|

市场调查报告书

商品编码

1844603

PMMA 微球:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)PMMA Microspheres - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

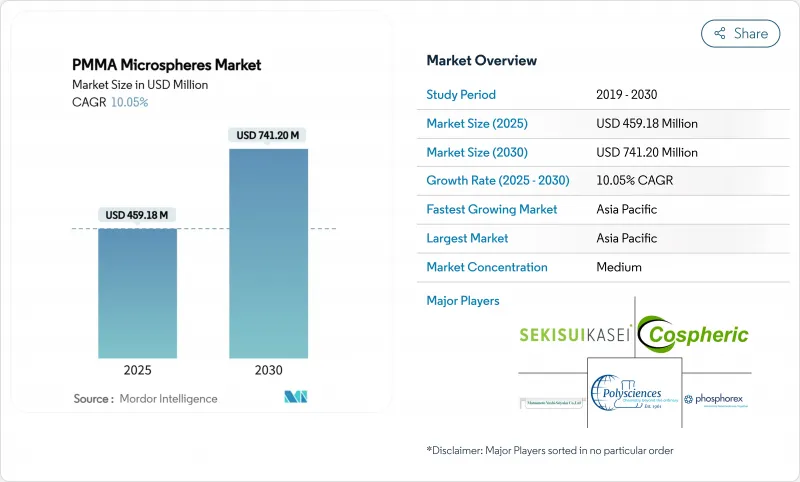

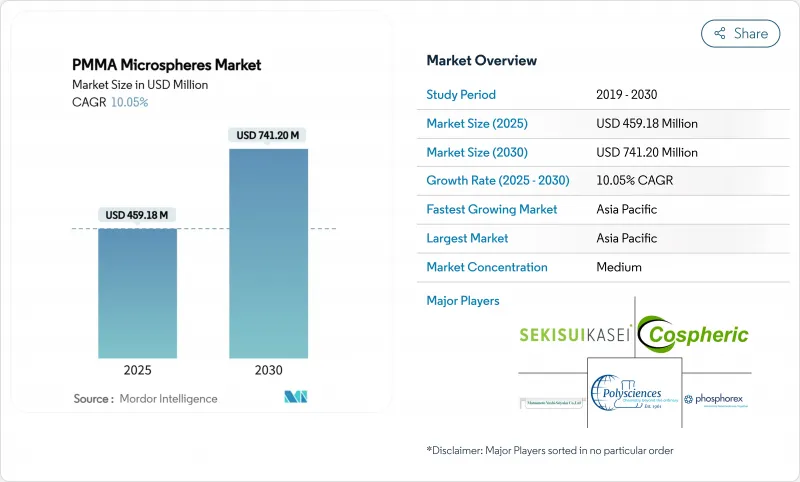

PMMA 微球市场规模预计在 2025 年为 4.5918 亿美元,预计到 2030 年将达到 7.412 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.05%。

这一积极的成长轨迹反映出其在美容医学、药物传输、先进光学和高性能涂料等众多领域的应用日益广泛。永久性皮肤填充剂需求的不断增长、节能LED/LCD生产的扩张以及向精准药物输送平台的转变,正在推动产量和销售的成长。生产商优先考虑单分散、表面改质等级的产品,这些产品在生命科学和电子应用领域具有溢价优势。商品微塑胶的监管压力非但没有抑制整体需求,反而永续创新转向永续或高价值领域,而主要MMA供应商的产能优化则支撑着更具挑战性但盈利的供应环境。

全球PMMA微球市场趋势与洞察

微创美容手术对 PMMA皮肤填充剂的需求不断增长

Bellafill 是唯一获得 FDA核准的含有 20% PMMA 微球的永久性注射剂,其皱纹矫正效果可持续长达 15 年。 4,725 例臀部整形手术报告的肉芽肿发生率仅为 0.011%,这为长期安全性提供了保障。 30-50 微米的微球透过促进胶原蛋白生长并抵抗吞噬作用,提供持久的组织支撑。大批量的身体塑形应用正在扩大 PMMA 微球市场,将患者群体拓展到脸部美容以外的领域。诊所重视降低復治频率,这为医疗级供应商带来了稳定的拉力。

扩大在药物传递和栓塞治疗的应用

PMMA微球的特异性蛋白质结合速率低于聚苯乙烯,从而提高了控制释放系统中的生物相容性。表面羧基官能基有利于药物结合,其1.19 g/cc的密度有利于离心操作。孔径为50 nm的单分散多孔颗粒的连续生产目前正支持肿瘤学领域的药物释放型珠。连续生产因其降低成本并提高批次一致性而日益受到商业性关注。

永久性皮肤填充剂安全性的监管审查

目前仅有一种基于PMMA的填充剂获得FDA批准,凸显了其严谨证据的必要性。不利事件与注射深度相关,而黏膜下注射会增加结节形成,因此需要强制进行从业人员训练。牛胶原蛋白载体必须进行皮肤测试,这会增加成本。新兴市场面临更严格的监管,这可能会延长核准时间,从而限制其广泛应用,儘管其临床耐久性更佳。

細項分析

到 2024 年,化妆品添加剂应用将占 PMMA 微球市场份额的 35.06%,这得益于其丝滑的质地、柔焦光学特性和活性剂的控释。高端护肤、彩妆品和防晒产品继续指定使用医用级、低残留 MMA 珠粒以满足安全审核。然而,欧盟的微塑胶法规正在将大容量大众市场乳液转向生物基填料,将 PMMA 需求转向免洗精华液和有针对性的抗衰老产品线。陶瓷致孔剂应用正以 11.80% 的复合年增长率加速成长。添加剂製造的氧化铝和氧化锆组件需要牺牲 PMMA 模板来形成均匀的孔隙网络,这对于抗热震性非常重要。预计显示薄膜中的光扩散器和工业涂料中的哑光添加剂将保持中等个位数增长,分别受到能源效率和低光泽饰面的推动。改质塑胶添加剂和涂料油墨添加剂领域透过提高衝击强度和流变控制,正在吸收稳定量的PMMA微球。

区域分析

到2024年,亚太地区将以39.12%的市占率引领PMMA微球市场,这主要得益于中国显示器面板製造商、日本精细化工专家和韩国消费电子品牌的推动。包括住友化学在新加坡的重组在内的产能整合,正在推动区域供应向特种级方向发展,同时到2030年,该地区的产量复合年增长率将达到10.64%。政府对半导体和医疗设备供应链的激励措施将进一步刺激下游消费。

北美受益于严格的FDA标准,有利于根据ISO-13485标准在国内生产注射填充剂微球和诊断产品。 Bellafill的特许经营权支撑着稳定的医疗需求,而总部位于威斯康辛州的Nouryon则扩大了用于包装和建筑添加剂的特种微球的生产。药物输送新兴企业受惠于研发税额扣抵和创业投资,即使在商品生产转移到海外的情况下,也能维持创新主导的消费。

儘管欧洲面临最严格的聚合物颗粒法规,但德国和荷兰的先进製造地仍为高利润涂料、汽车光学元件和植入式医疗设备供应PMMA微球。生产商正在投资生物基或化学回收原料,这符合欧盟的循环经济目标,并维持温和但盈利的成长。南美洲、中东和非洲是新兴的机会区,但进口依赖和监管不一致阻碍了这些地区的快速扩张,而医疗基础设施和基础设施涂料的激增将带来更高的需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 微创美容手术对 PMMA皮肤填充剂的需求不断增长

- 扩大在药物传递和栓塞治疗的应用

- 用作 LED/LCD 和涂料中的光扩散剂和消光剂

- 扩大在个人护理配方中的应用,以增强质感

- 需要 PMMA 校准珠的微流体诊断设备

- 市场限制

- 永久性真皮填充剂安全性的监管

- MMA单体价格波动影响生产成本

- 全球单分散、高精度等级的生产能力有限

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按用途

- 光扩散剂

- 消光剂

- 化妆品添加物

- 陶瓷多孔器

- 改性塑胶添加剂

- 涂料油墨添加剂

- 其他用途

- 按最终用户产业

- 生命科学与医学

- 个人护理和化妆品

- 电子产品

- 油漆和涂料

- 塑胶

- 陶瓷和复合材料

- 其他最终用户产业

- 按粒径

- 0-30µm

- 30-100µm

- 100μm以上

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Bangs Laboratories, Inc.

- CD Bioparticles

- Cospheric LLC

- EPRUI Biotech Co.,Ltd.

- Goodfellow Cambridge Ltd.

- Heyo Enterprises Co., Ltd.

- Kayaku AM.

- Matsumoto Yushi-Seiyaku Co.,Ltd

- microParticles GmbH

- Phosphorex

- Polysciences

- Sekisui Kasei Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Sunjin Beauty Science

第七章 市场机会与未来展望

The PMMA Microspheres Market size is estimated at USD 459.18 million in 2025, and is expected to reach USD 741.20 million by 2030, at a CAGR of 10.05% during the forecast period (2025-2030).

This strong trajectory reflects broadening adoption across aesthetic medicine, drug-delivery, advanced optics, and high-performance coatings. Growing demand for permanent dermal fillers, expansion of energy-efficient LED/LCD production, and the shift toward precision drug-delivery platforms are elevating volume and value growth. Producers are prioritizing monodisperse, surface-modified grades that command price premiums in life-science and electronics applications. Regulatory pressure on commodity microplastics is steering innovation toward sustainable or high-value niches rather than suppressing overall demand, while capacity optimization by large MMA suppliers is underpinning a tighter but more profitable supply environment.

Global PMMA Microspheres Market Trends and Insights

Growing Demand for PMMA Dermal Fillers in Minimally-Invasive Aesthetics

Bellafill, the only FDA-approved permanent injectable containing 20% PMMA microspheres, delivers wrinkle correction that persists for up to 15 years. A low 0.011% granuloma incidence reported across 4,725 gluteal-augmentation procedures underscores long-term safety. Microspheres in the 30-50 µm range resist phagocytosis yet foster collagen ingrowth, providing durable tissue support. Large-volume body-contouring usage is expanding the PMMA microspheres market by broadening the patient base beyond facial aesthetics. Clinics value reduced retreatment frequency, creating steady pull-through for medical-grade suppliers.

Expanding Use in Drug-Delivery & Embolization Therapies

PMMA microspheres offer lower nonspecific protein binding than polystyrene, improving biocompatibility in controlled-release systems. Surface carboxyl functionality enhances drug conjugation, while the density of 1.19 g/cc eases centrifugation handling. Continuous production of monodisperse porous particles with 50 nm pores now supports oncology drug-eluting beads. Commercial interest is rising as continuous manufacturing cuts costs and tightens batch consistency.

Regulatory Scrutiny Over Permanent Dermal-Filler Safety

Only one PMMA-based filler has FDA clearance, underscoring rigorous evidence requirements. Adverse events correlate with injection depth; submucosal placement increases nodule formation, prompting practitioner training mandates. Mandatory skin tests for bovine collagen carriers add cost. Emerging markets are tightening regulations, potentially lengthening approval timelines, and limiting broad uptake despite clinical durability advantages.

Other drivers and restraints analyzed in the detailed report include:

- Rising Utilisation in Personal-Care Formulations for Texture Enhancement

- Microfluidic Diagnostic Devices Requiring PMMA Calibration Beads

- MMA Monomer Price Volatility Impacting Production Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cosmetic Additive applications held 35.06% of PMMA microspheres market share in 2024, valued for imparting silky texture, soft-focus optics, and controlled release of actives. Premium skincare, color cosmetics, and suncare continue to specify medical-grade, low-residual MMA beads to satisfy safety audits. EU microplastic rules, however, are shifting large-volume mass-market lotions toward bio-based fillers, redirecting PMMA demand into leave-on serums and targeted anti-aging lines. Ceramic Porogen uses are accelerating at an 11.80% CAGR, as additive-manufactured alumina and zirconia components require sacrificial PMMA templates to engineer uniform pore networks critical for thermal-shock resistance. Light-diffusing agents in display films and matting additives in industrial coatings sustain mid-single-digit growth by delivering energy efficiency and low-gloss finishes, respectively. Modified Plastic Additive and Paints & Inks Additive segments absorb steady volumes where PMMA microspheres improve impact strength and rheology control.

The PMMA Microspheres Market Report is Segmented by Application (Light Diffusing Agent, Matting Agent, Cosmetic Additive, and More), End-User Industry (Lifesciences & Medical, Personal Care & Cosmetics, Electronics, and More), Particle Size (0-30 Mm, 30-100 Mm, Greater Than 100 Mm), and Geography (Asia-Pacific, North America, Europe, South America, Middle East & Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 39.12% of PMMA microspheres market share in 2024. China's display-panel makers, Japanese fine-chemicals specialists, and South Korean consumer-electronics brands provide a robust demand backbone. Capacity consolidation, including Sumitomo Chemical's Singapore restructuring, nudges regional supply toward specialty grades yet maintains volume growth through 2030 at a 10.64% CAGR. Government incentives for semiconductor and medical-device supply chains further broaden downstream consumption.

North America benefits from stringent FDA standards, which favor domestic output of ISO-13485-compliant beads for injectable fillers and diagnostics. The Bellafill franchise anchors steady medical demand, while Wisconsin-based Nouryon has scaled specialty microsphere output for packaging and construction additives. R&D tax credits and venture capital funding in drug-delivery start-ups sustain innovation-driven consumption even as commodity volumes migrate offshore.

Europe faces the most restrictive polymer-micro-particle regulation, yet advanced-manufacturing bases in Germany and the Netherlands channel PMMA microspheres into high-margin coatings, automotive optics, and implantable medical devices. Producers are investing in bio-based or chemically recycled feedstocks that align with EU circular-economy goals, sustaining modest but profitable growth. South America and the Middle East & Africa remain emerging opportunity zones where growing healthcare infrastructure and infrastructure coatings uptake create incremental demand, though import dependence and regulatory variability temper rapid expansion.

- Bangs Laboratories, Inc.

- CD Bioparticles

- Cospheric LLC

- EPRUI Biotech Co.,Ltd.

- Goodfellow Cambridge Ltd.

- Heyo Enterprises Co., Ltd.

- Kayaku AM.

- Matsumoto Yushi-Seiyaku Co.,Ltd

- microParticles GmbH

- Phosphorex

- Polysciences

- Sekisui Kasei Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Sunjin Beauty Science

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for PMMA dermal fillers in minimally-invasive aesthetics

- 4.2.2 Expanding use in drug-delivery and embolization therapies

- 4.2.3 Adoption as light-diffusing and matting agents in LED/LCD, coatings

- 4.2.4 Rising utilisation in personal-care formulations for texture enhancement

- 4.2.5 Microfluidic diagnostic devices requiring PMMA calibration beads

- 4.3 Market Restraints

- 4.3.1 Regulatory scrutiny over permanent dermal-filler safety

- 4.3.2 MMA monomer price volatility impacting production costs

- 4.3.3 Limited global capacity for monodisperse high-precision grades

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Light Diffusing Agent

- 5.1.2 Matting Agent

- 5.1.3 Cosmetic Additive

- 5.1.4 Ceramic Porogen

- 5.1.5 Modified Plastic Additive

- 5.1.6 Paints and Inks Additive

- 5.1.7 Other Applications

- 5.2 By End-user Industry

- 5.2.1 Lifesciences and Medical

- 5.2.2 Personal Care and Cosmetics

- 5.2.3 Electronics

- 5.2.4 Paints and Coatings

- 5.2.5 Plastics

- 5.2.6 Ceramics and Composites

- 5.2.7 Other End-user Industries

- 5.3 By Particle Size

- 5.3.1 0 - 30 µm

- 5.3.2 30 - 100 µm

- 5.3.3 Greater than 100 µm

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bangs Laboratories, Inc.

- 6.4.2 CD Bioparticles

- 6.4.3 Cospheric LLC

- 6.4.4 EPRUI Biotech Co.,Ltd.

- 6.4.5 Goodfellow Cambridge Ltd.

- 6.4.6 Heyo Enterprises Co., Ltd.

- 6.4.7 Kayaku AM.

- 6.4.8 Matsumoto Yushi-Seiyaku Co.,Ltd

- 6.4.9 microParticles GmbH

- 6.4.10 Phosphorex

- 6.4.11 Polysciences

- 6.4.12 Sekisui Kasei Co., Ltd.

- 6.4.13 Sumitomo Chemical Co., Ltd.

- 6.4.14 Sunjin Beauty Science

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment