|

市场调查报告书

商品编码

1851431

汽车电动液压动力方向盘:市场份额分析、产业趋势、统计数据和成长预测(2025-2030 年)Automotive Electro-Hydraulic Power Steering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

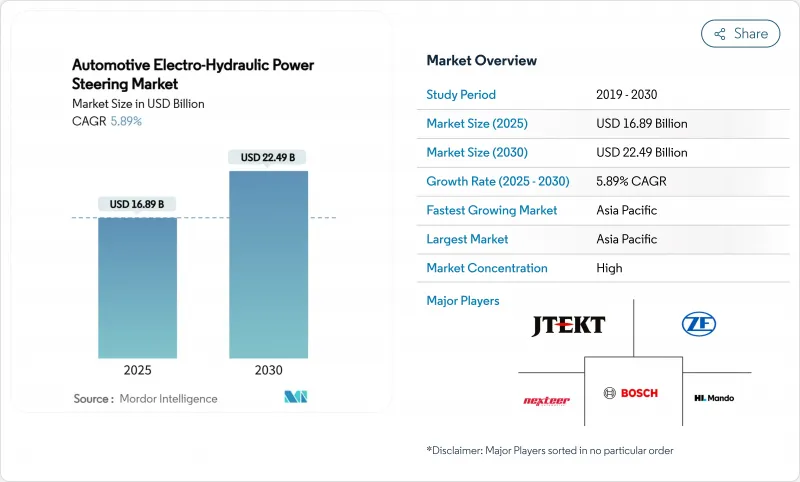

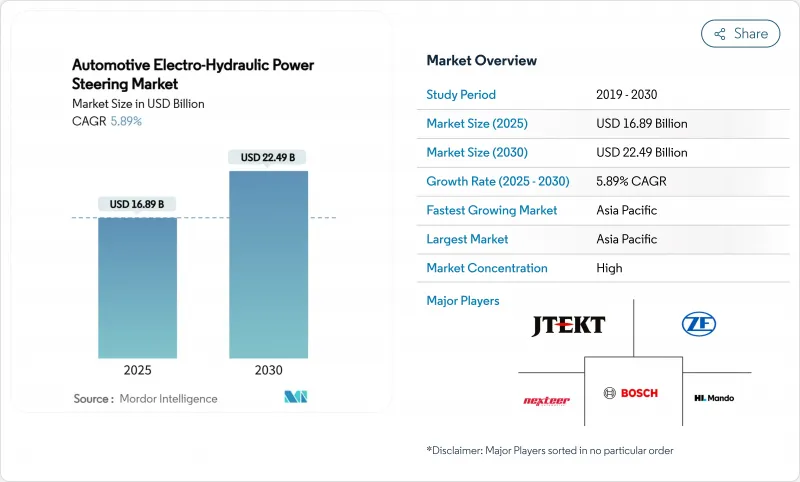

2025 年汽车电动液压动力方向盘市场价值为 168.9 亿美元,预计到 2030 年将达到 224.9 亿美元,预测期(2025-2030 年)复合年增长率为 5.89%。

这一前景主要受电动车产量成长、全球排放气体法规日益严格以及对线传技术(旨在提高转向能源效率)的需求不断增长所驱动。乘用车和轻型商用车的电气化推动了12V辅助负载的增加,与皮带驱动液压系统相比,按需式电动辅助转向帮浦(EHPS)的相对能耗性能得到提升。自动驾驶程式需要故障后仍能正常运作的转向系统架构,这进一步推动了EHPS的普及。儘管稀土材料的供应限制构成了一项关键风险,但全电动方向盘在轻型车领域带来了激烈的竞争。然而,EHPS是一项融合了液压动力和电子控制灵活性的桥樑技术,使供应商能够在内燃机、混合动力和纯电动平台上都受益。

全球汽车液压动力方向盘市场趋势及洞察

电动车产量增加和12V辅助电源负载增加

纯电动车和插电式混合动力车产量的不断增长,导致空调、资讯娱乐和安全功能等辅助负载增加,从而扩大了按需驱动式电液动力转向泵(EHPS)与连续驱动式液压泵之间的效率差距。预计到2024年,全球电动车销量将达到1,400万辆,其中纯电动车将占总销量的73%,为EHPS系统奠定了坚实的基础。商用车领域也呈现类似的趋势,预计2024年电动巴士的出货量将成长30%,进而推动节能转向解决方案的应用。目前,工程研发的重点是开发与车辆能量管理系统协同工作的泵浦控制演算法,以最大限度地降低车辆在匀速行驶时的电流消耗。

OEM厂商对L3+ ADAS转向冗余的需求

对于3级以上安全等级,ISO 26262标准规定了故障运作转向系统的要求,并明确了转向控制的ASIL-D完整性等级。采用双马达和液压辅助路径的EHPS架构提供了必要的冗余和容错能力,即使在断电或致动器故障的情况下也能保持转向能力。近期推出的产品,例如蔚来ET9上的线控转向解决方案,凸显了EHPS模组如何与电子执行器配合,实现可变转向比和紧急干预。因此,供应商必须对诊断、感测器融合和故障回退策略进行研发,以满足功能安全审核的要求。

稀土永磁马达供应链不稳定

钕、镝和铽的供应仍集中在小型矿山,其中中国占精炼产量的60%以上。 2024年出口许可证政策的调整推高了现货价格,并导致库存趋紧,促使汽车製造商重新考虑无磁同步磁阻马达和双源泵浦组件。转向系统製造商正在增加安全库存,并与矿商签订直接承购协议,以稳定前置作业时间。

细分市场分析

到2024年,乘用车将占据电动液压动力方向盘)市场64.31%的份额,EHPS将在紧凑型、中型和豪华车型平台上广泛应用。汽车製造商正在整合EHPS以实现自动启动/停止功能、轻度混合动力系统以及扩展高级驾驶辅助系统(ADAS)的配置。轻型商用车的电动液压动力方向盘市场规模预计将以7.27%的复合年增长率成长。

乘用车共享体现了高效的规模效应、车型更新周期以及高配置量,这些优势足以抵消电动帮浦的额外成本。由于中国、欧洲和美国部分州收紧了最后一公里配送法规,商用车计画正经历加速成长。重型卡车和客车的成长相对滞后,但随着电池组经济性和高压转向驱动技术的融合,未来有望崛起。

到2024年,转向马达将占电液压动力方向盘市场份额的36.53%。其高材料价值和关键性能作用将支撑整个组件组合。感测器和扭力模组到2030年将以7.73%的复合年增长率成长,因为ISO 26262冗余目标将使每个系统的位置和扭力感测通道数量翻倍。

永磁无刷马达因其高功率密度和快速响应能力,仍然是行业标准。供应商正投资研发基于铁氧体或磁阻式设计的电机,以避免使用稀土元素。随着线控转向软体层的扩展,控制ECU正向更高频宽的微控制器迁移,而密封泵壳现在也整合了冷却套,以延长工作週期。

区域分析

亚太地区仍是需求中心。该地区在2024年占据了电动液压动力方向盘47.57%的市场份额,预计到2030年将以8.75%的复合年增长率增长,成为规模最大、增长最快的地区。中国纯电动车和插电式混合动力车的产能推动了泵浦的大量需求。印度的FAME-II和PLI计划鼓励国内线控转向系统和泵浦设备的在地采购。日本为出口车型提供符合ISO 26262标准的高可靠性感测器和马达控制器。区域供应商受益于政府激励措施,这些措施降低了到岸成本,并缩短了集中在上海、广州、清奈和名古屋的OEM工厂的供应链。

随着排放气体法规日益严格,北美市场持续稳定扩张。美国)的多污染物排放标准和加州的「先进清洁汽车II」(Advanced Clean Car II)计画要求汽车製造商对包括转向系统在内的辅助系统进行电气化改造,以达到车辆排放目标。预计从2024年起,纯电动货车的普及率将翻一番,而电动液压辅助转向系统(EHPS)的应用也日益广泛,尤其是在小包裹和杂货运输车队中。此外,美国本土汽车製造商也透过资助铁氧体和磁阻马达的研究来规避稀土风险,从而支撑了该地区液压动力方向盘的市场规模,使其成为抵御市场衝击的韧性力量。加拿大的清洁交通信贷计画与美国的政策相呼应,进一步加强了跨国生产协同效应。

欧洲正引领高端汽车领域的创新。德国、瑞典和法国的汽车品牌正在推出线传转向平台,这些平台整合了EHPS(电子高压帮浦)作为安全冗余的致动器。采埃孚(ZF)计画于2025年初开始为一家中国高端汽车製造商量产相关产品。欧盟到2030年将整车二氧化碳排放量减少55%的目标,持续推动供应商在零件层面提升效率。随着豪华车和高性能车市场向800V架构转型,配备智慧能源回收演算法的EHPS模组将与线控刹车和主动悬吊系统相辅相成。东欧和中东地区拥有新兴的组装基地,但基础设施的不足和价格敏感度将阻碍短期内的普及,因此亚太地区将成为未来十年关键的成长引擎。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- OEM厂商对L3+ ADAS转向冗余的需求

- 电动车产量增加,12V辅助电源负载增加

- 轻型商用车快速电气化

- 更严格的二氧化碳/CAFE法规提高了转向效率

- 线控转向模组和EHPS帮浦集成

- 中国和印度的在地采购奖励(PLI、MIIT、FAME-II)

- 市场限制

- 稀土永磁电机供应链波动性

- 与传统HPS相比,前期成本较高

- 高温工作循环期间的可靠性问题

- 在B/C级车型中,全电动方向盘(EPS)车型与竞争对手竞争

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 大型商用车辆

- 公车和长途客车

- 非公路及特种车辆

- 依组件类型

- 转向电机

- 液压泵浦

- 感测器和扭矩模组

- ECU/控制器

- 水箱、软管等。

- 依推进类型

- 内燃机(ICE)

- 混合动力电动车(HEV)

- 电池电动车(BEV)

- 插电式混合动力电动车

- 燃料电池电动车(FCEV)

- 按销售管道

- 目的地设备製造商 (OEM)

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 印尼

- 越南

- 菲律宾

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- JTEKT Corporation

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Nexteer Automotive Corporation

- Mando Corporation

- NSK Ltd.

- Continental AG

- Thyssenkrupp Presta AG

- Hitachi Astemo

- Showa Corporation

- Knorr-Bremse Commercial Vehicle Systems GmbH

- Shanghai OE Industrial Co., Ltd.(Brogen EV Solutions)

第七章 市场机会与未来展望

The automotive electro-hydraulic power steering market was valued at USD 16.89 billion in 2025 and is projected to reach USD 22.49 billion by 2030, equal to a 5.89% CAGR during the forecast period (2025-2030).

This outlook stems from rising electric vehicle production, stricter global emissions rules, and growing requirements for steer-by-wire readiness that demand higher steering energy efficiency. Passenger car and light commercial vehicle electrification is lifting auxiliary 12 V loads, which improves the relative energy profile of on-demand EHPS pumps compared with belt-driven hydraulic systems. Autonomous driving programs call for fail-operational steering architectures, further reinforcing EHPS adoption. Rare-earth material constraints represent the main supply risk, while full electric power steering creates competitive pressure in smaller vehicle segments. Yet EHPS remains the bridge technology that pairs hydraulic force capability with electronic control flexibility, positioning suppliers to benefit across internal combustion, hybrid, and battery-electric platforms.

Global Automotive Electro-Hydraulic Power Steering Market Trends and Insights

Growing EV Production and Higher Auxiliary-12 V Loads

Escalating battery electric and plug-in hybrid volumes raise auxiliary loads for climate, infotainment, and safety functions, which amplifies the efficiency gap between on-demand EHPS pumps and continuously driven hydraulic pumps. Global EV sales reached 14 million units in 2024, with battery electric vehicles taking 73% of deliveries, creating a sizeable addressable base for EHPS systems. Commercial segments follow a similar path as electric buses logged 30% shipment growth in 2024, encouraging the adoption of energy-saving steering solutions. The engineering priority now focuses on pump control algorithms coordinating with vehicle energy management to minimize current draw during steady-state cruising.

OEM Demand for Steering Redundancy for L3+ ADAS

Level 3 and above automated driving creates fail-operational steering requirements under ISO 26262, stipulating ASIL-D integrity for steering control. EHPS architecture, with its dual electric motor and hydraulic assist paths, delivers the redundancy and fault tolerance needed to maintain steerability during power interruptions or actuator faults. Recent production launches such as the steer-by-wire solution in NIO's ET9 highlight how EHPS modules pair with electronic actuation to achieve variable steering ratios and emergency intervention. Suppliers, therefore, align R&D toward diagnostics, sensor fusion, and fallback strategies that satisfy functional safety audits

Supply Chain Volatility of Rare-Earth Permanent Magnet Motors

Neodymium, dysprosium, and terbium supply remains concentrated in small mines, with China accounting for more than 60% of refined output. Export licensing changes in 2024 raised spot prices and strained inventory, prompting automakers to review magnet-free synchronous reluctance motors and to dual-source pump assemblies. Steering suppliers are lengthening safety stocks and entering direct offtake agreements with miners to stabilize lead times.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Electrification of Light Commercial Vehicles

- Integration of Steer-By-Wire Modules With EHPS Pumps

- Up-Front Cost Premium vs Conventional HPS

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars commanded 64.31% of the electric hydraulic power steering market in 2024 on the strength of widespread adoption across compact, mid-size, and luxury platforms. Carmakers integrate EHPS to unlock stop-start compatibility, mild hybrid gains, and growing ADAS content. Electric hydraulic power steering market size for light commercial vehicles is projected to expand at a 7.27% CAGR because parcel fleets favor energy savings during urban duty cycles.

The passenger car share reflects efficient scale, model refresh cadence, and high configuration volumes that absorb the added cost of electronic pumps. Commercial vehicle programs show faster unit growth as final mile delivery regulations tighten in China, Europe, and several United States states. Heavy trucks and buses trail but represent future upside once battery pack economics and high voltage steering actuation converge.

Steering motors held 36.53% electric hydraulic power steering market share in 2024. Their high material value and critical performance role anchor the component mix. Sensors and torque modules will record a 7.73% CAGR through 2030, driven by ISO 26262 redundancy targets that double the number of position and torque sensing channels per system.

Permanent magnet brushless motors remain the industry standard because they deliver high power density and rapid response. Suppliers are investing in ferrite-based or reluctance designs to sidestep rare-earth exposure. Control ECUs migrate toward higher bandwidth microcontrollers as steer-by-wire software layers expand, while sealed pump housings incorporate integrated cooling jackets to extend duty cycles.

The Automotive Electro-Hydraulic Power Steering Market is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Component Type (Steering Motors, Hydraulic Pumps, and More ), Propulsion ( Internal Combustion Engine, and More), Sales Channel (Original Equipment Manufacturer (OEM), Aftermarket), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific remains the clear demand center. The region accounted for 47.57% electric hydraulic power steering market share in 2024 and is projected to expand at an 8.75% CAGR through 2030, making it the largest and fastest-growing territory. China's battery-electric and plug-in hybrid production scale drives high pump volumes. India's FAME-II and PLI schemes channel local sourcing toward domestic steer-by-wire and pump facilities. Japan contributes high-reliability sensors and motor controls that meet ISO 26262 targets for export models. Regional suppliers benefit from government incentives that lower landed costs and shorten supply chains for OEM plants clustered in Shanghai, Guangzhou, Chennai, and Nagoya.

North America follows with steady expansion as emissions rules tighten. The EPA's Multi-Pollutant Standards and California's Advanced Clean Cars II program compel automakers to electrify auxiliaries, including steering, to meet fleet targets. Battery-electric delivery van adoption has doubled since 2024, pulling EHPS content into parcel and grocery fleets. Domestic automakers also hedge rare-earth risk by funding ferrite and reluctance motor research, which supports regional electric hydraulic power steering market size resilience against supply shocks. Canada's clean-transport credits mirror United States policy and reinforce cross-border production synergies.

Europe anchors premium vehicle innovation. German, Swedish, and French brands are rolling out steer-by-wire platforms that integrate EHPS pumps as safety-redundant actuators, and ZF began series production for a Chinese luxury marque in early 2025. The European Union target of a 55% fleet-wide CO2 cut by 2030 keeps pressure on suppliers to deliver efficiency gains at component level. As luxury and performance segments migrate to 800 V architectures, EHPS modules with smart energy-recovery algorithms complement brake-by-wire and active suspension systems. Eastern Europe and the Middle East provide emerging assembly bases, but infrastructure gaps and price sensitivity temper near-term penetration, positioning Asia-Pacific as the principal growth engine through the decade.

- JTEKT Corporation

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Nexteer Automotive Corporation

- Mando Corporation

- NSK Ltd.

- Continental AG

- Thyssenkrupp Presta AG

- Hitachi Astemo

- Showa Corporation

- Knorr-Bremse Commercial Vehicle Systems GmbH

- Shanghai OE Industrial Co., Ltd. (Brogen EV Solutions)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 OEM Demand For Steering Redundancy For L3+ ADAS

- 4.2.2 Growing EV Production and Higher Auxiliary-12 V Loads

- 4.2.3 Rapid Electrification Of Light Commercial Vehicles (Elcv)

- 4.2.4 Tightening CO2 / CAFE Regulations Pushing Steering Efficiency

- 4.2.5 Integration Of Steer-By-Wire Modules With EHPS Pumps

- 4.2.6 Local Sourcing Incentives In China and India (PLI, MIIT, FAME-II)

- 4.3 Market Restraints

- 4.3.1 Supply-Chain Volatility Of Rare-Earth PM Motors

- 4.3.2 Up-Front Cost Premium Vs. Conventional HPS

- 4.3.3 Reliability Concerns In High-Temperature Duty Cycles

- 4.3.4 Competition From Full-Electric Power Steering (EPS) In B-/C-Segment Cars

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Heavy Commercial Vehicles

- 5.1.4 Buses and Coaches

- 5.1.5 Off-highway and Specialty Vehicles

- 5.2 By Component Type

- 5.2.1 Steering Motors

- 5.2.2 Hydraulic Pumps

- 5.2.3 Sensors and Torque Modules

- 5.2.4 ECU / Controllers

- 5.2.5 Reservoirs, Hoses and Others

- 5.3 By Propulsion Type

- 5.3.1 Internal-Combustion Engine (ICE)

- 5.3.2 Hybrid Electric Vehicle (HEV)

- 5.3.3 Battery Electric Vehicle (BEV)

- 5.3.4 Plug-in Hybrid Electric Vehicles

- 5.3.5 Fuel-Cell Electric Vehicle (FCEV)

- 5.4 By Sales Channel

- 5.4.1 Original Equipment Manufacturer (OEM)

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Indonesia

- 5.5.4.6 Vietnam

- 5.5.4.7 Philippines

- 5.5.4.8 Australia

- 5.5.4.9 New Zealand

- 5.5.4.10 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 JTEKT Corporation

- 6.4.2 Robert Bosch GmbH

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 Nexteer Automotive Corporation

- 6.4.5 Mando Corporation

- 6.4.6 NSK Ltd.

- 6.4.7 Continental AG

- 6.4.8 Thyssenkrupp Presta AG

- 6.4.9 Hitachi Astemo

- 6.4.10 Showa Corporation

- 6.4.11 Knorr-Bremse Commercial Vehicle Systems GmbH

- 6.4.12 Shanghai OE Industrial Co., Ltd. (Brogen EV Solutions)