|

市场调查报告书

商品编码

1844539

无菌包装:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Sterilized Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

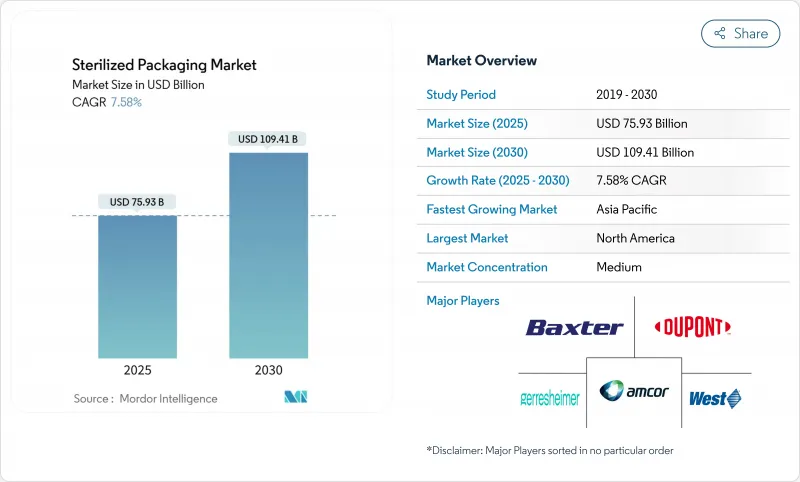

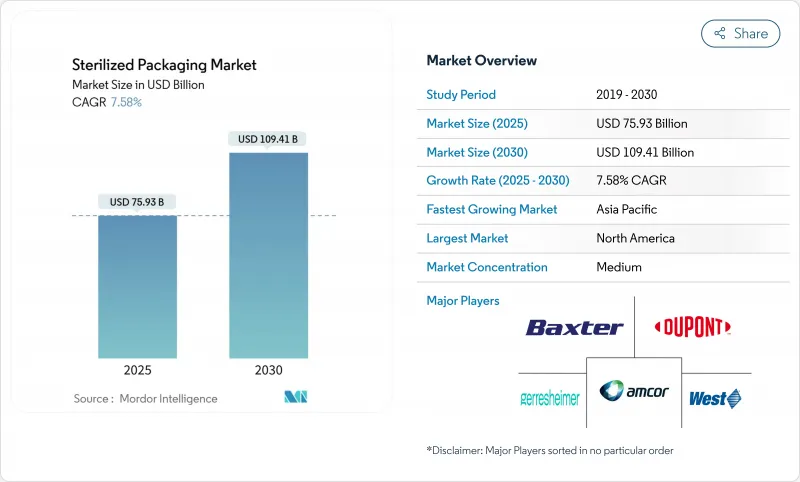

预计2025年灭菌包装市场规模将达759.3亿美元,2030年将达1,094.1亿美元,复合年增长率为7.58%。

全球法规日益严格、生技药品生产规模不断扩大以及控制医院内感染的压力日益增大,这些因素共同推动了医疗用品的需求。医院系统正在转向一次性包装,製药商正在指定更高阻隔性的包装,设备製造商则正在引入线上检测以降低召回风险。美国) 新的环氧乙烷 (EtO)排放法规已促使资本转向辐射和气相替代品,材料供应商也在迅速升级Tyvek和不织布,以满足下一波欧盟 PFAS 法规的要求。随着全球企业寻求合规和自动化所需的规模,整合正在加剧。

全球无菌包装市场趋势与洞察

医院内感染增加

每天,每31名美国住院患者中就有1人会感染医疗相关感染疾病,每年造成284亿美元的损失。医院强制要求关键器械使用阻隔性托盘和灭菌包装,许多医疗机构正在从可重复使用的器械包过渡到一次性使用,以减少责任。由于抗生素抗药性的存在,传统清洁方法已无法满足需求,一次性无菌包装市场的需求正在成长。包装加工商报告称,透气Tyvek盖的订单增加,这种盖可承受多次环氧乙烷(ETO)循环,同时保持10-6的无菌保证水准。

生技药品和注射剂的成长

到2030年,全球生技药品销售额可望达到8,560亿美元,而注射剂型的需求需要不会排放颗粒的超洁净容器。预填充式注射器的蓬勃发展迫使供应商认证更严格的容器密封测试,而细胞疗法製造商则要求包装在-196°C的低温下仍能保持完整性。肖特製药公司美国3.71亿美元的注射器工厂正是针对这些治疗方法而建,这表明其区域产能扩张与更严格的附件1法规相一致。

医用级聚合物价格波动

医用级树脂需要专用添加剂和耗时的验证,这限制了供应商的替代。地缘政治动盪和炼油厂停产推高了价格,使原本就面临高成本环氧乙烷减量计划的加工商更加捉襟见肘。在多个地区签订供应协议并拥有内部回收能力的公司可以获得更多利润。

細項分析

托盘和热成型包装能够容纳复杂的器械组,并允许即时目视检查,在2024年占据了无菌包装市场26.71%的份额。医院青睐透明盖子,因为它可以加快计数/清点程序,并减少手术室的延误。客製化的腔体可以限制产品移动,降低运输过程中被刺破的风险。泡壳和安瓿将成为成长最快的产品类别,到2030年,复合年增长率将达到9.41%,这主要得益于单位剂量生技药品,因为高价值剂量的药物可能会因污染而损失。

泡壳包装内先进阻隔膜的推广标誌着优质化。安装在热成型生产线上的人工智慧摄影机可以全速检查密封完整性,从而提高批次产量比率和文件记录品质。对于某些剂型和可重复使用的设备而言,袋装、瓶装、输液容器和泡壳仍然具有重要意义,但随着单剂量包装的普及,其增长正在放缓。记录温度和辐射暴露的智慧标籤正从试点阶段走向大规模应用,反映出更广泛的数位化。

塑胶在强度、透明度和成本方面取得了良好的平衡,到2024年仍将占据灭菌包装市场规模的62.24%。聚乙烯、聚丙烯和环烯烃共聚物具有耐环氧乙烷(ETO)、伽马射线和电子束的特性,但日益严格的永续性法规和原生树脂价格上涨正在推动其替代材料的发展。预计到2030年,不织布和Tyvek基材的复合年增长率将达到9.54%,因为它们的透气性和纤维强度使其能够与低残留灭菌剂搭配使用。

当必须尽量减少药物与产品之间的相互作用时,管瓶至关重要,尤其是对于低温运输较长的生技药品。金属托盘占据较小的市场,例如需要牢固固定和屏蔽运输的整形外科植入套件。虽然纸板在优先考虑生物降解性的二级纸盒中的应用正在增加,但一级灭菌仍然依赖高阻隔性。随着全氟辛烷磺酸 (PFAS) 的有效期临近,供应商越来越多地使用等离子涂层和氧化硅涂层来取代含氟聚合物。

区域分析

由于FDA的监管和高复杂药物上市率,北美将在2024年占据无菌包装市场的33.19%。庞大的合约灭菌网络和主要的树脂製造商保障了供应安全,而投资则集中在环氧乙烷(EtO)减排和新型电子束灭菌室。预计到2024年,Becton Dickinson的生物製药部门的销售额将超过10亿美元,凸显了该地区对高价值设备的偏好。

欧洲紧追在后,由于附件1的升级和早期采用不含PFAS的材料,其需求也趋于成熟。德国和爱尔兰拥有众多填充工厂,为全球生技药品供应链提供产品。欧盟2026年氟聚合物法规正在推动替代涂料的快速认证,使欧洲加工商成为先驱。永续性目标也推动了可重复使用二次包装的循环经济试点。

随着中国和印度扩大生物製药和小分子产品的生产以满足国内和出口市场的需求,到2030年,亚太地区将录得最快的复合年增长率,达到9.24%。区域监管机构将与ICH指南保持一致,推动对更高级别洁净室和辐射能力的投资。日本人口老化将推动居家医疗注射器的需求,而韩国和澳洲将成为智慧标籤低温运输包装的试验田。无菌包装市场的在地化生产能力将缩短前置作业时间并降低外汇风险。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 市场定义与研究假设

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 医院内感染增加

- 生技药品和注射剂的成长

- 全球严格的灭菌规定

- 扩大门诊病人和居家医疗环境

- 使用人工智慧进行线上无菌包装检测

- 细胞和基因治疗的低温运输需求

- 市场限制

- 医用级聚合物价格波动

- 环氧乙烷(EtO)排放合规成本

- 医药级伽玛射线辐照能力的局限性

- 氟聚合物阻隔膜中 PFAS 的审查

- 价值/供应链分析

- 关键法规结构的评估

- 关键相关人员影响评估

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 宏观经济因素的影响

第五章市场规模及成长预测

- 按产品

- 泡壳

- 小袋

- 瓶子

- 泡壳和安瓿

- 管瓶

- 托盘和热成型包装

- 输液容器和输液袋

- 其他的

- 按材质

- 塑胶(HDPE、PP、PET、PVC等)

- 玻璃

- 金属(铝箔、不銹钢)

- 纸和纸板

- 不织布/ Tyvek

- 按灭菌方法

- 化学(EtO、臭氧)

- 辐射(伽玛射线、电子束、X射线)

- 高温/蒸气

- 无菌灌装和精加工

- 按最终用户产业

- 医疗和手术器械

- 製药和生物技术

- 体外诊断

- 饮食

- 兽医和动物用药品

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Amcor plc

- DuPont de Nemours, Inc.

- Baxter International Inc.

- Gerresheimer AG

- SCHOTT AG

- West Pharmaceutical Services, Inc.

- AptarGroup, Inc.

- Tekni-Plex, Inc.

- Sealed Air Corporation

- Sonoco Products Company

- SteriPack Group

- Wipak Group

- Placon Corporation, Inc.

- SGD Pharma

- Becton, Dickinson and Company

- 3M Company

- Berry Global Group, Inc.

- Huhtamaki Oyj

- Sabert Corporation

- Winpak Ltd.

第七章 市场机会与未来趋势

- 閒置频段和未满足需求评估

The sterilized packaging market reached USD 75.93 billion in 2025 and is projected to climb to USD 109.41 billion by 2030, expanding at a 7.58% CAGR.

Demand is fueled by stricter global regulations, the growth of biologics manufacturing, and mounting pressure to curb hospital-acquired infections. Hospital systems are switching to single-use packs, pharmaceutical producers are specifying higher barrier formats, and equipment makers are embedding inline inspection to cut recall risks. The EPA's new ethylene-oxide (EtO) emission rules are already shifting capital toward radiation and vapor-phase alternatives, while material suppliers are fast-tracking Tyvek and non-woven upgrades to meet the next wave of EU PFAS limits. Consolidation is picking up as global players seek the scale needed to fund compliance and automation.

Global Sterilized Packaging Market Trends and Insights

Rising Incidence of Hospital-Acquired Infections

Healthcare-associated infections affect 1 in 31 U.S. hospital patients on any day, costing the system USD 28.4 billion annually. Hospitals are therefore mandating higher barrier trays and sterile wraps for critical instruments, and many facilities are shifting reusable sets to single-use formats to mitigate liability. Single-use sterilized packaging market demand rises further as antibiotic-resistant organisms render legacy cleaning inadequate. Packaging converters report growing orders for breathable Tyvek lids that withstand multiple EtO cycles while maintaining a sterility assurance level of 10-6.

Growth in Biologics and Injectable Drugs

Global biologics revenue is moving toward USD 856 billion by 2030, and demand for injectable formats requires ultra-clean containers that do not shed particulates. The prefilled syringe boom is compelling suppliers to certify tougher container-closure tests, while cell-therapy producers need packs that hold integrity at -196 °C. SCHOTT Pharma's USD 371 million U.S. syringe plant targets these therapies and shows how regional capacity expansion aligns with tighter Annex 1 rules.

Volatile Medical-Grade Polymer Prices

Medical-grade resins require specialty additives and lengthy validation, limiting supplier substitution. Geopolitical disruptions and refinery outages have spiked prices, squeezing converters that already face costly EtO abatement projects. Firms with multi-region supply contracts and in-house recycling capacity have more margin cover, whereas single-source buyers risk shortages and expedited-freight expenses.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Global Sterilization Regulations

- Expansion of Outpatient and Home-Care Settings

- Cost of Ethylene Oxide Emission Compliance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Trays and thermoform packs retained a 26.71% share of the sterilized packaging market in 2024 thanks to their ability to nest complex instrument sets and provide instant visual confirmation. Hospitals value clear lids that speed count-in and count-out procedures, reducing operating-room delays. Custom cavities lower product movement, cutting puncture risk in transit. Blisters and ampoules represent the fastest-rising product at a 9.41% CAGR through 2030, supported by unit-dose biologics where contamination can destroy high-value doses.

The push toward advanced barrier films within blisters illustrates premiumization. AI-equipped cameras on thermoform lines inspect seal integrity at full speed, improving batch yield and documentation. Pouches, bottles, IV containers, and clamshells remain relevant for specific dosage forms and reusable instruments, but growth is slower as unit-dose formats gain traction. Smart labels that log temperature or radiation exposure are migrating from trial to scale, reflecting broader digitization.

Plastics still accounted for 62.24% of sterilized packaging market size in 2024 because they balance strength, clarity, and cost. Polyethylene, polypropylene, and cyclic-olefin copolymers withstand EtO, gamma, and e-beam, yet rising sustainability rules and virgin-resin inflation encourage substitution. Non-woven and Tyvek substrates are forecast to rise 9.54% CAGR to 2030 as breathability and fiber strength help them pair with lower-residue sterilants.

Glass vials remain indispensable where drug-product interaction must approach zero, notably for biologics with long cold-chain legs. Metal trays occupy smaller niches such as orthopedic implant kits requiring rigid retention and shielded transport. Paperboard is gaining for secondary cartons where biodegradability is prized, though primary sterility still relies on higher barriers. As PFAS sunset dates approach, suppliers scale up plasma and silicon-oxide coatings to replace fluoropolymers.

The Sterilized Packaging Market Report is Segmented by Product (Clamshells, Pouches, Bottles, Blisters and Ampoules, Vials, and More), Material (Plastics, Glass, Metals, and More), Sterilization Method (Chemical, Radiation, and More), End-User Industry (Medical and Surgical Instruments, Pharmaceutical and Biological, In-Vitro Diagnostics, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 33.19% of sterilized packaging market share in 2024, anchored by FDA oversight and a high proportion of complex drug launches. Large contract sterilization networks and leading resin producers underpin supply security, while investment focuses on EtO abatement and new e-beam vaults. Becton Dickinson's biologic-delivery segment surpassed USD 1 billion in 2024, highlighting the region's tilt toward higher-value devices .

Europe follows with mature demand, driven by Annex 1 upgrades and early adoption of PFAS-free materials. Germany and Ireland host numerous fill-finish plants that feed global biologic supply chains. The EU's 2026 fluoropolymer limits spur rapid qualification of alternative coatings, positioning European converters as first movers. Sustainability targets also push circular-economy pilots for reusable secondary packs.

Asia-Pacific posts the fastest 9.24% CAGR to 2030 as China and India scale biologic and small-molecule output for domestic and export markets. Regional regulators are harmonizing with ICH guidelines, prompting investment in higher-grade cleanrooms and radiation capacity. Japan's aging population drives home-care syringe demand, while South Korea and Australia serve as test beds for smart-label cold-chain packs. Localizing sterilized packaging market capacity cuts lead times and cushions currency risk.

- Amcor plc

- DuPont de Nemours, Inc.

- Baxter International Inc.

- Gerresheimer AG

- SCHOTT AG

- West Pharmaceutical Services, Inc.

- AptarGroup, Inc.

- Tekni-Plex, Inc.

- Sealed Air Corporation

- Sonoco Products Company

- SteriPack Group

- Wipak Group

- Placon Corporation, Inc.

- SGD Pharma

- Becton, Dickinson and Company

- 3M Company

- Berry Global Group, Inc.

- Huhtamaki Oyj

- Sabert Corporation

- Winpak Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of hospital-acquired infections

- 4.2.2 Growth in biologics and injectable drugs

- 4.2.3 Stringent global sterilization regulations

- 4.2.4 Expansion of outpatient and home-care settings

- 4.2.5 AI-enabled inline sterile-pack inspection

- 4.2.6 Cell and gene-therapy cold-chain needs

- 4.3 Market Restraints

- 4.3.1 Volatile medical-grade polymer prices

- 4.3.2 Cost of ethylene oxide (EtO) emission compliance

- 4.3.3 Limited pharma-grade gamma irradiation capacity

- 4.3.4 PFAS scrutiny in fluoropolymer barrier films

- 4.4 Value / Supply-Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Clamshells

- 5.1.2 Pouches

- 5.1.3 Bottles

- 5.1.4 Blisters and Ampoules

- 5.1.5 Vials

- 5.1.6 Trays and Thermoform Packs

- 5.1.7 IV Containers and Bags

- 5.1.8 Others

- 5.2 By Material

- 5.2.1 Plastics (HDPE, PP, PET, PVC, Others)

- 5.2.2 Glass

- 5.2.3 Metals (Aluminum Foil, Stainless Steel)

- 5.2.4 Paper and Paperboard

- 5.2.5 Non-woven and Tyvek

- 5.3 By Sterilization Method

- 5.3.1 Chemical (EtO, Ozone)

- 5.3.2 Radiation (Gamma, e-Beam, X-Ray)

- 5.3.3 High Temperature / Steam

- 5.3.4 Aseptic Fill-Finish

- 5.4 By End-user Industry

- 5.4.1 Medical and Surgical Instruments

- 5.4.2 Pharmaceutical and Biological

- 5.4.3 In-Vitro Diagnostics

- 5.4.4 Food and Beverage

- 5.4.5 Veterinary and Animal Health

- 5.4.6 Other Industrial

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 DuPont de Nemours, Inc.

- 6.4.3 Baxter International Inc.

- 6.4.4 Gerresheimer AG

- 6.4.5 SCHOTT AG

- 6.4.6 West Pharmaceutical Services, Inc.

- 6.4.7 AptarGroup, Inc.

- 6.4.8 Tekni-Plex, Inc.

- 6.4.9 Sealed Air Corporation

- 6.4.10 Sonoco Products Company

- 6.4.11 SteriPack Group

- 6.4.12 Wipak Group

- 6.4.13 Placon Corporation, Inc.

- 6.4.14 SGD Pharma

- 6.4.15 Becton, Dickinson and Company

- 6.4.16 3M Company

- 6.4.17 Berry Global Group, Inc.

- 6.4.18 Huhtamaki Oyj

- 6.4.19 Sabert Corporation

- 6.4.20 Winpak Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment