|

市场调查报告书

商品编码

1844444

日本汽车液压致动器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Japan Automotive Hydraulic Actuators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

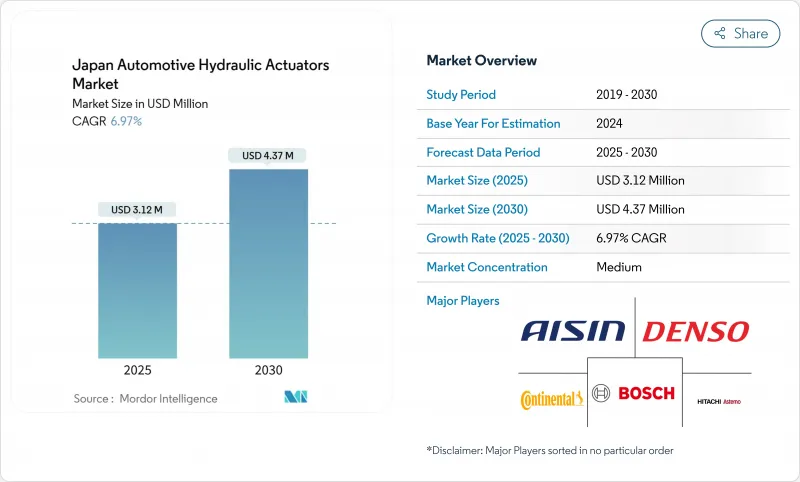

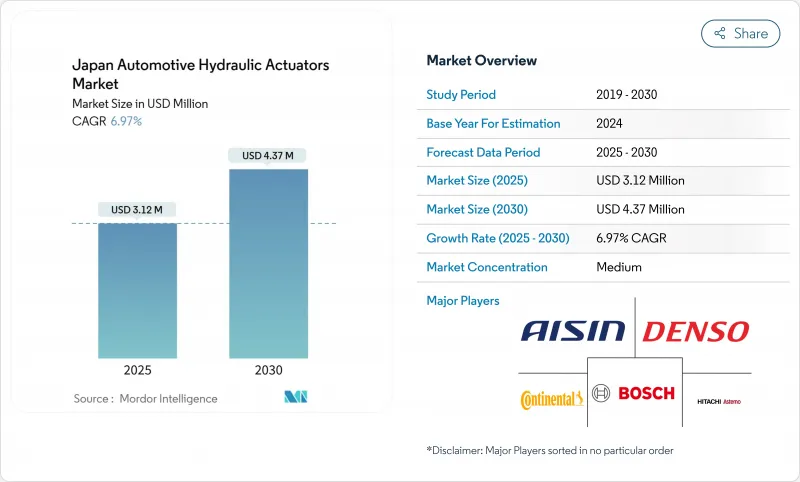

日本汽车液压致动器市场规模预计在 2025 年达到 312 万美元,到 2030 年达到 437 万美元,复合年增长率为 6.97%。

最新 JIS D 0801 和 UN R13-H 法规中概述的冗余煞车迴路需求强劲,即使在电气化持续成长的情况下,也支撑着成长。政府支持的氢动力卡车补贴、ADAS 的快速普及以及预测性维护的采用,进一步增强了日本汽车液压致动器市场,而美国对进口零件征收 25% 的新关税以及不断上涨的人事费用则对销售量构成了压力。原始设备製造商 (OEM) 继续青睐用于安全关键功能的液压解决方案,尤其是在中型和重型商用车中,由于液压致动器在苛刻的工作週期下提供了久经考验的可靠性,这些车辆现在有资格获得重大的氢能激励措施。

日本汽车液压致动器市场趋势与洞察

ADAS 的日益普及需要高响应度的液压煞车致动器

自动紧急煞车现已成为所有车型的强制性要求,因此需要响应时间低于50毫秒的液压煞车致动器。混合线控刹车架构在保持液压冗余的同时,实现了电子控制的精准性,促使供应商重新设计单元以实现与ECU的无缝整合。到2023年车型年,前方碰撞警报的采用率将达到94%,零件製造商将要求更高的价格以满足严格的性能要求。博世近期推出的线控刹车表明,电子覆盖层仍然依赖液压备援来确保故障安全运作。

更严格的 JIS D 0801/UN R13-H 安全法规推动了对液压冗余的需求

新的煞车法规要求多迴路液压系统即使在单一迴路发生故障时也能保持残余压力。合规工作正在推动串联主缸、双泵辅助器和整合压力感测器的采用。在备受关注的型号认证丑闻之后,零件认证收紧了审核追踪,使拥有强大品质系统的现有企业获得了竞争优势。

电动车转向电子机械致动器会削弱液压系统

电池电动平台中,电子机械煞车和悬吊的采用率正在上升,而液压致动器的采用率则在下降。采埃孚赢得了500万辆汽车的订单,将为其提供一套完全无需液压管路的线控刹车系统。针对纯电动车和燃料电池汽车的优惠补贴将进一步强化这一重点,推动现有的液压供应商向电子执行器领域拓展业务。

細項分析

到2024年,乘用车将在日本汽车液压致动器市场维持68.55%的份额,反映出个人出行需求的持续强劲。然而,预计到2030年,中型和重型商用车的复合年增长率将达到8.16%,最高,这得益于对指定使用耐腐蚀密封件的先进液压装置的氢动力卡车的奖励。这种转变将导致预测期内乘用车的份额略有下降,但由于每辆商用车安装的致动器数量增加,总产值将有所增加。随着最后一哩配送的扩展,轻型商用货车将继续稳步普及。

由于商用车对长寿命、高维护性、高负载循环性能的需求,日本汽车液压致动器市场正获得策略性成长。车队营运商优先考虑配备状态监控功能的致动器,以最大程度地减少停机时间,从而推动了对带感测器单元的需求。乘用车致动器的成长速度正在放缓,但对于车队的稳定性至关重要,它可作为混合液压电子系统的试验台,这些系统随后将迁移到更重型的平台。

受安全法规和近乎普及的安装需求推动,到2024年,煞车致动器将占日本汽车液压致动器市场规模的45.18%。然而,随着原始设备製造商在更严格的排放法规出台前提高排放气体效率,燃油喷射致动器到2030年的复合年增长率将达到7.34%,是最快的。喷射致动器组件内建的压力和温度感测器可实现预测性维护,并减少引擎非计划停机时间。

HVAC 混合门和座椅调整系统的销售将进一步成长,其中动力传动系统和安全应用将推动份额的成长,而煞车致动器将透过预测性维护来推动更换量并加强售后市场销售,因为诊断数据可以在踏板感觉恶化之前识别压力下降。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- ADAS 的日益普及需要高响应度的液压煞车致动器

- 随着 JIS D 0801/UN R13-H 安全法规变得越来越严格,对液压致动器冗余的需求也随之增加

- 疫情后乘用车生产復苏提振主机厂需求

- 随着车辆老化,更换週期变长,售后市场规模扩大

- 智慧型感测器整合致动器可实现预测性维护

- 氢动力卡车补贴推动专用液压装置的需求

- 市场限制

- 电动车转向电子机械致动器可减少液压零件

- 国内汽车产量下降限制了潜在成长

- 由于熟练工人短缺,精密油压设备的製造成本上升

- 石油洩漏环境处罚推高合规成本

- 价值/供应链分析

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中大型商用车

- 公车和长途客车

- 按应用程式类型

- 致动器

- 节气门致动器

- 座椅调整致动器

- 闭合致动器

- 燃油喷射致动器

- HVAC 混合式闸门致动器

- 其他的

- 按致动器设计

- 线性液压致动器

- 旋转液压致动器

- 按销售管道

- OEM

- 售后市场

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Denso Corporation

- Aisin Corporation

- Hitachi Astemo Ltd.

- Mitsubishi Electric Corporation

- KYB Corporation

- Akebono Brake Industry Co., Ltd.

- Robert Bosch GmbH

- Continental AG

- BorgWarner Inc.

- Nabtesco Corporation

- NSK Ltd.

- JTEKT Corporation

- Nissin Kogyo Co., Ltd.

- Parker Hannifin KK

第七章 市场机会与未来展望

The Japan automotive hydraulic actuators market size was valued at USD 3.12 million in 2025 and is forecast to reach USD 4.37 million by 2030, expanding at a 6.97% CAGR.

Persistent demand for redundant brake circuitry outlined in the latest JIS D 0801 and UN R13-H rules sustains growth even as electrification advances. Government-backed hydrogen truck subsidies, rapid ADAS uptake, and predictive-maintenance adoption further bolster the Japan automotive hydraulic actuators market, while new 25% tariffs on parts imported into the United States and rising labor costs weigh on volumes. OEMs continue to favor hydraulic solutions in safety-critical functions because they deliver proven reliability under harsh duty cycles, especially in medium and heavy commercial vehicles that now qualify for sizable hydrogen incentives.

Japan Automotive Hydraulic Actuators Market Trends and Insights

Rising ADAS Penetration Calls for High-Response Hydraulic Brake Actuators

Automatic emergency braking is now mandatory across vehicle categories, creating a need for hydraulic brake actuators that achieve sub-50-ms response times. Hybrid brake-by-wire architectures keep hydraulic redundancy while enabling electronic precision, pushing suppliers to redesign units for seamless ECU integration. Forward-collision warning adoption reached 94% by model year 2023, and component makers that meet the tighter performance window command premium pricing. Bosch's recent brake-by-wire rollouts illustrate how electronic control overlays still rely on hydraulic backup for fail-safe assurance .

Stricter JIS D 0801 / UN R13-H Safety Rules Raise Hydraulic Redundancy Needs

New braking rules require multi-circuit hydraulic systems able to retain residual pressure even under single-circuit failure. Compliance efforts spur uptake of tandem master cylinders, dual-pump boosters, and integrated pressure sensors. Component certification now involves tighter audit trails after widely publicized type-approval misconduct cases, giving incumbents with robust quality systems a competitive edge .

EV Shift Toward Electro-Mechanical Actuators Erodes Hydraulic Content

Battery-electric platforms increasingly specify electromechanical brakes and suspension, reducing hydraulic fitment. ZF won a 5 million-vehicle contract for full brake-by-wire systems that eliminate hydraulic lines entirely. Subsidies that favor BEVs and fuel-cell cars intensify the pivot, pushing incumbent hydraulic suppliers to diversify into electronic actuation.

Other drivers and restraints analyzed in the detailed report include:

- Passenger-Car Production Rebound Boosts OEM Demand

- Ageing Fleet Lengthens Replacement Cycles, Expanding Aftermarket Volumes

- Domestic Vehicle Production Decline Limits Volume Growth Potential

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars retained a 68.55% share of the Japan automotive hydraulic actuators market in 2024, reflecting entrenched personal-mobility demand. Yet medium and heavy commercial vehicles will record the highest 8.16% CAGR to 2030, buoyed by hydrogen-truck incentives that specify advanced hydraulic units with corrosion-resistant seals. This shift marginally dilutes passenger-car share over the forecast window but enlarges total output value because commercial vehicles carry higher actuator content per unit. Light commercial vans continue to see steady adoption as last-mile delivery expands.

The Japan automotive hydraulic actuators market gains strategic depth from commercial-vehicle requirements for long-life, serviceable designs that withstand high duty cycles. Fleet operators prioritize actuators with integrated condition monitoring to minimize downtime, propelling demand for sensorized units. Passenger cars, though slower growing, remain vital for volume stability and serve as a testbed for hybrid hydraulic-electronic systems that later migrate to heavier platforms.

Brake actuators commanded 45.18% of the Japan automotive hydraulic actuators market size in 2024, sustained by safety regulations and near-universal fitment. However, fuel-injection actuators will be the fastest 7.34% CAGR through 2030 as OEMs refine combustion efficiency ahead of stricter emission caps. Embedded pressure and temperature sensors inside the injector actuator assembly enable predictive maintenance, reducing unplanned engine downtime.

HVAC blend-door and seat-adjustment systems add incremental volume, but their share trails powertrain and safety applications. Predictive maintenance also uplifts brake-actuator replacements because diagnostic data now pinpoints declining pressure build-up before pedal feel deteriorates, strengthening aftermarket sales.

The Japan Automotive Hydraulic Actuators Market Report is Segmented by Vehicle Type (Passenger Car, Light Commercial Vehicle, Medium and Heavy Commercial Vehicle, and More), Application Type (Brake Actuator, Throttle Actuator, and More), Actuator Design (Linear Hydraulic Actuators and Rotary Hydraulic Actuators), and Sales Channel (OEM and Aftermarket). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Denso Corporation

- Aisin Corporation

- Hitachi Astemo Ltd.

- Mitsubishi Electric Corporation

- KYB Corporation

- Akebono Brake Industry Co., Ltd.

- Robert Bosch GmbH

- Continental AG

- BorgWarner Inc.

- Nabtesco Corporation

- NSK Ltd.

- JTEKT Corporation

- Nissin Kogyo Co., Ltd.

- Parker Hannifin K.K.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising ADAS penetration calls for high-response hydraulic brake actuators

- 4.2.2 Stricter JIS D 0801 / UN R13-H safety rules raise hydraulic redundancy needs

- 4.2.3 Passenger-car production rebound post-pandemic boosts OEM demand

- 4.2.4 Ageing fleet lengthens replacement cycles, expanding aftermarket volumes

- 4.2.5 Smart-sensor-integrated actuators enable predictive-maintenance adoption

- 4.2.6 Hydrogen-truck subsidies accelerate demand for specialty hydraulic units

- 4.3 Market Restraints

- 4.3.1 EV shift toward electro-mechanical actuators erodes hydraulic content

- 4.3.2 Domestic vehicle production decline limits volume growth potential

- 4.3.3 Skilled-machinist shortage inflates precision hydraulic manufacturing costs

- 4.3.4 Oil-leak environmental penalties raise compliance cost pressures

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Light Commercial Vehicle

- 5.1.3 Medium and Heavy Commercial Vehicle

- 5.1.4 Buses and Coaches

- 5.2 By Application Type

- 5.2.1 Brake Actuator

- 5.2.2 Throttle Actuator

- 5.2.3 Seat Adjustment Actuator

- 5.2.4 Closure Actuator

- 5.2.5 Fuel-Injection Actuator

- 5.2.6 HVAC Blend-Door Actuator

- 5.2.7 Others

- 5.3 By Actuator Design

- 5.3.1 Linear Hydraulic Actuators

- 5.3.2 Rotary Hydraulic Actuators

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Denso Corporation

- 6.4.2 Aisin Corporation

- 6.4.3 Hitachi Astemo Ltd.

- 6.4.4 Mitsubishi Electric Corporation

- 6.4.5 KYB Corporation

- 6.4.6 Akebono Brake Industry Co., Ltd.

- 6.4.7 Robert Bosch GmbH

- 6.4.8 Continental AG

- 6.4.9 BorgWarner Inc.

- 6.4.10 Nabtesco Corporation

- 6.4.11 NSK Ltd.

- 6.4.12 JTEKT Corporation

- 6.4.13 Nissin Kogyo Co., Ltd.

- 6.4.14 Parker Hannifin K.K.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment