|

市场调查报告书

商品编码

1844559

北美太阳能控制窗膜:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)North America Solar Control Window Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

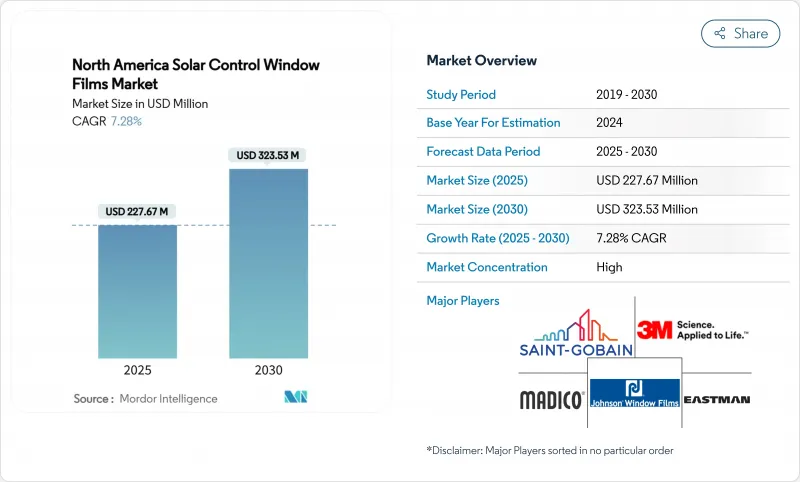

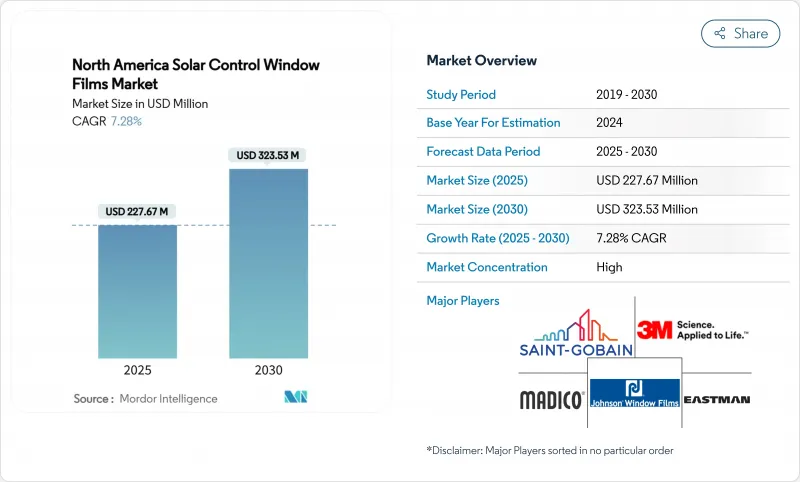

北美太阳能控制窗膜市场规模预计在 2025 年为 2.2767 亿美元,预计到 2030 年将达到 3.2353 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.28%。

推动成长的因素包括:更严格的建筑节能法规、联邦和州政府的税收优惠政策,以及汽车製造商为降低电动车空调负载而越来越多地使用太阳能控制膜。大众对紫外线照射风险的认识日益增强,尤其是在阳光地带,这为购买决策增添了健康保护的考量。企业在商业地产领域进行的ESG维修,透过升级现有建筑幕墙而非完全更换结构玻璃系统,显示出显着的营运成本节约。同时,USMCA框架下的动态供应链整合将使北美生产商能够有效地供应汽车和建筑市场,从而增强该地区的需求韧性。

北美太阳能控制窗膜市场趋势与洞察

严格的建筑节能标准和税收优惠

2024年《国际节能规范》将固定窗的允许空气洩漏限值从0.40立方英尺/平方英尺(约0.40立方英尺/分钟)降低至0.35立方英尺/平方英尺(约0.35立方英尺/分钟),促使建筑业主寻求高性能隔热膜等经济高效的维修解决方案。同时,《通货膨胀削减法案》允许房主在购买合格的隔热膜时申请30%的抵扣(最高600美元),商业地产可以利用第179D条抵扣来抵消安装成本。加州第24条和纽约市第97条地方法律强化了州一级的要求,制定了合规激励措施,优先考虑隔热膜维修,避免整个窗户更换週期。

汽车製造商越来越多地采用该技术来减少空调负荷

透过在层压过程中整合太阳热控制层,汽车製造商可将车内热增益降低约20%,从而延长电动车的续航里程。皮尔金顿的Galaxy 嵌装玻璃可阻挡65%的太阳热量和超过95%的紫外线,为工厂采用树立了标竿。 《美墨加协定》(USMCA)简化了跨国采购流程,墨西哥370亿美元的零件进口市场为当地玻璃贴膜製造商提供了规模。电动车的需求尤其强劲,因为空调负荷的降低会延长电池寿命,并降低与热劣化相关的保固成本。

智慧玻璃替代品的威胁

电致变色窗户透过动态光热控制,可实现17-23%的建筑节能,在优化的管理系统中优于静态薄膜。物联网整合可实现自动色调调节,并增加了传统薄膜所不具备的功能。生产规模效率正逐步缩小成本差距,智慧玻璃正逐渐成为商业预算的主流。儘管高昂的资本成本仍限制了其应用,但加速研发意味着未来十年高端建筑领域将面临竞争威胁。

細項分析

2024 年,真空镀膜反射膜以 46.18% 的份额占据北美太阳能控制窗膜市场首位,这要归功于溅镀沉淀的金属层,它可以在不影响可见光的情况下减少红外线增益。这些产品通常可实现低于 0.30 的太阳热增益係数,帮助商业大楼满足高冷却负荷气候下的能源法规。由于设施管理人员优先考虑营运节省而不是外部均匀性,因此需求依然强劲。然而,染色非反射产品正在迎头赶上,以较低的价格提供中性美感,到 2030 年,受郊区房主申请联邦税额扣抵的推动,其复合年增长率将达到 7.92%。透明非反射膜用于需要防紫外线同时适应日光的医院和学校。高性能混合薄膜虽然仍占据较小的市场份额,但其先进的陶瓷层为未来的产品开发指明了方向,这种陶瓷层在数十年的使用寿命内保持透明度和耐用性。

实验室的进展凸显了该领域的创新曲线。圣母大学报告了一种量子优化涂层,它可以将冷却能量减少三分之一,同时保持外部可见度,这表明薄膜效率有可能提升到一个新的水平。伊士曼等製造商正在将专有的红外线阻隔陶瓷涂层与压敏黏着剂结合,以进一步增强热反射。有机装饰膜在室内设计中仍然很重要,但面临预着色一体式Low-E低辐射镀膜玻璃的竞争。儘管如此,改造膜的吸引力——快速安装和对租户的干扰最小——帮助北美太阳能控制窗膜市场保持强劲,即使在技术先进但昂贵的智慧玻璃解决方案争夺未来规格的情况下。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 严格的建筑能源法规和税收优惠

- 汽车原始设备製造商越来越多地采用该技术来减少空调负荷

- 提高对紫外线照射和皮肤癌的认识

- ESG 为企业现有玻璃建筑幕墙改装

- 使用混合办公模式升级您的家庭办公室,以控制眩光

- 市场限制

- 智慧玻璃替代品的威胁

- IGU 的耐久性和变色问题

- Low-E镀膜嵌装玻璃日益普及

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按影片类型

- 透明(不反光)

- 染色(不反光)

- 真空镀膜(反射型)

- 高性能薄膜

- 其他电影类型

- 按吸收剂类型

- 有机的

- 无机/陶瓷

- 金属

- 按最终用户产业

- 建造

- 车

- 海洋

- 设计

- 其他最终用户产业

- 按地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- 3M

- Avery Dennison Corporation

- Decorative Films, LLC

- Eastman Chemical Company

- Garware Hi-Tech Films

- HUPER OPTIK USA

- Johnson Window Films, Inc.

- Madico

- Maxpro Window Films

- Polytronix, Inc.

- Purlfrost

- Saint-Gobain

- SOLAR CONTROL FILMS INC

- Thermolite, LLC

- XPEL

第七章 市场机会与未来展望

The North America Solar Control Window Films Market size is estimated at USD 227.67 million in 2025, and is expected to reach USD 323.53 million by 2030, at a CAGR of 7.28% during the forecast period (2025-2030).

Growth is supported by tighter building-energy codes, federal and state tax incentives, and expanded use of solar control films by original-equipment automotive manufacturers seeking to reduce air-conditioning loads in electric vehicles. Heightened public awareness of ultraviolet exposure risks, particularly in the Sun Belt, adds a health-protection dimension to purchasing decisions. Corporate ESG retrofits across commercial real estate demonstrate clear operating-expense savings by upgrading existing facades rather than replacing glazing systems outright. Meanwhile, dynamic supply-chain integration under USMCA allows North American producers to serve automotive and construction markets efficiently, reinforcing regional demand resilience.

North America Solar Control Window Films Market Trends and Insights

Stringent Building-Energy Codes & Tax Incentives

The 2024 International Energy Conservation Code lowered allowable air leakage for fixed fenestration from 0.40 cfm/ft2 to 0.35 cfm/ft2, pushing building owners toward cost-effective retrofit solutions such as high-performance films. Concurrently, the Inflation Reduction Act enables homeowners to claim a 30% credit-capped at USD 600-for qualified film purchases, while commercial properties leverage Section 179D deductions to offset installation costs. California Title 24 and New York City Local Law 97 strengthen state-level demand, creating compliance drivers that bypass full window replacement cycles in favor of film retrofits.

Rising OEM Adoption in Automotive to Cut A/C Load

Automakers integrate solar control layers during lamination, lowering cabin heat gain by roughly 20% and extending electric-vehicle range. Pilkington's Galaxsee glazing blocks 65% of solar heat and more than 95% of UV radiation, setting baseline specifications for factory adoption. USMCA simplifies cross-border sourcing, and Mexico's USD 37 billion component-import market provides scale for regional glass and film producers. Demand is particularly strong in electric vehicles, where every reduction in A/C load extends battery range and reduces warranty costs related to thermal degradation.

Smart-Glass Substitution Threat

Electrochromic windows achieve 17-23% building-energy savings through dynamic light and heat control, outperforming static films in optimized management systems. Integration with IoT enables automated tint adjustment, adding functionality beyond the reach of conventional films. Manufacturing scale efficiencies are gradually narrowing cost gaps, bringing smart glass into mainstream commercial budgets. Although high capital costs still limit penetration, accelerating R&D suggests a competitive threat in premium construction segments over the next decade.

Other drivers and restraints analyzed in the detailed report include:

- Heightened UV-Exposure & Skin-Cancer Awareness

- Corporate ESG Retrofits of Existing Glass Facades

- Durability & Discoloration Issues on IGUs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vacuum-coated reflective films led the North America Solar Control Window Films market with a 46.18% share in 2024, thanks to sputter-deposited metallic layers that cut infrared gain without compromising visible light. These products routinely deliver Solar Heat Gain Coefficient values below 0.30, helping commercial towers meet energy codes in climate zones with high cooling loads. Demand is sustained by facility managers prioritizing operating-expense savings over exterior uniformity concerns. Dyed non-reflective products, however, are catching up by offering neutral aesthetics at lower price points and enjoying a 7.92% CAGR through 2030, propelled by suburban homeowners claiming federal tax credits. Clear non-reflective variants serve hospitals and schools that require daylighting compliance while still blocking ultraviolet exposure. High-performance hybrid films occupy a smaller revenue niche but showcase the direction of future product development through advanced ceramic layering that maintains clarity and durability over multidecade lifetimes.

Laboratory advances highlight the segment's innovation curve. The University of Notre Dame reported quantum-optimized coatings capable of reducing cooling energy by one-third while preserving outward views, signaling potential step-change improvements in film efficacy. Manufacturers such as Eastman deploy proprietary infrared-blocking ceramic coatings combined with pressure-sensitive adhesives to raise the thermal rejection bar further. Organic-based decorative films retain relevance in interior design, yet face mounting competition from integrated low-E glass that arrives pre-tinted from the factory. Still, the retrofit appeal of films-quick installation and minimal tenant disruption-keeps the North America Solar Control Window Films market firmly in play, even as technically superior yet costlier smart glass solutions vie for future specification.

The North America Solar Control Window Films Market Report is Segmented by Film Type (Clear, Dyed, Vacuum-Coated, High Performance Films, Other Film Types), Absorber Type (Organic, Inorganic/Ceramic, Metallic), End-User Industry (Construction, Automotive, Marine, Design, Other End-User Industry), and Geography (United States, Canada, Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- 3M

- Avery Dennison Corporation

- Decorative Films, LLC

- Eastman Chemical Company

- Garware Hi-Tech Films

- HUPER OPTIK USA

- Johnson Window Films, Inc.

- Madico

- Maxpro Window Films

- Polytronix, Inc.

- Purlfrost

- Saint-Gobain

- SOLAR CONTROL FILMS INC

- Thermolite, LLC

- XPEL

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent building-energy codes and tax incentives

- 4.2.2 Rising OEM adoption in automotive to cut A/C load

- 4.2.3 Heightened UV-exposure and skin-cancer awareness

- 4.2.4 Corporate ESG retrofits of existing glass facades

- 4.2.5 Hybrid-work home-office upgrades for glare control

- 4.3 Market Restraints

- 4.3.1 Smart-glass substitution threat

- 4.3.2 Durability and discoloration issues on IGUs

- 4.3.3 Growing prevalence of low-E coated glazing

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Film Type

- 5.1.1 Clear (Non-reflective)

- 5.1.2 Dyed (Non-reflective)

- 5.1.3 Vacuum-Coated (Reflective)

- 5.1.4 High Performance Films

- 5.1.5 Other Film Types

- 5.2 By Absorber Type

- 5.2.1 Organic

- 5.2.2 Inorganic/Ceramic

- 5.2.3 Metallic

- 5.3 By End-user Industry

- 5.3.1 Construction

- 5.3.2 Automotive

- 5.3.3 Marine

- 5.3.4 Design

- 5.3.5 Other End-user Industry

- 5.4 By Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Avery Dennison Corporation

- 6.4.3 Decorative Films, LLC

- 6.4.4 Eastman Chemical Company

- 6.4.5 Garware Hi-Tech Films

- 6.4.6 HUPER OPTIK USA

- 6.4.7 Johnson Window Films, Inc.

- 6.4.8 Madico

- 6.4.9 Maxpro Window Films

- 6.4.10 Polytronix, Inc.

- 6.4.11 Purlfrost

- 6.4.12 Saint-Gobain

- 6.4.13 SOLAR CONTROL FILMS INC

- 6.4.14 Thermolite, LLC

- 6.4.15 XPEL

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment