|

市场调查报告书

商品编码

1844638

蛋品加工机械:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)Egg Processing Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

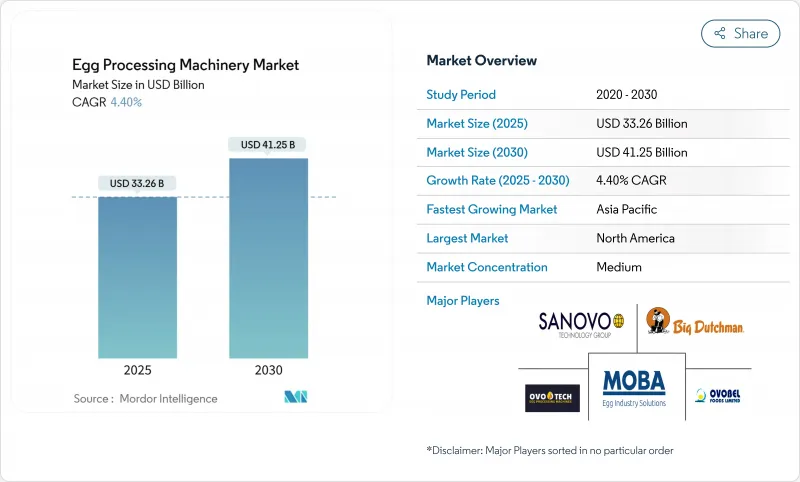

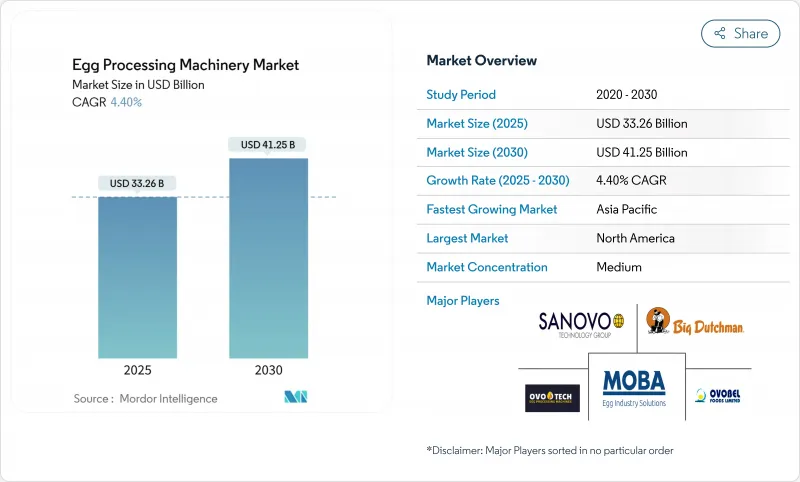

预计到 2025 年,鸡蛋加工机械市场规模将达到 332.6 亿美元,到 2030 年将达到 412.5 亿美元,复合年增长率为 4.40%。

这一增长是由自动化技术的进步、更严格的食品安全法规以及多样化的蛋白质消费模式所推动的。美国和欧洲的监管改革正在推动配备连续监控系统、强大的网路安全措施和基于人工智慧的安全功能的先进机械的采用,这也有助于缩短更换週期。在北美,加工商正在大力投资灵活的生产线,以应对高致病性禽流感爆发造成的供应链中断。与此同时,亚太地区的营运商正在迅速采用智慧技术,以满足由于人口增长和饮食偏好变化而激增的城市市场需求。竞争格局正在向整合的、解决方案导向的产品发展,这些产品将尖端硬体与进阶数据分析相结合。这些解决方案使加工商能够即时监控关键绩效指标,例如产量比率、能源效率和法规遵从性,从而提高营运效率、降低成本并确保符合食品安全标准。

全球蛋品加工机械市场趋势与洞察

加工和方便蛋製品的需求不断增长

随着消费者偏好转向即食、耐储存的蛋白质来源,对超越传统液态蛋应用的先进加工技术的需求持续成长。 Cal-Maine 于 2025 年以 2.58 亿美元收购 Echo Lake Foods,凸显了增值蛋製品的战略重要性。这一趋势正在加速加工设备的更换週期,因为製造商正在寻求能够生产创新产品的系统,例如蛋块、已烹调煎蛋捲和强化蛋白质的简便食品。这些产品需要精确的温度控制和强大的污染预防措施,因此先进的设备至关重要。均质机和喷雾干燥机产业尤其受益于这种转变,因为这些技术对于实现方便食品应用所需的改善质地和延长保质期至关重要。为了保持竞争力,设备製造商现在必须设计一个能够在一条生产线上容纳多种产品格式的系统。这项要求增加了生产系统的复杂性和资本密集度,并且与传统的单一产品设备相比设定了更高的标准。不断变化的市场动态凸显了加工技术创新和适应性的必要性,以满足对多样化、高品质方便食品日益增长的需求。

更加重视食品安全与卫生标准

日益严格的法规正从定期检查演变为持续监控,这对设备设计规范和通讯协定产生了重大影响。 FDA 更新的鸡蛋监管计划标准 (ERPS) 为州和联邦政府的合作建立了坚实的框架,从而提高了检查频率并要求更严格地报告数据。这种转变推动了采用内建监控系统、自动清洁技术和即时数据采集功能的先进设备,确保以最少的人工干预实现合规性。此外,美国开发的射频 (RF) 巴氏杀菌技术可在短短 24 分钟内将沙门氏菌减少 99.999%,比传统的 57 分钟流程快得多。能够无缝整合这些创新安全技术同时保持营运效率的供应商将享有竞争优势。在监管合规成本日益影响盈利的市场中,此类进步对于维持市场领先地位和满足不断发展的安全标准至关重要。

加工设备初始资本投入高

设备资金筹措的技术进步日益惠及大型加工企业,而小型业者则面临日益严峻的现代化挑战。这些挑战在资金筹措受限的新兴市场尤为突出。全自动鸡蛋加工生产线的全面安装需要超过1000万美元的巨额资本投资,凸显了中小企业面临的资金障碍。为了因应这些限制因素,印度政府已根据「食品加工生产挂钩奖励计画」为2025年拨款1.44亿美元,这表明需要政策主导的干预措施。融资缺口也为替代解决方案创造了机会,例如「设备即服务」模式和模组化系统,这些方案能够实现增量部署。然而,这些方法往往无法实现完全整合设施的营运效率。因此,资金有限的加工企业经常会推迟设备升级,使自身面临更大的不合规风险和竞争劣势。随着时间的推移,这些弱点可能会加剧,可能导致市场份额的损失和市场进一步分化。

細項分析

2024年,打蛋机占了29.97%的显着市场份额,巩固了其作为下游加工业务关键零件的地位。这一主导地位源于其在将带壳鸡蛋转化为液体形态方面的重要功能,这是进行增值加工之前的关键步骤。因此,打蛋机已成为该行业的基石。由于设备磨损和严格的卫生设计规范要求,该细分市场受益于稳定的更换需求。製造商为此开发了先进的打蛋系统,该系统整合了自动蛋壳分离和品质检测功能。这些创新不仅最大限度地降低了污染风险,还提高了产量比率效率并确保了性能的稳定性。在其他设备类别正在经历技术进步之际,打蛋机持续占据市场领先地位,凸显了该行业对机械加工解决方案的依赖。

预计到2030年,均质机的复合年增长率将达到6.49%,成为成长最快的机械类别。这一增长源于液态蛋应用中对产品一致性和延长保质期的需求日益增长。 MOBA的空化均质技术是该领域技术创新的一个显着例子,该技术可实现更温和的均质流程。与传统的高压系统相比,该技术透过延长巴氏杀菌机的运作并降低营运成本,显着提高了效率。该领域的快速成长反映了业界对均质机品质在决定最终产品性能方面起着关键作用的认识,尤其是在烘焙和食品服务应用中。现代均质机现在可以与巴氏杀菌系统无缝集成,以优化热处理,同时保持产品完整性。这种技术融合提高了整体加工效率,使均质机成为现代蛋品加工生产线的重要组成部分,而维持产品品质和营运效率是获得竞争优势的关键。

2024年,液态蛋将占46.45%的市场份额,预计到2030年将以7.15%的复合年增长率成长。这一成长凸显了液态蛋在食品服务、烘焙和工业应用中的多功能性,在这些领域,稳定的品质和便利的操作至关重要。该领域的优势在于它能够满足多种终端用户的需求,同时提高加工商的营运效率,包括与全蛋相比,简化了储存、运输和库存管理。工程水奈米结构(EWNS)等技术进步,可实现97.6%的大肠桿菌惰性率,用于蛋壳净化,进一步提高了安全性和质量,同时保留了液态蛋的天然保护性能。此外,先进的加工系统现已整合即时品质监控和自动污染检测功能,以确保产品规格的一致性。这个市场领导地位反映出食品业对标准化配料的日益青睐,因为标准化配料能够实现可预测且高效的製造流程。

