|

市场调查报告书

商品编码

1844464

次氯酸盐漂白剂:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Hypochlorite Bleaches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

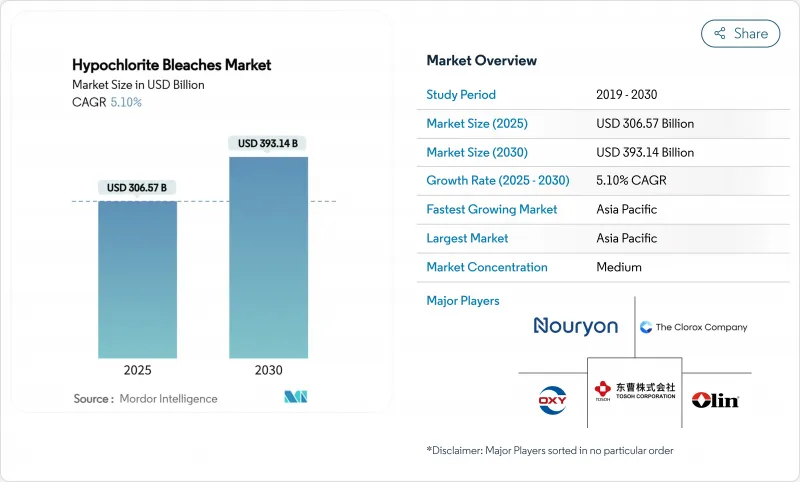

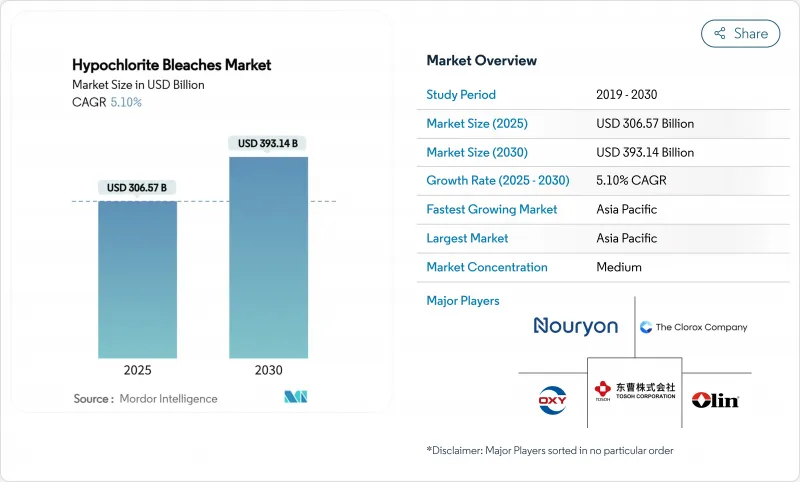

次氯酸盐漂白剂市场规模预计在 2025 年达到 3,065.7 亿美元,预计到 2030 年将达到 3,931.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.10%。

随着公共从氯气过渡到更安全的次氯酸钠溶液,市政用水和污水系统的基础设施投资(尤其是在亚太地区)正在推动需求。对本地製造业的投资(通常每家工厂超过7000万美元)也增强了供应链的韧性,节能的膜电解与开孔电解槽相比,可减少15%的用电量。次氯酸盐漂白剂市场也受益于监管的明确性。美国环保署2024年的修正案简化了次氯酸盐的运输,欧盟已批准次氯酸钙生物杀灭剂产品系列有效期至2035年,这两项法案都有利于采用溶液法。然而,随着过氧化物基替代品在纺织品和纸浆漂白领域越来越受欢迎,以及危险品法规提高了氧化剂的物料输送成本,竞争压力仍然存在。

全球次氯酸盐漂白剂市场趋势与洞察

增加水处理和卫生支出

2033年,全球水务基础设施支出预计将达到1兆美元,成长率为5.9%。市政和工业领域消毒需求的不断增长,将直接推动次氯酸盐漂白剂市场的发展。预计到2025年,受「水利使者」等政府计画的推动,印度对水处理化学品的需求将达到28亿美元。布拉格的一家工厂处理水量为3000公升/秒,同时将氯残留量保持在0.2-0.4 ppm,保护了80万居民的安全。智慧加药控制和人工智慧远端检测如今已非常普及,巩固了次氯酸盐在现代水网中的地位。

新兴亚洲地区纸浆和造纸产量快速成长

2024年,中国将消耗1300万吨木浆,其中60%以上将依赖进口;到2030年,印度的需求量可能达到920万吨,这将推动亚洲造纸厂次氯酸盐漂白剂市场的发展。趋势分析显示,造纸厂正在从氯气工艺转向更安全的次氯酸盐或二氧化氯工艺,以在满足白度目标的同时减少废水中的AOX(有机氧化物)。 RISE的一项初步研究发现,优化的次氯酸盐製程顺序能够维持纸张强度并减少化学品用量,从而为造纸厂带来成本和合规效益。东南亚许多新建造纸厂正在采用基于薄膜的电解装置,并将次氯酸盐供应整合到造纸厂公用设施中。

过氧化物漂白化学的日益普及

过氧化氢分解成水和氧气,消除了氯副产物,对寻求环保标章的工厂和染厂来说极具吸引力。结合紫外线/过氧化氢或臭氧的高级氧化过程在处理持久性有机物方面优于次氯酸盐,这使得次氯酸盐漂白剂市场成为一个专业的利基市场。欧洲高端纺织品製造商已经为过氧化物漂白棉支付了更高的永续性溢价,这给次氯酸盐配方带来了市场份额压力。

細項分析

次氯酸钠将在 2024 年占据次氯酸盐漂白剂市场的 58.91%,这得益于其在市政消毒和家庭清洁领域的成熟应用,而次氯酸钙预计将在 2035 年之前以每年 5.73% 的速度增长,这得益于欧盟批准其用于泳池和饮用水处理。

钠盐的优点在于其液体供应链和日趋成熟的现场发电技术。膜电解系统可将浓度提高至7% w/w,同时降低15%的电力成本,进而为投资电化学升级的工厂营运商扩大次氯酸盐漂白剂的市场规模。相反,钙盐的高稳定性和65-70%的有效氯使其适用于需要长期储存的偏远地区。锂盐和氯化钾仍属于小众市场,受成本和特殊工业需求的限制。

区域分析

预计到2024年,亚太地区将占据次氯酸盐漂白市场的43.26%,到2030年,该地区的复合年增长率将达到5.67%,因为各国政府将向供水管网投入创纪录的资金,而该地区的纸浆厂也将转向更安全的漂白过程。光是中国造纸业每年就消耗1,300万吨木浆,对次氯酸盐溶液的需求庞大。印度的「水利工程」(Jal Jeevan Mission)正在刺激对这种化学品的需求,而迪诺拉在香港推出的20台CECHLO装置则显示了市政部门对现场发电的热情。

北美次氯酸漂白剂市场虽然成熟,但仍在不断发展。美国环保署2024年颁布的《危险物质法规》将收紧氯气的使用,这推动了一系列社区漂白剂工厂的建设,投资额超过7000万美国,从而提升了综合製造商的收益。奥林公司的氯碱部门在2025年第一季的销售额超过9.245亿美元,年增4.5%。该公司的膜电解池维修正在提高能源效率,并帮助其在国内市场保持竞争优势。

儘管欧洲氯碱产业链面临约5,500亿美元的脱碳压力,但监管机构仍在透过钙的批准来支持次氯酸钠的研发。布拉格的次氯酸钠现场转换项目,为80万居民提供了3000公升/秒的次氯酸钠处理量,凸显了安全性的提升。儘管中东和非洲仍处于发展阶段,但对纺织品整理的投资以及应对水资源短缺的措施预计将推动次氯酸钠漂白剂市场高于平均水平的成长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 增加水处理和卫生支出

- 新兴亚洲地区纸浆和造纸产量快速成长

- 提升非洲纺织品加工能力

- 为偏远的公共设施部署现场次氯酸盐产生器

- 氯气淘汰法规有利于次氯酸盐

- 市场限制

- 过氧化物漂白化学的日益普及

- 严格的氧化化学品运输和储存规定

- 高级氧化过程(臭氧/AOP)的成长

- 氯碱价值链脱碳的压力

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按产品

- 次氯酸钠

- 次氯酸钙

- 次氯酸锂

- 次氯酸钾

- 按形式

- 液体

- 固体(颗粒、片剂、粉末)

- 按用途

- 纸浆和造纸

- 消毒剂

- 纺织产品

- 水产养殖

- 洗衣漂白剂

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析(%)/排名分析

- 公司简介

- Aditya Birla Chemicals

- AGC Chemicals

- Arkema SA

- Chlorum Solutions USA

- Cleanwater1 Inc.

- Clorox Company

- COVENTYA Group

- Ecoviz Kft

- Electrolytic Technologies LLC

- Hangzhou ASIA Chemical Engineering Co., Ltd

- HTH Pools(Arch Chemicals)

- Inovyn

- JSC AVANGARD

- Lanxess AG

- Lonza Group

- Nouryon

- Occidental Chemical(OxyChem)

- Odyssey Manufacturing Co.

- Olin Corporation

- Osaka Soda Co. Ltd.

- Shijiazhuang Xinlongwei Chemical

- Shouguang Tianwei Chemical

- Tianjin Yufeng Chemical

- Tosoh Corporation

- Union Overseas Enterprise Ltd.

第七章 市场机会与未来展望

The Hypochlorite Bleaches Market size is estimated at USD 306.57 billion in 2025, and is expected to reach USD 393.14 billion by 2030, at a CAGR of 5.10% during the forecast period (2025-2030), which underscores the sector's capacity to adapt to shifting regulations and technological advances.

Infrastructure spending on municipal water and wastewater systems, particularly in Asia Pacific, is vaulting demand as utilities transition from chlorine gas to safer sodium hypochlorite solutions. Investment in localized production-often upwards of USD 70 million per plant-also strengthens supply-chain resilience, while energy-efficient membrane-cell electrolysis is lowering power use by 15% compared with open-cell units. The Hypochlorite bleaches market further benefits from regulatory clarity: the EPA's 2024 revisions streamline hypochlorite transport, and the European Union has authorized calcium hypochlorite biocidal product families through 2035, both of which favor solution adoption. Competitive pressures persist, however, as peroxide-based alternatives gain popularity in textile and pulp bleaching, and hazardous-materials rules raise handling costs for oxidizers.

Global Hypochlorite Bleaches Market Trends and Insights

Escalating Water-Treatment & Sanitation Spending

Global water-infrastructure outlays are trending toward USD 1 trillion by 2033, advancing at 5.9% and directly lifting the Hypochlorite bleaches market through higher municipal and industrial disinfection needs. India exemplifies this surge, as government programs such as Jal Jeevan Mission push the nation's water-chemicals demand toward USD 2.8 billion by 2025. Remote facilities increasingly favor on-site sodium hypochlorite generation, eliminating chlorine-gas transport; Prague's installation treats 3,000 L s-1 while keeping residual chlorine within 0.2-0.4 ppm, protecting 800,000 residents. Smart dosing controls and AI-enabled telemetry are now common, cementing hypochlorite's role in modern water grids.

Surging Pulp & Paper Output in Emerging Asia

China consumed 13 million t of wood pulp in 2024, over 60% imported, and India may require 9.2 million t by 2030, driving the Hypochlorite bleaches market across Asia's paper mills. Trend analysis shows mills swapping chlorine gas for safer hypochlorite or chlorine-dioxide stages that cut effluent AOX while meeting brightness targets. Pilot studies by RISE reveal that optimized hypochlorite sequences preserve paper strength and curb chemical usage, providing mills with cost and compliance advantages. New capacity across Southeast Asia frequently incorporates membrane-based electrochlorination units, embedding hypochlorite supply within mill utilities.

Rising Shift Toward Peroxide-Based Bleaching Chemistries

Hydrogen peroxide decomposes into water and oxygen, eliminating chlorinated by-products and appealing to mills and dye-houses pursuing eco-labels. Advanced oxidation processes pairing UV/H2O2 or ozone outperform hypochlorite for difficult organics, nudging the Hypochlorite bleaches market toward specialty niches. Premium textile houses in Europe already pay a sustainability premium for peroxide-bleached cotton, exerting market-share pressure on hypochlorite formulations.

Other drivers and restraints analyzed in the detailed report include:

- Capacity Additions in African Textile Finishing

- Roll-out of On-Site Hypochlorite Generators for Remote Utilities

- Strict Transport & Storage Rules for Oxidizing Chemicals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sodium hypochlorite contributed 58.91% to the Hypochlorite bleaches market in 2024, supported by entrenched use in municipal disinfection and household cleaning. Calcium hypochlorite, however, is forecast to grow 5.73% annually, buoyed by its EU authorization for pool and potable-water treatment through 2035.

Sodium's supremacy rests on liquid supply chains and maturing on-site generation. Membrane-cell systems uplift concentration to 7% w/w with 15% lower electricity bills, enriching the Hypochlorite bleaches market size for plant operators investing in electrochemical upgrades. Conversely, calcium's stability and 65-70% available chlorine endear it to remote installations needing long shelf life. Lithium and potassium salts remain niche, limited by cost and specialized industrial needs.

The Hypochlorite Bleaches Market Report is Segmented by Product (Sodium Hypochlorite, Calcium Hypochlorite, Lithium Hypochlorite, Potassium Hypochlorite), Form (Liquid, Solid), Application (Pulp and Paper, Disinfectants, Textiles, Aquaculture, Laundry Bleach, Others), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific generated 43.26% of Hypochlorite bleaches market revenue in 2024 and will likely rise at 5.67% CAGR to 2030 as governments channel record sums into water networks and as regional pulp mills pivot to safer bleaching routes. China's paper industry alone consumes 13 million t of wood pulp yearly, creating a sizable pull for hypochlorite solutions. India's Jal Jeevan Mission stokes chemical demand while De Nora's 20-unit CECHLO deployment in Hong Kong shows municipal enthusiasm for on-site generation.

North America is a mature yet evolving arena for the Hypochlorite bleaches market. The EPA's 2024 hazmat rules tighten chlorine-gas usage, catalyzing a wave of USD 70 million-plus local bleach plants and buoying revenue at integrated producers; Olin's Chlor Alkali segment topped USD 924.5 million in Q1 2025, up 4.5% year on year. Membrane-cell retrofits bolster energy efficiency, ensuring domestic competitiveness.

Europe faces decarbonization pressure worth an estimated USD 550 billion across the chlor-alkali chain, yet regulatory backing for hypochlorite continues via calcium authorization. Prague's conversion to on-site sodium hypochlorite highlights safety gains, processing 3,000 L s-1 for 800,000 residents. The Middle East and Africa are nascent, but textile-finishing investments and water-scarcity countermeasures suggest above-average growth potential for the Hypochlorite bleaches market.

- Aditya Birla Chemicals

- AGC Chemicals

- Arkema SA

- Chlorum Solutions USA

- Cleanwater1 Inc.

- Clorox Company

- COVENTYA Group

- Ecoviz Kft

- Electrolytic Technologies LLC

- Hangzhou ASIA Chemical Engineering Co., Ltd

- HTH Pools (Arch Chemicals)

- Inovyn

- JSC AVANGARD

- Lanxess AG

- Lonza Group

- Nouryon

- Occidental Chemical (OxyChem)

- Odyssey Manufacturing Co.

- Olin Corporation

- Osaka Soda Co. Ltd.

- Shijiazhuang Xinlongwei Chemical

- Shouguang Tianwei Chemical

- Tianjin Yufeng Chemical

- Tosoh Corporation

- Union Overseas Enterprise Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating water-treatment and sanitation spending

- 4.2.2 Surging pulp and paper output in emerging Asia

- 4.2.3 Capacity additions in African textile finishing

- 4.2.4 Roll-out of on-site hypochlorite generators for remote utilities

- 4.2.5 Chlorine-gas phase-out regulations benefitting hypochlorites

- 4.3 Market Restraints

- 4.3.1 Rising shift toward peroxide-based bleaching chemistries

- 4.3.2 Strict transport and storage rules for oxidising chemicals

- 4.3.3 Growth of advanced oxidative processes (ozone/AOP)

- 4.3.4 Decarbonisation pressure on chlor-alkali value chain

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts(Value)

- 5.1 By Product

- 5.1.1 Sodium Hypochlorite

- 5.1.2 Calcium Hypochlorite

- 5.1.3 Lithium Hypochlorite

- 5.1.4 Potassium Hypochlorite

- 5.2 By Form

- 5.2.1 Liquid

- 5.2.2 Solid (Granular/Tablets/Powder)

- 5.3 By Application

- 5.3.1 Pulp and Paper

- 5.3.2 Disinfectants

- 5.3.3 Textiles

- 5.3.4 Aquaculture

- 5.3.5 Laundry Bleach

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Aditya Birla Chemicals

- 6.4.2 AGC Chemicals

- 6.4.3 Arkema SA

- 6.4.4 Chlorum Solutions USA

- 6.4.5 Cleanwater1 Inc.

- 6.4.6 Clorox Company

- 6.4.7 COVENTYA Group

- 6.4.8 Ecoviz Kft

- 6.4.9 Electrolytic Technologies LLC

- 6.4.10 Hangzhou ASIA Chemical Engineering Co., Ltd

- 6.4.11 HTH Pools (Arch Chemicals)

- 6.4.12 Inovyn

- 6.4.13 JSC AVANGARD

- 6.4.14 Lanxess AG

- 6.4.15 Lonza Group

- 6.4.16 Nouryon

- 6.4.17 Occidental Chemical (OxyChem)

- 6.4.18 Odyssey Manufacturing Co.

- 6.4.19 Olin Corporation

- 6.4.20 Osaka Soda Co. Ltd.

- 6.4.21 Shijiazhuang Xinlongwei Chemical

- 6.4.22 Shouguang Tianwei Chemical

- 6.4.23 Tianjin Yufeng Chemical

- 6.4.24 Tosoh Corporation

- 6.4.25 Union Overseas Enterprise Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Increasing Demand from the Aquaculture Industry