|

市场调查报告书

商品编码

1842679

元素分析:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Elemental Analysis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

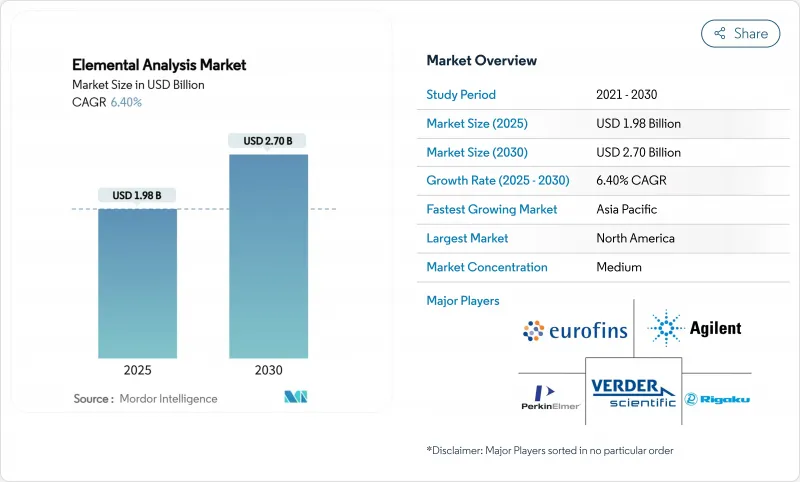

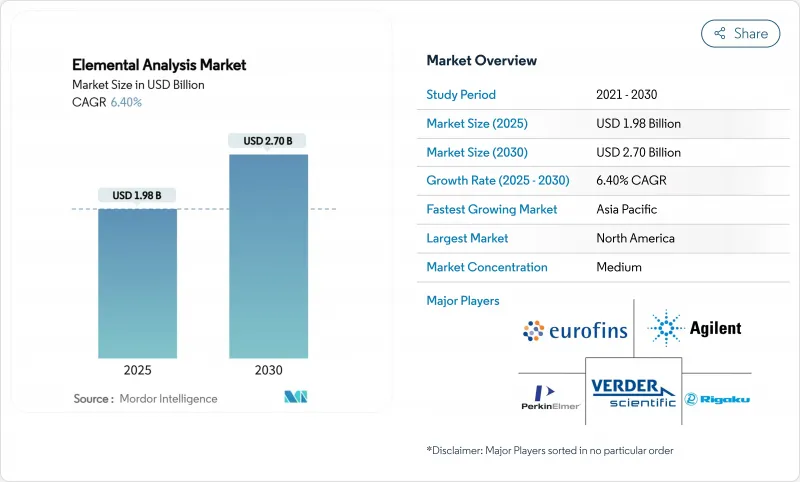

预计 2025 年元素分析市场价值将达到 19.8 亿美元,到 2030 年将扩大到 27 亿美元,复合年增长率为 6.4%。

这一增长反映了半导体製造厂所需的品管从常规转向超痕量表征、严格的药品杂质法规以及不断扩展的环境法规。对人工智慧自动化、氦气节约工作流程和混合多技术平台的投资增强了供应商的差异化。亚洲半导体产业的快速发展、全氟烷基化合物 (PFAS) 和亚硝胺法规的不断完善以及充足的生命科学研发预算增强了长期需求。同时,资本密集度、技术纯熟劳工短缺以及载气市场的波动抑制了短期成长动能。

全球元素分析市场趋势与洞察

增加生命科学领域的研发预算

预计到2024年,全球製药和生物技术研发支出将超过2,000亿美元,这将推动基于ICH Q3D指南的元素杂质检测需求。赛默飞世尔科技公司多年来400至500亿美元的併购计划,凸显了供应商对持续仪器需求的信心。预计製药分析测试市场本身将从2025年的97.4亿美元成长到2030年的145.8亿美元,复合年增长率为8.41%,超过分析化学的整体支出。这些投资巩固了ICP-MS、ICP-OES和燃烧分析仪的长期订单订单。自动化模组可以缩短週转时间并降低每个样品的成本,越来越多地与光谱仪捆绑销售。供应商也正在部署合规性软体,使彙报直接符合USP 232/233的限值要求。

全球药典对元素杂质的限量要求严格

美国FDA 于 2024 年更新了亚硝胺,加强了微量金属的分类系统,带来了直接的合规压力。 USP 将其药物分析杂质库扩展到 300 种原料药的近 1,000 个 PAI,迫使实验室扩展其多元素面板。 2025 年 3 月,FDA推出了化学污染物透明度工具,标誌着该机构继续关注食品中的金属监测。随后,即用型校准标准和云端基础的参考库迅速普及。仪器製造商越来越多地根据 21 CFR Part 11 对系统进行认证,以减少製药商的验证开销。这些趋势将元素分析市场与不断发展的药典指令紧密联繫在一起。

资本和维护成本高

单四极ICP-MS 装置的成本通常在 100,000 至 200,000 美元之间,而三重四极或高解析度型号的成本可能超过 400,000 美元,这对中型实验室来说是一笔不小的初始投资负担。气体、电力和消耗品意味着 ICP-MS 的年运行成本约为 13,250 美元,是 ICP-OES 设定的两倍以上。供应商通常建议签订全方位服务合同,每年支付购买价格的 10%,以涵盖检测器更换、预防性保养和软体更新。即使资金筹措,诸如废气处理和清洁能源的设备升级等隐性成本也会使计划预算额外增加 15-20%,减缓新兴市场的采用。随着氦气价格上涨和供应收紧,实验室面临直接营运费用进一步增加的问题,迫使许多实验室推迟仪器更新週期或转向租赁模式。

細項分析

在USP 232/233合规性和半导体污染控制的推动下,无机分析将在2024年占据元素分析市场份额的56.1%。 ICP-MS和ICP-OES平台将主导这一领域,用于检测药品和高纯度化学品中亚纳克/升级的砷、铅和镉。半导体代工厂要求对9N级製程化学品进行常规认证,这进一步巩固了其设备部署。供应商正将重点转向将无机金属检测与卤素和硫映射选项相结合的混合系统,从而扩展该平台在QA实验室中的效用。资本投资由延长的服务协议支撑,该协议保证基准漂移小于1 ppt,从而确保工厂长期的分析重现性。

有机元素分析虽然规模较小,但其复合年增长率高达 7.9%,高于整体元素分析市场。基于燃烧的 CHNSO 分析仪满足了药物开发对分子式确认的需求,目前配备了 90 位元自动取样器,循环时间仅为五分钟。食品安全实验室正在采用相同的平台进行蛋白质、脂肪和水分的定量分析,从而将其客户群扩展到製药和石化行业之外。供应商正在引入双炉配置,以同时测量高温聚合物和低温产品样品,从而减少停机时间。耦合软体可实现 LIMS元资料的无缝导入,从而减少运行后验证。

区域分析

受美国食品药物管理局 (FDA) 杂质指南、美国环保署 (EPA) PFAS 法规以及全球领先製药公司生产的推动,北美地区将在 2024 年占据销售额的 35.7%。美国製药公司占全球临床研发线的 40% 以上,将保持稳定的设备订单,而加拿大的采矿业将推动用于品位控制的 XRF 订单。在墨西哥,在岛津新子公司的支持下,契约製造活动蓬勃发展,扩大了区域用户群。

预计亚太地区将以7.5%的复合年增长率保持最快成长,这得益于各国政府对先进晶片製造厂和国内製药产能的津贴。日本的2奈米中试线和印度1002亿美元的半导体蓝图将扩大具有超微量纯度规格的潜在元素分析市场。中国对材料自给自足的追求推动了对电感耦合等离子体质谱仪(ICP-MS)的需求,而韩国的电池超级工厂正在采购LIBS系统进行线上阴极测试。在澳大利亚,矿产出口支撑了用于散装矿石筛检的XRF销售。

在严格的PFAS法规以及德国和法国强大的疫苗製造群的推动下,欧洲正经历稳定成长。欧盟的电池回收指令旨在2030年将电池生产能力提高50倍,这将推动超微量金属分析仪的订单成长。英国正专注于氮气加压ICP-MS以降低氦气的挥发性,而北欧国家则正在部署LIBS技术,以快速监测绿色钢铁中试工厂的炉渣。中东的铜矿计划和南美的锂卤水计画也正在开拓新的市场。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 增加生命科学领域的研发资金

- 世界各地药典中元素杂质法规日益严格

- 扩大食品和环境安全法规

- 尖端尖端的半导体级纯度要求

- 人工智慧驱动的自动多元素映射提高了吞吐量

- 电池回收热潮推动超微量金属检测

- 市场限制

- 高阶光谱仪的资本与维护成本高

- 交叉训练分析化学家短缺

- 复杂的样品製备工作流程延长了周转时间

- 全球氦气短缺导致ICP-MS营运预算膨胀

- 供应链分析

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按类型

- 有机元素分析

- 无机元素分析

- 依技术

- 破坏性技术

- 电感耦合发射光谱学(ICP-AES)

- 电感耦合等离子体质谱法(ICP-MS)

- 燃烧分析(CHNS/O)

- 其他的

- 无损检测技术

- X光萤光萤光光谱(XRF)

- 傅立叶转换红外线光谱(FTIR)

- 雷射诱导击穿光谱(LIBS)

- 其他的

- 破坏性技术

- 按最终用户

- 製药和生物技术公司

- 研究和学术机构

- 环境与食品检测实验室

- 工业/製造业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 市占率分析

- 公司简介{ }(英文)

- Thermo Fisher Scientific

- Agilent Technologies

- PerkinElmer

- Shimadzu Corporation

- Bruker Corporation

- Rigaku Corporation

- HORIBA Ltd

- Analytik Jena(Endress+Hauser)

- SPECTRO Analytical(AMETEK)

- Hitachi High-Tech Analytical Science

- Malvern Panalytical

- Elementar

- LECO Corporation

- Oxford Instruments

- Eurofins Scientific

- Element Materials Technology

- Verder Scientific(ELTRA)

- Anton Paar GmbH

- JEOL Ltd

- SciAps Inc.

- Micromeritics Instrument

- LECO Corporation

- Metrohm AG

第七章 市场机会与未来展望

The elemental analysis market was valued at USD 1.98 billion in 2025 and is forecast to expand to USD 2.7 billion by 2030, registering a 6.4% CAGR.

Growth reflects a shift from routine quality control toward ultra-trace characterization demanded by semiconductor fabs, stringent pharmaceutical impurity limits, and widening environmental regulations. Investments in AI-enabled automation, helium-saving workflows, and hybrid multi-technique platforms strengthen vendor differentiation. Rapid semiconductor buildouts across Asia, expanding PFAS and nitrosamine limits, and robust life-science R&D budgets reinforce long-term demand. Meanwhile, capital intensity, skilled-labor shortages, and volatile carrier-gas markets temper near-term momentum.

Global Elemental Analysis Market Trends and Insights

Growing R&D Funding in Life Sciences

Global pharma-biotech R&D spending crossed USD 200 billion in 2024, intensifying demand for elemental impurity testing under ICH Q3D guidelines. Thermo Fisher's multi-year USD 40-50 billion M&A pipeline underscores vendor confidence in sustained instrumentation demand. The pharmaceutical analytical-testing market itself is projected to rise from USD 9.74 billion in 2025 to USD 14.58 billion by 2030 at 8.41% CAGR, outpacing broader analytical chemistry spending. These investments solidify long-term orders for ICP-MS, ICP-OES, and combustion analyzers. Automation modules that shrink turnaround times and lower per-sample cost are increasingly bundled with spectrometers. Vendors also roll out compliance-ready software that aligns reporting directly with USP 232/233 limits.

Stringent Elemental-Impurity Limits in Global Pharmacopeias

The US FDA's 2024 nitrosamine update created immediate compliance pressure as it tightened classification systems for trace metals. USP expanded its pharmaceutical analytical impurity library to nearly 1,000 PAIs spanning 300 APIs, compelling laboratories to broaden multi-element panels. In March 2025, the FDA launched the Chemical Contaminants Transparency Tool, signaling a persistent agency focus on metals monitoring in foods. Rapid adoption of ready-to-use calibration standards and cloud-based reference libraries has followed. Instrument makers increasingly certify systems per 21 CFR Part 11 to reduce validation overhead for drug manufacturers. These trends keep the elemental analysis market firmly linked to evolving pharmacopeial directives.

High capital & maintenance costs

Single-quadrupole ICP-MS units typically list between USD 100,000 and USD 200,000, while triple-quadrupole or high-resolution models can exceed USD 400,000, placing a heavy upfront burden on mid-size laboratories. Annual operating expenses compound the challenge: gas, power, and consumables push yearly running costs for an ICP-MS to about USD 13,250, more than double the bill for an ICP-OES setup. Vendors generally recommend full-service contracts priced at 10% of the purchase value each year to cover detector replacement, preventive maintenance, and software updates. Even where financing spreads capital outlays, hidden costs such as facility upgrades for exhaust handling and clean power can add another 15-20% to project budgets, slowing adoption in emerging markets. As helium prices rise and supply tightens, labs face further escalation in direct operating expenditures, prompting many to postpone instrument refresh cycles or pivot to rental models.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Food & Environmental Safety Regulations

- Semiconductor-Grade Purity Requirements for Advanced Chips

- Global Helium Shortages Inflating ICP-MS Operating Budgets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Inorganic analysis captured 56.1% of the elemental analysis market share in 2024, buoyed by USP 232/233 compliance and semiconductor contamination control. ICP-MS and ICP-OES platforms dominate this segment, delivering sub-ng/L detection of As, Pb, and Cd in drug products and high-purity chemicals. Semiconductor foundries demand routine certification of 9N-grade process chemicals, further anchoring instrument placements. Vendor emphasis is shifting toward hybrid systems that bundle inorganic metals detection with options for halogen and sulfur mapping, extending platform utility across QA labs. Capital expenditure is sustained by extended service contracts that guarantee <1 ppt baseline drift, assuring fabs of long-term analytical reproducibility.

Organic elemental analysis, while smaller, is growing at 7.9% CAGR-faster than the overall elemental analysis market. Combustion-based CHNSO analyzers address drug-development needs for molecular formula confirmation and are now equipped with 90-position autosamplers offering 5-minute cycle times. Food-safety labs adopt the same platforms to quantify protein, fat, and moisture, expanding the customer base beyond pharma and petrochemicals. Vendors introduce dual oven configurations that measure high-temperature polymers alongside low-temperature agro-samples, reducing idle time. Coupled software allows seamless import of LIMS metadata, trimming post-run validation.

The Elemental Analysis Market is Segmented by Type (Organic Elemental Analysis and Inorganic Elemental Analysis), Technology (Destructive {ICP-AES, ICP-MS, and More} and Nondestructive {XRF, FTIR, and More), End User (Pharmaceutical & Biotechnology Companies, Research & Academic, and More), and Geography (North America, Europe, Asia Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 35.7% of revenue in 2024 on the strength of FDA impurity guidelines, EPA PFAS mandates, and world-leading pharma output.]US drugmakers account for over 40% of global clinical pipelines, sustaining steady instrument orders, while Canada's mining sector fuels XRF placements for grade control. Mexico's rising contract-manufacturing activity, supported by Shimadzu's new subsidiary, widens the regional user base.

Asia-Pacific is projected to deliver a 7.5% CAGR, the fastest worldwide, as governments subsidize advanced chip fabs and domestic drug production capabilities. Japan's 2-nm pilot lines and India's USD 100.2 billion semiconductor roadmap enlarge the addressable elemental analysis market through ultratrace purity specifications. China's push for materials self-sufficiency drives demand for ICP-MS, while South Korea's battery gigafactories purchase LIBS systems for inline cathode inspection. Australia's mining exports sustain XRF sales for bulk-ore screening.

Europe grows steadily on the back of stringent PFAS restrictions and strong vaccine manufacturing clusters in Germany and France. The EU's battery-recycling directive, targeting a 50-fold capacity increase by 2030, lifts orders for ultratrace metals analyzers. The United Kingdom emphasizes nitrogen-pressurized ICP-MS to mitigate helium volatility, and Nordic nations deploy LIBS for rapid slag monitoring in green-steel pilot plants. Eastern European mining expansions in Poland and Serbia add new sales channels, while Middle East copper projects and South American lithium brine operations open supplementary opportunities.

- Thermo Fisher Scientific

- Agilent Technologies

- PerkinElmer

- Shimadzu

- Bruker

- Rigaku

- HORIBA

- Analytik Jena (Endress+Hauser)

- SPECTRO Analytical (AMETEK)

- Hitachi High-Tech Analytical Science

- Malvern Panalytical

- Elementar

- LECO

- Oxford Instruments

- Eurofins

- Element Materials Technology

- Verder Scientific (ELTRA)

- Anton Paar

- JEOL

- SciAps Inc.

- Micromeritics Instrument

- LECO

- Metrohm

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing R&D Funding In Life Sciences

- 4.2.2 Stringent Elemental-Impurity Limits In Global Pharmacopeias

- 4.2.3 Expanding Food & Environmental Safety Regulations

- 4.2.4 Semiconductor-Grade Purity Requirements For Advanced Chips

- 4.2.5 AI-Enabled Automated Multi-Element Mapping Boosts Throughput

- 4.2.6 Battery-Recycling Boom Driving Ultratrace Metals Detection

- 4.3 Market Restraints

- 4.3.1 High Capital & Maintenance Costs Of High-End Spectrometers

- 4.3.2 Shortage Of Cross-Trained Analytical Chemists

- 4.3.3 Complex Sample-Prep Workflows Delay Turnaround Time

- 4.3.4 Global Helium Shortages Inflating ICP-MS Operating Budgets

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Organic Elemental Analysis

- 5.1.2 Inorganic Elemental Analysis

- 5.2 By Technology

- 5.2.1 Destructive Technologies

- 5.2.1.1 ICP-Atomic Emission Spectroscopy (ICP-AES)

- 5.2.1.2 ICP-Mass Spectrometry (ICP-MS)

- 5.2.1.3 Combustion Analysis (CHNS/O)

- 5.2.1.4 Others

- 5.2.2 Nondestructive Technologies

- 5.2.2.1 X-Ray Fluorescence Spectroscopy (XRF)

- 5.2.2.2 Fourier Transform Infrared Spectroscopy (FTIR)

- 5.2.2.3 Laser-Induced Breakdown Spectroscopy (LIBS)

- 5.2.2.4 Others

- 5.2.1 Destructive Technologies

- 5.3 By End User

- 5.3.1 Pharmaceutical & Biotechnology Companies

- 5.3.2 Research & Academic Institutions

- 5.3.3 Environmental & Food Testing Laboratories

- 5.3.4 Industrial & Manufacturing

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Thermo Fisher Scientific

- 6.3.2 Agilent Technologies

- 6.3.3 PerkinElmer

- 6.3.4 Shimadzu Corporation

- 6.3.5 Bruker Corporation

- 6.3.6 Rigaku Corporation

- 6.3.7 HORIBA Ltd

- 6.3.8 Analytik Jena (Endress+Hauser)

- 6.3.9 SPECTRO Analytical (AMETEK)

- 6.3.10 Hitachi High-Tech Analytical Science

- 6.3.11 Malvern Panalytical

- 6.3.12 Elementar

- 6.3.13 LECO Corporation

- 6.3.14 Oxford Instruments

- 6.3.15 Eurofins Scientific

- 6.3.16 Element Materials Technology

- 6.3.17 Verder Scientific (ELTRA)

- 6.3.18 Anton Paar GmbH

- 6.3.19 JEOL Ltd

- 6.3.20 SciAps Inc.

- 6.3.21 Micromeritics Instrument

- 6.3.22 LECO Corporation

- 6.3.23 Metrohm AG

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment