮胎市场的长期成长。

欧洲正在实施严格的排放和掩埋法规。欧盟7轮胎磨损上限和生产者延长责任框架与无气轮胎的可回收特性相契合。米其林透过富有远见的生产方式,充分利用欧洲大陆的政策趋势,帮助当地无气轮胎市场在保持性能的同时履行其气候变迁承诺。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 电动车原始设备製造商寻求快速防刺穿解决方案

- 采矿业努力减少轮胎停机时间

- 增加防爆轮胎机动平台的军事开支

- 欧盟掩埋法规趋严,有利于可回收非充气轮胎

- 3D列印格纹轮缩短原型製作週期

- 微型移动车队在最后一哩物流崛起

- 市场限制

- 单价比子午线轮胎更高

- 高速负载认证限制

- NVH 问题阻碍了 OEM 的发展

- 新合格法规的不确定性

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测(单位:美元)

- 按车辆类型

- 搭乘用车

- 商用车

- 越野车

- 摩托车

- 强力运动(ATV/UTV、雪上摩托车)

- 按材质

- 橡皮

- 塑胶

- 复合弹性体

- 依製造技术

- 3D列印格子

- 模压辐条网

- 层状蜂巢

- 按销售管道

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 纽西兰

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 埃及

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Michelin Group

- Goodyear Tire & Rubber Co.

- Continental AG

- Hankook Tire & Technology Group

- Bridgestone Corporation

- Trelleborg AB

- Toyo Tire Corporation

- Amerityre Corporation

- Tannus Ltd

- Polaris Inc.(Resilient Technologies)

- Kenda Rubber Industrial Co.

- Marathon Industries Inc.

- SMART Tire Company

第七章 市场机会与未来展望

The airless tires market size is currently valued at USD 14.74 billion in 2025 and is forecast to reach USD 18.22 billion by 2030, expanding at a 4.33% CAGR.

The transition from prototypes to commercial lines is progressing as electric-vehicle (EV) makers seek puncture-proof solutions, defense agencies specify run-flat mobility platforms, and sustainability regulations tighten disposal rules. Partnerships such as Tesla's ongoing testing discussions with Michelin's Uptis line illustrate how original equipment manufacturer (OEM) engagement accelerates mainstream acceptance. Rising demand from mining fleets, expanding micro-mobility services, and rapid iteration enabled by 3-D printed lattice structures further reinforce the airless tires market growth path. Incumbent tire firms deploy deep materials-science portfolios, yet higher unit costs and certification limits above 130 km/h continue to moderate the near-term adoption curve.

Global Airless Tires Market Trends and Insights

Rapid Puncture-Proof Solutions Demanded by EV OEMs

EV makers eliminate spare-tire space to extend cabin volume and curb weight; doing so elevates the cost of roadside failures. Uptis trials with Tesla illustrate how a single OEM decision can pull the wider airless tires market toward volume adoption. Fleet operators report up to 80% fewer breakdowns after switching to non-pneumatic tires, cutting unplanned downtime costs. Higher load tolerance for battery mass and torque aligns with airless construction advantages, while Michelin projects 200 million tire scrappage avoidance annually once deployment scales. These factors position EV platforms as the medium-term catalyst for the airless tires market momentum.

Mining Sector Push to Cut Tire Downtime

Haul-truck immobilization can exceed USD 100,000 in lost ore output. Bridgestone's Smart On-Site bundle couples airless tires with AI diagnostics, delivering predictive scheduling for pit fleets. Michelin's tire recycling plant in Chile processes 30,000 tons of earthmover tires annually, linking durability with circular value capture. The proven ROI persuades mine operators to accept premium pricing, sustaining Asia-Pacific-led expansion of the airless tires market.

Higher Unit Cost Versus Radial Tires

Current non-pneumatic units cost 40-60% above comparable radials owing to specialized polyurethane and composite inputs. Global output of 2.4 billion pneumatic units dwarfs current airless capacity, limiting economies of scale. Fleets in mining or parcel logistics are still buying due to downtime savings, yet mainstream passenger sales remain price sensitive, tempering the airless tires market trajectory during the medium term.

Other drivers and restraints analyzed in the detailed report include:

- Rising Military Spending on Run-Flat Mobility Platforms

- Stricter EU Landfill Rules Favoring Recyclable Non-Pneumatics

- Limited High-Speed Load Certifications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Off-road vehicles posted the highest 7.46% CAGR outlook, even though passenger models retained the largest 46.12% share. The airless tires market size for off-road machinery reached a significant value as mine operators prioritized uptime. Recreational ATVs and UTVs use spoked designs offering higher radial stiffness for rough terrain, thereby widening consumer segments.

The commercial-truck niche shows steady conversion because total-cost-of-ownership models reward puncture avoidance. Power-sports makers differentiate models through maintenance-free features attractive to remote trail riders. Two-wheeler use is a niche yet growing in urban settings where e-bike fleets value reliability. Overall, diverse vehicle classes collectively expand the airless tires market beyond its initial industrial anchor points.

Rubber held a 65.33% share in 2024, reflecting legacy supply chains and cost advantages, whereas composite elastomers are projected to register the fastest 6.15% CAGR. Incorporation of bio-sourced feedstocks advances circularity pledges; Michelin targets 40% renewable and recyclable content by 2030. Polyurethane-based elastomers offer superior crack resistance for spoke assemblies, enhancing durability across the airless tires market.

Rubber remains cost-effective for high-volume runs, yet environmental levies favor composites. Plastic formulations serve specialist chemical-resistant niches such as airport GSE. The materials evolution underscores how sustainability mandates are reshaping supplier strategies and reinforce premium positioning within the airless tires market.

The Airless Tires Market Report is Segmented by Vehicle Type (Passenger Vehicles, Commercial Vehicles, and More), Material (Rubber, Plastic, and More), Manufacturing Technology (3-D Printed Lattice, Molded Spoke Web, and More), Sales Channel (OEM and Aftermarket), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific combined the largest 38.55% slice with the fastest 8.25% CAGR. Government EV incentives, a dense OEM base, and domestic innovators such as Hankook's iFlex program power regional momentum. China's 34 of the top 75 global tire companies deliver scale and cost advantages, propelling the airless tires market in local and export channels.

North America benefits from defense contracts and advanced R&D ecosystems. American Engineering Group's zero-pressure work and Tesla-Michelin pilots demonstrate cross-sector validation. Producer-responsibility regulations in several states support recyclable designs, underpinning long-term growth of the airless tires market despite higher upfront costs.

Europe orchestrates stringent emission and landfill rules. Euro 7 tyre abrasion caps and extended-producer-responsibility frameworks align with airless recyclability attributes. Michelin leverages continental policy trends through Vision-aligned production, helping the regional airless tires market meet climate commitments while safeguarding performance.

- Michelin Group

- Goodyear Tire & Rubber Co.

- Continental AG

- Hankook Tire & Technology Group

- Bridgestone Corporation

- Trelleborg AB

- Toyo Tire Corporation

- Amerityre Corporation

- Tannus Ltd

- Polaris Inc. (Resilient Technologies)

- Kenda Rubber Industrial Co.

- Marathon Industries Inc.

- SMART Tire Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid puncture-proof solutions demanded by EV OEMs

- 4.2.2 Mining sector's push to cut tyre downtime

- 4.2.3 Rising military spending on run-flat mobility platforms

- 4.2.4 Stricter EU landfill rules favouring recyclable non-pneumatics

- 4.2.5 3-D printed lattice wheels slashing prototyping cycles

- 4.2.6 Growing micro-mobility fleets for last-mile logistics

- 4.3 Market Restraints

- 4.3.1 Higher unit cost versus radial tires

- 4.3.2 Limited high-speed load certifications

- 4.3.3 OEM hesitation due to NVH concerns

- 4.3.4 Regulatory uncertainty on new road-worthiness standards

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.1.3 Off-Road Vehicles

- 5.1.4 Two-Wheeler

- 5.1.5 Power Sports (ATV/UTV, Snowmobile)

- 5.2 By Material

- 5.2.1 Rubber

- 5.2.2 Plastic

- 5.2.3 Composite Elastomers

- 5.3 By Manufacturing Technology

- 5.3.1 3-D Printed Lattice

- 5.3.2 Molded Spoke Web

- 5.3.3 Layered Honeycomb

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Egypt

- 5.5.5.4 Turkey

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Michelin Group

- 6.4.2 Goodyear Tire & Rubber Co.

- 6.4.3 Continental AG

- 6.4.4 Hankook Tire & Technology Group

- 6.4.5 Bridgestone Corporation

- 6.4.6 Trelleborg AB

- 6.4.7 Toyo Tire Corporation

- 6.4.8 Amerityre Corporation

- 6.4.9 Tannus Ltd

- 6.4.10 Polaris Inc. (Resilient Technologies)

- 6.4.11 Kenda Rubber Industrial Co.

- 6.4.12 Marathon Industries Inc.

- 6.4.13 SMART Tire Company

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment