|

市场调查报告书

商品编码

1842628

施肥机:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Fertilizer Spreader - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

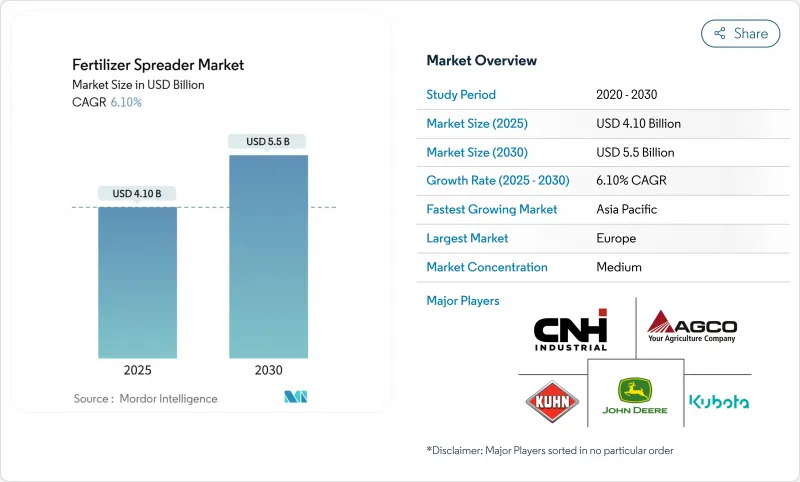

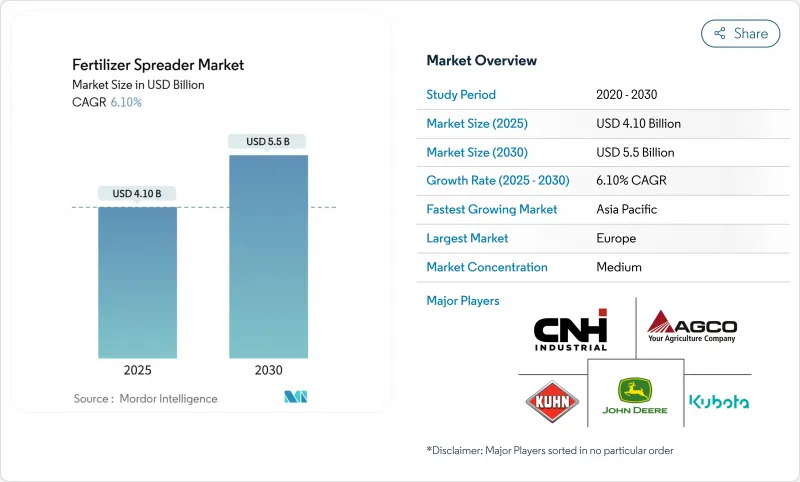

预计 2025 年施肥机市场规模将达到 41 亿美元,到 2030 年将增加至 55 亿美元,复合年增长率为 6.1%。

精密农业的进步、严重的劳动力短缺以及更严格的环境法规迫使生产商用支援GPS的变数设备替换或升级传统机械。虽然旋转式桨鼻罩因其覆盖范围广而仍然在大面积谷物生产中占据主导地位,但在均匀性和多种营养成分的精准度决定产量的领域,气动气流系统正日益受到青睐。北美和欧洲的补贴计画正在缩短高规格撒播机的投资回收期,而数销售管道也为小品牌进入市场开闢了新的途径。同时,对颗粒状微量营养素混合物和季节性液体肥料的需求不断增长,也拓宽了製造商必须支持的产品组合。

全球施肥机市场趋势与洞察

全球卡路里需求增加和耕地短缺

人口的稳定增长和饮食习惯的不断变化推动着每英亩产量的预期提升。由于土地扩张潜力有限,采用先进的气流机械进行均匀施肥对高价值作物而言日益重要。与土壤测绘平台同步的变数喷雾器使种植者能够微调施肥量,从而在现有土地上实现更高的产量。这些功能支持亚太和非洲地区以出口为导向的种植者在不加剧土壤劣化的情况下提高产量。能够在田间证明投资报酬率的製造商将能够充分利用这项持续的需求。

农业劳动力短缺与成本上升推动机械化

北美和西欧的农场经营正面临两位数的薪资上涨和操作员短缺。自走式喷雾器减少了对人员的需求,并能在天气变化前完成多条田间作业路线,将劳动力短缺转化为招聘机会。 GPS自动驾驶和堵塞感测器使缺乏经验的驾驶员也能达到与经验丰富的操作员相当的重迭精度,从而缓解了劳动力瓶颈。面对季节性劳动力迁移趋势的南美生产商也正在采用更高容量的PTO装置来维持产量。将远距离诊断和操作员培训捆绑在一起的设备供应商预计将获得额外的服务收入。

与传统喷涂方法相比,初始成本较高

先进喷雾器的价格从2.5万美元到20万美元不等,这对利润微薄、销量大的中小型农场来说是一个障碍。新兴经济体的信贷管道不均衡,因此生产者优先考虑短期流动性,而非多年的效率提升。 「设备即服务」模式,以公顷使用量收费,并针对传统桨鼻罩提供VRT套件改造,正作为过渡解决方案日益普及。原始设备製造商正在收费捆绑硬体、软体更新和农艺建议的订阅套餐,以缓解资金高峰并扩大市场覆盖范围。

細項分析

旋转式/桨鼻罩式施肥机市场规模将在2024年达到可观水平,占全球销售额的46%。气动气流设计虽然目前产量较低,但以9.6%的复合年增长率扩张。

空气撒播机也支援控制释放颗粒和包衣营养素,且不会出现颗粒偏析,使其成为高价饲料项目的首选技术。在多风地区,封闭式吊桿设计可最大限度地减少漂移,并符合日益严格的缓衝区法规。随着饲料供应商扩大其颗粒微量营养素供应,投资于优化吊桿长度和更有效率液压风扇驱动的製造商预计将继续获得市场份额。活性碳内衬落料斗和耐腐蚀合金的引入,旨在延长机器寿命,鑑于肥料撒播机市场资本成本的上升,这是一个重要的采购考虑因素。

传统的非 GPS 撒肥机仍占据肥料撒肥机市场份额的 72%,这反映了它们在成本敏感地区的高安装基数和诱人的低价,但精密/GPS 导引平台的复合年增长率为 11.0%,这受到可量化的投入节省和要求数位记录保存的环境合规性的推动。

透过行动电话网路传输的 VRT 处方允许操作员随时随地调整施肥量,确保营养液施用与高解析度土壤层相匹配。领先的原始设备製造商正在整合相容 ISOBUS 的控制器,使混合品牌车队能够共用地图和机器健康数据。透过智慧型手机存取的扩增实境校准工具可以减少设定错误,并降低学习曲线,而这正是施肥机市场先前升级的障碍。

区域分析

到2024年,欧洲将以29%的市场份额引领施肥机市场,这得益于其成熟的精密农业基础设施和补贴技术应用的通用农业政策奖励。严格的硝酸盐指令和流域保护条例使得变数施肥几乎成为大规模耕作作业的必要条件。该地区强大的经销商网路和成熟的融资管道为高规格机械的采购提供了顺畅的途径。瞄准该市场的製造商强调软体与农场管理平台的集成,以及与欧洲卫星校正讯号的兼容性,从而实现亚米级精度。

预计到2030年,亚太地区的复合年增长率将达到7.8%,成为全球成长最快的地区。在中国,政策转向在保持产量的同时降低施肥强度,这催生了对优化施用效率的喷雾器的需求。政府的农业现代化计画为机械化津贴,特别是针对多农合作社。印度农化产业规模在2024年将达到324亿美元,该产业正在扩张,显示对喷雾设备的投资潜力正在不断增长。製造商正在针对亚洲的具体情况进行设计,为稻田提供更窄的作业宽度,并为技术培训较少的操作员提供简化的控制设备。

儘管近期大宗商品价格波动和设备成本上涨带来不利影响,北美地区仍维持庞大的施肥机市场。大规模粮食种植强调精准技术和数据管理能力的整合,并与既定的数位化农业实践保持一致。然而,爱科集团2024年第二季销售额下降15.1%,反映出其谨慎的资本投资,因为农民更重视设备的使用寿命而非更换。製造商正在推出改装方案,为现有施肥机增加可变速率功能。巴西大豆种植面积的不断扩大推动了对高容量机器的需求,这些机器可以在较窄的喷洒窗口内覆盖大片田地,但由于外汇波动,南美洲的增长并不均衡。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 全球卡路里需求增加和耕地短缺

- 农业劳动力短缺与成本上升推动机械化

- 精准施肥设备补贴制度

- 采用变数施肥技术(VRT)

- 转向需要精确施用的颗粒状微量营养素混合物

- 奖励优化营养利用的碳信用计画激增

- 市场限制

- 与传统喷涂方法相比,初始成本更高

- 小规模农户意识低下

- 售后服务及校准服务网络分散

- 对化肥价格和农场收入的波动敏感

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 按机器类型

- 撒布机

- 旋转式/桨鼻罩撒布机

- 钟摆式撒布机

- 气流/气动喷雾器

- 液体肥料撒播机

- 依技术

- 传统的

- 精确/GPS导

- 自主/机器人相容

- 按驱动系统

- PTO 驱动

- 路线类型

- 自走式

- 手扶式/手动

- 按肥料类型

- 颗粒状

- 粉末

- 液体

- 按最终用途

- 农田作物种植户

- 专业/园艺

- 草坪和景观美化

- 果园和葡萄园

- 按销售管道

- OEM

- 经销商/分销商

- 在线的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 中东

- 沙乌地阿拉伯

- 土耳其

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- AGCO Corporation

- CNH Industrial NV(Exor NV)

- Deere & Company

- Kubota Corporation

- Kuhn Group(Bucher Industries)

- Mahindra & Mahindra Ltd.

- Amazone Werke

- BOGBALLE A/S(Erhvervsinvest)

- Rauch Landmaschinenfabrik

- Salford Group(Linamar Corporation)

- Jacto

- IRIS Spreaders Co., Ltd.

- Adams Fertilizer Equipment(Reppert Capital Partners)

- Teagle Machinery Limited

第七章 市场机会与未来展望

The fertilizer spreader market size is valued at USD 4.1 billion in 2025 and is forecast to climb to USD 5.5 billion by 2030, translating into a 6.1% CAGR.

Evolving precision-farming practices, acute labor shortages, and tightening environmental regulations are compelling growers to replace or upgrade conventional equipment with GPS-enabled variable-rate machines. Rotary spinner designs still dominate large-acreage grain production because of their wide swath coverage, yet pneumatic airflow systems are gaining traction where uniformity and multi-nutrient accuracy drive yield. Subsidy programs in North America and Europe are shortening payback cycles for high-specification spreaders, and digital sales channels are unlocking new routes to market for smaller brands. Meanwhile, rising demand for granular micronutrient blends and in-season liquid fertilization is widening the product mix that manufacturers must support.

Global Fertilizer Spreader Market Trends and Insights

Rising Global Calorie Demand and Arable-Land Scarcity

Steady population growth and changing diets are escalating yield-per-acre expectations. Because land expansion potential is limited, uniform nutrient placement through advanced airflow machines is becoming critical for high-value crops. Variable-rate spreaders that sync with soil-mapping platforms let growers fine-tune application, squeezing more output from existing hectares. These capabilities support export-oriented producers in Asia-Pacific and Africa, trying to lift productivity without aggravating soil degradation. Manufacturers able to prove field-level return on investment are well-positioned to ride this secular demand wave.

Shortage and Rising Cost of Agricultural Labour Stimulate Mechanization

Farm operations in North America and Western Europe face double-digit wage inflation and persistent operator gaps. Self-propelled spreaders reduce crew requirements and can finish multi-field routes before weather windows close, turning labor scarcity into a catalyst for adoption. GPS autosteer and blockage sensors allow less-experienced drivers to achieve overlap accuracy comparable to skilled operators, mitigating the talent bottleneck. South American growers confronting seasonal labor migration trends are also adopting higher-capacity PTO units to maintain throughput. Equipment suppliers that bundle remote diagnostics and operator training stand to capture additional service revenue.

High Upfront Cost vs. Conventional Broadcast Methods

Price tags on advanced spreaders range from USD 25,000 to USD 200,000, a hurdle for small and medium farms operating on thin margins. Credit access is uneven across emerging economies, so growers prioritize near-term liquidity over multi-year efficiency gains. Equipment-as-a-service models that charge per-hectare usage and retrofit VRT kits targeting legacy spinners are gaining popularity as bridge solutions. OEMs are experimenting with subscription packages bundling hardware, software updates, and agronomic advice to flatten capital spikes and widen market reach.

Other drivers and restraints analyzed in the detailed report include:

- Subsidy Programmes for Precision-Fertilizer Equipment

- Adoption of Variable-Rate Technology (VRT) for Fertilizer

- Low Farmer Awareness in Smallholder Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The fertilizer spreader market size for rotary/spinner units reached a substantial scale in 2024, commanding 46% of global sales as large-acreage grain farms value wide coverage and low operating costs. Pneumatic airflow designs, though currently smaller in volume, are expanding at a 9.6% CAGR because airflow paths deliver even distribution of multi-density blends critical to vegetables, orchards, and seed crops.

Airflow spreaders also support controlled-release pellets and coated nutrients without particle segregation, positioning them as the technology of choice for premium-price input programs. In regions with frequent wind events, their enclosed boom design minimizes drift, aligning with tightening buffer-zone regulations. Manufacturers investing in boom length optimization and hydraulic fan drive efficiency expect continued share gain as input suppliers broaden granular micronutrient offerings. Activated-carbon-lined drop hoppers and corrosion-resistant alloys are being introduced to lengthen machine life, a key buying consideration given rising capital costs within the fertilizer spreader market.

Conventional non-GPS spreaders still occupy 72% of the fertilizer spreader market share, reflecting the sheer installed base and the appeal of lower ticket prices in cost-sensitive geographies. Precision/GPS-guided platforms, however, are registering 11.0% CAGR backed by quantifiable input savings and environmental-compliance mandates that require digital record keeping.

VRT prescriptions transmitted over cellular networks let operators alter rates on the go, ensuring nutrient applications match high-resolution soil layers. Leading OEMs are integrating ISOBUS-compatible controllers so that mixed-brand fleets can share maps and machine health data, a capability prized by custom-applicator service providers managing multi-client routes. Augmented-reality calibration tools accessed via smartphones reduce set-up errors, lowering the learning curve that historically deterred upgrades within the fertilizer spreader market.

The Fertilizer Spreader Market Report is Segmented by Machine Type (Drop Spreaders and More), Technology (Conventional, Precision/GPS-Guided, and More), Drive Mechanism (PTO-Driven Mounted and More), Fertilizer Form (Granular and More), End-Use Application (Row-Crop Farms and More), Sales Channel (OEM and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe leads the fertilizer spreader market with a 29% share in 2024, reflecting mature precision-agriculture infrastructure and Common Agricultural Policy incentives that subsidize technology adoption. Stringent nitrate directives and watershed protection regulations make variable-rate application a near-requirement for large arable operations. The region's strong dealer networks and established financing channels smooth the path to high-specification machines. Manufacturers targeting this market emphasize software integration with farm management platforms and compatibility with European satellite correction signals that enable sub-meter accuracy.

The Asia-Pacific region is advancing at a 7.8% CAGR through 2030, the fastest regional growth rate globally. China's policy shift toward reduced fertilizer intensity while maintaining yields creates demand for spreaders that optimize placement efficiency. The government's agricultural modernization program subsidizes mechanization, particularly for cooperatives serving multiple smallholders. India's expanding agrochemical sector, valued at USD 32.4 billion in 2024, signals growing investment capacity for application equipment. Manufacturers are adapting designs for Asian conditions by offering narrower working widths for paddy fields and simplified controls for operators with limited technical training.

North America maintains a significant fertilizer spreader market size despite recent headwinds from commodity price volatility and rising equipment costs. Large-scale grain operations value precision technology integration and data management capabilities that align with established digital farming practices. However, AGCO's 15.1% sales decline in Q2 2024 reflects cautious capital spending as farmers prioritize equipment longevity over replacement. Manufacturers are responding with retrofit packages that add variable-rate capability to existing spreaders at lower entry points. South American growth is uneven due to currency fluctuations, though Brazil's expanding soybean acreage drives demand for high-capacity machines that can cover vast plantations during narrow application windows.

- AGCO Corporation

- CNH Industrial N.V. (Exor N.V.)

- Deere & Company

- Kubota Corporation

- Kuhn Group (Bucher Industries)

- Mahindra & Mahindra Ltd.

- Amazone Werke

- BOGBALLE A/S (Erhvervsinvest)

- Rauch Landmaschinenfabrik

- Salford Group (Linamar Corporation)

- Jacto

- IRIS Spreaders Co., Ltd.

- Adams Fertilizer Equipment (Reppert Capital Partners)

- Teagle Machinery Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global calorie demand and arable-land scarcity

- 4.2.2 Shortage and the rising cost of agricultural labor stimulate mechanization

- 4.2.3 Subsidy programmes for precision-fertiliser equipment

- 4.2.4 Adoption of variable-rate technology (VRT) for fertilizer

- 4.2.5 Shift to granular micronutrient blends requiring high-accuracy spread

- 4.2.6 The surge of carbon credit schemes rewarding optimized nutrient use

- 4.3 Market Restraints

- 4.3.1 High upfront cost vs. conventional broadcast methods

- 4.3.2 Low farmer awareness in smallholder economies

- 4.3.3 Fragmented after-sales and calibration service networks

- 4.3.4 Sensitivity to fertilizer price volatility and farm income swings

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Machinery Type

- 5.1.1 Drop Spreaders

- 5.1.2 Rotary/Spinner Spreaders

- 5.1.3 Pendulum Spreaders

- 5.1.4 Air-Flo/Pneumatic Spreaders

- 5.1.5 Liquid Fertilizer Sprayers

- 5.2 By Technology

- 5.2.1 Conventional

- 5.2.2 Precision/GPS-guided

- 5.2.3 Autonomous/Robotics-enabled

- 5.3 By Drive Mechanism

- 5.3.1 PTO-driven Mounted

- 5.3.2 Trailed

- 5.3.3 Self-propelled

- 5.3.4 Walk-behind/Manual

- 5.4 By Fertilizer Form

- 5.4.1 Granular

- 5.4.2 Powdered

- 5.4.3 Liquid

- 5.5 By End-use Application

- 5.5.1 Row-crop Farms

- 5.5.2 Specialty/Horticulture

- 5.5.3 Turf and Landscaping

- 5.5.4 Orchard and Vineyard

- 5.6 By Sales Channel

- 5.6.1 OEM

- 5.6.2 Dealer/Distributor

- 5.6.3 Online

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.1.4 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Spain

- 5.7.3.5 Russia

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 Turkey

- 5.7.5.3 UAE

- 5.7.5.4 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Egypt

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 AGCO Corporation

- 6.4.2 CNH Industrial N.V. (Exor N.V.)

- 6.4.3 Deere & Company

- 6.4.4 Kubota Corporation

- 6.4.5 Kuhn Group (Bucher Industries)

- 6.4.6 Mahindra & Mahindra Ltd.

- 6.4.7 Amazone Werke

- 6.4.8 BOGBALLE A/S (Erhvervsinvest)

- 6.4.9 Rauch Landmaschinenfabrik

- 6.4.10 Salford Group (Linamar Corporation)

- 6.4.11 Jacto

- 6.4.12 IRIS Spreaders Co., Ltd.

- 6.4.13 Adams Fertilizer Equipment (Reppert Capital Partners)

- 6.4.14 Teagle Machinery Limited