|

市场调查报告书

商品编码

1907207

食品加工机械:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Food Processing Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

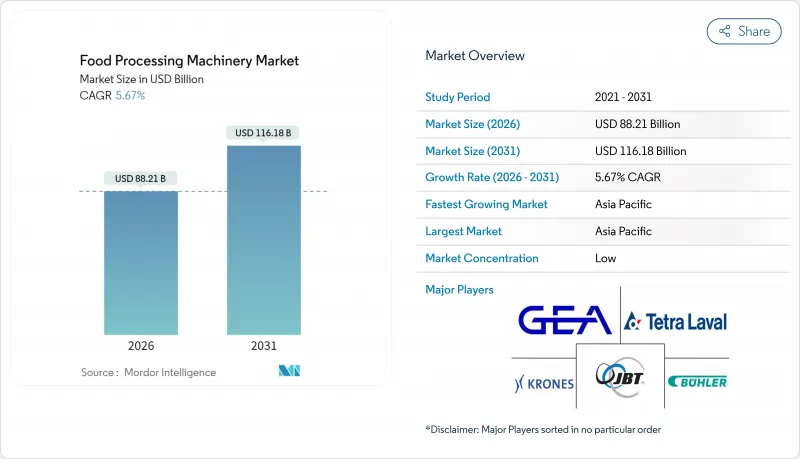

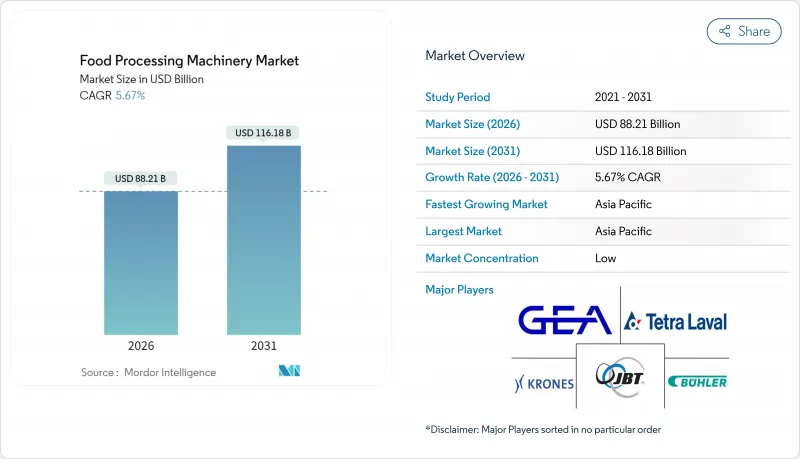

预计到 2026 年,食品加工机械市场价值将达到 882.1 亿美元,从 2025 年的 834.8 亿美元成长到 2031 年的 1,161.8 亿美元。

预计2026年至2031年年复合成长率(CAGR)为5.67%。

工厂车间的持续现代化、日益严格的卫生法规以及包装食品消费量的成长,共同支撑着这一成长趋势。加工机械仍然是收入的最大来源,因为製造商将初级加工设备视为提高生产效率和确保产品品质稳定的最可靠途径。亚太地区的工业扩张,加上不断壮大的中产阶级的购买力,正在推动该地区对符合不断变化的食品安全法规的先进系统的需求。自动化仍然是关键,目前半自动化生产线占据主导地位,但随着企业追求预测性维护、资源效率和即时品质监控,智慧和人工智慧设备正以最快的速度应用。分散的供应链使得竞争保持适度,技术创新者凭藉专业化的互联解决方案不断扩大市场份额。

全球食品加工机械市场趋势与洞察

对加工食品和简便食品食品的需求不断增长

消费者生活方式正朝着以便利为导向的消费模式转变,推动了加工和包装产业的持续资本投资。美国调理食品市场规模已达633亿美元,并以9.1%的复合年增长率成长,这催生了对能够适应不同产品配方和包装形式的灵活生产线的上游需求。对于提供模组化系统的製造商而言,这一趋势尤其有利,因为这些系统无需进行大规模重新配置即可实现快速产品切换。虚拟厨房营运商正越来越多地采用紧凑型、无废气排放的设备解决方案,以最大限度地利用空间并支援多种烹饪模式。例如,Altsham的Vector H系列多功能烤箱就支援七种虚拟主厨餐厅的营运。以配送为中心的经营模式与先进加工技术的结合,正在为面向都市区共享厨房运营的设备供应商创造一个新的市场细分领域。

工厂车间快速实现自动化和物联网集成

製造智慧平台正在将食品加工从被动维护模式转变为预测性营运模式,从而优化设备运转率和产品品质。罗克韦尔自动化公司的 FactoryTalk Analytics 平台能够即时监控製程参数,将计划外停机时间减少高达 30%,同时提高整体设备效率 (OEE)。这种技术变革在高产量加工环境中尤其显着,因为即使是微小的效率提升也能转化为可观的成本节约。智慧加工设备正日益融合边缘运算功能,透过实现本地决策而无需依赖云端连接,从而解决时间敏感型操作中的延迟问题。人工智慧在食品加工机械中的应用,例如 Chef Robotics 的人工智慧驱动的分切系统,该系统将产品一致性和产量比率提高了 30% 以上,这表明机器学习演算法可以优化份量控制并减少食物浪费。

先进卫生管理设备需要高额的资本投资和营运成本。

先进加工设备的投资障碍造成了市场分化,大型製造商与寻求经济高效的自动化解决方案的中小型企业之间存在着明显的市场隔阂。高度卫生的设计要求,例如采用316L不銹钢材质和特殊的表面处理工艺,显着增加了设备的成本,远高于标准工业机械。 GEA的入门级热成型机正是针对那些寻求先进包装功能但又不想投入高端系统所需资金的中小型企业而设计的。营运成本进一步加剧了初始投资的挑战,因为专用清洁剂、验证程序和维护通讯协定都需要持续的资金投入。这种成本结构对新兴市场製造商的影响尤其显着,他们必须在自动化带来的优势和资金限制之间取得平衡,这为提供灵活资金筹措和租赁模式的设备供应商创造了机会。

细分市场分析

在食品加工机械市场,加工设备预计到2025年将占总收入的53.92%,反映出製造商专注于核心价值创造。热加工、非热加工和挤压技术将成为产能扩张的基础,预计复合年增长率将达到5.04%。布勒的SmartLine系列产品(包括在印度生产的DirectBake智慧烤箱)提供高端燃烧控制和配方管理,并根据当地价格分布进行客製化。包装器材是收入排名第二的市场,它正透过整合控制系统加强与上游工程的联繫,这些控制系统可以同步灌装速度、封口温度和标籤供应。 CIP清洗装置、废弃物处理单元和HVAC系统等公用设施都连接到一个全厂仪錶板,用于分析水、能源和化学品消费量。这种连接表明食品加工机械市场正在从单机性能转向全线优化。

直销品牌和注重快速换线的「幽灵厨房」的兴起,推动了对灵活的小批量热处理系统的需求。同时,大型工厂正在安装高容量蒸发器、超高温瞬时灭菌(UHT)设备和无菌填充机,以支援出口管道。模组化热交换器、泵浦和阀组供应商帮助加工商分阶段进行投资,即使在现金流波动的情况下也能维持实施计画。随着网路安全PLC和工业乙太网标准的兴起,设备间的互通性不再是锦上添花,而是保持竞争力的必要条件。

食品加工机械市场按机器类型(加工机械等)、自动化程度(手动、半自动、全自动、智慧和人工智慧赋能)、应用领域(烘焙和糖果甜点等)以及地区(北美、欧洲、亚太、南美、中东和非洲)进行细分。预测数据以以金额为准。

区域分析

预计到2025年,亚太地区将占全球营收的38.21%,年复合成长率达5.33%,凸显其在全球产能扩张中的关键角色。食品出口的快速增长、都市区消费的不断增长以及政府为推动国内加工现代化而提供的激励措施,都为该地区的增长提供了支撑。印尼嘉吉公司和印度龙沙公司等大型跨国公司正在扩大本地生产规模,以满足国内市场和周边出口走廊的需求。该地区的采购部门越来越重视能够提供快速交货、在地采购采购备件和及时售后服务的机械供应商。这一趋势正在推动对模组化系统、自动化检测技术以及根据该地区独特的农作物和畜牧生产特征量身定制的连续加工生产线的需求。

北美地区正致力于优化现有基础设施,而非新建设。加工商正投资于数位化维修、预测维修系统和能源效率提升。钢铁和铝关税导致设备製造成本飙升25%,迫使买家转向区域性原始设备製造商 (OEM) 和在美国设有组装基地的全球性公司。市场正迅速采用机器人执行分装、包装和清洁等任务。这项转变的主要驱动因素是劳动力短缺、严格的卫生标准以及管理不同产品 SKU 生产差异的挑战。

拉丁美洲、中东和非洲正在齐心协力发展食品加工基础设施。这些倡议旨在加强粮食安全,减少收穫后损失,并重振农村农业产业价值链。创新技术包括移动式水果加工单元、货柜式乳製品生产线、太阳能脱水机和低压家禽漂烫机。这些技术对于低温运输匮乏、电力供应不稳定的地区尤其重要。儘管政府支持的现代化改造津贴公私合营正在帮助中小加工企业升级设备,但外汇波动和进口依赖等挑战仍然延缓了机械设备的订购。然而,这些地区的总体目标很明确:填补关键产能缺口,提高本地附加价值,并使供应与不断增长的国内需求相匹配。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对加工食品和简便食品食品的需求不断增长

- 工厂车间自动化和物联网整合的快速进展

- 全球更严格的食品安全和卫生法规

- 扩大亚太地区的食品製造能力

- 向灵活的小批量生产线转型,以服务D2C和幽灵厨房

- 美国和欧盟的近岸外包奖励措施和关税制度

- 市场限制

- 先进卫生管理设备需要高额的资本投资和营运成本。

- 能源和技术纯熟劳工成本上涨

- 由于半导体和感测器短缺导致交货延迟

- 互联处理设备的网路安全风险

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按机器类型

- 加工机械

- 初级加工

- 热处理

- 未经热处理

- 挤出成型系统

- 包装器材

- 初级包装

- 二级包装

- 生产线末端包装

- 真空包装/气调包装/无菌包装系统

- 公用设施及辅助系统

- 加工机械

- 按自动化级别

- 手动的

- 半自动

- 全自动

- 智慧与人工智慧赋能

- 透过使用

- 烘焙和糖果甜点

- 肉类、鱼贝类和肉品

- 乳製品及乳製品替代品

- 饮料

- 水果、蔬菜和坚果

- 调理食品及食材自煮包

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 荷兰

- 波兰

- 比利时

- 瑞典

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 印尼

- 韩国

- 泰国

- 新加坡

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 智利

- 秘鲁

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 摩洛哥

- 土耳其

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Buhler AG

- GEA Group AG

- Tetra Laval(Tetra Pak)

- John Bean Technologies(JBT)

- Krones AG

- Marel hf.

- Alfa Laval AB

- SPX FLOW Inc.

- Tomra Systems ASA

- Satake Corp.

- Anko Food Machine Co.

- Hosokawa Micron Corp.

- Atlas Pacific Engineering

- Provisur Technologies

- Syntegon Technology

- Marelec Food Tech

- Key Technology

- Heat and Control

- Middleby Corp.

- Urschel Laboratories

第七章 市场机会与未来展望

Food processing machinery market size in 2026 is estimated at USD 88.21 billion, growing from 2025 value of USD 83.48 billion with 2031 projections showing USD 116.18 billion, growing at 5.67% CAGR over 2026-2031.

Steady modernization of plant floors, stricter hygiene regulations, and rising consumption of packaged foods underpin this growth trajectory. Processing machinery continues to command the largest revenue share because manufacturers view primary transformation equipment as the surest route to throughput gains and consistent product quality. Asia-Pacific's industrial build-out, coupled with expanding middle-class purchasing power, accelerates regional demand for advanced systems that comply with evolving food-safety mandates. Automation remains pivotal; semi-automatic lines dominate current installations, yet smart and AI-enabled equipment records the fastest uptake as firms pursue predictive maintenance, resource efficiency, and real-time quality monitoring. Competitive intensity stays moderate in a fragmented supplier base, enabling technology disruptors to win share with specialized, connected solutions.

Global Food Processing Machinery Market Trends and Insights

Rising Demand for Processed and Convenience Foods

Consumer lifestyle shifts toward convenience-oriented consumption patterns drive sustained equipment investment across processing and packaging segments. The U.S. ready meals market reached USD 63.3 billion with a 9.1% CAGR growth, creating upstream demand for flexible processing lines capable of handling diverse product formulations and packaging formats. This trend particularly benefits manufacturers offering modular systems that accommodate rapid product changeovers without extensive reconfiguration. Ghost kitchen operators increasingly specify compact, ventless equipment solutions that maximize space utilization while enabling multi-concept food preparation, as demonstrated by Alto-Shaam's Vector H Series Multi-Cook Oven powering Virtual Chef Hall's seven-concept operations. The convergence of delivery-focused business models with advanced processing technology creates new market segments for equipment suppliers targeting urban commissary operations.

Rapid Automation and IoT Integration in Plant Floors

Manufacturing intelligence platforms transform food processing from reactive maintenance toward predictive operational models that optimize equipment utilization and product quality. Rockwell Automation's FactoryTalk Analytics platform enables real-time monitoring of processing parameters, reducing unplanned downtime by up to 30% while improving overall equipment effectiveness. This technological shift particularly impacts high-volume processing environments where marginal efficiency gains translate to significant cost savings. Smart processing equipment increasingly incorporates edge computing capabilities that enable local decision-making without relying on cloud connectivity, addressing latency concerns in time-sensitive operations. The integration of artificial intelligence in food processing machinery, exemplified by Chef Robotics' AI-enabled depositing systems achieving greater than 30% improvement in consistency and yield, demonstrates how machine learning algorithms optimize portion control and reduce food waste.

High Capex and Opex of Advanced Hygienic Machinery

Investment barriers for sophisticated processing equipment create market segmentation between large-scale manufacturers and smaller operators seeking cost-effective automation solutions. Advanced hygienic design requirements, including 316L stainless steel construction and specialized surface finishes, significantly increase equipment costs compared to standard industrial machinery. GEA's introduction of entry-level thermoforming machines specifically targets small and medium-sized companies seeking advanced packaging capabilities without the capital commitment of high-end systems. Operating expenses compound initial investment challenges, as specialized cleaning chemicals, validation procedures, and maintenance protocols require ongoing financial commitments. This cost structure particularly impacts emerging market manufacturers who must balance automation benefits against capital constraints, creating opportunities for equipment suppliers offering flexible financing and leasing models.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Global Food-Safety and Hygiene Regulations

- Expanding Food Manufacturing Capacity Across APAC

- Escalating Energy and Skilled-Labor Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Processing equipment captured 53.92% of 2025 revenue within the food processing machinery market, reflecting manufacturers' focus on core value generation. Thermal, non-thermal, and extrusion technologies form the backbone of capacity expansions and recorded a 5.04% CAGR outlook. Buhler's SmartLine release, including the DirectBake Smart oven produced in India, tailors high-end combustion and recipe controls to local price points. Packaging machinery ranks second in revenue yet increasingly integrates with upstream processes through unified controls that synchronize fill rates, sealing temperatures, and label feeds. Utilities such as CIP skids, waste-handling units, and HVAC systems tie into overarching plant-wide dashboards that analyze water, energy, and chemical consumption. This linkage illustrates how the food processing machinery market is moving from machine-level performance to holistic line optimization.

Demand for flexible, small-batch thermal systems rises alongside D2C brands and ghost kitchens that prioritize rapid changeovers. At the other end of the scale, mega-plants order high-throughput evaporators, UHT units, and aseptic fillers to serve export channels. Suppliers that modularize heat exchangers, pumps, and valve manifolds allow processors to phase investments over multiple budget cycles, keeping adoption on track even when cash flows fluctuate. As cyber-secure PLCs and industrial Ethernet become standard, equipment interoperability becomes a competitive requirement rather than a luxury.

The Food Processing Machinery Market is Segmented by Machinery Type (Processing Machinery and More), Automation Level (Manual, Semi-Automatic, Fully Automatic, Smart and AI-Enabled), Application (Bakery and Confectionery, and More), and Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). Forecasts are Provided in Value Terms (USD).

Geography Analysis

In 2025, the Asia-Pacific region is projected to contribute 38.21% to global revenue and is set to grow at a CAGR of 5.33%. This underscores the region's pivotal role in global capacity expansion. Factors such as surging food exports, urban consumption, and government incentives for modernizing domestic processing bolster the region's growth. Multinational giants, including Cargill in Indonesia and Lonza in India, are broadening their localized manufacturing to cater to both domestic markets and nearby export corridors. Procurement teams in the region are increasingly favoring machinery suppliers who offer shorter lead times, local spare parts, and swift after-sales service. This trend fuels demand for modular systems, automated inspection technologies, and continuous processing lines, all tailored to the region's unique crop and livestock profiles.

North America is focusing on optimizing its existing infrastructure instead of pursuing greenfield expansions. Processors are channeling investments into digital retrofits, predictive maintenance systems, and energy-efficient upgrades. Rising tariffs on steel and aluminium, leading to a 25% spike in equipment fabrication costs-are nudging buyers to turn to regional OEMs or global firms with U.S.-based assembly units. The market is witnessing a robust adoption of robotics for tasks like portioning, packaging, and sanitation. This shift is largely driven by labor shortages, stringent hygiene standards, and the challenge of managing production variability across diverse product SKUs.

In South America, the Middle East, and Africa, there's a concerted push to establish foundational food processing infrastructure. This initiative aims to bolster food security, curtail post-harvest losses, and invigorate rural agro-industrial value chains. Innovations like mobile fruit processing units, containerized dairy lines, solar-powered dehydrators, and low-pressure poultry scalders are being deployed. These technologies are especially beneficial in areas with limited cold-chain access and inconsistent grid connectivity. While government-backed modernization grants and public-private partnerships are aiding small and mid-sized processors in upgrading their equipment, challenges like foreign exchange volatility and a reliance on imports are causing delays in machinery orders. Nevertheless, the overarching goal in these regions remains clear: to bridge critical capacity gaps, enhance local value addition, and align supply with the growing domestic demand.

- Buhler AG

- GEA Group AG

- Tetra Laval (Tetra Pak)

- John Bean Technologies (JBT)

- Krones AG

- Marel hf.

- Alfa Laval AB

- SPX FLOW Inc.

- Tomra Systems ASA

- Satake Corp.

- Anko Food Machine Co.

- Hosokawa Micron Corp.

- Atlas Pacific Engineering

- Provisur Technologies

- Syntegon Technology

- Marelec Food Tech

- Key Technology

- Heat and Control

- Middleby Corp.

- Urschel Laboratories

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for processed and convenience foods

- 4.2.2 Rapid automation and IoT integration in plant floors

- 4.2.3 Stricter global food-safety and hygiene regulations

- 4.2.4 Expanding food manufacturing capacity across APAC

- 4.2.5 Shift toward flexible small-batch lines for D2C and ghost kitchens

- 4.2.6 Near-shoring incentives & tariff regimes in U.S./EU

- 4.3 Market Restraints

- 4.3.1 High capex and opex of advanced hygienic machinery

- 4.3.2 Escalating energy and skilled-labor costs

- 4.3.3 Semiconductor & sensor shortages delaying deliveries

- 4.3.4 Cyber-security risks in connected processing equipment

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Machinery Type

- 5.1.1 Processing Machinery

- 5.1.1.1 Primary Processing

- 5.1.1.2 Thermal Processing

- 5.1.1.3 Non-Thermal Processing

- 5.1.1.4 Extrusion and Forming Systems

- 5.1.2 Packaging Machinery

- 5.1.2.1 Primary Packaging

- 5.1.2.2 Secondary Packaging

- 5.1.2.3 End-of-Line packaging

- 5.1.2.4 Vacuum / MAP / Aseptic Systems

- 5.1.3 Utilities and Ancillary Systems

- 5.1.1 Processing Machinery

- 5.2 By Automation Level

- 5.2.1 Manual

- 5.2.2 Semi-Automatic

- 5.2.3 Fully Automatic

- 5.2.4 Smart and AI-Enabled

- 5.3 By Application

- 5.3.1 Bakery and Confectionery

- 5.3.2 Meat/Seafood and Meat-Alternative

- 5.3.3 Dairy and Dairy-Alternative

- 5.3.4 Beverages

- 5.3.5 Fruits, Vegetables & Nuts

- 5.3.6 Ready Meals and Meal Kits

- 5.3.7 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Belgium

- 5.4.2.9 Sweden

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Buhler AG

- 6.4.2 GEA Group AG

- 6.4.3 Tetra Laval (Tetra Pak)

- 6.4.4 John Bean Technologies (JBT)

- 6.4.5 Krones AG

- 6.4.6 Marel hf.

- 6.4.7 Alfa Laval AB

- 6.4.8 SPX FLOW Inc.

- 6.4.9 Tomra Systems ASA

- 6.4.10 Satake Corp.

- 6.4.11 Anko Food Machine Co.

- 6.4.12 Hosokawa Micron Corp.

- 6.4.13 Atlas Pacific Engineering

- 6.4.14 Provisur Technologies

- 6.4.15 Syntegon Technology

- 6.4.16 Marelec Food Tech

- 6.4.17 Key Technology

- 6.4.18 Heat and Control

- 6.4.19 Middleby Corp.

- 6.4.20 Urschel Laboratories