液态蛋也正利用其加工优势拓展新的应用领域,例如方便食品、蛋白质补充剂和机能性食品配料。美国农业部 (USDA) 开发的高频灭菌技术只需 24 分钟即可将沙门氏菌杀灭 99.999%,而传统製程则需 57 分钟。这种安全性的提升和加工时间的缩短为液态蛋的应用开启了新的可能性。支援该领域的设备製造商正经历着持续的需求成长,但他们也面临越来越大的压力,需要开发能够适应特殊配方并满足长期储存要求的系统。液态蛋正处于强劲的成长轨道,持续的技术创新和新应用的多元化发展预计将推动市场持续扩张。

区域分析

截至 2024 年,北美将占据 31.23% 的市场份额,这得益于先进的食品加工基础设施和严格的法规结构,这些框架促进了设备的持续现代化。该地区受益于广泛的自动化和对方便食品的强烈偏好。然而,与新兴地区相比,市场的成熟度限制了其成长潜力。供应链中断创造机会的一个显着例子是美国决定在 2025 年从土耳其进口 4.2 亿枚鸡蛋,以解决高致病性禽流感疫情造成的供不应求。儘管美国是美国唯一从进口鸡蛋的国家。这种情况凸显了对能够处理来自不同来源、具有不同品质标准的鸡蛋的适应性加工系统日益增长的需求。

亚太地区是成长最快的地区,预计到2030年复合年增长率将达到7.49%。这一增长主要得益于快速的都市化、不断增长的蛋白质消费以及政府主导。印度食品加工产业在2000年4月至2024年3月期间吸引了125.8亿美元的外国直接投资,彰显了该地区的投资吸引力和成长潜力。该地区的扩张为能够调整技术以满足当地偏好、监管要求和成本效益需求的设备供应商创造了巨大的机会。

在严格的监管合规和永续性的推动下,欧洲继续展现稳定的需求。相较之下,南美、中东和非洲地区则展现出新的机会,儘管成长受到基础设施缺乏和资本有限的限制。这些地理差异反映了食品加工产业不同的经济发展阶段和成熟度。它们也为设备供应商提供了实施区域特定策略并提供针对当地市场需求的资金筹措解决方案的机会。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 加工鸡蛋和方便鸡蛋製品的需求不断增长

- 更加重视食品安全与卫生标准

- 采用自动化和智慧加工技术

- 富含蛋白质的饮食和机能性食品越来越受欢迎

- 蛋品加工机械的技术进步

- 引进农场模组化巴氏杀菌系统,用于无笼鸡蛋生产

- 市场限制

- 加工机械初始投资高

- 中小企业采用率有限

- 鸡蛋加工废弃物对环境的担忧

- 来自植物性鸡蛋替代品的竞争

- 供应链分析

- 监管状况

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 按机器类型

- 打蛋器

- 蛋液分离器

- 巴氏杀菌机

- 均质机

- 喷雾干燥机

- 离心机和过滤器

- 其他机器类型(煮沸/冷却/去皮线)

- 按最终产品

- 液体鸡蛋

- 蛋粉

- 冷冻鸡蛋

- 按自动化程度

- 手动/小型系统

- 半自动

- 全自动

- 按最终用户

- 蛋製品製造商

- 烘焙和糖果甜点加工商

- 营养补充品和蛋白质成分公司

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 智利

- 秘鲁

- 其他南美

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 荷兰

- 波兰

- 比利时

- 瑞典

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 印尼

- 韩国

- 泰国

- 新加坡

- 其他亚太地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 摩洛哥

- 土耳其

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市场定位分析

- 公司简介

- Sanovo Technology Group

- Moba Group

- Ovobel Foods Limited

- OVO-TECH Sp. z oo

- Big Dutchman AG

- Dion Ltd

- OVOCONCEPT

- Ecat-iD Technology

- Palamatic Process SAS

- Egg Machines Inc.

- HCS Enterprises

- Paul Mueller Company

- NABEL Co.,Ltd.

- National Poultry Equipment

- Kyowa machinery

- Damtech

- Vencomatic Group

- OVORIDER DWC-LLC-DMCC

- Zhengzhou Wenming Machinery Co,. Ltd

- Hightop

第七章 市场机会与未来展望

The egg processing equipment market, valued at USD 33.26 billion in 2025, is projected to reach USD 41.25 billion by 2030, growing at a CAGR of 4.40%.

This growth is fueled by advancements in automation technologies, stringent food-safety regulations, and the increasing diversification of protein consumption patterns. Regulatory changes in the United States and Europe are driving the adoption of advanced machinery equipped with continuous monitoring systems, robust cybersecurity measures, and AI-based safety features, which are also contributing to shorter replacement cycles. In North America, processors are heavily investing in flexible production lines to counteract supply-chain disruptions, such as those caused by Highly Pathogenic Avian Influenza outbreaks. Concurrently, operators in the Asia-Pacific region are rapidly integrating smart technologies to meet the surging demand in urban markets, driven by population growth and changing dietary preferences. The competitive landscape is evolving towards integrated, solution-oriented offerings that combine state-of-the-art hardware with advanced data analytics. These solutions empower processors to monitor key performance indicators, such as yields, energy efficiency, and regulatory compliance, in real time, thereby enhancing operational efficiency, reducing costs, and ensuring adherence to food safety standards.

Global Egg Processing Machinery Market Trends and Insights

Rising demand for processed and convenience egg products

Shifting consumer preferences toward ready-to-eat and shelf-stable protein sources are driving sustained demand for advanced processing technologies that surpass traditional liquid egg applications. The acquisition of Echo Lake Foods by Cal-Maine for USD 258 million in 2025 highlights the strategic importance of value-added egg products, which offer higher profit margins but require advanced and specialized processing equipment. This trend is accelerating the replacement cycles for processing equipment, as manufacturers seek systems capable of producing innovative products such as egg bites, pre-cooked omelets, and protein-enriched convenience foods. These products demand precise temperature control and robust contamination prevention measures, making advanced equipment essential. The homogenizer and spray dryer segments are particularly benefiting from this shift, as these technologies are critical for achieving the texture modifications and extended shelf life required by convenience food applications. To remain competitive, equipment manufacturers must now design systems that can handle multiple product formats on a single production line. This requirement is increasing both the complexity and capital intensity of production systems, setting a higher standard compared to traditional single-product equipment. The evolving market dynamics underscore the need for innovation and adaptability in processing technologies to meet the growing demand for diverse, high-quality convenience food products.

Increasing focus on food safety and hygiene standards

Regulatory enforcement is evolving from periodic inspections to continuous monitoring, creating a profound impact on equipment design specifications and operational protocols. The FDA's updated Egg Regulatory Program Standards (ERPS) establish robust frameworks for state-federal collaboration, leading to more frequent inspections and stricter data reporting mandates. This shift is driving the adoption of advanced equipment featuring embedded monitoring systems, automated cleaning technologies, and real-time data capture capabilities, which ensure compliance with minimal manual intervention. Additionally, the USDA's development of Radio Frequency (RF) pasteurization technology, which achieves a 99.999% reduction in Salmonella in just 24 minutes-significantly faster than the traditional 57-minute process-demonstrates how regulatory requirements are accelerating technological advancements. Suppliers that can seamlessly integrate these innovative safety technologies while maintaining operational efficiency are positioned to gain a competitive edge. In markets where regulatory compliance costs increasingly influence profitability, such advancements are becoming critical for sustaining market leadership and meeting evolving safety standards.

High initial capital investment in processing equipment

Technological advancements in equipment financing are increasingly benefiting large processors, while smaller operations face growing challenges to modernization. These challenges are particularly pronounced in emerging markets, where access to financing remains constrained. Fully automated egg processing lines, which require significant capital investment exceeding USD 10 million for comprehensive installations, highlight the financial barriers smaller players encounter. To address such constraints, the Indian government has allocated USD 144 million in 2025 under its Production Linked Incentive Scheme for food processing, signaling the need for policy-driven interventions. The financing gap has also opened opportunities for alternative solutions, such as equipment-as-a-service models and modular systems, which enable incremental deployment. However, these approaches often fall short in delivering the operational efficiency of fully integrated installations. Consequently, processors with limited capital frequently delay equipment upgrades, exposing themselves to heightened risks of regulatory non-compliance and competitive disadvantages. Over time, these vulnerabilities can escalate, leading to potential market share erosion and further segmentation within the market.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of automation and smart processing technologies

- Rising popularity of protein-rich diets and functional foods

- Limited adoption in small- and medium-sized enterprises

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, egg breakers captured a significant 29.97% share of the market, solidifying their role as the cornerstone of downstream processing operations. This dominance stems from the essential function of converting shell eggs into liquid form, a critical step before any value-added processing can take place. As a result, egg breakers are fundamental to the industry's infrastructure. The segment benefits from steady replacement demand, driven by equipment wear and compliance with stringent sanitary design regulations. Manufacturers have responded by developing advanced breaking systems that incorporate automated shell separation and quality inspection features. These innovations not only minimize contamination risks but also enhance yield efficiency, ensuring consistent performance. The sustained market leadership of egg breakers highlights the industry's reliance on mechanical processing solutions, even as other equipment categories experience technological advancements.

Homogenizers are positioned as the fastest-growing machine category, with a projected CAGR of 6.49% through 2030. This growth is propelled by increasing demand for uniform product consistency and extended shelf life in liquid egg applications. A notable example of innovation in this segment is Moba's cavitation homogenizing technology, which enables gentler homogenization processes. This technology extends pasteurizer run times and reduces operational costs compared to traditional high-pressure systems, offering significant efficiency gains. The rapid growth of this segment reflects the industry's recognition of the critical role homogenization quality plays in determining the performance of final products, particularly in bakery and food service applications. Modern homogenizers now integrate seamlessly with pasteurization systems, optimizing thermal treatments while preserving product integrity. This technological convergence enhances overall processing efficiency and positions homogenizers as indispensable components in contemporary egg processing lines, where maintaining product quality and operational efficiency is key to achieving a competitive advantage.

In 2024, liquid eggs captured a significant 46.45% share of the market, with a projected CAGR of 7.15% through 2030. This growth highlights their versatility across food services, bakeries, and industrial applications, where consistent quality and ease of handling are critical. The segment's dominance is driven by its ability to meet the needs of multiple end-user categories while offering processors operational efficiencies, such as simplified storage, transportation, and inventory management compared to shell eggs. Technological advancements, such as engineered water nanostructures (EWNS) achieving a 97.6% E. coli inactivation rate for eggshell decontamination, have further enhanced the safety and quality of liquid eggs while preserving their natural protective properties. Additionally, advanced processing systems now integrate real-time quality monitoring and automated contamination detection, ensuring consistent product specifications. This market leadership reflects the food industry's growing preference for standardized ingredients that enable predictable and efficient manufacturing processes.

Liquid eggs are also expanding into emerging applications, including convenience foods, protein supplements, and functional food ingredients, leveraging their processing advantages. The USDA's development of Radio Frequency pasteurization technology, which reduces Salmonella by 99.999% in just 24 minutes compared to the traditional 57-minute process, has opened new opportunities for liquid egg applications by improving safety and reducing processing time. Equipment manufacturers supporting this segment are experiencing sustained demand growth but face increasing pressure to develop systems capable of handling specialized formulations and meeting extended shelf-life requirements. With a strong growth trajectory, liquid eggs are expected to continue their market expansion, driven by ongoing technological innovations and diversification into new applications.

The Global Egg Processing Equipment Market Report Segments the Industry by Machine Type (Egg Breakers, Egg Separators, and More); End Product (Liquid Eggs, and More); Automation Level (Manual/Small-Scale Systems, and More); End User (Egg Product Manufacturers, Bakery and Confectionery Processors, and More); and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America holds a 31.23% market share, supported by its advanced food processing infrastructure and stringent regulatory frameworks that drive continuous equipment modernization. The region benefits from widespread automation adoption and a strong preference for convenience foods. However, market maturity limits its growth potential compared to emerging regions. A notable example of supply chain disruptions creating opportunities is the U.S. decision to import 420 million eggs from Turkey in 2025 to address shortages caused by HPAI outbreaks. Turkey remains the only country from which the U.S. imports eggs, despite the U.S. producing over 7.5 billion eggs annually, as per the American Egg Board. This scenario highlights the increasing demand for adaptable processing systems capable of handling inputs from diverse sources with varying quality standards.

Asia-Pacific is positioned as the fastest-growing region, with a projected CAGR of 7.49% through 2030. This growth is driven by rapid urbanization, increasing protein consumption, and government-led initiatives aimed at modernizing food processing industries. India's food processing sector, which attracted USD 12.58 billion in FDI between April 2000 and March 2024, exemplifies the region's investment appeal and growth potential In China, agricultural trade dynamics, such as the rejection of 154 U.S. food shipments in early 2025, underscore the critical need for robust domestic processing capabilities and stringent quality control systems. The region's expansion creates significant opportunities for equipment suppliers who can adapt technologies to meet local preferences, regulatory requirements, and cost-efficiency demands.

Europe continues to exhibit steady demand, driven by strict regulatory compliance and sustainability mandates. In contrast, South America and the Middle East & Africa present emerging opportunities, albeit with growth constrained by infrastructure deficits and limited capital availability. These geographic disparities reflect varying stages of economic development and food processing industry maturity. They also highlight opportunities for equipment suppliers to implement region-specific strategies and offer financing solutions tailored to local market needs.

- Sanovo Technology Group

- Moba Group

- Ovobel Foods Limited

- OVO-TECH Sp. z o.o.

- Big Dutchman AG

- Dion Ltd

- OVOCONCEPT

- Ecat-iD Technology

- Palamatic Process SAS

- Egg Machines Inc.

- HCS Enterprises

- Paul Mueller Company

- NABEL Co.,Ltd.

- National Poultry Equipment

- Kyowa machinery

- Damtech

- Vencomatic Group

- OVORIDER DWC-LLC-DMCC

- Zhengzhou Wenming Machinery Co,. Ltd

- Hightop

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for processed and convenience egg products

- 4.2.2 Increasing focus on food safety and hygiene standards

- 4.2.3 Adoption of automation and smart processing technologies

- 4.2.4 Rising popularity of protein-rich diets and functional foods

- 4.2.5 Technological advancements in egg processing machinery

- 4.2.6 Emergence of on-farm modular pasteurization systems for cage-free egg production

- 4.3 Market Restraints

- 4.3.1 High initial capital investment in processing equipment

- 4.3.2 Limited adoption in small- and medium-sized enterprises

- 4.3.3 Environmental concerns over egg processing waste

- 4.3.4 Competition from plant-based egg substitutes

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Machine Type

- 5.1.1 Egg Breakers

- 5.1.2 Egg Separators

- 5.1.3 Pasteurizers

- 5.1.4 Homogenizers

- 5.1.5 Spray Dryers

- 5.1.6 Centrifuges and Filters

- 5.1.7 Other Machine Type (Boiling/Cooling/Peeling Lines)

- 5.2 By End Product

- 5.2.1 Liquid Eggs

- 5.2.2 Powdered Eggs

- 5.2.3 Frozen Eggs

- 5.3 By Automation Level

- 5.3.1 Manual/Small-Scale Systems

- 5.3.2 Semi-Automated

- 5.3.3 Fully Automated

- 5.4 By End User

- 5.4.1 Egg Product Manufacturers

- 5.4.2 Bakery and Confectionery Processors

- 5.4.3 Nutraceutical and Protein Ingredient Firms

- 5.4.4 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Peru

- 5.5.2.6 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Netherlands

- 5.5.3.6 Poland

- 5.5.3.7 Belgium

- 5.5.3.8 Sweden

- 5.5.3.9 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 Indonesia

- 5.5.4.6 South Korea

- 5.5.4.7 Thailand

- 5.5.4.8 Singapore

- 5.5.4.9 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Positioning Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Sanovo Technology Group

- 6.4.2 Moba Group

- 6.4.3 Ovobel Foods Limited

- 6.4.4 OVO-TECH Sp. z o.o.

- 6.4.5 Big Dutchman AG

- 6.4.6 Dion Ltd

- 6.4.7 OVOCONCEPT

- 6.4.8 Ecat-iD Technology

- 6.4.9 Palamatic Process SAS

- 6.4.10 Egg Machines Inc.

- 6.4.11 HCS Enterprises

- 6.4.12 Paul Mueller Company

- 6.4.13 NABEL Co.,Ltd.

- 6.4.14 National Poultry Equipment

- 6.4.15 Kyowa machinery

- 6.4.16 Damtech

- 6.4.17 Vencomatic Group

- 6.4.18 OVORIDER DWC-LLC-DMCC

- 6.4.19 Zhengzhou Wenming Machinery Co,. Ltd

- 6.4.20 Hightop