|

市场调查报告书

商品编码

1844703

聚合物微球:市场份额分析、产业趋势、统计和成长预测(2025-2030)Polymer Microspheres - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

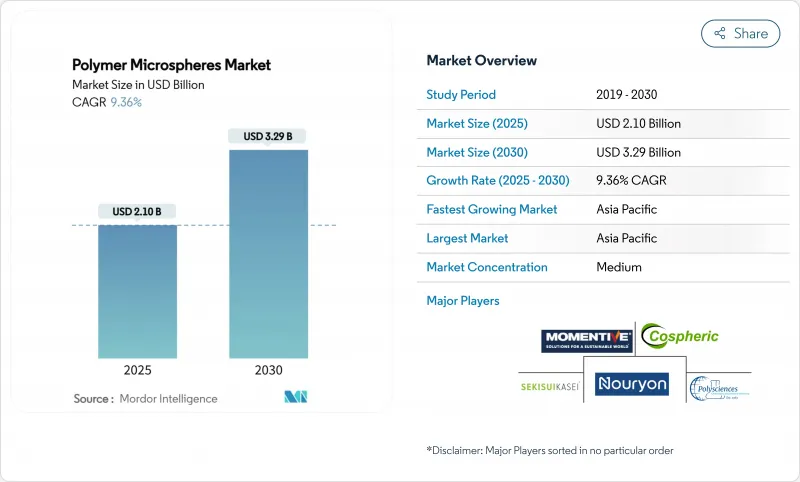

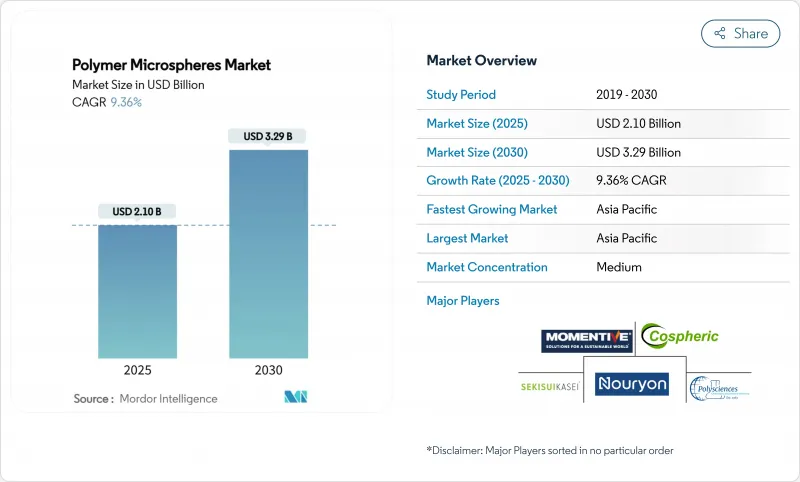

预计 2025 年聚合物微球市场规模为 21 亿美元,到 2030 年将达到 32.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.36%。

随着医药开发商寻求精准输送系统、汽车製造商加大轻量化力度以及增材製造商采用球形材料製造复杂部件,药物输送需求不断增长。采用聚乳酸-乙醇酸共聚物 (PLGA) 和其他可生物降解载体的药物製剂价格较高,足以抵消不断上涨的製造成本。汽车製造商正在使用中空和可膨胀等级的材料来降低零件密度,并支援减排和电气化目标。电子组装指定使用导热等级的材料用于先进封装,3D 列印服务机构则采购窄切粉末以实现稳定沉积。在供应方面,生物基创新正在重新定位老牌製造商,而苯乙烯和丙烯价格的波动正在挤压那些缺乏上游整合的公司的净利率。

全球聚合物微球市场趋势与洞察

标靶药物传递和控制释放药物的应用日益广泛

PLGA 和其他可生物降解载体能够实现精准的释放曲线,这促使药品製造商从传统片剂转向注射和植入式微球系统。封装生技药品的能力提高了稳定性,减少了低温运输损失,并增强了治疗效果。微流体製造如今实现了较窄的粒径分布,克服了历史上批次差异的影响。美国食品药物管理局)已批准超过 15 种基于 PLGA 的产品,开创了明确的监管先例。在个人化医疗计画中,可调节的释放动力学可根据个别药物动力学曲线进行个人化给药。已经拥有无菌微球产能的製药公司累积了较高的转换成本,并增强了其竞争地位。

汽车和运输部件对轻质填料的需求

欧洲监管机构要求减轻车辆整体重量以满足二氧化碳强度目标,鼓励在内饰、保险桿横樑和引擎盖下部件中使用中空球聚合物。在不影响机械刚度的情况下,密度可降低25%,进而延长电动车的续航里程。微球带来的低压成型缩短了循环时间,提高了工厂的生产效率。与复合材料製造商合作开发不同等级产品的供应商签订了多年的采购协议。随着纯电动车在产量中所占比例不断增长,白车身每减轻一公斤重量,都能为目标商标产品製造商带来实际的成本和续航里程效益。

化妆品和盥洗用品中微塑胶的监管

欧盟法规将冲洗类化妆品中的微塑胶含量限制在0.01%,这实际上禁止了洗面乳和牙膏中使用传统的聚苯乙烯球。全球品牌正在透过统一配方以符合单一合规标准,从而大幅削减一次性产品的销售。缺乏可生物降解替代品的供应商正经历收益的快速下降。新产品开发週期也将资源转移到监管测试上,从而推迟了相邻类别产品的上市。虽然可生物降解替代品的净利率更高,但这种短期转变对大量从事个人护理业务的公司构成了现金流挑战。

細項分析

2024年,膨体级产品将占总收入的52.76%,这得益于其在汽车和建筑复合材料领域的稳定应用。生物降解级产品虽然规模较小,但预计成长最快,复合年增长率将达到11.18%,因为监管机构和药物开发商青睐PLGA和聚己内酯基质来实现药物的控释。亚太地区的製剂製造商传统上专注于生产轻质填料的膨体球,现在正将产能多元化,进军生物降解级产品,以对冲未来的需求。

製药公司正在签订长期供应协议,以确保后期临床项目的产能,从而稳定订单。相较之下,学名药面临日益激烈的价格竞争,而国内製造商(尤其是中国和印度的製造商)正在利用其低成本优势。因此,到2030年,聚合物微球市场的收益结构将向利润率更高的可生物降解领域倾斜。

聚合物微球市场报告按类型(可膨胀微球、可生物降解微球)、材料成分(聚苯乙烯 (PS)、聚甲基丙烯酸甲酯 (PMMA)、聚乙烯 (PE)、其他)、最终用户行业(生命科学和製药、化妆品和个人护理、油漆和涂料、其他)和地区(亚太地区、北美、欧洲、南美、中东和非洲细分市场)。

区域分析

到2024年,亚太地区将占全球市场价值的37.20%,这反映了其在製药製造、半导体组装和汽车生产方面的优势。该地区预计复合年增长率为10.75%,这得益于原材料成本优势以及电动汽车组装的扩张,这些生产线注重轻质填料。印度的成长将受到国内药品产量增加以及本土化妆品品牌采用相容且可降解的替代品的推动。出口导向供应商正在利用成熟的物流将产品运往北美和欧洲,从而巩固亚太地区作为聚合物微球市场主要生产中心的地位。

该地区预计的 10.75% 复合年增长率是由原材料成本优势和强调轻质填充材的电动汽车组装的扩张所驱动。在印度,成长是由国内药品产量的增加和当地化妆品品牌采用兼容和可降解的替代品所推动的。出口导向供应商正在利用现有的物流将产品运往北美和欧洲,从而加强亚太地区作为聚合物微球市场主要生产中心的地位。

受药物输送技术创新和包含轻量化目标的严格企业平均燃油经济性法规的推动,北美市场保持着强劲的消费。合约研究机构和目标商标产品製造商正在与微球供应商合作,开发符合特定性能标准的独特等级。在欧洲,REACH法规收紧了微塑胶法规,迫使配方师采用可生物降解的微球。这项法规的推动正在推动个人护理和涂料等领域产品的快速改进。随着产业多元化发展,南美和中东/非洲市场的渗透率正在适度增长,但当地产能有限,供应依赖进口。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 标靶药物传递和控制释放药物的应用日益广泛

- 汽车和运输部件对轻质填料的需求

- 微电子製造业蓬勃发展

- 利用聚合物微球生长3D列印原料

- 低碳建筑材料生物基可膨胀微球的出现

- 市场限制

- 限制化妆品和盥洗用品中微塑胶的使用

- 石化原物料价格波动及供应中断风险

- 超均匀可生物降解微球的製造规模挑战

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按类型

- 可膨胀微球

- 可生物降解微球

- 按材料成分

- 聚苯乙烯(PS)

- 聚甲基丙烯酸甲酯(PMMA)

- 聚乙烯(PE)

- 聚氨酯(PU)

- 可生物降解聚合物(PLGA、PCL等)

- 其他(尼龙、PVDF等)

- 按最终用户产业

- 生命科学与製药

- 化妆品和个人护理

- 油漆和涂料

- 电子产品

- 陶瓷与复合材料

- 塑胶

- 其他终端用户产业(如 3D 列印、农业)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度分析

- 策略性倡议(併购、合资、联盟)

- 市占率(%)/排名分析

- 公司简介

- Bangs Laboratories Inc.

- CD Bioparticles

- Cospheric LLC

- DiaSorin SpA

- Evonik Industries AG

- Matsumoto Yushi Seiyaku Co., Ltd.

- Merck KGaA

- Momentive

- Nouryon

- Phosphorex Inc.

- PolyMicrospheres

- Polysciences Inc.

- Sekisui Kasei Co., Ltd.

- Sphere Fluidics Ltd.

- Sunjin Chemical Co., Ltd.

- Thermo Fisher Scientific Inc.

第七章 市场机会与未来展望

The Polymer Microspheres Market size is estimated at USD 2.10 billion in 2025, and is expected to reach USD 3.29 billion by 2030, at a CAGR of 9.36% during the forecast period (2025-2030).

Demand accelerates as drug developers seek precision delivery systems, automotive producers intensify lightweighting programs, and additive-manufacturing firms adopt spherical feedstocks for complex parts. Pharmaceutical formulations that exploit poly-lactic-co-glycolic acid (PLGA) and other biodegradable carriers bring price premiums that offset higher production costs. Automakers use hollow and expandable grades to cut part density, which supports emissions and electrification targets. Electronics assemblers specify thermally conductive variants for advanced packaging, while 3-D printing service bureaus purchase narrow-cut powders that ensure consistent layer deposition. On the supply side, bio-based innovations reposition incumbent producers, yet volatile styrene and propylene prices compress margins for firms without upstream integration.

Global Polymer Microspheres Market Trends and Insights

Rising Adoption in Targeted Drug Delivery and Controlled-Release Pharmaceuticals

Precise release profiles achievable with PLGA and other biodegradable carriers have shifted formulators away from traditional tablets toward injectable or implantable microsphere systems. The capability to encapsulate biologics improves stability, which reduces cold-chain losses and enhances therapeutic outcomes. Microfluidic manufacturing now delivers narrow particle-size distributions that overcome historic batch variability. The United States Food and Drug Administration has cleared more than 15 PLGA-based products, providing clear regulatory precedents. Personalized-medicine programs exploit tunable release kinetics, enabling dosing designed around individual pharmacokinetic profiles. Pharmaceutical companies that already own sterile microsphere capacity build high switching costs that reinforce competitive moats.

Demand for Lightweight Fillers in Automotive and Transportation Components

Regulators in Europe require fleetwide weight reductions that support CO2 intensity targets, encouraging polymers that integrate hollow spheres into interior trim, bumper beams, and under-hood parts. Density can fall by 25% with no loss in mechanical stiffness, a gain that extends electric vehicle driving range. Lower-pressure molding made possible by microspheres also trims cycle times, which improves plant productivity. Suppliers that co-develop grades with compounders lock in multiyear sourcing agreements. As battery-electric models account for a larger share of production, every kilogram removed from the body in white delivers tangible cost and range advantages for original equipment manufacturers.

Restrictions on Micro-Plastics in Cosmetics and Toiletries

European Union regulation limits microplastic content in rinse-off cosmetics to 0.01%, effectively banning conventional polystyrene spheres in facial scrubs and toothpastes. Global brands harmonize formulations to a single compliant standard, which removes a significant volume outlet for disposable grades. Suppliers that lack biodegradable alternatives see immediate revenue declines. New product development cycles also divert resources toward regulatory testing, slowing launches in adjacent categories. While bio-degradable replacements offer higher margins, the short-term shift challenges cash flows for firms heavily exposed to personal care.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Micro-Electronics Manufacturing

- Growth of 3-D Printing Feedstocks Using Polymer Microspheres

- Production-Scale Challenges in Ultra-Uniform Biodegradable Microspheres

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Expandable grades captured 52.76% of 2024 revenue, underpinned by steady use in automotive and construction composites, where controlled expansion lowers density without sacrificing strength. Biodegradable grades, while smaller, are forecast to grow fastest at 11.18% CAGR as regulators and drug developers favor PLGA and polycaprolactone matrices for controlled drug release. Asia-Pacific formulators historically focused on expandable spheres for lightweight fillers, now diversifying into bio-degradable capacity to hedge future demand.

Pharmaceutical contractors lock in long-term supply agreements that secure capacity for late-stage clinical programs, stabilizing order books. By contrast, generic expandable products face intensifying price competition, especially from domestic producers in China and India that leverage low-cost bases. As a result, revenue mix across the polymer microspheres market tilts toward higher-margin biodegradable segments through 2030.

The Polymer Microspheres Market Report is Segmented by Type (Expandable Microspheres, and Biodegradable Microspheres), Material Composition (Polystyrene (PS), Polymethyl-Methacrylate (PMMA), Polyethylene (PE), and More), End-User Industry (Life Sciences and Pharmaceuticals, Cosmetics and Personal Care, Paints and Coatings, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific holds a 37.20% share of the 2024 global value, reflecting its dominance in pharmaceutical manufacturing, semiconductor assembly, and automotive production. The region's 10.75% forecast CAGR stems from cost advantages in feedstocks and expanding electric-vehicle assembly lines that value lightweight fillers. India amplifies growth as domestic pharmaceutical output rises, and local cosmetics brands adopt compliant, degradable alternatives. Export-oriented suppliers leverage established logistics to ship to North America and Europe, reinforcing Asia-Pacific's role as the primary production hub for the polymer microspheres market.

The region's 10.75% forecast CAGR stems from cost advantages in feedstocks and expanding electric-vehicle assembly lines that value lightweight fillers. India amplifies growth as domestic pharmaceutical output rises, and local cosmetics brands adopt compliant, degradable alternatives. Export-oriented suppliers leverage established logistics to ship to North America and Europe, reinforcing Asia-Pacific's role as the primary production hub for the polymer microspheres market.

North America maintains strong consumption through innovation in drug delivery and stringent corporate average fuel economy regulations that embed lightweighting targets. Contract research organizations and original equipment manufacturers collaborate with microsphere suppliers on proprietary grades that meet unique performance criteria. Europe enforces micro-plastic restrictions under REACH, compelling formulators to adopt biodegradable spheres. This legislative push drives rapid product reformulation across personal care and paints. South America and the Middle-East, and Africa experience moderate uptake as industrial diversification advances, but supply relies on imports due to limited local production capacity.

- Bangs Laboratories Inc.

- CD Bioparticles

- Cospheric LLC

- DiaSorin S.p.A

- Evonik Industries AG

- Matsumoto Yushi Seiyaku Co., Ltd.

- Merck KGaA

- Momentive

- Nouryon

- Phosphorex Inc.

- PolyMicrospheres

- Polysciences Inc.

- Sekisui Kasei Co., Ltd.

- Sphere Fluidics Ltd.

- Sunjin Chemical Co., Ltd.

- Thermo Fisher Scientific Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption in Targeted Drug Delivery and Controlled-Release Pharmaceuticals

- 4.2.2 Demand for Lightweight Fillers in Automotive and Transportation Components

- 4.2.3 Surge in Micro-Electronics Manufacturing

- 4.2.4 Growth of 3-D Printing Feedstocks Using Polymer Microspheres

- 4.2.5 Emergence of Bio-Based Expandable Microspheres for Low-Carbon Building Materials

- 4.3 Market Restraints

- 4.3.1 Restrictions on Micro-Plastics in Cosmetics and Toiletries

- 4.3.2 Volatile Petrochemical Feedstock Prices and Supply Disruption Risk

- 4.3.3 Production-Scale Challenges in Ultra-Uniform Biodegradable Microspheres

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Expandable Microspheres

- 5.1.2 Biodegradable Microspheres

- 5.2 By Material Composition

- 5.2.1 Polystyrene (PS)

- 5.2.2 Polymethyl-methacrylate (PMMA)

- 5.2.3 Polyethylene (PE)

- 5.2.4 Polyurethane (PU)

- 5.2.5 Biodegradable Polymers (PLGA, PCL, etc.)

- 5.2.6 Others (Nylon, PVDF, etc.)

- 5.3 By End-User Industry

- 5.3.1 Life Sciences and Pharmaceuticals

- 5.3.2 Cosmetics and Personal Care

- 5.3.3 Paints and Coatings

- 5.3.4 Electronics

- 5.3.5 Ceramics and Composites

- 5.3.6 Plastics

- 5.3.7 Other End-User Industries (3-D Printing, Agriculture, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves (Mergers and Acquisitions, JVs, Collaborations)

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bangs Laboratories Inc.

- 6.4.2 CD Bioparticles

- 6.4.3 Cospheric LLC

- 6.4.4 DiaSorin S.p.A

- 6.4.5 Evonik Industries AG

- 6.4.6 Matsumoto Yushi Seiyaku Co., Ltd.

- 6.4.7 Merck KGaA

- 6.4.8 Momentive

- 6.4.9 Nouryon

- 6.4.10 Phosphorex Inc.

- 6.4.11 PolyMicrospheres

- 6.4.12 Polysciences Inc.

- 6.4.13 Sekisui Kasei Co., Ltd.

- 6.4.14 Sphere Fluidics Ltd.

- 6.4.15 Sunjin Chemical Co., Ltd.

- 6.4.16 Thermo Fisher Scientific Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment