|

市场调查报告书

商品编码

1844484

暖通空调设备:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)HVAC Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

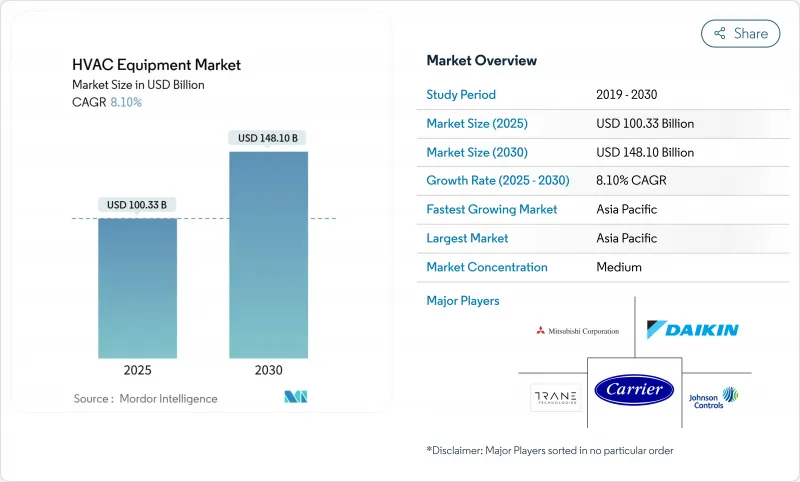

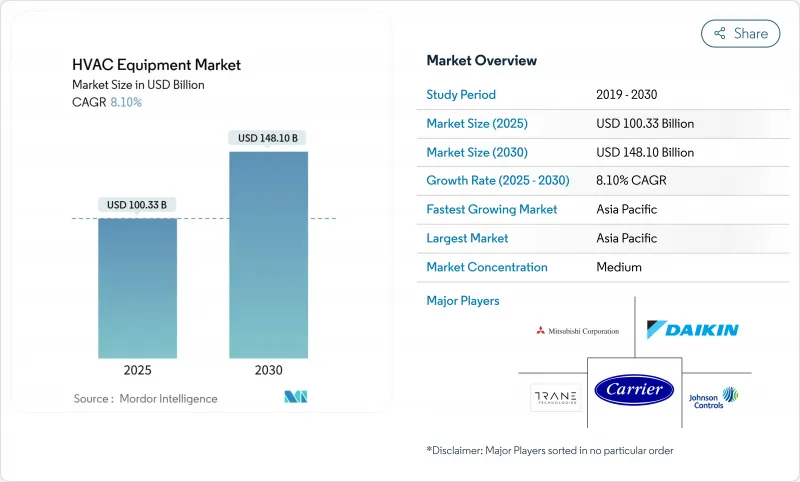

目前,暖通空调设备市场价值为 1,003.3 亿美元,预计到 2030 年将成长至 1,481 亿美元,复合年增长率为 8.1%。

成长动力源自于日益严格的能源效率法规、向低全球暖化潜势冷媒的转变,以及数位化控制升级,这些升级不仅提升了营运性能,也提升了最终用户价值。热泵奖励正在重塑欧洲和北美的供暖组合,数据中心的建设给传统的製冷设计带来压力,亚洲的都市化也促进了室内空调数量的增长。随着原始设备製造商(OEM)争夺寒冷气候热泵的软体人才和智慧财产权,顶级供应商之间的整合正在加速,而区域专家则向尚未开发的细分市场(例如偏远地区的太阳能混合系统)扩张。预计到2027年,与2025年1月冷媒截止日期相关的短期供应摩擦将有所缓解,这将为高端电气化解决方案提供更清晰的道路。

全球暖通空调设备市场趋势与洞察

更严格的欧洲建筑能源标准加速了热泵的普及

在欧洲,随着近零能耗建筑的强制要求,到2024年,热泵的安装数量将比2022年增加38%,新建建筑中的热泵普及率将达到所有售出单元的一半。在北欧国家,目前超过60%的新建住宅安装了热泵,大容量热泵也被引入商业房地产的维修中。

北欧和FLAP-D地区资料中心建设激增推动精密冷却需求

超过30千瓦的机架密度、每年35%的冷冻容量成长以及瑞典和挪威65%的新建专案开工率,正在推动液体冷却技术的采用。江森自控指出,资料中心计划目前占其商用暖通空调收益的18%,高于去年同期的12%。

成熟市场缺乏认证暖通空调技术人员

目前,全产业的重新设计成本已超过 100 亿美元,平均係统价格上涨了 8-12%。

細項分析

气温升高和都市区中等收入人口的成长将推动强劲的需求,到2024年,空调将占暖通空调设备市场的46.1%。同年,中国用房间室内空调的普及率达73% [cheaa.org]。在北美,无管道迷你分离式空调的年增长率达到18%,因为房主们追求无需维修管道即可享受分区舒适度。

VRF 仍然是成长最快的细分市场,到 2030 年的复合年增长率将达到 12.7%。医院、饭店和混合用途建筑重视同时供暖和冷气的灵活性。三菱电机的数据显示,2024 年全球 VRF 安装量激增 32%。

到 2024 年,维修和更换将占 HVAC 设备市场规模的 63.4%,这主要是由于 2005 年至 2010 年繁荣时期安装的系统的使用寿命终止。根据哈佛大学的一项研究,由于业主追求降低能源费用,到 2024 年,美国住宅 HVAC 更换量将增加 14%。

新建项目规模虽小,但预计年增率将达9.4%。 2023年美国能源法规将更加严格,最低能源效率基准值将提高15%,这将鼓励建商指定高端方案。基于性能的维修持续成长,江森自控指出,此类合约目前占其维修订单的32%。

暖通空调设备市场报告按设备类型(例如锅炉和熔炉、热泵)、安装类型(例如新建、维修/更换)、最终用户(例如住宅、商业)、建筑类型(例如办公大楼、医疗机构)和地区(例如美国、中国)对产业进行细分。市场规模和预测以美元计算。

区域分析

受城镇建设和中产阶级不断壮大的推动,到2024年,亚太地区将占据暖通空调设备市场的34.9%。仅中国就占了该地区42%的份额,但随着房地产活动的稳定,其年增长率放缓至6.8%。 [daikin.com] 日本和韩国青睐高规格的多联机(VRF)和空气清净机型号,而越南和印尼的商业建设则实现了两位数的成长。

北美地区占28.6%,得益于强劲的更换需求和通膨控制税收优惠,美国热泵销量激增32% [carrier.com]。资料中心和医疗保健计划推动商业收益成长22%。

欧洲占24.3%,儘管面临宏观经济逆风,但到2024年,热泵出货量仍将成长17%。由于欧盟成员国计划逐步淘汰石化燃料,暖通空调(HVAC)升级占欧盟维修支出的38%。

中东是成长最快的地区,预计复合年增长率为 10.6%,因为沙乌地阿拉伯的「2030 愿景」增加了大规模区域供冷能力,而阿联酋的开发商迅速采用 VRF。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 严格的欧洲建筑能源法规促进了热泵的采用

- 北欧和FLAP-D地区资料中心建设的快速成长将推动精密冷却的需求

- 亚洲高层住宅快速采用可变冷冻 (VRF) 系统

- 美国《通货膨胀削减法案》税额扣抵促进早期炉子更换週期

- 东欧区域供热扩张推动高容量锅炉维修

- 太阳能混合暖通空调系统在非洲离网采矿营地广受欢迎

- 市场限制

- 原始设备製造商过渡到低 GWP 冷媒的初始成本较高

- 成熟市场缺乏认证暖通空调技术人员

- 半导体供应链波动导致 VRF 逆变器供应受限

- 严格的欧盟含氟气体配额增加了进口商的合规负担

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 关键绩效指标

第五章市场规模及成长预测

- 依设备类型

- 加热设备

- 锅炉和熔炉

- 热泵

- 单元加热器

- 通风设备

- 空气调节机

- 加湿器和除湿器

- 空气过滤器

- 风机盘管机组

- 空调设备

- 单元空调

- 管道式分体

- 无管迷你分离式

- 套餐屋顶

- 变冷剂流量 (VRF) 系统

- 室内空调

- 包终端机空调

- 冷却器

- 加热设备

- 按安装类型

- 新建筑

- 改装/更换

- 按最终用户

- 住房

- 商业的

- 工业的

- 按建筑类型(商业)

- 办公大楼

- 医疗机构

- 酒店和休閒

- 零售店和商场

- 教育机构

- 资料中心

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 卡达

- 非洲

- 南非

- 奈及利亚

- 埃及

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Daikin Industries Ltd.

- Carrier Global Corp.

- Trane Technologies PLC

- Johnson Controls International PLC

- Mitsubishi Electric Corp.

- Lennox International Inc.

- Rheem Manufacturing Co.

- Midea Group

- Gree Electric Appliances Inc.

- NIBE Group

- Panasonic Corp.

- Samsung Electronics(HVAC Division)

- LG Electronics(Air-Solution)

- Bosch Thermotechnology

- Vaillant Group

- Alfa Laval AB

- Stiebel Eltron GmbH and Co. KG

- Systemair AB

- Greenheck Fan Corporation

- FlaktGroup

- TROX GmbH

- Swegon Group AB

- Hitachi-Johnson Controls Air Conditioning

- Danfoss A/S(Commercial Compressors)

第七章 市场机会与未来展望

The HVAC equipment market is currently valued at USD 100.33 billion, and forecasts show it climbing to USD 148.1 billion by 2030 on an 8.1% CAGR.

Growth momentum rests on tightening energy-efficiency rules, the pivot to low-GWP refrigerants and digital-control upgrades that lift both operating performance and end-user value. Demand is broad-based: heat-pump incentives in Europe and North America are reshaping heating portfolios, data-center build-outs are straining traditional cooling designs and urbanization in Asia keeps room-air-conditioner volumes rising. Consolidation among tier-one vendors is accelerating as OEMs race to lock in software talent and cold-climate heat-pump IP, while regional specialists are moving into unserved niches such as solar-hybrid systems for remote sites. Short-term supply frictions tied to the January 2025 refrigerant deadline are likely to ease by 2027, setting a clearer runway for premium electrification solutions.

Global HVAC Equipment Market Trends and Insights

Stringent Building-Energy Codes in Europe Accelerating Heat-Pump Adoption

Europe's near-zero-energy-building mandate moved heat-pump installations 38% higher in 2024 versus 2022, pushing penetration in new builds to half of all units sold across the bloc. Nordic countries now deploy heat pumps in more than 60% of new homes, and large-capacity variants are entering commercial retrofits, creating a durable pull for cold-climate technology providers

Surge in Data-Center Construction in Nordics and FLAP-D Elevating Precision-Cooling Demand

Rack densities topping 30 kW, a 35% annual leap in cooling capacity and 65% growth in Swedish-Norwegian build-starts are fuelling liquid-cooling adoption. Johnson Controls notes that data-center projects now generate 18% of its commercial HVAC revenue, up from 12% a year earlier.

Talent Shortage of Certified HVAC Technicians in Mature Markets

Industrywide redesign outlays now exceed USD 10 billion and have lifted average system prices 8-12%, a short-lived drag until economies of scale improve after 2026

Other drivers and restraints analyzed in the detailed report include:

- Rapid Uptake of VRF Systems in High-Rise Asian Residential Complexes

- Inflation Reduction Act Tax Credits Catalyzing Early Furnace-Replacement Cycles

- High Up-Front Cost of Low-GWP Refrigerant Transition for OEMs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air-conditioning units contributed 46.1% to the HVAC equipment market in 2024 as rising temperatures and urban middle-class growth kept demand resilient. Residential room air conditioners in China reached 73% penetration that year [cheaa.org]. Ductless mini-splits advanced 18% annually in North America, where homeowners want zonal comfort without duct retrofits.

VRF remains the fastest-growing sub-segment, expanding at a 12.7% CAGR through 2030. Hospitals, hotels and mixed-use towers prize its simultaneous heating-cooling flexibility. Mitsubishi Electric recorded a 32% jump in global VRF installations in 2024

Retrofit and replacement activity represented 63.4% of the HVAC equipment market size in 2024, largely because systems commissioned during the 2005-2010 boom have reached end of life. Harvard research shows U.S. household HVAC replacements rose 14% in 2024 as owners chased lower utility bills.

New construction, although smaller, is forecast to climb 9.4% annually. Stricter 2023 U.S. energy-code updates lifted minimum efficiency thresholds 15%, prompting builders to specify premium packages. Performance-based retrofits continue to gain ground, with Johnson Controls indicating such contracts account for 32% of its retrofit backlog

HVAC Equipment Market Report Segments the Industry by Equipment Type (Boilers and Furnaces, Heat Pumps and More), Installation Type (New Construction, Retrofit / Replacement and More), End User (Residential, Commercial and More), Building Type (Office Buildings, Healthcare Facilities and More), and Geography (United States, China and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 34.9% of the HVAC equipment market in 2024, driven by urban construction and middle-income expansion. China alone made up 42% of regional value, though its annual growth cooled to 6.8% as real-estate activity stabilized [daikin.com]. Japan and Korea favor high-spec VRF and air-purification models, while Vietnam and Indonesia post double-digit gains on commercial builds.

North America accounted for 28.6%, buoyed by robust replacement demand and a 32% surge in U.S. heat-pump sales following Inflation Reduction Act incentives [carrier.com]. Data-center and healthcare projects lifted commercial revenue 22%.

Europe held 24.3%; heat-pump shipments climbed 17% in 2024 despite macro headwinds. HVAC upgrades made up 38% of EU renovation-wave spending as member states schedule fossil-fuel phaseouts.

The Middle East is the fastest-growing pocket, forecast at a 10.6% CAGR, with Saudi Arabia's Vision 2030 adding large-scale district-cooling capacity and UAE developers adopting VRF at speed.

- Daikin Industries Ltd.

- Carrier Global Corp.

- Trane Technologies PLC

- Johnson Controls International PLC

- Mitsubishi Electric Corp.

- Lennox International Inc.

- Rheem Manufacturing Co.

- Midea Group

- Gree Electric Appliances Inc.

- NIBE Group

- Panasonic Corp.

- Samsung Electronics (HVAC Division)

- LG Electronics (Air-Solution)

- Bosch Thermotechnology

- Vaillant Group

- Alfa Laval AB

- Stiebel Eltron GmbH and Co. KG

- Systemair AB

- Greenheck Fan Corporation

- FlaktGroup

- TROX GmbH

- Swegon Group AB

- Hitachi-Johnson Controls Air Conditioning

- Danfoss A/S (Commercial Compressors)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Building Energy Codes in Europe Accelerating Heat-Pump Adoption

- 4.2.2 Surge in Data-Center Construction in Nordics and FLAP-D Region Elevating Precision Cooling Demand

- 4.2.3 Rapid Uptake of Variable-Refrigerant-Flow (VRF) Systems in High-Rise Asian Residential Complexes

- 4.2.4 Inflation Reduction Act (U.S.) Tax Credits Catalyzing Early Furnace Replacement Cycles

- 4.2.5 District-Heating Expansion in Eastern Europe Spurring Large-capacity Boiler Retrofits

- 4.2.6 Solar-Hybrid HVAC Packages Gaining Traction in Off-Grid African Mining Camps

- 4.3 Market Restraints

- 4.3.1 High Up-front Cost of Low-GWP Refrigerant Transition for OEMs

- 4.3.2 Talent Shortage of Certified HVAC Technicians in Mature Markets

- 4.3.3 Semiconductor Supply-Chain Volatility Constraining VRF Inverter Availability

- 4.3.4 Stringent F-Gas Quotas in EU Increasing Compliance Burden for Importers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Key Performance Indicators

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Equipment Type

- 5.1.1 Heating Equipment

- 5.1.1.1 Boilers and Furnaces

- 5.1.1.2 Heat Pumps

- 5.1.1.3 Unitary Heaters

- 5.1.2 Ventilation Equipment

- 5.1.2.1 Air Handling Units

- 5.1.2.2 Humidifiers and Dehumidifiers

- 5.1.2.3 Air Filters

- 5.1.2.4 Fan Coil Units

- 5.1.3 Air-Conditioning Equipment

- 5.1.3.1 Unitary Air Conditioners

- 5.1.3.1.1 Ducted Splits

- 5.1.3.1.2 Ductless Mini-Splits

- 5.1.3.1.3 Packaged Rooftops

- 5.1.3.1.4 Variable Refrigerant Flow (VRF) Systems

- 5.1.3.2 Room Air Conditioners

- 5.1.3.3 Packaged Terminal Air Conditioners

- 5.1.3.4 Chillers

- 5.1.1 Heating Equipment

- 5.2 By Installation Type

- 5.2.1 New Construction

- 5.2.2 Retrofit / Replacement

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 By Building Type (Commercial)

- 5.4.1 Office Buildings

- 5.4.2 Healthcare Facilities

- 5.4.3 Hospitality and Leisure

- 5.4.4 Retail Stores and Malls

- 5.4.5 Educational Institutions

- 5.4.6 Data Centers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Qatar

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Egypt

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Daikin Industries Ltd.

- 6.4.2 Carrier Global Corp.

- 6.4.3 Trane Technologies PLC

- 6.4.4 Johnson Controls International PLC

- 6.4.5 Mitsubishi Electric Corp.

- 6.4.6 Lennox International Inc.

- 6.4.7 Rheem Manufacturing Co.

- 6.4.8 Midea Group

- 6.4.9 Gree Electric Appliances Inc.

- 6.4.10 NIBE Group

- 6.4.11 Panasonic Corp.

- 6.4.12 Samsung Electronics (HVAC Division)

- 6.4.13 LG Electronics (Air-Solution)

- 6.4.14 Bosch Thermotechnology

- 6.4.15 Vaillant Group

- 6.4.16 Alfa Laval AB

- 6.4.17 Stiebel Eltron GmbH and Co. KG

- 6.4.18 Systemair AB

- 6.4.19 Greenheck Fan Corporation

- 6.4.20 FlaktGroup

- 6.4.21 TROX GmbH

- 6.4.22 Swegon Group AB

- 6.4.23 Hitachi-Johnson Controls Air Conditioning

- 6.4.24 Danfoss A/S (Commercial Compressors)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment