|

市场调查报告书

商品编码

1844640

电子黏合剂:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Electronics Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

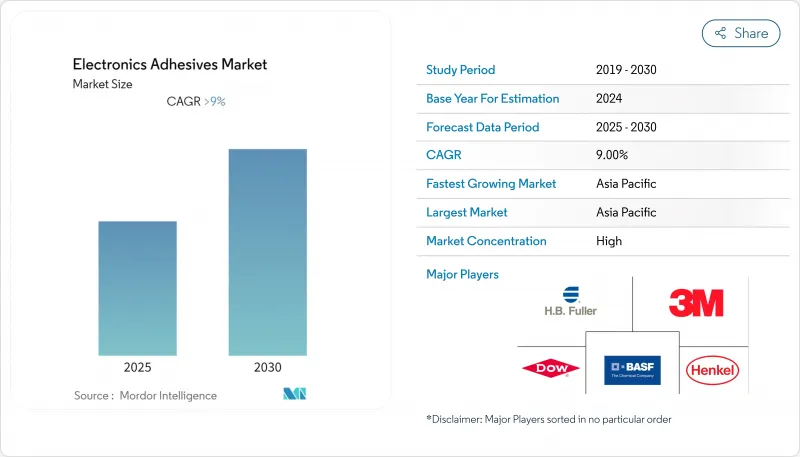

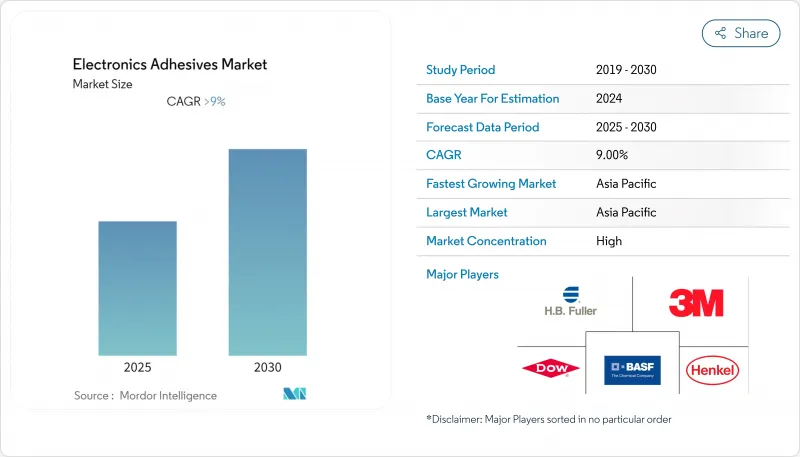

预计 2025 年电子黏合剂市场价值将达到 65.1 亿美元,到 2030 年预计将达到 100.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.04%。

元件小型化、表面黏着技术(SMT) 的日益普及以及先进显示器的快速普及是这项进步的关键驱动力。高密度封装推动了需求势头,它增加了互连数量,同时放大了热负荷,使得黏合剂成为越来越小的设备功能之间必不可少的热和机械缓衝器。製造商也优先考虑快速固化化学品,以缩短大批量生产线的周期时间,尤其是在亚洲契约製造中心。同时,永续性法规正在推动向无 PFAS、生物基和低 VOC 配方的转变,这些配方不会影响长期可靠性。这些主题结合起来表明,电子黏合剂市场的成长是由主导和价值共同主导的,创新产品在需要高耐热性和光学纯度的应用中占据了溢价。

全球电子黏合剂市场趋势与洞察

高密度封装的激增

高密度封装正在推动键合线的公差更接近微米级,这要求黏合剂具有严格的黏度窗口、可控的排气性能以及能够适应堆迭晶粒之间差异膨胀的模量。晶圆级封装 (WLP) 和 3D 整合使焊点暴露在回流焊接温度漂移中,峰值接近 260°C,而新配製的环氧-硅氧烷混合物可以满足阈值。 DELO 最新的晶圆级产品系列能够承受这些温度,同时保持适用于精密喷射头的流动特性。坚固耐用的材料的应用范围已从智慧型手机扩展到 ADAS(高级驾驶辅助系统)控制单元和微型工业感测器,而这两者都反映了消费设备的空间限制。

对需要黏合剂的表面黏着技术的需求不断增加

SMT 曾经是一种降低成本的工具,如今它能够实现超细间距组装,其中元件间隙小于焊膏公差。底部填充胶透过重新分配覆晶封装中的热机械应力并防止锡晶须扩散,降低了穿戴式电子设备的现场故障率。汽车资讯娱乐闆对减震和 1000 小时热循环耐久性的要求越来越高,这推动了对专用环氧-聚酰亚胺混合物的需求。设备製造商正在采用高吞吐量喷射点胶机和两级热/紫外线固化站来应对这项挑战,这些设备可将线上生产节拍时间缩短高达 40%,从而推动整个电子胶合剂市场的胶合需求。

环氧丙烯酸酯原料价格波动

环氧氯丙烷供应中断和运费上涨已将环氧树脂现货价格推至多年来的最高水平,挤压了小型复合材料生产商的毛利率。美国国际贸易委员会对某些亚洲环氧树脂进口的裁决,导致数週内加征关税并重新谈判合约。复合材料级树脂生产商的应对措施是将价格提高每吨150至200欧元,这直接增加了其黏合剂的成本基础。虽然顶级供应商正在透过签订多年期供应协议来对冲成本,但区域专业供应商正面临营运资金限制,这可能会抑制创新步伐。

細項分析

环氧树脂仍将是电子胶合剂市场最重要的组成部分,到2024年将占总收入的30.19%。其高内聚强度、介电稳定性和耐腐蚀性使其在汽车引擎盖下模组和工业驱动装置中广受欢迎。同时,丙烯酸树脂的复合年增长率为11.19%,因其快速的光固化和热固化特性以及基材柔韧性而备受推崇,使其成为智慧型手机镜头堆迭黏合的理想选择。利用木质素和植物油衍生物的生物基环氧树脂倡议旨在减少碳足迹,同时不牺牲260°C的峰值温度能力。当製造商需要在单一配方中实现快速固化特性时,专业组装厂更青睐混合环氧-丙烯酸酯混合物。传统的坚固性与新兴的灵活性之间的这种相互作用支撑了电子胶合剂市场多样化的配方蓝图。

第二梯队的聚氨酯系统适用于高振动环境,例如暴露在道路衝击下的电池模组,而有机硅和氰基丙烯酸酯则适用于高温功率装置和快速固定。双酚A缩水甘油醚的监管趋势正推动环氧树脂製造商转向替代单体,但长期需求基本面依然存在。製造商继续透过专有增韧剂实现差异化,将工作温度范围从-55°C扩展至175°C,从而在丙烯酸销售量加速成长的同时,巩固了环氧树脂的领先地位。

导电等级将占2024年销售额的43.90%,在焊料空洞威胁电路连续性的情况下,导电等级至关重要。银片环氧树脂在覆晶晶粒中占主导地位,含镍版本为5G天线提供经济高效的EMI屏蔽。紫外光固化胶黏剂的复合年增长率为12.04%,透过将生产线节拍缩短至数秒并实现现场光学检测,提高了相机模组工厂的一次通过产量比率。以氮化铝和氮化硼填料配製的导热环氧树脂散热率高达5 W/mK,可提高LED光通维持率和逆变器的运作时间。

在高压线路绝缘至关重要的领域,非导电结构环氧树脂的需求依然旺盛,尤其是在牵引逆变器和资料中心电源领域。结合了紫外光预凝胶和热感后固化的混合双固化产品正成为复杂三维组件的可行选择。目前市面上各种性能的产品正在增强电子胶合剂市场,使设计人员能够自由地同时优化电气、热学和光学参数。

区域分析

亚太地区将成为电子胶合剂市场最大的单一区域支柱,到2024年将占总收入的58.69%。受国家对先进封装生产线和晶圆级底部填充产能扩张的补贴推动,中国当地2024年的电子产品产量将增加11.3%。自2025年4月起,美国部分免除电子产品进口关税后,泰国和越南吸收了新的外国直接投资,并将组装计画转向东协丛集。从树脂反应器到全自动SMT生产线,该地区的一体化供应基地缩短了前置作业时间,并增强了成本领先优势。

《晶片与科学法案》为北美晶圆製造拨款520亿美元,推动了北美製造业的回流。这笔上游资本支出刺激了下游对无尘室级底部填充材料和液体热感界面材料的黏合剂需求。加拿大魁北克走廊地区同样拥有新的印刷电子试点工厂,该工厂优先发展生物基化学技术,这与欧洲的永续性概念相呼应。

随着《欧盟晶片法案》加强该地区微电子价值链,欧洲电子黏合剂市场预计将迎来復苏。包括逐步实施的PFAS限制措施在内的环境法规正在推动无氟润滑填料的研发。德国一级汽车製造商正在推进仪表板显示器可剥离等级的认证,而斯堪地那维亚的EMS供应商则强调低温固化以减少能源足迹。

南美洲和中东/非洲是新的前沿市场。巴西马瑙斯自由贸易区正在扩大家用电子电器组装,为适合热带潮湿环境的中等黏度丙烯酸树脂提供了机会。阿拉伯联合大公国(UAE)正将自己定位为区域物流枢纽,自由贸易区激励措施与以人工智慧为重点的研发园区相结合,预计将催生本地化的黏合剂混合工厂。儘管这些地区目前规模较小,但对于那些愿意规避专注于传统生产中心风险的公司来说,它们提供了充足的多元化发展潜力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 高密度贴装需求快速成长

- 对需要黏合剂的表面黏着技术的需求不断增加

- Mini LED 和 Micro LED 背光的采用率不断提高

- 电子黏合剂技术不断进步

- 扩大家电生产

- 市场限制

- 环氧树脂和丙烯酸酯原料价格波动

- 严格的VOC和RoHS/REACH合规成本

- 超薄软式电路板中的热失配问题

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 依树脂类型

- 环氧树脂

- 丙烯酸纤维

- 聚氨酯

- 其他树脂类型(硅胶、氰基丙烯酸酯等)

- 依产品类型

- 电导率

- 热导率

- 紫外线固化

- 其他产品类型(例如非导电)

- 按用途

- 三防胶

- 表面黏着技术

- 封装

- 电线定位

- 其他用途(底部填充、晶片黏接)

- 按最终用户产业

- 消费性硬体

- IT硬体

- 车

- 其他终端用户产业(工业、电力电子等)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- 3M

- Arkema

- Avery Dennison

- BASF

- DELO

- Dow

- Dymax Corporation

- HB Fuller Company

- Henkel AG and Co. KGaA

- Huntsman International LLC.

- ITW Engineered Polymers

- Master Bond Inc.

- NAMICS CORPORATION

- Panacol-Elosol GmbH

- Parker Hannifin Corp

- Permabond LLC

- Pidilite Industries Ltd.

- Shin-Etsu Chemical Co., Ltd.

第七章 市场机会与未来展望

The Electronics Adhesives Market size is estimated at USD 6.51 billion in 2025, and is expected to reach USD 10.03 billion by 2030, at a CAGR of 9.04% during the forecast period (2025-2030).

Rising component miniaturization, wider surface-mount technology (SMT) penetration, and rapid adoption of advanced displays are the primary forces guiding this progress. Demand momentum is reinforced by high-density packaging that increases interconnect counts while amplifying thermal loads, positioning adhesives as indispensable thermal and mechanical buffers between ever-smaller device features. Manufacturers are also prioritizing fast-curing chemistries that cut cycle times in high-volume lines, especially across Asian contract manufacturing hubs. At the same time, sustainability regulations are prompting shifts toward PFAS-free, bio-based, and low-VOC formulations that do not compromise long-term reliability. Taken together, these themes illustrate an electronics adhesives market whose growth is both volume-driven and value-driven, with innovative products commanding share premiums in applications requiring elevated heat resistance and optical purity.

Global Electronics Adhesives Market Trends and Insights

Surge in High-Density Packaging

High-density packaging pushes bond lines toward micron-level tolerances, demanding adhesives with tight-viscosity windows, controlled outgassing, and elastic moduli that absorb differential expansion among stacked die. Wafer-level packaging (WLP) and 3D integration expose joints to reflow excursions that peak near 260 °C, a threshold met by newly formulated epoxy-siloxane hybrids. DELO's latest wafer-level range sustains that temperature while maintaining flow behavior suitable for precision jetting heads. Robust materials have broadened beyond smartphones into advanced driver-assistance systems (ADAS) control units and compact industrial sensors, both of which mirror consumer device space constraints.

Increase in Demand for Surface-Mount Technology Requiring Adhesives

SMT once filled cost-reduction roles but now enables ultra-fine-pitch assembly where component clearances fall below solder paste tolerances. Underfill adhesives redistribute thermo-mechanical stress in flip-chip packages and arrest tin-whisker propagation, cutting field-failure rates in wearable electronics. Automotive infotainment boards add further requirements for vibration damping and 1,000-hour thermal-cycling durability, elevating demand for specialty epoxy-polyimide blends. Equipment makers respond with high-throughput jet dispensers and dual-stage thermal/UV curing stations that shrink in-line takt times by up to 40%, reinforcing adhesive uptake throughout the electronics adhesives market.

Volatility in Epoxy and Acrylate Feedstock Prices

Epichlorohydrin supply disruptions and freight surcharges pushed spot epoxy prices to multi-year highs, crimping gross margins for small formulators. The U.S. International Trade Commission's ruling against certain Asian epoxy imports introduced additional tariffs that filtered into contract renegotiations within weeks. Composite-grade resin producers responded with EUR 150-200 per-ton price hikes, directly raising adhesive cost bases. While top-tier vendors hedge via multi-year supply deals, regional specialists face working-capital strain that may curb innovation pace.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Mini-LED and Micro-LED Backlighting Adoption

- Growing Technological Advancements in Electronic Adhesives

- Stringent VOC and RoHS/REACH Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy resins remained paramount, accounting for 30.19% of 2024 revenue within the electronics adhesives market. Their high cohesive strength, dielectric stability, and resistance to harsh fluids keep them entrenched in under-the-hood automotive modules and industrial drives. Meanwhile, acrylic chemistries, expanding at an 11.19% CAGR, offer faster light-plus-heat curing and greater substrate flexibility, features prized by smartphone lens-stack bonding. Bio-based epoxy initiatives, leveraging lignin and vegetable-oil derivatives, aim to cut carbon footprints without sacrificing 260 °C peak-temperature capability. Across specialty assembly houses, hybrid epoxy-acrylate blends are gaining traction where manufacturers need snap-cure attributes in a single formulation. This interplay of legacy robustness and emerging agility underscores the diverse formulation roadmap powering the electronics adhesives market.

Second-tier polyurethane systems address vibration-rich settings such as battery modules that face road-surface shocks, whereas silicone and cyanoacrylate niches persist for high-temperature power devices and rapid fixturing. Regulatory attention on bisphenol-A diglycidyl ether is nudging epoxy suppliers toward alternative monomers, yet long-term demand fundamentals remain intact. Manufacturers continue to differentiate through proprietary toughening agents that widen operating windows from -55 °C to 175 °C, thereby cementing epoxy's leadership even as acrylic volumes accelerate.

Electrically conductive grades delivered 43.90% of 2024 sales, proving indispensable wherever solder voids threaten circuit continuity. Silver-flake epoxies dominate flip-chip die-attach, while nickel-loaded versions offer cost-effective EMI shielding for 5G antennas. UV-curing adhesives, scaling at a 12.04% CAGR, compress line tact times to seconds and enable in-situ optical inspection, elevating first-pass yields in camera module factories. Thermally conductive variants, infused with aluminum nitride or boron nitride fillers, dissipate up to 5 W/mK, extending LED lumen maintenance and inverter uptime.

Non-conductive structural epoxies sustain demand where isolation from high-voltage traces is non-negotiable, notably in traction inverters and data-center power supplies. Hybrid dual-cure products that combine UV pre-gelling with thermal post-cure are emerging as the go-to option for complex three-dimensional assemblies. The breadth of performance profiles available today strengthens the electronics adhesives market, giving designers latitude to optimize electrical, thermal, and optical parameters simultaneously.

The Electronics Adhesives Market Report is Segmented by Resin Type (Epoxy, Acrylic, and More), Product Type (Electrically Conductive, Thermally Conductive, and More), Application (Conformal Coating, Surface Mounting, and More), End-User Industry (Consumer Hardware, IT Hardware, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 58.69% of 2024 revenue, making it the single largest regional pillar of the electronics adhesives market. Mainland China raised electronics output by 11.3% in 2024 through state grants for advanced packaging lines and local wafer-level underfill capacity expansions. Thailand and Vietnam absorbed fresh foreign direct investment after the United States granted selected tariff exemptions on electronics imports from April 2025, redirecting assembly programs into ASEAN clusters. The region's integrated supply base-from resin reactors to fully automated SMT lines-compresses lead times and reinforces its cost leadership.

North America's reshoring narrative gained momentum via the CHIPS and Science Act, which allocates USD 52 billion toward domestic wafer fabrication. This upstream capital outlay is stimulating downstream adhesive demand for clean-room-grade underfills and liquid thermal interface materials. Canada's Quebec corridor likewise hosts new printed-electronics pilot plants that prioritize bio-based chemistries, mirroring sustainability pushes seen in Europe.

Europe is charting an electronics adhesives market size rebound as its own EU Chips Act strengthens local microelectronic value chains. Environmental regulations, including progressive PFAS limitations, are galvanizing R&D into fluorine-free lubricious fillers. Germany's automotive Tier 1s are qualifying debondable grades for dashboard displays, while Scandinavian EMS providers emphasize low-temperature curing to shrink energy footprints.

South America and the Middle East and Africa represent emerging frontiers. Brazil's Manaus free-trade zone is broadening consumer-electronic assembly, opening opportunities for mid-viscosity acrylics tailored to tropical humidity. The United Arab Emirates is positioning itself as a regional logistics hub, pairing free-zone incentives with AI-centered R&D parks that could seed localized adhesive blending plants. Though smaller today, these geographies add diversification prospects for firms eager to de-risk concentration within traditional production centers.

- 3M

- Arkema

- Avery Dennison

- BASF

- DELO

- Dow

- Dymax Corporation

- H.B. Fuller Company

- Henkel AG and Co. KGaA

- Huntsman International LLC.

- ITW Engineered Polymers

- Master Bond Inc.

- NAMICS CORPORATION

- Panacol-Elosol GmbH

- Parker Hannifin Corp

- Permabond LLC

- Pidilite Industries Ltd.

- Shin-Etsu Chemical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in High-Density Packaging Demand

- 4.2.2 Increase in Demand for Surface Mount Technology requiring Adhesives

- 4.2.3 Increasing Mini-LED and Micro-LED Backlighting Adoption

- 4.2.4 Growing Technological Advancements in Electronic Adhesives

- 4.2.5 Expansion of Consumer Electronics Production

- 4.3 Market Restraints

- 4.3.1 Volatility in Epoxy and Acrylate Feedstock Prices

- 4.3.2 Stringent VOC and RoHS/REACH Compliance Costs

- 4.3.3 Thermal-Mismatch Failures in Ultra-Thin Flexible Substrates

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Epoxy

- 5.1.2 Acrylic

- 5.1.3 Polyurethane

- 5.1.4 Other Resin Types (Silicone, Cyanoacrylate, etc.)

- 5.2 By Product Type

- 5.2.1 Electrically Conductive

- 5.2.2 Thermally Conductive

- 5.2.3 UV Curing

- 5.2.4 Other Product Types (Non-conductive, etc.)

- 5.3 By Application

- 5.3.1 Conformal Coating

- 5.3.2 Surface Mounting

- 5.3.3 Encapsulation

- 5.3.4 Wire Tacking

- 5.3.5 Other Applications (Underfill, Die-Attach)

- 5.4 By End-user Industry

- 5.4.1 Consumer Hardware

- 5.4.2 IT Hardware

- 5.4.3 Automotive

- 5.4.4 Other End-user Industries (Industrial and Power Electronics, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Avery Dennison

- 6.4.4 BASF

- 6.4.5 DELO

- 6.4.6 Dow

- 6.4.7 Dymax Corporation

- 6.4.8 H.B. Fuller Company

- 6.4.9 Henkel AG and Co. KGaA

- 6.4.10 Huntsman International LLC.

- 6.4.11 ITW Engineered Polymers

- 6.4.12 Master Bond Inc.

- 6.4.13 NAMICS CORPORATION

- 6.4.14 Panacol-Elosol GmbH

- 6.4.15 Parker Hannifin Corp

- 6.4.16 Permabond LLC

- 6.4.17 Pidilite Industries Ltd.

- 6.4.18 Shin-Etsu Chemical Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment