|

市场调查报告书

商品编码

1844544

电动方向盘:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Electric Power Steering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

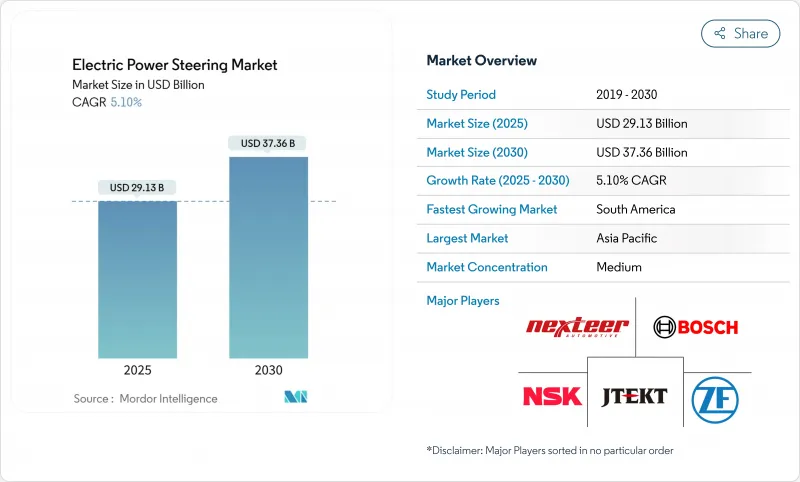

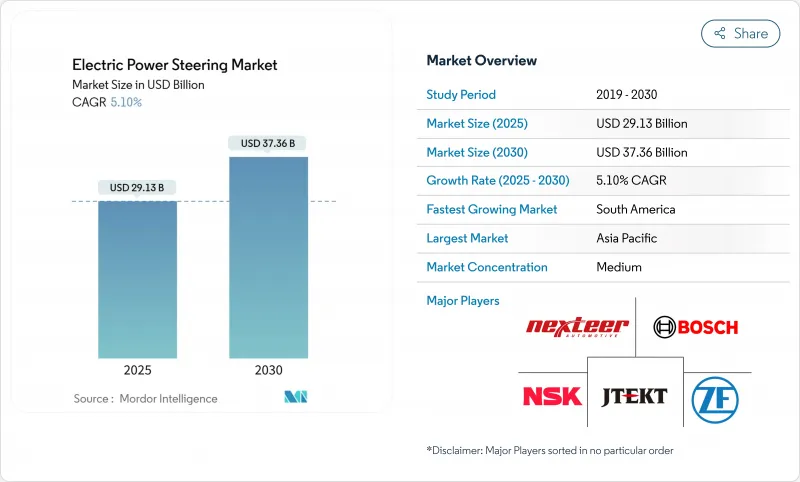

预计电动方向盘市场在 2025 年将达到 291.3 亿美元,到 2030 年将达到 373.6 亿美元,复合年增长率为 5.10%。

线传转向的普及、燃油经济性法规的收紧以及向软体定义汽车的转变,都在支持这一稳定的发展轨迹。汽车製造商现在将转向系统作为大规模客製化的门户,强调透过无线更新实现智慧软体校准。供应商正在将重点从纯机械专业知识转向符合 ISO/SAE 21434 和 UN R155 网路安全法规的整合电子架构。同时,亚太地区的主导地位受到中国电动车规模和日本精密组件传统的推动。南美洲电动车的加速普及正在推动成本敏感市场的下一波需求。现有的一级公司正在透过将电控系统、感测器和电机设计捆绑到承包模组中来捍卫自己的地位,这些模组可以根据不断发展的 ADAS 要求进行检验。

全球电动方向盘市场趋势与洞察

汽车平臺快速电气化

汽车电气化将从根本上改变电动辅助转向系统 (EPS) 的采用模式,因为它消除了液压系统固有的寄生损耗,而液压系统会消耗内燃机车辆的引擎功率。电动车需要节能的转向解决方案,而混合动力 EPS 系统已证明,与商用车应用中的传统液压动力方向盘相比,其能耗可降低 50% 以上。随着汽车製造商认识到 EPS 是整合再生煞车和优化电池续航里程的重要基础设施,这一转变正在加速。美国国家公路交通安全管理局 (NHTSA) 针对 2027-2031 年车型製定的企业平均燃油经济性标准要求每年燃油经济性提高 2%,这使得 EPS 的采用成为内燃机车辆的经济必需品,也是电动车的竞争优势。这种监管压力创造了双重市场动态:对于传统车辆而言,EPS 以合规性主导;而对于电动平台而言,EPS 则以性能提升为导向。

对燃油经济性和减少排放气体的需求不断增加

根据美国国家研究委员会的研究,更换液压系统可使中型车辆的油耗降低1.3%,重型车辆的油耗降低1.1%。由于整个车队的效率提升是迭加的,因此对于面临燃油成本上升和碳定价机制挑战的商用车营运商而言,EPS 具有经济吸引力。欧盟《通用安全法规 II》(2024 年 7 月生效)要求使用与 EPS 系统无缝整合的先进安全技术,从而形成监管协同效应,加速 EPS 的普及。效率要求与安全性的整合要求 EPS 成为一项基础技术,而非可选的附加技术。车队营运商越来越多地将 EPS 视为一项基础设施投资,它将赋能未来的自动驾驶能力,同时带来即时的营运成本节约。

单位成本高,而低成本车辆的液压系统则不然

在价格驱动的细分市场中,成本竞争仍然激烈,儘管营运效率低下,液压系统仍保持经济优势。印度汽车製造商展示了不同的成本管理方法,塔塔汽车公司将其 Harrier EV 的 80% 零件本地化,而 Ola Electric 等公司则开发无磁电机以避免对稀土材料的依赖。随着中国稀土出口限制对供应链造成压力,以及印度考虑放宽 50% 的本地化要求以维持电动车製造的可行性,成本差异变得更加明显。製造规模经济有利于大众市场中的现有液压系统供应商,从而造成市场分化,高檔车采用 EPS,而经济型车则抵制转型。在商用车应用中,挑战更加严峻,初始资本成本直接影响车辆盈利,必须证明明显的营运成本节约才能证明更高的购置价格是合理的。

細項分析

到2024年,管柱式EPS系统将占据54.23%的市场份额,这反映了其在主流汽车平臺中已确立的整合优势和成本效益。然而,双小齿轮配置将成为成长最快的细分市场,到2030年,复合年增长率将达到11.50%,这主要得益于自动驾驶应用对精度的要求以及转向响应特性的提升。小齿轮式系统在成本和性能之间实现了良好的平衡,在中阶应用中保持了稳定的市场影响。此细分市场的演变反映了製造商对未来出行需求的策略性定位,其中转向精度对于安全至关重要的自动驾驶功能至关重要。

蔚来ET9采用采埃孚线传技术,展现了先进的架构如何助力全新方向盘设计与更佳操控性,尤其有利于电动车平台。管柱式转向系统在改装应用和成本敏感型细分市场中保持主导地位,而双小齿轮转向系统则吸引了寻求差异化驾驶体验的高端製造商。技术进步标誌着市场的分化:大众市场车辆优先考虑管柱式转向系统久经考验的可靠性,而性能驱动型应用则转向双小齿轮转向系统的精准性能。

2024年,转向齿条/转向柱组件将维持42.61%的市场份额,成为所有车型EPS系统的机械基础。到2030年,感测器组件的复合年增长率将达到10.20%,成长最快,这反映了整合高阶驾驶辅助系统(ADAS)所需的回馈机制日益复杂。方向盘马达作为主要的驱动组件,性能稳定,而其他组件类型则融合了网路安全模组和无线更新功能等新兴技术。组件组合的演变表明,市场正从基础电气化向智慧型系统架构迈进。

感测器的成长轨迹与增强型车辆安全系统的监管要求一致,旨在提供准确的回馈,以实现紧急转向干预和车道维持辅助功能。 NSK 开发的力回馈致致动器和车轮致动器表明,下一代转向系统所需组件的复杂性日益提高。传统机械组件面临商品化的压力,而电子组件则因其先进的功能而拥有高昂的价格,从而重塑了供应商的价值提案和竞争态势。

区域分析

2024年,亚太地区将占电动方向盘市场收益的46.80%。中国垂直整合的电动车生态系统将国产马达控制器、整车模组和转向装置整合成具有成本竞争力的模组,用于国内和出口专案。蔚来汽车采用采埃孚(ZF)的线传,凸显了中国已准备好直接进入先进架构。同时,日本正在捍卫其在高精度轴承和角度感测器领域的领先地位,这使得本地供应商能够向全球一级供应商销售关键次组件。政府的碳中和奖励正在加速需求成长,而区域产能则确保了零件的供应。

欧洲是一个成熟但受法规主导的市场。欧盟通用安全法规II要求原始设备製造商(OEM)必须提供依赖EPS精度的车道维持和行人避让功能。供应商受益于稳定的规划週期和固定的实施日期。 2010年代中期的网路安全法规将进一步提高门槛,使车队管理集中在拥有专门软体团队的公司手中。

北美专注于能源效率法规。美国国家公路交通安全管理局(NHTSA)的CAFE标准要求乘用车燃油经济性在2031年之前每年提高2%。以巴西为首的南美是成长最快的地区,到2030年的复合年增长率将达到9%。 2024年,电动车销量飙升90%,显示免除进口电池模组关税后,电动车需求将持续成长。 Stellantis紧随其后,投资56亿欧元开发一款整合式电动辅助转向(EPS)的生物混合动力传动系统,用于双燃料运作。该地区的成长标誌着一项突破现有液压技术的技术飞跃。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 汽车平臺快速电气化

- 对燃油效率和减少排放气体的要求日益提高

- ADAS整合监理更加严格

- 线传研发突破

- 与一级/二级供应商合作开发48V电动动力传动系统模组

- 面向大规模客製化的OTA软体转向校准

- 市场限制

- 在低成本车辆中,单位成本高于液压系统

- 新兴市场的转向感有限且有安全隐患

- 马达控制器半导体供应链不稳定

- 电子控制栏网路安全风险

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 按类型

- 列类型

- 小齿轮类型

- 双小齿轮型

- 依组件类型

- 转向齿条/转向柱

- 感应器

- 方向盘马达

- 其他的

- 按车辆类型

- 搭乘用车

- 商用车

- 依推进类型

- 内燃机汽车

- 混合动力汽车

- 纯电动车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 南非

- 埃及

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- JTEKT Corporation

- Robert Bosch GmbH

- Nexteer Automotive

- ZF Friedrichshafen AG

- Denso Corporation

- NSK Ltd.

- Hyundai Mobis Co. Ltd.

- Mitsubishi Electric Corporation

- Hitachi Astemo Ltd.

- Thyssenkrupp Presta AG

- Mando Corporation

- Continental AG

第七章 市场机会与未来展望

The electric power steering market generated USD 29.13 billion in 2025 and will reach USD 37.36 billion by 2030, representing a 5.10% CAGR.

Rising penetration of steer-by-wire, tighter fuel-efficiency rules, and the shift toward software-defined vehicles underpin this steady trajectory. Automakers now emphasize intelligent software calibration delivered through over-the-air updates, using the steering system as a gateway for mass customization. Suppliers are pivoting from purely mechanical expertise to integrated electronic architectures that comply with ISO/SAE 21434 and UN R155 cybersecurity rules. At the same time, Asia-Pacific's dominant share rests on China's EV scale and Japan's precision-component heritage. South America's accelerating EV adoption signals the next demand wave in cost-sensitive markets. Incumbent Tier-1s defend their position by bundling electronic control units, sensors, and motor designs into turnkey modules that can be validated against evolving ADAS mandates.

Global Electric Power Steering Market Trends and Insights

Rapid Electrification of Vehicle Platforms

Vehicle electrification fundamentally reshapes EPS adoption patterns by eliminating the parasitic losses inherent in hydraulic systems that drain ICE engine power. Electric vehicles demand energy-efficient steering solutions, with hybrid EPS systems demonstrating over 50% energy consumption reduction compared to conventional hydraulic power steering in commercial vehicle applications. The transition accelerates as automakers recognize EPS as an essential infrastructure for regenerative braking integration and battery range optimization. NHTSA's Corporate Average Fuel Economy standards for model years 2027-2031 mandate 2% annual fuel efficiency improvements, making EPS adoption economically inevitable for ICE vehicles while providing competitive advantages for EVs. This regulatory pressure creates a dual-market dynamic where EPS becomes compliance-driven for traditional vehicles and performance-enhancing for electric platforms.

Increasing Demand for Fuel Efficiency and Emission Reduction

Fuel efficiency mandates drive EPS adoption through measurable consumption benefits, with National Research Council studies indicating 1.3% fuel reduction for midsize cars and 1.1% for large cars when replacing hydraulic systems. Efficiency gains compound across fleet operations, making EPS economically attractive for commercial vehicle operators facing rising fuel costs and carbon pricing mechanisms. European Union's General Safety Regulation II, effective July 2024, mandates advanced safety technologies that integrate seamlessly with EPS systems, creating regulatory synergies that accelerate adoption. The convergence of efficiency requirements and safety mandates EPS as a foundational technology rather than optional equipment. Fleet operators increasingly recognize EPS as an infrastructure investment that delivers immediate operational cost reductions while enabling future autonomous capabilities.

Higher Unit Cost vs. Hydraulic Systems in Low-Cost Cars

Cost competitiveness remains challenging in price-sensitive market segments where hydraulic systems maintain economic advantages despite operational inefficiencies. Indian automakers demonstrate varied approaches to cost management, with Tata Motors achieving 80% localization for Harrier EV components while companies like Ola Electric develop magnet-less motors to avoid rare-earth material dependencies. The cost differential becomes more pronounced as China's rare-earth export restrictions create supply chain pressures, with India considering the relaxation of 50% localization requirements to maintain EV manufacturing viability. Manufacturing scale economics favor established hydraulic system suppliers in volume segments, creating market bifurcation where premium vehicles adopt EPS while economy segments resist transition. The challenge intensifies in commercial vehicle applications where initial capital costs directly impact fleet profitability, requiring a clear operational savings demonstration to justify higher acquisition prices.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Mandates for ADAS Integration

- Steer-by-Wire R&D Breakthroughs

- Limited Steering Feel and Safety Concerns in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Column Type EPS systems commanded a 54.23% market share in 2024, reflecting their established integration advantages and cost-effectiveness for mainstream vehicle platforms. However, dual-pinion type configurations emerge as the fastest-growing segment at 11.50% CAGR through 2030, driven by precision requirements for autonomous driving applications and enhanced steering response characteristics. Pinion Type systems maintain a steady market presence in mid-range applications, offering balanced performance between cost and capability. The segment evolution reflects manufacturers' strategic positioning for future mobility requirements, where steering precision becomes critical for safety-critical autonomous functions.

ZF's steer-by-wire technology deployment in NIO's ET9 demonstrates how advanced architecture enables new steering wheel designs and improved maneuverability, particularly benefiting electric vehicle platforms. Column Type systems retain advantages in retrofit applications and cost-sensitive segments, while Dual Pinion configurations attract premium manufacturers seeking differentiated driving experiences. Technology progression suggests market bifurcation where volume segments prioritize proven Column Type reliability while performance-oriented applications migrate toward Dual Pinion precision capabilities.

Steering Rack/Column components maintained 42.61% market share in 2024, representing the mechanical foundation of EPS systems across all vehicle types. Sensor components accelerate fastest at 10.20% CAGR through 2030, reflecting the increasing sophistication of feedback mechanisms required for advanced driver assistance systems integration. Steering Motor segments provide consistent performance as the primary actuation component, while Other Component Types encompass emerging technologies like cybersecurity modules and OTA update capabilities. The component mix evolution indicates market maturation beyond basic electrification toward intelligent system architectures.

The sensor growth trajectory aligns with regulatory requirements for enhanced vehicle safety systems, where precise feedback enables emergency steering interventions and lane-keeping assistance functions. NSK's development of Force Feedback Actuators and Road Wheel Actuators for steer-by-wire applications exemplifies the component sophistication required for next-generation steering systems. Traditional mechanical components face commoditization pressure while electronic components command premium pricing through advanced functionality, reshaping supplier value propositions and competitive dynamics.

The Electric Power Steering Market Report is Segmented by Type (Column Type, Pinion Type, and Dual Pinion Type), Component Type (Steering Rack/Column, Sensor, Steering Motor, and More), Vehicle Type (Passenger Cars and Commercial Vehicles), Propulsion Type (Internal Combustion Engine Vehicles, Battery Electric Vehicles, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific anchored 46.80% of the electric power steering market revenue in 2024. China's vertically integrated EV ecosystem packages domestic motor controllers, vehicle domains, and steering gears into cost-competitive modules serving local and export programs. NIO's adoption of steer-by-wire from ZF underscores China's readiness to leap directly into advanced architectures. Japan, meanwhile, protects leadership in high-precision bearings and angle sensors, enabling local suppliers to sell critical sub-assemblies to global Tier-1s. Government incentives for carbon neutrality accelerate demand, and regional capacity ensures component availability.

Europe represents a mature but regulation-driven arena. The EU General Safety Regulation II forces OEMs to fit lane-keeping and pedestrian-avoidance functions that rely on EPS precision. Suppliers gain from stable planning cycles as implementation dates are locked. Mid-decade cybersecurity rules further elevate barriers, consolidating volume among companies with dedicated software teams.

North America focuses on efficiency mandates. NHTSA's CAFE standards impose 2% annual gains for passenger fleets through 2031. South America, led by Brazil, is the fastest-expanding region with a 9% CAGR through 2030. A 90% spike in EV sales in 2024 demonstrated pent-up demand once taxes were waived for imported battery modules. Stellantis followed with a EUR 5.6 billion commitment to develop Bio-Hybrid powertrains that integrate EPS for dual-fuel flexibility. The region's growth illustrates tech leapfrogging, bypassing hydraulic incumbency.

- JTEKT Corporation

- Robert Bosch GmbH

- Nexteer Automotive

- ZF Friedrichshafen AG

- Denso Corporation

- NSK Ltd.

- Hyundai Mobis Co. Ltd.

- Mitsubishi Electric Corporation

- Hitachi Astemo Ltd.

- Thyssenkrupp Presta AG

- Mando Corporation

- Continental AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid electrification of vehicle platforms

- 4.2.2 Increasing demand for fuel efficiency and emission reduction

- 4.2.3 Regulatory mandates for ADAS integration

- 4.2.4 Steer-by-wire RandD breakthroughs

- 4.2.5 Tier-1/2 collaboration on 48-V e-Powertrain modules

- 4.2.6 OTA software steering calibration for mass customisation

- 4.3 Market Restraints

- 4.3.1 Higher unit cost vs. hydraulic systems in low-cost cars

- 4.3.2 Limited steering feel and safety concerns in emerging markets

- 4.3.3 Semiconductor supply-chain volatility for motor controllers

- 4.3.4 Cyber-security risks in electronically actuated columns

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Type

- 5.1.1 Column Type

- 5.1.2 Pinion Type

- 5.1.3 Dual Pinion Type

- 5.2 By Component Type

- 5.2.1 Steering Rack/Column

- 5.2.2 Sensor

- 5.2.3 Steering Motor

- 5.2.4 Other Component Types

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Propulsion Type

- 5.4.1 Internal Combustion Engine Vehicles

- 5.4.2 Hybrid Vehicles

- 5.4.3 Battery Electric Vehicles

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Russia

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 United Arab Emirates

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 Turkey

- 5.5.4.4 South Africa

- 5.5.4.5 Egypt

- 5.5.4.6 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 JTEKT Corporation

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Nexteer Automotive

- 6.4.4 ZF Friedrichshafen AG

- 6.4.5 Denso Corporation

- 6.4.6 NSK Ltd.

- 6.4.7 Hyundai Mobis Co. Ltd.

- 6.4.8 Mitsubishi Electric Corporation

- 6.4.9 Hitachi Astemo Ltd.

- 6.4.10 Thyssenkrupp Presta AG

- 6.4.11 Mando Corporation

- 6.4.12 Continental AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment