|

市场调查报告书

商品编码

1844546

义大利电力:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Italy Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

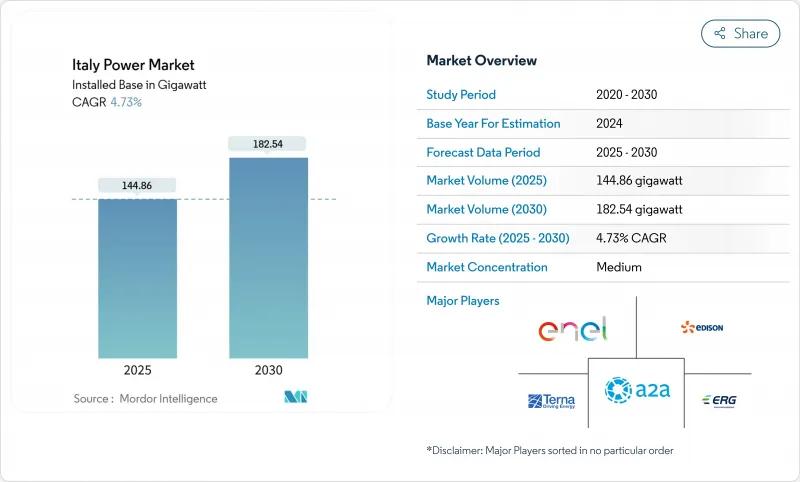

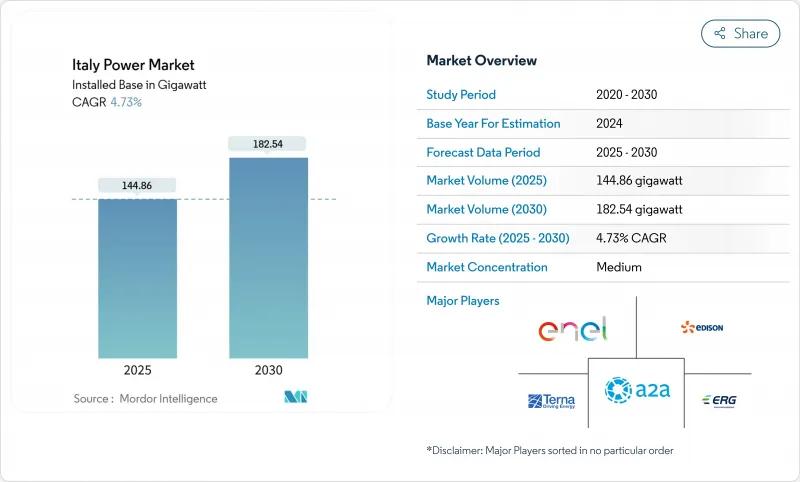

义大利电力市场规模预计将从 2025 年的 144.86 吉瓦扩大到 2030 年的 182.54 吉瓦,预测期内(2025-2030 年)的复合年增长率为 4.73%。

这项扩张得益于可再生能源的快速部署、到 2030 年 230 亿欧元的电网现代化支出,以及透过有意减少对俄罗斯天然气的依赖而实现的多元化。到 2024 年,可再生能源发电将满足该国 41.2% 的电力需求,这得益于太阳能光电发电成长 19.3% 和水力发电成长 30.4%。虽然天然气仍然是主要的可调度资源,但由于第 199/2021 号法令下的许可证简化和企业购电协议,太阳能光电发电装置正在加速发展。定于 2025 年 9 月举行的全网电池竞标会将在 2030 年前释放 9 吉瓦的电池储存容量,进一步支援间歇性再生能源。 2025 年 1 月的批发价格仍高达 143.03 欧元/兆瓦时,凸显了再生能源对于供应多样化和成本稳定的迫切性。

义大利电力市场趋势与洞察

根据199/2021号法令加速授权改革

第199/2021号法规的实施,透过许可证入口数位化和「适宜区域」的明确划分,将可再生能源计划的审批时间缩短了约三分之一。 2024年,太阳能发电容量限额提高,风电缓衝区缩小,申请数量增加。由于行政能力增强和认证安装商数量增加,北部地区的计划完成速度最快。 2024年8月颁布的FER2法令对改革进行了补充,引入了离岸风力发电双边差价合约,目标是到2028年达到4.6吉瓦。虽然仍有一个瓶颈,即超过30兆瓦计划的环境影响评估,但整体框架降低了投资者的门槛,并加速了义大利电力市场的转型。

电网规模电池容量市场竞标(Terna)

Terna 的 MACSE 机制是欧洲首个专用储能容量市场,旨在透过为期 15 年的计量型竞标,到 2030 年签订 9 吉瓦的储能容量合约。预计 2024 年电池安装量将达到 2.1 兆瓦,占新增电网连接的一半以上。 2025 年 9 月的首次竞标预计将授予 10 吉瓦时,吸引寻求收益确定性的国际开发商。义大利南部由于可再生弃风率高而提供了极佳的套利价差,而北部的工业区则需要储能来抑低尖峰负载和支持频率。竞标设计透过将容量、能源和配套服务收益,满足了义大利电力市场的需求,使储能成为加速可再生能源渗透的关键推动因素。

普利亚和Sicilia岛电网拥塞(延迟超过 36 个月)

超过348吉瓦的可再生能源计划正在等待併网,远超过现有系统的137.53吉瓦。普利亚大区和Sicilia的排队时间最长,开发商等待电网连接的时间超过36个月。这套颈源自于北向输电走廊的弱点以及新线路复杂的环境核准。 Terna公司165亿欧元的五年计画拨出大量资金用于缓解南部地区的电网拥堵,但建设前置作业时间仍然很长。专案延误导致资本成本上升,市场竞争力下降,太阳能和风电建设放缓,并限制了义大利电力市场的成长前景。

細項分析

到2024年,火力发电将占义大利电力市场容量的59%,提供灵活的基本负载和平衡服务。可再生约占发电量的41%,但由于组件价格下降和授权简化,其成长速度最快,到2030年复合年增长率将达5.32%。 2024年阴雨天气过后,水力发电占可再生能源发电量的贡献将恢復到35%,而受离岸风电显着增长的推动,风电占可再生能源发电量的比重将达到20%。煤炭发电量将降至总发电量的1.3%,并将在2025年逐步淘汰。

太阳能的成长主要由企业购电协议 (PPA) 和大型计划推动,但日益激烈的价格竞争已促使 Enel 调整其新建设,到 2027 年,太阳能光伏发电装置容量将达到 3.2 吉瓦,风电装置容量将达到 5.7 吉瓦。生质能和地热能提供基本负载可再生能源容量,随着煤炭淘汰和天然气成本上升,其价值日益凸显。随着储能和需量反应规模的扩大,可调度天然气在义大利电力市场的份额可能从 2028 年起下降,但在高压直流输电线路和电池消除间歇性影响之前,其作用仍将至关重要。

义大利电力市场报告按发电(火力发电和可再生)、终端用户(公共产业、商业/工业、住宅)以及输配电(仅定性分析)细分。市场规模和预测以装置容量(吉瓦)为单位。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 根据199/2021号法令加速许可改革

- 电网规模电池容量市场竞标(Terna)

- 2025年煤炭淘汰将造成产能缺口

- REPowerEU 资助的 HVDC计划(例如 Tyrrhenian Link)

- 奢侈品和快速消费品巨头的企业购电协议激增

- 超级奖金为屋顶太阳能奖励策略

- 市场限制

- 普利亚和Sicilia电网拥塞(延迟超过 36 个月)

- 离岸风力发电竞标失败(亚得里亚海地区)

- 天然气进口受地缘政治衝击(约90%)

- 风力发电厂景观许可诉讼

- 2024年义大利可再生能源结构

- 监理展望

- 技术展望(数位化、高压直流输电、储能)

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- PESTLE分析

第五章市场规模及成长预测

- 按来源分列的发电量

- 火力发电(天然气、石油、煤炭)

- 可再生能源(太阳能、风能、水力发电、地热等)

- 按最终用户

- 公共产业

- 住房

- 商业和工业

- 电力传输和分配(定性)

第六章 竞争态势

- 市场集中度

- 策略性倡议(併购、联盟、购电协议)

- 市场占有率分析(主要企业的市场排名/份额)

- 公司简介

- Enel SpA

- Terna SpA

- Edison SpA

- A2A SpA

- ERG SpA

- Acea SpA

- Sorgenia SpA

- Hera Group

- Eni Plenitude

- ENGIE SA(Italy)

- Renantis(Falck Renewables)

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy SA

- Prysmian Group

- Sonnedix Power Holdings Ltd

- SunPower Corporation

- RWE Renewables Italia

- Iberdrola Renovables Italia

- InterGen SpA

- PLT Energia SRL

第七章 市场机会与未来展望

The Italy Power Market size in terms of installed base is expected to grow from 144.86 gigawatt in 2025 to 182.54 gigawatt by 2030, at a CAGR of 4.73% during the forecast period (2025-2030).

The expansion is anchored in rapid renewable energy deployment, grid-modernization spending of EUR 23 billion through 2030, and deliberate diversification away from Russian gas. Renewable generation satisfied a record 41.2% of national electricity demand in 2024, led by a 19.3% surge in solar output and a 30.4% rebound in hydro generation. Natural gas remains the dominant dispatchable resource, but streamlined permitting under Legislative Decree 199/2021 and corporate power-purchase agreements are accelerating photovoltaic additions. Grid-scale battery auctions scheduled for September 2025 will unlock 9 GW of storage by 2030, further supporting intermittent renewables. Persistently high wholesale prices-143.03 EUR/MWh in January 2025-underscore the urgency of supply diversification and cost-stable renewables.

Italy Power Market Trends and Insights

Accelerated Permitting Reforms under Legislative Decree 199/2021

Implementation of Legislative Decree 199/2021 has trimmed authorization timelines for renewable projects by about one third, thanks to digitalized permitting portals and clearer zoning of "suitable areas". Photovoltaic capacity caps were raised and wind-farm buffer zones narrowed, boosting application volumes in 2024. Northern regions clear projects fastest because of higher administrative capacity and greater availability of certified installers. The August 2024 FER2 decree complemented the reform by introducing two-way contracts-for-difference for offshore wind, targeting 4.6 GW by 2028. Remaining bottlenecks revolve around environmental impact assessments for projects exceeding 30 MW, yet the overall framework is lowering investor barriers and accelerating the Italy power market transition.

Grid-scale Battery Capacity Market Auctions (Terna)

Terna's MACSE mechanism is Europe's first dedicated storage capacity market, aiming to contract 9 GW by 2030 through 15-year pay-as-bid auctions. Battery additions reached 2.1 GW in 2024, representing over half of new grid connections. The inaugural September 2025 auction will award 10 GWh, attracting international developers seeking revenue certainty. Southern Italy offers superior arbitrage spreads due to high renewable curtailment, whereas industrialized northern zones require storage for peak-shaving and frequency support. The auction design complements Italy's power market needs by monetizing capacity, energy, and ancillary services, enabling storage to act as the critical enabler for higher renewable penetration.

Grid Congestion in Apulia & Sicily (>=36-month Delays)

More than 348 GW of renewable projects await interconnection, dwarfing the current 137.53 GW system. Apulia and Sicily suffer the longest queues, with developers waiting over 36 months for grid access. The bottleneck stems from weak north-bound transmission corridors and complex environmental approvals for new lines. Terna's EUR 16.5 billion five-year plan allocates significant funding to relieve southern congestion, yet construction lead times remain protracted. Delays raise capital costs, erode PPA competitiveness, and slow solar and wind build-outs, constraining the Italy power market growth outlook.

Other drivers and restraints analyzed in the detailed report include:

- Coal Phase-out by 2025 Creating Capacity Gap

- REPowerEU-funded HVDC Projects (Tyrrhenian Link)

- Offshore Wind Tender Under-realisation (Adriatic)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermal power generation controlled 59% of Italy's power market size in 2024, supplying flexible baseload and balancing services. Renewable, while accounting for roughly 41% of generation, is expanding fastest at a 5.32% CAGR through 2030 under declining module prices and streamlined permitting. Hydroelectric contribution rebounded to 35% of renewable output after wetter 2024 conditions, and wind reached 20% of renewable capacity with significant offshore upside. Coal slipped to 1.3% of total production and will exit by 2025.

Solar's growth owes much to corporate PPAs and utility-scale projects, yet price cannibalization drives Enel to tilt its new-build mix toward 5.7 GW of wind versus 3.2 GW of solar by 2027. Biomass and geothermal provide baseload renewable capacity, which is increasingly valuable as coal retires and gas costs rise. The Italy power market share of dispatchable gas may decline beyond 2028 as storage and demand-response scale, but its role remains pivotal until HVDC links and batteries neutralize intermittency.

The Italy Power Market Report is Segmented by Power Generation From Source (Thermal and Renewable Power), End-Users (Utilities, Commercial and Industrial, and Residential), and Power Transmission and Distribution (Qualitative Analysis Only). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Enel SpA

- Terna SpA

- Edison SpA

- A2A SpA

- ERG SpA

- Acea SpA

- Sorgenia SpA

- Hera Group

- Eni Plenitude

- ENGIE SA (Italy)

- Renantis (Falck Renewables)

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy SA

- Prysmian Group

- Sonnedix Power Holdings Ltd

- SunPower Corporation

- RWE Renewables Italia

- Iberdrola Renovables Italia

- InterGen SpA

- PLT Energia SRL

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Permitting Reforms under Legislative Decree 199/2021

- 4.2.2 Grid-scale Battery Capacity Market Auctions (Terna)

- 4.2.3 Coal Phase-out by 2025 Creating Capacity Gap

- 4.2.4 REPowerEU-funded HVDC Projects (e.g., Tyrrhenian Link)

- 4.2.5 Corporate PPAs Surge among Luxury & FMCG Majors

- 4.2.6 Superbonus 110 % Stimulus for Rooftop PV

- 4.3 Market Restraints

- 4.3.1 Grid Congestion in Apulia & Sicily (>=36-month Delays)

- 4.3.2 Offshore Wind Tender Under-realisation (Adriatic)

- 4.3.3 Gas-Import Exposure to Geopolitical Shocks (~90 %)

- 4.3.4 Landscape-related Permit Litigation for Wind Farms

- 4.4 Italy Renewable Energy Mix, 2024

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook (Digitalisation, HVDC, Storage)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 Power Generation by Source

- 5.1.1 Thermal Power (Natural Gas, Oil, Coal)

- 5.1.2 Renewable Power (Solar, Wind, Hydro, Geothermal, etc)

- 5.2 By End-User

- 5.2.1 Utilities

- 5.2.2 Residential

- 5.2.3 Commercial and Industrial

- 5.3 Power Transmission & Distribution (Qualitative)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Enel SpA

- 6.4.2 Terna SpA

- 6.4.3 Edison SpA

- 6.4.4 A2A SpA

- 6.4.5 ERG SpA

- 6.4.6 Acea SpA

- 6.4.7 Sorgenia SpA

- 6.4.8 Hera Group

- 6.4.9 Eni Plenitude

- 6.4.10 ENGIE SA (Italy)

- 6.4.11 Renantis (Falck Renewables)

- 6.4.12 Vestas Wind Systems A/S

- 6.4.13 Siemens Gamesa Renewable Energy SA

- 6.4.14 Prysmian Group

- 6.4.15 Sonnedix Power Holdings Ltd

- 6.4.16 SunPower Corporation

- 6.4.17 RWE Renewables Italia

- 6.4.18 Iberdrola Renovables Italia

- 6.4.19 InterGen SpA

- 6.4.20 PLT Energia SRL

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment