|

市场调查报告书

商品编码

1892794

碾米机市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Rice Milling Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

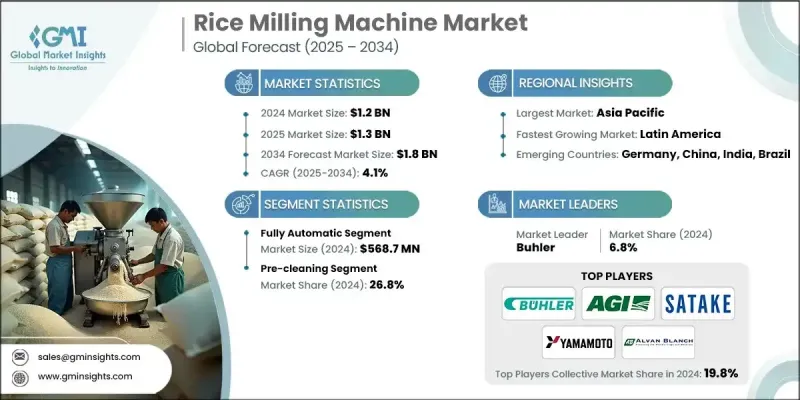

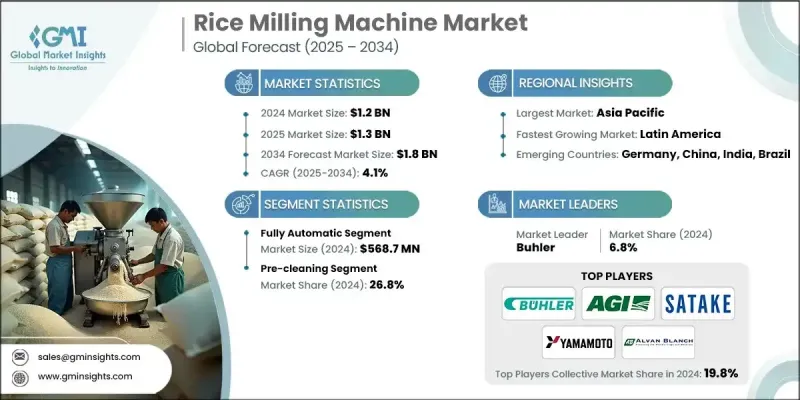

2024 年全球碾米机市场价值为 12 亿美元,预计到 2034 年将以 4.1% 的复合年增长率增长至 18 亿美元。

新兴经济体稻米产量的增加以及对高品质碾米设备需求的成长推动了市场的发展。自动化、节能设计和物联网系统的进步正在改变市场格局,使碾米厂能够在提高生产效率的同时最大限度地降低营运成本。全自动碾米系统因其能够实现即时监控、优化效能并确保产量稳定而日益普及。政府推动农业现代化的倡议鼓励采用先进的碾米解决方案,而製造商则正在开发专为小型农户量身定制的模组化和紧凑型机器。这些机器的产能可调,能够处理不同的稻米品种和季节性需求。随着自动化和智慧技术的普及,碾米设备正从传统设计朝向更灵活、互联和高效的系统发展,以满足大规模和在地化的加工需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 18亿美元 |

| 复合年增长率 | 4.1% |

2024 年,全自动领域创造了 5.687 亿美元的收入。这些系统通常与物联网功能集成,可实现即时监控、营运优化和品质稳定,尤其是在高需求市场。

2024 年,预清理环节占市场占有率的 26.8%。预清理对于去除石块、秸秆和灰尘等杂质、保护碾磨设备以及提高整体加工效率至关重要。

2024年,美国碾米机市占率达到79%,这主要得益于自动化碾米技术的日益普及和消费者对优质米需求的成长。该地区的製造商已推出先进的碾米机,以满足效率和品质方面的要求,从而支持不断增长的大米消费量。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 全球米消费和生产需求不断增长

- 碾米自动化技术进步

- 政府支持农业现代化的倡议

- 产业陷阱与挑战

- 缺乏机器操作熟练工人

- 先进铣削技术的前期投资较高

- 机会

- 对自动化和智慧铣削解决方案的需求不断增长

- 新兴市场扩张与小农户一体化

- 成长驱动因素

- 成长潜力分析

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 机器

- 监管环境

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码- 84378020)

- 主要进口国

- 主要出口国

- 风险评估与缓解

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依机器类型划分,2021-2034年

- 全自动

- 半自动

- 手动的

第六章:市场估计与预测:依技术划分,2021-2034年

- 传统铣削

- 智慧/物联网赋能的铣削

- 节能型研磨系统

第七章:市场估计与预测:依营运方式划分,2021-2034年

- 预先清洁

- 分离

- 等级

- 米漂白

- 其他

第八章:市场估算与预测:依产能划分,2021-2034年

- 小规模(低于10吨/天)

- 中等规模(10-50吨/天)

- 大规模(日产量超过50吨)

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 商业磨坊

- 农夫/小型磨坊主

第十章:市场估价与预测:依配销通路划分,2021-2034年

- 直接的

- 间接

第十一章:市场估计与预测:按地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- AG Growth International

- Alvan Blanch

- Buhler

- Fowler Westrup

- GG Dandekar

- Hubei Bishan

- Hubei Fotma

- Koolmill Systems

- Lushan Win Tone

- Mill Master

- PETKUS Technologie

- Ricetec

- Satake

- Yamamoto

- Zhejiang QiLi (QiLi Group)

The Global Rice Milling Machine Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 4.1% to reach USD 1.8 billion by 2034.

The growth is driven by increasing rice production in emerging economies and rising demand for high-quality rice processing equipment. Advancements in automation, energy-efficient designs, and IoT-enabled systems are transforming the market, allowing mills to enhance productivity while minimizing operational costs. Fully automatic milling systems are becoming popular as they enable real-time monitoring, optimize performance, and ensure consistent output. Government initiatives promoting agricultural modernization are encouraging the adoption of advanced milling solutions, while manufacturers are developing modular and compact machines tailored to small-scale farmers. These machines offer adjustable capacities to handle different rice varieties and seasonal demands. As automation and smart technologies gain traction, rice milling equipment is evolving from traditional designs toward more flexible, connected, and efficient systems, addressing both large-scale and localized processing needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $1.8 Billion |

| CAGR | 4.1% |

The fully automatic segment generated USD 568.7 million in 2024. These systems, often integrated with IoT capabilities, allow real-time monitoring, operational optimization, and consistent quality, particularly in high-demand markets.

The pre-cleaning segment accounted for a 26.8% share in 2024. Pre-cleaning is essential for removing impurities such as stones, straw, and dust, protecting milling equipment, and enhancing overall processing efficiency.

U.S. Rice Milling Machine Market held a 79% market share in 2024, fueled by growing adoption of automated milling technologies and rising demand for high-quality rice. Manufacturers in the region have introduced advanced milling machines to meet efficiency and quality expectations, supporting increasing rice consumption.

Major players operating in the Global Rice Milling Machine Market include AG Growth International, Alvan Blanch, Buhler, Fowler Westrup, G.G. Dandekar, Hubei Bishan, Hubei Fotma, Koolmill Systems, Lushan Win Tone, Mill Master, PETKUS Technologie, Ricetec, Satake, Yamamoto, and Zhejiang QiLi (QiLi Group). Companies in the Rice Milling Machine Market are prioritizing technological innovation, developing fully automatic and IoT-enabled solutions that enhance efficiency, product quality, and operational monitoring. Manufacturers are also focusing on modular and portable designs to cater to small-scale and regional farmers. Strategic partnerships and collaborations with local distributors help expand market reach and tailor solutions to specific agricultural needs. Firms are investing in R&D to improve energy efficiency, reduce operational costs, and accommodate different rice varieties and seasonal production requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine

- 2.2.3 Technology

- 2.2.4 Operation

- 2.2.5 Capacity

- 2.2.6 End Use

- 2.2.7 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global rice consumption and production demands

- 3.2.1.2 Technological advancements in rice milling automation

- 3.2.1.3 Government initiatives supporting agricultural modernization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Lack of skilled labor for machine operation

- 3.2.2.2 High initial investment for advanced milling technology

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for automated and smart milling solutions

- 3.2.3.2 Expansion in emerging markets and smallholder integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Machine

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS Code- 84378020)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Risk assessment and mitigation

- 3.10 Gap Analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Machine, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Fully automatic

- 5.3 Semi-automatic

- 5.4 Manual

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Conventional milling

- 6.3 Smart/IoT-enabled milling

- 6.4 Energy-efficient milling systems

Chapter 7 Market Estimates & Forecast, By Operation, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Pre-cleaning

- 7.3 Separating

- 7.4 Grading

- 7.5 Rice whitening

- 7.6 Other

Chapter 8 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Small-scale (below 10 tons/day)

- 8.3 Medium-scale (10-50 tons/day)

- 8.4 Large-scale (above 50 tons/day)

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Commercial mills

- 9.3 Farmers/small millers

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AG Growth International

- 12.2 Alvan Blanch

- 12.3 Buhler

- 12.4 Fowler Westrup

- 12.5 G.G. Dandekar

- 12.6 Hubei Bishan

- 12.7 Hubei Fotma

- 12.8 Koolmill Systems

- 12.9 Lushan Win Tone

- 12.10 Mill Master

- 12.11 PETKUS Technologie

- 12.12 Ricetec

- 12.13 Satake

- 12.14 Yamamoto

- 12.15 Zhejiang QiLi (QiLi Group)